Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - FB Financial Corp | d241660dex231.htm |

| EX-21.1 - EX-21.1 - FB Financial Corp | d241660dex211.htm |

| EX-16.1 - EX-16.1 - FB Financial Corp | d241660dex161.htm |

| EX-10.12 - EX-10.12 - FB Financial Corp | d241660dex1012.htm |

| EX-10.11 - EX-10.11 - FB Financial Corp | d241660dex1011.htm |

| EX-10.7 - EX-10.7 - FB Financial Corp | d241660dex107.htm |

| EX-10.2 - EX-10.2 - FB Financial Corp | d241660dex102.htm |

| EX-10.1 - EX-10.1 - FB Financial Corp | d241660dex101.htm |

| EX-4.1 - EX-4.1 - FB Financial Corp | d241660dex41.htm |

| EX-3.2 - EX-3.2 - FB Financial Corp | d241660dex32.htm |

| EX-3.1 - EX-3.1 - FB Financial Corp | d241660dex31.htm |

Table of Contents

Index to Financial Statements

As Filed with the Securities and Exchange Commission on August 19, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

FB Financial Corporation

(Exact Name of Registrant as Specified in Its Charter)

| Tennessee | 6022 | 62-1216058 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

211 Commerce Street, Suite 300,

Nashville, Tennessee 37201

(615) 313-0080

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Christopher T. Holmes

Chief Executive Officer

FB Financial Corporation

211 Commerce Street, Suite 300,

Nashville, Tennessee 37201

(615) 313-0080

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| Mark C. Kanaly Kyle G. Healy Alston & Bird LLP One Atlantic Center 1201 West Peachtree Street Atlanta, GA 30309 (404) 881-7000 |

Marc D. Jaffe Keith L. Halverstam Latham & Watkins LLP 885 Third Avenue New York, NY 10022 (212) 906-1200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title Of Each Class Of Securities To Be Registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount Of Registration Fee | ||

| Common Stock, par value $1.00 per share |

$115,000,000 | $11,580.50 | ||

|

| ||||

|

| ||||

| (1) | Includes shares which the underwriters have the right to purchase to cover over-allotments. |

| (2) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Index to Financial Statements

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated August 19, 2016

Preliminary prospectus

Shares

Common stock

This is the initial public offering of common stock of FB Financial Corporation, a bank holding company headquartered in Nashville, Tennessee. We operate primarily through our wholly-owned subsidiary, FirstBank, the third largest bank headquartered in Tennessee.

We are offering shares of our common stock. The selling shareholder identified in this prospectus is offering an additional shares of our common stock. See “Principal shareholders and selling shareholder”. We will not receive any proceeds from the sale of the shares by the selling shareholder. In connection with the termination of our status as an S Corporation, we intend to use approximately $ million of the net proceeds to us from the offering to (i) fund a cash distribution to our sole shareholder immediately after the closing of this offering in the amount of $55 million, which is intended to be non-taxable to our sole shareholder and represents a significant portion of our S Corporation earnings that have been, or will be, taxed to our sole shareholder, but not previously distributed to him, and (ii) subject to regulatory approval, to repay all $10.1 million aggregate principal amount of subordinated notes held by our sole shareholder, plus any accrued and unpaid interest thereon. See “Use of proceeds.”

Prior to this offering, there has been no established public market for our common stock. We currently estimate the public offering price of our common stock will be between $ and $ per share. We have applied to list our common stock on the New York Stock Exchange under the symbol “FBK.”

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 and, as a result, are subject to reduced public company disclosure standards. See “Implications of being an emerging growth company.”

| Per share | Total | |||||||

| Initial public offering price of our common stock |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds to us, before expenses |

$ | $ | ||||||

| Proceeds to the selling shareholder, before expenses |

$ | $ | ||||||

| (1) | See “Underwriting” beginning on page 198 of this prospectus for additional information regarding underwriting compensation. |

The underwriters have an option to purchase up to an additional shares of our common stock at the initial public offering price less the underwriting discount, within 30 days of the date of this prospectus. Of the shares subject to the underwriters’ option, shares will be offered by us and shares will be offered by the selling shareholder. See “Underwriting.”

Investing in our common stock involves risks. See “Risk factors” to read about factors you should consider before investing in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

These securities are not deposits, savings accounts or other obligations of any bank or savings association and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency and are subject to investment risks, including the possible loss of the entire amount you invest.

The underwriters expect to deliver the shares of our common stock to purchasers on or about , 2016, subject to customary closing conditions.

| J.P. Morgan | UBS Investment Bank | Keefe, Bruyette & Woods A Stifel Company |

The date of this prospectus is , 2016.

Table of Contents

Index to Financial Statements

| i | ||||

| i | ||||

| ii | ||||

| 1 | ||||

| 12 | ||||

| 15 | ||||

| 24 | ||||

| 53 | ||||

| 56 | ||||

| 57 | ||||

| 59 | ||||

| 60 | ||||

| 62 | ||||

| 69 | ||||

| Management’s discussion and analysis of financial condition and results of operations |

111 | |||

| 174 | ||||

| 180 | ||||

| 191 | ||||

| 193 | ||||

| 197 | ||||

| 203 | ||||

| Certain material U.S. federal income tax consequences for non-U.S. holders of common stock |

205 | |||

| 209 | ||||

| 217 | ||||

| 217 | ||||

| 217 | ||||

| F-1 | ||||

Table of Contents

Index to Financial Statements

You should rely only on the information contained in this prospectus. We, the selling shareholder and the underwriters have not authorized anyone to provide you with different or additional information. We, the selling shareholder and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any different or additional information that others may give you. If anyone provides you with different or inconsistent information, you should not rely on it.

We and the selling shareholder are offering to sell shares of our common stock, and intend to seek offers to buy shares of our common stock, only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of the delivery of this prospectus or any sale of our common stock. Our business, financial condition, results of operations and growth prospects may have changed since that date. Information contained on, or accessible through, our website is not part of this prospectus.

In this prospectus, “we,” “our,” “us,” “FB Financial Corporation” or “the Company” refers to FB Financial Corporation, a Tennessee corporation, and our consolidated banking subsidiary, FirstBank, a Tennessee state chartered bank, unless the context indicates that we refer only to the parent company, FB Financial Corporation. In this prospectus, “Bank” or “FirstBank” refers to FirstBank, our consolidated banking subsidiary. In this prospectus, “selling shareholder” means the selling shareholder named in the table under the heading “Principal shareholders and selling shareholder” in this prospectus.

Unless otherwise indicated or the context requires, all information in this prospectus assumes the underwriters’ option to purchase additional shares of our common stock to cover over-allotments is not exercised.

S Corporation status

Since 2001, we have elected to be taxed for U.S. federal income tax purposes as an “S Corporation” under the provisions of Sections 1361 through 1379 of the Internal Revenue Code of 1986, as amended (the “Code”). As a result, our net income has not been subject to, and we have not paid, U.S. federal income tax, and no provision or liability for U.S. federal income tax has been included in our consolidated financial statements. Instead, for U.S. federal income tax purposes our taxable income is “passed through” to our shareholder. Unless specifically noted otherwise, no amount of our consolidated net income or our earnings per share presented in this prospectus, including in our consolidated financial statements and the accompanying notes appearing in this prospectus, reflects any provision for or accrual of any expense for U.S. federal income tax liability for our Company for any period presented. Upon the consummation of this offering, our status as an S Corporation will terminate. Thereafter, our net income will be subject to U.S. federal income tax and the Company will bear the liability for those taxes.

