Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TIVO INC | a8-kfiledaugust222016.htm |

LEASE AGREEMENT

between

ECI FOUR GOLD STREET LLC

as “Landlord”

and

TIVO INC.

as “Tenant”

Table of Contents | ||

Section | Page | |

1 | PREMISES | 4 |

2 | TERM; POSSESSION | 4 |

3 | RENT | 5 |

4 | SECURITY DEPOSSIT | 12 |

5 | USE AND COMPLIANCE WITH LAWS | 13 |

6 | TENANT IMPROVEMENTS & ALTERATIONS | 17 |

7 | MAINTENANCE AND REPAIRS | 19 |

8 | TENANT'S TAXES | 23 |

9 | UTILITIES AND SERVICES | 23 |

10 | EXCULPATION AND INDEMNIFICATION | 25 |

11 | INSURANCE | 26 |

12 | DAMAGE OR DESTRUCTION | 28 |

13 | CONDEMNATION | 31 |

14 | ASSIGNMENT AND SUBLETTING | 32 |

15 | DEFAULT AND REMEDIES | 36 |

16 | LATE CHARGE AND INTEREST | 38 |

17 | WAIVER | 38 |

18 | ENTRY, INSPECTION AND CLOSURE | 39 |

19 | SURRENDER AND HOLDING OVER | 40 |

20 | ENCUMBRANCES | 41 |

21 | ESTOPPEL CERTIFICATES AND FINANCIAL STATEMENTS | 42 |

22 | NOTICES | 43 |

23 | ATTORNEYS' FEES | 43 |

24 | QUIET POSSESSION | 44 |

25 | SECURITY MEASURES | 44 |

26 | FORCE MAJEURE | 44 |

27 | RULES AND REGULATIONS | 44 |

28 | LANDLORD'S LIABILITY | 45 |

29 | CONSENTES AND APPROVALS | 45 |

30 | WAIVER OF RIGHT TO JURY TRIAL | 46 |

31 | BROKERS | 46 |

32 | [INTENTIONALLY OMITTED] | 46 |

33 | OFAC | 46 |

34 | ENTIRE AGREEMENT | 47 |

35 | MISCELLANEOUSS | 47 |

36 | AUTHORITY | 47 |

-i-

INDEX OF DEFINED TERMS | ||||

AAA | Exhibit B | Disbursement Conditions | Exhibit B | |

Abated Base Rent | 5 | DTSC Covenant | 16 | |

Abatement Notice | 5 | Early Existing Lease Expiration Date | Exhibit D | |

Additional Rent | 9 | Early Expiration Date | Exhibit D | |

Aesthetic Screening | Exhibit D | Earthquake Contribution Amount | 6 | |

Affiliate | 36 | Encumbrance | 41 | |

Alterations | 17 | Engineers | Exhibit B | |

Approved Space Plan | Exhibit B | Environmental Losses | 14 | |

Audit | 11 | Environmental Requirements | 14 | |

Award | 31 | EPA Agreement | 16 | |

Broker | 46 | Event of Default | 37 | |

Building 2100 | Exhibit D | Excess Deductible Share | 6 | |

Building 2100 Premises | Exhibit D | Existing Lease | 4 | |

Building 2100 Premises Allowance | Exhibit D | Existing Lease Security Deposit | 12 | |

Building 2100 Premises Term | Exhibit D | Existing Rooftop Equipment | Exhibit D | |

Building 2100 Premises Termination Date | Exhibit D | Expansion Amendment | Exhibit D | |

Building 2160 | 1 | Expansion Notice | Exhibit D | |

Building 2190 | 1 | Expansion Option | Exhibit D | |

Building Rules | 45 | Expedited Procedures | Exhibit B | |

Building Signage | Exhibit D | Expiration Date | 4 | |

Building Systems | 14 | Extension Option | Exhibit D | |

Buildings | 1 | Extension Period | Exhibit D | |

CGL | Exhibit B | FAA | Exhibit D | |

Changes | Exhibit B | Fair Market Base Rental | Exhibit D | |

Closing Date | 36 | FCC | Exhibit D | |

Commencement Date | 4 | Fees | 44 | |

Common Areas | 4 | Final Construction Documents | Exhibit B | |

Communication Equipment | Exhibit D | GAAP | 7 | |

Communication Services | Exhibit D | Generator | Exhibit D | |

Condemnation | 31 | Generator Area | Exhibit D | |

Condemnor | 31 | Handled by Tenant | 14 | |

Construction Documents | Exhibit B | Handling by Tenant | 14 | |

Contractor | Exhibit B | Hazardous Materials | 14 | |

Contractor's Application for Payment | Exhibit B | HVAC System | 13 | |

Control | 36 | Improvement Allowance | Exhibit B | |

Controls | 23 | Interest Rate | 39 | |

Converted Improvement Allowance Amount | Exhibit B | Interior Common Areas | Exhibit C | |

Cosmetic Changes | 17 | Land | 4 | |

Date of Condemnation | 31 | Landlord | 4 | |

Design-Build Drawings | Exhibit B | Landlord Delay | Exhibit B | |

Design-Build Specifications | Exhibit B | Landlord Delay | Exhibit B | |

Landlord Entities | Exhibit B | |||

Landlord Parties | 16 | |||

Landlord’s Completion Estimate | 29 | |||

-ii-

Late Charge | 38 | Representatives | 14 | |

Laws | 6 | Required Action | Exhibit D | |

LC Reduction Conditions | Exhibit D | Review Notice | 11 | |

Lease | 4 | Roof Space | Exhibit D | |

Letter of Credit | Exhibit D | Second Notice | Exhibit D | |

License Agreement | Exhibit D | Secured Area | 40 | |

Loan | Exhibit E | Security Deposit | 12 | |

LOC Expiration Date | Exhibit D | Security Deposit Laws | Exhibit D | |

Monument Signs | Exhibit D | Security Instrument | Exhibit E | |

Mortgagee | 42 | Service Contract | 20 | |

New Lease Notice | 41 | Service Failure | 24 | |

Note | Exhibit E | Signage Conditions | Exhibit D | |

Notice Date | Exhibit D | Space Plan | Exhibit B | |

OFAC | 47 | Space Planner | Exhibit B | |

Operating Costs | 6 | Structural Elements | 21 | |

Operating Expenses | 8 | Swing Space Termination Notice | Exhibit D | |

Original Existing Lease | 4 | Tank | Exhibit D | |

Parking Facility | 4 | Taxes | 9 | |

Permits | Exhibit B | Telecommunications Provider | 25 | |

Permitted Hazardous Materials | 15 | Tenant | 4 | |

Permitted Transfer | 36 | Tenant Improvements | 17 | |

Permitted Transferee | 36 | Tenant’s Extension Notice | Exhibit D | |

Permitted Use | 13 | Tenant’s Review | 11 | |

Plans and Specifications | Exhibit D | Tenant’s Share | 9 | |

Premises | 4 | Tenant’s Taxes | 23 | |

Premises Utilities | 24 | Term | 4 | |

Project | 4 | Termination Fee | Exhibit D | |

Property Manager | 27 | Termination Notice | Exhibit D | |

Proposed Transferee | 33 | Termination Option | Exhibit D | |

Reconstruction Delays | 31 | Trade Fixtures | 19 | |

Reimbursable Costs | Exhibit D | Transaction | 36 | |

Removal Conditions | 18 | Transfer | 33 | |

Rent | 12 | Transfer Consideration | 34 | |

Rent Abatement Period(s) | 5 | Transfer Costs | 34 | |

Rental Tax | 23 | Transferee | 33 | |

Repair/Service Notice | Exhibit D | Visitors | 14 | |

-iii-

BASIC LEASE INFORMATION

Lease Date: | For identification purposes only, the date of this Lease is August 12, 2016. |

Landlord: | ECI FOUR GOLD STREET LLC, a California limited liability company |

Tenant: | TIVO INC., a Delaware corporation |

Project: | Gold Street Technology Park |

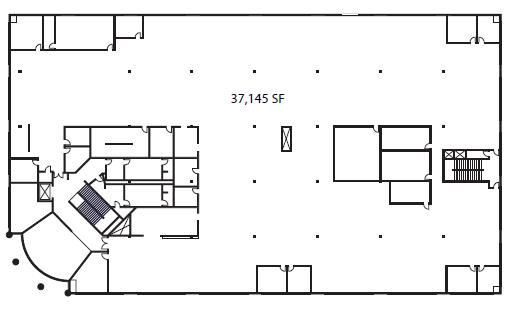

Premises: | Rentable Area: Approximately 127,124 rentable square feet The Premises is comprised of (i) approximately 62,950 rentable square feet located at 2160 Gold Street, San Jose, CA 95002 (“Building 2160”); and (ii) approximately 64,174 rentable square feet located at 2190 Gold Street, San Jose, CA 95002 (“Building 2190” and, collectively with Building 2160, the “Buildings”). The term “Building” may be used in the Lease to apply to Building 2160 and/or Building 2190, as indicated by the context in which such term is used. |

