Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - XERIANT, INC. | banj_ex321.htm |

| EX-31.1 - CERTIFICATION - XERIANT, INC. | banj_ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

xANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2015

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission file number 000-54277

Banjo & Matilda, Inc. |

(Exact name of registrant as specified in its charter). |

Nevada | 27-1519178 | |

State or other jurisdiction of incorporation or organization | (I.R.S. Employer Identification No.) | |

1221 2nd St Santa Monica, CA, 90401 | ||

(Address of principal executive offices) |

Registrant's telephone number, including area code: 310 890 5652

Securities registered under Section 12(b) of the Act:

Title of each class: | Name of each exchange on which registered: | |

None | None |

Securities registered under Section 12(g) of the Act:

Common Stock, $0.00001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes ¨ No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | ¨ | Smaller reporting company | x |

(Do not check if a smaller reporting company) |

| ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity of the registrant held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's second fiscal quarter ended December 31, 2014 was $ 6,351,557.

As of August 23, 2016, the registrant had outstanding 38,108,146 shares of common stock.

Documents Incorporated by Reference: None.

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this "Report") contains "forward-looking statements" within the meaning of the Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions, or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as "anticipate," "believes," "can," "could," "may," "predicts," "potential," "should," "will," "estimate," "plans," "projects," "continuing," "ongoing," "expects," "intends," and similar words or phrases. Accordingly, these statements are only predictions and involve estimates, known and unknown risks, assumptions, and uncertainties that could cause actual results to differ materially from those expressed in them. Our actual results could differ materially from those anticipated in such forward-looking statements as a result of several factors more fully described in Item 1A of this Report under the caption "Risk Factors" and elsewhere in this Report, including the exhibits hereto.

All forward-looking statements are necessarily only estimates of future results, and actual results may differ materially from expectations. The inclusion of this forward-looking information should not be regarded as a representation by us or any other person that the future plans, estimates, or expectations contemplated by us will be achieved. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, and financial needs. You are cautioned not to place undue reliance on such statements which should be read in conjunction with the other cautionary statements that are included elsewhere in this Report. Any forward-looking statement speaks only as of the date on which it is made and we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws.

Use of Certain Defined Terms

Except where the context otherwise requires and for the purposes of this Report only:

· | The "Registrant," "the Company," "we," "our," "us" and similar phrases refer to Banjo & Matilda, Inc., a Nevada corporation (formerly known as Eastern World Solutions, Inc.) which is a reporting company under the Exchange Act. |

· | "Banjo & Matilda" and "B&M" refer to the two operating subsidiaries Banjo & Matilda (Australia) Pty Ltd, a corporation organized under the laws of Australia, and Banjo & Matilda (USA), Inc a corporation organized under the laws of Delaware, both wholly-owned subsidiaries of the Registrant. |

· | "Exchange Act" refers to the Securities Exchange Act of 1934, as amended. |

· | "SEC" refers to the Securities and Exchange Commission. |

· | "Securities Act" refers to the Securities Act of 1933, as amended. |

Item 1. Business

Banjo & Matilda (www.banjoandmatilda.com) is an e-commerce only, direct to consumer accessible luxury brand targeting high consumers in the Generation X & Baby Boomer demographics.

Corporate History

Banjo & Matilda, Inc. was originally incorporated in Nevada on December 18, 2009 under the name Eastern World Group, Inc. and changed its name to Banjo & Matilda, Inc. on September 24, 2013 and is now located in Santa Monica, California.

| 3 |

Acquisition of Banjo & Matilda Pty Ltd.

Prior to the acquisition of Banjo & Matilda Pty Ltd. under the Exchange Agreement defined below, we were a development stage company without any operating revenues or earnings. Time and resources of the then-management was dedicated to organize the Registrant, obtain interim financing (including a public offering in December 2010 of a minimum of 1.5 million shares of common stock for $75,000 by former management of the Registrant), and develop a business plan.

On November 14, 2013, we entered into a Share Exchange Agreement (the "Exchange Agreement") with Banjo & Matilda Pty Ltd, ("Banjo & Matilda") and the shareholders of Banjo & Matilda ("B&M Shareholders"). Pursuant to the Exchange Agreement, 100% of the issued and outstanding capital stock of Banjo & Matilda was acquired, making it a wholly-owned subsidiary of ours (the "Transaction"). There was no prior relationship between the Company and its affiliates and Banjo & Matilda and its affiliates.

In consideration for the purchase of 100% of the issued and outstanding capital stock of Banjo & Matilda under the Exchange Agreement, we issued B&M Shareholders an aggregate of 18,505,539 restricted shares of common stock of the Company.

On November 15, 2013, we entered into an employment agreement with the Banjo & Matilda co-founders: Brendan Macpherson, as the Chief Executive Officer of the Registrant, and Belinda Storelli Macpherson, as its Chief Creative Officer. Each employment agreement has an initial term of three years and will automatically renew for an additional term of three years. Either party may elect not to renew the Employment Agreement by written notice delivered to the other party no later than August 30th of the final year of the term. In addition, either employee may terminate the employment agreement upon 30 days written notice.

On July 1st 2015, the operations of Banjo & Matilda Pty Ltd were transferred to Banjo & Matilda (Australia) Pty Ltd. A wholly owned subsidiary of Banjo & Matilda Inc.

Company Overview

Banjo & Matilda was founded by Australian born Creative Director Belinda Storelli Macpherson in 2009, after an extensive career in publicity, fashion publishing and marketing. Prior company's where Belinda worked include Grazia, Harpers Bazaar and Maddison fashion magazines, major film studios including Warner Brothers, Universal Studios and Columbia Tri-Star Pictures; and, the Australian tourism industry marketing body Tourism Australia. Belinda also founded her own publicity firm "Global Artist" which she successfully sold to a larger group in 2002.

Belinda identified the emerging casualization of the luxury fashion market and combined her passion for cashmere, the Australian beach lifestyle and frustration over the lack of accessible quality cashmere to create a new, more relevant luxury brand. One that was born on line as a direct to consumer e-commerce model thereby eliminating the unnecessary margin's that department and specialty stores take, enabling the brand to focus on a luxury quality product, but without inflated luxury prices.

General Market issues; Market opportunity

The traditional apparel market sales model is experiencing significant changes due to the challenges physical store retailers are experiencing. This is negatively impacting fashion businesses which rely primarily on the traditional wholesale to retail sales due to lower sales, higher returns and discounts caused by struggling physical retailers. E-commerce spending in the apparel and luxury sectors has reached a critical mass which enables brands like Banjo & Matilda to build a direct to consumer e-commerce model which cuts out the unnecessary retail mark up to department and specialty stores and build a successful brand/business.

Total global apparel sales reached $1.1T+ in 2014 with personal luxury goods spending accounting for $260B, equal to approximately 25% of apparel sales. Online luxury goods sales are growing 4 times faster than physical store sales, reaching $15B in 2014, and are expected to triple through 2019.

