Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - DYCOM INDUSTRIES INC | dyfy2016q4earningsreleasee.htm |

| 8-K - 8-K - DYCOM INDUSTRIES INC | dycomfy2016q48k-earningsre.htm |

4th Quarter Fiscal 2016

Results Conference Call

August 24, 2016

Exhibit 99.2

2

Forward Looking Statements and Non-GAAP

Information

This presentation contains “forward-looking statements”. Other than statements of historical facts, all statements contained in

this presentation, including statements regarding the Company’s future financial position, future revenue, prospects, plans and

objectives of management, are forward-looking statements. Words such as “outlook,” “believe,” “expect,” “anticipate,”

“estimate,” “intend,” “should,” “could,” “project,” and similar expressions, as well as statements in future tense, identify

forward-looking statements. You should not consider forward-looking statements as a guarantee of future performance or

results. Forward-looking statements are based on information available at the time those statements are made and/or

management’s good faith belief at that time with respect to future events. Such statements are subject to risks and

uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the

forward-looking statements. Important factors, assumptions, uncertainties, and risks that could cause such differences are

discussed in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on

September 4, 2015, our Quarterly Report on Form 10-Q filed with the SEC on May 27, 2016 and other filings with the SEC. The

forward-looking statements in this presentation are expressly qualified in their entirety by this cautionary statement. The

Company undertakes no obligation to update these forward-looking statements to reflect new information, or events or

circumstances arising after such date.

This presentation includes certain “Non-GAAP” financial measures as defined by Regulation G of the SEC. As required by the

SEC, we have provided a reconciliation of those measures to the most directly comparable GAAP measures on the Regulation G

slides included as slides 13 through 19 of this presentation. Non-GAAP financial measures should be considered in addition to,

but not as a substitute for, our reported GAAP results.

3

Participants and Agenda

Participants

Steven E. Nielsen

President & Chief Executive Officer

Timothy R. Estes

Chief Operating Officer

H. Andrew DeFerrari

Chief Financial Officer

Richard B. Vilsoet

General Counsel

Agenda

Introduction and Q4-16 Overview

Industry Update

Financial & Operational Highlights

Outlook

Conclusion

Q&A

4

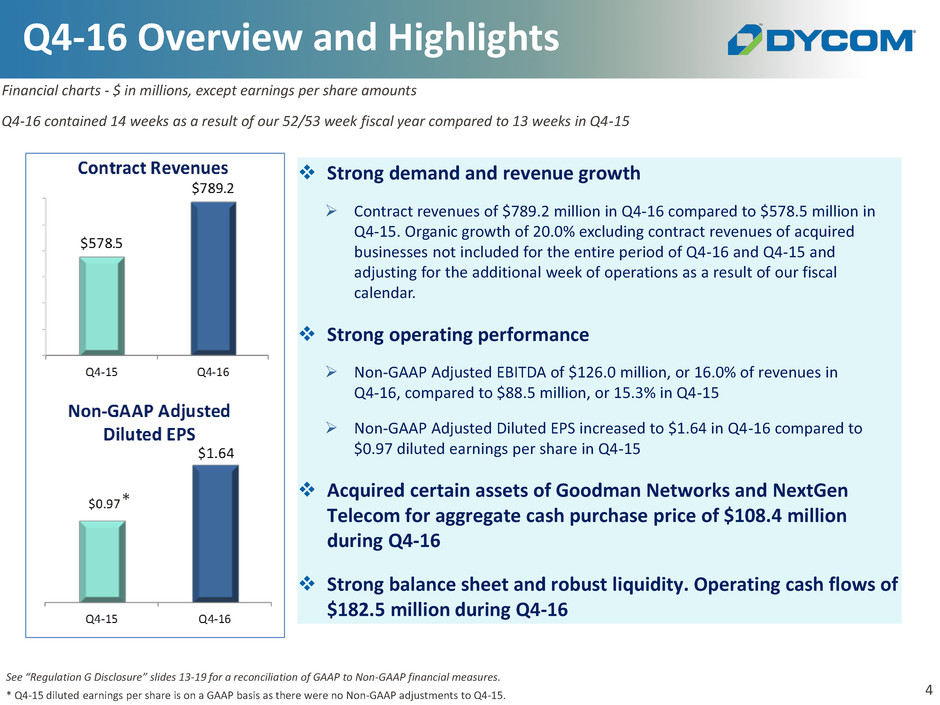

Strong demand and revenue growth

Contract revenues of $789.2 million in Q4-16 compared to $578.5 million in

Q4-15. Organic growth of 20.0% excluding contract revenues of acquired

businesses not included for the entire period of Q4-16 and Q4-15 and

adjusting for the additional week of operations as a result of our fiscal

calendar.

Strong operating performance

Non-GAAP Adjusted EBITDA of $126.0 million, or 16.0% of revenues in

Q4-16, compared to $88.5 million, or 15.3% in Q4-15

Non-GAAP Adjusted Diluted EPS increased to $1.64 in Q4-16 compared to

$0.97 diluted earnings per share in Q4-15

Acquired certain assets of Goodman Networks and NextGen

Telecom for aggregate cash purchase price of $108.4 million

during Q4-16

Strong balance sheet and robust liquidity. Operating cash flows of

$182.5 million during Q4-16

Financial charts - $ in millions, except earnings per share amounts

Q4-16 Overview and Highlights

See “Regulation G Disclosure” slides 13-19 for a reconciliation of GAAP to Non-GAAP financial measures.

* Q4-15 diluted earnings per share is on a GAAP basis as there were no Non-GAAP adjustments to Q4-15.

