Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Pure Storage, Inc. | pstg-ex991_6.htm |

| 8-K - 8-K - Pure Storage, Inc. | pstg-8k_20160525.htm |

Exhibit 99.2

Dietz on the Day: Delivering Growth at Scale and Pure Storage Q2 Results

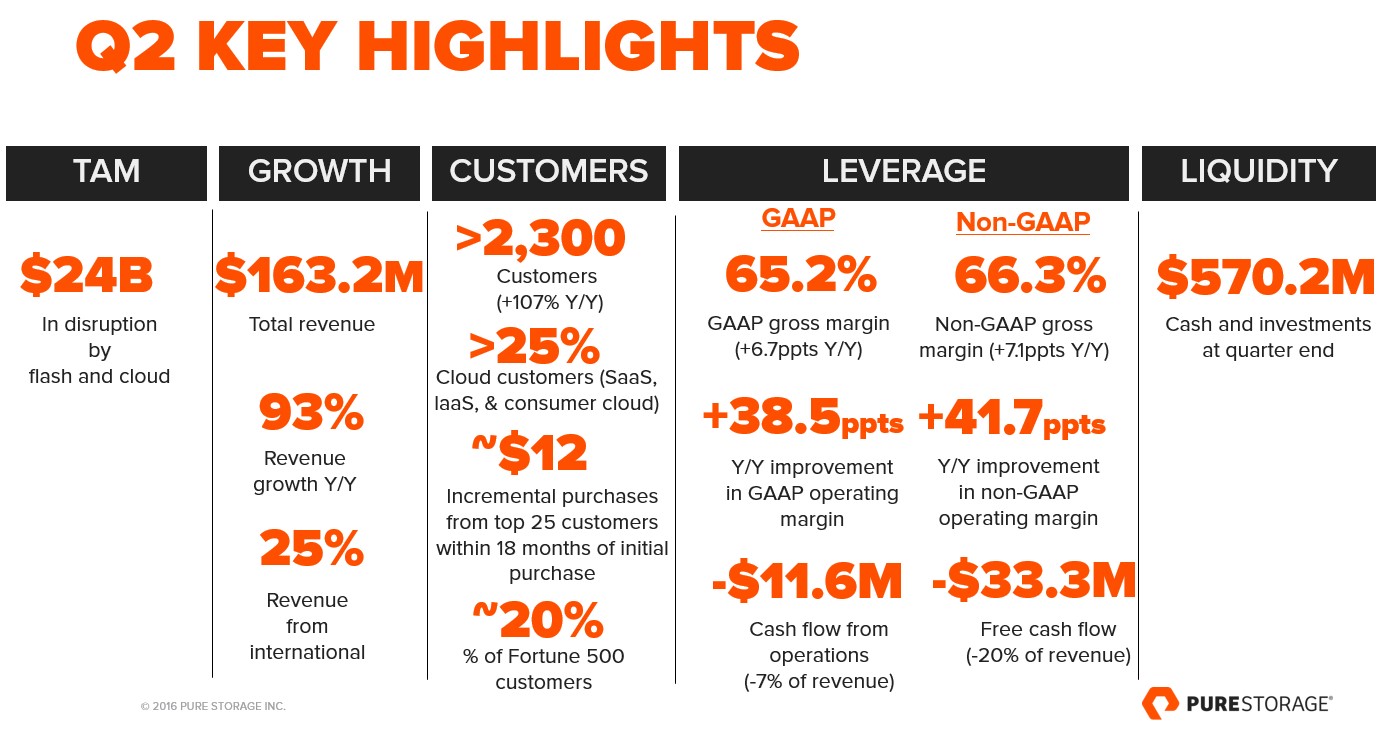

Pure Storage (NYSE:PSTG) is continuing its unprecedented growth streak: In the second quarter, our revenues were $163 million, up 93% from the year-ago quarter, and beating the midpoint of our guidance by 5%.

