Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Arc Logistics Partners LP | d222037d8k.htm |

Investor Presentation August 2016 Exhibit 99.1

Cautionary Note Forward Looking Statements Certain statements and information in this presentation constitute "forward-looking statements." Certain expressions including "believe," "expect," "intends," or other similar expressions are intended to identify Arc Logistics Partners LP’s (the “Partnership” or “Arc Logistics”) current expectations, opinions, views or beliefs concerning future developments and their potential effect on the Partnership. While management believes that these forward-looking statements are reasonable when made, there can be no assurance that future developments affecting the Partnership will be those that it anticipates. The forward-looking statements involve significant risks and uncertainties (some of which are beyond the Partnership's control) and assumptions that could cause actual results to differ materially from the Partnership's historical experience and its present expectations or projections. Important factors that could cause actual results to differ materially from forward-looking statements include but are not limited to: (i) adverse economic, capital markets and political conditions; (ii) changes in the market place for the Partnership's services; (iii) changes in supply and demand of crude oil and petroleum products; (iv) actions and performance of the Partnership's customers, vendors or competitors; (v) changes in the cost of or availability of capital; (vi) unanticipated capital expenditures in connection with the construction, repair or replacement of the Partnership's assets; (vii) operating hazards, unforeseen weather events or matters beyond the Partnership's control; (viii) inability to consummate acquisitions, pending or otherwise, on acceptable terms and successfully integrate acquired businesses into the Partnership's operations; (ix) effects of existing and future laws or governmental regulations; and (x) litigation. Additional information concerning these and other factors that could cause the Partnership's actual results to differ from projected results can be found in the Partnership's public periodic filings with the Securities and Exchange Commission ("SEC"), including the Partnership's Annual Report on Form 10-K for the year ended December 31, 2015, as filed with the SEC on March 11, 2016 and any updates thereto in the Partnership's subsequent quarterly reports on Form 10-Q and current reports on Form 8-K. These factors are not necessarily all of the important factors that could cause actual results to differ materially from those expressed in any of the forward-looking statements contained herein. Other unknown or unpredictable factors could also have material adverse effects on the Partnership’s future results. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date thereof. The Partnership undertakes no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise. The Partnership does not, as a matter of course, disclose projections as to future operations, earnings or other results. However, the Partnership may include herein certain prospective financial information, including estimated EBITDA. To the extent prospective financial information is included herein, such information was not prepared with a view toward disclosure, but, in the view of the Partnership’s management, was prepared on a reasonable basis, reflects the best currently available estimates and judgments and presents, to the best of the Partnership’s knowledge and belief, the expected course of action and expected future financial performance of the Partnership’s assets. However, this information is not fact and should not be relied upon as being indicative of future results, and readers of this presentation are cautioned not to place undue reliance on the prospective financial information.