Banjo & Matilda is known for luxury quality casual cashmere knitwear which retails for 1/3rd of the price of a traditional luxury brand offering similar quality. Streamlining the production process by partnering with cashmere yarn producers in inner Mongolia (where 98% of the worlds cashmere originates), and manufacturing in specialist factories with deep knitting expertise, the company sells directly to customers online, avoiding the typical costs of wholesale/retailer mark-up -- conveniently delivering a luxury quality product at an accessible price point.

| 4 |

Our Products

Banjo & Matilda offers a comprehensive line of luxury women's cashmere knitwear including sweaters and pants, and accessories such as cashmere scarves, slippers, eye-masks and travel blankets. Banjo & Matilda also collaborates with high profile artists or celebrities to create exclusive limited edition pieces. In 2013, we collaborated with singer Bryan Adams and prior collaborations include prominent businesswoman, television host, model and actress Elle Macpherson, British artist Tracey Emin and Australian singer/songwriter, model and actress Natalie Imbrugila and most recently Gwyneth Paltrow's successful lifestyle blog GOOP. The company is planning to expand its product lines to include broader lifestyle offering of apparel items, home products, menswear, children's apparel, and gifts.

Product Manufacturing

Banjo & Matilda use third party contract manufacturers rather than operating manufacturing facilities itself. All yarns and fabrics are sourced from reputable suppliers. Materials used are typically the highest grade that can be sourced. Banjo & Matilda works with a number of manufacturers; during fiscal 2015; no single manufacturer produced more than 35% of our products. Our manufacturers provide us with the speed to market necessary to respond quickly to changing trends and increased demand. We have developed a solid relationship with our manufacturers and take great care to ensure that they share Banjo & Matilda's commitment to quality and ethics. We do not, however, have any long-term agreements requiring us to use any manufacturer, and no manufacturer is required to produce our products in the long-term. We regularly secure and test new manufacturing partners and believe that the services of additional, or other, manufacturers and/or suppliers of our fabrics can continue to be obtained with little or no additional expense to us and/or delay in the timeliness of our production process.

Product Distribution

We commenced our business as an e-commerce only direct to consumer model. In fiscal 2013 year we embarked on a strategic wholesale program to assist driving brand awareness and revenue growth in the Northern Hemisphere markets. Through the 2015 period in conjunction with our relocation to the US we scaled the wholesale business and operations reaching 200+ retail outlets, stocked in major department stores and key independent boutiques. As a result of this scaling, lower gross margins from wholesale sales, and general market conditions we withdrew from the wholesale distribution channel in January 2016 to focus on our core e-commerce model and strategy.

Competition

There is meaningful competition in the luxury apparel industry with emphasis on the brand image and recognition as well as product quality, style, and distribution. Banjo & Matilda successfully competes thanks to a premium and unique brand, unique designs, and attainable price points previously not available in the luxury product sector. This enables the brand to acquire and keep customers which would not typically purchase traditional luxury products due to the much higher price points. There are limited entrants into the market with similar cashmere focused e-commerce offerings which directly compete in terms of product quality and price point.

Intellectual Property

Banjo & Matilda has registered trademarks in Australia and the USA. We believe we own the material trademarks used in connection with the marketing, distribution and sale of all of our products in Australia, the United States, and Europe (and in the other countries in which our products are currently or intended to be either sold or manufactured). We also own the (i) website URL's including and associated to banjoandmatilda.com (as well as banjoandmatilda.au, banjoandmatilda.com, thesweaterexchange.com etc.), (ii) account "@BanjoMatilda" on Twitter, (iii) account "@Banjoandmatilda" on Instagram and (iv) Facebook page "Banjo & Matilda". We also maintain an account on Pinterest.com.

Employees

As of June, 2015 we had twelve employees located in Australia, Hong Kong and the United States. Since exiting the wholesale business, the employee count has been reduced as of June 1, 2016 to six located across Australia and the United States.

Key Management

In addition to Belinda Storelli Macpherson, the company considers its CEO - Brendan Macpherson a key member of its management team. Brendan Macpherson has helped Belinda Storelli Macpherson build the business, initially overseeing finance and e-commerce marketing on a part time basis. After selling his shareholdings in an Australian retail food chain in 2013, Mr. Macpherson joined the company full time. Mr. Macpherson has a background in establishing, building and selling brands and businesses. See Brendan Macpherson's linked in profile.

| 5 |

Item 1A. Risk Factors

An investment in our common stock involves a high degree of risk. In evaluating us and our business, you should carefully consider the risks and uncertainties described below and the other information and our consolidated financial statements and related notes included herein. The risks provided below may not be all the risks we face. If any of events described in the risks below actually occurs, our financial condition or operating results may be materially and adversely affected, the price of our common stock may decline, perhaps significantly, and you could lose all or a part of your investment.

Risks Related to Our Business

Any material disruption of our information systems could disrupt our business and reduce our sales. We are dependent on information systems to operate our e-commerce websites, process transactions, respond to guest inquiries, manage inventory, purchase, sell and ship goods on a timely basis and maintain cost-efficient operations. Any material disruption or slowdown of our systems, including a disruption or slowdown caused by our failure to successfully upgrade our systems, system failures, viruses, computer "hackers" or other causes, could cause information, including data related to customer orders, to be lost or delayed which could result in delays in the delivery of products to our retail and wholesale customers or lost sales, which could reduce demand for our products and cause our sales to decline. If changes in technology cause our information systems to become obsolete, or if our information systems are inadequate to handle our growth, we could lose retail or wholesale customers.

The fluctuating cost of raw materials, particularly cashmere, could increase our cost of goods sold and cause our results of operations and financial condition to suffer. The fabric used to make our products is primarily cashmere, although we also use natural fibers, including cotton. Our costs for raw materials are affected by, among other things, weather, consumer demand, speculation on the commodities market, the relative valuations and fluctuations of the currencies of producer versus consumer countries and other factors that are generally unpredictable and beyond our control. Increases in the cost of raw materials, including petroleum or the prices we pay for our yarn, could have a material adverse effect on our cost of goods sold, results of operations, financial condition and cash flows.

The apparel industry is heavily influenced by general macroeconomic cycles that affect consumer spending, and a prolonged period of depressed consumer spending could have a material adverse effect on our business, financial condition and operating results. The apparel industry has historically been subject to cyclical variations, recessions in the general economy and uncertainties regarding future economic prospects that can affect consumer spending habits. Purchases of luxury items, such as our products, tend to decline during recessionary periods, when disposable income is lower. The success of our operations depends on a number of factors impacting discretionary consumer spending, including general economic conditions, consumer confidence, wages and unemployment, housing prices, consumer debt, interest rates, fuel and energy costs, taxation and political conditions. A continuation or worsening of the current weakness in the global economy or the economy in our key markets (Australia, the United States and Europe) may negatively affect consumer and wholesale purchases of our products and could have a material adverse effect on our business, financial condition and operating results.

