UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________________

AMENDMENT NO. 1

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 15, 2010

_______________________________________________________________

PRIME GLOBAL CAPITAL GROUP INCORPORATED

(Exact name of registrant as specified in its charter)

| NEVADA | 000-54288 | 26-4309660 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) | (I.R.S. Employer Identification No.) |

E-5-2, Megan Avenue 1, Block E

Jalan Tun Razak

50400 Kuala Lumpur, Malaysia

(Address of principal executive offices) (Zip Code)

+603 2162 0773

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

EXPLANATORY NOTE

This Amendment No. 1 to Form 8-K amends Item 1.01 of our Current Report on Form 8-K filed with the Securities and Exchange Commission on November 15, 2010. This Amendment No. 1 to Form 8-K is being filed to revise our disclosures regarding the sale of our common stock to include the names of the purchasers and the amount of shares purchased thereby.

Except as described above, this Amendment No. 1 to Form 8-K does not amend, update or change any other items or disclosures in the original filing and does not purport to reflect any information or events subsequent to the filing date of the original filing. As such, this amended Form 8-K report speaks only as of the date the original filing was filed, and the Registrant has not undertaken herein to amend, supplement or update any information contained in the original filing to give effect to any subsequent events. Accordingly, this amended Form 8-K should be read in conjunction with the Registrant’s filings made with the Securities and Exchange Commission subsequent to the filing of the original filing, including any amendment to those filings.

Item 1.01 Entry into a Material Definitive Agreement.

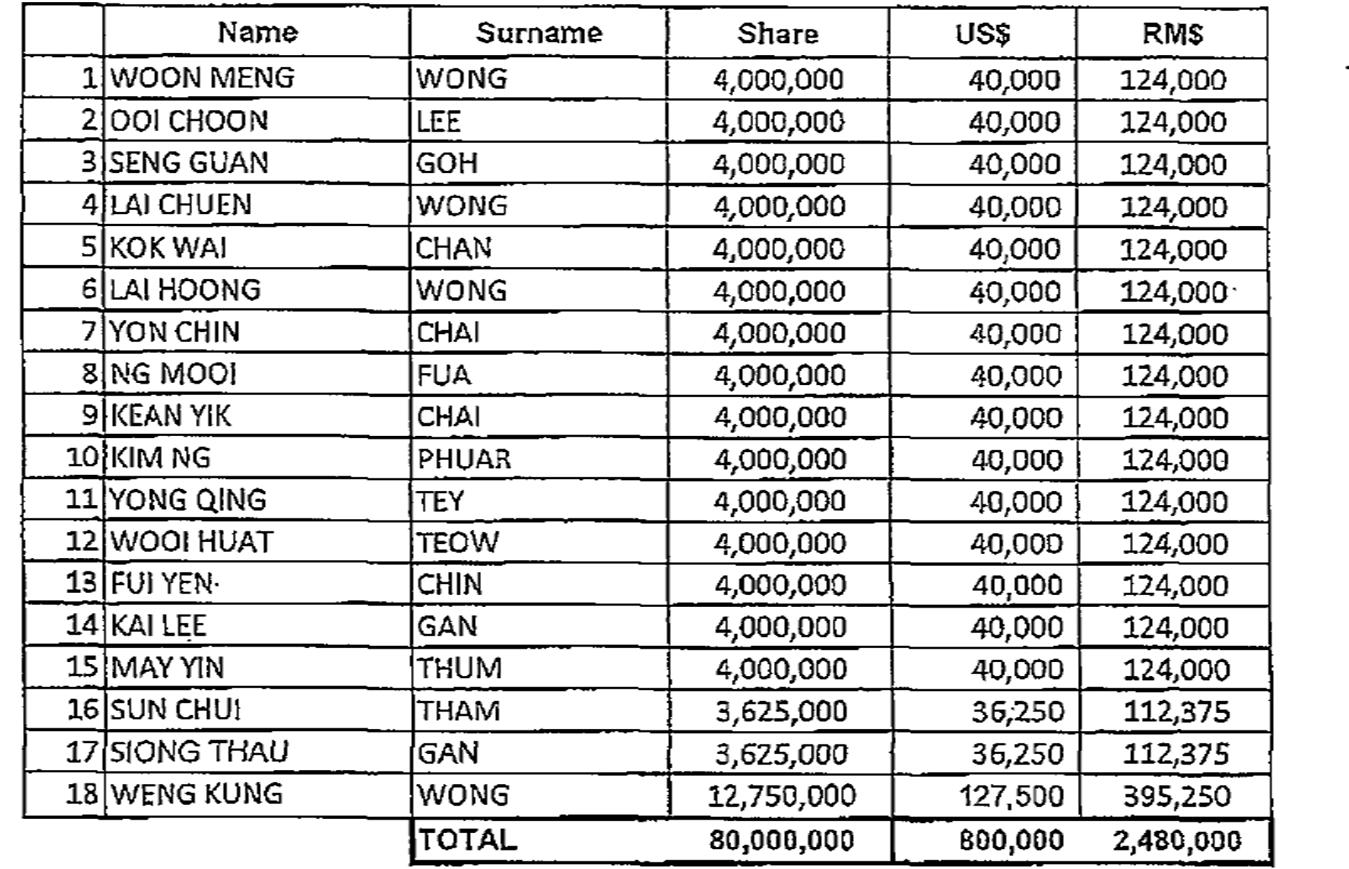

On November 15, 2010, Home Touch Holding Company, a Nevada corporation (the “Company”) consummated the sale to 18 accredited investors of an aggregate of 80,000,000 shares of its common stock, par value $0.001 (the “Shares”), at a per share price of $0.01, or $800,000 in the aggregate, in accordance with the terms and conditions of certain subscription agreements made with such investors (the “Subscription Agreements”). The Subscription Agreements contain terms and conditions that are normal and customary for a transaction of this type. The Company expects to receive net proceeds of approximately $795,000 from the sale of the Shares and will use the net proceeds for general corporate purposes. The Shares were sold pursuant to the exemption provided by Section 4(2) of the Securities Act of 1933, as amended and Regulation D promulgated thereunder.

The 18 investors are set forth below:

| 2 |

The foregoing description of the form of Subscription Agreements is qualified in its entirety by reference thereto, which is filed as Exhibit 10.1 to this Current Report, respectively, and is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| PRIME GLOBAL CAPITAL GROUP INCORPORATED | ||

| Dated: August 12, 2016 | ||

| By: | /s/ Liong Tat Teh | |

| Liong Tat Teh | ||

| Chief Financial Officer | ||

| 3 |