Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - G&K SERVICES INC | gk201672ex322.htm |

| EX-32.1 - EXHIBIT 32.1 - G&K SERVICES INC | gk201672ex321.htm |

| EX-31.2 - EXHIBIT 31.2 - G&K SERVICES INC | gk201672ex312.htm |

| EX-31.1 - EXHIBIT 31.1 - G&K SERVICES INC | gk201672ex311.htm |

| EX-24 - EXHIBIT 24 - G&K SERVICES INC | gk201672-ex24.htm |

| EX-23.1 - EXHIBIT 23.1 - G&K SERVICES INC | gk201672-ex231.htm |

| EX-21 - EXHIBIT 21 - G&K SERVICES INC | gk201672-ex21.htm |

| EX-3.(B) - EXHIBIT 3.(B) - G&K SERVICES INC | gk201672-ex3b.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________

FORM 10-K

____________________________________________________________

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Fiscal Year Ended July 2, 2016

Commission file number 0-4063

____________________________________________________________

G&K SERVICES, INC.

(Exact name of registrant as specified in its charter)

MINNESOTA | 41-0449530 | |

(State of incorporation) | (I.R.S. Employer Identification No.) | |

5995 OPUS PARKWAY

MINNETONKA, MINNESOTA 55343

(Address of principal executive offices)

Registrant’s telephone number, including area code (952) 912-5500

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on which Registered | |

Class A Common Stock (par value $0.50 per share) | The NASDAQ Stock Market LLC | |

Securities registered pursuant to Section 12(g) of the Act:

None

____________________________________________________________

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | x | Accelerated filer | o |

Non-accelerated filer | o (do not check if a smaller reporting company) | Smaller reporting company | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of December 24, 2015 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the registrant’s voting common equity held by non-affiliates was approximately $1,264,374,953.

On August 23, 2016, 19,683,483 shares of the registrant's Class A Common Stock were outstanding.

____________________________________________________________

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this report, to the extent not set forth herein, will be provided in accordance with Instruction G(3) to Form 10-K within 120 days after the end of the fiscal year to which this report relates.

G&K Services, Inc.

Form 10-K

For the fiscal year ended July 2, 2016

Table of Contents

PAGE | |

2

PART I

ITEM 1. | BUSINESS |

G&K Services, Inc., founded in 1902 and headquartered in Minnetonka, Minnesota, is a service-focused provider of branded uniform and facility services programs. We deliver value to our customers by enhancing their image and brand, and by promoting workplace safety, security and cleanliness. We accomplish this by providing a wide range of workwear and protective safety apparel through rental and direct purchase programs. We also supply a variety of facility products and services, including floor mats, towels, mops, restroom hygiene products, and first aid supplies. We have a team of 8,000 employees who operate from approximately 160 locations. These locations serve customers in 96 of the top 100 metropolitan markets across the United States and Canada.

Customers, Products and Services

We serve a diverse base of customer locations in virtually all industries, including automotive, warehousing, distribution, transportation, energy, manufacturing, food processing, retail, restaurants, construction and trades, hospitality, government, healthcare and others. We provide service to customers of almost every size, from Fortune 100 companies to small and midsize firms. Our largest customer represents approximately 2% of our total revenue. Over one million people within our customer base wear G&K work apparel every work day.

Our customer-focused relationships involve customers renting or directly purchasing uniforms and providing facility products and services to meet a variety of critical needs in the workplace, including:

• | Image – work apparel helps companies project a professional image through their employees and frame the perception of credibility, knowledge, trust and quality to their customers. Employees in uniform are perceived as well trained, competent and dependable. Branded work apparel promotes a company's brand identity and allows employees in uniform to convey a company's image. |

• | Safety and security – protective work apparel helps protect employees from difficult environments, such as heavy soils, heat, flame or chemicals. Additionally, uniforms help improve workplace security by identifying employees working for a particular company or department. Facility services products, such as floor mats and first aid supplies, also help improve workplace safety. |

• | Workplace cleanliness and hygiene – facility services products, such as floor mats, towels, mops, and restroom supplies, help ensure a clean, well-maintained facility, which is safer for employees and more attractive to customers. |

• | Employee retention – work apparel enhances worker morale and helps build teamwork in addition to providing a tangible employee benefit. |

• | Product protection – work apparel and facility services help protect products against sources of contamination in various industries, including the food, pharmaceutical and healthcare industries. |

With a comprehensive understanding of our customers' requirements, we enhance our customers' image and safety by consistently providing superior service and high quality work apparel and facility products and services. Through proprietary tracking systems, a rigorous inspection program, broad product inventories and an accurate measuring system, we promise our customers that deliveries are complete, on time and in good repair. By utilizing advanced technology and offering simple service agreements, we strive to make certain that billing is simple, accurate and predictable. In addition, we employ communication systems and perform closed-loop customer satisfaction practices to ensure our customers' needs are met promptly.

We utilize a collaborative approach to advise and assist our customers in choosing a work apparel program that best meets their unique brand, image, identity and safety needs. Our comprehensive range of work apparel and uniform rental programs offers flexibility in styles, colors and quantities, and sets service and distribution expectations to customer requirements. We can quickly source and access garments to provide rapid response as customer needs change due to increases, decreases or turnover in their work force. Professional cleaning, finishing, repair, embellishment and replacement of uniforms in use is a normal part of the rental service. Our handling of the details of a work apparel program allows our customers to focus on running their core business and not be concerned with the management time, operating costs and environmental exposures involved in running their own work apparel program or on-premise laundry.

We also offer complete facility services programs that provide a wide range of dust control, maintenance, hand care and hygiene products and services. These programs include floor mat offerings (traction control, logo, message, scraper, anti-fatigue), towel products (shop, kitchen, bar, bath, dish, continuous roll, microfiber), mop offerings (dust, microfiber, wet), fender covers, selected linen items, restroom hygiene products and first aid supplies. Our regularly scheduled weekly service of these products and services helps our customers maintain a clean, safe and attractive environment within their facilities for their employees and customers.

3

Our customers also need a wide selection of branded apparel across a variety of jobs. Our comprehensive direct sale catalog business features a broad product selection, high quality embellishment, efficient distribution and various ordering and payment capabilities. We have developed a vast and comprehensive product offering of some of the leading brands in our industry tailored to the needs of our various market segments through our catalog offering. This branded apparel program can be used for uniform programs, employee rewards and recognition, trade shows and vendor appreciation programs.

For most of our customers, we provide weekly service, with our highly talented service professionals visiting customers' locations. This regular customer contact helps ensure we are meeting our customers' needs, while promoting strong relationships that lead to high customer retention and additional sales opportunities.

Recent Development

On August 15, 2016, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Cintas Corporation (“Cintas”) and Bravo Merger Sub, Inc., a wholly owned subsidiary of Cintas (“Merger Sub”), pursuant to which we will be acquired by Cintas by Merger Sub merging with and into us such that we will become a wholly owned subsidiary of Cintas (the “Merger”). At the effective time of the merger, each outstanding share of Class A common stock will be converted into the right to receive $97.50 per share in cash. For additional discussion of the Merger see “Proposed Merger with Cintas Corporation” in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Annual report on Form 10-K.

