Attached files

| file | filename |

|---|---|

| EX-10.1 - EXHIBIT 10.1 - TEAM INC | ex10-1teamthirdamendmentfi.htm |

| 8-K - FORM 8-K - TEAM INC | form8-kcreditfacilityamend.htm |

56

93

138

66

109

161

75

123

180

115

148

197

161

180

212

194

205

225

Business Review

August 2016

Exhibit 99.1

56

93

138

66

109

161

75

123

180

115

148

197

161

180

212

194

205

225

1

Safe Harbor Statement

Certain forward-looking information contained herein is being provided in accordance with the provisions of the

Private Securities Litigation Reform Act of 1995. We have made reasonable efforts to ensure that the

information, assumptions and beliefs upon which this forward-looking information is based are current,

reasonable and complete. Such forward-looking statements involve estimates, assumptions, judgments and

uncertainties. There are known and unknown factors that could cause actual results or outcomes to differ

materially from those addressed in the forward-looking information. Such known factors are detailed in the

Company's Annual Report on Form 10-K and in the Company's Quarterly Reports on Form 10-Q as filed with the

Securities and Exchange Commission, and in other reports filed by the Company with the Securities and

Exchange Commission from time to time. Accordingly, there can be no assurance that the forward-

looking information contained herein will occur or that objectives will be achieved. We assume no obligation to

publicly update or revise any forward-looking statements made today or any other forward-looking statements

made by the Company, whether as a result of new information, future events or otherwise.

56

93

138

66

109

161

75

123

180

115

148

197

161

180

212

194

205

225

2

Non-GAAP Financial Measures (Unaudited)

The Company uses supplemental non-GAAP financial measures which are derived from the consolidated financial information including

adjusted net income; adjusted net income per share, earnings before interest and taxes (“EBIT”); adjusted EBIT; and adjusted earnings before

interest, taxes, depreciation and amortization (“adjusted EBITDA”) to supplement financial information presented on a GAAP basis. Adjusted

net income and adjusted earnings per share, each as defined by the Company, exclude the following items from net income: acquisition costs

associated with business combinations, non-routine legal costs and professional fees for acquired business integration and changing our

fiscal year end, losses on the revaluation of contingent consideration, non-capitalized ERP implementation costs, losses on our investment in

Venezuela, certain other non-routine items and the related income tax impacts. EBIT, as defined by the Company, excludes discontinued

operations, income tax expense, interest charges and items of other (income) expense and therefore is equal to operating income reported in

accordance with GAAP. Adjusted EBIT further excludes the following items: acquisition costs associated with business combinations, non-

routine legal costs and professional fees for acquired business integration and changing our fiscal year end, losses on the revaluation of

contingent consideration, non-capitalized ERP implementation costs and certain other non-routine items. Adjusted EBITDA further excludes

from adjusted EBIT depreciation, amortization and non-cash share based compensation costs.

Management believes that excluding certain items from GAAP results allows management to better understand the consolidated financial

performance from period to period and to better identify operating trends that may not otherwise be apparent. Moreover, the Company

believes these non-GAAP financial measures will provide its stakeholders with useful information to help them evaluate operating

performance. However, there are limitations to the use of the non-GAAP financial measures represented in this presentation. The Company’s

non-GAAP financial measures may not be comparable to similarly titled measures of other companies who may calculate non-GAAP financial

measures differently than TEAM does, limiting the usefulness of those measures for comparative purposes.

The non-GAAP financial measures are not meant to be considered as indicators of performance in isolation from or as a substitute for net

income as a measure of operating performance or to cash flows from operating activities as a measure of liquidity, prepared in accordance

with GAAP, and should be read only in conjunction with financial information presented on a GAAP basis. Refer to previously filed Quarterly

Earnings Release filings on Form 8-K for additional information on the Non-GAAP financial measures.