Privacy breaches and other cyber security risks related to our e-commerce business could negatively affect our reputation, credibility and business. We are responsible for storing data relating to our customers and employees and rely on third parties for the operation of parts of our e-commerce website, banjoandmatilda.com, and for the various social media tools and websites we use as part of our marketing strategy. Our online store on our website is operated by a third-party provider. Consumers, lawmakers and consumer advocates alike are increasingly concerned over the security of personal information transmitted over the Internet, consumer identity theft and privacy. We require that our third-party service provider implements reasonable security measures to protect our customers' identity and privacy. We do not, however, control these third-party service providers and cannot guarantee that no electronic or physical computer break-ins and security breaches will occur in the future. Likewise, our systems and technology are subject to the risk of system failures, viruses, "hackers" and other causes that are out of our control. Any perceived or actual unauthorized disclosure of personally identifiable information regarding our customers or website visitors could harm our reputation and credibility, reduce our online sales, impair our ability to attract website visitors and reduce our ability to attract and retain customers, and potentially expose us to significant related liability. Finally, we could incur significant costs in complying with the multitude of local, national and foreign laws regarding the use and unauthorized disclosure of personal information (to the extent they are applicable). We also may incur significant costs in our implementation of additional security measures to comply with applicable laws and industry standards and to further protect customer data.

The departure of our co-founders could have a material adverse effect on our business. We depend on the services and management experience of our co-founders, Belinda Storelli Macpherson and Brendan Macpherson, who have substantial experience and expertise in our business. In particular, Ms. Macpherson has provided design leadership to Banjo & Matilda since its inception. She is instrumental to our marketing and publicity strategy and is closely identified with both our brand and company. Our ability to maintain our brand image and leverage the goodwill associated with Ms. Macpherson may be damaged if we were to lose her services. We have an employment agreement with Ms. Macpherson, but she has the right to terminate her employment agreement at any time upon 30 days written notice. The employment agreement contains a covenant not to compete, but it is only applicable if her severance payments equal at least $100,000 and is limited to six months duration and geographically to within a five-mile radius of any location where we design, manufacture or sell our knitwear. Accordingly, Ms. Macpherson could terminate her employment agreement with us and within a short time engage in a competing business, which could materially adversely affect us. In addition, the leadership of Brendan Macpherson, our Chief Executive Officer, has been a critical element of Banjo & Matilda's success. Mr. Macpherson also has the right, under his employment agreement with us, to terminate his employment at any time upon 30 days written notice The loss of services of Mr. Macpherson and/or Ms. Macpherson or any negative public perception with respect to, or relating to, the loss of one or more of these individuals could have a material adverse effect on our business, financial condition and operating results.

| 6 |

If our manufacturing contractors fail to use acceptable, ethical business practices, our business and reputation could suffer. We do not own or operate any manufacturing facilities. We use third-party contract manufacturers, mostly in China. We require our manufacturing contractors to operate in compliance with applicable laws, rules and regulations regarding working conditions, employment practices and environmental compliance. Additionally, we impose upon our business partners operating guidelines that require additional obligations in those three areas in order to promote ethical business practices, and our staff and third parties we retain for such purposes periodically visit and monitor the operations of our manufacturing contractors to determine compliance. However, we do not control our manufacturing contractors or their labor and other business practices. If one of our manufacturing contractors violates applicable labor or other laws, rules or regulations or implements labor or other business practices that are generally regarded as unethical in our markets, such as Australia, Europe or the United States, the shipment of finished products to us could be interrupted, orders could be cancelled, relationships could be terminated and our reputation could be damaged. Any of these events could have a material adverse effect on our business, financial condition and operating results.

Due to the highly competitive nature of the apparel industry, our success depends on our ability to meet consumer demands, respond to fashion trends, and provide superior quality. There is intense competition in the sector of the apparel industry in which Banjo & Matilda participates. Banjo & Matilda competes with many other apparel companies, some of which are larger and have greater financial resources, more comprehensive product lines; longer-standing relationships with suppliers, manufacturers, and retailers; greater distribution and marketing capabilities; and, stronger brand recognition and loyalty than Banjo & Matilda. Our competitors' greater capabilities in these areas may enable them to better differentiate their products from Banjo & Matilda, withstand periodic downturns in the apparel industry, compete more effectively on the basis of price and production and more quickly develop new products. Management of Banjo & Matilda believes in order to be successful in this industry we must be able to evaluate and respond to changing consumer demand and taste and to remain competitive in the areas of style and quality while operating within the significant domestic and foreign production and delivery constraints of the industry.

Our inability to successfully manage the growth of our business may have a material adverse effect on our business, results of operations and financial condition. We intend to continue our growth strategy to grow our online customer base and sales, wholesale customer base, expand our product offerings and add retail stores. Our ability to execute this growth strategy is subject to significant risks, some of which are beyond our control, including:

· the inherent uncertainty regarding general economic conditions · our ability to obtain adequate financing for our expansion plans · the degree of competition in new markets and its effect on our ability to attract new customers; and · our ability to recruit qualified personnel, in particular in areas where we face a great deal of competition

Our future success will be highly dependent upon our ability to manage successfully the expansion of our operations. Our ability to manage and support our growth effectively will be substantially dependent on our ability to implement adequate improvements to our financial, inventory, and management controls, and hire sufficient numbers of effective financial, accounting, administrative, and management personnel. We may not succeed in our efforts to identify, attract and retain such personnel.

We are already highly leveraged and our growth strategies require significant capital investments and may require us to seek external financing, which may not be available on terms favorable to us. Our business operations and growth strategies require substantial capital investments, the availability of which depends on our ability to generate cash flow from operations, borrow funds on satisfactory terms and raise funds in the capital markets. Our ability to arrange for financing to support our capital expenditures and the cost of such financing are dependent on numerous factors, including general economic and capital markets conditions, interest rates and credit availability from banks or other lenders, many of which are beyond our control. In addition, increases in interest rates or the failure to obtain external financing on terms favorable to us will affect our financing costs and our results of operations. We are already highly leveraged and rely on capital contributions and loans from our principal shareholders and third parties, including: the $250,000 Convertible Note from Raymond Key secured by a lien on substantially all of our assets, two loans from KBM Worldwide Inc. in the amount, collectively, of $148,600; a $1.5 million trade facility with Sallyport Commercial Finance, a factoring and asset-based lending company; and a Loan Facility Agreement with Harboursafe Holdings (which company is controlled by our chief executive officer, Brendan Macpherson) in the amount of approximately $963,000, secured by our intellectual property. We may not be able to obtain future financing in amounts or on terms acceptable to us.