Rentable Area of Project: | Approximately 302,600 rentable square feet |

Rentable Area of the Buildings: | Building 2160 – approximately 62,950 rentable square feet Building 2190 – approximately 64,174 rentable square feet |

Term: | One hundred twenty-five (125) full calendar months |

Commencement Date: | September 1, 2016 |

Expiration Date: | January 31, 2027 |

Base Rent: | 9/1/2016 – 1/31/2017: $177,973.60 per month 2/1/2017 – 1/31/2018: $247,891.80 per month* 2/1/2018 – 1/31/2019: $255,328.55 per month 2/1/2019 – 1/31/2020: $262,988.41 per month 2/1/2020 – 1/31/2021: $270,878.06 per month 2/1/2021 – 1/31/2022: $279,004.40 per month 2/1/2022 – 1/31/2023: $287,374.54 per month 2/1/2023 – 1/31/2024: $295,995.77 per month 2/1/2024 – 1/31/2025: $304,875.65 per month 2/1/2025 – 1/31/2026: $314,021.92 per month 2/1/2026 – 1/31/2027: $323,442.57 per month |

-1-

*Base Rent is subject to abatement pursuant to Section 3.1 | |

Maintenance, Operating Costs and Taxes: | This is a “triple net lease” where Tenant is responsible (a) for maintenance and for payment of certain expenses directly to providers, and (b) to reimburse Landlord for Tenant’s Share of “Operating Costs” and “Taxes”, all in accordance with the applicable provisions of the Lease. |

Tenant’s Share: | 100% of Building 2160 100% of Building 2190 42.01% of the Project |

Security Deposit: | $247,680.00 in cash, plus, if applicable pursuant to Sections 14.9 and 47 of this Lease, a Letter of Credit in an amount equal to $1,252,320.00 (in which event the total Security Deposit held by Landlord hereunder shall equal $1,500,000.00). |

Landlord’s Address for Payment of Rent: | ECI Four Gold Street LLC P.O. Box 396098 San Francisco, CA 94139-6098 |

Landlord’s Address for Notices: | ECI FOUR GOLD STREET LLC c/o Embarcadero Capital Partners 1301 Shoreway Road, Suite 250 Belmont, CA 94002 Attention: John Hamilton with a copy to: Mr. Gregory B. Shean Farella Braun + Martel LLP The Russ Building, 30th Floor 235 Montgomery Street San Francisco, CA 94104 |

Tenant’s Address for Notices: | TiVo Inc. 2160 Gold Street San Jose, CA 95002 Attention: Pavel Kovar |

Broker: | Jones Lang LaSalle, representing Tenant |

-2-

Guarantor: | As of the date of this Lease, there is no guarantor |

Property Manager: | Embarcadero Realty Services LP |

Additional Provisions: | 37. Existing Lease Termination 38. Parking 39. Extension Options 40. Termination Option 41. Building 2100 Premises 42. Roof Space for Dish/Antenna 43. Monument Signage 44. Building Signage 45. Generator 46. Right Of First Offer On 2100 Building Premises 47. Letter of Credit |

Exhibits:

Exhibit A: The Premises

Exhibit B: Construction Rider

Exhibit C: Building Rules

Exhibit D: Additional Provisions

Exhibit E: Form of Non-disturbance, Subordination and Attornment Agreement

Exhibit F: Form of Landlord Consent to Assignment and Assumption of Lease

Exhibit F-1: Form of Landlord Consent to Sublease

Exhibit G-1: Tenant’s Confidentiality Requirements

Exhibit G-2: Form of Confidentiality Agreement

Exhibit H: Permitted Hazardous Materials

Exhibit I: Building 2100 Premises

Exhibit J: Form of Letter of Credit

Exhibit K: Existing Rooftop Equipment

The Basic Lease Information set forth above is part of the Lease. In the event of any conflict between any provision in the Basic Lease Information and the Lease, the Lease shall control.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

-3-

THIS LEASE (the “Lease”) is made as of the Lease Date set forth in the Basic Lease Information, by and between the Landlord identified in the Basic Lease Information (“Landlord”), and the Tenant identified in the Basic Lease Information (“Tenant”). Landlord and Tenant hereby agree as follows:

1.PREMISES.

1.1 Leasing of the Premises. Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, upon the terms and subject to the conditions of this Lease, the space identified in the Basic Lease Information as the Premises (the “Premises”), in the Buildings located at the addresses specified in the Basic Lease Information, in the Project as described in the Basic Lease Information (the “Project”). The approximate configuration and location of the Premises is shown on Exhibit A. Landlord and Tenant agree that the rentable area of the Premises, each Building and the Project for all purposes under this Lease shall be the Rentable Areas specified in the Basic Lease Information. Subject to Tenant’s rights pursuant to Section 42 and Section 44 of this Lease, Landlord reserves the right to use the roof and exterior walls of the Buildings without payment to Tenant, for any purpose (other than the display of signage for other tenants of the Project or third parties) which does not materially interfere with Tenant’s use or occupancy of the Premises. Pursuant to Civil Code section 1938, Landlord states that, as of the date of this Lease, the Premises has not undergone inspection by a “Certified Access Specialist” to determine whether the Premises meet all applicable construction-related accessibility standards under California Civil Code section 55.53.

1.2 The Land and Common Areas. The land (the “Land”) includes the parcel(s) of land on which the Project is situated. Tenant shall have the non-exclusive right to use in common with other tenants in the Project, subject to this Lease, those portions of the Project, including the parking facilities serving the Project (the “Parking Facility”), which are provided, from time-to-time, for use in common by Landlord, Tenant and any other tenants in the Project (such areas are referred to herein as the “Common Areas”). Landlord shall at all times operate the Common Areas in a manner no less than the quality Landlord has maintained the Common Areas under the Existing Lease (as defined in Section 2.2 below) and, in any event, in a manner consistent with the common areas in other similar buildings located in the same geographic region as the Building and owned by similarly situated owners and in compliance with all applicable Laws. The manner in which the Common Areas are maintained and operated shall be subject to such reasonable and non-discriminatory rules, regulations and restrictions as Landlord may make from time to time.

2.TERM; POSSESSION.

2.1 Term. The term of this Lease (the “Term”) shall commence on the Commencement Date set forth in the Basic Lease Information (the “Commencement Date”) and, unless sooner terminated, shall expire on the Expiration Date set forth in the Basic Lease Information (the “Expiration Date”).

2.2 Possession. Tenant currently is in possession of the Premises pursuant to the terms of that certain Lease dated October 6, 1999 (the “Original Existing Lease”, and as amended, the “Existing Lease”) between Landlord (as successor in interest to Bixby Technology Center, LLC, a Delaware limited liability company, as successor in interest to WIX/NSJ Real Estate Limited Partnership, a Delaware limited partnership) and Tenant, which Existing Lease is scheduled to expire, by its terms, as of January 31, 2017; provided, however, that the Existing Lease shall

-4-

terminate prior to such date, subject to the terms and conditions of Section 37. Accordingly, as of the date hereof, Tenant hereby accepts the demised Premises in its current “as-is” condition and configuration pursuant to this Lease. Tenant agrees that the Premises are in good order and satisfactory condition, and that there are no representations or warranties by Landlord regarding the condition of the Premises or either Building. Landlord hereby agrees that Tenant shall not have any removal or restoration requirements with respect to alterations, additions and improvements made by or on behalf of Tenant pursuant to the Existing Lease (including with respect to any alterations or other leasehold improvements except with respect to existing voice and data wiring and cabling which Tenant shall be obligated to remove (and perform any related restoration) existing in the Premises as of the date of this Lease).

3.RENT.

3.1 Base Rent. Tenant agrees to pay to Landlord the Base Rent set forth in the Basic Lease Information, without prior notice or demand, on the first (1st) day of each and every calendar month during the Term. Base Rent for any partial month at the beginning or end of the Term shall be prorated based on the actual number of days in the month.