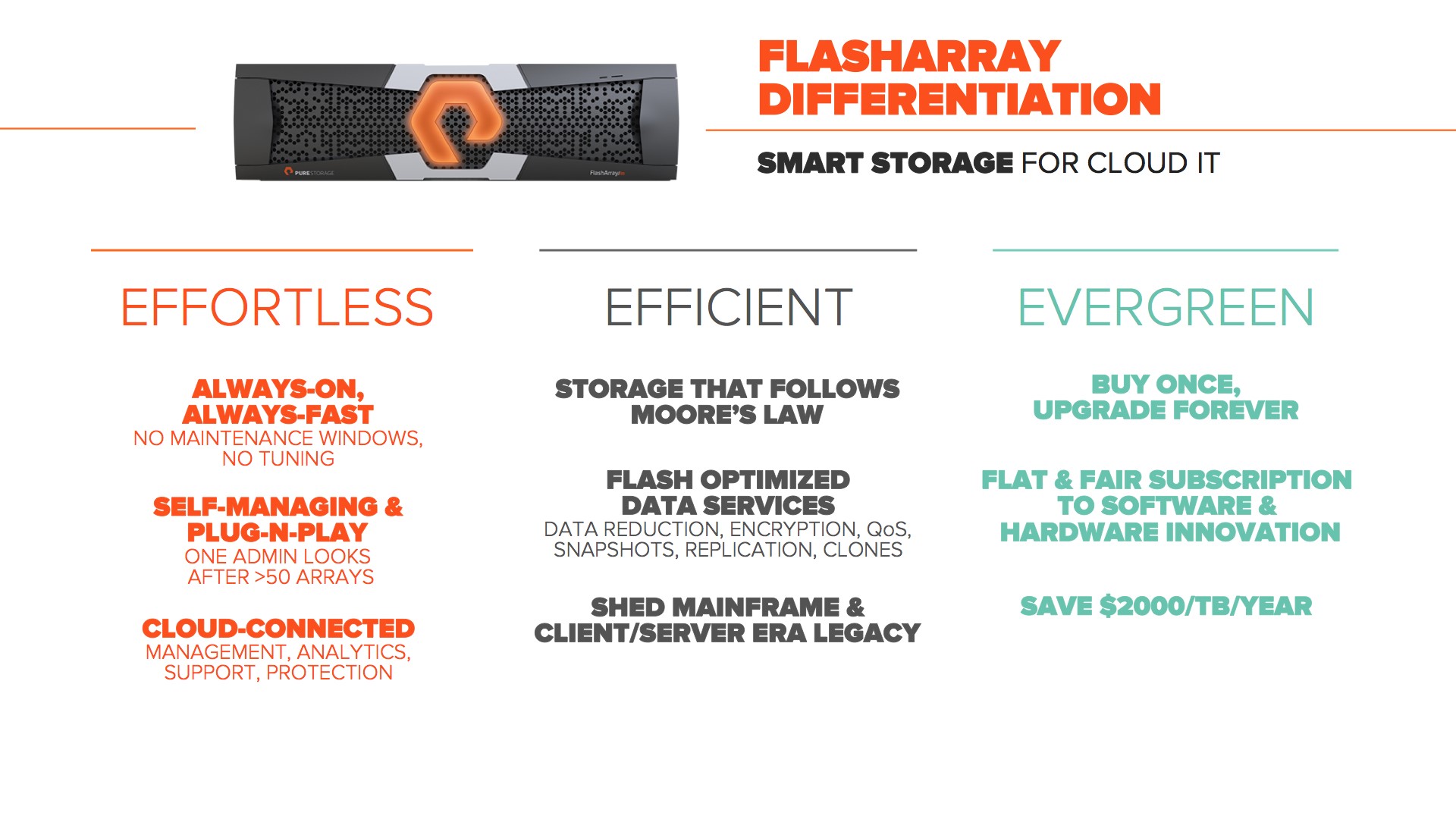

How can Pure grow so explosively in a hyper competitive storage market in which most of our competitors are flat to shrinking? First, Pure pioneered the all-flash array (AFA) category, and is the benchmark to which other vendors compare. But more importantly, from the outset our mission was to reinvent data center storage, not simply drive a media shift. Pure Storage is special because we innovated to deliver a dramatically better customer experience, not because we offer all-flash. Apple, after all, didn’t set out to build an all-flash phone. They revolutionized the world through the advent of the smartphone and the mobile Internet experience it delivered - it wasn’t about moving from disks to flash (the original iPods had a disk inside). The same thing is now unfolding in enterprise storage, as customers rip out complex, services intensive mainframe and client-server era technology in favor of Smart Storage, offering the simplicity, automation, resiliency and customer friendly business model essential for cloud IT. Smart storage allows customers to store data for far less cost, protect it with strong security, and delivers the bandwidth necessary to mine that data for new analytic insights or even machine learning.