This prospectus includes statistical and other industry and market data that we obtained from governmental reports and other third party sources. Our internal data, estimates and forecasts are based on information obtained from governmental reports, trade and business organizations and other contacts in the markets in which we operate and our management’s understanding of industry conditions. Although we believe that this information (including the industry publications and third party research, surveys and studies) is accurate and reliable, we have not independently verified such information. In addition, estimates, forecasts and assumptions are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the “Risk factors” section and elsewhere in this prospectus.

i

Table of Contents

Index to Financial Statements

Implication of being an emerging growth company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to other public companies. As an emerging growth company:

| • | we may present only two years of audited financial statements, discuss only our results of operations for two years in related “Management’s discussions and analysis of financial condition and results of operations” and provide less than five years of selected financial data in this registration statement; |

| • | we are exempt from the requirement to provide an auditor attestation from our auditors on management’s assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act; |

| • | we may choose not to comply with any new requirements adopted by the Public Company Accounting Oversight Board, or PCAOB, requiring mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and our audited financial statements; |

| • | we are permitted to provide less extensive disclosure regarding our executive compensation arrangements pursuant to the rules applicable to smaller reporting companies, which means we do not have to include a compensation discussion and analysis and certain other disclosure regarding our executive compensation in this prospectus; and |

| • | we are not required to hold nonbinding advisory votes on executive compensation or golden parachute arrangements. |

We may take advantage of these provisions for up to five years unless we earlier cease to be an emerging growth company. We will cease to be an emerging growth company if we have more than $1.0 billion in annual gross revenues, have more than $700.0 million in market value of our common stock held by non-affiliates, or issue more than $1.0 billion of non-convertible debt in a three-year period. We have elected to adopt the reduced disclosure requirements described above regarding our executive compensation arrangements for purposes of the registration statement of which this prospectus is a part. In addition, we expect to take advantage of certain of the reduced reporting and other requirements of the JOBS Act with respect to the periodic reports we will file with the SEC and proxy statements that we use to solicit proxies from our shareholders.

The JOBS Act also permits us an extended transition period for complying with new or revised financial accounting standards affecting public companies until they would apply to private companies. However, we have elected not to take advantage of this extended transition period, which means that the financial statements included in this prospectus, as well as any financial statements that we file in the future, will be subject to all new or revised accounting standards generally applicable to public companies. Our election not to take advantage of the extended transition period is irrevocable.

ii

Table of Contents

Index to Financial Statements

This summary highlights selected information contained in this prospectus. This summary does not contain all the information that you should consider before investing in our common stock. You should read the entire prospectus carefully, including the “Risk factors,” “Cautionary note regarding forward-looking statements” and “Management’s discussion and analysis of financial condition and results of operations” sections, the historical financial statements and the accompanying notes included in this prospectus.

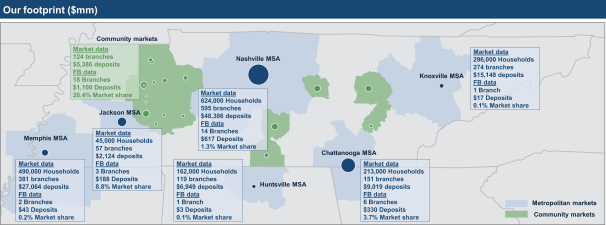

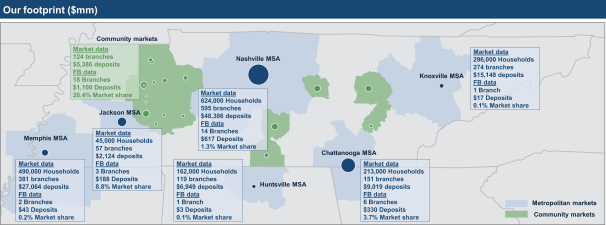

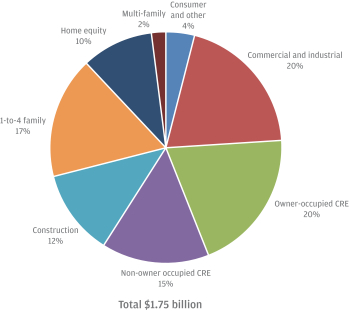

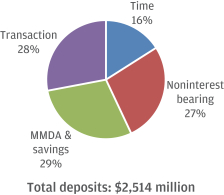

Overview

We are a bank holding company, headquartered in Nashville, Tennessee. Our wholly-owned bank subsidiary, FirstBank, is the third largest Tennessee-headquartered bank, based on total assets. FirstBank provides a comprehensive suite of commercial and consumer banking services to clients in select markets in Tennessee, North Alabama and North Georgia. Our footprint includes 45 full-service bank branches serving the Tennessee metropolitan markets of Nashville, Chattanooga, Knoxville, Memphis, Jackson, and Huntsville (AL) in addition to 12 community markets. FirstBank also provides mortgage banking services utilizing its bank branch network and mortgage banking offices strategically located throughout the southeastern United States in addition to a national internet delivery channel. As of June 30, 2016, we had total assets of $2.9 billion, total loans of $2.1 billion, deposits of $2.5 billion, and shareholder’s equity of $266 million.

Throughout our history, we have steadfastly maintained a community banking approach of personalized relationship-based service. As we have grown, maintaining this relationship-based approach utilizing local, talented and experienced bankers in each market has been an integral component of our success. Our bankers leverage their local knowledge and relationships to deliver timely solutions to our clients. We empower these bankers by giving them local decision making authority complemented by appropriate risk oversight. In our experience, business owners and operators prefer to deal with decision makers and our banking model is built to place the decision maker as close to the client as possible. We have designed our operations, technology, and centralized risk oversight processes to specifically support our operating model. We deploy this operating model universally in each of our markets, regardless of size. We believe we have a competitive advantage in our markets versus both smaller community banks, larger regional and national banks. Our robust offering of products, services and capabilities differentiates us from community banks and our significant local market knowledge, client service level and the speed with which we are able to make decisions and deliver our services to customers differentiate us from larger regional and national banks.

We seek to leverage our operating model by focusing on profitable growth opportunities across our footprint, consisting of both high-growth metropolitan markets and stable community markets. As a result, we are able to strategically deploy our capital across our markets to take advantage of the opportunities with the greatest certainty of profitable growth and the highest returns.

Our operating model is executed by a talented management team lead by our Chief Executive Officer, Christopher Holmes. Mr. Holmes, a 24-year banking veteran originally from Lexington, Tennessee, joined the Bank in 2010 as Chief Banking Officer and was named Chief Executive Officer in 2013. Mr. Holmes has an extensive background in both metropolitan and community banking gained from his time at several larger public financial institutions. Mr. Holmes has assembled a highly effective management team, blending members that have a long history with FirstBank and members that have significant banking experience at other in-market banks. This leadership team offers us a fresh perspective and implemented a new strategic plan in 2012 that called for significant incremental investments in the Nashville, Tennessee market.

1

Table of Contents

Index to Financial Statements

Our execution of the plan has driven balanced, profitable growth by increasing our presence in the high-growth Nashville market while maintaining our strong presence in community markets and providing a replicable model for additional metropolitan market growth.

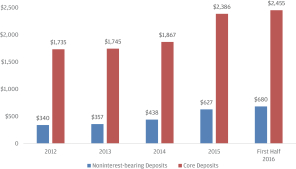

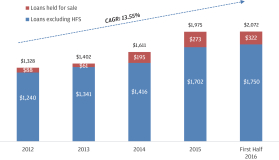

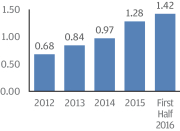

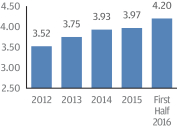

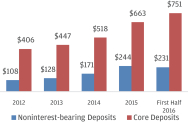

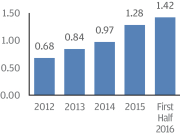

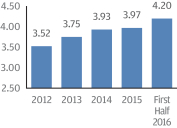

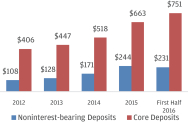

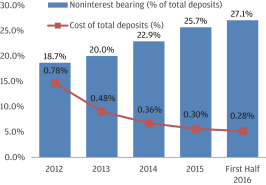

Our team has delivered strong financial results under our strategic plan, as evidenced by consistent improvement in our tax-adjusted return on average assets, net interest margin, core and noninterest bearing deposit balances, and loan balances. We believe that these strong results validate our operating model and strategies and position us for continued profitable growth and improved efficiencies.

| Tax-adjusted ROAA (%) | Fully tax equivalent net interest margin (%) | |

|

| |

| Deposits ($ in millions) | Total loans ($ in millions) | |

|

|

|

Note: Our tax-adjusted return on average assets includes a pro forma provision for federal income taxes using a combined effective income tax rate of 33.76%, 35.37%, 35.63%, 35.08% and 37.39% for the years ended December 31, 2012, 2013, 2014 and 2015 and the six months ended June 30, 2016, respectively. Our net interest margin is shown on a tax-equivalent basis. Core deposits and net interest margin on a tax equivalent basis are non-GAAP financial measures. See our reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures under the caption “Selected historical consolidated financial data: GAAP reconciliation and management explanation of non-GAAP financial measures.”