Notwithstanding anything in this Lease to the contrary, so long as an Event of Default is not then occurring, Tenant shall be entitled to deliver written notice to Landlord (an “Abatement Notice”) requesting an abatement of Base Rent with respect to the Premises, as originally described in this Lease, in the amount of $247,891.80 per month for up to six (6) full calendar months. The maximum total amount of Base Rent abated with respect to the Premises in accordance with the foregoing shall equal $1,487,350.80 (the “Abated Base Rent”). Tenant’s Abatement Notice shall expressly identify the period(s) during which Tenant elects to receive the Abated Base Rent (such period(s), the “Rent Abatement Period(s)”), which Rent Abatement Period(s) shall in no event commence earlier than thirty (30) days after the date of Tenant’s Abatement Notice. Tenant’s Abatement Notice shall be deemed ineffective if the same does not specify the Abatement Period(s). Notwithstanding anything to the contrary contained in this Section 3.1, any unused Abated Base Rent remaining after December 31, 2017 shall accrue to the sole benefit of Landlord, it being understood that Tenant shall not be entitled to any credit, abatement or other concession in connection therewith. If Tenant defaults under this Lease beyond applicable notice and cure periods at any time during any Rent Abatement Period(s) and fails to cure such default within any applicable cure period under the Lease, then Tenant’s right to receive the Abated Base Rent shall toll (and Tenant shall be required to pay Base Rent during such period of any Tenant default) until Tenant has cured, to Landlord’s reasonable satisfaction, such default and at such time Tenant shall be entitled to receive any unapplied Abated Base Rent until fully applied. Only Base Rent shall be abated pursuant to this Section, as more particularly described herein, and Tenant’s Share of Operating Costs and Taxes and all other Rent and other costs and charges specified in this Lease shall remain as due and payable pursuant to the provisions of this Lease.

If the Basic Lease Information provides for any change in Base Rent by reference to years or months (without specifying particular dates), the change will take effect on the applicable annual or monthly anniversary of the Commencement Date (which might not be the first (1st) day of a calendar month).

3.2 Additional Rent: Operating Costs and Taxes.

-5-

(a) Definitions.

(1) “Operating Costs” means all costs of managing, operating, maintaining and repairing the Building, including all costs, expenditures, fees and charges for: (A) operation, maintenance and repair of the Building (including maintenance, repair and replacement of glass, the roof covering or membrane, and landscaping); (B) utilities and services (including telecommunications facilities and equipment, recycling programs and trash removal), and associated supplies and materials; (C) compensation (including employment taxes and fringe benefits) for persons who perform duties in connection with the operation, management, maintenance and repair of the Building, such compensation to be appropriately allocated for persons who also perform duties unrelated to the Building; (D) property, liability, rental income and other insurance (including coverage for earthquake and flood if carried by Landlord) relating to the Building, and expenditures for commercially reasonable deductible amounts under such insurance, provided that, if applicable, the payment of Tenant’s Share of any earthquake deductible which is included in Operating Costs shall not exceed $500,000.00 (the “Earthquake Contribution Amount”) for any single earthquake event (which for this purpose, means the initial earthquake and aftershocks that relate to such initial earthquake if the same are generally considered by the insurance industry to be one single event) during the initial Term (provided, however, that Tenant shall pay as part of Operating Costs an initial $100,000.00 and the remaining amount (that is the amount in excess of $100,000.00 up to the Earthquake Contribution Amount (the “Excess Deductible Share”)) shall be amortized over a period of five (5) years commencing the year following Tenant’s initial $100,000.00 payment, with interest on the unamortized amount at one percent (1%) in excess of the Wall Street Journal prime lending rate announced from time to time). Tenant shall only pay the initial $100,000.00 in the year incurred and thereafter pay only the amortized portion of such Excess Deductible Share in equal monthly installments during the remainder of the Term (including any extension thereof) following the year in which the initial payment was made; (E) licenses, permits and inspections; (F) complying with the requirements of any law, statute, ordinance or governmental rule or regulation or any orders pursuant thereto (collectively “Laws”) first enacted, interpreted or enforced against the Building on or after the Lease Date; (G) amortization of the cost of “Non-Structural Components” (as defined below) and amortization of the cost of capital improvements which are required to comply with Laws first enacted, interpreted or enforced against the Building on or after the Lease Date, or which are reasonably intended to reduce Operating Costs, or which are required to comply with present or future governmentally-mandated conservation programs, or, with respect to any multi-tenant building, which are made by Landlord (and which are not Landlord’s obligation with respect to any entire Building which is leased by Tenant) to improve the utility, efficiency or capacity of any Building System, or for the safety, comfort and convenience of the tenants of such multi-tenant building, with interest on the unamortized balance at the rate reasonably paid by Landlord on funds borrowed to finance such capital improvements (or, if Landlord finances such improvements out of Landlord’s funds without borrowing, the rate that Landlord would have paid to borrow such funds, as reasonably determined by Landlord), over the useful life of such item in accordance with generally accepted real estate management and accounting principles, consistently applied (“GAAP”), as reasonably determined by Landlord; and (H) any other cost, expenditure, fee or charge, whether or not hereinbefore described, which in accordance with generally accepted property management practices (to the extent consistent with comparable buildings in the same geographic region as the Building) would be considered an expense of managing, operating, maintaining and repairing the Building.

-6-

Operating Costs shall also include (but without duplication) those costs, expenditures, fees and charges of the same type and nature as items (A) through (H) in the foregoing paragraph that are incurred at the Project level to the extent the same are equitably allocated to the Building, including by way of example, (I) accounting, legal and other professional fees incurred in connection with the operation of the Project; (J) property management fees (provided that such management fees for the Project shall not exceed in the aggregate three percent (3%) of the total Base Rent payable by Tenant under the Lease); (K) a reasonable allowance for depreciation of machinery and equipment used to operate and maintain the Project (to the extent the original cost of such machinery and equipment is not included in Operating Costs); (L) the costs to contest the validity or applicability of any Laws that may affect the Project; and (M) any shared Project costs or Common Area maintenance costs and expenses (including costs and expenses of operating, managing, owning and maintaining the Common Areas, and non-building specific costs). With respect to any Building of which Tenant is not the sole tenant (e.g., the building in which the Building 2100 Premises is located), Operating Costs for any calendar year during which average occupancy of the Building is less than one hundred percent (100%) shall be calculated based upon the Operating Costs that would have been incurred if the Building had an average occupancy of one hundred percent (100%) during the entire calendar year.

Landlord agrees to act in a commercially reasonable manner in incurring Operating Costs, taking into consideration the class and the quality of the Building.

Notwithstanding anything to the contrary contained herein, in the event Tenant has received any free or abated rent during the Term of this Lease, or other such concession, the amount of such free or abated rent or any other such concession shall be included in the calculation to determine the amount of any property management fee or other such fee included in Operating Costs.

Operating Costs shall not include (i) capital improvements (except as specifically enumerated above); (ii) costs of special services rendered to individual tenants (including Tenant) for which a separate reimbursement is received; (iii) ground rent, and interest and principal payments on loans or indebtedness secured by the Building or Project; (iv) any “tenant allowances”, “tenant concessions” and other costs or expenses incurred in fixturing, furnishing, renovating or otherwise improving, decorating or redecorating space for tenants or other occupants of the Project, or vacant leaseable space in the Project; (v) costs of services or other benefits of a type which are not available to Tenant but which are available to other tenants or occupants, and costs for which Landlord is reimbursed by other tenants other than through payment of tenants’ shares of Operating Costs and Taxes; (vi) leasing commissions, attorneys’ fees and other expenses incurred in connection with leasing space in the Project or enforcing such leases; (vii) depreciation or amortization, other than as specifically enumerated above; (viii) any cost or expense related to removal, cleaning, abatement or remediation of Hazardous Materials (defined below) in or about the Project, including, without limitation, hazardous substances in the ground water or soil, except to the extent such removal, cleaning, abatement or remediation is related to the general repair and maintenance of the Project (e.g., the cleanup of a normal and customary oil leak from a vehicle that parked in the Parking Facility); (ix) sums (other than property management fees, it being agreed that the property management fees included in Operating Costs are as described in, and subject to, Section 3.2(a)(1)(J) above) paid to subsidiaries or other affiliates of Landlord for services on or to the Project, Building and/or Premises, but only to the extent that the costs of such services exceed the competitive cost for such services rendered by persons or entities of similar skill, competence

