Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - Turnpoint Medical Devices, Inc. | v442032_ex23-1.htm |

| EX-10.11 - EXHIBIT 10.11 - Turnpoint Medical Devices, Inc. | v442032_ex10-11.htm |

| EX-10.10 - EXHIBIT 10.10 - Turnpoint Medical Devices, Inc. | v442032_ex10-10.htm |

| EX-10.9 - EXHIBIT 10.9 - Turnpoint Medical Devices, Inc. | v442032_ex10-9.htm |

| EX-10.8 - EXHIBIT 10.8 - Turnpoint Medical Devices, Inc. | v442032_ex10-8.htm |

| EX-10.7 - EXHIBIT 10.7 - Turnpoint Medical Devices, Inc. | v442032_ex10-7.htm |

| EX-10.6 - EXHIBIT 10.6 - Turnpoint Medical Devices, Inc. | v442032_ex10-6.htm |

| EX-10.5 - EXHIBIT 10.5 - Turnpoint Medical Devices, Inc. | v442032_ex10-5.htm |

| EX-10.4 - EXHIBIT 10.4 - Turnpoint Medical Devices, Inc. | v442032_ex10-4.htm |

| EX-10.3 - EXHIBIT 10.3 - Turnpoint Medical Devices, Inc. | v442032_ex10-3.htm |

| EX-10.1 - EXHIBIT 10.1 - Turnpoint Medical Devices, Inc. | v442032_ex10-1.htm |

| S-1/A - S-1/A - Turnpoint Medical Devices, Inc. | v442032_s1a.htm |

Exhibit 10.2

DEVELOPMENT AGREEMENT

This Development Agreement (this “Agreement”) executed this 29th day of October, 2014, effective as of March 28, 2014 (the “Effective Date”), is by and between Point Medical, Inc., a Delaware corporation (“PMI”), and Leveraged Developments LLC, a New Hampshire limited liability company (“LD”). PMI and LD are individually a “Party”, and together are the “Parties,” to this Agreement.

WITNESSETH

WHEREAS, LD and PMI are parties to the Point Medical, Inc. Leveraged Developments LLC License/Development/Intellectual Property and Collaboration Agreement Terms dated 28 March 2014 (the “Term Sheet”), which contemplates this Agreement as well as the Asset Purchase and Intellectual Property Assignment Agreement (as hereafter defined), and the Parties have been performing pursuant to terms thereof, it being understood that this Agreement and the Asset Purchase and Intellectual Property Assignment Agreement will supersede and terminate the Term Sheet effective as the date hereof to the extent of the matters contemplated by this Agreement and effective as of the Closing to the extent of the matters contemplated by the Asset Purchase and Intellectual Property Agreement;

WHEREAS, PMI and LD are simultaneously entering into an Asset Purchase and Intellectual Property Assignment Agreement (the “Asset Purchase and Intellectual Property Assignment Agreement”) pertaining to the transfer by LD to PMI of tangible and intangible assets pertaining to the Product;

WHEREAS, certain personnel of LD have expertise in the engineering and development of the Product, PMI desires for such personnel to continue to carry out the engineering, development and Regulatory Approval of the Product pursuant to the Development Program, on behalf of and for the benefit of PMI;

WHEREAS, in entering into this Agreement, it is in the best interest of both PMI and LD to support the market entry, validation, market approval and market acceptance of the Product as the best-in-class technology that enables a new clinical standard of care, and for LD to collaborate with and assist PMI in negotiations with Third Parties to secure acceptable transfer costs, margins and other business objectives;

WHEREAS, it is the intent and expectation of the Parties to collaborate on marketing initiatives such as trade shows, expert panels/advisors, and trade organization involvement as appropriate in supporting the mutual interest of both Parties to the extent determined by PMI; and,

NOW THEREFORE, in consideration of the foregoing recitals and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

1. Recitals. The representations contained in the foregoing ‘WHEREAS clauses’ are incorporated into this Agreement as if fully set forth herein.

2. Definitions. For the purpose of this Agreement, the following definitions shall be applicable:

2.1 “Affiliates” shall have the meaning as set forth within the Asset Purchase and Intellectual Property Assignment Agreement.

2.2 “Assigned Intellectual Property Rights” shall have the meaning as set forth within the Asset Purchase and Intellectual Property Assignment Agreement.

2.3 “Assigned Patent Rights” shall have the meaning as set forth within the Asset Purchase and Intellectual Property Assignment Agreement.

2.4 “Assigned Trademark Rights” shall have the meaning as set forth within the Asset Purchase and Intellectual Property Assignment Agreement.

2.5 “Carlisle Intellectual Property Assignment Agreement” shall have the meaning set forth in the Asset Purchase and Intellectual Property Assignment Agreement.

2.6 “Closing” shall have the meaning as set forth within the Asset Purchase and Intellectual Property Assignment Agreement.

2.7 “Closing Date” shall mean that date on which the Closing occurs.

2.8 “Competing Product” means any product, item or Improvement which competes or potentially competes with the Product including any Product Accessory or any product or item conceived of in connection with the Research and Development Agreement or which constitutes an Improvement to the Product including any Product Accessory or other improvement to any product or item conceived of in connection with the Research and Development Agreement.

2.9 “Commercially Reasonable Efforts” shall mean, with respect to the development or commercialization of the Product, efforts and resources commonly used in the medical device industry for a product of similar commercial potential at a similar stage in its lifecycle, taking into consideration its safety and efficacy, its cost to develop, the competitiveness of alternative products, its proprietary position, the likelihood of regulatory approval, its profitability, and all other relevant factors. Commercially Reasonable Efforts shall be determined on a market-by market basis without regard to the particular circumstances of a Party, including any other product opportunities of such Party.

2.10 “Confidential Information” shall have the meaning set forth in the Confidential Disclosure Agreement by and between the Parties dated February 28, 2014, except as modified by Section 8 of this Agreement.

2.11 “Control” or “Controlled” shall mean Information and Inventions, Patent Rights or other intellectual property right, possession of the ability, whether directly or indirectly, and whether by ownership, license or otherwjse, to assign, or grant a license, sublicense or other right to or under, as provided for herein without violating the tenns of any agreement or other arrangement with any Third Party.

2

2.12 “Development” shall have the meaning ascribed to it in the Carlisle Intellectual Property Assignment Agreement.