Our history

Originally chartered in 1906, we are one of the longest continually operating banks in Tennessee. While our deep community roots go back over 100 years, our growth trajectory changed in 1984 when Tennessee businessman James W. Ayers, our Chairman and sole shareholder, acquired Farmers State Bank with an associate. In 1988, we purchased the assets of First National Bank of Lexington, Tennessee and changed our name to FirstBank, forming the foundation of our current franchise. In 1990, Mr. Ayers became the sole shareholder and has remained our sole owner since that time. Under Mr. Ayers’ ownership, we have grown from a community bank with only $14 million in assets in 1984 to the third largest bank headquartered in Tennessee, based on total assets.

2

Table of Contents

Index to Financial Statements

From 1984 to 2001, we operated as a rural community bank growing organically and through small acquisitions in community markets in West Tennessee. In 2001, our strategy evolved from serving purely community markets to include a modest presence in metropolitan markets, expanding our reach and enhancing our growth. We entered Nashville and Memphis in 2001 by opening a branch in each of those markets. In 2004 and 2008, we opened our first branches in Knoxville and Chattanooga, respectively. Although we experienced some growth in each metropolitan market, it did not become a major strategic focus until we implemented our current metropolitan growth strategy in the Nashville metropolitan statistical area (MSA) in 2012. The successful implementation of this strategy has resulted in 73% deposit growth in the Nashville MSA from December 31, 2012 to June 30, 2016, making it our largest market with 42% of our loans held for investment and 31% of our total deposits, as of June 30, 2016. As a result of this evolution, we now operate a balanced business model that serves a diverse customer base in both metropolitan and community markets.

On September 18, 2015, we completed our acquisition of Northwest Georgia Bank, a 110-year old institution with six branches, serving clients in the Chattanooga MSA. Including the effects of purchase accounting adjustments, we acquired net assets with a fair value of $272 million which includes a bargain purchase gain of $2.8 million, loans with a fair value of $79 million and deposits with a fair value of $246 million. We believe that this acquisition will accelerate our already planned expansion in Chattanooga by significantly augmenting our client base, increasing our brand awareness and providing us with the scale to attract leading bankers to further enhance our market penetration and profitable growth. In connection with the acquisition, we merged two of our existing FirstBank branches into NWGB branches in May 2016.

Our services

We are dedicated to serving the banking needs of businesses, professionals and individuals in our metropolitan and community markets through our community banking approach of personalized, relationship-based service. We deliver a wide range of banking products and services tailored to meet the needs of our clients across our footprint. Through the Bank, we offer a broad range of lending products to our clients, which includes businesses with up to $250 million in annual revenues, business owners, real estate investors and consumers. Our commercial lending products include working capital lines of credit, equipment loans, owner-occupied and non-owner-occupied real estate construction loans, “mini-perm” real estate term loans, and cash flow loans to a diversified mix of clients, including small and medium sized businesses. Our consumer lending products include first and second mortgage loans, home equity lines of credit and consumer installment loans to purchase cars, boats and other recreational vehicles. We also offer a full range of transaction and interest bearing depository products and services to meet the demands of each segment within our client base.

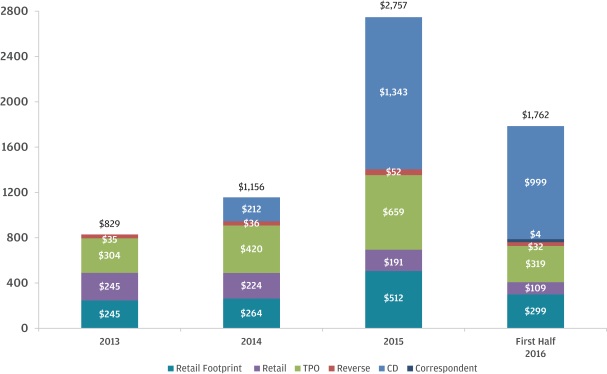

We offer a wide range of residential mortgage products and services through mortgage offices strategically located throughout the southeastern United States and through our internet delivery channel. We also offer smaller community banks and mortgage companies a host of diverse, third-party mortgage services. Our goal is to sell all of the mortgage loans our mortgage banking segment originates to Ginnie Mae, Fannie Mae, Freddie Mac or, to a lesser extent, an array of private national mortgage investors. We sold approximately $2.7 billion of the $2.8 billion of mortgage loans that we originated in 2015. In 2014, we expanded our mortgage business by beginning to service loans that we originate, or acquire through our third party origination contracts, and that we sell in the secondary markets in an effort to capture additional revenue and create cross-selling opportunities for our banking products. As of June 30, 2016, we serviced approximately $4.0 billion of residential mortgage loans.

3

Table of Contents

Index to Financial Statements

Our markets

Our market area is the southeastern United States, centered around Tennessee, and includes portions of North Alabama and North Georgia. The market area has attractive economic, population, and household income growth statistics that provide a favorable business environment. We believe that the strong economic growth in our market area has created a favorable operating environment for us.

Tennessee has no individual income tax and it has a favorable business climate, as evidenced by the following:

| • | Tennessee was ranked #4 in the country for business by Chief Executive magazine in May 2016; |

| • | Tennessee was named 2014 State of the Year for economic development by Business Facilities magazine in January 2015 and ranked #2 best business climate by Business Facilities magazine in July 2015 |

| • | Tennessee was ranked #4 for foreign direct investment job commitments in 2014 according to the 2015 Global Location Trends report by IBM Institute for Business Value; and |

| • | Tennessee was ranked #4 in the country for doing business by Area Development magazine in September 2015. |

The following tables show our deposit market share ranking among all banks and community banks (which we define as banks with less than $15 billion in assets) in Tennessee as of June 30, 2015. Of the 10 largest banks in the state based on total deposits, 7 are national or regional banks, which we believe provides us with significant opportunities to gain market share from these banks.

4

Table of Contents

Index to Financial Statements

Top 10 banks in Tennessee

| Rank | Company name | Headquarters | Branches (#) |

Total deposits ($bn) |

Deposit market share (%) |

% of company deposits |

||||||||||||||

| 1 |

First Horizon National Corp. (TN) | Memphis, TN | 152 | 17.8 | 13.7 | 94.8 | ||||||||||||||

| 2 |

Regions Financial Corp. (AL) | Birmingham, AL | 238 | 17.5 | 13.4 | 18.3 | ||||||||||||||

| 3 |

SunTrust Banks Inc. (GA) | Atlanta, GA | 143 | 13.5 | 10.4 | 9.4 | ||||||||||||||

| 4 |

Bank of America Corp. (NC) | Charlotte, NC | 58 | 10.5 | 8.1 | 0.9 | ||||||||||||||

| 5 |

Pinnacle Financial Partners (TN) | Nashville, TN | 50 | 7.2 | 5.5 | 100.0 | ||||||||||||||

| 6 |

U.S. Bancorp (MN) | Minneapolis, MN | 104 | 2.7 | 2.1 | 1.0 | ||||||||||||||

| 7 |

BB&T Corp. (NC) | Winston-Salem, NC | 49 | 2.5 | 1.9 | 1.5 | ||||||||||||||

| 8 |

FB Financial Corp (TN) | Nashville, TN | 45 | 2.0 | 1.6 | 91.2 | ||||||||||||||

| 9 |

Simmons First National Corp. (AR) | Pine Bluff, AR | 40 | 1.9 | 1.5 | 30.1 | ||||||||||||||

| 10 |

Wells Fargo & Co. (CA) | San Francisco, CA | 19 | 1.7 | 1.3 | 0.2 | ||||||||||||||

|

|

||||||||||||||||||||

Top 10 banks under $15bn assets in Tennessee

| Rank | Company name | Headquarters | Branches (#) |

Total deposits ($bn) |

Deposit market share (%) |

% of company deposits |

||||||||||||||

| 1 |

Pinnacle Financial Partners (TN) | Nashville, TN | 49 | 7.2 | 5.5 | 100.0 | ||||||||||||||

