Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - BERRY GLOBAL GROUP, INC. | t1600547_ex99-1.htm |

| 8-K - FORM 8-K - BERRY GLOBAL GROUP, INC. | t1600547_8k.htm |

Exhibit 99.2

May 2015 Acquisition of AEP Industries Inc. August 2016

Forward - Looking Statements This presentation includes “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 and Section 21 E of the Securities Exchange Act of 1934 , as amended, with respect to our financial condition, results of operations and business and our expectations or beliefs concerning future events . All statements regarding Berry’s, AEP’s or their respective subsidiaries’ expected future financial position, results of operations, cash flows, funds from operations, dividends and dividend plans, financing plans, business strategy, budgets, projected costs, operating metrics, capital expenditures, competitive positions, acquisitions, investment opportunities, merger integration, growth opportunities, dispositions, expected lease income, plans and objectives of management for future operations and statements that include words such as “anticipate,” “if,” “believe,” “plan,” “estimate,” “expect,” “intend,” “may,” “could,” “should,” “would,” “will,” “seeks,” “approximately,” “outlook,” “looking forward” and other similar expressions or the negative form of the same are forward - looking statements . Forward - looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the potential timing or consummation of the proposed transaction or the anticipated benefits thereof, including, without limitation, future financial and operating results . Berry and AEP caution readers that these and other forward - looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward - looking statements . Important risk factors that may cause such a difference include, but are not limited to risks and uncertainties related to (i) the ability to obtain shareholder and regulatory approvals, or the possibility that they may delay the transaction or that such regulatory approval may result in the imposition of conditions that could cause the parties to abandon the transaction, (ii) the risk that a condition to closing of the merger may not be satisfied ; (iii) the ability of Berry to integrate the acquired business successfully and to achieve anticipated cost savings and other synergies, (iv) the possibility that other anticipated benefits of the proposed transaction will not be realized, including without limitation, anticipated revenues, expenses, earnings and other financial results, and growth and expansion of the new combined company’s operations, and the anticipated tax treatment, (v) potential litigation relating to the proposed transaction that could be instituted against Berry, AEP or their respective directors, (vi) possible disruptions from the proposed transaction that could harm Berry’s or AEP’s business, including current plans and operations, (vii) potential adverse reactions or changes to relationships with clients, employees, suppliers or other parties resulting from the announcement or completion of the merger, (viii) changes in prices and availability of resin and other raw materials and our ability to pass on changes in raw material prices on a timely basis, (ix) continued availability of capital and financing and rating agency actions, (x) legislative, regulatory and economic developments and (xi) catastrophic loss of one of our key manufacturing facilities, natural disasters, and other unplanned business interruptions ; as well as management’s response to any of the aforementioned factors . These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the proxy statement/prospectus that will be included in the registration statement on Form S - 4 that will be filed with the Securities and Exchange Commission (“SEC”) in connection with the proposed transaction . While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form S - 4 are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties . Unlisted factors may present significant additional obstacles to the realization of forward looking statements . Consequences of material differences in results as compared with those anticipated in the forward - looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Berry’s or AEP’s consolidated financial condition, results of operations, credit rating or liquidity . Neither Berry nor AEP assumes any obligation to provide revisions or updates to any forward looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws . Non - GAAP Financial Measures This presentation includes certain non - GAAP financial measures such as operating EBITDA, adjusted EBITDA, adjusted net income, and adjusted free cash flow intended to supplement, not substitute for, comparable measures . Reconciliations of non - GAAP financial measures to GAAP financial measures are provided at the end of the presentation . Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided . Adjusted EBITDA is a non - GAAP financial measure used by management to measure performance of the Company’s operations, and also among the criteria upon which performance - based compensation may be based . Adjusted EBITDA also is used by our lenders for debt covenant compliance purposes . For further information about our non - GAAP measures, please see our earnings release, SEC filings and supplemental data at the end of this presentation . 2 Safe Harbor Statements

No Offer or Solicitation This presentation is not intended to and does not constitute an offer to sell or the solicitation of an offer to buy, sell or solicit any securities or any proxy, vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended . In connection with the proposed transaction, Berry expects to prepare and file with the SEC a registration statement on Form S - 4 containing a proxy statement/prospectus and other documents with respect to Berry’s proposed acquisition of AEP . Investors are urged to read the proxy statement/prospectus (including all amendments and supplements thereto) and other relevant documents filed with the SEC if and when they become available because they will contain important information about the proposed transaction . Additional Information and Where to Find It Investors may obtain free copies of the registration statement, the proxy statement/prospectus and other relevant documents filed by Berry and AEP with the SEC (when they become available) through the website maintained by the SEC at www . sec . gov . Copies of the documents filed by Berry with the SEC will also be available free of charge on Berry’s website at www . berryplastics . com and copies of the documents filed by AEP with the SEC are available free of charge on AEP’s website at www . aepinc . com . Participants in Solicitation Relating to the Merger Berry, AEP and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from AEP’s shareholders in respect of the proposed transaction . Information regarding Berry’s directors and executive officers can be found in Berry’s definitive proxy statement filed with the SEC on January 20 , 2016 . Information regarding AEP’s directors and executive officers can be found in AEP’s definitive proxy statement filed with the SEC on February 25 , 2016 . Additional information regarding the interests of such potential participants will be included in the proxy statement/prospectus and other relevant documents filed with the SEC in connection with the proposed transaction if and when they become available . These documents are available free of charge on the SEC’s website and from Berry and AEP, as applicable, using the sources indicated above . 3 Additional Information