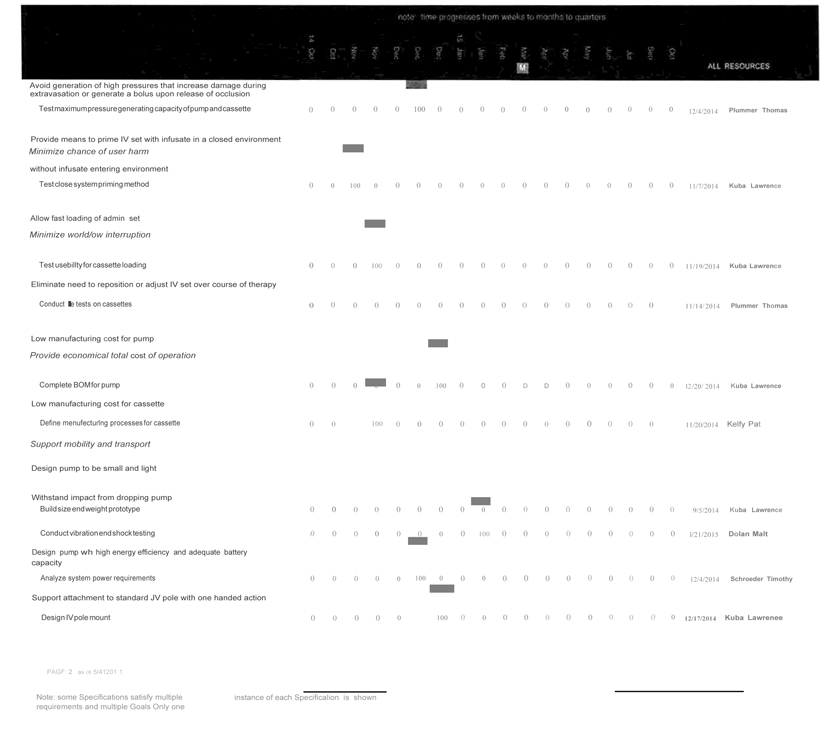

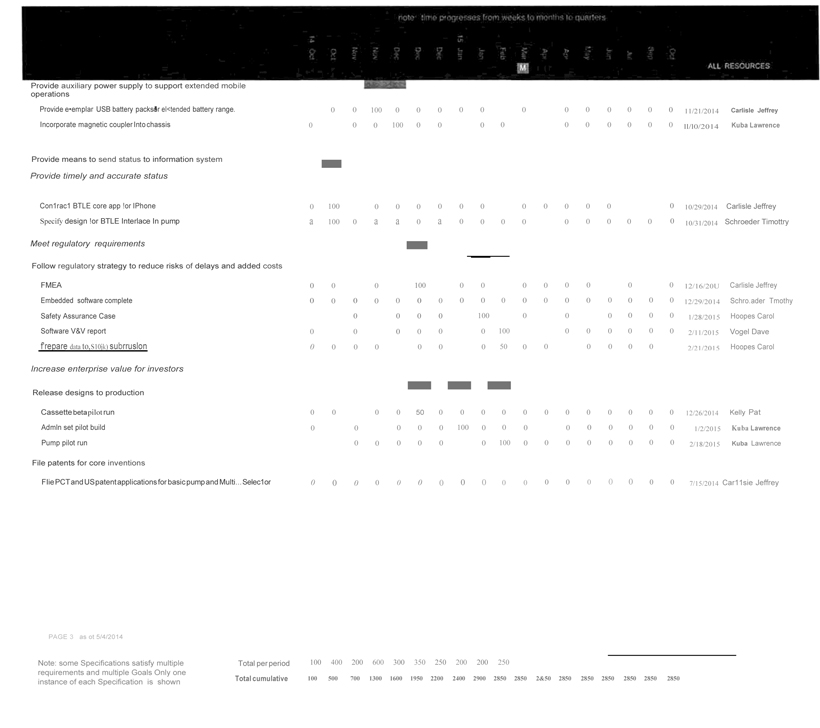

2.13 “Development Plan” means the plan for the development of the Product, including requirements, features, specifications, priorities, milestones, constraints and time schedule and other infonnation delivered and agreed to by the parties from time to time. The Development Plan as of the date of the execution of this Agreement is attached as Exhibit A. Beginning not later than thirty (30) days after the date of the signing of this Agreement and thereafter on a monthly basis or more frequently as shall be mutually agreed, LD and PMI will, in good faith, meet, discuss and update the Development Plan. The Development Plan shall be based upon the application by LD of Commercially Reasonable Efforts to the Development Program in order to apply for Regulatory Approval for the optimized Product at the earliest possible date.

2.14 “Development Program” shall mean the program for designing, engineering, developing, optimizing, testing, initiating manufacturing and obtaining Regulatory Approval for commercial marketing of the Product pursuant to the Development Plan and Product Accessories checklist.

2.15 “Field” shall mean any and all commercial use, commercial markets and any research applications related to the field of medicine, including but not limited to (i) any and all hospital-based applications for the Product, (ii) any and all clinic or clinical-based applications for the Product, and (iii) any and all non-hospital sites or non-hospital markets, nursing facilities, veterinary facilities, including but in no way limited to alternate site, alternate care, emergency care, and home care markets.

2.16 “First Commercial Sale” shall mean the date on which PMI or its designated agent, in a commercial transaction, first sells the Product to a Third Party following Regulatory Approval, including but limited to FDA approval.

2.17 “FDA” shall mean The Food and Drug Administration of the United States Department of Health and Human Services, or any successor agency(ies) thereof performing similar functions.

2.18 “Gross Margin” shall mean Net Sales minus cost of goods sold (“COGS”).

2.19 “Improvement” shall mean any modification, variation or revision to an apparatus, method, product or technology, or any discovery, technology, device, process or formulation related to an apparatus, method, product or technology, whether or not patented or patentable, including any enhancement in the manufacture or steps or processes thereof, ingredients, preparation, presentation, formulation, method, product or technology, any discovery or development of any new or expanded indications for an apparatus, method, product or technology, or any discovery or development that improves the stability, safety or efficacy of an apparatus, method, product or technology), in each case, to the extent related to the Technology or the Product including without limitation the Product Accessories and/or Assigned Intellectual Property Rights.

3

2.20 “Information and Inventions” shall mean all technical, scientific and other know how and information, trade secrets, knowledge, technology, means, methods, processes, practices, formulas, instructions, skills, techniques, procedures, experiences, ideas, technical assistance, designs, drawings, assembly procedures, computer programs, apparatuses, specifications, data, results and other material, including pre-clinical and clinical trial results, manufacturing procedures and test procedures and techniques, (whether or not confidential, proprietary, patented or patentable) in written, electronic or any other form now known or hereafter developed, and all Improvements, whether to the foregoing or otherwise, and other discoveries, developments, inventions, and other intellectual property (whether or not confidential, proprietary, patented or patentable), in each case, to the extent related to the Technology or the Product including without limitation the Product Accessories and/or Assigned Intellectual Property Rights.

2.21 “Intellectual Property Rights” shall have the meaning set forth in the Carlisle Intellectual Property Assignment Agreement.

2.22 “LD Note to PMI” shall have the meaning set forth within the Asset Purchase and Intellectual Property Assignment Agreement.

2.23 “LD Post-Effective Date Know-How” shall mean all proprietary knowledge, information and expertise obtained, developed or created by LD after the Effective Date or as to which LD has rights relating to the Technology, whether or not covered by any patent, patent application or future patent application, software, derivative works, and other works, whether copyrightable or not, copyright design, trademark, trade secret or other industrial or intellectual property rights, including without limitation the Technology Intellectual Property, Improvements, Information and Inventions.

2.24 “Multi-Source Selector” shall mean the planned device referenced in Exhibit B for selecting and directing different fluid sources to the Pump for administering infusion therapy.

2.25 “Net Sales” shall mean the gross amounts invoiced for sales of the Product in the Territory by PMI, its Affiliates and/or its sublicensees to Third Parties, less deductions for the following costs actually allowed or incurred:

(i) freight, postage and transportation charges on shipment of such Product to the customer, including handling and insurance on such shipment;

(ii) sales (such as VAT or its equivalent) and excise taxes, other consumption taxes, customs duties and other governmental charges imposed upon the sale of the Product to the customer;

(iii) charge-back payments, rebates, and similar product- specific payments paid to a governmental entity specifically with respect to sales of the Product under a governmental rebate program;

4

(iv) trade, quantity and cash discounts actually granted to the customer with respect to the Product;

(v) credits, rebates and charge-backs, and allowances or credits to the customer on account of damaged products, rejection or returns of the Product or on account of retroactive price reductions affecting the Product;

(vi) actual bad debt expense not to exceed 3% of gross amounts invoiced; and

(vii) any item similar in character or substance to any of the foregoing prevailing at the time and customary in the medical device industry at the time as determined by PMI.

Notwithstanding the foregoing, sales among a Party and its Affiliates or permitted sublicensees for resale shall be excluded from the computation of Net Sales; provided, however, that the subsequent resale shall be included in Net Sales hereunder. If a Product is sold for consideration other than cash, the Net Sales from such sale or transfer shall be deemed the then fair market value of such Product. The supply of the Product without charge (i) as commercial samples, (ii) as charitable donations or (iii) for use in development and post-marketing studies shall be excluded from the computation of Net Sales.

In the event that a Product is sold as part of a Combination Product (as defined in Section 5.7), Net Sales from sales of such Combination Product shall be determined pursuant to this same Section 5.7.

2.26 “Patent” shall mean a patent or a patent application, including any divisions, continuations, continuations-in-part, invention certificates, substitutions, reissues, reexaminations, extensions, registrations, patent term extensions, supplementary protection certificates and renewals of any of the above, and any foreign equivalents of any of the foregoing.

2.27 “Patent Rights” shall mean any of the following: (a) United States patents; (b) United States patent applications (both provisional and non-provisional), PCT patent applications, and divisionals, continuations and claims of continuation-in-part applications which shall be directed to subject matter specifically described in such United States and/or PCT patent applications, and the resulting patents (whether such divisionals, continuations or continuation in-part applications are based upon a United States patent, United States patent application or PCT application); (c) any patents resulting from reissues or reexaminations of the United States patents described in (a) and (b) above; (d) foreign patents; (e) foreign patent applications and, to the extent applicable, divisionals, continuations and claims of continuation-in-part applications which shall be directed to subject matter specifically described in such foreign patent applications, and the resulting patents (whether such divisionals, continuations or continuation in-part applications are based upon a foreign patent application or a foreign patent); (f) any foreign patents, resulting from foreign procedures similar to United States reissues and reexaminations, of the foreign patents and applications described in (d) and (e) above as disclosed within Assigned Patent Rights, Improvements, and Information and Inventions; and, (g) any additional inventions conceived after the Effective Date and during the Term of this Agreement ) which relate to the Technology which are not covered under subparts (a) -(g).