Fluctuations in exchange rates could adversely affect our business as well as result in foreign currency exchange losses in our U.S. dollar financials. The functional currency of Banjo & Matilda is Australian dollars. The accounts of Banjo & Matilda are maintained, and its financial statements are expressed, in Australian dollars. Such financial statements are translated into U.S. dollars with the Australian dollar as the functional currency. All assets and liabilities are translated at the exchange rate at the balance sheet date, stockholder's equity is translated at the historical rates and income statement items are translated at the average exchange rate for the period. Transactions in foreign currencies are initially recorded at the functional currency rate ruling at the date of transaction. Any differences between the initially recorded amount and the settlement amount are recorded as a gain or loss on foreign currency transaction in the statements of operations. The resulting translation adjustments are reported under other comprehensive income as a component of shareholders' equity. The value of the Australian dollar against the U.S. dollar and other currencies is affected by, among other things, changes in political and economic conditions and U.S. and Australian foreign exchange policies. Any material change in the exchange ratio between the Australian dollar and the U.S dollar may materially and adversely affect our reported amounts in U.S dollars of cash flows, revenues, earnings and financial position and the value of, and any dividends payable to, our shares of common stock in U.S. dollars.

| 7 |

In addition, we sell our knitwear worldwide and purchases of our knitwear are made in foreign currencies and recorded in Australian dollars at exchange rates then in effect. We also transact business with wholesalers, retail outlets, manufacturers and distributors in various foreign countries, including China, Europe and the United States. Transactions are denominated in foreign currencies and recorded in Australian dollars at the rates of exchange in effect at the time of each transaction. Exchange gains and losses are recognized for the different foreign exchange rates applied when the foreign currency assets and liabilities are settled. Any material fluctuations in exchange rates between the Australian dollar and these foreign currencies could materially adversely affect our results of operations.

We are required to make significant estimates and assumptions in the preparation of our financial statements and our estimates and assumptions may not be accurate. The preparation of our financial statements in conformity with generally accepted accounting principles in the United States of America ("GAAP") requires our management to make significant estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting periods. Critical estimates include, among other things, the collectability of accounts receivable, accounts payable, sales returns and recoverability of long-term assets. If our underlying estimates and assumptions prove to be incorrect, our financial condition and results of operations may be materially different from that reported in our financial statements.

Risks Related to Our Common Stock and Our Status as a Public Company

We may need to raise additional capital by sales of our common stock, which may adversely affect the market price of our common stock and your rights in us may be reduced. We will need to raise additional funds to expand our online sales, increase wholesale sales, expand our product lines and add retail stores. In order to satisfy our funding requirements, we may consider issuing additional debt or equity securities. If we issue equity or convertible debt securities to raise such additional funds, our existing stockholders may experience dilution, and the new equity or debt securities may have rights, preferences and privileges senior to those of our existing stockholders. If we incur additional debt, it may increase our leverage relative to our earnings or to our equity capitalization, requiring us to pay additional interest expenses and potentially lower our credit ratings. We may not be able to market such issuances on favorable terms, or at all, in which case, we may not be able to develop or enhance our products, execute our business plan, take advantage of future opportunities or respond to competitive pressures.

There is a limited public trading market for our common stock, which may have an unfavorable impact on our stock price and liquidity.Our common stock is not listed on any exchange; it is quoted on the OTCQB quotation service. We have not engaged a broker-dealer to make a market in our common stock. There has been a limited trading market for our common stock in the past and there can be no assurance that a trading market in our shares of common stock will develop and be sustained. The trading market for securities of companies quoted on the OTCQB or other quotation systems is substantially less liquid than the average trading market for companies listed on Nasdaq or a national securities exchange. The quotation of our shares on the OTCQB or other quotation system may result in a less liquid market available for existing and potential shareholders to trade shares of our common stock, could depress the trading price of our common stock and could have a long-term adverse impact on our ability to raise capital in the future. Holders of our common stock should be willing to hold onto their shares for a long period of time.

State securities laws may limit secondary trading, which may restrict the states in which and conditions under which you can sell the shares offered by this prospectus. Secondary trading in our common stock will not be possible in any state until the common stock is qualified for sale under the applicable securities laws of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in the state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, the common stock in any particular state, the common stock could not be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the liquidity for the common stock could be significantly impacted thus causing you to realize a loss on your investment.

The Registrant's board of directors designated a series of preferred stock without shareholder approval that has voting rights that adversely affect the voting power of holders of the Registrant's common stock and may have an adverse effect on its stock price. The Registrant's Certificate of Incorporation provides for the authorization of 100,000,000 shares of "blank check" preferred stock. Pursuant to our Articles of Incorporation, the Registrant's Board of Directors is authorized to issue such "blank check" preferred stock with rights that are superior to the rights of stockholders of the Registrant's common stock, including a conversion price then approved by our Board of Directors, which conversion price may be substantially lower than the market price of shares of the Registrant's common stock, without stockholder approval. In connection with the Registrant's employment agreement with its Chief Executive Officer, Brendan Macpherson, the Board of Directors authorized 1,000,000 shares of preferred stock with each share having 100 votes until Mr. Macpherson's employment agreement expires or terminates. The Registrant issued the 1,000,000 shares of preferred stock to Mr. Macpherson pursuant to his employment agreement and, upon the filing of a certificate of designation for such preferred shares and the subsequent issuance of such shares, Mr. Macpherson gained voting control of the Registrant, which has a negative effect on the voting power of the holders of the Registrant's common stock and may cause its stock price to decline.

| 8 |

Brendan Macpherson, our Chief Executive Officer, has significant influence over us, including control over decisions that require the approval of stockholders, which could limit your ability to influence the outcome of key transactions, including a change of control. Brendan Macpherson, our Chief Executive Officer, owns significant portion of our outstanding shares of common stock, and 1,000,000 shares of super-voting preferred stock until his employment agreement expires or terminates, and consequently has effective control over our business, including matters requiring the approval of our stockholders, such as election of directors, approval of significant corporate transactions and the timing and distribution of dividends, if any, on our common stock. In addition, Mr. Macpherson controls our policies and operations, including, among other things, the appointment of management, future issuances of our common stock or other securities, the incurrence of debt by us, and the entering into of extraordinary transactions.

Mr. Macpherson may have interests that do not align with the interests of our other stockholders, including with regard to pursuing acquisitions, divestitures, and other transactions that, in his judgment, could enhance his equity value, even though such transactions might involve risks to our other stockholders. For example, Mr. Macpherson could cause us to make acquisitions that increase our indebtedness. Mr. Macpherson will have effective control over our decisions to enter into such corporate transactions regardless of whether others believe that any transaction is in our best interests. Such control may have the effect of delaying, preventing, or deterring a change of control of our company, could deprive stockholders of an opportunity to receive a premium for their common stock as part of a sale of our company, and might ultimately affect the market price of our common stock.

We will incur significant costs as a result of operating as a public company, and our management will be required to devote substantial time to new compliance requirements, including establishing and maintaining internal controls over financial reporting, and we may be exposed to potential risks if we are unable to comply with these requirements. As a public company we will incur significant legal, accounting and other expenses under the Sarbanes-Oxley Act of 2002, together with rules implemented by the Securities and Exchange Commission and applicable market regulators. These rules impose various requirements on public companies, including requiring certain corporate governance practices. Our management and other personnel will need to devote a substantial amount of time to these requirements. Moreover, these rules and regulations will increase our legal and financial compliance costs and will make some activities more time-consuming and costly.