-7-

and experience; (x) any expenses for which Landlord has received actual reimbursement (other than through Operating Costs) including by insurance carried by, or if Landlord failed to carry insurance required of Landlord hereunder, by insurance that is required to be carried by Landlord or condemnation proceeds; and Landlord shall use commercially reasonable efforts to pursue claims under insurance policies, existing warranties and/or guaranties or against other third parties, as applicable, to pay such costs; (xi) costs in connection with leasing space in the Project, including brokerage commissions, brochures and marketing supplies, legal fees in negotiating and preparing lease documents; (xii) interest (except as provided above for the amortization of capital improvements); (xiii) fines, costs or penalties incurred as a result and to the extent of a violation by Landlord of any applicable Laws; (xiv) any fines, penalties or interest resulting from the active negligence or willful misconduct of Landlord; (xv) costs incurred by Landlord for the repair of damage to the Building, to the extent that Landlord is reimbursed for such costs by insurance proceeds, contractor warranties, guarantees, judgments or other third party sources; (xvi) reserves of any kind; (xvii) costs incurred in connection with the operation of the business of the entity constituting “Landlord” (as distinguished from the costs of operating the Project, including accounting and legal matters, costs of defending any lawsuits with any Mortgagee, costs of selling, syndicating, financing, mortgaging or hypothecating any of Landlord’s interest in the Project, maintaining, repairing and managing the Building) including, but not limited to, Landlord’s or Landlord’s managing agent’s general corporate overhead and general administrative expenses; (xviii) Landlord’s charitable and political contributions; (xix) advertising and promotional expenditures; (xx) costs incurred by Landlord in connection with the correction of latent defects in the original construction of the Building; (xxi) salaries, wages, bonuses and other compensation (including hospitalization, medical, surgical, retirement plan, pension plan, union dues, parking privileges, life insurance, including group life insurance, welfare and other fringe benefits, and vacation, holidays and other paid absence benefits) of employees above the grade of general manager (or of equal level); (xxii) the cost of any “tenant relations” parties, events or similar promotions; (xxiii) costs, fines or penalties incurred due to Landlord’s violation of any Law; (xxiv) the costs of signs in or on the Building or Project identifying the owner of the Building or Project; (xxv) the cost of capital repairs or maintenance except as expressly provided in this Lease; (xxvi) the cost of restoring the Project or any portion thereof following a Casualty (provided the foregoing shall not apply to insurance deductibles or restrict any direct Tenant liability as set forth in this Lease); and (xxvii) any other cost, expenditure, fee or charge, whether or not hereinbefore described, which in accordance with generally accepted property management practices (to the extent consistent with comparable buildings in the same geographic region as the Building) would not be considered an expense of managing, operating, maintaining and repairing the Building. Operating Costs shall be determined by Landlord in accordance with GAAP. Tenant acknowledges and agrees that any “Operating Expenses” that are payable by Tenant on an amortized basis under the Existing Lease shall continue to be included in Operating Costs hereunder and shall be payable by Tenant to Landlord in the same manner as set forth in the Existing Lease.

Because the Project contains more than one building, Operating Costs shall, for purposes of calculating Tenant’s payments pursuant to Section 3.2 below, mean (a) all Operating Costs equitably allocable to the particular Building (e.g., repairs to the roof of the Building), plus (b) a proportionate share of all Operating Costs that relate to multiple buildings or to the Project generally (e.g., landscaping) (such proportionate share to be based on the rentable area of the Premises, or particular portion thereof, as a percentage of the rentable area of all of the buildings in the Project to which such Operating Costs relate).

-8-

(2) “Taxes” means that portion of the following taxes on the Project which are allocable to the Building in Landlord’s reasonable judgment: all real property taxes and general, special or district assessments or other governmental impositions, of whatever kind, nature or origin, imposed on or by reason of the ownership or use of the Project; governmental charges, fees or assessments for transit or traffic mitigation (including area-wide traffic improvement assessments and transportation system management fees), housing, police, fire or other governmental service or purported benefits to the Project; personal property taxes assessed on the personal property of Landlord used in the operation of the Project; service payments in lieu of taxes and taxes and assessments of every kind and nature whatsoever levied or assessed in addition to, in lieu of or in substitution for existing or additional real or personal property taxes on the Project or the personal property described above; any increases in the foregoing caused by changes in assessed valuation, tax rate or other factors or circumstances; and the reasonable cost of contesting by appropriate proceedings the amount or validity of any taxes, assessments or charges described above. To the extent paid by Tenant or other tenants as “Tenant’s Taxes” (as defined in Section 8 - Tenant’s Taxes), “Tenant’s Taxes” shall be excluded from Taxes. Taxes shall also not include Landlord’s gross receipts taxes, personal and corporate taxes, inheritance and estate taxes, franchise, excess profits taxes or any charges or penalties or interest accrued through Landlord's nonpayment or late payment of taxes or assessments. All tax payments shall be paid by Landlord in the maximum number of installments permitted by Law and shall not be included as Taxes except in the year in which such installment is actually paid.

(3) “Tenant’s Share” means (i) with respect to a Building, the Rentable Area of the Premises divided by the total Rentable Area of the Building, as set forth in the Basic Lease Information; and (ii) with respect to the Project, the Rentable Area of the Premises divided by the total Rentable Area of the Project, as set forth in the Basic Lease Information. If the Rentable Area of the Premises is changed by Tenant’s leasing of additional space hereunder or for any other reason, Tenant’s Share shall be adjusted accordingly.

(b) Additional Rent.

(1) Tenant shall pay Landlord as “Additional Rent” for each calendar year or portion thereof during the Term Tenant’s Share of the sum of (x) the amount of Operating Costs, and (y) the amount of Taxes.

(2) Prior to the Commencement Date and each calendar year thereafter, Landlord shall notify Tenant of Landlord’s estimate of Operating Costs, Taxes and Tenant’s Additional Rent for the following calendar year (or first partial year following the Commencement Date). Commencing on the Commencement Date, and in subsequent calendar years, on the first (1st) day of January of each calendar year and continuing on the first (1st) day of every month thereafter in such year, Tenant shall pay to Landlord one-twelfth (1/12th) of the Additional Rent, as reasonably estimated by Landlord for such full calendar year. If Landlord thereafter estimates that Operating Costs or Taxes for such year will vary from Landlord’s prior estimate, Landlord may, by notice to Tenant (which notice may be given no more than twice in any calendar year), revise the estimate for such year (and Additional Rent shall thereafter be payable based on the revised estimate).

(3) As soon as reasonably practicable after the end of each calendar year, Landlord shall furnish Tenant a statement with respect to such year, showing Operating

-9-

Costs, Taxes and Additional Rent for the year, and the total payments made by Tenant with respect thereto. Unless Tenant raises any objections to Landlord’s statement within the one hundred twenty (120) day period described in Section 3.2(c) below, such statement shall conclusively be deemed correct and Tenant shall have no right thereafter to dispute such statement or any item therein or the computation of Additional Rent based thereon. If Tenant does object to such statement, then Landlord shall provide Tenant with reasonable verification of the figures shown on the statement and the parties shall negotiate in good faith to resolve any disputes. Any objection of Tenant to Landlord’s statement and resolution of any dispute shall not postpone the time for payment of any amounts due Tenant or Landlord based on Landlord’s statement, nor shall any failure of Landlord to deliver Landlord’s statement in a timely manner relieve Tenant of Tenant’s obligation to pay any amounts due Landlord based on Landlord’s statement. However, if Landlord fails to furnish Landlord’s statement to Tenant for a given calendar year within twenty-four (24) months after the expiration of the calendar year to which such statement applies and such failure continues for an additional thirty (30) days after Landlord’s receipt of a written request from Tenant that such statement is furnished, Landlord shall be deemed to have waived any rights to recover any underpayment of Operating Costs from Tenant (except to the extent such underpayment is attributable to a default by Tenant in its obligation to make estimated payments of Operating Costs), and Tenant shall be deemed to have waived any credit regarding overpayment of Operating Costs by Tenant; provided that such twenty-four (24) month time limit shall not apply to Taxes. Further, in no event shall the foregoing provision describing the time period during which Landlord is to deliver Landlord’s statement in any manner limit or otherwise prejudice Landlord’s right to modify such statement after such time period if new, additional or different information relating to such statement of actual costs is discovered or otherwise determined.