| 2 |

FB Financial Corp (TN) | Nashville, TN | 45 | 2.0 | 1.6 | 91.2 | ||||||||||||||

| 3 |

Simmons First National Corp. (AR) | Pine Bluff, AR | 40 | 1.9 | 1.5 | 30.1 | ||||||||||||||

| 4 |

Wilson Bank Holding Co. (TN) | Lebanon, TN | 25 | 1.7 | 1.3 | 100.0 | ||||||||||||||

| 5 |

Home Federal Bank of Tennessee (TN) | Knoxville, TN | 23 | 1.7 | 1.3 | 100.0 | ||||||||||||||

| 6 |

Franklin Financial Network Inc (TN) | Franklin, TN | 14 | 1.6 | 1.2 | 100.0 | ||||||||||||||

| 7 |

Capital Bank Finl Corp (NC) | Charlotte, NC | 57 | 1.3 | 1.0 | 19.7 | ||||||||||||||

| 8 |

First Citizens Bancshares Inc. (TN) | Dyersburg, TN | 23 | 1.3 | 1.0 | 100.0 | ||||||||||||||

| 9 |

First Farmers Merchants Corp. (TN) | Columbia, TN | 19 | 1.1 | 0.8 | 100.0 | ||||||||||||||

| 10 |

Clayton Bank and Trust (TN) | Knoxville, TN | 29 | 1.0 | 0.8 | 100.0 | ||||||||||||||

|

|

||||||||||||||||||||

Note: Market data sourced from SNL Financial and gives pro forma effect to any acquisitions announced as of July 22, 2016 as if they occurred on June 30, 2015; total assets as of June 30, 2016.

Our six metropolitan markets.

We currently operate in the six metropolitan markets listed below.

Nashville is the largest MSA in Tennessee, our largest market and one of the fastest growing cities in the U.S., with a booming cultural scene, vibrant healthcare industry, established music and entertainment industry, and 24 universities and colleges. Nashville has experienced 37% population growth from 2000 to 2015, and its population is expected to double in the next 20 years. Between 2010 and 2015, Nashville’s job growth of 18.1% was 10 percentage points higher than that of the U.S. Nashville’s diverse economy and strong business community are major attractions for corporations and professionals. Nashville was ranked as the national leader in advanced industry job growth by the Brookings Institute in August 2016. Nashville was ranked #2 in KPMG’s April 2014 listing of the Most Attractive Mid-Sized Cities for Business and #5 on Forbes’ May 2015 listing of the Best Big Cities for Jobs. We believe that these positive trends will continue, providing us with ample opportunity for future growth in the Nashville MSA.

Memphis is the 2nd largest MSA in Tennessee. It has a diversified business base and the busiest cargo airport in North America. Memphis is headquarters to 240 companies employing over 91,000 people, including Fortune

5

Table of Contents

Index to Financial Statements

500 companies AutoZone, International Paper and FedEx, which alone employs over 32,000 people in Memphis. Memphis benefits from 10 million tourists visiting annually, which generated approximately $3 billion for the local economy during 2014. In 2015, Memphis was named a Top 25 Best City for Jobs by Glassdoor, a leading online job search community.

Knoxville is the 3rd largest MSA in Tennessee. It has 120 automotive component manufacturers in the area, which provide approximately 13,000 jobs. The University of Tennessee is located in Knoxville, generating over $1.5 billion in income annually and supporting in excess of 30,000 jobs during 2014. The tourism industry is beginning to grow and Knoxville is taking its place alongside Chattanooga and Asheville, N.C. as a destination city in the Southern Appalachian Mountains. Knoxville was ranked by Forbes in 2015 as the second most affordable city in the United States and is currently experiencing accelerated employment growth.

Chattanooga is the 4th largest MSA in Tennessee. It has a diverse economy with over 28,000 businesses that employ over 260,000 people and generate an estimated $41 billion in annual sales. Chattanooga has experienced population growth of 11% between 2000 and 2010 and is expected to experience 20% population growth by 2021. Chattanooga was recently ranked #4 on Wallethub’s Best Cities to Start a Business list and was named a Best to Invest city by Site Selection magazine.

Jackson is the 6th largest MSA in Tennessee and is the 2nd largest city in West Tennessee following Memphis. Given a high-quality workforce, favorable tax environment and efficient logistical foundation, Jackson has developed into a leading industrial and distribution center in the state of Tennessee, with particular strength in manufacturing. Employers such as Berry Plastics, Delta Faucets, Gerdau, Kellogg’s, LyondellBassell Industries, Owens Corning and Stanley Black & Decker have established meaningful operations in the Jackson area. Further aiding the bright economic future of the region is a diverse complex of six accredited higher educational institutions and two state-of-the-art technical and professional training vocational schools. Jackson also enjoys a vibrant cultural community, with symphony concerts, blues fests, and community theater, as well as minor league professional baseball and a host of collegiate and local athletic organizations.

Huntsville has one of the strongest technology economies in the nation, with over 300 companies performing sophisticated government, commercial and university research. Huntsville has a high concentration of engineers and Ph.D.’s and has a number of major government programs, including NASA and the U.S. Army, including the Redstone Arsenal, which contains a government and contractor work force that employs approximately 40,000. Huntsville also has one of the highest concentrations of Inc. 500 companies and a number of offices of Fortune 500 companies.

Our community markets.

We are a leading bank in Tennessee’s community markets. These community markets continue to offer us opportunities to profitably grow our market share. The table below shows our presence, as of June 30, 2015, in community markets where we have over $60 million in deposits.

Top FirstBank community markets

| Market |

FB market rank |

FB branches (#) |

FB deposits ($mm) |

FB deposit market share |

Percent of total FB deposits |

|||||||||||||||

| Lexington |

1 | 3 | $ | 305 | 54.3% | 13.3% | ||||||||||||||

| Huntingdon |

2 | 2 | 119 | 23.8% | 5.2% | |||||||||||||||

| Smithville |

2 | 1 | 99 | 26.3% | 4.3% | |||||||||||||||

| Camden |

2 | 2 | 97 | 26.1% | 4.2% | |||||||||||||||

| Paris |

3 | 2 | 96 | 17.8% | 4.2% | |||||||||||||||

| Waverly |

2 | 1 | 63 | 24.2% | 2.7% | |||||||||||||||

|

|

||||||||||||||||||||

Note: Market data sourced from SNL Financial and gives pro forma effect to any acquisitions announced as of July 22, 2016 as if they occurred on June 30, 2015

6

Table of Contents

Index to Financial Statements

Market characteristics and mix.

Metropolitan markets. Our metropolitan markets are characterized by attractive demographics and strong economies and offer substantial opportunity for future growth. Our metropolitan markets collectively have approximately $108 billion of total deposits and a total population in excess of 5.2 million people, with a projected weighted average annual population growth rate of 4.9% through 2021 according to SNL Financial, as compared to a national average of 3.7%. We compete in these markets with national and regional banks that currently have the largest market share positions and with community banks primarily focused only on a particular geographic area or business niche. We believe we are well positioned to grow our market penetration among our target clients of small to medium sized businesses and the consumer base working and living in these metropolitan markets. In our experience, such clients demand the product sophistication of a larger bank, but prefer the customer service, relationship focus and local connectivity of a community bank. We believe that our size, product suite and operating model offer us a competitive advantage in these markets versus our smaller competitors, many of which are focused only on specific counties or industries. Our operating model driven by local talent with strong community ties and local authority serves as a key competitive advantage over our larger competitors. We believe that, as a result, we are well positioned to leverage our existing franchise to expand our market share in our metropolitan markets.

Community markets. Our community markets tend to be more stable throughout various economic cycles, with primarily retail and small business customer opportunities and more limited competition. This leads to an attractive profitability profile and smaller ticket, more granular loan and deposit portfolios. We increased our deposits in our community markets by 5% from 2012 through the first half of 2016. Our community markets are standalone markets and not suburbs of larger markets. We primarily compete in these markets with community banks that have less than $1 billion in total assets. We compete effectively against these smaller community banks by providing a broader and more sophisticated set of products and capabilities while still maintaining our local service model. These markets are being deemphasized by national and regional banks. As a result, we are often the employer of choice for talented bankers in these communities. We believe that our operating model and long-term success in these markets positions us well for continued growth in our existing community markets and to take advantage of attractive opportunities in other community markets.