Acquisitions

Our industry continues to consolidate as many family-owned, local operators and regional companies have been acquired by larger providers. We have historically participated in this consolidation with an acquisition strategy focused on expanding our geographic presence and/or expanding our local market share in order to further leverage our existing production facilities. We remain active in evaluating quality acquisitions that would strengthen our business. We completed one small acquisition in fiscal year 2016 that was not material to our consolidated financial results.

Competition

We believe many customers in our industry choose providers based on the consistency of superior customer service received, hence our focus on service excellence. The customer-supplier relationship, unique business needs, brand awareness, quality image and improving safety are also key attributes in selecting a uniform provider. In addition, product quality, fit, comfort, price and breadth of products offered are factors in the decision process. We rank among North America's largest work apparel providers and encounter competition from many companies in the geographic areas we serve. We compete effectively in our core work apparel and facility services business because of our focus on Delivering Uniform Service Excellence®.

Manufacturing and Suppliers

We manufactured approximately 48% of the work apparel that we placed into service in fiscal year 2016. These garments are primarily manufactured in the Dominican Republic. Various outside vendors are used to supplement our additional product needs, including garments, floor mats, towels, mops, linens and related products. Although we occasionally experience product shortages, we are not currently aware of any circumstances that would materially limit our ability to obtain raw materials to support the manufacturing process or to obtain garments or other items to meet our customers' needs.

Environmental Matters

Our operations, like those of our competitors, are subject to various federal, state and/or local laws, rules and regulations respecting the environment, including potential discharges into water and air and the generation, safe handling, storage, transportation and disposal of waste and hazardous substances. We generate certain amounts of waste in connection with our laundry operations, including wastewater, wastewater sludge, waste oil and other residues. In a limited number of instances, certain of these wastes are classified as hazardous under applicable laws, rules and regulations. We continue to make significant investments in properly handling and disposing of these wastes to help ensure safety and compliance with applicable regulations and operating our business, emphasizing our environmental stewardship obligations and responsibilities.

Additionally, we are involved in various property remediation projects. Currently, we have three such projects nearing completion, which we expect will be completed within previously established reserves. We also have four other projects on which we are currently working.

As part of our continued efforts on the four projects mentioned above, in the fourth quarter of fiscal year 2015, we determined it was likely that the parties that were contractually obligated to remediate contamination resulting from prior use of perchloroethylene, or PCE, other dry cleaning solvents and other contaminants at three of these previously purchased locations would not be able to continue to meet these obligations because of their respective financial condition. These projects relate to acquisitions which date as far back as the 1970s; the most recent one was in 2007. As a result of the foregoing, we recorded a

4

charge of $3.9 million to increase our remediation-related reserves for these projects to $4.7 million as of June 27, 2015. As of July 2, 2016 our remediation-related reserves were approximately $3.6 million as discussed in Note 12, "Commitments and Contingencies" of Notes to Consolidated Financial Statements.

In order to determine whether any additional exposure for remediation exists, commencing in fiscal year 2016, we assessed six additional sites which we acquired and that had historical dry cleaning operations. The environmental assessment of four of these sites is complete, with no further action required. We continue to assess the remaining two sites. With respect to these remaining two sites, while we believe additional costs may be probable, they are not yet reasonably estimable. Therefore, beyond amounts to cover our ongoing assessment of these two sites, we have not recorded any additional reserves for these properties. While such charges may be material, including with respect to reported operating results in a particular period, we believe the likelihood that any charges will have a material adverse effect on our results of ongoing operations or financial position is remote.

We discuss certain legal matters in this Annual Report on Form 10-K under Part I, Item 1A. Risk Factors - Compliance with environmental laws and regulations could result in significant costs that adversely affect our operating results, Item 3. Legal Proceedings, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, Item 8. Financial Statements and Supplementary Data in Note 12, "Commitments and Contingencies" of Notes to Consolidated Financial Statements. While it is impossible to ascertain the ultimate legal and financial liability with respect to contingent liabilities, including lawsuits, legal matters, claims and environmental contingencies, we expect to incur additional charges to remediate PCE and other contamination at certain sites we have acquired. Based on information currently available, it is also possible that we may incur additional losses in excess of established reserves for other environmental matters. While such charges may be significant we believe the likelihood that any charges will have a material adverse effect on our results of ongoing operations or financial position is remote, although the impact on reported operating results in any particular period may be material.

Employees

Our U.S. operations had approximately 6,700 employees as of July 2, 2016, of which approximately 10% are represented by various labor unions. Approximately 5% of our U.S. employees that are represented by the various labor unions participate in collective bargaining agreements that expire in the next 12 months. We believe our U.S. employee relations are good.

Our Canadian operations had approximately 1,300 employees as of July 2, 2016, of which approximately 65% are represented by various labor unions. Approximately 50% of our Canadian employees that are represented by the various labor unions participate in collective bargaining agreements that expire in the next 12 months. We believe our Canadian employee relations are likewise good.

Foreign and Domestic Operations

Financial information relating to foreign and domestic operations is set forth in Note 13, "Segment Information" of Notes to Consolidated Financial Statements included in Item 8 of this Form 10-K.

Intellectual Property

We own a portfolio of registered trademarks, trade names and licenses, and certain U.S. and foreign process and manufacturing patents relating to our business. These proprietary properties, in the aggregate, constitute a valuable asset. We do not believe, however, that our business is dependent upon any single proprietary property or any particular group of proprietary properties.

Seasonality and Working Capital

We do not consider our business to be seasonal to any significant extent or subject to any unusual working capital requirements.

Available Information

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports are available free of charge, as soon as reasonably practicable, after we electronically file such material with, or furnish it to, the United States Securities and Exchange Commission ("SEC"). These reports are available on our website at http://www.gkservices.com and on the SEC's website at http://www.sec.gov. Information included on our website is not deemed to be incorporated into this Annual Report on Form 10-K.

ITEM 1A. | RISK FACTORS |

The statements in this section, as well as statements described elsewhere in this Annual Report on Form 10-K, or in other filings made with the SEC, describe risks that could materially and adversely affect our business, financial condition and results of operations and the trading price of our securities. These risks are not the only risks that we face. Our business, financial condition and results of operations could also be materially affected by additional factors that are not presently known to us or that we currently consider to be immaterial to our operations.

5

In addition, this section sets forth statements which constitute our cautionary statements under the Private Securities Litigation Reform Act of 1995.

FORWARD-LOOKING STATEMENTS

The Private Securities Litigation Reform Act of 1995 provides a safe harbor from civil litigation for forward-looking statements. Forward-looking statements may be identified by words such as "estimates," "anticipates," "projects," "plans," "expects," "intends," "believes," "seeks," "could," "should," "may" and "will" or the negative versions thereof and similar expressions and by the context in which they are used. Such statements are based upon our current expectations and speak only as of the date made. These statements are subject to various risks, uncertainties and other factors that could cause actual results to differ from those set forth in or implied by this Annual Report on Form 10-K. Factors that might cause such a difference include, but are not limited to, the possibility of greater than anticipated operating costs, lower sales volumes, the performance and costs of integration of acquisitions or assumption of unknown liabilities in connection with acquisitions, fluctuations in costs of materials and labor, costs and possible effects of union organizing or other union activities, strikes, loss of key management, uncertainties regarding any existing or newly-discovered expenses and liabilities related to environmental compliance and remediation, failure to achieve and maintain effective internal controls for financial reporting required by the Sarbanes-Oxley Act of 2002, the initiation or outcome of arbitrations, litigation or governmental investigations, higher than assumed sourcing or distribution costs of products, the disruption of operations from catastrophic events or from the proposed Merger, disruptions in capital markets, the liquidity of counterparties in financial transactions, changes in federal and state tax laws, failure to complete the proposed Merger in a timely manner, or at all, economic uncertainties and the reactions of competitors in terms of price and service. We undertake no obligation to update any forward-looking statements to reflect events or circumstances arising after the date on which they are made, except as required by law.