(4) If Tenant’s Additional Rent as finally determined for any calendar year exceeds the total payments made by Tenant on account thereof, Tenant shall pay Landlord the deficiency within thirty (30) days of Tenant’s receipt of Landlord’s statement. If the total payments made by Tenant on account thereof exceed Tenant’s Additional Rent as finally determined for such year (including as a result of any Tax reduction or relief pursuant to Section 3.2(d)), Tenant’s excess payment shall be credited toward the rent next due from Tenant under this Lease. For any partial calendar year at the beginning or end of the Term, Additional Rent shall be prorated on the basis of a three hundred and sixty (360)-day year by computing Tenant’s Share of the Operating Costs and Taxes for the entire year and then prorating such amount for the number of days during such year included in the Term. The obligations of Landlord to refund any overpayment of Additional Rent and of Tenant to pay any Additional Rent not previously paid shall survive the expiration or termination of this Lease, Landlord shall pay to Tenant or Tenant shall pay to Landlord, as the case may be, within thirty (30) days after Tenant’s receipt of Landlord’s final statement for the calendar year in which this Lease terminates, the difference between Tenant’s Additional Rent for that year, as finally determined by Landlord, and the total amount previously paid by Tenant on account thereof.

If for any reason Taxes for any year during the Term are reduced, refunded or otherwise changed, Tenant’s Additional Rent shall be adjusted accordingly. If Taxes are temporarily reduced as a result of space in the Project being leased to a tenant that is entitled to an exemption from property taxes or other taxes, then for purposes of determining Additional Rent for each year in which Taxes are reduced by any such exemption, Taxes for such year shall be calculated on the basis of the amount the Taxes for the year would have been in the absence of the exemption.

-10-

(c) Tenant’s Review and Audit Right. Within one hundred twenty (120) days after Tenant receives Landlord’s statement of Operating Costs for a calendar year (which statement shall show Landlord’s determination of Operating Costs with reasonable specificity), if Tenant in good faith questions or contests the accuracy of Landlord’s statement of Operating Costs for such calendar year, then Tenant may give Landlord written notice (“Review Notice”) that Tenant intends to review Landlord’s records of the Operating Costs for that calendar year to which the statement applies (“Tenant’s Review”), subject to the following terms and conditions: (a) Tenant shall not be entitled to conduct Tenant’s Review at any time that an Event of Default is continuing; (b) Tenant’s Review shall be done during normal business hours, at the local office of the property manager for the Building in the San Francisco Bay Area, and (c) Tenant shall not conduct Tenant’s Review more than one (1) time for any calendar year. Failure of Tenant to give Landlord a Review Notice within the above one hundred twenty (120)-day period shall render the statement of Operating Costs conclusive and binding on Tenant for all purposes. Tenant’s Review shall be conducted only by an employee of Tenant or a certified public accounting firm of regional or national standing employed by Tenant on an hourly or fixed fee basis, and not on a contingency fee basis. Tenant acknowledges that Tenant’s right to conduct Tenant’s Review for the preceding calendar year is for the exclusive purpose of determining whether Landlord has complied with the terms of the Lease with respect to Operating Costs and Landlord’s determination thereof. Within a reasonable time after receipt of the Review Notice, Landlord shall make all pertinent records available for inspection that are reasonably necessary for Tenant to conduct Tenant’s Review. Tenant shall not remove such records from the location where the same have been made available, but Tenant shall have the right to make copies of the same at Tenant’s expense. Tenant shall have thirty (30) days after Landlord shall have provided copies of or access to all relevant documents and data to complete Tenant’s Review. Tenant shall deliver to Landlord a copy of the results of Tenant’s Review within fifteen (15) days after completing Tenant’s Review. If, after conducting Tenant’s Review, Tenant disputes the amount of Operating Costs charged by Landlord, Tenant may, by written notice to Landlord, request an independent audit of such books and records (the “Audit”). The Audit shall be conducted by an independent certified public accountant selected by Landlord who has not been employed by Landlord or an affiliate of Landlord in the previous five (5) years, who is reasonably acceptable to Tenant, and who is with a certified public accounting firm of regional or national standing licensed to do business in the State of California. Tenant shall be solely responsible for all costs, expenses and fees incurred for the Audit, provided, however, if the Audit shows that Landlord overstated Operating Costs for the subject year by more than five percent (5%), then Landlord shall pay all reasonable costs, expenses and fees incurred by Tenant for the Audit (including Tenant’s reasonable and documented out-of-pocket costs incurred in connection therewith); provided, however, that in no event shall Landlord be obligated to reimburse Tenant for costs in excess of $7,500.00. The records obtained by Tenant shall be treated as confidential. In no event shall Tenant be permitted to examine Landlord’s records or to dispute any statement of Operating Costs unless Tenant has paid and continues to pay all Rent when due. Within thirty (30) days after final determination, the party that owes the other party an amount to bring the amounts actually paid into agreement with the amounts that should have been paid, shall pay such amounts to the other party. The provisions of this Subsection (c) shall survive the expiration of this Lease.

(d) Tax Contests. During the Term, if Landlord, in its good faith business judgment, deems the Taxes levied against the Project for any tax fiscal year to be excessive or, if Tenant requests in writing that Landlord contest Taxes and Landlord elects to do so, Landlord

-11-

shall exercise commercially reasonable efforts to seek Proposition 8 and other available property tax relief for any fiscal year during the Term with respect to the Project as a whole only (the cost and expense therefor shall be included in Operating Costs) and any such relief shall be allocated among all tenants of the Project pursuant to their respective allocable shares. If Landlord elects not to contest Taxes as provided in the immediately preceding sentence, but Tenant desires to have Landlord conduct such appeal for the Project, and notifies Landlord of the same, Landlord shall seek Proposition 8 and other available property tax relief for any fiscal year during the Term with respect to the Project as a whole only and Tenant shall be liable for all of the reasonable and actual out-of-pocket costs and expenses incurred by Landlord in conducting such appeal. In such event, to the extent any Taxes are refunded, such proceeds shall first be allocated to reimburse Tenant for the costs and expenses paid by Tenant pursuant to the immediately preceding sentence, and the remaining proceeds shall be allocated among all tenants of the Project pursuant to their respective allocable shares.

3.3 Payment of Rent. All amounts payable or reimbursable by Tenant under this Lease, including late charges and interest (collectively, “Rent”), shall constitute rent and shall be payable and recoverable as rent in the manner provided in this Lease. Unless otherwise provided herein, all sums payable to Landlord on demand under the terms of this Lease shall be payable within thirty (30) days after Landlord invoices Tenant therefor or otherwise makes demand of the amounts due. Except as otherwise expressly provided in this Lease, all rent shall be paid without offset or deduction in lawful money of the United States of America to Landlord at Landlord’s Address for Payment of Rent as set forth in the Basic Lease Information, or to such other person or at such other place as Landlord may from time to time designate.

4.SECURITY DEPOSIT. Tenant shall deposit with Landlord the amount specified in the Basic Lease Information as the Security Deposit (the “Security Deposit”), as security for the performance of Tenant’s obligations under this Lease. Landlord is currently holding the sum of $247,680.00 (the “Existing Lease Security Deposit”) as a security deposit pursuant to the terms of the Existing Lease. Landlord shall transfer the unapplied balance of the Existing Lease Security Deposit (which Existing Lease Security Deposit shall be subject to the terms and conditions of the Existing Lease until the termination thereof) to the Security Deposit required under this Lease. If the unapplied Existing Lease Security Deposit is less than the Security Deposit due under this Lease, Tenant shall deposit with Landlord, upon demand, a sum sufficient to cure such deficiency so that the total Security Deposit deposited or transferred to Landlord hereunder is not less than $247,680.00. In addition to the cash Security Deposit, if applicable pursuant to the terms of Section 14.9 and Article 47 of this Lease, Tenant shall tender a Letter of Credit in in an amount equal to $1,252,320.00 subject to the terms and conditions of Article 47 of this Lease. Landlord may (but shall have no obligation to) use the Security Deposit or any portion thereof to cure any breach or default by Tenant under this Lease, to fulfill any of Tenant’s obligations under this Lease, or to compensate Landlord for any damage Landlord incurs as a result of Tenant’s failure to perform any of Tenant’s obligations hereunder. In such event Tenant shall pay to Landlord on demand an amount sufficient to replenish the Security Deposit. Pursuant to applicable Laws, Landlord shall return to Tenant the Security Deposit or the balance thereof then held by Landlord and not applied as provided above within thirty (30) days after the later of the date on which (i) Tenant surrenders the Premises to Landlord in accordance with the terms and conditions of this Lease; and (ii) Tenant cures any outstanding breach or default by Tenant of this Lease. Landlord may commingle the Security Deposit with Landlord’s general and other funds. Landlord shall not be required to pay interest on the Security Deposit to Tenant. Tenant waives the provisions of

-12-

Section 1950.7 of the California Civil Code (provided that Tenant’s waiver shall not include a waiver of the provisions of Section 1950.7(b) regarding the priority of Tenant’s claim to the Security Deposit), and all other provisions of Law now in force or that become in force after the date of this Lease, which provide that Landlord may claim from a security deposit only those sums reasonably necessary to remedy defaults in the payment of Rent, to repair damage caused by Tenant, or to clean the Premises. Landlord and Tenant agree that Landlord may, in addition, claim and use those sums necessary to compensate Landlord for any foreseeable or unforeseeable loss or damage caused by the act or omission by Tenant, including, without limitation, any post default damages and such remedies to which Landlord is entitled under the provisions of Section 15.2 of this Lease.