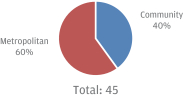

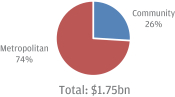

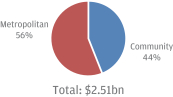

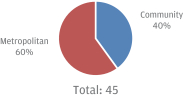

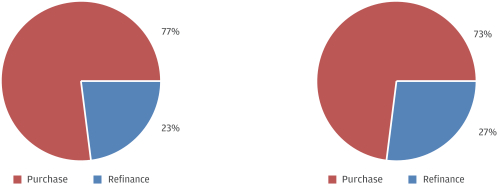

Market mix. The charts below show our branch, loan and deposit mix between our metropolitan and community markets as of June 30, 2016.

| Branches: | Loans Held for Investment: | Total deposits: | ||

|

|

| ||

Our competitive strengths

We believe the following strengths provide us with competitive advantages over other banks in our markets and provide us with the necessary foundation to successfully execute our growth strategies.

7

Table of Contents

Index to Financial Statements

Depth and experience of senior management team. We have a deep and experienced senior management team. The team, as evidenced by the leaders of our banking markets and mortgage segment highlighted below, combines long histories at FirstBank with significant market and industry knowledge gained from employment with other successful banks.

Christopher Holmes: President and Chief Executive Officer. Mr. Holmes has served as President of FirstBank since 2012 and as President and Chief Executive Officer since 2013. Originally from Lexington, Tennessee, Mr. Holmes has a background in both rural communities and urban metro centers that is uniquely suited for leadership at FirstBank. As President and Chief Executive Officer, he is responsible for leading and managing all facets of the bank’s operations, including establishing its long-term goals, strategies and corporate vision. Prior to joining FirstBank in 2010 as Chief Banking Officer, Mr. Holmes served as the Director of Corporate Financial Services and the Chief Retail Banking Officer for Greenville, S.C.-based The South Financial Group. Previously, he worked for 20 years in the Memphis market, first as a certified public accountant with Ernst & Young and then in several management positions for National Bank of Commerce (which was acquired by SunTrust) and Trustmark National Bank.

James Gordon: Chief Financial Officer. Mr. Gordon was appointed as our Chief Financial Officer in January 2016. Prior to joining us, Mr. Gordon was a Partner at Horne LLP from 2011 to 2016. Horne LLP served as our independent accounting firm before our appointment of RSM US LLP as our independent auditor in 2015 and Mr. Gordon served as our lead audit partner while at Horne. Before joining Horne, Mr. Gordon served as CFO of The South Financial Group, a large publicly traded bank holding company headquartered in Greenville, SC, from 2007 to 2010. In his capacity as CFO of The South Financial Group, his primary responsibilities included overseeing all of the accounting, financial, investor relations and related functions as well as the Mortgage, SBA Lending and Information Technology divisions. Previously, he was the Chief Risk Officer for Union Planters from 2002 to 2004, Chief Accounting Officer for National Bank of Commerce for 2004 and as Partner with PricewaterhouseCoopers and BDO.

Wilburn (Wib) Evans: President, FirstBank Ventures. As President of FirstBank Ventures, Mr. Evans has overall responsibility for our mortgage banking business and investment services, including strategies for fee income businesses. Mr. Evans joined FirstBank in 1987 as Chief Financial Officer, a position that he held for almost 10 years before being promoted to Executive Vice President in 1996 and later to Chief Operating Officer. Prior to joining FirstBank, Mr. Evans worked as a certified public accountant with BDO.

Allen Oakley: Middle and East Tennessee Regional President. In his role, Mr. Oakley oversees the banking operations in Middle and East Tennessee and plays an important role in achieving strategic growth goals for the region. Mr. Oakley has more than 33 years of banking experience, mostly in the Tennessee market. Prior to joining FirstBank in 2012, Mr. Oakley served for 5 years as Executive Vice President and Middle Tennessee Manager of the Corporate, Commercial, and Public and Institutional Groups of Regions Bank. Prior to that role, Mr. Oakley worked for SunTrust as Managing Director for the Corporate and Investment Banking Division from the late 1990’s to 2006.

David Burden: West Tennessee Regional President. In his role as the West Tennessee Regional President, Mr. Burden has authority over banking operations in Memphis, Huntsville, and West Tennessee, which includes most of our leading market share legacy markets. Mr. Burden has more than 15 years of experience at FirstBank and 30 years in banking. Before joining FirstBank, Mr. Burden held the positions of senior vice president and senior lending officer for Union Planters Bank and First American Bank. Early in his career, he served as a federal regulator for 4 years.

8

Table of Contents

Index to Financial Statements

In addition to our senior management team, our market leaders have an average of over 28 years of experience and an average tenure of 15 years with us. We believe that we also have significant depth in our overall management in lending, credit administration, finance, operations and information technology.

Strong growth coupled with profitability. We have delivered attractive growth and returns since the implementation of our strategic plan designed to leverage our competitive advantages in both metropolitan and community markets in 2012. Our execution of the plan has delivered strong growth, primarily from our Nashville metropolitan strategy and mortgage expansion, coupled with positive returns from our legacy community markets.

| 2012 | 2013 | 2014 | 2015 |

Six months ended |

||||||||||||||||

| Net Income (in millions) |

$ | 20.5 | $ | 26.9 | $ | 32.5 | $ | 47.9 | $30.4 | |||||||||||

| Pro forma net income(1) |

$ | 14.6 | $ | 18.6 | $ | 22.4 | $ | 33.1 | $20.4 | |||||||||||

| Tax-Adjusted ROAA(1) |

0.68 | % | 0.84 | % | 0.97 | % | 1.28 | % | 1.42 | % | ||||||||||

| Core Deposits (in billions)(2) |

$ | 1.74 | $ | 1.75 | $ | 1.87 | $ | 2.39 | $2.46 | |||||||||||

| Loans held for investment (in billions) |

$ | 1.24 | $ | 1.34 | $ | 1.42 | $ | 1.70 | $1.75 | |||||||||||

| Nonperforming loans/loans(3) |

4.17 | % | 2.12 | % | 1.21 | % | 0.71 | % | 0.66 | % | ||||||||||

|

|

||||||||||||||||||||

| (1) | Our pro forma net income and tax-adjusted return on average assets include a pro forma provision for federal income taxes using a combined effective income tax rate of 33.76%, 35.37%, 35.63%, 35.08% and 37.39% for the years ended December 31, 2012, 2013 and 2014 and 2015 and six months ended June 30, 2016, respectively. |

| (2) | Core deposits is a non-GAAP financial measure, and, as we calculate core deposits, the most directly comparable GAAP financial measure is total deposits. See our reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures under the caption “Selected historical consolidated financial data: GAAP reconciliation and management explanation of non-GAAP financial measures.” |

| (3) | Excludes loans acquired from Northwest Georgia Bank, and therefore is a non-GAAP measure. See our reconciliation of non-GAAP measures to their most comparable GAAP measures under the caption “Selected historical consolidated financial data: GAAP reconciliation and management explanation of non-GAAP financial measures.” |

Ability to recruit and retain talented people. The success of our operating model, which depends on local knowledge and decision making, is directly related to our ability to attract and retain talented bankers in each of our markets. We strive to attract and retain these bankers by fostering an entrepreneurial environment, empowering them with local authority and providing them with sufficient infrastructure and resources to support their growth while also providing management with appropriate oversight. We believe that our family culture built around respect, teamwork and empowerment makes us attractive for talented bankers and associates across our geographic footprint. We pride ourselves on being a great place to work, which is evidenced by our recognition as a Top Workplace for 2015 by The Tennessean, Nashville’s principal newspaper. In the Nashville market alone, we have added 15 new bankers since 2012, including the current President of our Middle and East Tennessee region, Allen Oakley, a 32-year banking veteran.

Scalable, decentralized operating model. We operate each of our markets as individual markets, with an experienced market leader in charge of each market. Each of our market leaders and bankers is empowered to make local decisions up to specified limits set by the Bank’s board of directors and our senior management team based on experience and track record. We believe that the delivery by our bankers of in-market client decisions, coupled with strong, centralized risk and credit support, allows us to best serve our clients. This operating model has been proven successful in our existing markets and we believe it is highly replicable and scalable. We have a robust infrastructure bolstered by our recent conversion to a new core processing system in the second quarter of 2016, that can support our model as we grow in existing and new markets either organically or through opportunistic acquisitions.