Also note that we provide the following cautionary discussion of risks, uncertainties and assumptions relevant to our business. Actual results may differ from certain assumptions we have made causing actual events to vary from expected results. These are factors that, individually or in the aggregate, could cause our actual results to differ materially from expected and historical results. We note these factors for investors as permitted by the Private Securities Litigation Reform Act of 1995. You should understand that it is not possible to predict or identify all such factors. Consequently, you should not consider the following to be a complete discussion of all potential risks or uncertainties.

RISKS RELATED TO BUSINESS OPERATIONS

General economic factors may adversely affect our financial performance.

General economic conditions may adversely affect our financial performance. Increases in labor costs, including healthcare, minimum wages, insurance costs, higher material costs for items, such as linens, other textiles and various raw materials, higher fuel and other energy costs, higher interest rates, inflation, higher tax rates and other changes in tax laws and other economic factors could increase our costs and could adversely affect our results of operations.

Fluctuations in Canadian currency could have an adverse effect on our results of operations and financial condition.

Certain of our foreign revenue and operating expenses are transacted in local currencies. Therefore, our results of operations and certain receivables and payables are subject to foreign exchange rate fluctuations.

Increased competition could adversely affect our financial performance.

We operate in a highly competitive industry and compete with national, regional and local providers. Service, product quality, design, fit, comfort, price, breadth of products offered and convenience to the customer are the primary competitive elements in these industries. If existing or future competitors seek to gain or retain market share by reducing prices, we may be required to lower prices, which could be detrimental to our operating results. Our competitors also generally compete with us for possible acquisitions, which can increase the price for acquisitions. In addition, our customers and prospects may decide to perform certain services in-house instead of outsourcing such services. These competitive pressures could adversely affect our sales and operating results.

Failure to comply with various state and federal regulations could adversely affect our results of operations.

Numerous complex federal and provincial regulations apply to our business, as do various regulations promulgated by state and local agencies. These regulations govern a wide variety of employment practices and include requirements surrounding minimum wages, overtime, working conditions and citizenship. We are also subject to numerous transportation and safety laws and regulations. Without limiting the generality of the foregoing, our business is subject to regulations promulgated by the U.S. Department of Transportation and under the Occupational Safety and Health Act of 1970, as amended. Likewise, as a contractor to the United States government, various regulations promulgated by the Office of Federal Contract Compliance Programs apply to our business. We have incurred, and will continue to incur, additional costs in the ordinary course of our business in complying with these various regulations. Additionally, changes in these laws or regulations could substantially increase our operating costs or otherwise affect how we operate our business. Failure to comply with these regulations could

6

result in fines by government authorities and payment of damages to private litigants, affect our ability to service our customers, result in debarment of us as a contractor to the United States government and adversely affect our financial condition, results of operations and prospects.

Compliance with environmental laws and regulations could result in significant costs that adversely affect our operating results.

Our operating facilities are subject to stringent environmental laws, rules and regulations relating to the protection of the environment and health and safety matters, including those governing the potential discharges of pollutants to the air and water, the management and disposal of hazardous substances and wastes and the clean-up of contaminated sites. The operation of our business entails risks under environmental laws and regulations. We could incur significant costs, including, without limitation, clean-up costs, fines, sanctions and claims by regulators or third parties for property damage and personal injury, as a result of violations or liabilities under these laws and regulations, which among other things, could require us to reduce or cease use of certain equipment and/or limit or stop production at certain facilities. These consequences could have a material adverse effect on our results of operations and financial condition and disrupt customer relationships.

We are currently involved in a limited number of legal matters at various locations related to environmental laws and regulations. As part of our ongoing operations, we also are involved in various property remediation efforts. Historically, we have borne our property remediation costs as part of our ongoing operations. In particular, we have three projects nearing completion, which we expect will be completed within previously established reserves. We are also working on four other projects. As part of our continued efforts on these four projects, in the fourth quarter of 2015, we determined it was likely that the parties that were contractually obligated to remediate contamination resulting from prior use of PCE and other contaminants at three of these previously purchased locations would not be able to continue to meet these obligations because of their respective financial condition. These projects relate to acquisitions which date as far back as the 1970s; the most recent one was in 2007. As a result of the foregoing, we recorded a charge of $3.9 million to increase our remediation-related reserves for these projects to $4.7 million as of June 27, 2015. As of July 2, 2016 our remediation-related reserves were approximately $3.6 million as discussed in Note 12, "Commitments and Contingencies" of Notes to Consolidated Financial Statements.

In order to determine whether any additional exposure for remediation exists, commencing in fiscal year 2016, we assessed six additional sites which we previously acquired and that had historical dry cleaning operations. The environmental assessment of four of these sites is complete, with no further action required. We continue to assess the remaining two sites. With respect to these remaining two sites, while we believe additional costs may be probable, they are not yet reasonably estimable. Therefore, beyond amounts to cover our ongoing assessments of these two sites, we have not recorded any additional reserves for these properties.

Our ongoing assessments will inform our next set of actions and could reveal other environmental contamination that needs to be remediated. We may incur additional charges to remediate at these sites. Further, based on information currently available, it is possible that we may incur additional losses in excess of established reserves for other environmental matters. While such charges may be significant, we believe the likelihood that any charges will have a material adverse effect on our results of ongoing operations or financial position is remote, although the charges in any particular period could be materially affected by changes in our assumptions or strategies related to these contingencies, the imposition of clean-up obligations and the discovery of alleged contamination or changes out of our control. However, these amounts are not estimable at this time. In addition, potentially significant expenditures could be required to comply with environmental laws and regulations, including requirements that may be adopted or imposed in the future.

Under environmental laws, an owner or operator of real estate may be required to pay the costs of removing or remediating hazardous materials located on or emanating from property, regardless of whether the owner or operator knew of or was responsible for the presence of such hazardous materials. While we regularly engage in environmental due diligence in connection with acquisitions, we can give no assurance that locations that have been acquired or leased have been operated in compliance with environmental laws and regulations during prior periods, nor can we give any assurance that existing remediation projects or future uses or conditions will not make us liable under these laws or expose us to regulatory or third-party actions, including third party suits.

Additionally, we must maintain compliance with various permits and licenses issued to us in connection with our operations, or we must apply for and obtain such permits and licenses. Any failure on our part to maintain such compliance or to apply for and receive such permits and licenses could have a material adverse effect on our ability to continue operations at a particular location.

We may be subject to information technology system failures, network disruptions and breaches in data security.