5

2.28 “Product” shall have the meaning as set forth within the Asset Purchase and Intellectual Property Assignment Agreement.

2.29 “Product Accessories” shall have the meaning as set forth within the Asset Purchase and Intellectual Property Assignment Agreement.

2.30 “Pump” shall mean the infusion pump Product based on the IP conveyed in the Asset Purchase and Intellectual Property Assignment Agreement.

2.31 “Regulatory Approval” shall mean any approval, licenses, registrations, or authorizations of any applicable supra-national, federal, national, regional, state, provincial or local regulatory agencies, departments, bureaus, commissions, councils or other government Regulatory Authority regulating or otherwise exercising authority with respect to the Product in the Territory and required for the manufacture, use, storage, import, transport or sale of any such Product in any country of the Territory, including but not limited Pre-Market Notifications (“510(k)”) European Commission (“EC”) Annex II CE Mark certifications, Doctor and Dentist Exemption Certificates (“DDX”), Clinical Trials in Marketed Products (“CTMP”), Drug Master Files (“DMF”), national filings, Manufacturing Authorization Applications (“MAA”), MAA dossiers, MAA renewals, MAA variations and Clinical Trials Exemptions (“CTX”).

2.32 “Regulatory Authority” shall mean any applicable supra-national, federal, national, regional, state, provincial or local regulatory agencies, departments, bureaus, commissions, councils or other government entities regulating or otherwise exercising authority with respect to the Technology or the Product in the Territory.

2.33 “Regulatory Changes” shall mean any changes in or to a Product, its components or its Regulatory Approval imposed by the applicable Regulatory Authority subsequent to Regulatory Approval. For the avoidance of doubt, changes which LD makes for product quality, compliance requirements, and productivity improvements not imposed by the applicable Regulatory Agency shall not be considered Regulatory Changes.

2.34 “Research and Development Agreement” shall mean the Research and Development Agreement of even date herewith.

2.35 “Specifications” shall mean the minimum specification for the manufacture and performance of the Product, which shall be established by LD and agreed upon by the Parties and documented in the Development Plan and additionally through Product Accessories.

2.36 “Technology” shall have the meaning as set forth within the Asset Purchase and Intellectual Property Assignment Agreement.

2.37 “Technology Intellectual Property” shall mean any Patent, Patent Rights or Trademark that at any applicable time after the Effective Date during the Term is Controlled by LD that is necessary or useful to make, use, sell, offer for sale, import or export the Product including without limitation Product Accessories for use in the Field within the Territory.

6

2.38 “Term” shall have the meaning set forth in Section 6.

2.39 “Territory” shall mean worldwide.

2.40 “Third Party” shall mean any entity other than PMI or LO and their respective Affiliates.

2.41 “Trademark” shall mean any word, name, symbol, device, or any combination thereof used by a person or any other entity or which a person or any other entity has a bona fide intention to use in commerce to identify and distinguish the goods produced or distributed, including a unique product, from those manufactured or sold by others to indicate the source of those goods.

2.42 “Transferred Assets” shall have the meaning ascribed to it by the Asset Purchase and Intellectual Property Assignment Agreement.

2.43 “Valid Claim” shall mean, with respect to a particular country, either: (i) a claim of an issued and unexpired patent included within the Patent Rights that has not been held permanently revoked, unenforceable ·or invalid by a decision of a court or other governmental agency of competent jurisdiction, unappealable or unappealed within the time allowed for appeal, and that has not been admitted to be invalid or unenforceable through reissue or disclaimer or otherwise; or (ii) a claim of a pending patent application included within the Patent Rights that claim was filed in good faith and has not been abandoned or finally disallowed without the possibility of appeal or refiling of said application. In the event that a claim of an issued and unexpired patent within the Patent Rights is held by a court or other governmental agency of competent jurisdiction to be unenforceable, unpatentable or invalid, and such holding is reversed on appeal by a higher court or agency of competent jurisdiction, such claim shall be reinstated thereafter as a Valid Claim hereunder.

| 3. | Development Program. |

3.1 Purpose and Scope. The Parties wish to and hereby agree pursuant to the terms hereof to collaborate in the development and commercialization of the Product within the Field. LD under this Agreement will have responsibility for engineering and developing the initial Product and Product Accessories, subject to the terms hereof. PMI under this Agreement will provide consideration to LD for specific deliverables, including all technical development activities, pre-production activities, regulatory filings and completed product readiness for product launch and shipments. LD will be the development party in this Agreement and PMI will be the commercial party with all title and rights to the assigned technology and Product as defined in the Asset Purchase and Intellectual Property Assignment Agreement. To that end, the Parties will embark on a Development Program with each party bearing specified responsibilities, all as further described herein. This Agreement contemplates the development, support of PMI’s filing and otherwise for obtaining Regulatory Approval, and manufacturing preparations completed by LD and the marketing and commercial sale of the Product by PMI. PMI, at its sole discretion, may fund additional product development programs with LD beyond the Product and/or within the time frame and payment schedule currently set forth in Section 3.6, and nothing in this Agreement shall be deemed to extend beyond or to apply to anything other than the Product, or to limit or obligate PMI in any way with respect to products other than the Product. Notwithstanding the foregoing, PMI agrees to reasonably consult with LO as to its interest in and capabilities with respect to the development of products in addition to the Product.

7

3.2 Development of the Product. The Parties each agree that they will use Commercially Reasonable Efforts to develop the Product as set forth by the Development Program in view of the specified responsibilities of each Party. To this end, the Parties shall develop mutually agreeable Specifications for the Product based on the parameters as set forth in the Development Plan (attached to this Agreement and included herein as Exhibit A) and Product Accessories checklist (attached to this Agreement as Exhibit B) and pursuant to the results of activities undertaken during the course of the Development Program. The Parties will work constructively together to insure all options necessary for a minimally marketable Product having gained Regulatory Approval are planned for and completed under the Development Program.

| 3.3 | Conduct of Development Program. |

3.3.1 LD’s Obligations. LO shall use its good faith business and scientific judgment as applied to commercial development projects, to allocate sufficient time, effort, equipment and facilities to carry out the Development Program in accordance with the timelines set forth therein, including but not necessarily limited to the timeline pursuant to the Development Plan. LD shall work diligently, consistent with accepted business practices and legal requirements, to develop the Product. Such LD obligations shall at least include (i) use Commercially Reasonable Efforts to diligently complete development of the Product as indicated through the Development Program, (ii) prepare for and initiate manufacturing of the Product in conjunction with a selected Third Party manufacturer (including with Mack Holding Company), (iii) support of PMI’s efforts to obtain Regulatory Approval for the Product, including without limitation by way of creating and preparing all Product related material needed in conjunction with the filing for Regulatory Approval, (iv) advise and assist PMI on negotiations with MACK Group Corporation (MACK) or any other proposed Third Party manufacturer of the Product or any Product Accessory, to the extent requested by PMI, and (v) advise PMI on PMI’s plans for successful commercial Product launch and execution, to the extent requested by PMI. LD shall conduct its efforts hereunder in strict accordance with all applicable laws, regulations and guidelines, including without limitation, the requirements for Regulatory Approval. For the avoidance of doubt, LD shall not, in any capacity, directly or indirectly engage in the marketing or commercial sale of the Product or any Product Accessory or any other product pertaining to the Transferred Assets or any LD Post-Closing Know-How, other than providing assistance to PMI or an authorized PMI licensee as indicated in this subsection.

8

3.3.2 PMI’s Obligations. PMI shall use its good faith business and scientific judgment as applied to commercial development projects, to allocate sufficient time and effort to carry out its obligations under the Development Program, including but not necessarily limited to the timeline pursuant to the Development Plan. Such PMI obligations shall at least include (i) securing the capital reasonably needed to support the Development Program, (ii) develop and prepare critical go-to-market elements for successful Product commercial release, (iii) file for Regulatory Approval for the Product; (iv) develop and implement a product support/tracking and customer clinical support plan, (v) work with LO as required in collaboration on final design and market readiness for the first Product given Regulatory Approval, (vi) engage new customers and partners as appropriate in preparation for the launch of the Product upon Regulatory Approval, and (vii) engage in the offer for sale, sale, export or import of the Product either directly or through an authorized PMI licensee or other distribution channel, and manage the process and be solely responsible for the cost of any recall or field remediation action for any Product which is sold. PMI shall also promptly evaluate each iteration of the Product prototype to enable LO to meet its performance deadlines pursuant to the Development Plan and obligations pursuant to Section 3.3.1. PMI shall conduct its efforts hereunder in strict accordance with all applicable laws, regulations and guidelines, including without limitation, the requirements for Regulatory Approval.