9

Table of Contents

Index to Financial Statements

Disciplined and deliberate risk management. Risk management is a cornerstone of our culture and is emphasized throughout every area of the organization. Our decentralized operating model is balanced by individual lending authorities based on demonstrated experience and expertise. Larger credit decisions involve credit officers and/or senior management. We have invested in technology to monitor all credits, ensuring compliance with our policies. We strive for a balanced loan portfolio taking into consideration borrower and industry concentrations. Our risk management strategy also includes rigorous systems and processes to monitor liquidity, interest rate, operations and compliance risk.

Preferred acquirer. We have a strong record of adding value through acquisitions and have completed seven bank and two mortgage company acquisitions under our current ownership. Our acquisition of Northwest Georgia Bank is the most recent example of an attractive strategic and financial transaction. Our key operational associates have integration experience with FirstBank and other institutions. We are a disciplined acquirer focused on opportunities that meet our internal return targets, maintain or enhance our earnings per share and add to our strong core deposit franchise. Our long-term personal relationships with many of the bank owners and CEOs in our markets lead to a natural dialogue when they choose to explore a sale of their company. Additionally, we believe that our size and ability to operate effectively in both community and metropolitan markets make us an attractive option to smaller banks seeking an acquirer.

Our business strategy

We believe there are significant growth opportunities across our footprint. Our competitive strengths position us to take advantage of these opportunities to deliver strong growth and attractive returns by focusing on the following core strategies.

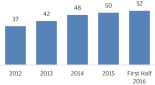

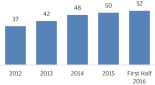

Enhance market penetration in metropolitan markets. In recent years, we have successfully grown our franchise in the Nashville MSA by executing our metropolitan growth strategy. The strategy is centered on the following: recruiting the best bankers and empowering them with local authority; developing branch density; building brand awareness and growing our business and consumer banking presence; and expanding our product offering and capabilities. These strategies coupled with our personalized, relationship-based client service have contributed significantly to our success. Additionally, we believe that our scale, resources and sophisticated range of products provides us with a competitive advantage over the smaller community banks in the Nashville MSA and our other MSAs. As a result of these competitive advantages and growth strategies, the Nashville MSA has become our largest market. With approximately a 1.6% market share, based on deposits as of June 30, 2015, we are still in the early stage of executing our Nashville growth strategy and intend to continue to efficiently increase our market penetration. The following charts show our significant growth in the Nashville MSA since 2012.

| Nashville loans ($ in millions)

|

Nashville deposits ($ in millions)

|

Nashville bankers (#)

| ||

|

|

|

Note: The loan and deposit charts reflect our loans, noninterest bearing deposits and core deposits in our Nashville market as of the end of each period. The banker chart reflects the total number of our bankers in our Nashville market as of the end of each period.

10

Table of Contents

Index to Financial Statements

Based on market and competitive similarities, we believe our growth strategies are transferable to our other metropolitan markets. We intend to implement these strategies with an initial focus on the Chattanooga MSA. Our acquisition of Northwest Georgia Bank will accelerate our growth in Chattanooga and, we believe, will give us the necessary scale to enhance operating leverage and drive profitability in that market.

Pursue opportunistic acquisitions. While most of our growth has been organic, we have completed nine acquisitions under our current ownership, including our recent acquisition of Northwest Georgia Bank. We pursue acquisition opportunities that meet our internal return targets, enhance market penetration, and possess strong core deposits. We believe that numerous small to mid-sized banks or branch networks will be available for acquisition in metropolitan and community markets throughout Tennessee as well as in attractive contiguous markets in the coming years due to industry trends, such as scale and operational challenges, regulatory pressure, management succession issues and shareholder liquidity needs. In Tennessee alone, there are approximately 150 banks with total assets of less than $1 billion. We believe that we are positioned as a natural consolidator because of our financial strength, reputation and operating model.

Improve efficiency by leveraging technology and consolidating operations. We have invested significantly in our bankers, infrastructure and technology in recent years, including our conversion to a new core processing system in the second quarter of 2016, which we believe has created a scalable platform that will support future growth across all of our markets. Our bankers and branches, especially in the Nashville MSA, continue to scale in size and we believe there is capacity to grow our business without adding significantly to our branch network. We plan to continue to invest, as needed, in our technology and business infrastructure to support our future growth and increase operating efficiencies. We intend to leverage these investments to consolidate and centralize our operations and support functions while protecting our decentralized client service model.

Seize opportunities to expand noninterest income. While our primary focus is on capturing opportunities in our core banking business, we have successfully seized opportunities to grow our noninterest income by providing our people with the flexibility to take advantage of market opportunities. As part of our strategic focus to grow our noninterest income, we have significantly expanded our mortgage business by hiring experienced loan officers, implementing our consumer direct internet delivery channel in 2014 and offering our mortgage clients the personalized attention that is the cornerstone of our Bank. As a result, our mortgage banking income has grown from $19.0 million in annual revenues in 2012 to $70.2 million in annual revenues in 2015 and has already generated $54.6 million in revenues during the first half of 2016. We have also successfully expanded our fee-based businesses to include more robust treasury management and investment services. We intend to continue emphasizing these business lines, which we believe will serve as strong customer acquisition channels and provide us with a range of cross-selling opportunities, while making our business stronger and more profitable.

Our corporate information

Our principal executive office is located at 211 Commerce Street, Suite 300, Nashville, Tennessee 37201, and our telephone number is (615) 313-0080. Through FirstBank, we maintain an Internet website at www.firstbankonline.com. The information contained on or accessible from our website does not constitute a part of this prospectus and is not incorporated by reference herein.

11

Table of Contents

Index to Financial Statements

The following summary of the offering contains basic information about the offering and our common stock and is not intended to be complete. It does not contain all the information that may be important to you. For a more complete understanding of our common stock, please refer to the section of this prospectus entitled “Description of our capital stock.”

| Common stock offered by us |

shares. |

| shares if the underwriters’ option is exercised in full. |

| Common stock offered by selling shareholder |

shares. |

| shares if the underwriters’ option is exercised in full. |

| Common stock to be outstanding after this offering |

shares. |

| shares if the underwriters’ option is exercised in full. |

| The number of shares of common stock to be outstanding after this offering is based on shares outstanding as of , 2016, and excludes the equity awards being granted to certain of our executive officers and employees in connection with this offering and the conversion of outstanding EBI plan units and Mr. Holmes’ existing deferred compensation arrangement from cash settled awards to stock settled awards in connection with this offering. See “Executive compensation and other matters—Summary of one-time IPO equity awards, conversion of deferred compensation and conversion of EBI units” herein for a discussion of these equity awards and the conversion of these cash settled awards into stock settled awards and “Description of our capital stock” herein for a discussion of the shares of common stock to be outstanding after this offering. |

| Use of proceeds |

We estimate that the net proceeds to us from this offering, after deducting underwriting discounts and commissions and the estimated offering expenses, will be approximately $ million, or approximately $ million if the underwriters’ option is exercised in full, assuming an initial offering price of $ per share (the midpoint of the range set forth on the cover page of this prospectus). We intend to use approximately $ million of the net proceeds to us from this offering to (i) fund the $55 million distribution to our sole shareholder described below and (ii) subject to regulatory approval, to repay all $10.1 million aggregate principal amount of subordinated notes held by our sole shareholder, plus any accrued and unpaid interest thereon. We intend to use the remaining net proceeds to us from this offering to support our growth, including to fund organic growth and implement our strategic initiatives, which may include the potential expansion of our business through opportunistic |