5.USE AND COMPLIANCE WITH LAWS.

5.1 Use. The Premises shall be used and occupied for administration, research and development, shipping and receiving and general business office purposes and for no other use or purpose (“Permitted Use”). Tenant shall comply with all present and future Laws relating to Tenant’s use or occupancy of the Premises (and make any Alterations as required to comply with all such Laws to the extent that such Laws are triggered by (a) Tenant’s particular use of the Premises (other than general office use in the Premises) or (b) any Alterations and Tenant Improvements (subject to the terms and conditions of Exhibit B)), and shall observe the “Building Rules” (as defined in Section 27 - Rules and Regulations). Tenant shall not do, bring, keep or sell anything in or about the Premises that is prohibited by, or that will cause a cancellation of or an increase in the existing premium for, any insurance policy covering the Project or any part thereof. Tenant shall not permit the Premises to be occupied or used in any manner that will constitute waste or a nuisance, or disturb the quiet enjoyment of or otherwise annoy other tenants in the Building. Without limiting the foregoing, the Premises shall not be used for educational activities, practice of medicine or any of the healing arts, providing social services, for any governmental use (including embassy or consulate use), or for personnel agency, customer service office, studios for radio, television or other media, travel agency or reservation center operations or uses. Tenant shall not, without the prior consent of Landlord, (i) bring into the Building or the Premises anything that may cause substantial noise, odor or vibration, overload the floors in the Premises or the Building or any of the heating, ventilating and air-conditioning system(s) (“HVAC System”), mechanical, elevator, plumbing, electrical, fire protection, life safety, security or other systems in the Building (“Building Systems”), or jeopardize the structural integrity of the Building or any part thereof; (ii) connect to the utility systems of the Building any apparatus, machinery or other equipment other than typical low power task lighting or office equipment; or (iii) connect to any electrical circuit in the Premises any equipment or other load with aggregate electrical power requirements in excess of 80% of the connected load rated capacity of the circuit. Tenant’s use of electricity shall never exceed the safe capacity of the feeders to the Building or the risers or wiring installation of the Building. Other than in connection with Tenant’s construction of the initial Tenant Improvements in the Premises, Tenant, at Landlord’s sole cost and expense, agrees to reasonably cooperate with Landlord with respect to any voluntary “green” or sustainable programs with respect to the Premises (it being agreed that Tenant shall not be responsible to make any Alterations to the Premises or to replace any equipment or property of Tenant in connection therewith unless Landlord agrees to pay for all costs and expenses in connection therewith).

5.2 Hazardous Materials.

-13-

(a) Definitions.

(1) “Hazardous Materials” shall mean any substance: (A) that now or in the future is regulated or governed by, requires investigation or remediation under, or is defined as a hazardous waste, hazardous substance, pollutant or contaminant under any governmental statute, code, ordinance, regulation, rule or order, and any amendment thereto, including the Comprehensive Environmental Response Compensation and Liability Act, 42 U.S.C. §9601 et seq., and the Resource Conservation and Recovery Act, 42 U.S.C. §6901 et seq., or (B) that is toxic, explosive, corrosive, flammable, radioactive, carcinogenic, dangerous or otherwise hazardous, including gasoline, diesel fuel, petroleum hydrocarbons, polychlorinated biphenyls (PCBs), asbestos, radon and urea formaldehyde foam insulation.

(2) “Environmental Requirements” shall mean all present and future Laws, orders, permits, licenses, approvals, authorizations and other requirements of any kind applicable to Hazardous Materials.

(3) “Handled by Tenant” and “Handling by Tenant” shall mean and refer to any installation, handling, generation, storage, use, disposal, discharge, release, abatement, removal, transportation, or any other activity of any type by Tenant or its agents, employees, contractors, licensees, assignees, sublessees, transferees or representatives (collectively, “Representatives”) or its guests, customers, invitees, or visitors (collectively, “Visitors”), at or about the Premises in connection with or involving Hazardous Materials.

(4) “Environmental Losses” shall mean all costs and expenses of any kind, damages, including foreseeable and unforeseeable consequential damages, fines and penalties incurred in connection with any violation of and compliance with Environmental Requirements and all losses of any kind attributable to the diminution of value, loss of use or adverse effects on marketability or use of any portion of the Premises or Project.

(b) Tenant’s Covenants. No Hazardous Materials shall be Handled by Tenant at or about the Premises or Project without Landlord’s prior written consent, which consent may be granted, denied, or conditioned upon compliance with Landlord’s requirements, all in Landlord’s absolute discretion. Notwithstanding the foregoing, normal quantities and use of those Hazardous Materials customarily used in the conduct of general office activities, such as copier fluids and cleaning supplies (and such other Hazardous Materials described in Exhibit H) (“Permitted Hazardous Materials”), may be used and stored at the Premises without Landlord’s prior written consent, provided that Tenant’s activities at or about the Premises and Project and the Handling by Tenant of all Hazardous Materials shall comply at all times with all Environmental Requirements. At the expiration or termination of the Lease, Tenant shall promptly remove from the Premises and Project all Hazardous Materials Handled by Tenant at the Premises or the Project. Tenant shall keep Landlord fully and promptly informed of all Handling by Tenant of Hazardous Materials other than Permitted Hazardous Materials. Tenant shall be responsible and liable for the compliance with all of the provisions of this Section by all of Tenant’s Representatives and Visitors, and all of Tenant’s obligations under this Section (including its indemnification obligations under paragraph (e) below) shall survive the expiration or termination of this Lease.

(c) Compliance. Tenant shall at Tenant’s expense promptly take all actions required by any governmental agency or entity in connection with or as a result of the Handling by

-14-

Tenant of Hazardous Materials at or about the Premises or Project, including inspection and testing, performing all cleanup, removal and remediation work required with respect to those Hazardous Materials, complying with all closure requirements and post-closure monitoring, and filing all required reports or plans. All of the foregoing work and all Handling by Tenant of all Hazardous Materials shall be performed in a good, safe and workmanlike manner by consultants qualified and licensed to undertake such work and in a manner that will not interfere with any other tenant’s quiet enjoyment of the Project or Landlord’s use, operation, leasing and sale of the Project. Tenant shall deliver to Landlord prior to delivery to any governmental agency, or promptly after receipt from any such agency, copies of all permits, manifests, closure or remedial action plans, notices, and all other documents relating to the Handling by Tenant of Hazardous Materials at or about the Premises or Project. If any lien attaches to the Premises or the Project in connection with or as a result of the Handling by Tenant of Hazardous Materials, and Tenant does not cause the same to be released, by payment, bonding or otherwise, within ten (10) days after notice of the attachment thereof, Landlord shall have the right but not the obligation to cause the same to be released and any reasonable sums expended by Landlord (plus Landlord’s administrative costs) in connection therewith shall be payable by Tenant on demand.