*

Q4-16 contained 14 weeks as a result of our 52/53 week fiscal year compared to 13 weeks in Q4-15

5

Industry increasing network bandwidth dramatically

Major industry participants deploying significant wireline networks

Newly deployed networks provisioning 1 gigabit speeds; speeds

beyond 1 gigabit envisioned

Industry developments have produced opportunities which in

aggregate are without precedent

Delivering valuable service to customers

Currently providing services for 1 gigabit full deployments across the

country in dozens of metropolitan areas to a number of customers

Revenues and opportunities driven by this industry standard

accelerated

Customers are revealing with more specificity multi-year initiatives

that are being implemented and managed locally

Calendar 2016 performance to date and outlook clearly

demonstrate we are currently in the early stages of a massive

investment cycle in wireline networks

Dycom’s scale, market position and financial strength position

it well as opportunities continue to expand

Industry Update

6

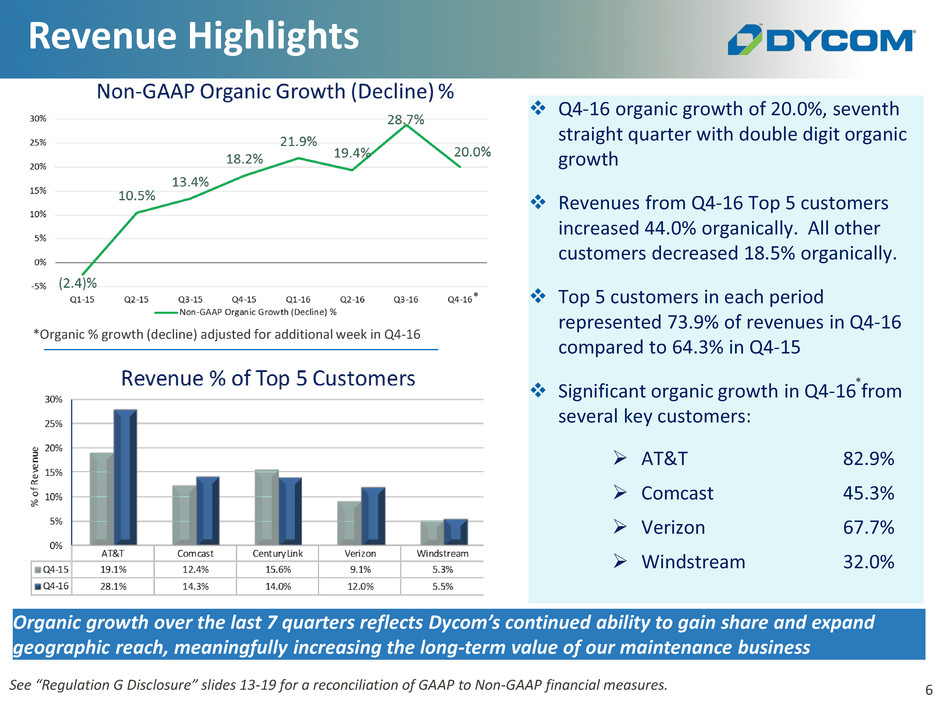

Revenue Highlights

Q4-16 organic growth of 20.0%, seventh

straight quarter with double digit organic

growth

Revenues from Q4-16 Top 5 customers

increased 44.0% organically. All other

customers decreased 18.5% organically.

Top 5 customers in each period

represented 73.9% of revenues in Q4-16

compared to 64.3% in Q4-15

Significant organic growth in Q4-16 from

several key customers:

See “Regulation G Disclosure” slides 13-19 for a reconciliation of GAAP to Non-GAAP financial measures.

Organic growth over the last 7 quarters reflects Dycom’s continued ability to gain share and expand

geographic reach, meaningfully increasing the long-term value of our maintenance business

AT&T 82.9%

Comcast 45.3%

Verizon

67.7%

Windstream 32.0%

*Organic % growth (decline) adjusted for additional week in Q4-16

*

*

7

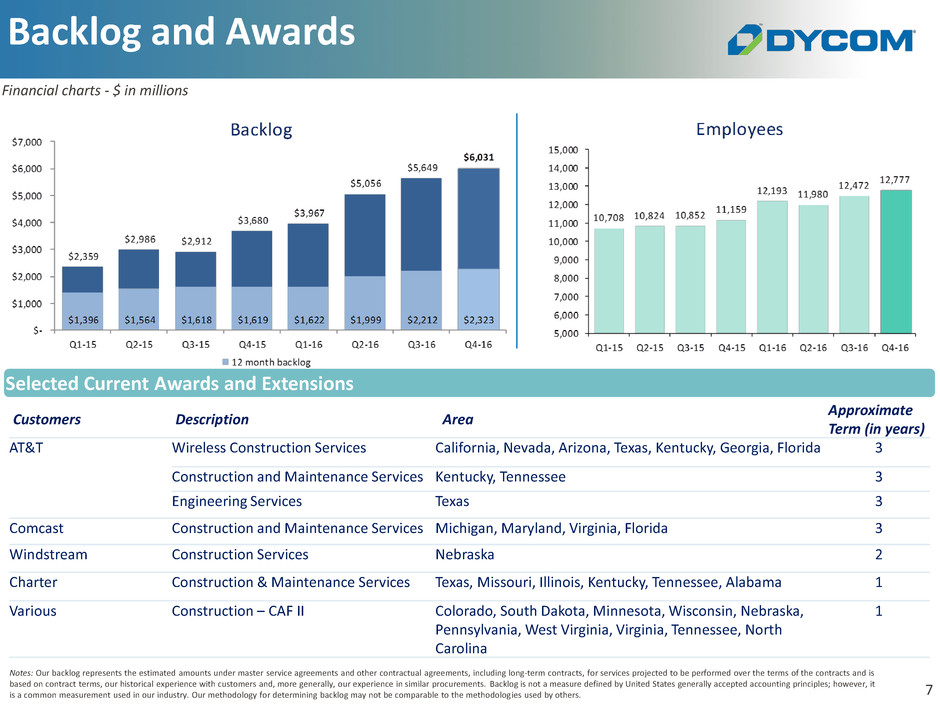

Customers Description Area

Approximate

Term (in years)

AT&T Wireless Construction Services California, Nevada, Arizona, Texas, Kentucky, Georgia, Florida 3

Construction and Maintenance Services Kentucky, Tennessee 3

Engineering Services Texas 3

Comcast Construction and Maintenance Services Michigan, Maryland, Virginia, Florida 3

Windstream Construction Services Nebraska 2

Charter Construction & Maintenance Services Texas, Missouri, Illinois, Kentucky, Tennessee, Alabama 1

Various Construction – CAF II Colorado, South Dakota, Minnesota, Wisconsin, Nebraska,

Pennsylvania, West Virginia, Virginia, Tennessee, North

Carolina

1

Backlog and Awards

Notes: Our backlog represents the estimated amounts under master service agreements and other contractual agreements, including long-term contracts, for services projected to be performed over the terms of the contracts and is

based on contract terms, our historical experience with customers and, more generally, our experience in similar procurements. Backlog is not a measure defined by United States generally accepted accounting principles; however, it

is a common measurement used in our industry. Our methodology for determining backlog may not be comparable to the methodologies used by others.