In the quarter, Pure increased our customer count by over 350 to more than 2,300, including new customers. One of these is Sally Beauty Supply, who selected Pure to improve performance and enable a simple, cost effective disaster recovery solution. International markets contributed 25% of revenue, a new high for Pure, as our business continues to gain traction overseas at outfits like British Airways and The University of Tokyo. We now provide storage to nearly 100 firms within the Fortune 500, up from about 50 this time last year.

At the same time Pure is delivering excellent growth at scale, we are increasing our operating leverage. GAAP and non-GAAP operating margin, at -36.4% and -19.3%, improved more than 2X and 3X, respectively, from our year-ago quarter. The company remains on track to reach sustained positive cash flow in the second half of next year, and our use of cash since our IPO has been modest -$32 million in combined free cash flow over the past four quarter, all while driving $585 million in revenue over the same period. Given our more than $570 million in cash and zero debt, we are uniquely well positioned to execute on our vision of building a profitable, multi-billion dollar business and the #1 global brand in storage over the next few years.

FlashBlade. Like its older sibling FlashArray, Pure Storage’s new FlashBlade is far faster, simpler, more reliable and less costly to own than the disk-centric storage it is replacing. Unstructured data storage based on mechanical disk, as well as that of the public cloud, is big and slow, while FlashBlade is big and fast. FlashBlade is poised to redefine big data/capacity-optimized storage as FlashArray reset the bar for performance storage, both products being years ahead of the competition.

While our top line results did not depend on our doing so, this quarter we shipped our first FlashBlade production systems to customers (one quarter ahead of plan) - one such customer is Baylor Miraca Genetics Labs who is using FlashBlade to transform its genetics research pipeline to radically improve competitiveness in the marketplace. They chose Pure in part because their physical footprint came in at 1/10th of that offered by competing solutions. In their own words:"All of your competitors came in and treated us as a transaction. From the moment your team walked in, I could sense the passion to truly transform us, not sell us." Another new FlashBlade user is one of our existing clients, Farm Bureau of Michigan, who chose FlashBlade for its ease of storage allocation and ability to deliver high performance infrastructure to the business.

We do not expect FlashBlade to be material to our financials this year, but it bodes well that the technology is being put to work in such future growth areas as software development, chip design, self-driving cars, Internet of Things, genomics and movie making. With the unstructured data market growing at greater than 20% CAGR, we are convinced our FlashBlade business will mirror that of FlashArray, and with Pure already operating at scale, we expect its rate of growth will be well faster.

You can read more about FlashBlade in IDC’s Putting File- and Object-Based Storage Vendors En Garde and The New York Times: “As a Data Deluge Grows, Companies Rethink Storage.”

Differentiation. Putting SSDs into 20+ year old storage architectures does not make them modern any more than the failed effort of tape vendors to add mechanical disk to their tape farms did. Smart Storage can pay for itself, in terms of dramatically reduced cost of operations, in strengthening security, in density and energy efficiency, as well as in enabling the transformation of business applications through greater performance. There’s ample evidence of Pure Storage’s differentiation versus legacy retrofits:

• | Earlier this week, we learned that Pure Storage is for the third year in a row positioned in the Leaders Quadrant in Gartner’s 2016 Magic Quadrant for Solid-State Arrays. We believe this is the most comprehensive, major industry report derived from thousands of Gartner interactions with storage customers globally and is the ultimate guide for storage shoppers; |

• | Pure Storage’s Net Promoter Score is now up to 83 (as audited by Satmetrix), and is in the top 1% of scores they have seen across consumer and enterprise businesses. Pure is averaging more than 50 points higher in NPS than third party scores for our major competitors; and |

• | Pure Storage became a global top 10 share player in storage faster than any company in history, and we continue our growth at scale. |