We rely upon sophisticated information technology systems and infrastructure, as well as strong security procedures and tools, to operate our business and ensure the secure storage and transmission of information. The size and complexity of our computer systems make them potentially vulnerable to breakdown, malicious intrusion and random attack. Likewise, computer networks

7

and the internet are, by nature, vulnerable to unauthorized access. An accidental or willful security breach could result in unauthorized access to and/or use of sensitive data. Our security measures could be breached by third-party action, computer viruses, accidents, or error or misconduct by an employee or contractor. Because techniques used to obtain unauthorized access, disable or degrade service, or to sabotage computer systems, change frequently, it may be difficult to detect the use of such techniques immediately and we may be unable to implement adequate preventive measures. Unauthorized parties may also attempt to gain access to our systems or facilities through various means, including hacking into our systems or facilities, fraud, trickery or other means of deceiving employees, contractors and temporary staff, or using stolen credit cards to purchase goods. We have encountered threats of this type from time to time, none of which have materially impacted our operations or financial results.

Although we maintain a system of information security and controls, a party that is able to circumvent our security measures could cause interruption in our operations, damage our computers or those of our users, or otherwise damage our reputation. Depending on the severity, any of these events could adversely affect our operations and financial results. In addition, if we were to experience an information security breach, we may be required to expend significant amounts to remedy, protect against, or mitigate the effect of the breach, and we may not be able to remedy the situation in a timely manner, or at all. While we have invested in protection of data and information technology, there can be no assurance that our efforts will prevent breakdowns or breaches in our systems that could adversely affect our business.

Risks associated with the suppliers from whom our products are sourced, and the cost of those products, could adversely affect our operating results.

The products we sell are sourced from a variety of domestic and international suppliers. Global sourcing of many of these products is an important factor in our financial performance. We endeavor that all of our suppliers comply with applicable laws, including, without limitation, labor and environmental laws. Our ability to secure and maintain qualified suppliers who meet our standards and to access products in a timely and efficient manner can be a significant challenge, especially with respect to suppliers located and goods sourced outside the United States. Political and economic stability in the countries in which foreign suppliers are located, the financial stability of suppliers, failure to meet our supplier standards, labor problems experienced by our suppliers, the availability and cost of raw materials to suppliers, currency exchange rates, transport availability and cost, inflation and other factors relating to the suppliers and the countries in which they are located are beyond our control. In addition, United States and Canadian foreign trade policies, tariffs and other impositions on imported goods, trade sanctions imposed on certain countries, the limitation on the importation of certain types of goods or of goods containing certain materials from other countries and other factors relating to foreign trade are beyond our control. Our continued compliance with the disclosure requirements relating to the sourcing of so-called conflict minerals from the Democratic Republic of Congo and certain other adjoining countries as required by the Dodd-Frank Act is predicated upon the timely receipt of accurate information from suppliers, who may be unwilling or unable to provide us with the relevant information. As a result, these requirements could adversely affect our costs, the availability of materials used in our products and our relationships with customers and suppliers. These and other factors affecting our suppliers and our access to products could adversely affect our operating results.

Fluctuations in demand for our products and services may adversely impact our financial results.

Continued uncertainty in global economic conditions may pose a risk to the overall economy as consumers and businesses may defer purchases in response to tighter credit and negative financial news. This could negatively impact our customers and consequently have a negative impact on our financial performance. If demand for our products and services fluctuates as a result of economic conditions or otherwise, our revenue and operating margin could be negatively impacted. Important factors that could cause demand for our products and services to fluctuate include:

• | changes in business and economic conditions, including downturns in specific industry segments and/or the overall economy; |

• | changes in consumer confidence caused by changes in market conditions, including changes in the credit market, expectations for inflation and energy prices; |

• | competitive pressures, including pricing pressures, from companies that have competing products and services; |

• | changes in customer needs; |

• | changes in our customers' employment levels, which impact the number of users of our products and services; |

• | strategic actions taken by our competitors; and |

• | market acceptance of our products and services. |

If our customers' demand for our products and services decreases, our plant and manufacturing capacity could be underutilized, and we may be required to record an impairment of our long-lived assets, including facilities and equipment, as well as

8

intangible assets, which would increase our expenses. A change in demand for our products and services, and changes in our customers' needs, could have a variety of negative effects on our competitive position and our financial results, and, in certain cases, may reduce our revenue, increase our costs and lower our gross margin percentage.

Legal proceedings may adversely affect our financial condition and operating results.

From time to time we are party to various legal claims and proceedings, including those relating to employment and regulatory matters. Certain of these claims or proceedings or potential future proceedings, if decided adversely against us or settled by us, may result in a liability that is material to our financial condition and operating results. We discuss current lawsuits and other litigation to which we are party in greater detail under Item 3. Legal Proceedings and Item 8. Financial Statements and Supplementary Data in Note 12, "Commitments and Contingencies" of Notes to Consolidated Financial Statements.

Risks associated with our acquisition strategy could adversely affect our operating results.

Historically, a portion of our growth has come from acquisitions. We continue to evaluate opportunities for acquiring businesses that may supplement our internal growth. However, there can be no assurance that we will be able to identify and purchase suitable operations. In addition, the success of any acquisition depends in part on our ability to integrate the acquired business. The process of integrating acquired businesses may involve unforeseen difficulties and may require a disproportionate amount of our management's attention and our financial and other resources. Although we conduct due diligence investigations prior to each acquisition, there can be no assurance that we will discover all operational deficiencies or material liabilities of an acquired business for which we may be responsible as a successor owner or operator. The failure to successfully integrate these acquired businesses or to discover such liabilities could adversely affect our operating results.

Increases in fuel, energy and commodity costs could adversely affect our results of operations and financial condition.

Motor fuel, natural gas, electricity, cotton, polyester and other commodities represent a significant cost within our business. The price of these commodities, which are required to run our vehicles and equipment and manufacture our garments, can be unpredictable and can fluctuate based on events beyond our control, including geopolitical developments, supply and demand for oil and gas, actions by oil and gas producers, war, terrorism and unrest in oil producing countries, regional production patterns, limits on refining capacities, natural disasters and environmental concerns. Increases in the cost of these commodities could adversely affect our results of operations and financial condition.

Failure to preserve positive labor relationships could adversely impact our operations and financial results.

Significant portions of our Canadian labor force are unionized, and a lesser portion of United States employees are unionized. While we believe that our Canadian and U.S. employee relations are good, we continue to face pressure from labor unions, and could experience increased pressure. If we do encounter pressure from labor unions, any resulting labor unrest could disrupt our business by impairing our ability to produce and deliver our products and services. In addition, significant union representation would require us to negotiate with many of our employees collectively and could adversely affect our results by restricting our ability to maximize the efficiency of our operations.

Inability to attract and retain employees could adversely impact our operations.

Our ability to attract and retain employees is important to our operations. Our ability to expand our operations is in part impacted by our ability to increase our labor force. In the event of a labor shortage, or in the event of a change in prevailing labor and/or immigration laws, we could experience difficulty in delivering our services in a high-quality or timely manner and we could be forced to increase wages in order to attract and retain employees, which would result in higher operating costs.

Loss of our key management or other personnel could adversely impact our business.

Our success is dependent on the skills, experience and efforts of our senior management and other key personnel. If, for any reason, one or more senior executives or key personnel were not to remain active in our company, or if we are unable to attract and retain key personnel, our results of operations could be adversely affected.

Unexpected events could disrupt our operations and adversely affect our operating results.