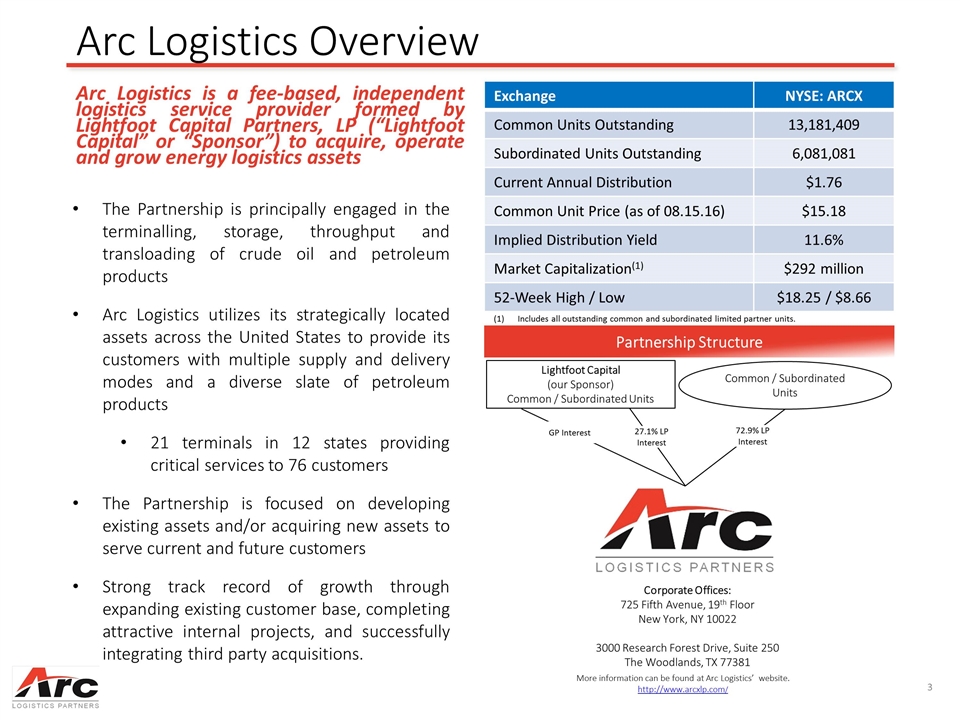

Arc Logistics Overview Arc Logistics is a fee-based, independent logistics service provider formed by Lightfoot Capital Partners, LP (“Lightfoot Capital” or “Sponsor”) to acquire, operate and grow energy logistics assets Exchange NYSE: ARCX Common Units Outstanding 13,181,409 Subordinated Units Outstanding 6,081,081 Current Annual Distribution $1.76 Common Unit Price (as of 08.15.16) $15.18 Implied Distribution Yield 11.6% Market Capitalization(1) $292 million 52-Week High / Low $18.25 / $8.66 Partnership Structure Lightfoot Capital (our Sponsor) Common / Subordinated Units Common / Subordinated Units GP Interest 27.1% LP Interest 72.9% LP Interest Corporate Offices: 725 Fifth Avenue, 19th Floor New York, NY 10022 3000 Research Forest Drive, Suite 250 The Woodlands, TX 77381 More information can be found at Arc Logistics’ website. http://www.arcxlp.com/ Includes all outstanding common and subordinated limited partner units. The Partnership is principally engaged in the terminalling, storage, throughput and transloading of crude oil and petroleum products Arc Logistics utilizes its strategically located assets across the United States to provide its customers with multiple supply and delivery modes and a diverse slate of petroleum products 21 terminals in 12 states providing critical services to 76 customers The Partnership is focused on developing existing assets and/or acquiring new assets to serve current and future customers Strong track record of growth through expanding existing customer base, completing attractive internal projects, and successfully integrating third party acquisitions.