12

Table of Contents

Index to Financial Statements

| acquisitions, for working capital and other general corporate purposes, and to strengthen our regulatory capital position. |

| We will not receive any proceeds from the sale of shares of our common stock in this offering by the selling shareholder. |

| See “Use of proceeds.” |

| Distribution to our sole shareholder |

We have approximately $ million of S Corporation earnings, which have been, or will be, taxed to our sole shareholder, but have not been distributed to him. As a result and in connection with the termination of our status as an S Corporation, we are able to make a cash distribution to our sole shareholder in an amount equal to these taxed, yet undistributed, earnings that is intended to be non-taxable to him. |

| In connection with this offering, we intend to make a cash distribution to our sole shareholder in the amount of $55 million, which is intended to be non-taxable to our sole shareholder and represents a significant portion of our S Corporation earnings that have been, or will be, taxed to our sole shareholder, but not distributed to him. The distribution will be contingent upon, and payable to our sole shareholder immediately following, the closing of this offering. Purchasers of our common stock in this offering will not be entitled to receive any portion of this distribution. |

| In addition, subject to regulatory approval, we intend to use a portion of the net proceeds to us from this offering to fund the repayment of all $10.1 million aggregate principal amount of the subordinated notes held by our sole shareholder, plus any accrued and unpaid interest thereon. |

| Dividend policy |

Historically, we have been an S Corporation, and as such, we have paid distributions to our sole shareholder to assist him in paying the U.S. federal income taxes on our taxable income that is “passed through” to him as well as additional amounts for returns on capital. Following this offering, our dividend policy and practice will change because we will be taxed as a C Corporation and, therefore, we will no longer pay distributions to provide our shareholders with funds to pay U.S. federal income tax on their pro rata portion of our taxable income. |

| After this offering, we intend to retain our future earnings, if any, to fund the development and growth of our business and we do not anticipate paying any dividends to the holders of our common stock in the foreseeable future. |

| For additional information, see “Dividend policy.” |

13

Table of Contents

Index to Financial Statements

| Directed share program |

At our request, the underwriters have reserved up to 10% of the common stock being offered by this prospectus for sale at the initial public offering price to our directors, officers, and other individuals associated with us and members of their families. The sales will be made by UBS Financial Services Inc., a selected dealer affiliated with UBS Securities LLC, an underwriter of this offering, through a directed share program. We do not know if these persons will choose to purchase all or any portion of these reserved shares, but any purchases they do make will reduce the number of shares available to the general public. Any reserved shares not so purchased will be offered by the underwriters to the general public on the same terms as the other shares of common stock. Participants in the directed share program who purchase more than $500,000 of shares shall be subject to a -day lock-up with respect to any shares sold to them pursuant to that program. This lock-up will have similar restrictions and an identical extension provision to the lock-up agreements described below. Any shares sold in the directed share program to our directors, executive officers or selling stockholders shall be subject to the lock-up agreements described below. |

| New York Stock Exchange listing |

We have applied to have our common stock approved for listing on the New York Stock Exchange under the symbol “FBK.” |

| Risk factors |

An investment in shares of our common stock involves a high degree of risk. You should carefully read and consider the risks discussed in the “Risk factors” and “Cautionary note regarding forward-looking statements” sections of this prospectus and all other information in this prospectus before making a decision to invest in shares of our common stock. |

14

Table of Contents

Index to Financial Statements

Summary historical consolidated financial data

The following tables set forth (i) our summary historical condensed consolidated financial data as of and for six months ended June 30, 2016 and 2015, (ii) our summary consolidated financial data as of and for the years ended December 31, 2015, 2014 and 2013, (iii) other data as of and for the periods indicated and (iv) certain pro forma information to reflect our conversion from a subchapter S Corporation to a C Corporation in connection with this offering as if it had occurred at the beginning of each period. The summary historical consolidated financial data as of and for the years ended December 31, 2015, 2014 and 2013 have been derived from, and qualified by reference to, the Company’s audited financial statements included elsewhere in this prospectus and should be read in conjunction with those consolidated financial statements and notes thereto. The summary historical consolidated financial data as of and for the six months ended June 30, 2016 and 2015 have been derived from our unaudited interim consolidated financial statements included elsewhere in this prospectus. The summary historical consolidated financial data reflects the 100-for-one stock split that was effectuated prior to this offering. As such, all share and per share amounts have been retroactively adjusted to reflect the stock split for all periods presented.

The following summary historical consolidated financial data of the Company should be read in conjunction with, and are qualified by reference to, “Management’s discussion and analysis of financial condition and results of operations” and the consolidated financial statements and notes thereto included elsewhere in this prospectus. Our historical results for any prior period are not necessarily indicative of results to be expected in any future period.

| As of and for the six months ended June 30, (unaudited) |

As of and for year ended December 31, | |||||||||||||||||||

| (dollars in thousands, except per share data and ratio) | ||||||||||||||||||||

| 2016 | 2015 | 2015 | 2014 | 2013 | ||||||||||||||||

| Statement of Income Data |

||||||||||||||||||||

| Total interest income |

$ | 58,922 | $ | 48,846 | $ | 102,782 | $ | 92,889 | $ | 87,082 | ||||||||||

| Total interest expense |

4,621 | 4,405 | 8,910 | 9,513 | 11,606 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Net interest income |

54,301 | 44,441 | 93,872 | 83,376 | 75,476 | |||||||||||||||

| Provision for loan losses |

(798 | ) | 222 | (3,064 | ) | (2,716 | ) | (1,519 | ) | |||||||||||

| Total noninterest income |

69,391 | 41,223 | 92,380 | 50,802 | 41,386 | |||||||||||||||

| Total noninterest expense |

91,942 | 61,033 | 138,492 | 102,163 | 89,584 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Net income before income taxes |

32,548 | 24,409 | 50,824 | 34,731 | 28,797 | |||||||||||||||

| State income tax expense |

2,174 | 1,649 | 2,968 | 2,269 | 1,894 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Net income |

