Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LCNB CORP | form8-kinvestorconference8.htm |

Line

0.00

Left Margin

2.90

Right Margin

5.00

LCNB Investment Highlights

August 2016

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

Forward-Looking Statements

1

This presentation, as well as other written or oral communications made from time to time by us, contains certain forward-looking information within the meaning of the

Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. These statements relate to future events or future predictions, including

events or predictions relating to our future financial performance, and are generally identifiable by the use of forward-looking terminology such as “believes,” “expects,”

“may,” “will,” “should,” “plan,” “intend,” “target,” or “anticipates” or the negative thereof or comparable terminology, or by discussion of strategy or goals or other future

events, circumstances or effects. These forward-looking statements regarding future events and circumstances involve known and unknown risks, including those risk

factors set forth in our Annual Report on Form 10-K for the year ended December 31, 2015, and other SEC filings, uncertainties and other factors that may cause our

actual results, levels of activity, financial condition, performance or achievements to be materially different from any future results, levels of activity, financial condition,

performance or achievements expressed or implied by such forward-looking statements. This information is based on various assumptions, estimates or judgments by

us that may not prove to be correct. Important factors to consider and evaluate in such forward-looking statements include:

· changes in competitive and market factors that might affect our results of operations;

· changes in laws and regulations, including without limitation changes in capital requirements under the Basel III capital standards;

· changes in our business strategy or an inability to execute our strategy due to the occurrence of unanticipated events;

· our ability to identify potential candidates for, and consummate, acquisition or investment transactions;

· the timing of acquisition or investment transactions;

· our failure to complete any or all of the transactions described herein on the terms currently contemplated;

· local, regional and national economic conditions and events and the impact they may have on us and our customers;

· targeted or estimated returns on assets and equity, growth rates and future asset levels;

· our ability to attract deposits and other sources of liquidity and capital;

· changes in the financial performance and/or condition of our borrowers;

· changes in the level of non-performing and classified assets and charge-offs;

· changes in estimates of future loan loss reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements, as well

as changes in borrowers payment behavior and creditworthiness;

· changes in our capital structure resulting from future capital offerings or acquisitions;

· inflation, interest rate, securities market and monetary fluctuations;

· the affects on our mortgage warehouse lending and retail mortgage businesses of changes in the mortgage origination markets, including changes due to changes in

monetary policies, interest rates and the regulation of mortgage originators, services and securitizers;

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

Forward-Looking Statements

2

· timely development and acceptance of new banking products and services and perceived overall value of these products and services by users;

· changes in consumer spending, borrowing and saving habits;

· technological changes;

· our ability to grow, increase market share and control expenses, and maintain sufficient liquidity;

· volatility in the credit and equity markets and its effect on the general economy;

· the potential for customer fraud;

· effects of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight

Board, the Financial Accounting Standards Board and other accounting standard setters;

· the businesses of the Bank and any acquisition targets or merger partners and subsidiaries not integrating successfully or such integration being more difficult,

time-consuming or costly than expected;

· our ability to integrate currently contemplated and future acquisition targets may be unsuccessful, or may be more difficult, time-consuming or costly than

expected; and

· material differences in the actual financial results of merger and acquisition activities compared with expectations.

These forward-looking statements are subject to significant uncertainties and contingencies, many of which are beyond our control. Although we believe that the

expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, financial condition, performance or

achievements. Accordingly, there can be no assurance that actual results will meet our expectations or will not be materially lower than the results contemplated in this

presentation. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this document or, in the case of

documents referred to or incorporated by reference, the dates of those documents. We do not undertake any obligation to release publicly any revisions to these

forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events, except as may be

required under applicable law.