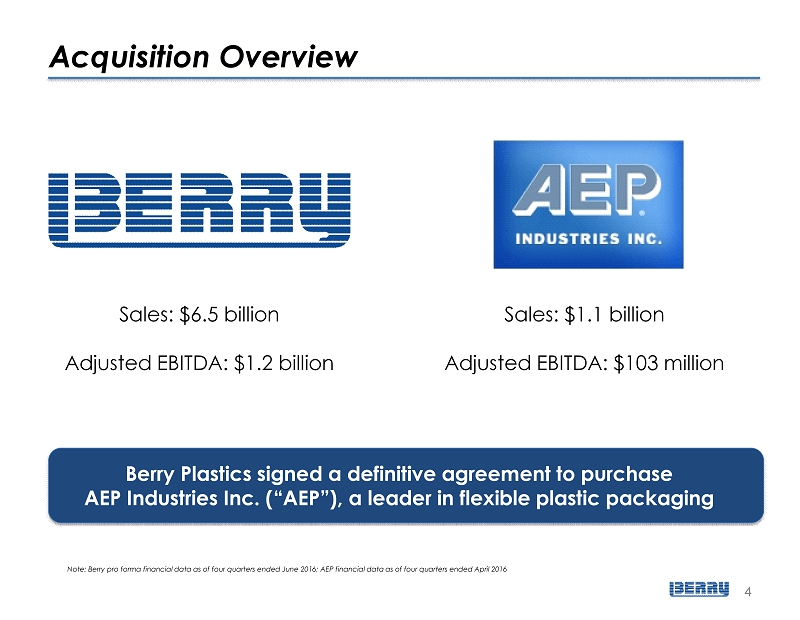

Acquisition Overview 4 Berry Plastics s igned a d efinitive a greement to purchase AEP Industries Inc. (“AEP”), a l eader in flexible p lastic p ackaging Sales: $6.5 billion Adjusted EBITDA: $1.2 billion Sales: $1.1 billion Adjusted EBITDA: $103 million Note: Berry pro forma financial data as of four quarters ended June 2016; AEP financial data as of four quarters ended April 2016

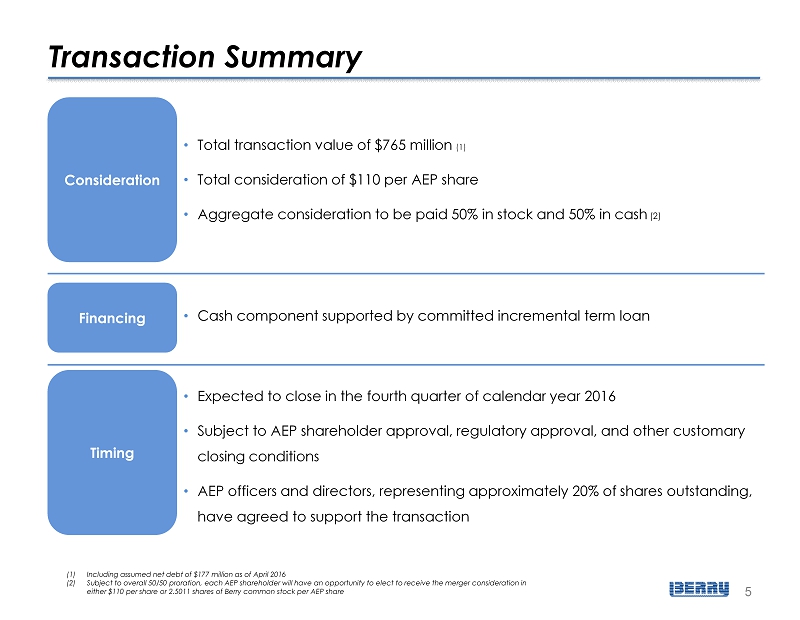

Transaction Summary 5 Consideration • Total transaction value of $765 million (1) • Total consideration of $110 per AEP share • Aggregate consideration to be paid 50% in stock and 50% in cash Timing • Expected to close in the fourth quarter of calendar year 2016 • Subject to AEP shareholder approval, regulatory approval, and other customary closing conditions • AEP officers and directors, representing approximately 20% of shares outstanding, have agreed to support the transaction Financing • Cash component supported by committed incremental term loan (1) Including assumed net debt of $177 million as of April 2016 (2) Subject to overall 50/50 proration, each AEP shareholder will have an opportunity to elect to receive the merger consideratio n i n either $110 per share or 2.5011 shares of Berry common stock per AEP share (2)

