Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Phillips Edison & Company, Inc. | ntriearningscall8kq22016.htm |

The Grocery REITPhillips Edison-ARC

Grocery Center REIT II

1

Phillips Edison Grocery Center REIT I, Inc.

Second Quarter 2016 Results

www.grocerycenterREIT1.com

DST: 888.518.8073

Griffin Capital Services: 866.788.8614

The Grocery REITPhillips Edison-ARC

Grocery Center REIT II

2

Agenda

• Portfolio & Results

• Financial Performance

• Other Updates

R. Mark Addy - President and COO

The Grocery REITPhillips Edison-ARC

Grocery Center REIT II

3

Forward-Looking Statement Disclosure

This presentation and the corresponding call may contain forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

These statements include, but are not limited to, statements related to the Company’s expectations

regarding the performance of its business, its financial results, its liquidity and capital resources, the

quality of the Company’s portfolio of grocery anchored shopping centers and other non-historical

statements. You can identify these forward-looking statements by the use of words such as “outlook,”

“believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “projects,”

“predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other

comparable words. Such forward-looking statements are subject to various risks and uncertainties, such

as the risks that retail conditions may adversely affect our base rent and, subsequently, our income, and

that our properties consist primarily of retail properties and our performance, therefore, is linked to the

market for retail space generally, as well as other risks described under the section entitled "Risk

Factors" in the Company's Annual Report on Form 10-K for the year ended December 31, 2015, and the

Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2016, as such factors may be

updated from time to time in the Company’s periodic filings with the SEC, which are accessible on the

SEC’s website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual

outcomes or results to differ materially from those indicated in these statements. These factors should

not be construed as exhaustive and should be read in conjunction with the other cautionary statements

that are included in this presentation, the corresponding call and in the Company’s filings with the SEC.

The Company undertakes no obligation to publicly update or revise any forward-looking statement,

whether as a result of new information, future events, or otherwise.

The Grocery REITPhillips Edison-ARC

Grocery Center REIT II

4

Q2 2016 Portfolio Highlights

• 149 properties

• 28 states

• 25 leading grocery anchors

• 16 million square feet

• 96.1% occupied

• 79.3% of rents from grocer,

national and regional tenants

Information as of 6/30/2016.

The Grocery REITPhillips Edison-ARC

Grocery Center REIT II

5

Q2 2016 Portfolio Highlights

Grocer % of ABR # ofLocations

Kroger 8.5% 37

Publix 7.8% 31

Albertsons-Safeway 4.4% 13

Ahold USA 3.4% 6

Giant Eagle 2.8% 7

Top 5 Grocers by % of Annualized Base Rent

Annualized Base Rent by Tenant Type Annualized Base Rent by Tenant Industry

We calculate annualized base rent as monthly contractual rent as of June 30, 2016, multiplied by 12 months.