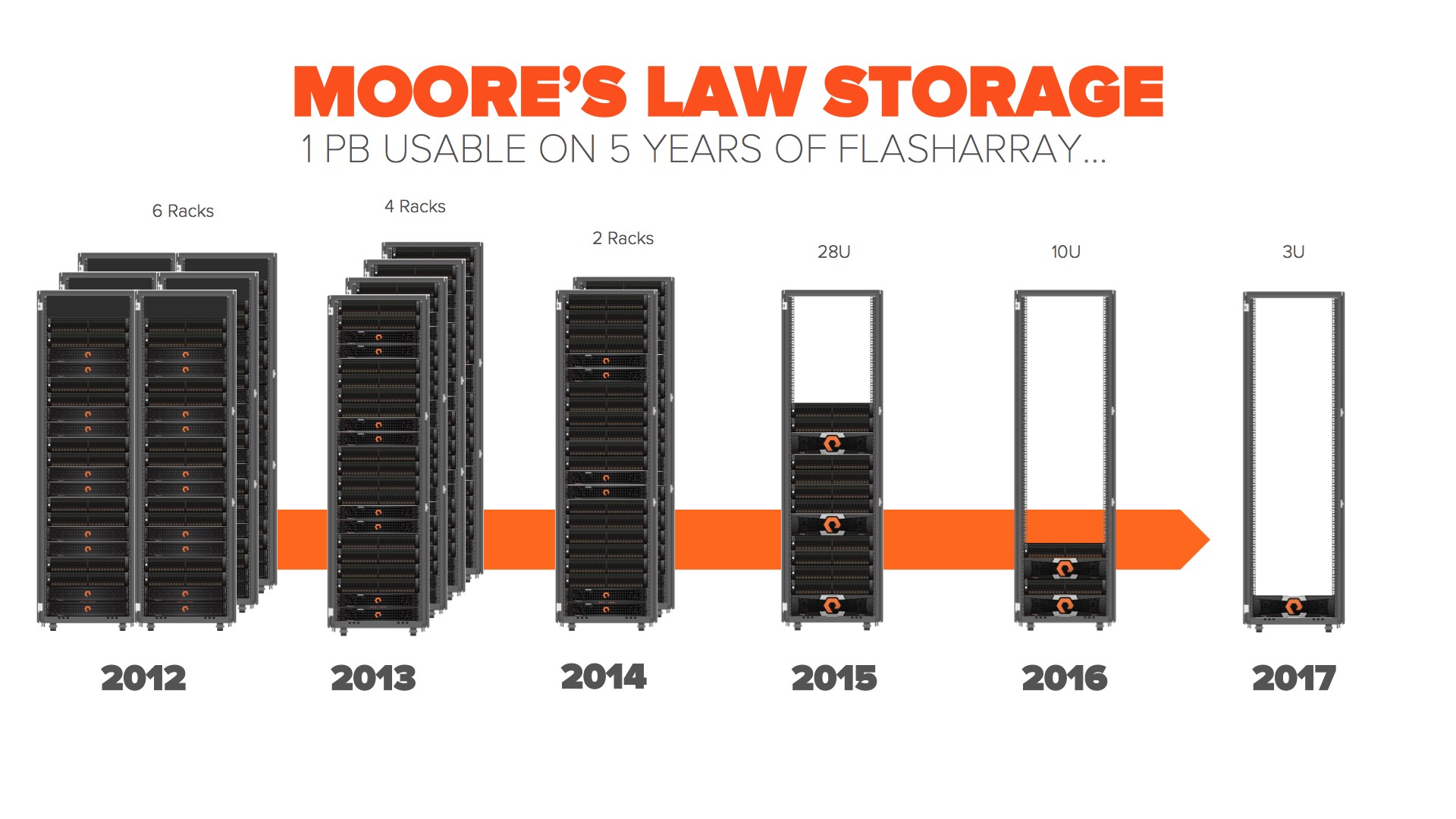

Why aren’t Pure’s competitors able to modernize their storage? Why did Blackberry and Motorola lose the smartphone market to Apple and Samsung? Because it turns out that getting the software, hardware and business model right to make storage smart is supremely difficult. This, rather than the transition to flash, is why their businesses are shrinking while ours is growing. In our view, it remains unclear if any vendors currently above us in the top 10 will be able to adapt their last century technology to the demands of modern IT. The pace of change required to keep up with Moore’s Law is, out of reach for legacy designs and business models: consider the progression of 1PB of Pure Storage over 5 years under our Evergreen architecture and business model.