56

93

138

66

109

161

75

123

180

115

148

197

161

180

212

194

205

225

• Leading provider of specialty industrial services

related to maintenance and installation of

pressurized piping systems and processes and

inspection – focused primarily on the energy

industry

• Recurring revenue business model – services are

primarily oriented towards the maintenance and

monitoring of existing facilities, but also support

new facilities and facility expansions

• Services are critical and essential to clients and are

driven by ongoing operational and safety

requirements

• Organized in three complementary and synergistic

business units:

— TeamQualspec, delivering NDT Inspection and

Heat Treating

— TeamFurmanite, delivering Mechanical Services

— Quest Integrity Group (QIG)

• Principal services are North American centric;

significant upside exists in foreign markets—

especially with the recent acquisition of Furmanite

3

TEAM’s Business and Service Offering Overview

Overview of TEAM

• Premier NDT Inspection and

assessment services

• Full range of traditional and

advanced NDE methods

• Pipeline integrity management

• Leading Field Heat Treating

Company in NAM

• Proprietary In-line inspection

tools

• Advanced engineering and

assessment

• Pipeline Integrity Management

(PIM)

• Premier Mechanical Service

Company

• On stream Services

• Turnaround/project services

Team

Qualspec

Team

Furmanite

Quest

Integrity

Group (QIG)

Business Units

56

93

138

66

109

161

75

123

180

115

148

197

161

180

212

194

205

225

4

Our Primary Competitive Attributes---Building the Premier

Global Industrial Services Company

Industrial Services Market Leadership – This means Extending our market leadership in the

fragmented mechanical services and inspection industries, and meeting client demands for more

single source accountability, capability, capacity and priority resource allocations.

Standard Services to Customized, Fully Integrated Solutions – This means Providing a natural

escalation path, from standard and specialty individual services to advanced, fully integrated solutions

as/when client circumstances demand.

Highly Trained and Experienced Workforce – This means Deploying 8,000+ highly trained and

qualified employees, often with local plant or asset-specific knowledge, to help clients index and

support best practices.

Practical Technology-Enablement – This means Applying mechanical and inspection/NDT

technology to improve and predict condition assessment, and to enable safe, compliant and cost

effective maintenance and repairs.

Regional Resources and Responsiveness – This means Leveraging the availability of regional

resources and equipment at over 220 locations in 22 countries, maximizing service responsiveness

and reliability.

56

93

138

66

109

161

75

123

180

115

148

197

161

180

212

194

205

225

5

Furmanite Acquisition Summary

• Team, Inc. acquired Furmanite in an all equity transaction.

• Acquisition purchase price was $282MM (including debt), representing a 9x multiple of Furmanite

2015 EBITDA of $30MM. (includes $3 million from business to be sold).

• Merger was stock-for-stock.

o Furmanite shareholders received 0.215 shares of TEAM common stock for each share of

Furmanite common stock.

o Furmanite shareholders own approximately 27% of combined company.

• Merger closed on February 29, 2016.

4

56

93

138

66

109

161

75

123

180

115

148

197

161

180

212

194

205

225

1999 2004 2004 2007 2008 2010 2011 2012 2013 2015 2016 2016 2016

Company

EA

Revenues $9 $15 $90 $58 $22 $22 $12 $22 $6 $170 $345 $9 $8

Rationale Add NDT

inspection

capability

into core

industrial

service

offering

Expand

field heat

treating

services

portfolio

Bolster under-

performing

non-

destructive

testing and

field heat

treating

branches

Increase

Canadian

penetration,

becoming #2

Canadian

inspection

service

provider

Extend

mechanical

service

presence to

Europe

Broaden

service and

product

offering;

deepen

skilled labor

pool;

geographic

expansion

Extend

mechanical

service

presence

to Pacific

Northwest

Broaden

domestic

inspection

and repair

platform to

storage

tanks

Access

to

industrial

rope

access

services

package

Established

TEAM as the

premier US

NDT

inspection

company

Established

TEAM as

premier NA

Mechanical

Services

company and

expands our

penetration in

Europe and

Asia Pacific

Team’s first

inspection

operation outside

of North America

(Europe).