Selected Current Awards and Extensions

Financial charts - $ in millions

8

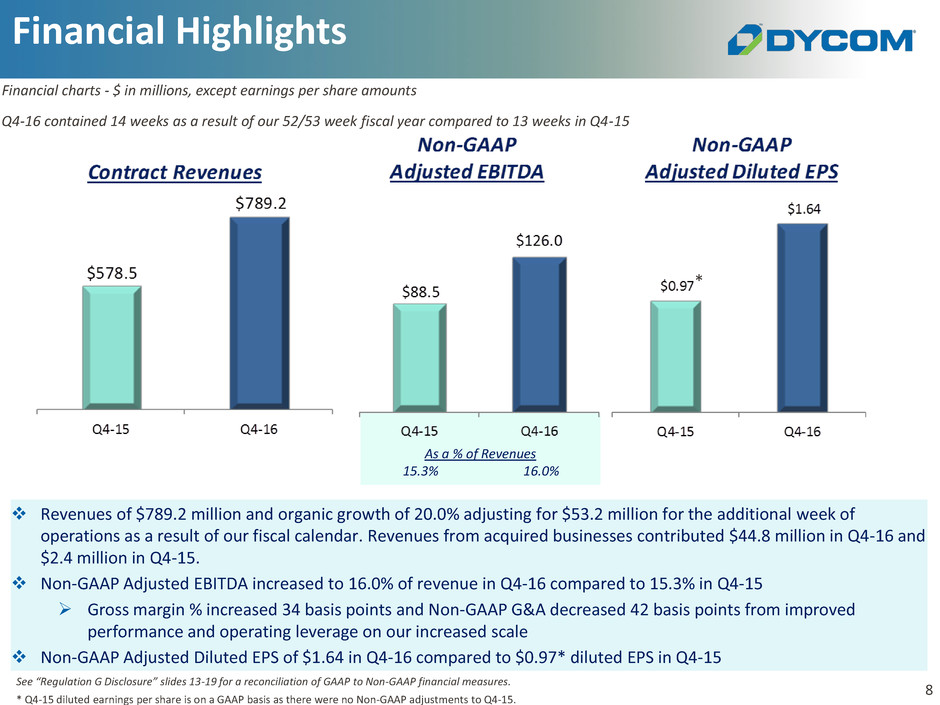

As a % of Revenues

15.3% 16.0%

Revenues of $789.2 million and organic growth of 20.0% adjusting for $53.2 million for the additional week of

operations as a result of our fiscal calendar. Revenues from acquired businesses contributed $44.8 million in Q4-16 and

$2.4 million in Q4-15.

Non-GAAP Adjusted EBITDA increased to 16.0% of revenue in Q4-16 compared to 15.3% in Q4-15

Gross margin % increased 34 basis points and Non-GAAP G&A decreased 42 basis points from improved

performance and operating leverage on our increased scale

Non-GAAP Adjusted Diluted EPS of $1.64 in Q4-16 compared to $0.97* diluted EPS in Q4-15

Financial Highlights

See “Regulation G Disclosure” slides 13-19 for a reconciliation of GAAP to Non-GAAP financial measures.

* Q4-15 diluted earnings per share is on a GAAP basis as there were no Non-GAAP adjustments to Q4-15.

Financial charts - $ in millions, except earnings per share amounts

*

Q4-16 contained 14 weeks as a result of our 52/53 week fiscal year compared to 13 weeks in Q4-15

9

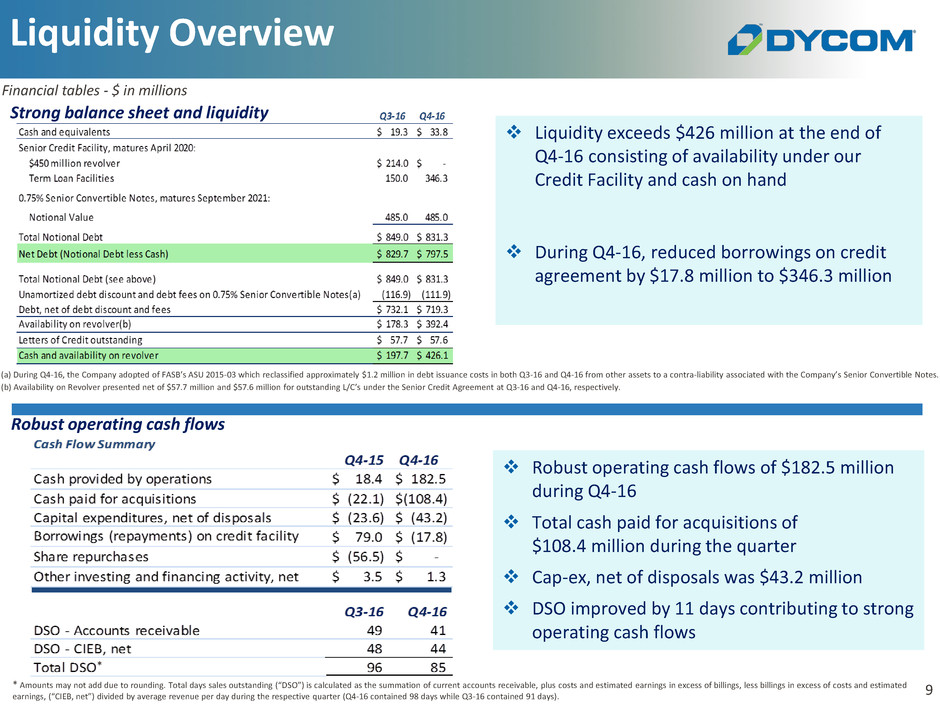

Strong balance sheet and liquidity

Liquidity Overview

(a) During Q4-16, the Company adopted of FASB’s ASU 2015-03 which reclassified approximately $1.2 million in debt issuance costs in both Q3-16 and Q4-16 from other assets to a contra-liability associated with the Company’s Senior Convertible Notes.

(b) Availability on Revolver presented net of $57.7 million and $57.6 million for outstanding L/C’s under the Senior Credit Agreement at Q3-16 and Q4-16, respectively.