3.3.3 Expenses. In any collaborative activity pursuant to development of a Product, reasonable travel expenses may be reimbursed from one Party to the other Party as appropriate and standard in the industry. As a default understanding, each Party will be responsible for its own expenses, unless mutually agreed otherwise on a case by case basis.

| 3.4 | Clinical Trials and Regulatory Approval. |

3.4.1 Clinical Trials. Subject to the terms of the Development Plan and further pursuant to Section 3.3.1, in the Territory, LD shall (i) use its Commercially Reasonable Efforts to conduct required clinical trials of the Product and support PMI’s efforts to obtain Regulatory Approval for the Product and for applicable regulatory compliance, and (ii) be responsible for all activities related to the development and quality assurance/quality control relating to the Product and (iii) include PMI in such efforts in a consultative capacity at PMI’s sole discretion.

3.4.2 Regulatory Approval. Subject to the terms of the Development Plan and further pursuant to Section 3.3.1, LD shall use its Commercially Reasonable Efforts to prepare all Product related materials needed for Regulatory Approval, including supporting any Pre Market Notifications (“51O(k)”) submitted by PMI to the FDA, and shall have primary responsibility for: (i) all clinical data and reports related to Product studies, and (ii) data support for all Regulatory Approvals covering the Product in the Territory. LD and PMI shall consult with each other, to the extent determined by PMI, with respect to communications with the FDA, and LD shall provide copies to PMI of all proposed FDA data and other material for submission to FDA, as much as in advance of the proposed submission or delivery as reasonably practicable. The Parties shall cooperate in good faith with respect to all such submissions and meetings with the FDA relating to regulatory approval of the Product. All regulatory dossiers or other regulatory filings pursuant to this Section 3.4.2 for the Product shall be the sole and exclusive property of PMI.

3.5 PMI Site Visits to LD. Upon the delivery of five (5) days prior written notice, PMI shall have the right to visit the facilities of LD to meet with LD representatives for any purpose whatsoever relating to this Agreement and/or the Development Program, including without limitation status conferences, development updates and oversight of the Development Program.

9

3.6 Development Costs. PMI shall fund the development of the Product through the Regulatory Approval process and Product release according to the following payment schedule, with the first payment due to LD on the l st day of the month following the Effective Date, with subsequent monthly payments due to LD on the 1st day of each succeeding month until the cumulative payment total equals One Million Dollars ($1,000,000), with a sliding monthly payment scale as indicated in this Section 3.6; provided, however, that such payment obligations shall cease in the event that the Closing under the Asset Purchase and Intellectual Property Assignment Agreement shall not occur as provided for therein. Provided that such Closing shall occur, an additional payment of $200,000 from PMI to LO shall occur upon the latter of (i) the 1st day of month twelve ( 12) following the Effective Date or (ii) obtaining Regulatory Approval of a Product. PMI may, at its sole discretion, accelerate payment of development costs pursuant to this Section 3.6 to coincide with an accelerated completion of a first Product under the Development Program. Any such accelerated payment schedule shall be memorialized as an amendment to this Agreement.

| Month | Monthly Payment Due (US$, in OOO’s) | Cumulative Amount (US$, in OOO’s) | ||||||

| 1 | 40 | 40 | ||||||

| 2 | 30 | 70 | ||||||

| 3 | 50 | 120 | ||||||

| 4 | 120 | 240 | ||||||

| 5 | 120 | 360 | ||||||

| 6 | 120 | 480 | ||||||

| 7 | 120 | 600 | ||||||

| 8 | 120 | 720 | ||||||

| 9 | 120 | 840 | ||||||

| 10 | 120 | 960 | ||||||

| 11 | 40 | 1000 | ||||||

| Latter of Month 12 or Regulatory Approval | 200 | 1200 | ||||||

3.7 Regulatory Inspections. LD, or any entity contracted by LD to manufacture the Product, shall cooperate with any inspection of its facilities by a Regulatory Authority in the Territory, including but not limited to any inspection by such Regulatory Authority prior to the granting of Regulatory Approval to market the Products in the Territory. LD shall notify PMI as soon as possible of any notification received by LD from any Regulatory Authority in the Territory to conduct an inspection of its manufacturing or other facilities used in the manufacturing, packaging, storage or handling of the Product, or relating to any claim of non compliance with regulatory requirements. Copies of all correspondence and notices relevant to the Product to and from the Regulatory Authority in the Territory will be provided by LD to PMI.

3.8 Regulatory Changes. The Parties each agree that any Regulatory Changes shall automatically become part of the Project including the Development Plan.

10

3.9 Records. LD will maintain for the longer of a period of ten (10) years or per regulatory requirements all records generated in the course of its performance under this Agreement and necessary to evidence compliance with such laws and regulations as are applicable to the design and manufacture of the Product. All such records shall be deemed the property of PMI, and a true and correct copy of any such records shall promptly made available to PMI whenever requested by PMI.

3.10 Consultants and Subcontractor§.. LD shall, as part of its regular project management communication to PMI, identify any consultant or subcontractor who is to provide services under this Agreement prior to the retention of same. Except as may be otherwise approved by PMI, such consultant or subcontractor shall not be retained unless they have entered into a written agreement with the Parties whereby the consultant or subcontractor agrees to (i) hereby assign to PMI all rights, title and interest in any intellectual property, know-how and the like (which shall be deemed LD Post-Closing Know-How under this Agreement) developed as a result of their providing such services, (ii) agree to execute any documents and take all actions that are reasonably necessary to perfect such assignment in the future; and (iii) provide to PMI any licenses in any intellectual property owned, controlled or utilized by such consultant or subcontractor that may be required in order for PMI to utilize LD Post-Closing Know-How developed by the consultants or subcontractors as a result of their providing such services.

| 4. | Intellectual Property and License Grants. |

4.1 Ownership of Intellectual Property Rights. LD hereby assigns and agrees to assign to PMI all Intellectual Property Rights created or arising after the Effective Date in the Development including without limitation all Improvements to the Technology and/or Technology Intellectual Property and Assigned Intellectual Property Rights including LO Post Effective Date Know-How and other Information and Inventions that are conceived, discovered, developed or otherwise made by or on behalf of LD during the Term of this Agreement (or its Affiliates or its licensors or sublicensees), whether or not patented or patentable.

4.2 Disclosure and Assignment. LD shall promptly disclose to PMI in writing, the conception or reduction to practice, or the discovery, development or making of all Intellectual Property Rights created or arising after the Effective Date in the Development including without limitation all Improvements to the Technology and/or Technology Intellectual Property and Assigned Intellectual Property Rights including LO Post-Effective Date Know-How and other Information and Inventions that are conceived, discovered, developed or otherwise made by or on behalf of LD during the Term of this Agreement (or its Affiliates or its licensors or sublicensees), whether or not patented or patentable, and shall, and does hereby, assign, and shall cause its Affiliates or its sublicensees to so assign, to PMI, without additional compensation, all of their respective rights, titles and interests in and to any and all of the foregoing. To the extent necessary to assign any such intellectual property rights, LD shall enter into and execute all reasonable and appropriate assignments, transfers and other agreements, and enter into all agreements with its employees, contractors, and Affiliates or sublicensees, that are necessary or appropriate to ensure the assignment of such intellectual property and intellectual property rights to PMI.

11

4.3 lnventorship. The determination of whether Improvement and/or Information and Inventions are conceived, discovered, developed or otherwise made by a Party for the purpose of identifying initial proprietary rights (including any patent, trademark, copyright or other intellectual property rights) therein, shall, for purposes of this Agreement, be made in accordance with applicable United States law.

| 4.4 | Grant of Licenses to LD. |

4.4.1 License Grant to LD Within the Field. Pursuant to the transfer of all rights, title and interest in the Intellectual Property Rights from LD to PMI as described in Section 4.1 and, following the Closing, the Assigned Intellectual Property Rights, PMI hereby grants back to LD an exclusive right and license within the Field to use the foregoing to the extent necessary to conduct the Development Program and pursuant to the LD obligations as set forth in Section 3.3.1 during the Term of this Agreement. For the avoidance of doubt, this grant to LD within the Field during the Term of the Agreement shall not, in any capacity, extend to the commercial sale, offer for sale, import or export of the Product relating to any such sale, other than providing assistance to PMI or an authorized PMI sublicensee.

