Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TerraForm Power NY Holdings, Inc. | terp8-kbondholderproposala.htm |

1

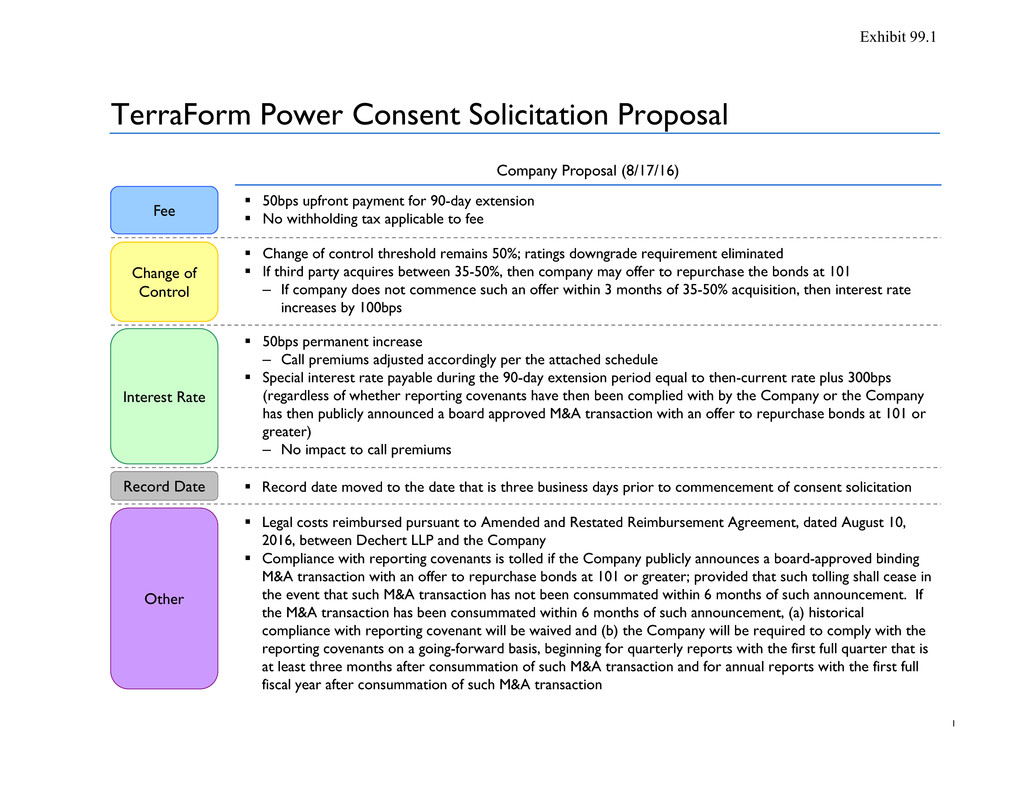

TerraForm Power Consent Solicitation Proposal

Company Proposal (8/17/16)

Fee

Change of

Control

Record Date

Other

Interest Rate

�ƒ50bps upfront payment for 90-day extension

�ƒNo withholding tax applicable to fee

�ƒChange of control threshold remains 50%; ratings downgrade requirement eliminated

�ƒIf third party acquires between 35-50%, then company may offer to repurchase the bonds at 101

– If company does not commence such an offer within 3 months of 35-50% acquisition, then interest rate

increases by 100bps

�ƒ50bps permanent increase

– Call premiums adjusted accordingly per the attached schedule

�ƒSpecial interest rate payable during the 90-day extension period equal to then-current rate plus 300bps

(regardless of whether reporting covenants have then been complied with by the Company or the Company

has then publicly announced a board approved M&A transaction with an offer to repurchase bonds at 101 or

greater)

– No impact to call premiums

�ƒLegal costs reimbursed pursuant to Amended and Restated Reimbursement Agreement, dated August 10,

2016, between Dechert LLP and the Company

�ƒCompliance with reporting covenants is tolled if the Company publicly announces a board-approved binding