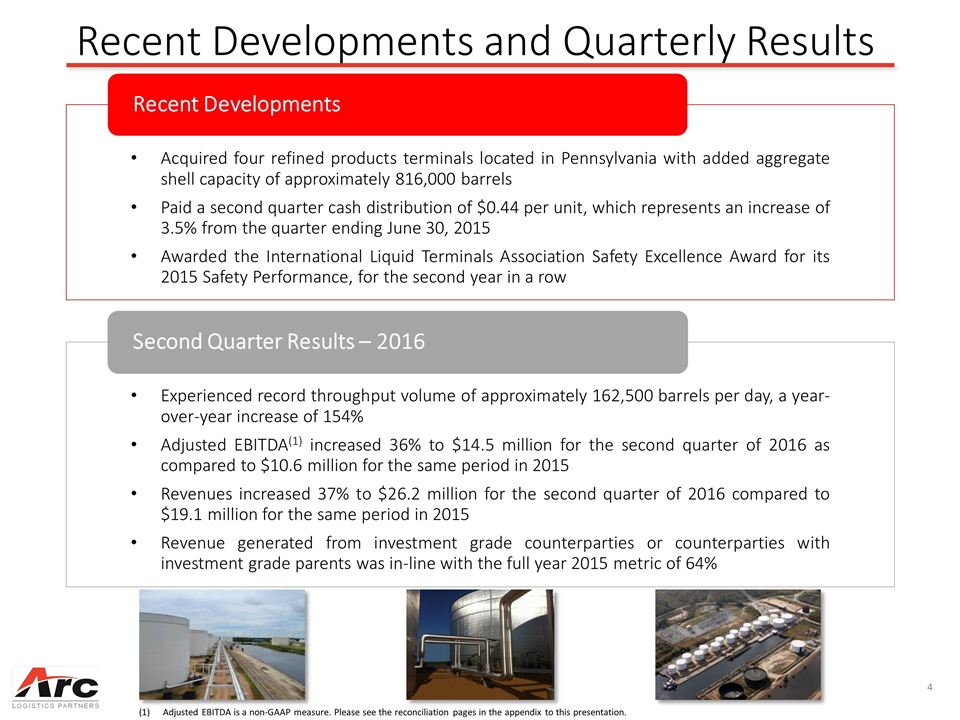

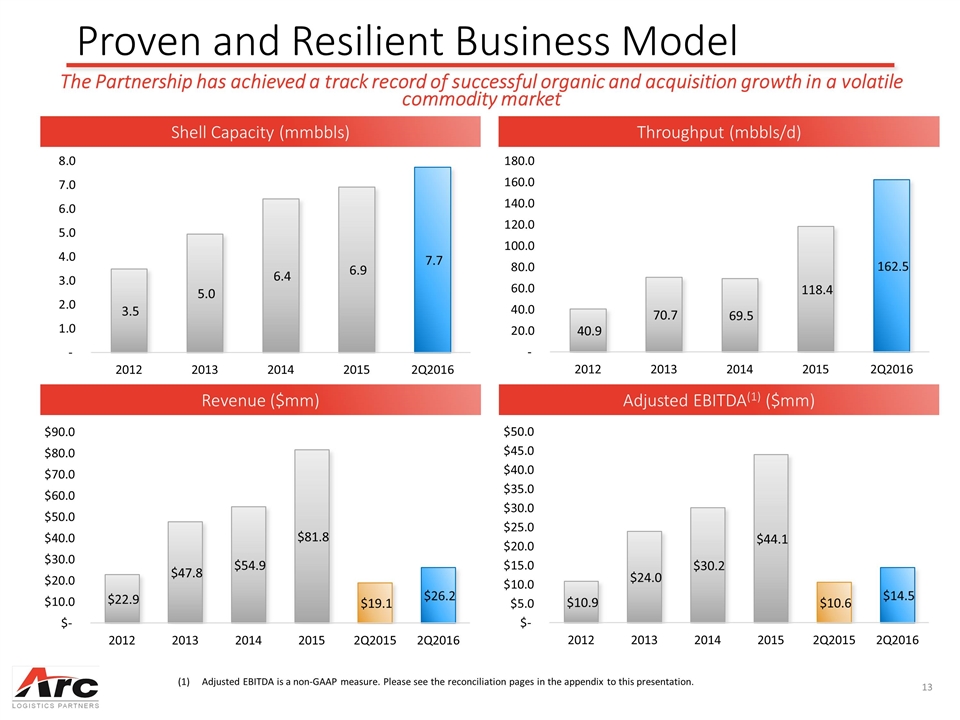

Recent Developments and Quarterly Results Adjusted EBITDA is a non-GAAP measure. Please see the reconciliation pages in the appendix to this presentation. Recent Developments Acquired four refined products terminals located in Pennsylvania with added aggregate shell capacity of approximately 816,000 barrels Awarded the International Liquid Terminals Association Safety Excellence Award for its 2015 Safety Performance, for the second year in a row Experienced record throughput volume of approximately 162,500 barrels per day, a year-over-year increase of 154% Second Quarter Results – 2016 Paid a second quarter cash distribution of $0.44 per unit, which represents an increase of 3.5% from the quarter ending June 30, 2015 Revenues increased 37% to $26.2 million for the second quarter of 2016 compared to $19.1 million for the same period in 2015 Revenue generated from investment grade counterparties or counterparties with investment grade parents was in-line with the full year 2015 metric of 64% Adjusted EBITDA (1) increased 36% to $14.5 million for the second quarter of 2016 as compared to $10.6 million for the same period in 2015

Investment Highlights A fee-based, growth-oriented, independent logistics service provider Diversified and well positioned asset portfolio Stable and predictable cash flow profile Customer driven, attractive and visible growth opportunities Experienced management team with a proven track record Financial flexibility to achieve growth opportunities Supportive sponsor group with energy industry expertise Commitment to managing to the highest EH&S standards

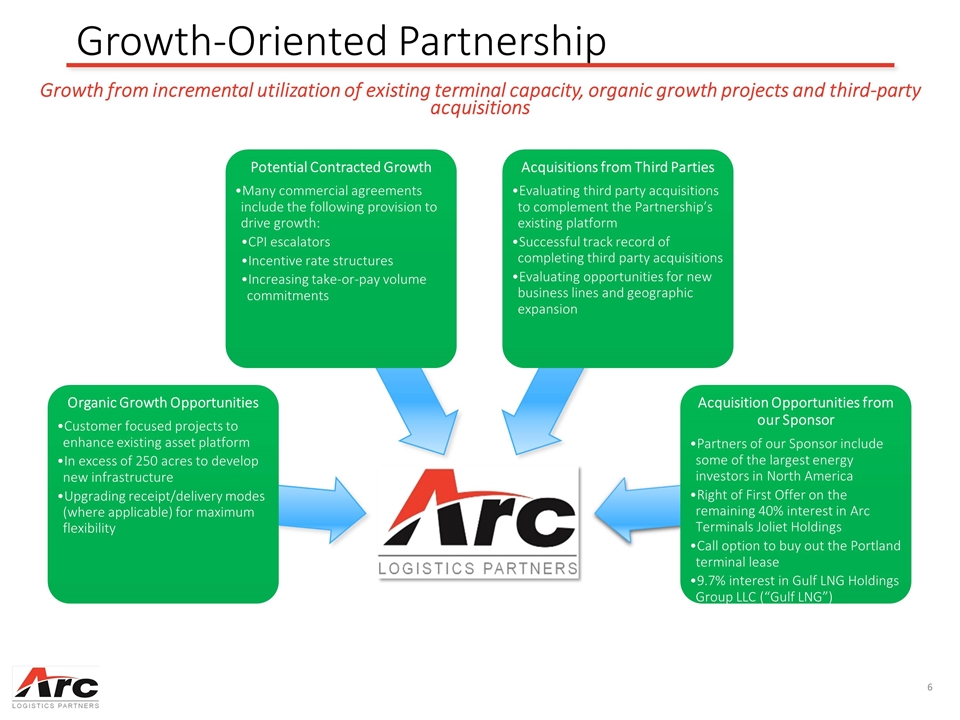

Growth-Oriented Partnership Growth from incremental utilization of existing terminal capacity, organic growth projects and third-party acquisitions Organic Growth Opportunities Potential Contracted Growth Acquisitions from Third Parties Acquisition Opportunities from our Sponsor Customer focused projects to enhance existing asset platform In excess of 250 acres to develop new infrastructure Upgrading receipt/delivery modes (where applicable) for maximum flexibility Many commercial agreements include the following provision to drive growth: CPI escalators Increasing take-or-pay volume commitments Evaluating third party acquisitions to complement the Partnership’s existing platform Successful track record of completing third party acquisitions Evaluating opportunities for new business lines and geographic expansion Partners of our Sponsor include some of the largest energy investors in North America Right of First Offer on the remaining 40% interest in Arc Terminals Joliet Holdings Call option to buy out the Portland terminal lease 9.7% interest in Gulf LNG Holdings Group LLC (“Gulf LNG”) Incentive rate structures