4.4.2 License Grant to LD Outside the Field. Pursuant to the transfer of all rights, title and interest in the Intellectual Property Rights from LD to PMI as described in Section 4.1 and following the Closing in the Assigned Intellectual Property Rights, PMI hereby grants back to LD a non-exclusive, royalty free, perpetual, fully paid-up right and license under the Intellectual Property Rights and after the Closing under the Assigned Intellectual Property Rights to make, have made, use, sell, offer for sale, import and export products solely outside the Field; provided, however, that PMI shall have a right of refusal to market, sell, commercialize and distribute any such product. Such right of first refusal shall be triggered by written notice by LD to PMI given in accordance with this Agreement detailing the nature, scope and other material information relating to the opportunity, whereupon PMI shall have a 90 day right to exclusively negotiate with LD pertaining thereto. In the event that LD and PMI shall fail to reach agreement prior to the expiration of such 90 day period, LD shall not enter into any agreement with any third party that is materially more favorable to such third party than the last written offer made by PMI without first offering PMI such terms and PMI not having accepted same within 90 days of being so offered by LD in writing, following which the foregoing provisions of this sentence shall continue to apply.

4.4.3 Sublicenses by LD. LD shall have the right to grant sublicenses under the rights and licenses granted pursuant to Section 4.4.1 and Section 4.4.2, including express restrictions thereof, with the prior written consent of PMI, which shall not be unreasonably withheld, conditioned or delayed, to Third Parties.

4.4.4 No Implied License to LD. LD acknowledges that the rights and licenses granted to LD under Section 4.4.1 and Section 4.4.2 is limited to the scope expressly granted, and all other rights under the Assigned Intellectual Property Rights are expressly reserved by PMI.

12

| 4.5 | Patent Prosecution and Maintenance. |

4.5.1 Patent Prosecution. The prosecution, filing and maintenance of all Patent Rights and applications shall be the responsibility of PM I. All decisions with respect to prosecution of the Patent Rights are reserved to PMI.

4.5.2 Patent Counsel and Expenses of Patent Right Prosecution. Ifrequested by PMI, LD shall transfer responsibility of prosecution and maintenance of Assigned Patent Rights to an outside law firm agreeable to PMI, which shall also be designated to prosecute any patent applications relating to prosecution of Improvements or Information and Inventions. Payment of all fees and costs, including without limitation attorneys’ fees, relating to the filing, prosecution, and maintenance of the Patent Rights shall be the responsibility of LD prior to the date of execution of this Agreement, and after the date of the execution of this Agreement, shall be the responsibility of PMI.

| 4.6 | Infringement. |

4.6.1 Infringement by a Product. In the event of the institution of any suit in the Territory by a Third Party against PMI or LD or its sublicensees for patent infringement involving the manufacture, use, sale, distribution or marketing of the Product, the party sued shall promptly notify the other party in writing. PMI shall have the right to defend such suit at its expense. Each party shall assist and cooperate in any such litigation without expense to the other party.

4.6.2 Infringement by a Third Party. In the event that PMI or LD become aware of actual or threatened infringement of a Patent, that party shall promptly notify the other party and confirm it in writing. PMI shall have the sole right to bring, at its own expense, an infringement action against any Third Party and to use LD’s name in connection therewith, holding LD harmless in such event. If PMI does not commence a particular infringement action within six (6) months, LD, after notifying PMI in writing, shall be entitled to bring such infringement action at its own expense. The Party conducting such action shall have full control over its conduct. In any event, LD and PMI shall assist one another and cooperate in any such litigation at the other’s request without expense to the requested party.

4.6.3 Recovery. PMI and LD shall recover their respective actual out-of-pocket expenses, or equitable proportions thereof, associated with any litigation or settlement thereof from any recovery made by either Party (“Expenses”), with the Party conducting the action first being entitled to full recovery of their Expenses, followed by recovery of Expenses incurred by the non-conducting Party. Any excess amounts (after Expenses) shall be the sole and exclusive property of the party who brought and financed the infringement action.

4.6.4 Status. The Parties shall keep one another informed of the status of and of their respective activities regarding any litigation or settlement thereof concerning the Product. LD may not settle any such infringement action if the settlement adversely impacts on the validity or scope of any Patent without the prior written consent of PMI.

13

| 4.7 | Trademark Registration, Maintenance and Enforcement. |

4.7.1 Original Trademark. Upon the Closing under the Asset Purchase and Intellectual Property Assignment Agreement, PMI may use the “Breeze™” for commercialization of the Product in the Field within the Territory.

4.7.2 Additional Trademarks. In the event that applicable legal requirements should necessitate the use of a trademark other than the original trademark pursuant to Section 4.8.1 for the Product, the Parties shall cooperate in proposing and designating an additional suitable trademark or, in the alternative, select a suitable additional Trademark for use with the Product through utilization of an international branding institute, whereby PMI shall bear costs related to branding/rebranding of the Product. Each such additional Trademark shall be owned by PMI.

4.7.3 Registration and Maintenance of the Trademark(s). As soon as is practicable after the Closing, PMI shall use Commercially Reasonable Efforts to apply for, obtain, and maintain registration of the original trademark Breeze™ in its name with the United States Patent and Trademark Office using trademark counsel engaged by PMI.

4.7.4 Defense of Trademark Against Third Party Infringement. LO agrees to notify PMI in writing of any known or suspected conflicting use of any Trademark, and the application for registration or use of trademarks confusingly similar thereto, or of any known or suspected infringements or of unfair competition involving the Trademark in the Territory promptly after it acquires knowledge thereof. PMI shall be responsible for the defense of the Trademark and will use Commercially Reasonable Efforts to defend the Trademark. At the reasonable request of PMI, LD shall cooperate with PMI and render PMI its commercially reasonable assistance in the defense of the Trademark, subject to reimbursement of the related out of pocket expenses of LD. Any damages and costs recovered shall be for PMl’s sole benefit. In case PMI decides not to defend the Trademark within thirty (30) days of LD’s written request to do so, LD shall be entitled to do so at its own expense in cooperation and with the commercially reasonable assistance of PMI and, in such case, any damages and costs recovered shall be for LD’s sole benefit, subject to reimbursement of the out of pocket expenses of PMI related to PMl’s assistance.

4.7.5 Goodwill of Trademark(s). Each Party shall use its Commercially Reasonable Efforts to establish and maintain the goodwill in the Territory of the Trademarks in the course of performing its obligations under this Agreement. LD agrees that all use of original or additional trademarks will inure to the benefit of PMI. Without limitation, to the extent permitted by law, all goodwill deriving from the use of the either the original or additional trademark pursuant to the terms of this Agreement or otherwise arising out of this Agreement shall accrue solely and exclusively to PMI.

14

5. Additional Payments. In addition to the development costs payable by PMI to LD pursuant to Section 3.8, PMI shall make the following additional payments to LD, under the terms hereof:

5.1 Success Fees. PMI shall pay to LD a success fee in the amount of (i) $100 for each Pump and (ii) $120 for each Multi-Source Selector (the “Success Fee”) beginning on the latter of (x) the date of the First Commercial Sale of a Product or (y) receipt by LO of the final payment of Two Hundred Thousand U.S. Dollars ($200,000) paid by PMI pursuant to Section 3.6, on a quarterly basis within 45 days of the quarter close. The Success Fee shall be payable for each Pump and Multi-Source Selector sold by PMI directly or indirectly through any licensee, distributor or OEM anywhere in the world; provided, however, that any particular Pump or Multi-Source Selector shall be subject to only one Success Fee payment obligation, nor shall used or reconditioned Pumps or Multi-Source Selectors be subject to a Success Fee.

5.2 Success Fee Shares. PMI shall issue 50,000 shares of PMI common stock to LO or its nominee to be held in escrow with PMI’s attorneys which shall vest and be released from escrow to LD if Regulatory Approval for the Product shall be granted by FDA prior to July 1, 2015. In the event such Regulatory Approval shall not be granted prior to July 1, 2015, such shares shall not vest and shall be released from escrow back to PMI.