The Sarbanes-Oxley Act requires, among other things, that we maintain effective internal controls for financial reporting and disclosure controls and procedures. In particular, we must perform system and process evaluations and testing of our internal controls over financial reporting to allow management to report on the effectiveness of our internal controls over financial reporting, as required by Section 404 of the Sarbanes-Oxley Act. Compliance with Section 404 may require that we incur substantial accounting expenses and expend significant management efforts. We have concluded that our disclosure controls and procedures and our internal controls over financial reporting are not effective due to material weaknesses identified in our internal controls over financial reporting. These material weaknesses include: lack of a full-time Chief Financial Officer with accounting expertise, lack of a formal review process and ineffective oversight due to the lack of an audit committee comprised of independent directors. Remediating these weaknesses will require the expenditure of capital to hire additional staff and other measures. If we cannot take steps to timely remediate the weaknesses in our internal controls, the market price of our stock could decline if investors and others lose confidence in the reliability of our financial statements. Similarly, we could have difficulty attracting third-party lenders and market-makers in our common stock if such lenders or broker-dealers believe they cannot rely on our financial statements as materially accurate. In addition, we could be subject to sanctions or investigations by the SEC or other applicable regulatory authorities.

Our management is not familiar with the United States securities laws. Our management is generally unfamiliar with the requirements of the United States securities laws, our Chief Executive Officer and Chief Financial Officer, Brendan Macpherson, does not possess accounting expertise which could adversely impact our ability to comply with legal, regulatory, and financial reporting requirements under the U.S. securities laws. Our management may not be able to implement programs and policies in an effective and timely manner to adequately respond to such legal, regulatory and reporting requirements, including the establishment and maintenance of internal control over financial reporting. Any such deficiencies, weaknesses or lack of compliance could have a materially adverse effect on our ability to comply with the reporting requirements of the Exchange Act, which are necessary to maintain public company status, and could result in investigations by the Securities and Exchange Commission, and other regulatory authorities that could be costly, divert management's attention and disrupt our business, If we were to fail to fulfill those obligations, our ability to operate as a public company would be in jeopardy, in which event you could lose your entire investment in our company. The company utilized a third party consultant to help with reporting in accordance with US GAAP and filing with SEC.

| 9 |

If a trading market in our common stock ever develops, the market price of our common stock can become volatile, leading to the possibility of its value being depressed at a time when you may want to sell your holdings. If a trading market in our common stock develops, the market price of our common stock could become volatile. Numerous factors, many of which are beyond our control, may cause the market price of our common stock to fluctuate significantly. These factors include:

- | our earnings releases, actual or anticipated changes in our earnings, fluctuations in our operating results or our failure to meet the expectations of financial market analysts and investors; |

- | changes in financial estimates by us or by any securities analysts who might cover our stock; |

- | speculation about our business in the press or the investment community; |

- | significant developments relating to our relationships with our wholesale customers or suppliers; |

- | stock market price and volume fluctuations of other publicly traded companies and, in particular, those that are in our industry; |

- | customer demand for our products or luxury goods in general; |

- | investor perceptions of our industry in general and Banjo & Matilda in particular; |

- | the operating and stock performance of comparable companies; |

- | general economic conditions and trends; |

- | changes in accounting standards, policies, guidance, interpretation or principles; |

- | loss of external funding sources; |

- | sales of our common stock, including sales by our directors, officers or significant stockholders; and |

- | additions or departures of key personnel. |

Securities class action litigation is often instituted against companies following periods of volatility in their stock price. Should this type of litigation be instituted against us, it could result in substantial costs to us and divert our management's attention and resources. Moreover, securities markets may from time to time experience significant price and volume fluctuations for reasons unrelated to the operating performance of particular companies. These market fluctuations may adversely affect the price of our common stock and other interests in our Company at a time when you want to sell your interest in us.

We do not intend to pay dividends for the foreseeable future. We have never declared or paid any cash dividends on our common stock and do not intend to pay any cash dividends in the foreseeable future. We anticipate that we will retain all of our future earnings for use in the development of our business and for general corporate purposes. Any determination to pay dividends in the future will be at the discretion of our board of directors. Accordingly, investors must rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize any future gains on their investments.

| 10 |

Our common stock is considered "a penny stock" and, as a result, it may be difficult to trade a significant number of shares of our common stock. The Securities and Exchange Commission ("SEC") has adopted regulations that generally define "penny stock" to be an equity security that has a market price of less than $5.00 per share, subject to specific exemptions. Since our common stock has been eligible for quotation on the OTC markets (such as the bulletin board), the market price of our common stock has been less than $5.00 per share. We expect the market price for our common stock will remain less than $5.00 per share for the foreseeable future and, therefore, may be a "penny stock" according to SEC rules. This designation requires any broker or dealer selling these securities to disclose certain information concerning the transaction, obtain a written agreement from the purchaser and determine that the purchaser is reasonably suitable to purchase the securities. These rules may restrict the ability of brokers or dealers to sell our common stock and may affect the ability of investors hereunder to sell their shares. In addition, because our stock is quoted on the OTC markets, investors may find it difficult to obtain accurate quotations of the stock and may experience a lack of buyers to purchase such stock or a lack of market makers to support the stock price.

As a former shell company, holders of restricted shares of our common stock cannot rely on Rule 144 to resell their shares until the conditions of the rule are met. Prior to the consummation of the Exchange Agreement, we were considered a shell company. As a result, we are subject to the provisions of Rule 144(i) which limit reliance on Rule 144 by shareholders owning stock in a shell company (or a former shell company). Under current interpretations, unregistered shares issued after we first became a shell company cannot be resold under Rule 144 until the following conditions are met:

- | We cease to be a shell company; |

- | We remain subject to the Exchange Act reporting obligations; |

- | We file all required Exchange Act reports during the preceding 12 months; and |

- | At least one year has elapsed from the time we filed our "Form 10 information" reflecting the fact that we ceased to be a shell company. |

Consequently, until the first anniversary of the filing of our Current Report on Form 8-K, filed November 18, 2013, reflecting that we ceased to be a shell company, holders of restricted shares of our common stock cannot rely on Rule 144 to sell such shares, and may do so then only if we have then filed all required Exchange Act reports during the preceding 12 months.

Item 2. Properties

The company currently subleases offices in Santa Monica United States as its principle operational headquarters and executive offices, occupying 600 square feet. at a monthly rental of $1,500. Banjo & Matilda (Australia) Pty Ltd leases a 1,076 square foot retail store located at 76 William Street, Paddington, New South Wales, Australia. Banjo & Matilda leases these premises on a month to month basis. The monthly fixed rent for this space is approximately $4,433 per month. Management believes that the facilities are adequate for the Company's current needs and for the foreseeable future. In addition management believes the terms of the leases are consistent with market standards and were arrived at through arm's-length negotiation.