Unexpected events, including, without limitation, fires at facilities, security breaches, cyber attacks, natural disasters, such as hurricanes and tornados, public health emergencies, war or terrorist activities, unplanned utility outages, supply disruptions, failure of equipment or systems or changes in laws and/or regulations impacting our business, could adversely affect our operating results. These events could result in disruption of customer service, physical damage or temporary closure of one or more key operating facilities, or the temporary disruption of information systems.

Failure to achieve and maintain effective internal controls could adversely affect our business and stock price.

Effective internal controls are necessary for us to provide reliable financial reports. All internal control systems, no matter how well designed, have inherent limitations. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. While we continue to evaluate our internal controls,

9

we cannot be certain that these measures will ensure that we implement and maintain adequate controls over our financial processes and reporting in the future. If we fail to maintain the adequacy of our internal controls or if we or our independent registered public accounting firm were to discover material weaknesses in our internal controls, we will not be able to conclude that we have effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act of 2002. Failure to achieve and maintain an effective internal control environment could cause us to be unable to produce reliable financial reports or prevent or detect fraud. This may cause investors to lose confidence in our reported financial information, which could have a material adverse effect on our stock price.

Failure to execute our business plan could adversely affect our business and stock price.

Successful execution of our business plan is not assured as there are several obstacles to success, including the economic environment, a competitive industry and entries by us into new markets. In addition, there can be no assurance that our efforts, if properly executed, will result in our desired outcome of improved financial performance.

RISKS RELATED TO MERGER

Our proposed merger may not be completed on a timely basis, or at all, and the failure to complete or delays in completing the merger could adversely affect our business, financial results and stock price.

On August 16, 2016, we announced that we entered into a merger agreement (the “Merger Agreement”) with Cintas Corporation and Bravo Merger Sub, Inc., a wholly-owned subsidiary of Cintas (“Merger Sub”), which provides that Cintas will acquire all of our outstanding shares of Class A common stock at a price of $97.50 per share in cash. Subject to the terms and conditions of the Merger Agreement, Merger Sub will be merged with and into the company (the “Merger”) with the company surviving the Merger as a wholly-owned subsidiary of Cintas. The Merger is subject to a number of customary conditions set forth in the Merger Agreement, including the approval of our shareholders and receipt of regulatory approvals, which are not within our control. We can provide no assurance as to when, or if, the conditions to the closing of the Merger will be satisfied or waived, that other events will not intervene to delay or result in the termination of the Merger, or that the Merger will be consummated or consummated in the timeframe or manner currently anticipated.

Any delay in closing or a failure to close could have a negative impact on our business, financial results and stock price as well as our relationships with our customers, suppliers or employees, and a negative impact on our ability to pursue alternative strategic transactions and/or our ability to implement alternative business plans.

The Merger Agreement contains provisions that restrict our ability to pursue alternatives to the Merger and, in specified circumstances, could require us to pay Cintas Corporation a termination fee.

Under the Merger Agreement, we are restricted, subject to certain exceptions, from initiating, soliciting, or knowingly facilitating or encouraging any inquiries or making of proposals or offers with regard to any inquiry, proposal or offer for a competing acquisition proposal or participating in any negotiations, discussions or furnishing any non-public information in connection therewith. If we receive a competing acquisition proposal and our board (after consultation with its outside counsel and financial advisors) determines that such proposal is more favorable to our shareholders than the Merger and the board recommends such proposal to our shareholders, Cintas may be entitled to terminate the Merger Agreement. Under such circumstances, we may be required to pay Cintas a termination fee equal to $60 million. These provisions could discourage a third party that may have interest in acquiring all or a significant part of the company from considering or proposal that acquisition, even if such third party were prepared to enter into a transaction that would be more favorable to us and our shareholders than the Merger.

Our business and financial results could be adversely impacted during the pendency of the Merger.

The announcement of the proposed Merger, whether or not consummated, may cause disruptions to our business or business relationships and create uncertainty surrounding our ongoing business operations, which could have an adverse impact on our financial condition, results of operations, cash flows and share price, including as a result of the following (all of which could be exacerbated by a delay in completion of the Merger):

• | the attention of our management may be directed to transaction-related considerations and may be diverted from the day-to-day operations of our business; |

• | our employees may experience uncertainty about their future roles with us, which might adversely affect our ability to hire, retain and motivate key personnel and other employees; |

• | our relationships with employees, customers, suppliers, regulators and other third parties with which we maintain business relationships may experience uncertainty prior to the closing of the Merger and seek alternative relationships with third parties or seek to terminate or re-negotiate their relationships with us; and |

• | the Merger Agreement restricts us from engaging in certain actions without the consent of Cintas, which may affect our ability to execute on our business strategies and attain our financial and other goals, including continuing efforts to |

10

transform our business in accordance with strategic goals established by our management and could prevent us from pursuing opportunities that may arise prior to the consummation of the Merger.

In addition, we have incurred, and will continue to incur, significant costs, expenses, and fees for professional services and other transaction costs in connection with the Merger, and many of these fees and costs are payable by us regardless of whether or not the Merger is consummated.

Legal proceedings may be filed against the Board in connection with the Merger, the outcomes of which are uncertain and could delay or prevent the completion of the Merger.

Legal proceedings may be filed by our shareholders against us or our board that challenge the proposed Merger. Among other remedies, these shareholders could seek to enjoin the merger. The outcome of any such litigation is uncertain. Such potential lawsuits could prevent or delay the consummation of the Merger from becoming effective within the anticipated timeframe and may result in substantial costs to us.

We have incurred and will incur direct and indirect costs as a result of the Merger.

We will incur substantial expenses in connection with completing the Merger. A portion of the transaction costs related to the Merger will be incurred regardless of whether the Merger is completed. Many of the expenses that will be incurred, by their nature, are difficult to estimate accurately. These costs could adversely affect our financial condition and results of operation prior to the Merger.

ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

ITEM 2. | PROPERTIES |

We occupy approximately 160 facilities located primarily in the United States and Canada. These facilities include our processing, branch, garment manufacturing, distribution and administrative support locations. We clean and supply rental items from approximately 50 facilities located in 40 cities in the United States and 10 cities in Canada. We own approximately 96% of our processing facilities, which average approximately 45,000 square feet in size.

ITEM 3. | LEGAL PROCEEDINGS |

We are involved in a variety of legal actions relating to personal injury, employment, environmental and other legal matters arising in the normal course of business, including, without limitation, those described below.

As part of its general enforcement efforts, over the past four years, the U.S. Department of Labor, Office of Federal Contract Compliance Programs (OFCCP) initiated compliance evaluations at a number of our locations to review and assess our current affirmative action activities and employment practices. To close all outstanding compliance evaluations, we entered into a Conciliation Agreement with the OFCCP agreeing to take proactive efforts to address any remaining issues or concerns that were raised by the agency, none of which we expect will have a material impact on our ongoing operations. All amounts that we agreed to pay under this agreement were within previously established reserves.

We may incur additional charges for environmental remediation for PCE and other contamination at facilities we own that have historically conducted dry cleaning operations. We discuss current environmental reserves in greater detail in Item 1A. Risk Factors and within our critical accounting policies in Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations and Supplementary Data in Note 12, "Commitments and Contingencies" of Notes to Consolidated Financial Statements.

We cannot predict the ultimate outcome of these or other similar matters with certainty and it is possible that we may incur additional losses in excess of established reserves. However, we believe the possibility of a material adverse effect on our results of ongoing operations or financial condition is remote, although the impact on reported operating results in any particular period may be material.