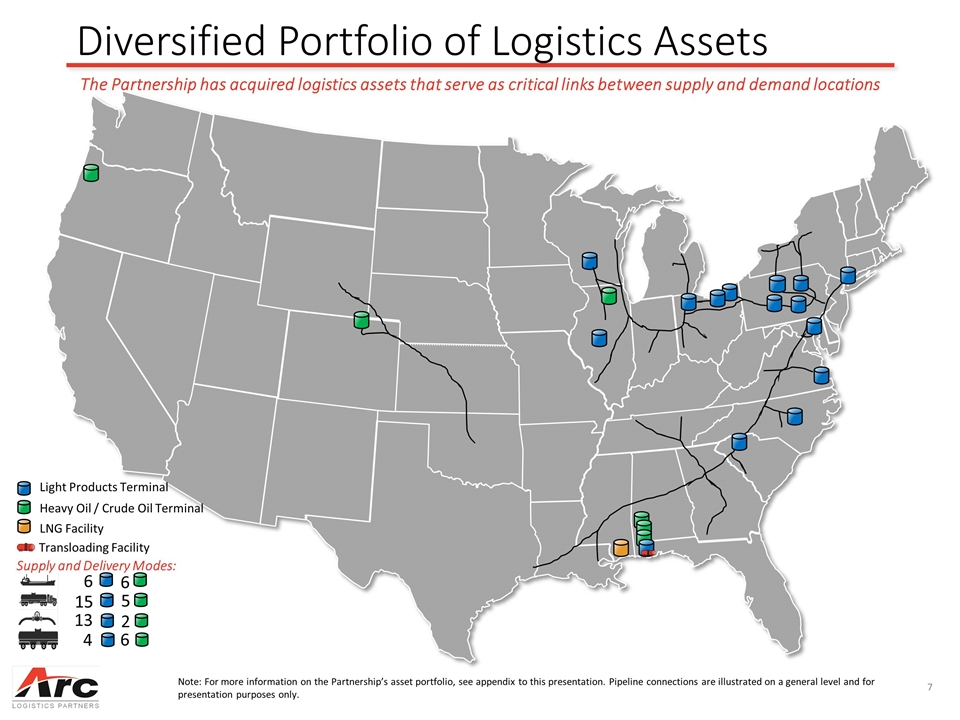

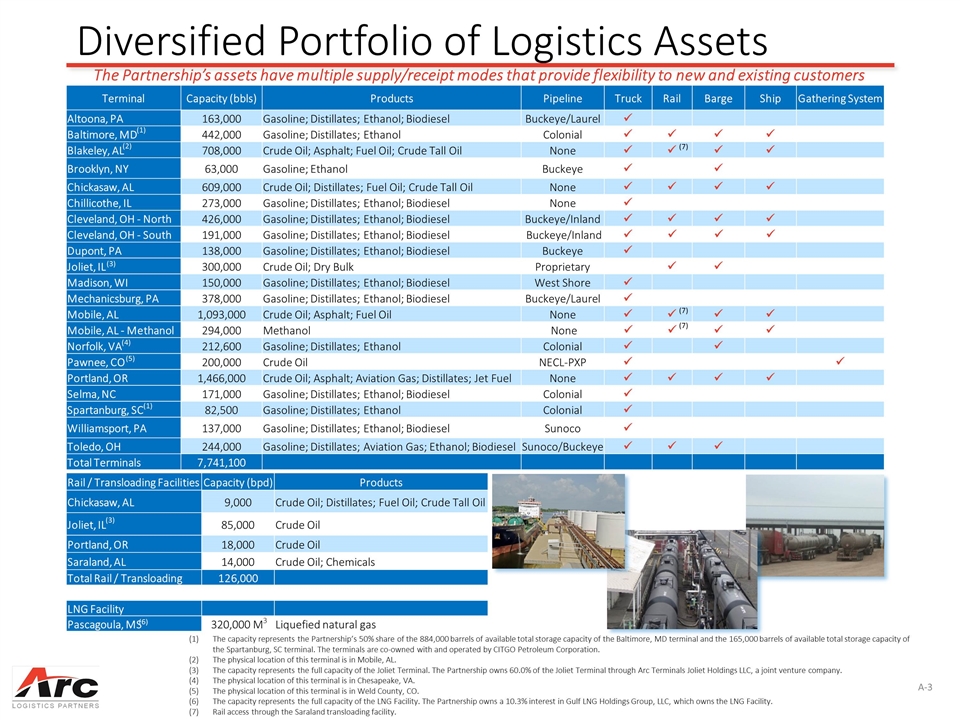

Diversified Portfolio of Logistics Assets The Partnership has acquired logistics assets that serve as critical links between supply and demand locations LNG Facility 6 4 Note: For more information on the Partnership’s asset portfolio, see appendix to this presentation. Pipeline connections are illustrated on a general level and for presentation purposes only. 6 6 15 13 Barge/Ship access Truck access Pipeline access Rail access 5 2 Supply and Delivery Modes: Transloading Facility Light Products Terminal Heavy Oil / Crude Oil Terminal