(d) Landlord’s Rights. Subject to the provisions of Section 18 below, Landlord shall have the right, but not the obligation, to enter the Premises at any reasonable time and, except in the case of the emergency (where no notice shall be required), upon not less than twenty-four (24) hours written notice (i) to confirm Tenant’s compliance with the provisions of this Section 5.2, and (ii) to perform Tenant’s obligations under this Section if Tenant has failed to do so after reasonable notice to Tenant. Landlord shall also have the right to engage qualified Hazardous Materials consultants to inspect the Premises and review the Handling by Tenant of Hazardous Materials, including review of all permits, reports, plans, and other documents regarding same. If the reports of such consultants show that Tenant was in violation of Tenant’s obligations under this Section 5.2, then Tenant shall pay to Landlord on demand the reasonable costs of Landlord’s consultants’ fees and all reasonable out-of-pocket costs incurred by Landlord in performing Tenant’s obligations under this Section.

(e) Tenant’s Indemnification. The term Landlord Parties (“Landlord Parties”) refers singularly and collectively to Landlord and the shareholders, partners, venturers, and members of Landlord, and the respective officers, directors, employees, managers, owners and any affiliates or agents of such entities and persons. Tenant agrees to indemnify, defend, protect and hold harmless the Landlord Parties from all Environmental Losses and all other claims, actions, losses, damages, liabilities, costs and expenses of every kind, including reasonable attorneys’, experts’ and consultants’ fees and costs, incurred at any time (including, without limitation, any time during the term of the Existing Lease) and arising from or in connection with the Handling by Tenant of Hazardous Materials at or about the Project or Tenant’s failure to comply in full with all Environmental Requirements with respect to the Premises or with those obligations applicable to Tenant as set forth in Paragraphs 5.2(g) and (h) below.

(f) EPA Agreement Disclosure. Tenant is aware that the Project is subject to an Agreement and Covenant not to Sue (Docket No. 97-15) entered into by Landlord’s predecessor-in-interest and the U.S. Environmental Protection Agency (the “EPA Agreement”), and may now or in the future be subject to other documents that are promulgated pursuant to the EPA Agreement. Tenant acknowledges that this Lease and Tenant’s rights and occupancy pursuant to this Lease all are subject to the terms and conditions of the EPA Agreement and

-15-

Tenant shall comply with the EPA Agreement, to the extent applicable to Tenant, including without limitation, the requirement in Paragraph 12 of the EPA Agreement to provide access to the U.S. Environmental Protection Agency, and any other governmental agency, and their respective agents.

(g) DTSC Covenant Disclosure. Tenant is aware that the Project is subject to a Covenant and Agreement for Environmental Restriction, recorded as of October 21, 2004, for the benefit of and enforceable by the California Department of Toxic Substances Control and for the benefit of the U.S. Environmental Protection Agency (the “DTSC Covenant”), and may now or in the future be subject to other documents that are promulgated pursuant to the DTSC Covenant. Tenant acknowledges that this Lease and Tenant’s rights and occupancy pursuant to this Lease all are subject to the terms and conditions of the DTSC Covenant, and Tenant shall comply with the DTSC Covenant, to the extent applicable to Tenant, including without limitation, the restrictions set forth in Paragraphs 4.01 through 4.05 of the DTSC Covenant.

(h) Health and Safety Code 25359.7 Disclosure. Landlord is providing the following statutorily-required notice to commercial tenants, pursuant to California Health and Safety Code Section 25359.7. As documented in the DTSC Covenant and EPA Agreement, Landlord knows or has reasonable cause to believe that a historical release of hazardous substances, including but not limited to asbestos, has come to be located on or beneath the Land.

(i) Tenant’s Additional Environmental Responsibilities. In addition to Tenant’s obligations as set forth in Paragraphs 5.2(b) through (h) above, Tenant agrees that it shall not conduct any of the following activities without receiving Landlord’s prior written consent, which consent may be granted, denied, or conditioned upon compliance with Landlord’s requirements, all in Landlord’s absolute discretion: (1) any excavation or subsurface work on the Premises; (2) any puncturing or penetration of the building slab or underlying moisture/vapor barrier; and (3) any interference with, or obstruction, damaging, dismantling, destroying, or removal of, any environmental remedial or monitoring equipment installed on or in the Premises, including without limitation, any methane monitoring equipment.

6.TENANT IMPROVEMENTS & ALTERATIONS.

6.1 Landlord and Tenant shall perform their respective obligations with respect to design and construction of any improvements to be constructed and installed in the Premises (the “Tenant Improvements”), as provided in the Construction Rider. Except for any Tenant Improvements to be constructed by Tenant as provided in the Construction Rider, Tenant shall not make any alterations, improvements or changes to the Premises or the Buildings, including installation of any security system or telephone or data communication wiring, (“Alterations”), without Landlord’s prior written consent. Notwithstanding the foregoing, Tenant shall not require Landlord’s consent to for minor, non-structural Alterations that (a) do not affect any of the Building Systems, (b) are not visible from the exterior of the Premises, (c) do not affect the water tight character of the Building or its roof, (d) do not require a building permit, (e) do not move any interior walls or otherwise change the layout of the Premises, (f) are of a cosmetic nature, such as painting, wallpapering, hanging pictures and installing carpeting, and (g) cost in the aggregate less than $250,000.00 (excluding Building standard paint and carpet) during any calendar year (“Cosmetic Changes”), so long as Tenant gives Landlord notice of the proposed Cosmetic Change at least ten (10) days prior to commencing the Cosmetic Change and complies

-16-

with all of the following provisions. All Alterations shall be completed by Tenant at Tenant’s sole cost and expense: (1) with due diligence, in a good and workmanlike manner, using new materials; (2) in compliance with plans and specifications approved by Landlord (which approval shall not be unreasonably withheld, conditioned or delayed); (3) in compliance with the reasonable construction rules and regulations promulgated by Landlord for the Project from time to time; (4) in accordance with all applicable Laws (including all work, whether structural or non-structural, inside or outside the Premises, required to comply fully with all applicable Laws and necessitated by Tenant’s work); and (5) subject to all industry standard reasonable and non-discriminatory conditions which Landlord may in Landlord’s reasonable discretion impose. Such conditions may include requirements for Tenant to: (i) with respect to Alterations costing $500,000.00 or more, provide payment or performance bonds or additional insurance (from Tenant or Tenant’s contractors, subcontractors or design professionals), or other evidence reasonably satisfactory to Landlord that Tenant has the financial resources to complete the Alterations; provided that, so long as there is no material and adverse change to Tenant’s financial condition as of the date of this Lease (as reasonably determined by Landlord), Landlord shall not require any of the foregoing in connection with any Alterations performed by or on behalf of Tenant; (ii) use contractors or subcontractors reasonably approved by Landlord; and (iii) subject to the provisions of Section 2.2 and the following provisions of this Section 6.1, remove all or part of the Alterations prior to or upon expiration or termination of the Term, as designated by Landlord. The term “Alterations” also includes any and all alterations, improvements, or additions made to the Premises by or on behalf of Tenant prior to the Commencement Date of this Lease or pursuant to the terms of the Existing Lease. Notwithstanding anything to the contrary contained herein, so long as Tenant’s written request for consent for a proposed Alteration contains the following statement in large, bold and capped font “PURSUANT TO SECTION 6 OF THE LEASE, IF LANDLORD CONSENTS TO THE SUBJECT ALTERATION, LANDLORD SHALL NOTIFY TENANT IN WRITING WHETHER OR NOT LANDLORD WILL REQUIRE SUCH ALTERATION TO BE REMOVED AT THE EXPIRATION OR EARLIER TERMINATION OF THE LEASE.”, at the time Landlord gives its consent for any Alterations, if it so does, Tenant shall also be notified whether or not Landlord will require that such Alterations be removed upon the expiration or earlier termination of this Lease. Notwithstanding anything to the contrary contained in this Lease, at the expiration or earlier termination of this Lease and otherwise in accordance with Section 19.1 hereof, Tenant shall, subject to the provisions of Section 2.2 and the following provisions of this Section 6.1, be required to remove all Alterations made to the Premises except for any such Alterations which Landlord expressly indicates or is deemed to have indicated shall not be required to be removed from the Premises by Tenant. If Tenant’s written notice strictly complies with the foregoing and if Landlord fails to notify Tenant within ten (10) business days of Landlord’s receipt of such notice whether Tenant shall be required to remove the subject Alterations at the expiration or earlier termination of this Lease, it shall be assumed that Landlord shall require the removal of the subject Alteration at the expiration or earlier termination of this Lease. Notwithstanding anything to the contrary contained in this Lease, it is agreed that, other than data and telecommunications wiring and cabling, Tenant shall have no obligation to remove from the Premises any office improvements standard in office/R&D buildings substantially similar to, and in the vicinity of, the Buildings in the Project as of the date of this Lease, such as gypsum board, partitions, ceiling grids and tiles, fluorescent lighting panels, Building standard doors and carpeting (the “Removal Conditions”). If any work outside the Premises, or any work on or adjustment to any of the Building Systems, is required in connection with or as a result of the Tenant Improvements or any Alterations, such work shall be performed at Tenant’s expense by contractors reasonably approved by Landlord. Landlord’s right

-17-

to reasonably review and approve (or reasonably withhold approval of) Tenant’s plans, drawings, specifications, contractor(s) and other aspects of construction work proposed by Tenant is intended solely to protect Landlord, the Project and Landlord’s interests. No approval or consent by Landlord shall be deemed or construed to be a representation or warranty by Landlord as to the adequacy, sufficiency, fitness or suitability thereof or compliance thereof with applicable Laws or other requirements. Except as otherwise provided in Landlord’s consent, all Alterations shall upon installation become part of the realty and be the property of Landlord.