Turbinate is a

mechanical

furnace and

pipe cleaning

business

recognized as

a service

leader in the

European

market.

6

Significant Acquisitions Overview

GA

TCI

Cooperheat

MQSXRI Aitec

($ in millions)

56

93

138

66

109

161

75

123

180

115

148

197

161

180

212

194

205

225

7

TEAM Proforma Business Structure

TEAM ($1,365)

Mechanical Services ($605)

Furmanite ($300)

(acquired March 2016)

Inspection & Heat Treating

($685)

NDT=$562, HT=$123

QualSpec ($170)

(acquired July 2015)

Furmanite ($45) NDT & HT

Quest ($75)

(FYE 2015 Pro Forma Revenue in millions)

56

93

138

66

109

161

75

123

180

115

148

197

161

180

212

194

205

225

8

TEAM Historical and Pro Forma Revenue and EBITDA

Highlights

($ in millions)

260

318

479 498 454

508

624

714

813

926

1365

$29

$41

$62 $60

$46

$63

$79 $79

$90

$96

$136

$0

$50

$100

$150

$200

$250

$300

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

Revenue Adj. EBITDA

% Margin 11% 13% 13% 12% 10% 12% 13% 11% 11% 10% 10%

2006-2013 – Reporting year June 1st to May 31st

2014-2015 – Reporting year January 1st to December 31st

• 20% Revenue CAGR since 2006

• 12% average annual Adj.

EBITDA margin since 2006

• Major acquisitions of QualSpec

(2015) and Furmanite (2016)

add $500MM+ of Revenue

56

93

138

66

109

161

75

123

180

115

148

197

161

180

212

194

205

225

9

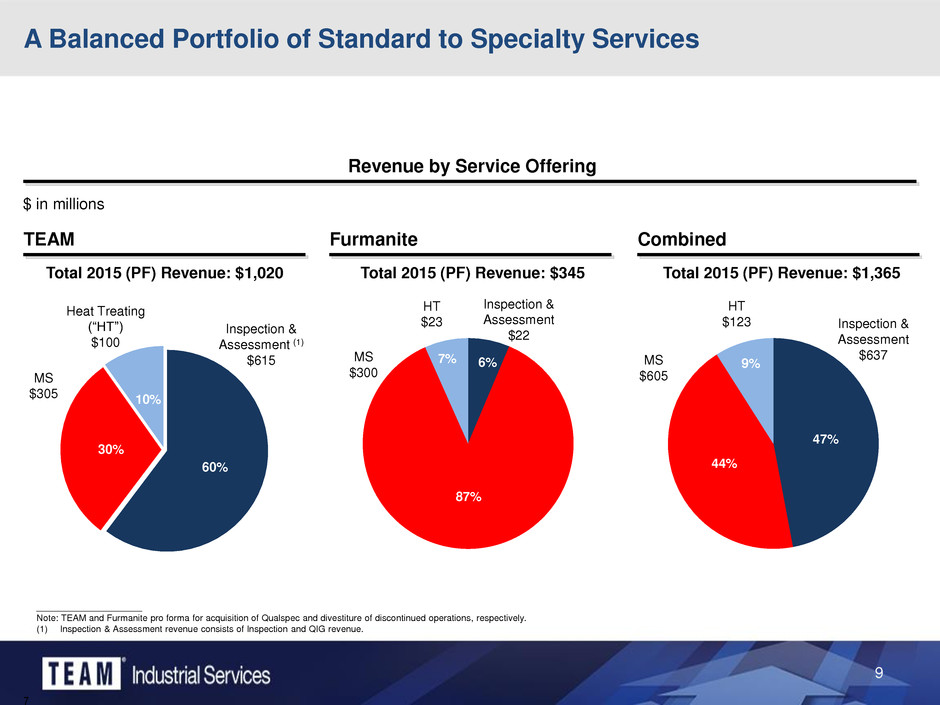

A Balanced Portfolio of Standard to Specialty Services

60%

30%

10%

TEAM Furmanite Combined

47%

44%

9%

Total 2015 (PF) Revenue: $1,020

$ in millions

Total 2015 (PF) Revenue: $345 Total 2015 (PF) Revenue: $1,365

_____________________

Note: TEAM and Furmanite pro forma for acquisition of Qualspec and divestiture of discontinued operations, respectively.