Grocery

41.5%

National and

Regional

37.8%

Local

20.7%

Grocery

41.5%

Retail Stores

21.9%

Services

22.6%

Restaurants

14.0%

The Grocery REITPhillips Edison-ARC

Grocery Center REIT II

6

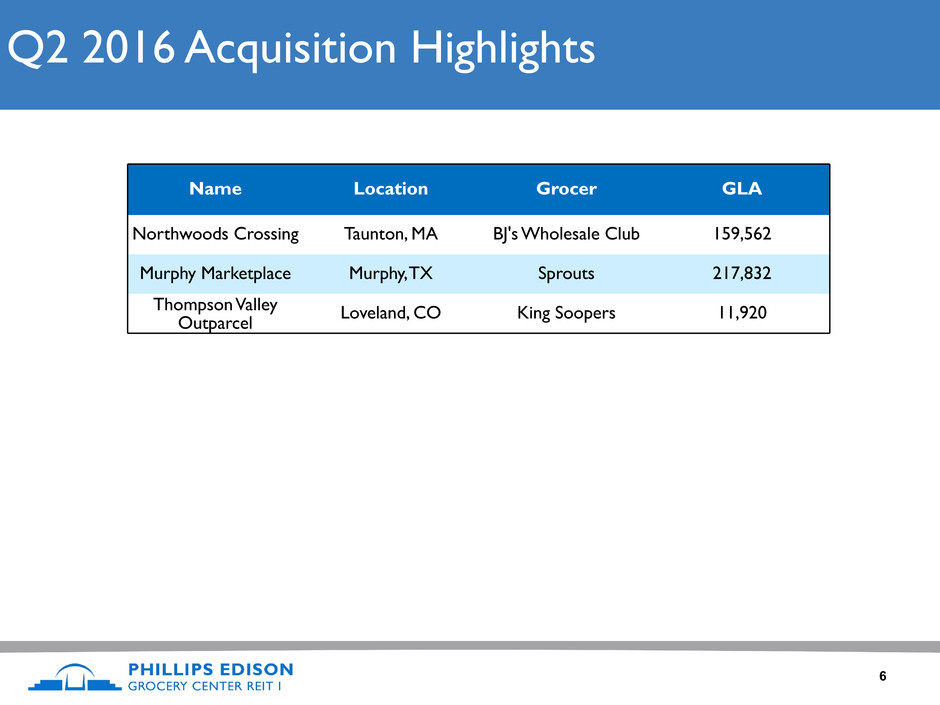

Name Location Grocer GLA

Northwoods Crossing Taunton, MA BJ's Wholesale Club 159,562

Murphy Marketplace Murphy, TX Sprouts 217,832

Thompson Valley

Outparcel Loveland, CO King Soopers 11,920

Q2 2016 Acquisition Highlights

The Grocery REITPhillips Edison-ARC

Grocery Center REIT II

7

Year to Date 2016 Same-Center(1) Net Operating Income

Three Months Ended June 30, Six Months Ended June 30,

(in thousands) 2016 2015 $ Change % Change 2016 2015 $ Change % Change

Revenues:

Rental income(2) $ 41,794 $ 40,516 $ 1,278 $ 83,865 $ 81,138 $ 2,727

Tenant recovery income 14,194 12,184 2,010 28,750 25,357 3,393

Other property income 229 317 (88) 375 615 (240)

56,217 53,017 3,200 6.0% 112,990 107,110 5,880 5.5%

Operating expenses:

Property operating expenses 8,750 7,801 949 18,027 17,255 772

Real estate taxes 8,288 7,775 513 16,726 15,315 1,411

17,038 15,576 1,462 9.4% 34,753 32,570 2,183 6.7%

Total Same-Center NOI $ 39,179 $ 37,441 $ 1,738 4.6% $ 78,237 $ 74,540 $ 3,697 5.0%

(1) Represents 133 properties that we owned and operated prior to January 1, 2015, excluding five properties classified as redevelopment.

(2) Excludes straight-line rental income and the net amortization of above- and below-market leases.

The Grocery REITPhillips Edison-ARC

Grocery Center REIT II

8

Q2 2016 Financial Performance

Three Months Ended June 30, Six Months Ended June 30,

(In thousands) 2016 2015 $ Change(1) % Change 2016 2015 $ Change(1) % Change

Net Income Attributable to Stockholders $ 560 $ 5,370 $ (4,810) (89.6)% $ 2,779 $ 10,341 $ (7,562) (73.1)%

Funds from Operations (FFO) 26,150 30,265 (4,115) (13.6)% 53,688 59,632 (5,944) (10.0)%

Modified Funds from Operations (MFFO) 25,895 29,581 (3,686) (12.5)% 51,737 58,751 (7,014) (11.9)%

(1) For the three and six months ended June 30, 2016, the variance in net income, FFO, and MFFO was primarily related to an increase of $4.7 million

and $9.3 million, respectively, in cash asset management fees as a result of the change in asset management fee structure in October 2015, partially

offset by growth in property income.

The Grocery REITPhillips Edison-ARC

Grocery Center REIT II

9

Debt Profile as of June 30, 2016

• Debt to Total Enterprise Value: 31.9%*

• Weighted-Average Interest Rate: 3.2%

• Weighted-Average Years to Maturity: 3.1

• Fixed-rate debt: 71.0%

• Variable-rate debt: 29.0%

*Calculated as net debt (total debt, excluding below-market debt adjustments and deferred financing costs, less cash and cash equivalents) as a

percentage of enterprise value (equity value, calculated as total common shares and OP units outstanding multiplied by the estimated value per share

of $10.20, plus net debt).

The Grocery REITPhillips Edison-ARC

Grocery Center REIT II

10

Company Updates

• Reaffirmed estimated net asset value per share of $10.20 as of

March 31, 2016*

• Completed Tender Offer

• Share Repurchase Program Status

• Partnered with Griffin Capital Corporation

* Please note that the estimated value per share is not intended to represent an enterprise or liquidation value of our company. It is important to

remember that the estimated value per share may not reflect the amount you would obtain if you were to sell your shares or if we liquidated our

assets. Further, the estimated NAV per share is as of a moment in time, and the value of our shares and assets may change over time as a result of

several factors including, but not limited to, future acquisitions or dispositions, other developments related to individual assets, and changes in the

real estate and capital markets, and we do not undertake to update the estimated NAV per share to account for any such events. You should not rely

on the estimated NAV per share as being an accurate measure of the then-current value of your shares in making a decision to buy or sell your

shares, including whether to participate in our dividend reinvestment plan or our share repurchase program. For a description of the methodology

and assumptions used to determine the estimated NAV per share, see the current Report on Form 8-K filed with the U.S. Securities and Exchange

Commission on April 15, 2016.