For instance, FlashArray's upgradable design means that customers won't be left behind as the memory access protocol NVMe supercedes those designed for mechanical disk, representing yet another difficult leap for legacy storage. For more on the storage disruption, please see our blog This Is Your Father’s Storage Industry, But Not for Long.

Cloud. Over time most application software is going to be managed by those that develop it, which is why Software as a Service (SaaS) is such an important factor in the cloud discussion. When we think about SaaS, we think of companies like Intuit, Workday and ServiceNow, but consumer software is also delivered as a service --- think Apple, Facebook and LinkedIn. While SaaS and consumer cloud companies often use AWS, Azure and Google Cloud for certain workloads, the majority are building their own specialized clouds for their customer facing, performance intensive applications, finding that they can deliver higher service levels for lower cost than with their public cloud alternatives.

SaaS & Consumer cloud is a market Pure is uniquely well positioned to play in. Sales to cloud customers (Software as a Service/SaaS, Infrastructure as a Service/IaaS, and consumer cloud) continue to represent more than a quarter ofour business. Pure continues to work with cloud customers like LinkedIn, Intuit, Workday and ServiceNow. Also this quarter, NIFTY Corporation, the leading public cloud provider in Japan, chose Pure over a host of computing solutions to expand its business in APAC. Evergreen Storage helps future-proof NIFTY's cloud business strategy, allowing for rapid, painless capacity growth as NIFTY's customer base expands.

In SaaS alone, Pure has over 150 customers, a substantial portion of which made purchases in Q2, and according to Gartner, the SaaS market continues to see strong growth(20%+ expected in 2016). While still unlikely that we will supply storage to “do it yourselfers” Amazon or Google, IDC expects the SaaS and consumer cloud segment, in which Pure is enjoying success, to be larger than the hyper-scale public cloud in 2019.

Partners. In Q2, we continued to advance our converged infrastructure partnership with Cisco, delivering two new Cisco Validated Designs (CVDs) for our joint FlashStack solution, which embody thousands of hours of testing to ensure faster more reliable deployment for customers (Cisco blog here). We also continued to strengthen our relationships with our channel partners, whodrove nearly 80% of new logo wins in the quarter. What’s it like to be a partner working with Pure? Here’s what Kevin Prahm, VP of Sales and Operations, at Applied Computer Solutions (ACS) has shared with us:

"Historically, datacenters were a significant cost center but now customers are exploring new technologies and methodologies in order to drive additional efficiencies, lower costs,and create competitive advantages," said Kevin Prahm, VP of Sales and Operations, ACS. "Pure Storage offers customers a unique technology coupled with an innovative business model. Whether customers become interested in the Love Your Storage Guarantee or the Evergreen Storage business model, Pure continues to transform the storage market and has allowed ACS to create new and differentiated opportunities.”

Thank you. Let me close with our deep gratitude for all those that have joined Pure along our journey, including our customers, partners, investors and employees. Despite fierce competition, Pure remains on track toward our long term goal of building the leading global brand in the $24 billion data center storage market.

Forward Looking Statements. This post contains forward-looking statements regarding industry and technology trends, our strategy, positioning and opportunity, and our products (including FlashArray and FlashBlade), business and operations, including our future margins, growth prospects and operating model. Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results may differ materially from the results predicted, and reported results should not be considered as an indication of future performance. The potential risks and uncertainties that could cause actual results to differ from the results predicted include, among others, those risks and uncertainties included under the caption “Risk Factors” and elsewhere in our filings and reports with the U.S. Securities and Exchange Commission, including, but not limited to, our Quarterly Report on Form 10-Q for the fiscal year ended July 31, 2016, which is available on our investor relations website at investor.purestorage.com and on the SEC website at www.sec.gov. Additional information will also be set forth in our Quarterly Report on Form 10-Q for the quarter ended July 31, 2016. All information provided in this post is as of August 25, 2016, and we undertake no duty to update this information unless required by law.

Non-GAAP Financial Measures. This post contains certain non-GAAP financial measures about the company’s performance. For the most directly comparable GAAP financial measures and a reconciliation of these non-GAAP financial measures to GAAP measures, please see our earnings release issued on August 25, 2016, which includes tables captioned “Reconciliations of non-GAAP results of operations to the nearest comparable GAAP measures” and “Reconciliation from net cash used in operating activities to free cash flow.”