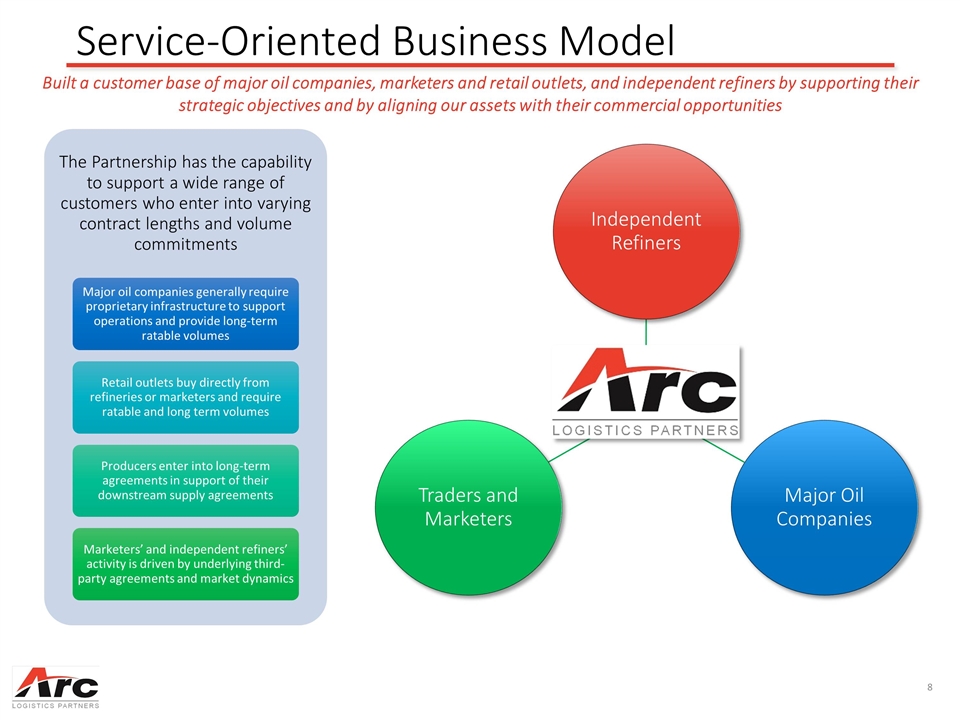

Service-Oriented Business Model Built a customer base of major oil companies, marketers and retail outlets, and independent refiners by supporting their strategic objectives and by aligning our assets with their commercial opportunities Arc Independent Refiners Major Oil Companies Traders and Marketers The Partnership has the capability to support a wide range of customers who enter into varying contract lengths and volume commitments Major oil companies generally require proprietary infrastructure to support operations and provide long-term ratable volumes Retail outlets buy directly from refineries or marketers and require ratable and long term volumes Producers enter into long-term agreements in support of their downstream supply agreements Marketers’ and independent refiners’ activity is driven by underlying third-party agreements and market dynamics

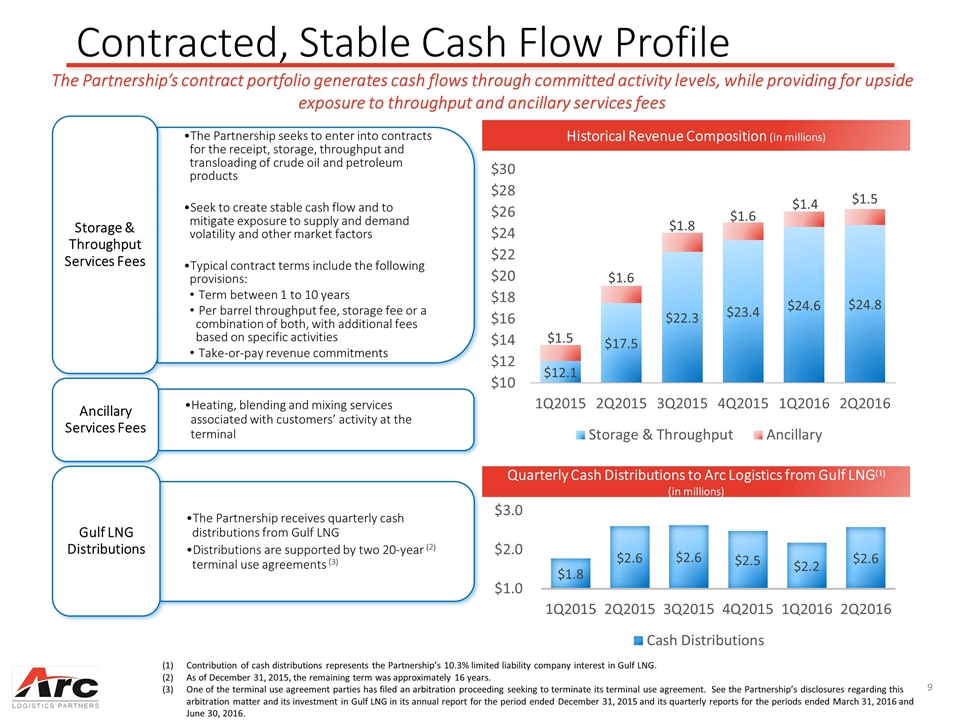

Contracted, Stable Cash Flow Profile The Partnership’s contract portfolio generates cash flows through committed activity levels, while providing for upside exposure to throughput and ancillary services fees Historical Revenue Composition (in millions) Quarterly Cash Distributions to Arc Logistics from Gulf LNG(1) (in millions) Contribution of cash distributions represents the Partnership’s 10.3% limited liability company interest in Gulf LNG. As of December 31, 2015, the remaining term was approximately 16 years. One of the terminal use agreement parties has filed an arbitration proceeding seeking to terminate its terminal use agreement. See the Partnership’s disclosures regarding this arbitration matter and its investment in Gulf LNG in its annual report for the period ended December 31, 2015 and its quarterly reports for the periods ended March 31, 2016 and June 30, 2016. Storage & Throughput Services Fees The Partnership seeks to enter into contracts for the receipt, storage, throughput and transloading of crude oil and petroleum products Ancillary Services Fees Heating, blending and mixing services associated with customers’ activity at the terminal Seek to create stable cash flow and to mitigate exposure to supply and demand volatility and other market factors Typical contract terms include the following provisions: Term between 1 to 10 years Per barrel throughput fee, storage fee or a combination of both, with additional fees based on specific activities Take-or-pay revenue commitments Gulf LNG Distributions The Partnership receives quarterly cash distributions from Gulf LNG Distributions are supported by two 20-year (2) terminal use agreements (3)