5.3 Offset Relating to the Mack Loan. PMI may withhold twenty five percent (25%) of amounts due to LD under Section 5.1 and apply such amount to the LD Note to PMI. Amounts withheld shall be applied first to interest due under the LO Note to PMI, and thereafter to principal.

5.4 Advance Payments. In order to promote acceleration of Product development, or for any other purpose to advance development, commercialization or marketing aspects under this Agreement, PMI, at its sole discretion, may provide additional cash payments beyond the amounts payable by PMI to LD pursuant to the timed development costs pursuant to Section 3.6. Any such advance payments shall be credited to PMI against any other payments due LD pursuant to Sections 3.6, 5.1, or pursuant to the Research and Development Agreement.

5.5 Transfer Payments. It is contemplated that MACK will serve as the original equipment manufacturer (“OEM”) to supply the Product. LD agrees that PMI may negotiate the OEM transfer prices with MACK. PMI shall purchase Product directly from MACK at transfer prices specified in MACK agreements with LD, or as subsequently agreed to by PMI with Mack. LD and PMI will cooperate in any commercially reasonable strategy to lower manufacturing costs through constructive negotiations with MACK and continuous process improvements.

5.6 Success Fee Term. The obligation of PMI to pay the Success Fee pursuant to Section 5.1 shall continue for the Product and country-by-country basis, until the latest of:

(a) Expiration of the last to expire Valid Claim covering the use, importation, or sale of the Product in the country of sale; or

(b) Fifteen (15) years after the First Commercial Sale of the Product in such country.

Notwithstanding the foregoing terms of this Section 5.6, upon the closing of the sale of all or substantially all of the assets of PMI relating to the Product (the “PMI Product Assets”), the Success Fees provided for in Section 5.1 will terminate effective immediately on the effective date of such transaction. In consideration of such termination, PMI will pay LD the greater of (i) three percent (3.0%) of the “Net Proceeds” attributable to the PMI Product Assets, when and to the extent received, or (ii) ten million dollars ($10,000,000). “Net Proceeds” shall mean gross proceeds from such transaction less all debts, obligations (including without limitation indemnification obligations) and payables relating to such assets including the fees, costs expenses of such transaction. “Received” means not subject to escrow and when otherwise available without restriction.

15

5.7 Taxes. PMI shall pay, without limitation any tax, levy, income fee withholding tax or charge required by any statute, law, rule or regulation now in effect or hereafter enacted including, without limitation, sales, use, value-added, property, fees and excise or other similar taxes, licenses, import permits, state, county, city or other taxes arising out of or relating to this Agreement. Notwithstanding the foregoing, if (a) the appropriate governmental entity imposes a withholding tax on any sums payable to LD by PMI in connection with this Agreement and (b) such tax is paid by PMI on LD’s behalf, then PMI may deduct the amount of any such tax paid from the fees due to LD under this Section 5, provided that PMI provides LD with an accounting of any and all such payments prior to such deduction. Notwithstanding the foregoing, LD is responsible for the payment of all income and other taxes due upon receipt of any payments made to it pursuant to this Agreement.

5.8 Method of Payment. All payments required to be made by PMI hereunder shall be made by electronic transfer of immediately available funds in United States Dollars through a bank designated by LD. In determining the proper rate of exchange to be applied to the payments due hereunder, it is agreed that PMI shall calculate Success Fees on a quarterly basis in local currency (with each such month considered to be a separate accounting period for the purpose of computing the Success Fees) and that PMI shall compute a conversion of each such monthly total into United States currency utilizing the selling rate of exchange in effect on the last day of each relevant calendar quarter as listed in the Wall Street Journal.

5.9 Payment of Success Fees; Reports. Within forty five (45) days following each quarter after the Closing Date, PMI shall make an accounting of all units sold for which a Success Fee is payable under Section 5.1 accrued during each such quarter, together with payment for the Success Fee which is due for such quarter under the terms of this Agreement.

5.10 Audit. During the Term and for one (1) year thereafter PMI shall maintain complete and accurate books and records relating to this Agreement. LD shall, at its own expense upon no less than ten (10) days’ notice to PMI, have the right to cause independent auditors, designated by LD, to audit the records of PMI for the purpose of verifying the accuracy of the amounts due to LD under this Agreement; provided that PMI shall be obligated to pay such expenses if the auditor determines that PMI prepared such reports incorrectly resulting in underpayment of the Success Fees by more than five percent (5%) for the period being audited. PMI shall immediately pay any such underpayments to LD.

| 6. | Term and Termination. |

6.1 Term. Unless otherwise terminated pursuant to this Section 6, this Agreement shall remain in full force and effect on a country-by-country basis until the later of (a) expiration date of the last to expire of any issued Patent Right that includes at least one Valid Claim and (b) the twentieth (20th) anniversary of the Closing Date (the “Term”), at which time PMI will be entitled to exploit all Products and Technology without restriction or payment, unless this agreement is earlier terminated in accordance with the following provisions of this Section 6.

16

| 6.2 | Termination. |

6.2.1 Termination for Material Breach. Each Party shall have the right to terminate this Agreement and its obligations hereunder in the event of a material breach by the other party, or materially fails to perform, its obligations under this A!:J, J’eement and fails to cure such breach or nonperformance within twenty (20) days after receiving from the non-breaching Party written notice thereof, the non-breaching Party in its sole discretion may terminate this Agreement upon prior notice to the defaulting Party.

6.2.2 Termination by Mutual Consent. This Agreement may be terminated by the mutual consent of PMI and LD.

6.2.3 Termination for Failure to Close. PMI in its sole discretion may terminate this Agreement in the event that the Closing under the Asset Purchase and Intellectual Property Transfer Agreement shall fail to occur through no default on the part of PMI.

6.2.4 Termination Upon Sale of PMI. This Agreement shall terminate upon the sale of all or substantially all of the assets of PMI, provided that PMI pays to LD the Success Fee in accordance with Section 5.6 of this Agreement.

6.2.5 Termination Upon Insolvency. Termination by the non insolvent or non breaching party in the event of the liquidation or dissolution of the other party, the filing by or against the other party of a petition in bankruptcy or insolvency, the assignment by the other party of its assets for the benefit of its creditors, the admission by the other party of its inability to pay its debts as they come due, the appointment of a receiver or trustee for the assets of the other, or the making of any voluntary arrangement by the other party with its creditors, which event is not discharged, waived or cured within sixty (60) days after the occurrence thereof. Without limiting any of any party’s rights under any other provision of this Agreement, each party’s rights under this Agreement will include those rights afforded by 11 U.S.C. 365(n) and any successor statute thereto (the “Code”). If the bankruptcy trustee of a party as a debtor or such party as a debtor-in-possession rejects this Agreement under 11 U.S.C. 365, either other party may elect to retain its rights hereunder for the duration of this Agreement and avail itself of all rights and remedies to the full extent contemplated by this Agreement, 11 U.S.C. 365(n), and any other relevant sections of the Code or other relevant non-bankruptcy law.

6.3 Accrued Obligations. Notwithstanding any termination under this Section 6, any obligation to pay payments which had accrued or become payable as of the date of termination shall survive termination of this Agreement.

6.4 Ownership of Intellectual Property. No termination of this Agreement shall modify, limit or affect PMI’s ownership interest in the Intellectual Property Rights and other rights provided for by Article IV hereof nor limit or affect LD’s obligations to PMI with respect thereto.

17

6.5 Force Majeure Events. If either Party is prevented from performing any of its obligations hereunder (other than payment obligations) due to any cause which is beyond the non-performing Party’s reasonable control, including, without limitation, fire, explosion, flood, or other acts of God; acts, regulations, or laws of any government; war, terrorist act or civil commotion; strike, lock-out or labor disturbances; or failure of public utilities or common carriers (a “Force Maieure Event”), such non-performing Party shall not be liable for breach of this Agreement with respect to such non-performance to the extent such non-performance is due to a Force Majeure Event. Such non-performance will be excused for as long as such event shall be continuing (whichever period is shorter), provided that the non-performing Party gives immediate written notice to the other Party of the Force Majeure Event. Such non-performing Party shall exercise all reasonable efforts to eliminate the Force Majeure Event and to resume performance of its affected obligations as soon as practicable. Should the event of Force Majeure continue unabated for a period of 60 days or more, the Parties shall enter into good faith discussions with a view to alleviating its affects or to agreeing upon such alternative arrangements as may be fair and reasonable having regard to the circumstances prevailing at that time.