Financial tables - $ in millions

Robust operating cash flows

* Amounts may not add due to rounding. Total days sales outstanding (“DSO”) is calculated as the summation of current accounts receivable, plus costs and estimated earnings in excess of billings, less billings in excess of costs and estimated

earnings, (“CIEB, net”) divided by average revenue per day during the respective quarter (Q4-16 contained 98 days while Q3-16 contained 91 days).

Liquidity exceeds $426 million at the end of

Q4-16 consisting of availability under our

Credit Facility and cash on hand

During Q4-16, reduced borrowings on credit

agreement by $17.8 million to $346.3 million

Robust operating cash flows of $182.5 million

during Q4-16

Total cash paid for acquisitions of

$108.4 million during the quarter

Cap-ex, net of disposals was $43.2 million

DSO improved by 11 days contributing to strong

operating cash flows

*

10

Q1-2016

Included for

comparison

Q1-2017 Outlook and Commentary

Contract Revenues $ 659.3 $780 - $810 Broad range of demand from several large customers

Robust 1 gigabit deployments, cable capacity projects and CAF II accelerating, core

market share growth

Total revenue expected to include approximately $55.0 million in Q1-17 compared

to $29.9 million in Q1-16 from businesses acquired in Q1-16 and Q4-16

For the fiscal year of 2017, recently acquired operations of Goodman Networks

expected to produce revenues of approximately $100 million

Gross Margin % 23.1% Gross Margin % which

increases slightly

from Q1-16

Solid mix of customer growth opportunities

G&A Expense % 7.8% G&A as a % of revenue

in-line with Q1-16

G&A as a % of revenue supports our increased scale

Outlook for G&A expense % includes share-based compensation Share-based compensation $ 4.5 $ 5.7

Depreciation &

Amortization

$ 27.4 $35.0 - $35.7 Depreciation reflects cap-ex supporting growth and maintenance

Includes amortization of approximately $6.2 million in Q1-17 compared to

$4.8 million in Q1-16

Non-GAAP Adjusted Interest

Expense

$ 7.4 Approximately $ 4.5

Includes 0.75% cash coupon on Senior Convertible Notes, interest on Senior Credit

Agreement, amortization of debt issuance costs and other interest. Q1-16 also

included interest on 7.125% Notes previously outstanding.

Non-GAAP Adjusted Interest Expense excludes non-cash amortization of debt

discount of $4.3 million in Q1-17 compared to $1.8 million in Q1-16

Other Income, net $ 1.5 $ 0.2 - $ 0.6 Other income, net primarily includes gain (loss) on sales of fixed assets and discount

charges related to non-recourse sales of accounts receivable in connection with a

customer’s supplier payment program

Loss on debt

extinguishment

$16.3 $ - Q1-16 included pre-tax charge of $16.3 million for loss on debt extinguishment in

connection with the redemption of the 7.125% senior subordinated notes

Non-GAAP Adjusted EBITDA

%

16.0% Non-GAAP Adjusted

EBITDA % in-line or better

than the Q1-16 result

Adjusted EBITDA amount increases from revenue growth and strong operating

performance

Diluted Earnings per Share

$ 1.24

Non-GAAP Adjusted

Diluted EPS

$ 1.55 - $ 1.70

Non-GAAP Adjusted Diluted EPS excludes non-cash amortization of debt discount

on Senior Convertible Notes. See slide 18 for reconciliation of guidance for Non-

GAAP Adjusted Diluted Earnings per Common Share

Effective tax rate of approximately 37.5% during Q1-17

Diluted Shares 33.9 million 32.2 million

Q1-2017 Outlook

See “Regulation G Disclosure” slides 13-19 for a reconciliation of GAAP to Non-GAAP financial measures.

Financial table- $ in millions, except earnings per share amounts (% as a percent of contract revenues)

11

Looking Ahead to Q2-2017

Q2-2016

Included for comparison

Q2-2017 Outlook and Commentary

Contract Revenues $ 559.5 Total revenue growth %

in high teens or slightly

better as a % of revenue

compared to Q2-16

Expectation of normal winter weather patterns

Broad range of demand from several large customers

Robust 1 gigabit deployments, cable capacity projects and CAF II

accelerating, core market share growth

Total revenue expected to include approximately $20.0 million in Q2-17

from businesses acquired in Q4-16 compared to none in Q2-16

Gross Margin %

19.5% Gross Margin % which

increases from Q2-16

Solid mix of customer growth opportunities

Q2 margins display impacts of seasonality including:

* inclement winter weather

* fewer available workdays due to holidays

* reduced daylight work hours

* restart of calendar payroll taxes

G&A Expense % 8.4% G&A as a % of revenue

in-line with Q2-16

G&A as a % of revenue supports our increased scale

Outlook for G&A expense % includes share-based compensation Share-based compensation $ 4.2 $ 5.2

Depreciation &

Amortization

$ 29.9 $35.5 - $36.2

Depreciation reflects cap-ex supporting growth and maintenance

Includes amortization of approximately $6.1 million in Q2-17 compared to

$4.7 million in Q2-16

Non-GAAP Adjusted

Interest Expense

$ 3.7 Approximately $ 4.3 Non-GAAP Adjusted Interest Expense excludes non-cash amortization of

debt discount of $4.4 million in Q2-17 compared to $4.1 million in Q2-16

Other Income, net $ 1.1 $ 0.2 - $ 0.7 Other income, net primarily includes gain (loss) on sales of fixed assets and

discount charges related to non-recourse sales of accounts receivable in

connection with a customer’s supplier payment program

Non-GAAP Adjusted

EBITDA %

11.9% Non-GAAP Adjusted

EBITDA % which

increases from Q2-16

Adjusted EBITDA increases from revenue growth and improved operating

performance

See “Regulation G Disclosure” slides 13-19 for a reconciliation of GAAP to Non-GAAP financial measures.