11

PART II

ITEM 5. | MARKET FOR REGISTRANT'S COMMON STOCK, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our Class A Common Stock, referred to herein as our "common stock," is quoted on the Global Select Market of The NASDAQ Stock Market LLC under the symbol "GK." The following table sets forth the high and low reported sale prices for the common stock as quoted on the Global Select Market of The NASDAQ Stock Market LLC, for the periods indicated.

High | Low | ||||||

Fiscal 2016 | |||||||

1st Quarter | $ | 72.89 | $ | 64.15 | |||

2nd Quarter | 72.10 | 61.17 | |||||

3rd Quarter | 73.34 | 51.94 | |||||

4th Quarter | 77.66 | 69.76 | |||||

Fiscal 2015 | |||||||

1st Quarter | $ | 57.85 | $ | 47.40 | |||

2nd Quarter | 72.54 | 53.62 | |||||

3rd Quarter | 74.11 | 65.69 | |||||

4th Quarter | 73.81 | 68.57 | |||||

As of August 23, 2016, we had 645 registered holders of record of our common stock.

We paid quarterly dividends aggregating to $30.4 million and $24.5 million in fiscal years 2016 and 2015, respectively. Dividends per share were $1.48 and $1.24 in fiscal years 2016 and 2015, respectively. We anticipate regular dividends in fiscal year 2017 will total $1.56 per share, or approximately $31.0 million. Our debt agreements contain restrictive covenants, which could limit the amount of cash dividends. See Note 5, "Long-Term Debt" of Notes to Consolidated Financial Statements for further information on our restrictive covenants.

ISSUER PURCHASE OF EQUITY SECURITIES

The table below sets forth information regarding repurchases we made of our common stock during the periods indicated.

Period | Total Number of Shares Purchased | Average Price Paid Per Share | Total Number of Shares Purchased as Part of Publicly Announced Plan | Maximum Dollar Value of Shares that May Yet Be Purchased Under the Plan | ||||||||||

March 27, 2016 - April 30, 2016 | 48,172 | $ | 72.91 | 48,172 | $ | 99,666,774 | ||||||||

May 1, 2016 - May 28, 2016 | 38,761 | $ | 72.58 | 38,761 | $ | 96,853,471 | ||||||||

May 29, 2016 - July 2, 2016 | 37,182 | $ | 75.59 | 37,182 | $ | 94,043,059 | ||||||||

Total | 124,115 | $ | 73.61 | 124,115 | $ | 94,043,059 | ||||||||

In August 2015, our Board of Directors authorized a $100.0 million increase in our share repurchase program, bringing the total amount authorized to $275.0 million as of July 2, 2016. Under this repurchase program, we repurchased 510,841 shares totaling $34.5 million in fiscal year 2016, 266,426 shares totaling $17.6 million in fiscal year 2015 and 204,819 shares totaling $11.7 million in fiscal year 2014. All of these repurchases were in open market transactions. As of July 2, 2016 we had approximately $94.0 million remaining under this authorization.

12

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth certain information as of July 2, 2016 with respect to equity compensation plans under which securities are authorized for issuance:

Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights (A) | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights (B) | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (A)) | ||||||

Equity compensation plans approved by security holders (1): | |||||||||

Restated Equity Incentive Plan (2013) (2) | 716,188 | $ | 42.94 | 1,206,048 | |||||

Employee Plans (3) | 1,221 | 21.11 | — | ||||||

Total: | 717,409 | $ | 42.90 | 1,206,048 | |||||

Equity compensation plans not approved by security holders: | |||||||||

None | — | — | — | ||||||

Total | 717,409 | $ | 42.90 | 1,206,048 | |||||

(1) | See Note 10, "Stockholders' Equity" of Notes to Consolidated Financial Statements. |

(2) | Our Restated Equity Incentive Plan (2013) was approved at our November 6, 2013 annual meeting of shareholders. The outstanding shares listed for this plan include the initial shares authorized under our 2006 and 2010 Equity Incentive Plans, as well as the additional shares authorized when the restated plan was approved. |

(3) | Includes our 1998 Stock Option and Compensation Plan. |

13

STOCKHOLDER RETURN PERFORMANCE GRAPH

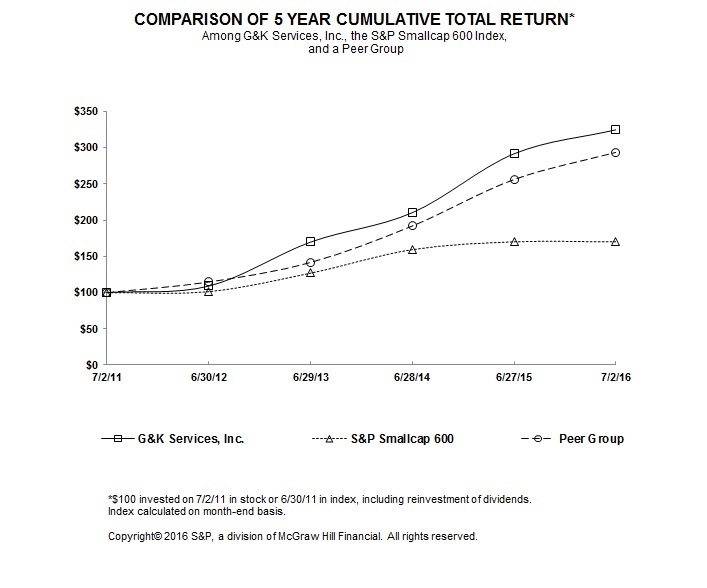

The following graph shows a five-year comparison of the cumulative total return on $100 invested in our common stock, the Standard and Poor’s ("S&P") SmallCap 600 Index and a Peer Group in the uniform services industry, consisting of Cintas Corporation and UniFirst Corporation.

The graph illustrates the cumulative values at the end of each succeeding fiscal year resulting from the change in the stock price, assuming a reinvestment of dividends. Over the five year period, G&K stock grew to $324.70, compared to $170.05 for the S&P SmallCap 600 and $293.56 for the Peer Group.

14

ITEM 6. | SELECTED FINANCIAL DATA |

The following table sets forth certain selected financial data. All amounts are in thousands, except per share data.

2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

(53 weeks) | (52 weeks) | (52 weeks) | (52 weeks) | (52 weeks) | |||||||||||||||

(1) | (2) | (3) | (4) | (5) | |||||||||||||||

Rental and direct sale revenue | $ | 978,041 | $ | 937,642 | $ | 900,869 | $ | 866,018 | $ | 828,953 | |||||||||

Net Income from Continuing Operations | 72,439 | 59,870 | 56,065 | 50,506 | 24,487 | ||||||||||||||

Per Share Data: | |||||||||||||||||||

Basic earnings per share from continuing operations | 3.65 | 3.01 | 2.83 | 2.62 | 1.32 | ||||||||||||||

Diluted earnings per share from continuing operations | 3.61 | 2.95 | 2.78 | 2.58 | 1.31 | ||||||||||||||

Dividends per share: | |||||||||||||||||||

Regular | 1.480 | 1.240 | 1.080 | 0.780 | 0.585 | ||||||||||||||

Special | — | — | 6.00 | — | 6.00 | ||||||||||||||

Total Assets | 921,537 | 928,197 | 923,519 | 897,286 | 873,731 | ||||||||||||||

Long-Term Debt | 231,148 | 243,600 | 266,230 | 175,000 | 218,018 | ||||||||||||||

Stockholders' Equity | 389,540 | 394,350 | 374,044 | 467,008 | 403,059 | ||||||||||||||

We utilize a 52 or 53 week fiscal year ending on the Saturday nearest June 30.