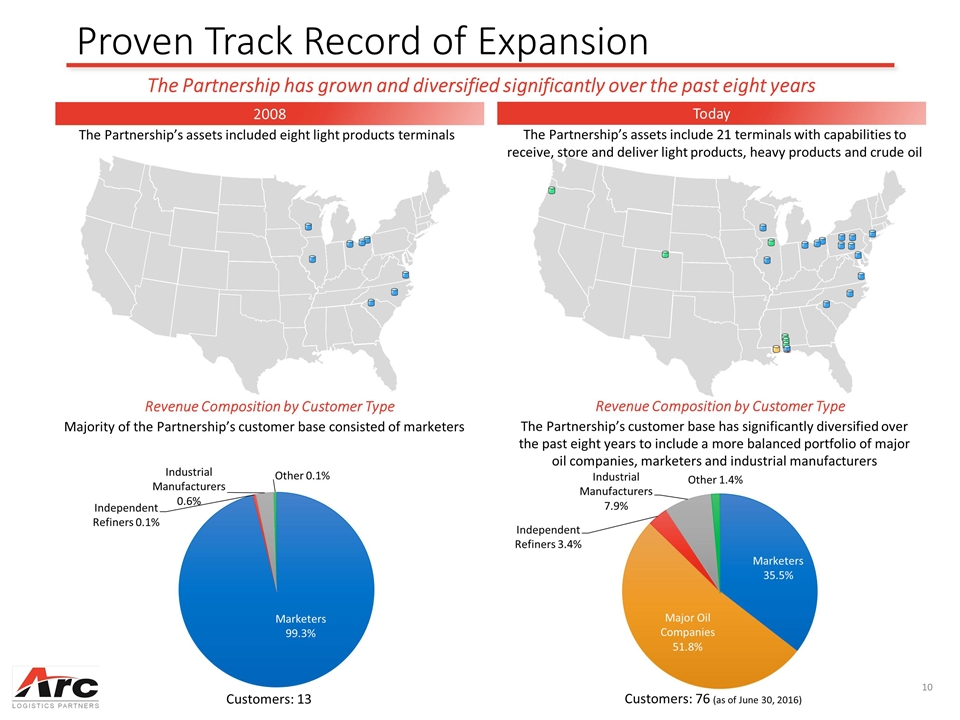

Proven Track Record of Expansion 2008 Today The Partnership has grown and diversified significantly over the past eight years The Partnership’s assets included eight light products terminals The Partnership’s assets include 21 terminals with capabilities to receive, store and deliver light products, heavy products and crude oil Majority of the Partnership’s customer base consisted of marketers The Partnership’s customer base has significantly diversified over the past eight years to include a more balanced portfolio of major oil companies, marketers and industrial manufacturers Customers: 13 Customers: 76 (as of June 30, 2016) Revenue Composition by Customer Type Revenue Composition by Customer Type

Growth Opportunities The Partnership is currently undertaking and / or pursuing several organic growth opportunities Marine facility upgrades and expansion projects Installing bio-blending systems in multiple terminals Tank expansion projects in multiple terminals Rail expansion projects in multiple terminals Available land for expansion