(1) Inspection & Assessment revenue consists of Inspection and QIG revenue.

Inspection &

Assessment (1)

$615

MS

$305

Inspection &

Assessment

$637 MS

$605

6%

87%

7%

Inspection &

Assessment

$22

MS

$300

Revenue by Service Offering

7

Heat Treating

(“HT”)

$100

HT

$23

HT

$123

56

93

138

66

109

161

75

123

180

115

148

197

161

180

212

194

205

225

Team Furmanite Combined

Employees 6,000 2,300 8,300

Locations 140 80 220

Countries 15 16 22

10

Geographic Scale, Scope and Customer Access

North America (85%) – US (76%)/CA (9%) Europe (10%) Rest of World (5%)

Combined Entity Snapshot Key Benefits

• Better attract and retain skilled employees

• Cross-sell services to existing customers

• Creates more “large project” capabilities

• Better access and service new customers

• Enhances purchasing power among supplier base

TEAM

$931

Furmanite

$224 TEAM

$48

Furmanite

$87

TEAM

$41 Furmanite

$34

$ in millions

_____________________

Note: Represents 2015 Pro-Forma revenue

Total 2015 (PF) Revenue: $1,155 Total 2015 (PF) Revenue: $135 Total 2015 (PF) Revenue: $75

8

56

93

138

66

109

161

75

123

180

115

148

197

161

180

212

194

205

225

11

U.S. Locations (Team, Furmanite & QualSpec)

TEAM Branch Office

TEAM Branch Office and Equipment Center

TEAM Corporate Office

QualSpec Resident Locations

QualSpec Offices

Quest Distribution Location

Furmanite Location

Furmanite Manufacturing Location

56

93

138

66

109

161

75

123

180

115

148

197

161

180

212

194

205

225

12

Blue-Chip Customer Base

Refineries

45%

Other

17%

Pipeline

8%

Power

8%

Petro-

Chemical

22%

• Diverse customer base across several large industrial markets

• Industry-leading, blue-chip customers

• 7,000 active customers and minimal concentrations

• Multi-year service agreements with major customers

56

93

138

66

109

161

75

123

180

115

148

197

161

180

212

194

205

225

13

An Attractive Growth Platform

Breadth of

Services

New Capital

Construction

Pipeline

Integrity

Management

LNG Boom and

Cheap Feed

Stocks

Leading North

America Market

Position

Areas of Growth

• Opportunity to capitalize on

procurement consolidation trends by

customers who prefer larger, specialized

service providers

• Leading NAM market position; breadth

of service lines and geographic reach

provide opportunity to gain share in

highly fragmented market

• New construction starts, specifically in

the Gulf coast, provide long-term

opportunities

• Existing and new pipeline construction

create demand for our specialized

integrity management programs

• Cheap feed stock is driving max

production capacities, which stresses

equipment usage leading to more

service opportunities

56

93

138

66

109

161

75

123

180

115

148

197

161

180

212

194

205

225

August 28, 2015

Questions

14

56

93

138

66

109

161

75

123

180

115

148

197

161

180

212

194

205

225

Investor Information

15

Stock Ticker

NYSE: TISI

Website: www.teaminc.com

Headquarters

Team Industrial Services

13131 Dairy Ashford #600

Sugar Land, Texas 77478

Team Contacts

Ted Owen: President and CEO

+1 281.388.5525 |ted.owen@teaminc.com

Greg Boane: Executive Vice President and CFO

+1 281.388.5541 |greg.boane@teaminc.com

56

93

138

66

109

161

75

123

180

115

148

197

161

180

212

194

205

225

Appendix

16

56

93

138

66

109

161

75

123

180

115

148

197

161

180

212

194

205

225

17

TEAM’s Business Integration Bet

8

Note: Based on unaudited pro forma consolidated results of operations as if the acquisition of Furmanite and Qualspec had occurred at the beginning of fiscal