(1) | Fiscal year 2016 was a 53 week year, all other fiscal years presented above were 52 weeks. |

(2) | Fiscal year 2015 includes a pretax charge of $6.5 million associated with the withdrawal from several multi-employer pension plans and a pretax charge of $3.9 million associated with the environmental reserves established. Total assets reflects the retrospective adoption of a new accounting pronouncement which, among other things, requires deferred tax assets and liabilities to be combined and presented as noncurrent in our Consolidated Balance Sheets. See Note 1, "Summary of Significant Accounting Policies" of Notes to Consolidated Financial Statements for further information about prior year reclassifications. |

(3) | Fiscal year 2014 includes a pretax charge of $9.9 million associated with the withdrawal from several multi-employer pension plans and a pretax loss of $12.8 million on the divestiture of our Direct Sale Program Business and our Ireland Business, offset by the benefit of the change in estimated merchandise in-service amortization lives of $6.1 million. |

(4) | Fiscal year 2013 includes net pretax charges of $8.2 million related to restructuring and impairment charges and an increase in our estimated liability associated with the exit of a multi-employer pension plan, offset by the benefit of the change in estimated merchandise in-service amortization lives. |

(5) | Fiscal year 2012 includes a pretax charge of $24.0 million associated with withdrawing from a multi-employer pension plan. |

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion and analysis should be read in conjunction with the Consolidated Financial Statements and related notes thereto which are included herein. We utilize a 52 or 53 week fiscal year ending on the Saturday nearest June 30. Fiscal year 2016 was a 53 week year. Fiscal years 2015 and 2014 were 52 week years.

Overview

G&K Services, Inc., founded in 1902 and headquartered in Minnetonka, Minnesota, is a service-focused provider of branded uniform and facility services programs. We deliver value to our customers by enhancing their image and brand, and by promoting workplace safety, security and cleanliness. We accomplish this by providing a wide range of workwear and protective safety apparel through rental and direct purchase programs. We also supply a variety of facility products and services, including floor mats, towels, mops, restroom hygiene products, and first aid supplies.

We operate our business by executing a business strategy called our Game Plan, which is focused on delivering superior customer service and a commitment to operational excellence. Our Game Plan has four elements:

1. Keep our customer promise

2. Accelerate focused growth

3. Drive operational excellence, and

15

4. Strengthen our high performing team

Executing this strategy has led to significant improvement in our business performance and financial results, including solid organic revenue growth, expanded operating margins, and strong cash flows.

We use several financial metrics to measure the progress of our strategy. Our primary focus is on improving profitability, which we measure using operating income margin, and return on invested capital ("ROIC"), which we define as annualized adjusted income from operations after tax, divided by the sum of total debt less cash, plus stockholders’ equity. We are also focused on driving revenue growth, measured primarily using the organic growth rate, which is calculated using revenue, adjusted for foreign currency exchange rate differences, acquisitions, and divestitures. Finally, we strive to maximize cash flow provided by operating activities. In August 2015, we introduced a new set of financial goals for the company, called our 15/5 Goals. These goals call for the company to achieve 15% operating margin and 15% ROIC, along with 5% or greater average revenue growth by the end of fiscal year 2019.

Our industry continues to consolidate as many family-owned, local operators and regional companies have been acquired by larger providers. We have participated in this consolidation with an acquisition strategy focused on expanding our geographic presence and/or expanding our local market share in order to further leverage our existing production facilities. We remain active in evaluating select acquisitions that would strengthen our business.

Our operating results are affected by the volatility in key input costs, especially cotton, polyester, crude oil and foreign currency exchange rates, which may contribute to significant changes in merchandise, labor and energy costs.

We periodically adjust our operations to serve our customers in the most efficient and cost effective manner. As part of these adjustments, we may realign our workforce, close production or branch facilities or divest operations. We are continuously assessing our business and making necessary adjustments.

In the second quarter of fiscal year 2014, we divested our Ireland Business and in the third quarter of fiscal year 2014, we sold our Direct Sale Program Business. These divestitures have been reflected as Discontinued Operations in our Consolidated Statements of Operations. See Note 14, "Discontinued Operations" of Notes to Consolidated Financial Statements for additional information.

Critical Accounting Policies

The discussion of the financial condition and results of operations are based upon the Consolidated Financial Statements, which have been prepared in conformity with United States Generally Accepted Accounting Principles ("GAAP"). As such, management is required to make certain estimates, judgments and assumptions that are believed to be reasonable based on the information available. These estimates and assumptions affect the reported amount of assets and liabilities, revenues and expenses, and disclosure of contingent assets and liabilities at the date of the financial statements. Actual results may differ from these estimates under different assumptions or conditions.

Critical accounting policies are defined as the most important and pervasive accounting policies used, areas most sensitive to material changes from external factors and those that are reflective of significant judgments and uncertainties. See Note 1, "Summary of Significant Accounting Policies" of Notes to Consolidated Financial Statements for additional discussion of the application of these and other accounting policies.

Revenue Recognition and Allowance for Doubtful Accounts

Our rental operations business is largely based on written service agreements whereby we agree to pick up soiled merchandise, launder and then deliver clean uniforms and other products. The service agreements generally provide for weekly billing upon completion of the laundering process and delivery to the customer. Accordingly, we recognize revenue from rental operations in the period in which the services are provided. Revenue from rental operations also includes billings to customers for lost or damaged merchandise. Direct sale revenue is recognized in the period in which the product is shipped. Total revenues do not include sales tax as we consider ourselves a pass-through conduit for collecting and remitting sales tax.

Estimates are used in determining the collectability of accounts receivable. Management analyzes specific accounts receivable and historical bad debt experience, customer credit worthiness, current economic trends and the age of outstanding balances when evaluating the adequacy of the allowance for doubtful accounts. Significant management judgments and estimates are used in connection with establishing the allowance in any accounting period. We generally write-off uncollectible accounts receivable after all internal avenues of collection have been exhausted.

Inventory and Merchandise in Service

Inventories are stated at the lower of first-in, first-out cost or market. Merchandise placed in service to support our rental operations is amortized into cost of rental operations over the estimated useful lives of the underlying items, on a straight-line basis, which results in a matching of the cost of the merchandise with the weekly rental revenue generated by the merchandise.

16

Estimated lives of rental merchandise in service range from six months to four years. In establishing estimated lives for merchandise in service, management considers historical experience and the intended use of the merchandise.

We review the estimated useful lives of our in-service inventory assets on a periodic basis or when trends in our business indicate that the useful lives for certain products might have changed. The selection of estimated useful lives is a sensitive estimate in which a change in lives could have a material impact on our results of operations.