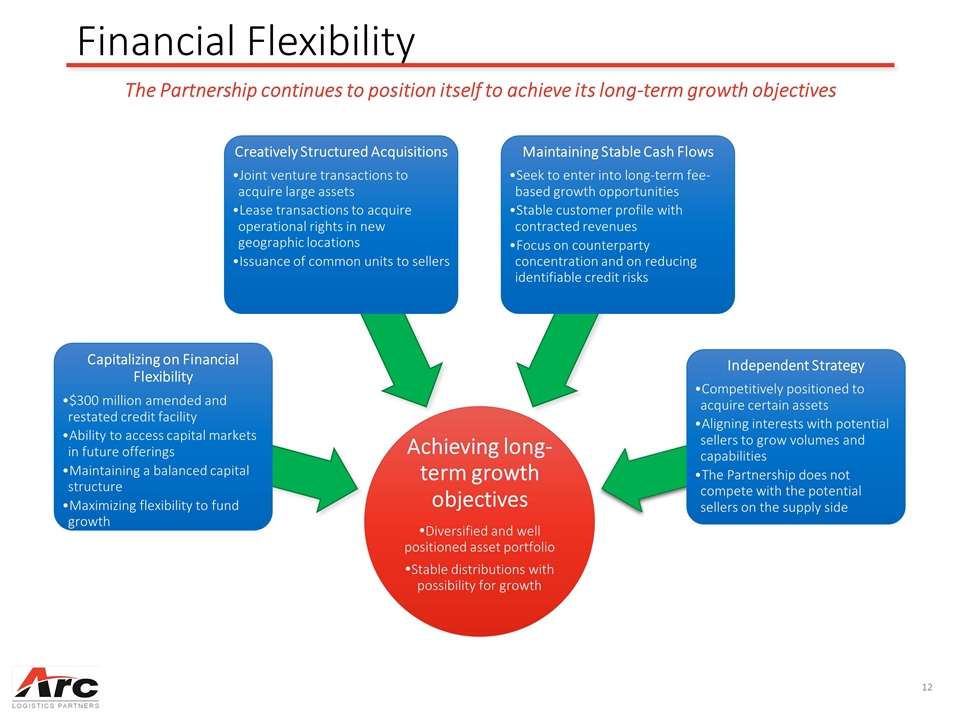

Financial Flexibility The Partnership continues to position itself to achieve its long-term growth objectives Capitalizing on Financial Flexibility Creatively Structured Acquisitions Maintaining Stable Cash Flows $300 million amended and restated credit facility Ability to access capital markets in future offerings Maintaining a balanced capital structure Joint venture transactions to acquire large assets Lease transactions to acquire operational rights in new geographic locations Issuance of common units to sellers Seek to enter into long-term fee-based growth opportunities Stable customer profile with contracted revenues Focus on counterparty concentration and on reducing identifiable credit risks Independent Strategy Maximizing flexibility to fund growth Competitively positioned to acquire certain assets Aligning interests with potential sellers to grow volumes and capabilities The Partnership does not compete with the potential sellers on the supply side Achieving long-term growth objectives Ÿ Diversified and well positioned asset portfolio Ÿ Stable distributions with possibility for growth

Proven and Resilient Business Model The Partnership has achieved a track record of successful organic and acquisition growth in a volatile commodity market Shell Capacity (mmbbls) Throughput (mbbls/d) Revenue ($mm) Adjusted EBITDA(1) ($mm) Adjusted EBITDA is a non-GAAP measure. Please see the reconciliation pages in the appendix to this presentation.

Appendix

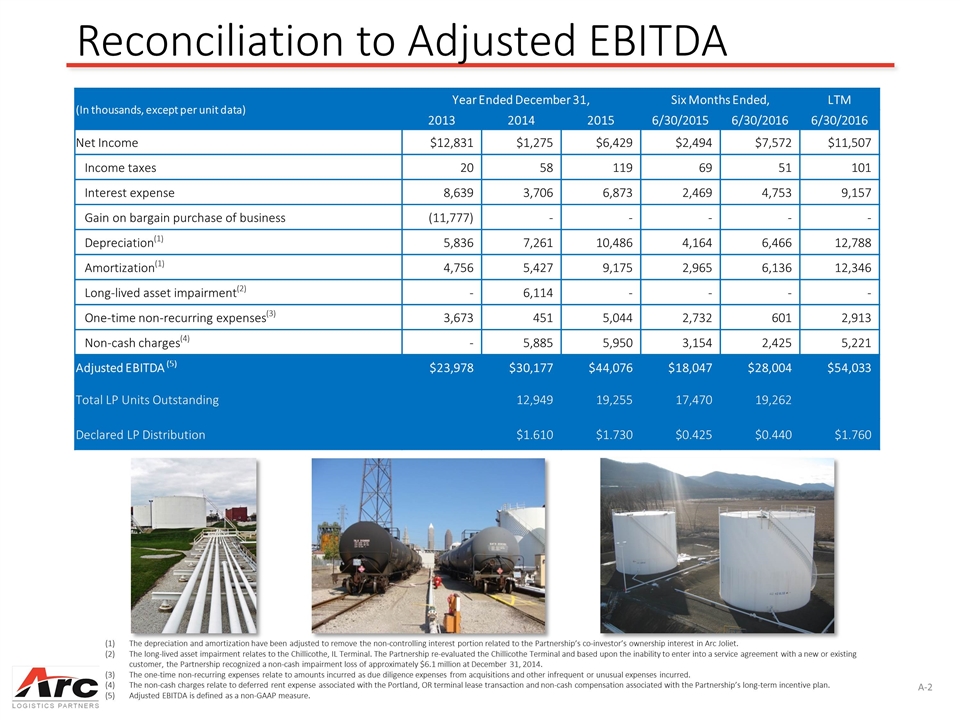

Non-GAAP Financial Measures Non-GAAP Financial Measures The Partnership defines Adjusted EBITDA as net income before interest expense, income taxes and depreciation and amortization expense, as further adjusted for other non-cash charges and other charges that are not reflective of our ongoing operations. Adjusted EBITDA is a non-GAAP financial measure that management and external users of the Partnership's consolidated financial statements, such as industry analysts, investors, lenders and rating agencies, may use to assess (i) the performance of the Partnership's assets without regard to the impact of financing methods, capital structure or historical cost basis of the Partnership's assets; (ii) the viability of capital expenditure projects and the overall rates of return on alternative investment opportunities; (iii) the Partnership's ability to make distributions; (iv) the Partnership's ability to incur and service debt and fund capital expenditures; and (v) the Partnership's ability to incur additional expenses. The Partnership believes that the presentation of Adjusted EBITDA provides useful information to investors in assessing its financial condition and results of operations. The GAAP measure most directly comparable to Adjusted EBITDA is net income. Adjusted EBITDA should not be considered as an alternative to net income. Adjusted EBITDA has important limitations as an analytical tool because it excludes some but not all items that affect net income. Readers should not consider Adjusted EBITDA in isolation or as a substitute for analysis of the Partnership's results as reported under GAAP. Additionally, because Adjusted EBITDA may be defined differently by other companies in the Partnership's industry, its definitions of Adjusted EBITDA may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. Please see the reconciliation of net income to Adjusted EBITDA in the accompanying table. A-1