The Grocery REITPhillips Edison-ARC

Grocery Center REIT II

11

Appendix

The Grocery REITPhillips Edison-ARC

Grocery Center REIT II

12

Reconciliation of Non-GAAP Financials

We present Same-Center Net Operating Income (“Same-Center NOI”) as a supplemental measure of our performance. We define Net Operating Income (“NOI”) as total operating

revenues less property operating expenses, real estate taxes, and non-cash revenue items. Same-Center NOI represents the NOI for the 133 properties that were operational for the

entire portion of both comparable reporting periods, were not acquired during or subsequent to the comparable reporting periods, and were not classified as redevelopment. We

believe that NOI and Same-Center NOI provide useful information to our investors about our financial and operating performance because each provides a performance measure of the

revenues and expenses directly involved in owning and operating real estate assets and provides a perspective not immediately apparent from net income. Because Same-Center NOI

excludes the change in NOI from properties acquired after December 31, 2014, it highlights operating trends such as occupancy levels, rental rates, and operating costs on properties

that were operational for both comparable periods. Other REITs may use different methodologies for calculating Same-Center NOI, and accordingly, our Same-Center NOI may not be

comparable to other REITs.

Same-Center NOI should not be viewed as an alternative measure of our financial performance since it does not reflect the operations of our entire portfolio, nor does it reflect the

impact of general and administrative expenses, acquisition expenses, interest expense, depreciation and amortization, other income, or the level of capital expenditures and leasing costs

necessary to maintain the operating performance of our properties that could materially impact our results from operations.

The table below is a comparison of the Same-Center NOI for the three and six months ended June 30, 2016 and 2015 (in thousands):

Three Months Ended June 30, Six Months Ended June 30,

(in 000s) 2016 2015 $ Change % Change 2016 2015 $ Change % Change

Revenues:

Rental income(1) $ 41,794 $ 40,516 $ 1,278 $ 83,865 $ 81,138 $ 2,727

Tenant recovery income 14,194 12,184 2,010 28,750 25,357 3,393

Other property income 229 317 (88) 375 615 (240)

56,217 53,017 3,200 6.0% 112,990 107,110 5,880 5.5%

Operating expenses:

Property operating expenses 8,750 7,801 949 18,027 17,255 772

Real estate taxes 8,288 7,775 513 16,726 15,315 1,411

17,038 15,576 1,462 9.4% 34,753 32,570 2,183 6.7%

Total Same-Center NOI $ 39,179 $ 37,441 $ 1,738 4.6% $ 78,237 $ 74,540 $ 3,697 5.0%

(1) Excludes straight-line rental income and the net amortization of above- and below-market leases.

The Grocery REITPhillips Edison-ARC

Grocery Center REIT II

13

Reconciliation of Non-GAAP Financials

Below is a reconciliation of net income (loss) to Same-Center NOI for the six months ended June 30, 2016 and 2015 (in thousands):

Funds from Operations and Modified Funds from Operations

Funds from operations (“FFO”) is a non-GAAP performance financial measure that is widely recognized as a measure of REIT operating

performance. We use FFO as defined by the National Association of Real Estate Investment Trusts (“NAREIT”) to be net income (loss),

computed in accordance with accounting principles generally accepted in the United States of America (“GAAP”) excluding extraordinary

items, as defined by GAAP, and gains (or losses) from sales of depreciable real estate property (including deemed sales and settlements of

pre-existing relationships), plus depreciation and amortization on real estate assets and impairment charges, and after related adjustments

for unconsolidated partnerships, joint ventures and noncontrolling interests. We believe that FFO is helpful to our investors and our

management as a measure of operating performance because, when compared year to year, it reflects the impact on operations from

trends in occupancy rates, rental rates, operating costs, development activities, general and administrative expenses, and interest costs,

which are not immediately apparent from net income.