Financial table- $ in millions (% as a percent of contract revenues)

12

Conclusion

Firm and strengthening end market opportunities

Telephone companies deploying FTTX to enable video offerings and 1 gigabit

connections

Cable operators continuing to deploy fiber to small and medium businesses with

overall cable capital expenditures, new build opportunities, and capacity expansion

projects increasing

Connect America Fund (“CAF”) II projects in planning, engineering, and construction,

with activity accelerating. We are executing meaningful assignments from one

recipient for fixed wireless deployments

Customers are consolidating supply chains creating opportunities for market share

growth and increasing the long-term value of our maintenance business

Encouraged that industry participants are committed to multi-year

capital spending initiatives which in most cases are meaningfully

accelerating and expanding in scope

13

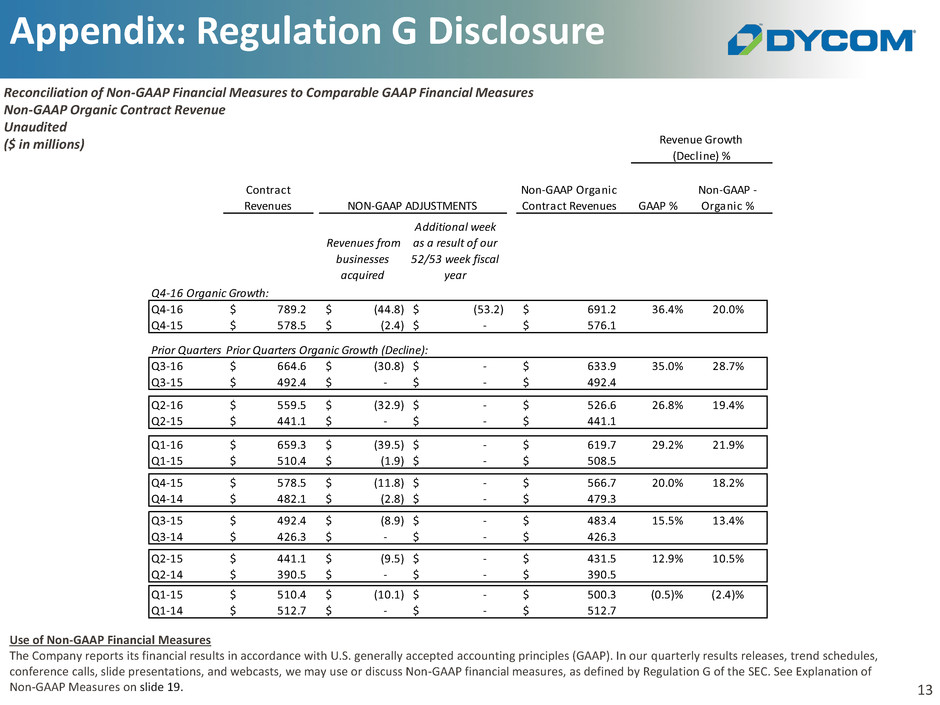

Appendix: Regulation G Disclosure

Use of Non-GAAP Financial Measures

The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules,

conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of

Non-GAAP Measures on slide 19.

Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures

Non-GAAP Organic Contract Revenue

Unaudited

($ in millions)

GAAP %

Non-GAAP -

Organic %

Revenues from

businesses

acquired

Additional week

as a result of our

52/53 week fiscal

year

Q4-16 Organic Growth:

Q4-16 789.2$ (44.8)$ (53.2)$ 691.2$ 36.4% 20.0%

Q4-15 578.5$ (2.4)$ -$ 576.1$

Prior Quarters Organic Growth (Decline):P ior Qua ters Organic Growth (Decline):

Q3-16 664.6$ (30.8)$ -$ 633.9$ 35.0% 28.7%

Q3-15 492.4$ -$ -$ 492.4$

Q2-16 559.5$ (32.9)$ -$ 526.6$ 26.8% 19.4%

Q2-15 441.1$ -$ -$ 441.1$

Q1-16 659.3$ (39.5)$ -$ 619.7$ 29.2% 21.9%

Q1-15 510.4$ (1.9)$ -$ 508.5$

Q4-15 578.5$ (11.8)$ -$ 566.7$ 20.0% 18.2%

Q4-14 482.1$ (2.8)$ -$ 479.3$

Q3-15 492.4$ (8.9)$ -$ 483.4$ 15.5% 13.4%

Q3-14 426.3$ -$ -$ 426.3$

Q2-15 441.1$ (9.5)$ -$ 431.5$ 12.9% 10.5%

Q2-14 390.5$ -$ -$ 390.5$

Q1-15 510.4$ (10.1)$ -$ 500.3$ (0.5)% (2.4)%

Q1-14 512.7$ -$ -$ 512.7$

Contract

Revenues NON-GAAP ADJUSTMENTS

Revenue Growth

(Decline) %

Non-GAAP Organic

Contract Revenues

14

Notes: Amounts above may not add due to rounding.

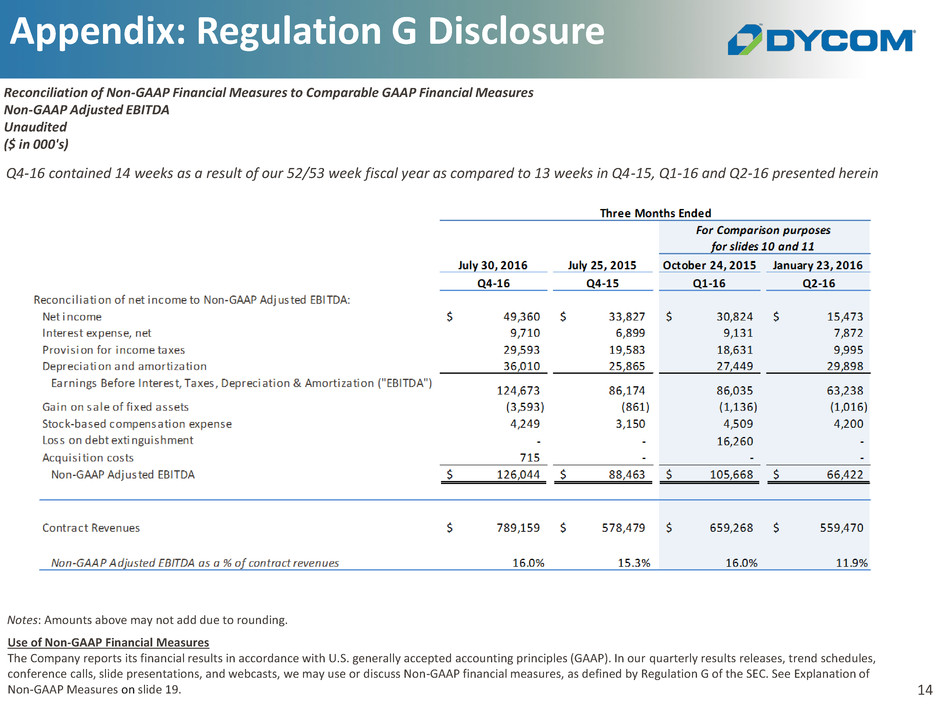

Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures

Non-GAAP Adjusted EBITDA

Unaudited

($ in 000's)

Use of Non-GAAP Financial Measures

The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules,

conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of

Non-GAAP Measures on slide 19.