Reconciliation to Adjusted EBITDA (In thousands, except per unit data) Year Ended December 31, Six Months Ended, LTM 2013 2014 2015 6/30/2015 6/30/2016 6/30/2016 Net Income $12,831 $1,275 $6,429 $2,494 $7,572 $11,507 Income taxes 20 58 119 69 51 101 Interest expense 8,639 3,706 6,873 2,469 4,753 9,157 Gain on bargain purchase of business (11,777) - - - - - Depreciation(1) 5,836 7,261 10,486 4,164 6,466 12,788 Amortization(1) 4,756 5,427 9,175 2,965 6,136 12,346 Long-lived asset impairment(2) - 6,114 - - - - One-time non-recurring expenses(3) 3,673 451 5,044 2,732 601 2,913 Non-cash charges(4) - 5,885 5,950 3,154 2,425 5,221 Adjusted EBITDA (5) $23,978 $30,177 $44,076 $18,047 $28,004 $54,033 Total LP Units Outstanding 12,949 19,255 17,470 19,262 Declared LP Distribution $1.610 $1.730 $0.425 $0.440 $1.760 The depreciation and amortization have been adjusted to remove the non-controlling interest portion related to the Partnership’s co-investor’s ownership interest in Arc Joliet. The long-lived asset impairment relates to the Chillicothe, IL Terminal. The Partnership re-evaluated the Chillicothe Terminal and based upon the inability to enter into a service agreement with a new or existing customer, the Partnership recognized a non-cash impairment loss of approximately $6.1 million at December 31, 2014. The one-time non-recurring expenses relate to amounts incurred as due diligence expenses from acquisitions and other infrequent or unusual expenses incurred. The non-cash charges relate to deferred rent expense associated with the Portland, OR terminal lease transaction and non-cash compensation associated with the Partnership’s long-term incentive plan. Adjusted EBITDA is defined as a non-GAAP measure. A-2

Diversified Portfolio of Logistics Assets The capacity represents the Partnership’s 50% share of the 884,000 barrels of available total storage capacity of the Baltimore, MD terminal and the 165,000 barrels of available total storage capacity of the Spartanburg, SC terminal. The terminals are co-owned with and operated by CITGO Petroleum Corporation. The physical location of this terminal is in Mobile, AL. The capacity represents the full capacity of the Joliet Terminal. The Partnership owns 60.0% of the Joliet Terminal through Arc Terminals Joliet Holdings LLC, a joint venture company. The physical location of this terminal is in Chesapeake, VA. The physical location of this terminal is in Weld County, CO. The capacity represents the full capacity of the LNG Facility. The Partnership owns a 10.3% interest in Gulf LNG Holdings Group, LLC, which owns the LNG Facility. Rail access through the Saraland transloading facility. The Partnership’s assets have multiple supply/receipt modes that provide flexibility to new and existing customers (6) (6) (6) (6) (1) (2) (4) (3) (7) (1) (4) (5) A-3 Terminal Capacity (bbls) Products Pipeline Truck Rail Barge Ship Gathering System Altoona, PA 163,000 Gasoline; Distillates; Ethanol; Biodiesel Buckeye/Laurel ü Baltimore, MD 442,000 Gasoline; Distillates; Ethanol Colonial ü ü ü ü Blakeley, AL 708,000 Crude Oil; Asphalt; Fuel Oil; Crude Tall Oil None ü ü ü ü Brooklyn, NY 63,000 Gasoline; Ethanol Buckeye ü ü Chickasaw, AL 609,000 Crude Oil; Distillates; Fuel Oil; Crude Tall Oil None ü ü ü ü Chillicothe, IL 273,000 Gasoline; Distillates; Ethanol; Biodiesel None ü Cleveland, OH - North 426,000 Gasoline; Distillates; Ethanol; Biodiesel Buckeye/Inland ü ü ü ü Cleveland, OH - South 191,000 Gasoline; Distillates; Ethanol; Biodiesel Buckeye/Inland ü ü ü ü Dupont, PA 138,000 Gasoline; Distillates; Ethanol; Biodiesel Buckeye ü Joliet, IL 300,000 Crude Oil; Dry Bulk Proprietary ü ü Madison, WI 150,000 Gasoline; Distillates; Ethanol; Biodiesel West Shore ü Mechanicsburg, PA 378,000 Gasoline; Distillates; Ethanol; Biodiesel Buckeye/Laurel ü Mobile, AL 1,093,000 Crude Oil; Asphalt; Fuel Oil None ü ü ü ü Mobile, AL - Methanol 294,000 Methanol None ü ü ü ü Norfolk, VA 212,600 Gasoline; Distillates; Ethanol Colonial ü ü Pawnee, CO 200,000 Crude Oil NECL-PXP ü ü Portland, OR 1,466,000 Crude Oil; Asphalt; Aviation Gas; Distillates; Jet Fuel None ü ü ü ü Selma, NC 171,000 Gasoline; Distillates; Ethanol; Biodiesel Colonial ü Spartanburg, SC 82,500 Gasoline; Distillates; Ethanol Colonial ü Williamsport, PA 137,000 Gasoline; Distillates; Ethanol; Biodiesel Sunoco ü Toledo, OH 244,000 Gasoline; Distillates; Aviation Gas; Ethanol; Biodiesel Sunoco/Buckeye ü ü ü Total Terminals 7,741,100 Rail / Transloading Facilities Capacity (bpd) Products Chickasaw, AL 9,000 Crude Oil; Distillates; Fuel Oil; Crude Tall Oil Joliet, IL 85,000 Crude Oil Portland, OR 18,000 Crude Oil Saraland, AL 14,000 Crude Oil; Chemicals Total Rail / Transloading 126,000 LNG Facility Pascagoula, MS 320,000 M3 Liquefied natural gas (1) (1) (2) (3) (3) (4) (5) (6) (7) (7) (7)