Notwithstanding the foregoing, but subject to the terms of this Section 6.1, Tenant shall not be required to remove any portion of the Tenant Improvements to the extent the same are expressly shown in the Space Plan (attached as Schedule 4 to Exhibit B), other than wiring and cabling, which shall be removed by Tenant on or before the expiration or earlier termination of the Lease; provided, however, that Landlord shall have the right, in its sole discretion (but subject to the Removal Conditions), to revise the determination of Tenant’s removal and restoration obligations with respect to any portion of the Tenant Improvements not expressly shown or not shown to completion on the Space Plan or otherwise modified or more fully depicted on the Final Construction Documents.

Notwithstanding the provisions of Section 5.2(i) above, Landlord shall not withhold its consent to Tenant’s proposed installation of a reasonable number of electric vehicle charging stations in the Parking Facility, provided, however, the installation of such electric vehicle charging stations shall be subject to all of the other provisions of this Section 6.

6.2 Before making any Alterations, Tenant shall submit to Landlord for Landlord’s prior approval reasonably detailed final plans and specifications prepared by a licensed architect or engineer, a copy of the construction contract, including the name of the contractor and all subcontractors for material trades proposed by Tenant to make the Alterations and a copy of the contractor’s license. Tenant shall reimburse Landlord upon demand for any reasonable, out-of-pocket expenses incurred by Landlord in connection with any Alterations made by Tenant, including reasonable fees charged by Landlord’s contractors or consultants to review plans and specifications prepared by Tenant and to update the existing as-built plans and specifications of the Building to reflect the Alterations. Before commencement of any Alterations Tenant shall (i) obtain all applicable permits, authorizations and governmental approvals and deliver copies of the same to Landlord, and (ii) give Landlord at least ten (10) days prior written notice and shall cooperate with Landlord in posting and maintaining notices of non-responsibility in connection with the Alterations. Within thirty (30) days following the completion of any Alterations Tenant shall deliver to Landlord “as built” plans showing the completed Alterations. The “as built” plans shall be “hard copy” on paper and in digital form (if done on CAD), and show the Alterations in reasonable detail, including (a) the location of walls, partitions and doors, including fire exits and ADA paths of travel, (b) electrical, plumbing and life safety fixtures, and (c) a reflected ceiling plan showing the location of heating, ventilating and air conditioning registers, lighting and life safety systems.

6.3 In connection with all Alterations (other than the Tenant Improvements and any Cosmetic Alterations), Landlord shall be entitled to a construction coordination fee equal to two percent (2%) of the first four hundred thousand dollars ($400,000) of construction costs, and one percent (1%) of any additional construction costs.

-18-

6.4 Tenant shall keep the Premises and the Project free and clear of all liens arising out of any work performed, materials furnished or obligations incurred by Tenant. If any such lien attaches to the Premises or the Project, and Tenant does not cause the same to be released by payment, bonding or otherwise within ten (10) days after Tenant’s notice thereof, Landlord shall have the right but not the obligation to cause the same to be released, and any sums expended by Landlord (plus Landlord’s administrative costs) in connection therewith shall be payable by Tenant on demand with interest thereon from the date of expenditure by Landlord at the Interest Rate (as defined in Section 16.2 - Interest).

6.5 Subject to the provisions of Section 5 - Use and Compliance with Laws and the other provisions of this Section 6, Tenant may install and maintain furnishings, equipment, movable partitions, business equipment and other trade fixtures (“Trade Fixtures”) in the Premises, provided that the Trade Fixtures do not become an integral part of the Premises or the Building. Tenant shall promptly repair any damage to the Premises or the Building caused by any installation or removal of such Trade Fixtures.

7.MAINTENANCE AND REPAIRS.

7.1 Maintenance and Repairs for Full Building Portions of the Premises. The terms and conditions of this Section 7.1 shall apply to all portions of the Premises comprising an entire building within the Project:

(a) Tenant agrees that the Premises are in a good and tenantable condition. Except for those portions of the Building to be maintained by Landlord pursuant to Section 7.1(b) below, during the Term, Tenant, at Tenant’s expense but under the direction of Landlord, shall maintain and repair all parts of the Premises, including, without limitation, the HVAC Systems serving the Premises, the electrical and plumbing systems within the Premises (including such portion of such systems outside of the Premises, but exclusively serving the Premises, and assuring the free flow of Tenant's sanitary sewer line to the main line serving the Premises), including the lighting and plumbing fixtures, the restrooms serving the Premises, interior stairways (if any) in the Premises, the interior and exterior glass, plate glass skylights, interior walls, floor coverings, ceiling (ceiling tiles and grid), Tenant Improvements, Alterations, fire extinguishers, outlets and fixtures, and any appliances (including dishwashers, hot water heaters and garbage disposers) in the Premises, in good condition, and keep the Premises in a clean, safe and orderly condition. In addition to the above-listed items, Tenant, at Tenant’s sole cost and expense, shall procure and maintain a service contract (the “Service Contract”) for preventive maintenance and regular inspection of the HVAC Systems serving the Premises on a quarterly basis, including filter changes with a service and maintenance contracting firm reasonably acceptable to Landlord. Tenant shall follow all reasonable recommendations of said contractor for the maintenance, repair and replacement of the HVAC Systems serving the Premises. Said contractor shall furnish a complete report of any defective conditions found to be existing with respect to such HVAC Systems, together with any recommendations for maintenance, repair and/or replacement thereof. Said report shall be furnished to Tenant with a copy to Landlord. In addition, and except with respect to material capital repairs (as defined below) which material capital repairs shall be included in Operating Costs, Tenant shall be responsible for the cost of repairs to the HVAC Systems serving the Premises which are not covered by the Service Contract. For purposes of this Lease, “material capital repairs” is a single capital repair item costing more than ten thousand dollars ($10,000.00) (provided that Tenant shall be liable for the cost of the

-19-

same to the extent required due to Tenant’s misuse or Tenant’s failure to properly maintain the subject replaced item). Notwithstanding the provisions of this Section 7.1(a) or Section 7.2(a) below to the contrary, if, during the initial Term of this Lease, any replacement or material capital repair is required to be performed by Tenant to the HVAC Systems or other Building Systems pursuant to this Section 7.1, and such repair or replacement is of a capital nature (and with respect to a capital repair, qualifies as a material capital repair), as reasonably determined by Landlord using GAAP, then, so long as (i) Tenant has maintained the Service Contracts in accordance with this Section 7.1(a), (ii) Tenant has properly and in good faith consistently maintained and repaired such Building Systems in accordance with this Section 7.1(a) or Section 7.2(a) below, as the case may be, and (iii) the need for any such replacement or material capital repair does not arise from acts (other than normal and appropriate use in accordance with the Permitted Use) or omissions, abuse or misuse by Tenant or any of Tenant’s Representatives or Visitors, then Landlord shall perform such material capital repair at its cost and Tenant shall reimburse Landlord for such cost and expense by payments of monthly Additional Rent in an amount that would fully amortize such cost and expense, with interest at one percent (1%) in excess of the Wall Street Journal prime lending rate announced from time to time, as of the date such expense is incurred, over the projected useful life of the HVAC Systems being replaced, as reasonably determined by Landlord. Such Additional Rent obligation shall continue until such cost and expense is fully amortized or until the expiration of the Term, as it may be extended from time to time, whichever comes first. Landlord’s obligation to replace the HVAC Systems hereunder shall not apply to any supplemental heating, ventilating and air conditioning unit installed by or for the benefit of Tenant.