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

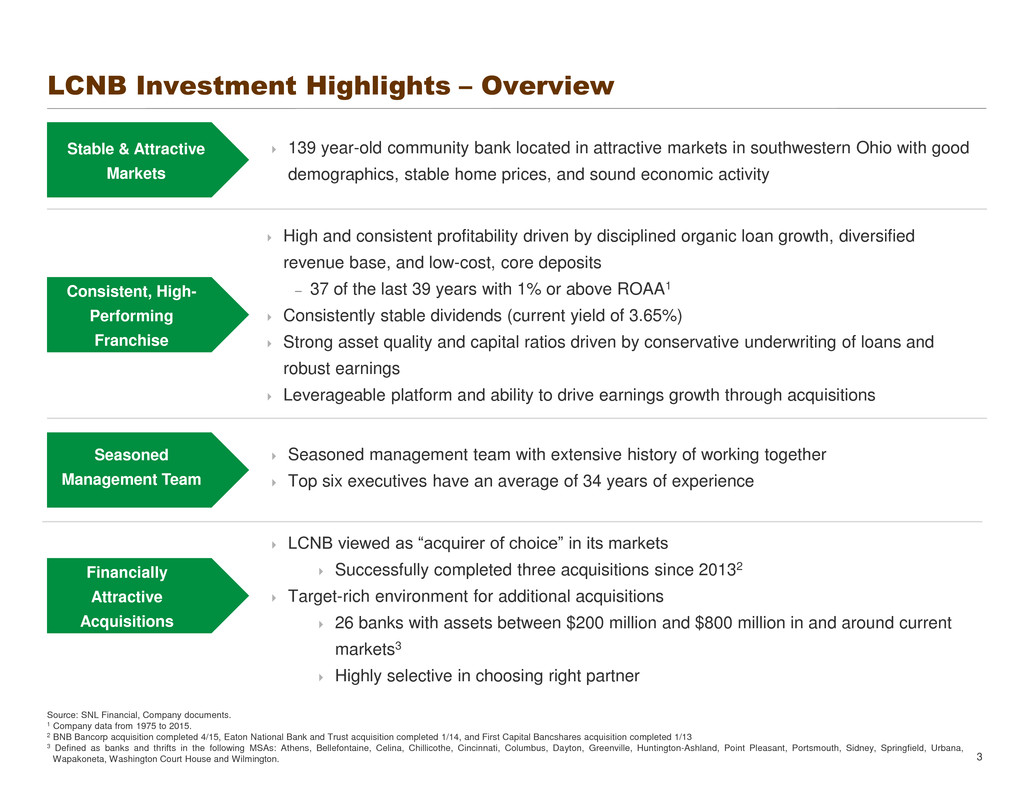

High and consistent profitability driven by disciplined organic loan growth, diversified

revenue base, and low-cost, core deposits

– 37 of the last 39 years with 1% or above ROAA1

Consistently stable dividends (current yield of 3.65%)

Strong asset quality and capital ratios driven by conservative underwriting of loans and

robust earnings

Leverageable platform and ability to drive earnings growth through acquisitions

LCNB Investment Highlights – Overview

3

Stable & Attractive

Markets

Consistent, High-

Performing

Franchise

Seasoned

Management Team

Financially

Attractive

Acquisitions

139 year-old community bank located in attractive markets in southwestern Ohio with good

demographics, stable home prices, and sound economic activity

Seasoned management team with extensive history of working together

Top six executives have an average of 34 years of experience

Source: SNL Financial, Company documents.

1 Company data from 1975 to 2015.

2 BNB Bancorp acquisition completed 4/15, Eaton National Bank and Trust acquisition completed 1/14, and First Capital Bancshares acquisition completed 1/13

3 Defined as banks and thrifts in the following MSAs: Athens, Bellefontaine, Celina, Chillicothe, Cincinnati, Columbus, Dayton, Greenville, Huntington-Ashland, Point Pleasant, Portsmouth, Sidney, Springfield, Urbana,

Wapakoneta, Washington Court House and Wilmington.

LCNB viewed as “acquirer of choice” in its markets

Successfully completed three acquisitions since 20132

Target-rich environment for additional acquisitions

26 banks with assets between $200 million and $800 million in and around current

markets3

Highly selective in choosing right partner

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

LCNB Investment Highlights – Recent Events

4

Highlights of 2Q 2016

Acquisition of BNB Bancorp, Inc.