6.6 Survival. All rights granted and obligations undertaken by the Parties hereunder shall terminate immediately upon the event of any termination or expiration of this Agreement, except for the following which shall survive according to their terms: Sections 3.9, 4.1, 4.2, 4.3, 6.3, 6.4, 6.6, 7, 8, 9, 10.1, 10.2, 10.3, 10.4, 10.5, 10.8, 10.9, 10.10 and 10.11. For the avoidance of doubt, LD shall not grant or sublicense to any Third Party any rights granted pursuant to Section 4.4.1 and Section 4.4.2 subsequent to termination or expiration of this Agreement.

| 7. | Indemnification. |

7.1 Indemnification by PMI. PMI hereby agrees to indemnify, hold harmless and defend LD against any and all expenses, costs of defense (including without limitation attorneys’ fees, witness fees, damages, judgments, fines and amounts paid in settlement) and any amounts LD becomes legally obligated to pay because of any Third Party claim or claims against it to the extent that such claim or claims (i) arise out of the breach or alleged breach of any representation or warranty by PMI hereunder, or (ii) arise from a Third Party claim of injury or death or damage to property resulting from such Third Party’s use of the Product and not caused by LD’s negligence or misconduct in the performance of its obligations under this Agreement, or (iii) are due to the negligence or misconduct of PMI; provided that such indemnification obligation shall not apply to the extent such claims are covered by LD’s indemnity set forth in Section 7.2 below.

7.2 Indemnification by LD. LD hereby agrees to indemnify, hold harmless and defend PMI against any and all expenses, costs of defense (including without limitation attorneys’ fees, witness fees, damages, judgments, fines and amounts paid in settlement) and any amounts PMI becomes legally obligated to pay because of any claim or claims against it to the extent that such claim or claims (i) arise out of the breach or alleged breach of any representation or warranty by LD hereunder, (ii) are due to the negligence or misconduct of LD, or (iii) arise from a Third Party claim of injury or death or damage to property resulting from such Third Party’s use of the Product to the extent caused by LD’s negligence or misconduct in the performance of its obligations under this Agreement; provided that, such indemnification shall not apply to the extent such claims are covered by PMI’s indemnity set forth in Section 7.1 above.

18

7.3 Procedure. Each Party’s agreement to indemnify, defend and hold the other harmless under Sections 7.1 and 7.2 is conditioned on the indemnified party (a) providing written notice to the indemnifying party of any claim arising out of the indemnified activities within thirty (30) days after the indemnified party has knowledge of such claim; (b) permitting the indemnifying party to assume full responsibility to investigate, prepare for and defend against any such claim; (c) assisting the indemnifyi ng party, at the indemnifying party’s reasonable expense, in the investigation of, preparation for and defense of any claim; and (d) not compromising or settling such claim without the indemnified party’s written consent. In the event that the parties cannot agree as to the application of Sections 7.1 and 7.2 above to any particular loss or claim, the parties may conduct separate defenses of such claim. Each Party further reserves the right to claim indemnity from the other in accordance with Sections 7.1 and 7.2 above upon resolution of the underlying claim, notwithstanding subsection (b) above.

7.4 Insurance Coverage. Each Party represents and warrants that it is covered and will continue to be covered by a comprehensive insurance program which covers all of each Party’s activities and obligations hereunder. Each Party shall provide the other party with written notice at least fifteen (15) days prior to any cancellation or material change in such insurance program that reduces coverage thereunder. Each Party shall maintain such insurance program, or other program with comparable coverage, beyond the expiration or termination of this Agreement during (i) the period that any Product produced pursuant to this Agreement is intended to be used in a clinical trial and (ii) to be sold commercially following Regulatory Approval.

| 8. | Confidentiality; Restrictive Covenants. |

8.1 Confidential Information. The Party’s rights and obligations with respect to Confidential Information disclosed under this Agreement shall be governed by the Confidential Disclosure Agreement executed between the Parties dated as February 18, 2014, except as set forth below.

8.2 Authorized Disclosure. The Parties agree that the terms, but not the mere existence, of this Agreement and the Asset Purchase and Intellectual Property Assignment Agreement will be considered Confidential Information of both Parties. Notwithstanding the foregoing, either Party may make disclosures required by law or regulation, provided prior notice is given to the other Party whenever possible, and may disclose the general terms of this Agreement and the Asset Purchase and Intellectual Property Assignment Agreement to bona fide potential corporate partners, and to financial underwriters, prospective investors, acquirers and merger partners, and other Parties with a need to know such information. Any such disclosures, and any disclosure of the development of Products or other developments under this Agreement, including but not limited to press releases, will be reviewed and consented to by each party prior to such disclosure. Such consent shall not be untimely or unreasonably withheld by either party. All such disclosures shall be made only to Parties under an obligation of confidentiality.

Notwithstanding any other provision of this Agreement, each party may disclose Confidential Information if such disclosure:

(a) is in response to a valid order of a court or other governmental body of the United States or a foreign country, or any political subdivision thereof; provided, however, that the responding party shall first have given notice to the other party hereto and shall have made a reasonable effort to obtain a protective order requiring that the Confidential Information so disclosed be used only for the purposes for which the order was issued;

19

| (b) | is otherwise required by law or regulation, including SEC related documents; or · |

(c) is otherwise necessary to file or prosecute patent applications, prosecute or defend litigation or comply with applicable governmental regulations or otherwise establish rights or enforce obligations under this Agreement, but only to the extent that any such disclosure is necessary.

8.3 Return of Confidential Information. Upon termination of this Agreement, each Party shall use diligent efforts (including without limitation a diligent search of files and computer storage devices) to return all Confidential Information received by it from the other party, provided, however, that the receiving party may keep one copy of such Confidential Information for legal archival purposes. Access to the copy so retained by the receiving party’s legal department shall be restricted to counsel and such Confidential Information shall not be used except in the resolution of any claims or disputes arising out of this Agreement.

8.4 Publications. Except as required by law, neither party shall publish or present the results of studies carried out with respect to Products without the opportunity for prior review by the other party. Each party shall provide to the other the opportunity to review any proposed abstracts, manuscripts or presentations which relate to Products at least thirty (30) days prior to their intended submission for publication and such submitting party agrees, upon written request from the other party, not to submit such abstract or manuscript for publication or to make such presentation until the other party is given a reasonable period of time to seek patent protection for any material in such publication or presentation that it believes is patentable.

8.5 Restrictive Covenants. LD and Jeffrey Carlisle (the “Executive”) each agree beginning with Effective Date until the later of (i) the one year anniversary of the Effective Date, (ii) Regulatory Approval for the Product, or (iii) May 30, 2017 (such date being 30 days after the date of the last payment which will be due under the Research and Development Agreement) (such time period, the “Restrictive Covenant Period”) that:

(a) Neither LD nor the Executive will, directly or indirectly, individually or as a consultant to, or an employee, officer, director, manager, member, stockholder, partner, member, investor, lender or other owner or participant in any business entity (other than through PMI as provided for herein), engage in or assist any other person or entity to engage in any business which competes with any business in which PMI is engaging or in which PMI actively plans to engage (as evidenced by meaningful efforts by PMI with respect thereto), anywhere in the world, including without limitation providing any design or development work for any Competing Product; provided, that, this Section 8.5(a) shall not prohibit the Executive from acquiring, solely as a passive investment, up to 1% of the securities of any publicly traded company whose activities may be in breach of the foregoing;

20

(b) Neither LD nor the Executive will, directly or indirectly, (i) solicit in competition with PMI, divert or take away, or attempt to solicit in competition with PMI, divert or take away, the business or relationship of PMI with any of its customers, clients, distributors, OEMs, licensees, licensors, dealers, referral sources, business partners, suppliers, vendors, service providers, consultants, lenders, investors, or any other person or entity with whom PMI does business (collectively, “Business Partners”), or (ii) otherwise interfere with PMI’s business relationship with any of its Business Partners;

(c) Neither LD nor the Executive will, directly or indirectly, solicit, recruit, hire or engage, or otherwise interfere with the business relationship of PMI with, any current or former employee of PMI, other than any person who ceased to be employed by PMI for a period of at least six (6) months; and

(d) Neither LD nor the Executive will, directly or indirectly, intentionally assist any person or entity in performing any activity prohibited by Sections 8.5(a), (b) or (c).

(e) Notwithstanding anything in the foregoing provisions of Section 8.5 to the contrary, Section 8.5 shall be not be deemed to apply to, or to restrict LD or the Executive from his involvement in, (i) Our Health Connector, a medical records provider, as described in Exhibit 8.5(e)(i), and (ii) continuation of his activities in the field of patient care monitoring, also known as patient monitoring, as described in Exhibit 8.5(e)(ii).