M&A transaction with an offer to repurchase bonds at 101 or greater; provided that such tolling shall cease in

the event that such M&A transaction has not been consummated within 6 months of such announcement. If

the M&A transaction has been consummated within 6 months of such announcement, (a) historical

compliance with reporting covenant will be waived and (b) the Company will be required to comply with the

reporting covenants on a going-forward basis, beginning for quarterly reports with the first full quarter that is

at least three months after consummation of such M&A transaction and for annual reports with the first full

fiscal year after consummation of such M&A transaction

�ƒRecord date moved to the date that is three business days prior to commencement of consent solicitation

Exhibit 99.1

2

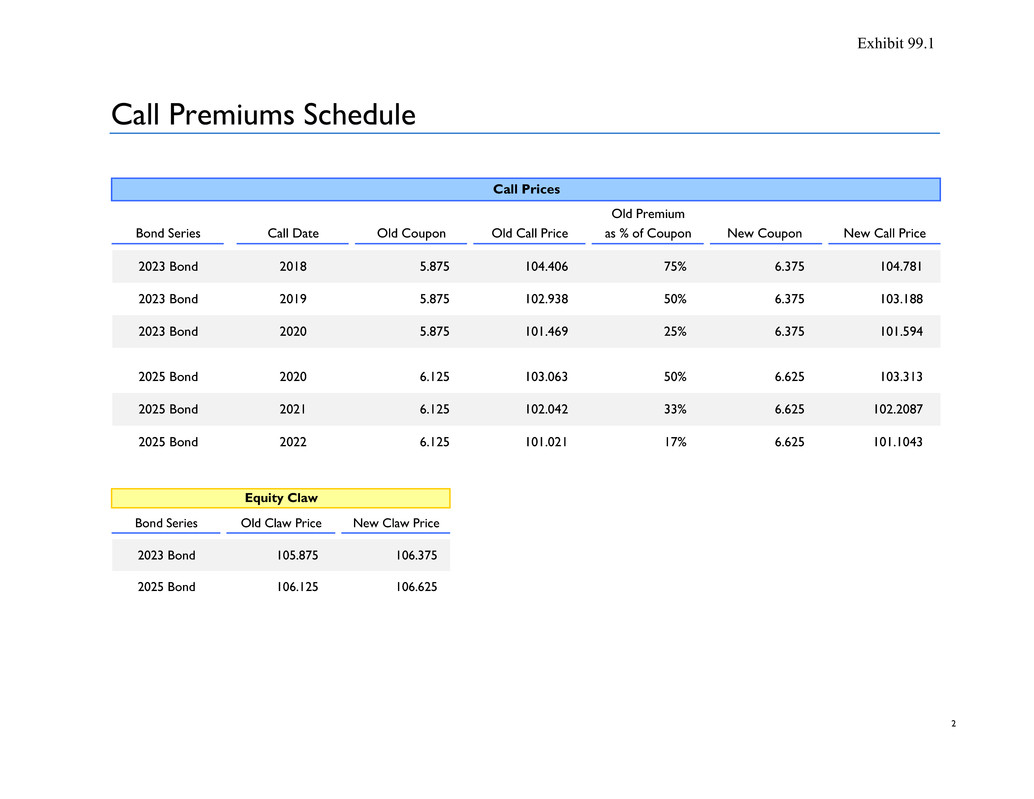

Call Premiums Schedule

Call Prices

Old Premium

Bond Series Call Date Old Coupon Old Call Price as % of Coupon New Coupon New Call Price

2023 Bond 2018 5.875 104.406 75% 6.375 104.781

2023 Bond 2019 5.875 102.938 50% 6.375 103.188

2023 Bond 2020 5.875 101.469 25% 6.375 101.594

2025 Bond 2020 6.125 103.063 50% 6.625 103.313

2025 Bond 2021 6.125 102.042 33% 6.625 102.2087

2025 Bond 2022 6.125 101.021 17% 6.625 101.1043

Equity Claw

Bond Series Old Claw Price New Claw Price

2023 Bond 105.875 106.375

2025 Bond 106.125 106.625

�(�[�K�L�E�L�W��

�

��