Appendix: Regulation G Disclosure

Q4-16 contained 14 weeks as a result of our 52/53 week fiscal year as compared to 13 weeks in Q4-15, Q1-16 and Q2-16 presented herein

15

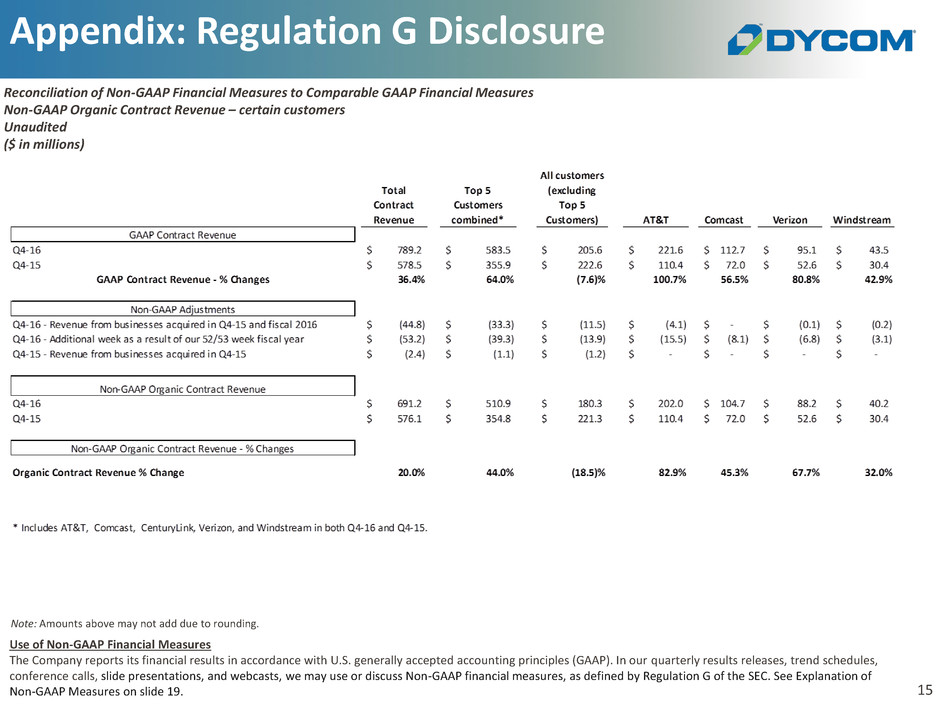

Note: Amounts above may not add due to rounding.

Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures

Non-GAAP Organic Contract Revenue – certain customers

Unaudited

($ in millions)

Use of Non-GAAP Financial Measures

The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules,

conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of

Non-GAAP Measures on slide 19.

Appendix: Regulation G Disclosure

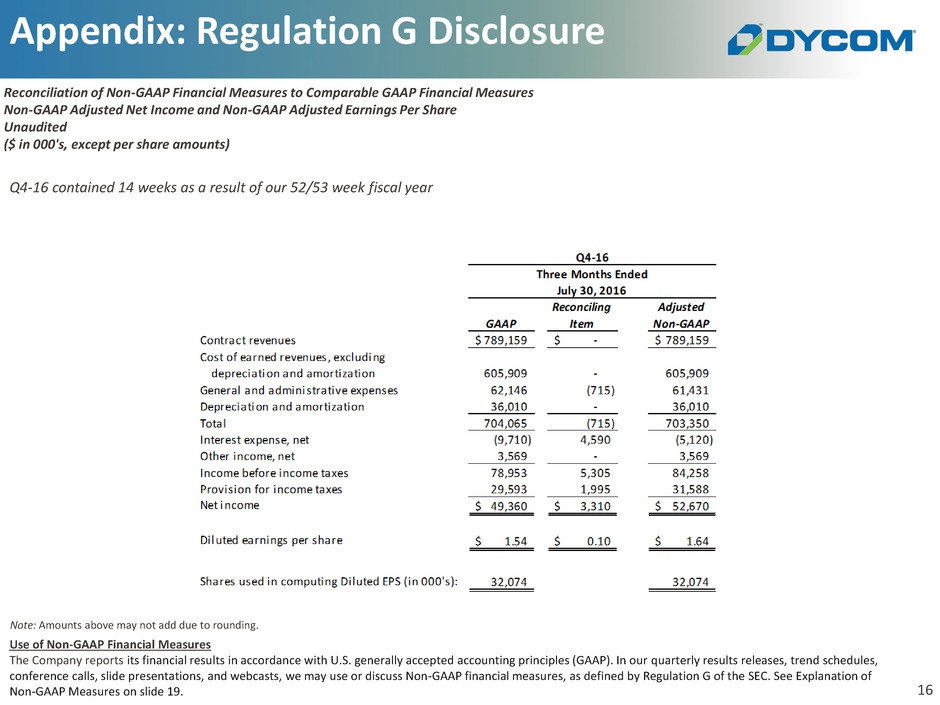

16

Note: Amounts above may not add due to rounding.

Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures

Non-GAAP Adjusted Net Income and Non-GAAP Adjusted Earnings Per Share

Unaudited

($ in 000's, except per share amounts)

Use of Non-GAAP Financial Measures

The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules,

conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of

Non-GAAP Measures on slide 19.