8.6 Right of First Refusal on any Competing Product. PMI shall have a right of refusal to market, sell, commercialize and distribute any Competing Product which is developed by LD or the Executive or any Affiliate of his, directly or indirectly (such person or entity, the “Developer”), during the three (3) year period following the end of the Restrictive Covenant Period. Such right of first refusal shall be triggered by written notice by the Developer to PMI given in accordance with this Agreement detailing the nature, scope and other material information relating to the Competing Product, whereupon PMI shall have a 90 day right to exclusively negotiate with the Developer pertaining thereto. In the event that the Developer and PMI shall fail to reach agreement prior to the expiration of this 90 day period, the Developer shall not enter into any agreement with any third party that is materially more favorable to such third party than the last written offer made by PMI without first offering PMI such terms and PMI not having accepted same within 90 days of being so offered by the Developer in writing, following which the foregoing provisions of this sentence shall continue to apply.

9. Representation and Warranties.

9.1 Representations and Warranties of Both Parties. Each Party hereby represents, warrants, and covenants to the other Party, as of the date of the execution of this Agreement, that:

9.1.1 Duly Organized. Each Party is duly organized, validly existing and in good standing under the laws of the jurisdiction of its incorporation and has full corporate power and authority to enter into this Agreement and to carry out the provisions hereof;

9.1.2 Due Authorization. Each Party has taken all necessary action on its part to authorize the execution and delivery of this Agreement and the performance of its obligations hereunder;

21

9.1.3 Binding Agreement. This Agreement has been duly executed and delivered on behalf of such Party, and constitutes a legal, valid, binding obligation, enforceable against it in accordance with the terms hereof;

9.1.4 No Conflict. The execution, delivery and performance of this Agreement by such Party does not conflict with any agreement, instrument or understanding, oral or written, to which it is a party or by which it is bound, nor violate any law or regulation of any court, governmental body or administrative or other agency having jurisdiction over such Party;

9.1.5 Government Authorization. No government authorization, consent, approval, license, exemption of or filing or registration with any court or governmental department, commission, board, bureau, agency or instrumentality, domestic or foreign, under any applicable laws, rules or regulations currently in effect, is or will be necessary for, or in connection with, the transaction contemplated by this Agreement or any other agreement or instrument executed in connection herewith, or for the performance by it of its obligations under this Agreement and such other agreements except as may be required under the Merger Agreement or to obtain HSR clearance; and,

9.1.6 Infringement. Neither Party received any notice or other communication from a Third Party that the practice of the Technology, the Product, or the Technology Intellectual Property infringes such Third Party’s intellectual property rights.

9.1.7 FDA Debarment. To the best of its knowledge, it has not employed (and, to the best of its knowledge without further duty of inquiry, has not used a contractor or consultant that has employed) and in the future will not employ (or, to the best of its knowledge without further duty of inquiry, use any contractor or consultant that employs) any individual or entity debarred by the FDA (or subject to a similar sanction of EMA), or, to the best of its knowledge without further duty of inquiry, any individual who or entity which is the subject of an FDA debarment investigation or proceeding (or similar proceeding of EMA), in the conduct of the pre-clinical activities or clinical trials of the Product.

10. Miscellaneous.

10.1 Agency. Neither party is, nor will be deemed to be, an employee, agent or legal representative of the other party for any purpose. Neither party will be entitled to enter into any contracts in the name of, or on behalf of the other party, nor will a party be entitled to pledge the credit of the other party in any way or hold itself out as having authority to do so. This Agreement is an arm’s-length agreement between the parties and shall not constitute or be construed as a joint venture.

10.2 No Third Party Beneficiaries. Except as specifically provided in this Agreement, this Agreement shall not confer any rights or remedies upon any Person other than the Parties and their respective successors and permitted assigns.

10.3 Entire Agreement. Except as agreed to by the parties in writing, this Agreement, and Exhibits hereto, together with the Asset Purchase and Intellectual Property Assignment Agreement and its attachments and schedules and the Research and Development Agreement, constitute the entire agreement among the Parties and supersedes any prior understandings, agreements or representations by or among the Parties, whether written or oral, with respect to the subject matter hereof, including. without limitation, as to the matters contemplated by this Agreement, the Term Sheet.

22

10.4 Successors and Assigns. Neither this Agreement nor the rights or obligations of the Parties under this Agreement shall be assignable without the written consent of the non assigning Party and any such purported assignment without the written consent of the non assigning Party shall be void and without effect; provided, however that PMI may assign its rights hereunder at the closing of a sale of all or substantially all of the assets relating to the Technology or a change of control transaction in which the holders of the voting securities of PMI immediately before such transaction own less than 50% of the voting securities of the surviving entity immediately after giving effect to such transaction. Except as otherwise provided herein, this Agreement and all covenants and agreements contained herein shall be binding upon and inure to the benefit of the Parties hereto, their permitted successors, permitted representatives and permitted assigns.

10.5 Severability. Any term or provision of this Agreement that is invalid or unenforceable in any situation in any jurisdiction shall not affect the validity or enforceability of the remaining terms and provisions hereof or the validity or enforceability of the offending term or provision in any other situation or in any other jurisdiction. In the event that any term or provision of this Agreement would, under applicable law, be invalid or unenforceable in any respect, each Party intends that such provision will be construed by modifying or limiting it so as to be valid and enforceable to the maximum extent compatible with, and possible under, applicable law. For any such invalid or unenforceable provision, the Parties shall use commercially reasonable efforts to negotiate a substitute valid and enforceable provision while preserving to the fullest extent possible the intent and agreements of the Parties set forth herein.

10.6 Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original but all of which together shall constitute one and the same instrument, notwithstanding variations in format or file designation which may result from the electronic transmission, storage and printing of copies of this Agreement from separate computers or printers. Facsimile signatures and signatures transmitted via PDF shall or by any other electronic means shall be treated as original signatures.

10.7 Headings. The Section headings contained in this Agreement are inserted for convenience only and shall not affect in any way the meaning or interpretation of this Agreement.

10.8 Notices. All communications between LD and PMI relating to this Agreement and the subject matter hereof shall be directed to the persons designated to receive notices set forth in this Section 10.8 or such other individuals as they may designate. All notices, requests, demands, Claims and other communications under this Agreement shall be in writing. Any notice, request, demand, Claim or other communication under this Agreement shall be deemed duly given (i) when delivered personally to the recipient, (ii) upon confirmation of facsimile (with a confirmation copy to be sent by overnight delivery) or (iii) one business day following the date sent when sent by overnight delivery, at the following address:

23

If to LO:

Jeffrey Carlisle, Member

Leveraged Developments LLC

75 Congress Street

Portsmouth, NH 03801

If to PMI:

Jerry Ruddle, President and COO

Point Medical, Inc.

665 Martinsville Road, Suite 219

Basking Ridge, NJ 07920

Either Party may change the named party and address to which notices, requests, demands, Claims and other communications under this Agreement are to be delivered by giving the other Party notice in the manner herein set forth.

10.9 Governing Law. This Agreement shall be governed by and construed in accordance with the domestic laws of the State of Delaware without giving effect to any choice or conflict of law provision or rule (whether of the State of Delaware or any other jurisdiction) that would cause the application of the laws of any jurisdiction other than the State of Delaware. The Parties hereto submit to the exclusive jurisdiction of the State and Federal courts in the State of Delaware and New Castle County with respect to any dispute.

10.10 Amendments and Waivers. No amendment of any provision of this Agreement shall be valid unless the same shall be in writing and signed by PMI and LO. No waiver by any Party of any provision of this Agreement or any default, misrepresentation or breach of warranty or covenant under this Agreement, whether intentional or not, shall be valid unless the same shall be in writing and signed by the Party making such waiver nor shall such wavier be deemed to extend to any prior or subsequent default, misrepresentation or breach of warranty or covenant under this Agreement or affect in any way any rights arising by virtue of any prior or subsequent such occurrence. Any consent, waiver or amendment signed by LO shall be deemed the consent, waiver or amendment of LO and its Affiliates and any consent, waiver or amendment signed by PMI shall be deemed the consent, waiver or amendment of PMI’s and its Affiliates pursuant hereto.

10.11 Expenses. Except as expressly stated otherwise, each of the Parties will bear his or its own costs and expenses (including legal and accounting fees and expenses) incurred in connection with this Agreement and transactions contemplated hereby and thereby.