Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NATIONAL BEVERAGE CORP | fizz20160824_8k.htm |

Exhibit 99.1

|

|

|

|

NASDAQ: FIZZ | |

|

For Immediate Release | |

|

Contact: Office of the Chairman, Grace Keene |

NATIONAL BEVERAGE CORP.

CONFIRMS PREDICTED

HISTORIC FIRST QUARTER

FORT LAUDERDALE, FL, August 24, 2016 . . . National Beverage Corp. (NASDAQ: FIZZ) today confirmed a triumphant first quarter of its Fiscal Year 2017.

“When does authenticity stop being a trait and become a stalwart description?” was the question posed to Nick A. Caporella, Chairman and Chief Executive Officer. “When absolute performance demands it,” was his answer!

(in millions except EPS)

For the first quarter ended July 30, 2016 -

|

Op. |

Net |

|||||||||||||||||||||||

|

Revenues |

Income |

Income |

EPS |

EBITDA * |

Cash |

|||||||||||||||||||

|

FY 2017 |

$ | 217 | $ | 44 | $ | 29 | $ | 0.62 | $ | 47 | $ | 133 | ||||||||||||

|

Growth |

17 | % | 69 | % | 69 | % | 68 | % | 62 | % | 100 | % | ||||||||||||

Over the past couple of years, National Beverage has indicated that the industry was evolving and the company was heavily engaged in a metamorphic transformation. Well, FY2016 and first quarter FY2017 definitely confirms this – leaving no doubt that National Beverage is leading this healthy revolution.

“Much is happening to us, for us and with us that point to and test our authenticity. From our founding through our last preview press release dated August 10, 2016, we have strived to be genuine and extremely straightforward in our views with our consumers and shareholders. When questioned about the value of our brands or our specific new course within the industry, we articulated with exceptional results,” emphasized Caporella.

-more-

National Beverage Corp.

Page 2

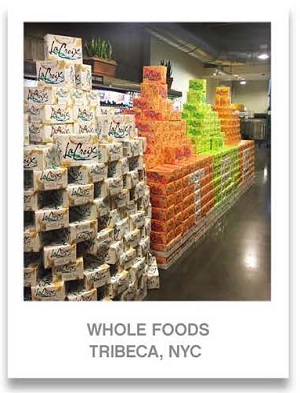

“We coined the term ‘Innocent’ and placed it on our packages. We continue to develop and design as though we are stimulated directly by our consumers. We are generous and rewarding to our employees, consumers, community and shareholders because we want to be! We manage National Beverage like we own it, because we do. We work to provide such an exciting future as though we were the only shareholders of this wonderful enterprise, because we nearly are! We are the future of America because we offer better choices for better health. Our brands, LaCroix and Shasta Sparkling Water SDA (soft drink alternative), are improving lives while smartly stimulating consumer self-esteem. Additional capacity and expanding distribution are intensifying our future revenues.

While some play Truth or Dare, we play . . . Authentic and Healthy,” concluded a proud Caporella.

National Beverage’s iconic brands are the genuine essence . . . of America.

“Patriotism” – If Only We Could Bottle It!

Fun, Flavor and Vitality . . . the National Beverage Way

|

|

|

|

-more-

National Beverage Corp.

Page 3

National Beverage Corp.

Consolidated Results for the Periods Ended

July 30, 2016 and August 1, 2015

| Balance Sheet Statistics | Three Months Ended | ||||||||||

| July 30, 2016 vs. August 1, 2015 | July 30, 2016 | August 1, 2015 | |||||||||

| (in thousands, except per share amounts) | |||||||||||

|

Cash |

Net Sales |

$ | 217,108 | $ | 185,386 | ||||||

| $132.6 million - Up 100% |

|

||||||||||

|

Net Income |

$ | 28,995 | $ | 17,113 | |||||||

|

Working Capital |

|||||||||||

| $176.7 million - Up 57% |

|

Earnings Per |

|||||||||

| Common Share |

|

||||||||||

|

Total Assets |

Basic |

|

$ | .62 | $ | .37 | |||||

| $350.3 million - Up 30% |

|

Diluted |

|

$ | .62 | $ | .37 | ||||

|

Average Common Shares |

|||||||||||

| Outstanding |

|

||||||||||

| Basic |

|

46,556 | 46,397 | ||||||||

| Diluted |

|

46,767 | 46,591 | ||||||||

This press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include fluctuations in costs, changes in consumer preferences and other items and risk factors described in the Company's Securities and Exchange Commission filings. The Company disclaims an obligation to update any such factors or to publicly announce the results of any revisions to any forward-looking statements contained herein to reflect future events or developments.

*Although the Company reports its financial results in accordance with accounting principles generally accepted in the United States ("GAAP"), management believes that the disclosure of EBITDA, a non-GAAP financial measure, may provide users with additional insights into the operating performance of the business. EBITDA (in millions) for the quarter ended July 30, 2016 of $47.1 is calculated by adding the following expenses back to Net Income: Depreciation and Amortization of $3.1; Net Interest Expense of $0; and Provision for Income Taxes of $15.1.