Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - SYNOVUS FINANCIAL CORP | d157265dex991.htm |

| 8-K - FORM 8-K - SYNOVUS FINANCIAL CORP | d157265d8k.htm |

| Exhibit 99.2

|

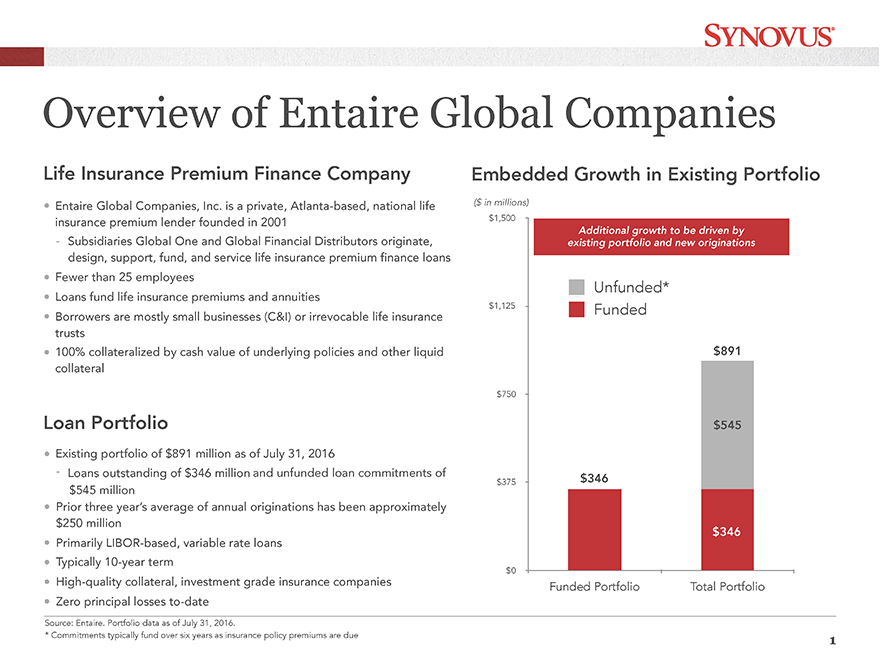

Source: Entaire. Portfolio data as of July 31, 2016.* Commitments typically fund over six years as insurance policy premiums are dueOverview of Entaire Global CompaniesLife Insurance Premium Finance CompanyLoan Portfolio$0$375$750$1,125$1,500Funded Portfolio Total Portfolio$891$545FundedUnfunded* Entaire Global Companies, Inc. is a private, Atlanta-based, national lifeinsurance premium lender founded in 2001- Subsidiaries Global One and Global Financial Distributors originate,design, support, fund, and service life insurance premium finance loans Fewer than 25 employees Loans fund life insurance premiums and annuities Borrowers are mostly small businesses (C&I) or irrevocable life insurancetrusts 100% collateralized by cash value of underlying policies and other liquidcollateral Existing portfolio of $891 million as of July 31, 2016 Loans outstanding of $346 million and unfunded loan commitments of $545 million Prior three year’s average of annual originations has been approximately$250 million Primarily LIBOR-based, variable rate loans Typically 10-year term High-quality collateral, investment grade insurance companies Zero principal losses to-dateEmbedded Growth in Existing PortfolioAdditional growth to be driven byexisting portfolio and new originations($ in millions)$346$3461