Item 3. Legal Proceedings

We are not a party to any pending litigation and to our knowledge, no such litigation is contemplated or threatened. To our knowledge, none of our directors, officers, 5% shareholders or affiliates are party to any legal proceedings that would have a material adverse effect on our business, financial condition or operating results.

Item 4. Mine Safety Disclosures.

| 11 |

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

Our common stock is quoted on the OTCQB under the symbol "BANJ" (prior to November 14, 2013 the stock was quoted under the symbol "ESRN"). The OTCQB is a quotation service that displays real-time quotes, last-sale prices, and volume information in over-the-counter ("OTC") equity securities. An OTCQB equity security generally is an equity that is not listed or traded on Nasdaq or a national securities exchange. Because there has been no established trading market for our common stock, we have not presented any historical prices in this report.

Our fiscal year end changed from December 31 to June 30 in connection with the Exchange Agreement with Banjo & Matilda Ltd. in November 2013.

Our Transfer Agent

We have appointed Olde Monmouth Stock Transfer Company, with offices at 200 Memorial Parkway, Atlantic Highlands, New Jersey 07716, phone number 732-872-2727, as transfer agent for our shares of common stock. The transfer agent is responsible for all record-keeping and administrative functions in connection with our shares of common stock.

Holders

As of June 15, 2015, there are approximately 125 holders of record of our common stock and a total of 39,508,146 shares of common stock outstanding, without giving effect to 20,214,970 shares which are to be issued and the cancellation of 1,400,000 shares which Belinda and Brendan Macpherson have agreed to return to the Company.

Dividends

We have not declared any cash dividends, nor do we intend to do so. We are not subject to any legal restrictions respecting the payment of dividends, except that they may not be paid to render us insolvent. Dividend policy will be based on our cash resources and needs and it is anticipated that all available cash will be needed for our operations in the foreseeable future.

Penny Stock Regulations

The SEC has adopted regulations which generally define so-called "penny stocks" to be an equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. The Registrant's common stock is a "penny stock" and is subject to Rule 15g-9 under the Exchange Act, or the Penny Stock Rule. This rule imposes additional sales practice requirements on broker-dealers that sell such securities to persons other than established customers and "accredited investors" (generally, individuals with a net worth in excess of $1,000,000 or annual incomes exceeding $200,000, or $300,000 together with their spouses). For transactions covered by Rule 15g-9, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser's written consent to the transaction prior to sale. As a result, this rule may affect the ability of broker-dealers to sell our securities and may affect the ability of purchasers to sell any of our securities in the secondary market, thus possibly making it more difficult for us to raise additional capital.

For any transaction involving a penny stock, unless exempt, the rules require delivery, prior to any transaction in penny stock, of a disclosure schedule required by the SEC relating to the penny stock market. Disclosure is also required to be made about sales commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements are required to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock.

There can be no assurance that the Registrant's common stock will qualify for exemption from the Penny Stock Rule. Even if the Registrant's common stock were exempt from the Penny Stock Rule, the Registrant would remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority to restrict any person from participating in a distribution of penny stock, if the SEC finds that such a restriction would be in the public interest.

| 12 |

Rule 144

Prior to completion of the closing under the Exchange Agreement, the Registrant was considered a shell company. As a result, the Registrant is subject to the provisions of Rule 144(i) which limit reliance on Rule 144 by shareholders owning stock in a shell company (or a former shell company). Under current interpretations, unregistered shares issued after the Registrant first became a shell company cannot be resold under Rule 144 until the following conditions were met:

- | The registrant ceases to be a shell company; |

- | The Registrant remains subject to the Exchange Act reporting obligations; |

- | The Registrant files all required Exchange Act reports during the preceding 12 months; and |

- | At least one year has elapsed from the time the Registrant files "Form 10 information" reflecting the fact that the Registrant ceased to be a shell company. |

Consequently, until the first anniversary of the filing of the Registrant's Current Report on Form 8-K, filed November 18, 2013, holders of the Registrant's common stock cannot rely on Rule 144 to sell restricted shares of common stock,and may do so then only if we have then filed all required Exchange Act reports during the preceding 12 months.

Securities Authorized for Issuance under Equity Compensation Plans

The Registrant does not have any equity compensation plans and accordingly there are no shares authorized for issuance under an equity compensation plan.

Issuer Purchases of Our Equity Securities

No repurchases of our common stock were made by our company or its affiliates during the fourth quarter of our fiscal year ended June 30, 2015. There have been no recent sales of unregistered securities by us which have not already been reported in an 8-K or 10-Q.

Item 6. Selected Financial Data.

Not applicable because we are a smaller reporting company.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of our financial condition and results of operations should be read in conjunction with the audited and unaudited financial statements and the notes to those statements included elsewhere in this Report. This discussion contains forward-looking statements that involve risks and uncertainties. You should specifically consider the various risk factors identified in this Report that could cause actual results to differ materially from those anticipated in these forward-looking statements.

Financial Results

The following discussion of the results of operations constitutes management's review of the factors that affected the financial and operating performance for the fiscal years ended June 30, 2015 and June 30, 2014. This discussion should be read in conjunction with the financial statements and notes thereto contained elsewhere in this report. The Company has a June 30 fiscal year end.

The accounts of Banjo & Matilda during the years ended June 30, 2014 and 2015, were maintained, and its consolidated financial statements were expressed, in Australian dollars. Such financial statements were translated into United States Dollars with the Australian Dollar as the functional currency to prepare the consolidated financial statements included in this Report. All assets and liabilities were translated at the exchange rate at the balance sheet date, stockholder's equity is translated at the historical rates and income statement items are translated at the average exchange rate for the period. Transactions in foreign currencies are initially recorded at the functional currency rate ruling at the date of transaction. Any differences between the initially recorded amount and the settlement amount are recorded as a gain or loss on foreign currency transaction in the consolidated statements of operations. The resulting translation adjustments are reported under other comprehensive income as a component of shareholders' equity.

| 13 |

Executive summary

For the financial year ended June 30, 2015, we grew total revenue by 22% to $2,756,459 from $2,264,264 in 2014 (or 31% on a constant currency exchange rate basis) while relocating our head office to Los Angeles in conjunction with a listing on the OTCQB in the United States. Importantly, we increased our e-commerce sales by 42% from $611,532 to $867,153 year over year, and re-positioned our company to take full advantage of our e-commerce channel.

Expansion of our wholesale business in the US and Northern Hemisphere markets increased our brand awareness and customer discovery. Once customers discovered the brand and product, a portion of these new customers converted to e-commerce purchasers, where it is more convenient for them to purchase online and there is a greater selection of product available.

As a result of our wholesale expansion and general wholesale/retail market conditions, we invested more than we had budgeted and incurred greater than forecast losses as a result. This resulted from a combination of lower wholesale margins driven by retail market conditions, significantly increased overheads to support wholesale growth, and a one-time write down of sample inventory produced to build a pipeline of product to expand our sales representation in the outlets that carried products.