$ | 30,374 | $ | 22,760 | $ | 47,856 | $ | 32,462 | $ | 26,903 | ||||||||||

|

|

|

|||||||||||||||||||

| Net interest income (tax—equivalent |

$ | 55,412 | $ | 45,472 | $ | 95,887 | $ | 85,487 | $ | 77,640 | ||||||||||

| Per Common Share |

||||||||||||||||||||

| Basic and diluted net income |

$ | 1.77 | $ | 1.32 | $ | 2.79 | $ | 1.89 | $ | 1.57 | ||||||||||

| Book value(1)(2) |

15.47 | 13.19 | 13.78 | 12.53 | 11.04 | |||||||||||||||

| Tangible book value(2)(6) |

12.41 | 10.30 | 10.66 | 9.59 | 8.01 | |||||||||||||||

|

|

||||||||||||||||||||

15

Table of Contents

Index to Financial Statements

| As of and for the six months ended June 30, (unaudited) |

As of and for year ended December 31, | |||||||||||||||||||

| (dollars in thousands, except per share data and ratio) | ||||||||||||||||||||

| 2016 | 2015 | 2015 | 2014 | 2013 | ||||||||||||||||

| Pro Forma Statement of Income and Per Common Share Data(2)(5) |

||||||||||||||||||||

| Pro forma combined provision for income tax |

$ | 12,169 | $ | 8,964 | $ | 17,896 | $ | 12,374 | $ | 10,185 | ||||||||||

| Pro forma net income |

20,379 | 15,445 | 33,118 | 22,357 | 18,612 | |||||||||||||||

| Pro forma net income per common share—basic and diluted |

1.19 | 0.90 | 1.93 | 1.30 | 1.08 | |||||||||||||||

| Summary Balance Sheet Data |

||||||||||||||||||||

| Cash and due from banks |

$ | 52,122 | $ | 56,119 | $ | 53,893 | $ | 40,093 | $ | 41,943 | ||||||||||

| Loans held for investment |

1,750,304 | 1,507,632 | 1,701,863 | 1,415,896 | 1,341,347 | |||||||||||||||

| Allowance for loan losses |

(23,734 | ) | (29,030 | ) | (24,460 | ) | (29,030 | ) | (32,353 | ) | ||||||||||

| Loans held for sale |

322,249 | 328,300 | 273,196 | 194,745 | 61,062 | |||||||||||||||

| Available-for-sale securities, fair value |

550,307 | 573,179 | 649,387 | 652,601 | 685,547 | |||||||||||||||

| Foreclosed real estate, net |

9,902 | 6,199 | 11,641 | 7,259 | 8,796 | |||||||||||||||

| Total assets |

2,917,958 | 2,532,836 | 2,899,420 | 2,428,189 | 2,258,387 | |||||||||||||||

| Total deposits |

2,514,297 | 2,026,505 | 2,438,474 | 1,923,569 | 1,803,567 | |||||||||||||||

| Core deposits(6) |

2,455,298 | 1,975,861 | 2,386,154 | 1,866,535 | 1,745,492 | |||||||||||||||

| Borrowings |

55,785 | 135,988 | 74,616 | 143,850 | 137,861 | |||||||||||||||

| Total shareholder’s equity(2) |

265,768 | 226,607 | 236,674 | 215,228 | 189,687 | |||||||||||||||

| Summary Ratios |

||||||||||||||||||||

| Return on average: |

||||||||||||||||||||

| Assets(3) |

2.11% | 1.86% | 1.86% | 1.40% | 1.22% | |||||||||||||||

| Shareholder’s equity(3) |

23.94% | 20.46% | 20.91% | 15.94% | 13.98% | |||||||||||||||

| Average shareholder’s equity to average assets |

8.82% | 9.09% | 8.88% | 8.81% | 8.73% | |||||||||||||||

| Net interest margin (tax-equivalent basis)(6) |

4.20% | 4.02% | 3.97% | 3.93% | 3.75% | |||||||||||||||

| Efficiency ratio (tax-equivalent basis)(6) |

69.54% | 71.60% | 73.26% | 76.15% | 75.43% | |||||||||||||||

| Loans to deposit ratio |

69.61% | 74.40% | 69.79% | 73.61% | 74.37% | |||||||||||||||

| Yield on interest-earning assets |

4.55% | 4.41% | 4.34% | 4.37% | 4.31% | |||||||||||||||

| Cost of interest-bearing liabilities |

0.47% | 0.51% | 0.49% | 0.56% | 0.70% | |||||||||||||||

| Cost of total deposits |

0.28% | 0.32% | 0.30% | 0.36% | 0.48% | |||||||||||||||

| Pro Forma Summary Ratios |

||||||||||||||||||||

| Pro forma return on average assets(3)(5) |

1.42% | 1.27% | 1.28% | 0.97% | 0.84% | |||||||||||||||

| Pro forma return on average equity(3)(5) |

16.06% | 13.91% | 14.47% | 10.98% | 9.67% | |||||||||||||||

|

|

||||||||||||||||||||

16

Table of Contents

Index to Financial Statements

| As of and for the six months ended June 30, (unaudited) |

As of and for year ended December 31, | |||||||||||||||||||

| (dollars in thousands, except per share data and ratio) | ||||||||||||||||||||

| 2016 | 2015 | 2015 | 2014 | 2013 | ||||||||||||||||

| Credit Quality Ratios |

||||||||||||||||||||

| Allowance for loan losses to loans, net of unearned |

1.41% | 1.93% | 1.50% | 2.05% | 2.41% | |||||||||||||||

| Allowance for loan losses to nonperforming loans |

213.70% | 177.09% | 211.10% | 168.75% | 113.83% | |||||||||||||||

| Nonperforming loans to loans, net of unearned |

0.66% | 1.09% | 0.68% | 1.21% | 2.12% | |||||||||||||||

| Capital Ratios (Company) |

||||||||||||||||||||

| Shareholder’s equity to assets |

9.11% | 8.95% | 8.16% | 8.86% | 8.40% | |||||||||||||||

| Tier 1 leverage capital (to average assets) |

7.98% | 8.35% | 7.64% | 8.10% | 7.97% | |||||||||||||||

| Tier 1 capital (to risk-weighted assets(4) |

9.57% | 10.63% | 9.58% | 11.32% | 11.47% | |||||||||||||||

| Total capital (to risk-weighted assets)(4) |

11.00% | 12.40% | 11.15% | 13.18% | 13.41% | |||||||||||||||

| Tangible common equity to tangible assets(6) |

7.44% | 7.13% | 6.43% | 6.93% | 6.24% | |||||||||||||||

| Common Equity Tier 1 (to risk-weighted assets) (CET1)(4) |

8.30% | 9.07% | 8.23% | N/A | N/A | |||||||||||||||

| Capital Ratios (Bank) |

||||||||||||||||||||

| Shareholder’s equity to assets |

10.12% | 10.11% | 9.17% | 10.09% | 9.73% | |||||||||||||||

| Tier 1 leverage capital (to average assets) |

8.02% | 8.31% | 7.65% | 8.10% | 7.98% | |||||||||||||||

| Tier 1 capital (to risk-weighted assets)(4) |

9.65% | 10.66% | 9.63% | 11.34% | 11.54% | |||||||||||||||

| Total capital to (risk-weighted assets)(4) |

10.92% | 12.22% | 11.02% | 12.96% | 13.20% | |||||||||||||||

| Tangible common equity to tangible assets(6) |

8.47% | 8.31% | 7.46% | 8.47% | 7.60% | |||||||||||||||

| Common Equity Tier 1 (to risk-weighted assets) (CET1)(4) |

9.65% | 10.66% | 9.63% | N/A | N/A | |||||||||||||||

|

|

||||||||||||||||||||

| (1) | Book value per share equals our total shareholder’s equity as of the date presented divided by the number of shares of our common stock outstanding as of the date presented. The number of shares of our common stock outstanding as of June 30, 2016 and 2015 and December 31, 2015, 2014 and 2013 was 17,180,000. |

| (2) | If we gave effect to our conversion from a subchapter S Corporation to a subchapter C Corporation in connection with this offering as of June 30, 2016, we would have recorded a deferred tax liability of approximately $15.1 million along with a corresponding $12.8 million decrease to shareholder’s equity. This pro forma adjustment is not reflected in the amounts presented above. |

| (3) | We have calculated our return on average assets and return on average equity for a year by dividing net income for that period by our average assets and average equity, as the case may be, for that period. We have calculated our pro forma return on average assets and pro forma return |

17

Table of Contents

Index to Financial Statements

| on average equity for a period by calculating our pro forma net income for that period as described in footnote 5 below and dividing that by our average assets and average equity, as the case be, for that period. We calculate our average assets and average equity for a period by dividing the sum of our total asset balance or total stockholder’s equity balance, as the case may be, as of the close of business on each day in the relevant period and dividing by the number of days in the period. |

| (4) | We calculate our risk-weighted assets using the standardized method of the Basel III Framework as of December 31, 2015 and June 30, 2016 and the Basel II Framework for all previous periods, as implemented by the Federal Reserve and the FDIC. |

| (5) | We have calculated our pro forma net income, pro forma net income per share, pro forma returns on average assets and pro forma return on average equity for each period shown by calculating a pro forma provision for federal income tax using an assumed combined effective income tax rate of 37.39% and 36.72% for six months ended June 30, 2016 and 2015 and 35.08%, 35.63% and 35.37% for the years ended December 31, 2015, 2014 and 2013, respectively, and adjusting our historical net income for each period to give effect to the pro forma provision for U.S. federal income tax for such period. |

| (6) | These measures are not measures recognized under generally accepted accounting principles (United States) (“GAAP”), and are therefore considered to be non-GAAP financial measures. See “GAAP reconciliation and management explanation of non-GAAP financial measures” for a reconciliation of these measures to their most comparable GAAP measures. |

| (7) | Excludes loans acquired from Northwest Georgia Bank. |

GAAP reconciliation and management explanation of non-GAAP financial measures

We identify certain of the financial measures discussed in our summary historical consolidated financial data as being “non-GAAP financial measures.” In accordance with the SEC’s rules, we classify a financial measure as being a non-GAAP financial measure if that financial measure excludes or includes amounts, or is subject to adjustments that have the effect of excluding or including amounts, that are included or excluded, as the case may be, in the most directly comparable measure calculated and presented in accordance with generally accepted accounting principles as in effect from time to time in the United States in our statements of income, balance sheets or statements of cash flows.

Net interest income (tax-equivalent basis), net interest margin (tax-equivalent basis) and efficiency ratios (tax-equivalent basis) include the effects of taxable-equivalent adjustments using a combined federal and state income tax rate of 39.225% to increase tax-exempt interest income to a tax-equivalent basis.

The non-GAAP financial measures that we discuss in our summary historical consolidated financial data should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. Moreover, the manner in which we calculate the non-GAAP financial measures that we discuss in our summary historical consolidated financial data may differ from that of other companies reporting measures with similar names. You should understand how such other banking organizations calculate their financial measures similar or with names similar to the non-GAAP financial measures we have discussed in our summary historical consolidated financial data when comparing such non-GAAP financial measures. The following reconciliation table provides a more detailed analysis of these non-GAAP financial measures

Tax-equivalent net interest income and net interest margin