Existing portfolio of $891 million as of July 31, 2016

Loans outstanding of $346 million and unfunded loan commitments of $545 million

|

|

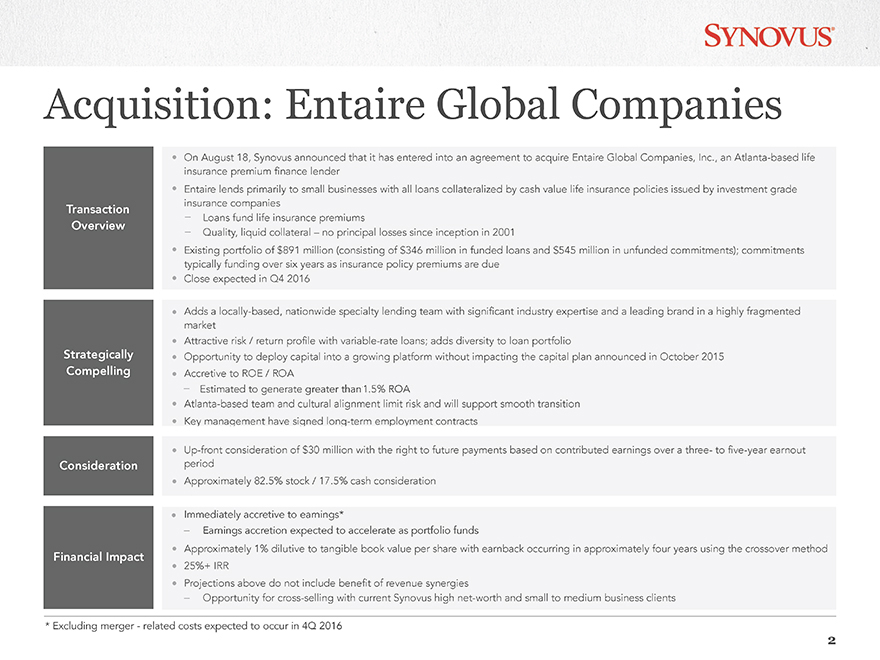

Acquisition: Entaire Global Companies On August 18, Synovus announced that it has entered into an agreement to acquire Entaire Global Companies, Inc., an Atlanta-based lifeinsurance premium finance lender Entaire lends primarily to small businesses with all loans collateralized by cash value life insurance policies issued by investment gradeinsurance companies– Loans fund life insurance premiums– Quality, liquid collateral – no principal losses since inception in 2001 Existing portfolio of $891 million (consisting of $346 million in funded loans and $545 million in unfunded commitments); commitmentstypically funding over six years as insurance policy premiums are due Close expected in Q4 2016 Up-front consideration of $30 million with the right to future payments based on contributed earnings over a three- to five-year earnoutperiod Approximately 82.5% stock / 17.5% cash consideration Earnings accretion expected to accelerate as portfolio funds, providing $0.02 of accretion in 2017 and $0.03 of accretion in 2018, withcontinued growth thereafter Approximately 1% dilutive to tangible book value per share with earnback occurring in approximately four years using the crossover method 25%+ IRR Projections above do not include benefit of revenue synergies– Opportunity for cross-selling with current Synovus high net-worth and small to medium business clientsTransactionOverviewStrategicallyCompellingConsiderationFinancial Impact Adds a locally-based, nationwide specialty lending team with significant industry expertise and a leading brand in a highly fragmentedmarket Attractive risk / return profile with variable-rate loans; adds diversity to loan portfolio Opportunity to deploy capital into a growing platform without impacting the capital plan announced in October 2015 Accretive to ROE / ROA Atlanta-based team and cultural alignment limit risk and will support smooth transition Key management have signed long-term employment contracts2

Estimated to generate greater than 1.5% ROA

Immediately accretive to earnings*

Earnings accretion expected to accelerate as portfolio funds

*Excluding merger-related costs expected to occur in 4Q 2016

|

|

Forward-Looking StatementsThis slide presentation and certain of our other filings with the Securities and Exchange Commission contain statements that constitute “forward-lookingstatements” within the meaning of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of theSecurities Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward-looking statements. You can identifythese forward-looking statements through Synovus’ use of words such as “believes,” “anticipates,” “expects,” “may,” “will,” “assumes,” “should,”“predicts,” “could,” “would,” “intends,” “targets,” “estimates,” “projects,” “plans,” “potential” and other similar words and expressions of the futureor otherwise regarding the outlook for Synovus’ future business and financial performance and/or the performance of the banking industry andeconomy in general. These forward-looking statements include, among others, our expectations regarding the impact of the foregoing transaction toearnings per share, return on equity, return on assets, dilution to tangible book value, internal rates of return and the projected earnback; ourexpectations on loan growth, growth strategy and future profitability, our expectations regarding the closing of the foregoing transaction, the benefits ofthe proposed transaction and the assumptions underlying our expectations. Prospective investors are cautioned that any such forward-lookingstatements are not guarantees of future performance and involve known and unknown risks and uncertainties which may cause the actual results,performance or achievements of Synovus to be materially different from the future results, performance or achievements expressed or implied by suchforward-looking statements. Forward-looking statements are based on the information known to, and current beliefs and expectations of, Synovus’management and are subject to significant risks and uncertainties. Actual results may differ materially from those contemplated by such forward-lookingstatements. A number of factors could cause actual results to differ materially from those contemplated by the forward-looking statements in this pressrelease. Many of these factors are beyond Synovus’ ability to control or predict.These forward-looking statements are based upon information presently known to Synovus’ management and are inherently subjective, uncertain andsubject to change due to any number of risks and uncertainties, including, without limitation, the risk that the closing conditions to the proposedtransaction may not be satisfied, the length of time necessary to consummate the proposed transaction, difficulties and delays in integrating the Entairebusiness, the risk that the benefits from the proposed transaction may not be fully realized or may take longer than expected to be realized, businessdisruption following the proposed transaction, inability to retain key employees following the proposed transaction, the diversion of management’sattention as a result of the proposed transaction and the risks and other factors set forth in Synovus’ filings with the Securities and ExchangeCommission, including its Annual Report on Form 10-K for the year ended December 31, 2015 under the captions “Cautionary Notice RegardingForward-Looking Statements” and “Risk Factors” and in Synovus’ quarterly reports on Form 10-Q and current reports on Form 8-K. We believe theseforward-looking statements are reasonable; however, undue reliance should not be placed on any forward-looking statements, which are based oncurrent expectations and speak only as of the date that they are made. We do not assume any obligation to update any forward-looking statements as aresult of new information, future developments or otherwise, except as otherwise may be required by law.3