In January 2016, we withdrew from the wholesale sales channel to exclusively focus on our e-commerce channel. Even though we incurred losses in wholesale, we considered this an investment in building a core US e-commerce customer base which now represents approximately 30% of online sales. Further reinforcing our decision to withdraw from wholesale, we recorded our first monthly profit in March 2016 being our first full month with no wholesale related overheads.

Although we have made the decision to forego unprofitable revenue in the short term in wholesale, the wholesale business we built to date has been instrumental in positioning us to become a successful e-commerce business & brand in the USA by getting our brand exposed to key retailers, customers and the press. If appropriate in the future, we may re-enter the wholesale business, but it is unlikely.

We have experienced strong growth in core e-commerce KPI's including web site traffic, average transaction value, and growth in email and social media subscriber bases. We have growing brand awareness and a high value customer base, $1MM or more in run rate revenue, a pipeline of developed product, and 7 years of experience in product development, sourcing, e-commerce, and operations. We have also demonstrated the ability to achieve a strong ROI on our digital marketing investment, which means we can efficiently deploy future capital injected to maximize e-commerce sales and build firm value.

As a result, we now have a disruptive e-commerce business model which has the potential to be significantly more valuable than a traditional apparel business.

Valuations for these new e-commerce models vary widely but can command firm valuations of 4 to 5 times annual revenue or more.

2015 Financial Highlights

| · | Revenue increased 31% to $2,735,367 on a constant currency basis as a result of increased e-commerce and wholesale sales. |

| ||

| · | Gross Margins declined 5% points to 35% primarily due to thinner margins in our wholesale business required to support our retail price point strategy |

| ||

| · | Operating Expenses before corporate and public company, depreciation and amortization, finance, and one-time expenses increased 37% to $1,568,996 mainly as a result of increased staffing and related expenses to the wholesale business, and one off costs due to re-locating the operations to Los Angeles. |

| ||

| · | Operating Loss before corporate and public company, finance, depreciation and amortization, and one-time expenses and was $608,971. |

| ||

| · | Corporate & Public company expenses: Excluding one-time expenses, corporate & public company expenses reduced 27% to $187,702. |

| 14 |

| · | One-time Expenses: A one-time write down of sales and design samples of $488,324 was expensed under operating expenses. A one-time provision for doubtful debts of $197,341 was expensed under corporate & public company expenses. |

| ||

| · | Net Loss inclusive of all operations was $1,961,036. |

Revenue

FY2015 Revenue increased 31% to $2,735,367 compared to FY2014 on a constant currency basis. In January 2015 we relocated our operations from Sydney Australia to Los Angeles to enable us to be closer to, and capture a higher share of the lucrative US market. We expanded our team managing wholesale from 1.5 people to 4. Implemented a wholesale ERP system, set up a local US 3PL distribution center to support wholesale distribution.

E-commerce

Online sales increased 42% to $867,153 on a constant currency basis despite the focus of building and supporting the wholesale business. This focus on wholesale limited growth in our online business during the period. Meaningfully higher growth rates and revenue could have been achieved.

Retail (Paddington Australia)

Store sales increased 19% to $281,578. We maintain our store in Paddington Australia because of the higher margin retail sales and we continue to use the resources to manage Australian customer support for online sales, and where possible local shipping & returns to/from Australian based customers.

Wholesale

Wholesale sales increased 35% on a constant currency basis.

In line with our strategy to build wholesale distribution and brand awareness to help promote our e-commerce channel, we continued our focus on expanding our wholesale customer base through the period prior to exiting the business in January 2016.

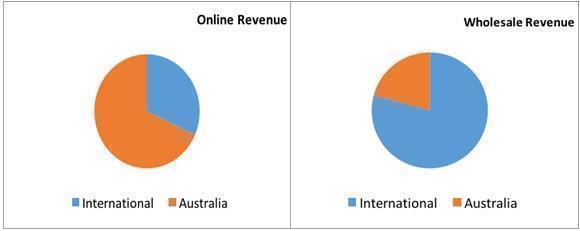

Since January 1 2016, international sales have increased to 32% of total e-commerce.

The proven penetration of sales into the US and Northern Hemisphere markets (representing 80% of wholesale revenue in FY2015, demonstrates the growth opportunity to expand e-commerce sales into Northern Hemisphere markets in the same proportion or more.

| 15 |

Gross Margins

During the FY2015 period Gross Margins decreased 5% points from 40% to 35% primarily as a result of thinner margins in our wholesale business. Best practice Gross Margins for larger apparel brands are in excess of 50% - most typically 55% -58%. A main driver of lower margins is the price points required to deliver the brands proposition of luxury products and non-luxury prices. Due to these retail price point targets, wholesale margins are heavily impacted. This also creates upward pressure on retail price points which erodes the brand proposition. With the withdrawal from the wholesale business channel this will improve margins significantly, and remove upward pressure on price points which will provide greater flexibility to deliver the brand proposition. In addition we have identified other opportunities to improve margins:

· We continued to maintain our Australian retail price points at the same nominal value as our USD international price points through the period. With the reduction in AUD vs USD currency, the gross margin on product sold into Australia declined significantly. In January 2016 we adjusted our Australian RRP price points to be 25% higher in nominal terms to our USD RRP's which should increase gross margins by approximately 50%. · Reduced number of styles required for our wholesale business means we can do larger and more regular runs of a smaller number of styles per factory. This is will improve manufacturing efficiency and lowers costs without our factories reducing their margins or quality. · Planned expansion of product lines with naturally higher gross margins will increase overall average margins when these are released.

Expenses

During the FY2015 period total operating expenses increased from 92% from $1,375,475 to $2,636,568 which includes one-time expenses, finance costs, public company, depreciation and amortization: The key reasons for this increase was:

| · | One-time write down of samples inventory of $488,324. We have now adopted a policy of expensing all sampling costs even though a significant portion of these samples will be sold at a later date. |

| ||

| · | One-time provision for doubtful debts of $197,341. |

| ||

| · | Financing and Finance costs increased 79% to $472,860 primarily as a result associated with our use of trade financing to support our wholesale business. |

| ||

| · | An abnormal expense related to relocating to the USA from Australia. Additional expenses were incurred re-locating some key staff and establishing operations in the US. Further, while the revenue opportunity is much greater being based in the North American market, general costs are higher in the US market increasing overall overheads. |

Liquidity and Capital Resources

We are highly leveraged and will continue to borrow to acquire inventory and fund sales. Our ability to expand our sales is limited by the amount we can borrow to acquire supplies and contract for the manufacture of our products. The Company has been able to obtain the funds necessary to increase its sales each year through both capital contributions and loans from its principal shareholders and third parties. The Company anticipates that it will continue to be able to access funds to grow its business. There can be no assurance, however, that the terms on which such funds will be made available will be favorable to the Company or its shareholders. The sale of any equity securities or instruments convertible into equity of the Company will dilute the interests of its current shareholders. The rates at which we can acquire funds will directly impact our ability to operate profitably and generate positive cash flow. In addition to relying upon debt, we will seek to raise equity to support our efforts to grow. The current ratio of the company is 0.63. There is no assurance that debt or equity financing will be available to us on acceptable terms, if at all, and, in all events, the sale of equity or instruments convertible into equity will dilute the interests of our current shareholders.

| 16 |

During the twelve months ended June 30, 2015, we used approximately $1,125,867 of net cash in our operating activities. This reflects our net loss from continuing operations of $2,004,722 and the source of cash which reflects the decrease in our trade receivables and inventory which decreased by $12,015 and $438,185, respectively, from June 30, 2014 to June 30, 2015.