Acquisition Rationale 6 • Highly complementary products, geographic footprint, and customers • Increases Berry’s scale with low execution risk • Annual cost synergies expected to meet or exceed $50 million • Deleveraging and accelerates pathway to leverage goal • Value creating for Berry shareholders after expected cost synergies ‒ Expected to be accretive to adjusted net income and adjusted free cash flow (“FCF”) by 10 %+ ‒ Adds approximately $85 million (1) of annual pro forma FCF (1) Reflects pro forma AEP data as of four quarters ended April 2016

AEP Overview • A leader in flexible plastic packaging products, producing over 15,000 types of multi - purpose and flexible packaging films • Strong North American footprint with 14 manufacturing facilities strategically located across the U.S. and Canada • Long - standing, diverse base of 3,000+ customers • Significant momentum, generating record financial results over each of the last several quarters • Four quarters ended April 2016: net sales of $1.1 billion and adjusted EBITDA of $103 million on ~1 billion pounds of resin purchases 7 AEP – A Flexible Packaging Leader Custom Films Canliners Printed & Converted Film PROformance Films Shrink Bundle Film Tubing Stretch Wrap Hand Wrap Pre - Cooked Meals Food / Beverage Food Bags Seal Wrap Premium Canliners Stretch Wrap Food Contact x x x x x x = Overlap with Berry Key Products x Food Contact

8 Significant, Clearly Identifiable Cost Synergies Annual Cost Synergies Expected to Meet or Exceed $50 Million • Procurement savings opportunity (~1 billion pounds of additional resin purchases) • Improved utilization of assets across AEP / Berry plant network • Sharing of best practices across AEP / Berry manufacturing platforms • Reduction of combined SG&A and other direct and indirect costs • Reduced freight cost by leveraging expanded plant network

+ = Four quarters ended Net Sales $1,467 $1,107 $2,574 $7,634 Adjusted EBITDA $269 $103 $422 $1,365 % of Net Sales 18.3% 9.3% 16.4% 17.9% Adjusted EBITDA - Capex $226 $93 $369 $1,075 % of Net Sales 15.4% 8.4% 14.3% 14.1% Employees 3,600 2,600 6,200 23,600 Manufacturing Facilities 28 14 42 129 Engineered Materials Division (EMD) 9 Acquisition of AEP Adds Scale to Berry’s EMD Pro Forma Pro Forma EMD Note: $ in millions (1) Including $50 million of expected cost synergies (1) (1) June 2016 April 2016

11.1% 10.1% 6.1% 6.0% 5.6% 5.6% 5.6% 4.6% 3.7% Berry PF Berry Sealed Air Crown Sonoco Bemis Silgan Ball Aptar Four quarters ended - June 2016 Berry Adjusted EBITDA $1,212 Pro forma adjustments (1) (98) Operating EBITDA $1,114 Capital expenditures (280) Cash interest expense (252) Taxes (2) (107) Working capital 69 Restructuring and other (3) (69) Adjusted free cash flow $475 Adjusted FCF with AEP (4) $560 10 Industry Leading Free Cash Flow Components of Free Cash Flow Note: $ in millions (1) Pro forma adjustments include Operating EBITDA and unrealized cost savings from the Avintiv acquisition (2) Includes tax receivable agreement payment in FY ’16 Guidance of $57 million made in October 2015 and other cash taxes (3) Includes integration expenses and other business optimization costs (4) Reflects pro forma AEP financial data as of four quarters ended April 2016 (5) Based on market data as of June 30, 2016. Free cash flow defined as operating cash flow less net capex and is based on management guidance, except Ball and Aptar (based on Wall St. consensus estimates ) Adjusted FCF: Adjusted Free Cash Flow Yield (2016E ) (5) Increased Pro Forma Free Cash Flow to Accelerate Deleveraging $560 $475 $550 $425 $278 $275 $175 ~$600 $185

Summary 11 • Compelling synergy opportunity • Low execution risk • Net deleveraging • Increased scale in resin purchasing • Accretive to shareholder value x x x x x

12 Appendix: Financial Data

13 Note: $ in Millions, Unaudited (1) Pro forma adjustments include Operating EBITDA and unrealized cost saving from Avintiv acquisition (2) Includes business optimization and integration expenses (3) Includes $50 million of expected cost synergies, net of tax Exhibit 1 Four Quarters Ended Berry AEP June 2016 April 2016 Adjusted EBITDA $1,212 $103 PF Adjustments (1) (98) - Depreciation and amortization (477) (30) Other non-cash charges (43) 6 Business optimization and other expense (2) (30) - Restructuring and impairment (31) - Other income, net 22 - Interest expense, net (261) (18) Income tax expense (87) (22) Net Income $207 $39 Cash flow from operating activities 812 62 Net additions to property, plant and equipment (280) (10) Payments of tax receivable agreement (57) - Synergies, net of tax (3) - 33 Adjusted Free Cash Flow $475 $85