year 2015. These results are not necessarily indicative of the results which would actually have occurred if the acquisitions had taken place at the beginning of

fiscal year 2015, nor are they necessarily indicative of future results.

$ in millions

Current

FY 2015 Market Market 2018

Pro Forma Adjustment Growth Target

Total Revenues 1,365 1,250 250 1,500

Adjusted EBITDA 136 105 50 155

10% 8% 20% 10%

Merger Related Synergies 25

Performance Improvement 20

Targeted EBITDA 200

13%

56

93

138

66

109

161

75

123

180

115

148

197

161

180

212

194

205

225

18

Pro Forma Revenue 2015

Note: Based on unaudited pro forma consolidated results of operations as if the acquisition of Furmanite and Qualspec had occurred at the beginning of fiscal year 2015. These results are not necessarily indicative of

the results which would actually have occurred if the acquisitions had taken place at the beginning of fiscal year 2015, nor are they necessarily indicative of future results.

REVENUE SUMMARY

Three Months Ending Mar. 31, Jun. 30, Sep. 30 and Dec. 31, 2015

(Unaudited)

($ in millions)

PFORMA Revenues (Incl. QSpec and FRM) Q1 '15 Q2 '15 Q3 '15 Q4 '15 TOTAL FY '15

Team QualSpec 152 174 157 155 638

Team Furmanite 154 173 155 171 653

Quest Integrity 16 24 16 18 74

Total TEAM Consolidated 322 371 328 344 1,365

56

93

138

66

109

161

75

123

180

115

148

197

161

180

212

194

205

225

19

Pro Forma Revenue Summary Q216 vs. Q215

Note: Based on unaudited pro forma consolidated results of operations as if the acquisition of Furmanite and Qualspec had occurred at the beginning of fiscal year 2015. These results are not necessarily indicative of

the results which would actually have occurred if the acquisitions had taken place at the beginning of fiscal year 2015, nor are they necessarily indicative of future results.

REVENUE SUMMARY

Three Months Ending June 30, 2016 and 2015

(Unaudited)

($ in millions)

Q2 '16 Q2 '15 $ Change % Change

TEAM Consolidated

Team Consolidated Pro Forma 336 371 (34) (9%)

Less: Heat Treating Services 17 28 (11) (39%)

Less: Quest Integrity 20 24 (4) (17%)

Plus: Fort McMurray Fire Impact 5 - 5

Adjusted Pro Forma Revenues 304 319 (14) (4%)

TEAM QualSpec

Team QualSpec Pro Forma 156 174 (18) (10%)

Less: Heat Treating Services 17 28 (11) (39%)

Plus: Fort McMurray Fire Impact 2 - 2

Adjusted Pro Forma Revenues 141 146 (5) (3%)

TEAM Furmanite

Team Furmanite Pro Forma 160 173 (13) (8%)

Plus: Fort McMurray Fire Impact 3 - 3

Adjusted Pro Forma Revenues 163 173 (10) (6%)

Quest Integrity 20 24 (4) (17%)

56

93

138

66

109

161

75

123

180

115

148

197

161

180

212

194

205

225

20

Merger Cost Synergies Achievement to Date (June 30, 2016)

Annualized Savings (Millions)

Operations 8.43$

Executive Level 2.83$

Corporate Functions 1.35$

Headcount Savings Total 12.61$

Public Company Costs 2.01$

Business Insurance Renewal 4.00$

Total 18.63$

Note: This schedule represents the merger cost synergies achieved to date on an annual run-rate basis.