We estimate losses related to inventory obsolescence by examining our inventory to determine if there are indicators that carrying values exceed the net realizable value. Significant factors that could indicate the need for inventory write-downs include the age of the inventory, anticipated demand for our products, historical inventory usage, revenue trends and current economic conditions. We believe that adequate adjustments have been made in the Consolidated Financial Statements; however, in the future, product lines and customer requirements may change, which could result in an increase in obsolete inventory reserves or additional inventory impairments.

Environmental Costs

We accrue various environmental related costs, which consist primarily of estimated clean-up costs, fines and penalties, when it is probable that we have incurred a liability and the amount can be reasonably estimated. When a single amount cannot be reasonably estimated but the cost can be estimated within a range, we accrue the minimum estimated amount. This accrued amount reflects our assumptions regarding the nature of the remedy and the outcome of discussions with regulatory agencies. Changes in the estimates on which the accruals are based, including unanticipated government enforcement actions or changes in environmental regulations, could result in higher or lower costs. Accordingly, as investigations and other actions proceed, it is likely that adjustments in our accruals will be necessary to reflect new information. While we cannot predict the ultimate outcome of any of these matters with certainty, we believe the possibility of a material adverse effect on our results of ongoing operations or financial position is remote, although the impact on reported operating results in any particular period may be material.

Accruals for environmental liabilities are included in the "Accrued expenses - Other" and "Other Noncurrent Liabilities" line items in the Consolidated Balance Sheets. The cost of operating and maintaining environmental control equipment is charged to expense in the period incurred.

For additional information see Note 12, "Commitments and Contingencies" of Notes to Consolidated Financial Statements.

Historically, we have borne our property remediation costs as part of our ongoing operations. We evaluate potential environmental liabilities on a regular basis, and are involved in various property remediation efforts. In particular, we have three projects nearing completion, which we expect will be completed within previously established reserves. We also have four other projects on which we are currently working.

As part of our continued efforts on the four projects mentioned above, in the fourth quarter of 2015, we determined it was likely that the parties that were contractually obligated to remediate contamination at three of our previously purchased locations would not be able to continue to meet these obligations because of their respective financial condition. These projects relate to acquisitions which date as far back as the 1970s; the most recent one was in 2007. As a result of the foregoing, we recorded a charge of $3.9 million to increase our remediation-related reserves for these projects to $4.7 million as of June 27, 2015. As of July 2, 2016 our remediation-related reserves is $3.6 million as discussed in Note 12, "Commitments and Contingencies" of Notes to Consolidated Financial Statements.

In order to determine whether any additional exposure for contamination remediation exists, we have conducted environmental assessments on an additional six sites which we acquired that had historical dry cleaning operations. The environmental assessment of four of these sites is complete, with no further action required. Two remain under investigation. With respect to two these sites, while we believe additional costs are probable, they are not yet reasonably estimable. Therefore beyond amounts to cover our ongoing assessments, we have not recorded any reserve for these properties. While such charges may be material, we believe the likelihood that any charges will have a material adverse effect on our results of ongoing operations or financial position is remote, although the impact on reported operating results in any particular period may be material.

Goodwill, Intangible Assets and Other Long-Lived Assets

The fair value of the purchase price of acquisitions in excess of the fair value of the underlying net assets is recorded as goodwill. Non-competition agreements that limit the seller from competing with us for a fixed period of time and acquired customer contracts are stated at fair value upon acquisition and are amortized over the terms of the respective agreements or estimated average life of an account, which ranges from five to 20 years.

We test goodwill for impairment in the fourth quarter of each fiscal year or upon the occurrence of events or changes in circumstances that indicate that the asset might be impaired. We have determined that the reporting units for our goodwill impairment review are our operating segments. Based on this analysis, we have identified two reporting units as of the fiscal year 2016 testing date. Our reporting units are U.S. Rental operations and Canadian Rental operations, with respective goodwill

17

balances of $270.0 million and $54.5 million at July 2, 2016. During fiscal year 2014, we divested our Direct Sales reporting unit. Other than this divestiture, there have been no other changes to our reporting units or in the allocation of goodwill to each respective reporting unit in fiscal years 2016, 2015 or 2014.

In fiscal years 2016, 2015 and 2014, we performed a qualitative assessment to test our reporting units' goodwill for impairment. Based on our qualitative assessment, we determined that it is more likely than not (i.e., a likelihood of more than 50%) that the fair value of all reporting units is greater than their carrying amount and therefore no impairment of goodwill was identified. All goodwill associated with our Direct Sales reporting unit had been previously impaired and written off prior to divestiture. During the second quarter of fiscal year 2014, we recorded an impairment loss related to the divestiture of our Ireland Business of $0.3 million.

Long-lived assets, including definite-lived intangible assets, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of such assets may not be recoverable. Recoverability is measured by comparison of the carrying amount of the asset to the future undiscounted cash flows the asset is expected to generate. If the carrying value is not projected to be recovered by future undiscounted cash flows, the amount of any impairment is measured as the difference between the carrying value and the fair value of the impaired asset. There were no impairment charges for intangible assets in fiscal years 2016, 2015 or 2014.

Future events could cause us to conclude that impairment indicators exist and that goodwill, other intangibles and other long-lived assets associated with acquired businesses are impaired. Any resulting impairment loss could have a material impact on our financial condition and results of operations.

Income Taxes

Provisions for federal, state, and foreign income taxes are calculated based on reported pretax earnings and current tax law. Significant judgment is required in determining income tax provisions and evaluating tax positions. We periodically assess our liabilities and contingencies for all periods that are currently open to examination or have not been effectively settled based on the most current available information. If it is more likely than not that our tax position will be denied, we record our best estimate of the resulting tax liability and any applicable interest and penalties in the Consolidated Financial Statements.

Deferred tax assets and liabilities are recorded for temporary differences between the tax basis of assets and liabilities and their reported amounts in the financial statements, using statutory rates in effect for the year in which the differences are expected to reverse. We present the tax effects of these deferred tax assets and liabilities separately for each major tax jurisdiction. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the results of operations in the period that the changes are enacted. We record valuation allowances to reduce deferred tax assets when it is more likely than not that some portion of the asset may not be realized. We evaluate our deferred tax assets and liabilities on a periodic basis. We believe that we have adequately provided for our future income tax obligations based upon current facts, circumstances and tax law.

18

Results of Operations

The percentage relationships to revenues of certain income and expense items for the three fiscal years ended July 2, 2016, June 27, 2015 and June 28, 2014, and the percentage changes in these income and expense items between years are presented in the following table:

Percentage of Revenues | Percentage Change | |||||||||||||

Years Ended | Between Years | |||||||||||||

Fiscal 2016 | Fiscal 2015 | Fiscal 2014 | F16 vs. F15 | F15 vs. F14 | ||||||||||

Rental and direct sale revenue | 100.0 | % | 100.0 | % | 100.0 | % | 4.3 | % | 4.1 | % | ||||

Cost of rental and direct sale revenue | 65.8 | 66.2 | 66.0 | 3.5 | 4.4 | |||||||||

Gross margin | 34.2 | 33.8 | 34.0 | 5.8 | 3.5 | |||||||||

Pension withdrawal and associated expenses | — | 0.7 | 1.1 | (100.0 | ) | (34.0 | ) | |||||||

Selling and administrative | 21.7 | 22.3 | 22.2 | 1.7 | 4.4 | |||||||||

Income from continuing operations | 12.5 | 10.8 | 10.7 | 21.2 | 5.3 | |||||||||