Appendix: Regulation G Disclosure

Q4-16 contained 14 weeks as a result of our 52/53 week fiscal year

17

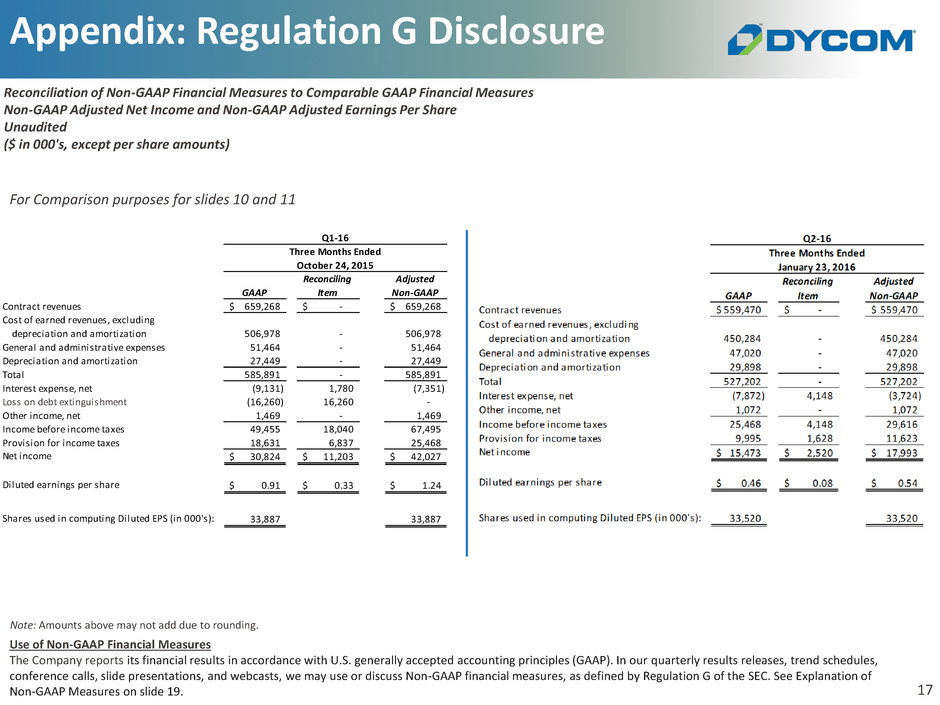

Note: Amounts above may not add due to rounding.

Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures

Non-GAAP Adjusted Net Income and Non-GAAP Adjusted Earnings Per Share

Unaudited

($ in 000's, except per share amounts)

Use of Non-GAAP Financial Measures

The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules,

conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of

Non-GAAP Measures on slide 19.

Appendix: Regulation G Disclosure

GAAP

Reconciling

Item

Adjusted

Non-GAAP

Contract revenues 659,268$ -$ 659,268$

Cost of earned revenues, excluding

depreciation and amortization 506,978 - 506,978

General and administrative expenses 51,464 - 51,464

Depreciation and amortization 27,449 - 27,449

Total 585,891 - 585,891

Interest expense, net (9,131) 1,780 (7,351)

Loss on debt extinguishment (16,260) 16,260 -

Other income, net 1,469 - 1,469

Income before income taxes 49,455 18,040 67,495

Provision for income taxes 18,631 6,837 25,468

Net income 30,824$ 11,203$ 42,027$

Diluted earnings per share 0.91$ 0.33$ 1.24$

Shares used in computing Diluted EPS (in 000's): 33,887 33,887

Three Months Ended

October 24, 2015

Q1-16

For Comparison purposes for slides 10 and 11

18

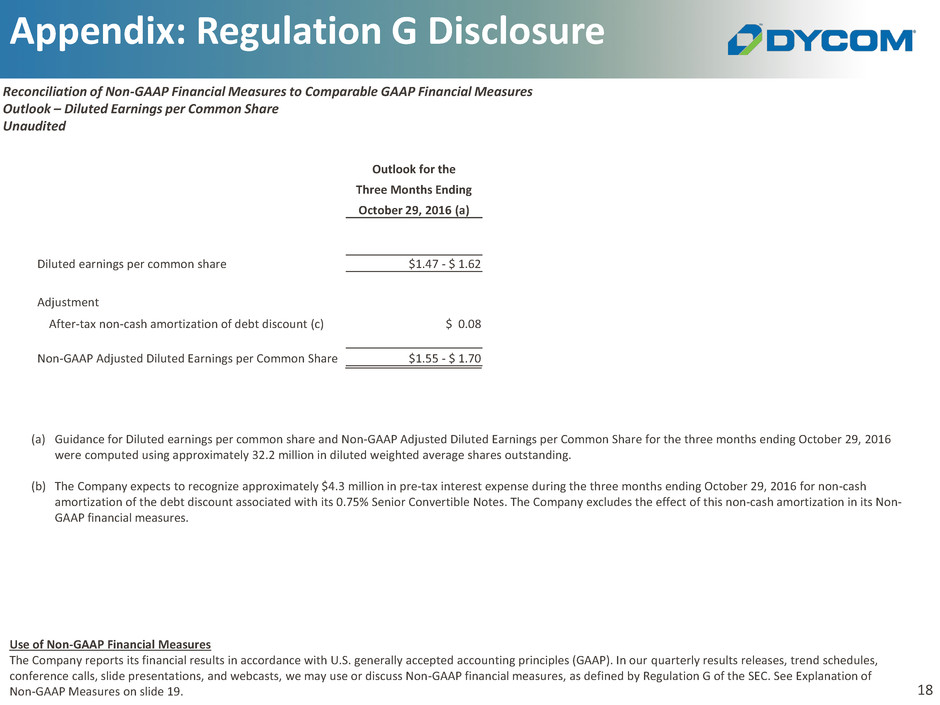

Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures

Outlook – Diluted Earnings per Common Share

Unaudited

Use of Non-GAAP Financial Measures

The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules,

conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of

Non-GAAP Measures on slide 19.

(a) Guidance for Diluted earnings per common share and Non-GAAP Adjusted Diluted Earnings per Common Share for the three months ending October 29, 2016

were computed using approximately 32.2 million in diluted weighted average shares outstanding.

(b) The Company expects to recognize approximately $4.3 million in pre-tax interest expense during the three months ending October 29, 2016 for non-cash

amortization of the debt discount associated with its 0.75% Senior Convertible Notes. The Company excludes the effect of this non-cash amortization in its Non-

GAAP financial measures.