Three Months Ended June 30, Six Months Ended June 30,

2016 2015 2016 2015

Net income $ 583 $ 5,461 $ 2,836 $ 10,500

Adjusted to exclude:

Interest expense, net 7,574 7,543 15,333 14,337

Other expense, net 42 5 158 125

General and administrative expenses 8,461 2,509 16,014 4,871

Acquisition expenses 1,502 1,487 1,522 3,222

Depreciation and amortization 25,977 25,271 51,683 50,001

Net amortization of above- and below-market leases (310) (176) (582) (354)

Straight-line rental income (814) (1,361) (1,725) (2,605)

NOI 43,015 40,739 85,239 80,097

Less: NOI from centers excluded from Same-Center (3,836) (3,298) (7,002) (5,557)

Total Same-Center NOI $ 39,179 $ 37,441 $ 78,237 $ 74,540

The Grocery REITPhillips Edison-ARC

Grocery Center REIT II

14

Reconciliation of Non-GAAP Financials

Since the definition of FFO was promulgated by NAREIT, GAAP has expanded to include several new accounting pronouncements, such

that management and many investors and analysts have considered the presentation of FFO alone to be insufficient. Accordingly, in

addition to FFO, we use modified funds from operations (“MFFO”), which excludes from FFO the following items:

• acquisition fees and expenses;

• straight-line rent amounts, both income and expense;

• amortization of above- or below-market intangible lease assets and liabilities;

• amortization of discounts and premiums on debt investments;

• gains or losses from the early extinguishment of debt;

• gains or losses on the extinguishment of derivatives, except where the trading of such instruments is a fundamental

attribute of our operations;

• gains or losses related to fair-value adjustments for derivatives not qualifying for hedge accounting; and

• adjustments related to the above items for joint ventures and noncontrolling interests and unconsolidated entities in the

application of equity accounting.

We believe that MFFO is helpful in assisting management and investors with the assessment of the sustainability of operating

performance in future periods and, in particular, after our acquisition stage is complete, because MFFO excludes acquisition expenses that

affect operations only in the period in which the property is acquired. Thus, MFFO provides helpful information relevant to evaluating our

operating performance in periods in which there is no acquisition activity.

The Grocery REITPhillips Edison-ARC

Grocery Center REIT II

15

Reconciliation of Non-GAAP Financials

Neither FFO nor MFFO should be considered as an alternative to net income (loss) or income (loss) from continuing operations

under GAAP, nor as an indication of our liquidity, nor is either of these measures indicative of funds available to fund our cash needs,

including our ability to fund distributions. MFFO may not be a useful measure of the impact of long-term

operating performance on value if we do not continue to operate our business plan in the manner currently contemplated.

Accordingly, FFO and MFFO should be reviewed in connection with other GAAP measurements. FFO and MFFO should not

be viewed as more prominent measures of performance than our net income or cash flows from operations prepared in

accordance with GAAP. Our FFO and MFFO as presented may not be comparable to amounts calculated by other REITs.The

following section presents our calculation of FFO and MFFO and provides additional information related to our

operations.

The Grocery REITPhillips Edison-ARC

Grocery Center REIT II

16

Reconciliation of Non-GAAP Financials

Three Months Ended June 30, Six Months Ended June 30,

(in 000s) 2016 2015 2016 2015

Calculation of FFO

Net income attributable to stockholders $ 560 $ 5,370 $ 2,779 $ 10,341

Adjustments:

Depreciation and amortization of real estate assets 25,977 25,271 51,683 50,001

Noncontrolling interest (387) (376) (774) (710)

FFO attributable to common stockholders $ 26,150 $ 30,265 $ 53,688 $ 59,632

Calculation of MFFO

FFO attributable to common stockholders $ 26,150 $ 30,265 $ 53,688 $ 59,632

Adjustments:

Acquisition expenses 1,522 3,222 1,522 3,222

Net amortization of above- and below-market leases (582) (354) (582) (354)

Write-off of unamortized deferred financing fees 56 93 105 140

Straight-line rental income (1,725) (2,605) (1,725) (2,605)

Amortization of market debt adjustment (1,169) (1,322) (1,169) (1,322)

Change in fair value of derivatives (21) (70) 32 (23)

Noncontrolling interest 43 61 43 61

MFFO attributable to common stockholders $ 24,274 $ 29,290 $ 51,914 $ 58,751

Earnings per common share:

Basic:

Weighted-average common shares outstanding 183,514 184,342 182,880 183,669

Net income per share $ 0.00 $ 0.03 $ 0.02 $ 0.06

FFO per share 0.14 0.16 0.29 0.32

MFFO per share 0.14 0.16 0.28 0.32

Diluted:

Weighted-average common shares outstanding 186,299 187,127 185,665 187,127

Net income per share $ 0.00 $ 0.03 $ 0.01 $ 0.06

FFO per share 0.14 0.16 0.29 0.32

MFFO per share 0.14 0.16 0.28 0.32

The Grocery REITPhillips Edison-ARC

Grocery Center REIT II

17

Thank You

www.grocerycenterREIT1.com

DST: 888.518.8073

Griffin Capital Services: 866.788.8614