During the twelve months ended June 30, 2014, we used approximately $868,660 of net cash in our operating activities. This reflects our net loss from continuing operations of $626,742 and the use of cash to increase our trade receivables and inventory which grew by $314,016 and $282,868, respectively, from June 30, 2013 to June 30, 2014.

Cash (Used) in Investing Activities

During the twelve months ended June 30, 2015, net cash used in investing activities of $3,600 primarily reflects purchases of fixed assets for $3,600.

During the twelve months ended June 30, 2014, net cash used in investing activities of $32,578 reflects the purchase of intangible assets of $24,220 and the purchase of fixed assets of $8,358.

Cash Provided by Financing Activities

During the twelve months ended June 30, 2015, net cash provided by financing activities of $1,458,768 primarily reflects proceeds from issuance of common stock for $369,600, net proceeds from loans of $529,485 and an increase in trade financing of $512,016.

During the twelve months ended June 30, 2014, net cash provided by financing activities of $923,501 primarily proceeds from the issuance of stock of $290,000, net proceeds of loans of $639,133 and an increase in trade financing of $166,350.

Commitments for Capital Expenditures

We do not have substantial commitments for capital expenditures. All of our products are manufactured by third parties, enabling us to scale up operations without acquiring substantial production equipment. Although we will need to increase our design capabilities and augment our sales and administrative staff as we grow, the rate of growth of these expenses should be less than the rate of growth of our revenue. Further, we anticipate that as we expand our sales, the interest rates, fees and other expenses we pay to obtain credit, should be lower than those we incur presently. Of course, any substantial growth in our revenues will require additional equity which, if available, will dilute the interests of our current shareholders. We do anticipate a slight increase in the rate of growth of our operating expenses this year due to, among other factors, the fact that our historical financial statements do not include the expenses associated with being a public company.

Off Balance Sheet Items

We do not have any off-balance sheet arrangements, financings, or other relationships with unconsolidated entities or other persons, also known as "special purpose entities" (SPEs).

Critical Accounting Policies

Use of Estimates

The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported revenues and expenses during the period covered by the financial statements. Actual results could differ from estimates. Significant estimates include collectability of accounts receivable, valuation of inventory, sales return and recoverability of long-term assets.

| 17 |

Revenue Recognition

Revenue is recognized when persuasive evidence of an arrangement exists, delivery has occurred, the fee is fixed or determinable, and collectability is probable. Revenue generally is recognized net of allowances for returns and any taxes collected from customers to be remitted to governmental authorities.

Cost of Sales

Cost of sales consists primarily of inventory costs, as well as warehousing costs (including the cost of warehouse labor), shipping, importation duties and charges, third party royalties, and product samples.

Inventory

Inventories are valued at the lower of cost (determined on a weighted average basis) or market. Management compares the cost of inventories with the market value and allowance is made to write down inventories to market value, if lower.

Allowance for Doubtful Accounts

The Company maintains reserves for potential credit losses on accounts receivable. Management reviews the accounts receivable and analyzes historical bad debts, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the adequacy of these reserves.

Exchange Gain (Loss)

To date, the Company's transactions were denominated in foreign currency and were recorded in Australian dollars (AUD) at the rates of exchange in effect when the transactions occurred. Exchange gains and losses are recognized for the different foreign exchange rates applied when the foreign currency assets and liabilities are settled.

Foreign Currency Translation and Comprehensive Income (Loss)

The accounts of the Company were maintained, and its financial statements were expressed, in AUD. Such financial statements were translated into USD with the AUD as the functional currency. All assets and liabilities were translated at the exchange rate at the balance sheet date, stockholder's equity is translated at the historical rates and income statement items are translated at the average exchange rate for the period. Transactions in foreign currencies are initially recorded at the functional currency rate ruling at the date of transaction. Any differences between the initially recorded amount and the settlement amount are recorded as a gain or loss on foreign currency transaction in the statements of operations. The resulting translation adjustments are reported under other comprehensive income as a component of shareholders' equity.

Recently Issued Accounting Pronouncements

There have been no new accounting pronouncements during the year ended June 30, 2014 that we believe would have a material impact on our financial position or results of operations.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

Not applicable because we are a smaller reporting company.

Item 8. Financial Statements and Supplementary Data.

The financial statements start on page F-1.

| 18 |

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

Dismissal of Lichter, Yu & Associates, Inc. as Principal Accountant

On August 10, 2015, we advised Lichter, Yu & Associates, Inc. ("LY"), engaged on January 14, 2014, that it had been dismissed as our independent registered public accounting firm. The dismissal of LY was approved by our Board of Directors.

LY audited our consolidated financial statements as at and for the years ended June 30, 2014 and 2013, and their report thereon did not contain an adverse opinion or disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting principles.

Engagement of Farber Hass Hurley LLP as Principal Accountant

On August 10, 2015, we engaged Farber Hass Hurley LLP ("FHH") as our registered independent public accountants for the fiscal year ended June 30, 2015. The decision to engage FHH was approved by our Board of Directors.

In connection with this change of registered independent public accountants, there were no disagreements between the Registrant and our former accountants, Lichter Yu & Associates LLP, of the type described in Item 304 (a)(1)(iv) of Regulation S-K and the related instructions, or any reportable event as described in Item 304(a)(1)(v) of Regulation S-K.

Item 9A. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

Our management is responsible for maintaining disclosure controls and procedures that are designed to ensure that information required to be disclosed in the reports that the Registrant files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC's rules and forms. In addition, the disclosure controls and procedures must ensure that such information is accumulated and communicated to the Registrant's management, including its Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required financial and other required disclosures.

On November 14, 2013, we acquired Banjo & Matilda, a closely-held privately owned Australian company whose operations were conducted in Australia, in a transaction treated as a reverse acquisition. At such time we adopted the system of disclosure controls and procedures of Banjo & Matilda as ours.

At June 30, 2015, an evaluation of the effectiveness of our disclosure controls and procedures (as defined in Rules 13(a)-15(e) and 15(d)-15(e) of the Exchange Act) was carried out under the supervision and with the participation of Brendan Macpherson our Chief Executive Officer and Chief Financial Officer. Based on his evaluation of our disclosure controls and procedures, he concluded that at June 30, 2014, our disclosure controls and procedures are not effective due to material weaknesses in our internal controls over financial reporting discussed directly below.

Management's Annual Report on Internal Control over Financial Reporting