Outlook for the

Three Months Ending

October 29, 2016 (a)

Diluted earnings per common share $1.47 - $ 1.62

Adjustment

After-tax non-cash amortization of debt discount (c) $ 0.08

Non-GAAP Adjusted Diluted Earnings per Common Share $1.55 - $ 1.70

Appendix: Regulation G Disclosure

19

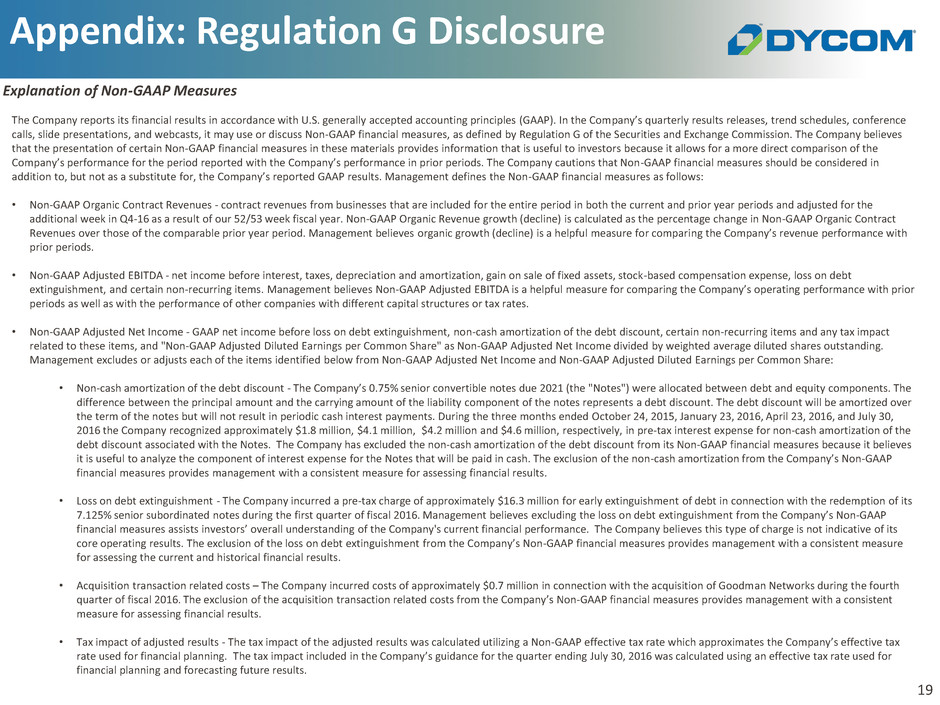

Explanation of Non-GAAP Measures

The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In the Company’s quarterly results releases, trend schedules, conference

calls, slide presentations, and webcasts, it may use or discuss Non-GAAP financial measures, as defined by Regulation G of the Securities and Exchange Commission. The Company believes

that the presentation of certain Non-GAAP financial measures in these materials provides information that is useful to investors because it allows for a more direct comparison of the

Company’s performance for the period reported with the Company’s performance in prior periods. The Company cautions that Non-GAAP financial measures should be considered in

addition to, but not as a substitute for, the Company’s reported GAAP results. Management defines the Non-GAAP financial measures as follows:

• Non-GAAP Organic Contract Revenues - contract revenues from businesses that are included for the entire period in both the current and prior year periods and adjusted for the

additional week in Q4-16 as a result of our 52/53 week fiscal year. Non-GAAP Organic Revenue growth (decline) is calculated as the percentage change in Non-GAAP Organic Contract

Revenues over those of the comparable prior year period. Management believes organic growth (decline) is a helpful measure for comparing the Company’s revenue performance with

prior periods.

• Non-GAAP Adjusted EBITDA - net income before interest, taxes, depreciation and amortization, gain on sale of fixed assets, stock-based compensation expense, loss on debt

extinguishment, and certain non-recurring items. Management believes Non-GAAP Adjusted EBITDA is a helpful measure for comparing the Company’s operating performance with prior

periods as well as with the performance of other companies with different capital structures or tax rates.

• Non-GAAP Adjusted Net Income - GAAP net income before loss on debt extinguishment, non-cash amortization of the debt discount, certain non-recurring items and any tax impact

related to these items, and "Non-GAAP Adjusted Diluted Earnings per Common Share" as Non-GAAP Adjusted Net Income divided by weighted average diluted shares outstanding.

Management excludes or adjusts each of the items identified below from Non-GAAP Adjusted Net Income and Non-GAAP Adjusted Diluted Earnings per Common Share:

• Non-cash amortization of the debt discount - The Company’s 0.75% senior convertible notes due 2021 (the "Notes") were allocated between debt and equity components. The

difference between the principal amount and the carrying amount of the liability component of the notes represents a debt discount. The debt discount will be amortized over

the term of the notes but will not result in periodic cash interest payments. During the three months ended October 24, 2015, January 23, 2016, April 23, 2016, and July 30,

2016 the Company recognized approximately $1.8 million, $4.1 million, $4.2 million and $4.6 million, respectively, in pre-tax interest expense for non-cash amortization of the

debt discount associated with the Notes. The Company has excluded the non-cash amortization of the debt discount from its Non-GAAP financial measures because it believes

it is useful to analyze the component of interest expense for the Notes that will be paid in cash. The exclusion of the non-cash amortization from the Company’s Non-GAAP

financial measures provides management with a consistent measure for assessing financial results.

• Loss on debt extinguishment - The Company incurred a pre-tax charge of approximately $16.3 million for early extinguishment of debt in connection with the redemption of its

7.125% senior subordinated notes during the first quarter of fiscal 2016. Management believes excluding the loss on debt extinguishment from the Company’s Non-GAAP

financial measures assists investors’ overall understanding of the Company's current financial performance. The Company believes this type of charge is not indicative of its

core operating results. The exclusion of the loss on debt extinguishment from the Company’s Non-GAAP financial measures provides management with a consistent measure

for assessing the current and historical financial results.

• Acquisition transaction related costs – The Company incurred costs of approximately $0.7 million in connection with the acquisition of Goodman Networks during the fourth

quarter of fiscal 2016. The exclusion of the acquisition transaction related costs from the Company’s Non-GAAP financial measures provides management with a consistent

measure for assessing financial results.

• Tax impact of adjusted results - The tax impact of the adjusted results was calculated utilizing a Non-GAAP effective tax rate which approximates the Company’s effective tax

rate used for financial planning. The tax impact included in the Company’s guidance for the quarter ending July 30, 2016 was calculated using an effective tax rate used for

financial planning and forecasting future results.

Appendix: Regulation G Disclosure

4th Quarter Fiscal 2016

Results Conference Call

August 24, 2016