Closed acquisition of BNB Bancorp in April 2015

– Added approximately $109 million in assets, $36 million in loans, $99 million in deposits and two branches

– Purchase price of $12.6 million, equal to 1.27x tangible book value

LCNB reported quarterly core EPS of $0.28.

Net interest income continued to increase, growing from $9.8 million in 1Q 2016 to $10.1 million in 2Q 2016.

Quarterly core ROAA and ROATCE remained strong at 0.89% and 11.30%, respectively.

Asset quality remained strong with 2Q 2016 NPAs/assets (excluding TDRs) of 0.26%, decreased charge-off

ratio from 0.35% in 2Q 2015 to 0.09% in 2Q 2016.

LCNB continued to be well capitalized, with 2Q 2016 tangible common equity to tangible assets of 8.7%.

Source: SNL Financial, Company documents

Acquisition of Eaton National Bank and Trust Co.

Closed acquisition of Eaton National Bank and Trust Co. in January 2014

– Added approximately $183 million in assets, $124 million in loans, $134 million in deposits and five branches

– Purchase price of $24.8 million (100% cash), equal to 1.42x tangible book value

– Completed a $28.8 million equity offering to strengthen pro forma capital levels

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

$1.3 billion in assets and $1.1 billion in deposits

headquartered in Lebanon, OH (Warren County)

36 branches in southwestern Ohio, primarily in and around

the attractive Cincinnati MSA

11th largest bank in the Cincinnati MSA by deposits

– Warren County, inside Cincinnati MSA, is the third

fastest growing county of the 88 counties in Ohio with

a 3.47% projected population growth rate

– Warren County also possesses the second highest

median household income in Ohio at $88,921,

compared to the national average of $59,865

LCNB’s major business lines serving that market include:

– Retail

– Commercial

– Trust and Investments with $284 million under

management and an Investment Services Division with

$164 million

LCNB Investment Highlights – The Franchise

5

LCNB Branch Map

LCNB Deposits in Top Three Markets

Source: SNL Financial, Company documents. Deposit data and rankings as of 6/30/15

Market Branches 2015 Rank

Deposits

($000)

Percent of

Franchise (%)

Cincinnati 20 11 671,793 62.0%

Dayton 4 11 131,348 12.1%

Chillicothe 5 4 106,577 9.8%

Total in Top 3 29 909,718 83.9%

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

LCNB Investment Highlights – Management Team

6

Experienced management team with an average of 34 years of banking experience and many executives have

worked together for over 20 years

Name

Years of

Banking

Experience Title Background

Stephen P. Wilson 41 Chairman

Joined LCNB in 1975 and LCNB Board of Directors in 1982. Former

CEO of LCNB, Chairman of the American Bankers Association (2010 -

2011), and a former Board Member of the Federal Reserve Bank of

Cleveland.

Steve P. Foster 42 CEO

Joined LCNB in 1977 and has served as Internal Auditor, Branch

Manager, Loan Officer, and CFO. He was elected to the LCNB Board of

Directors in 2005.

Robert C. Haines 24

Chief Financial

Officer

Joined LCNB in 1992 and has served as Internal Auditor, Assistant Trust

Officer, Vice President of IT, and CFO. He also serves as LCNB's

primary contact with its transfer agent.

Leroy F. McKay 30

Executive Vice

President

Joined LCNB in 1996 and serves as Head of the Trust Department,

Investment Officer for the bank's investment portfolio.

Eric J. Meilstrup 28

Executive Vice

President

Joined LCNB in 1988 and has served in Item Processing and various

positions in Operations. Currently runs LCNB Operations.

Matthew P. Layer 34

Executive Vice

President

Joined LCNB in 1982 and has served as Branch Manager, Head of

Secondary Markets, Head of Real Estate Lending, and Chief Lending

Officer.

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

LCNB Investment Highlights – Financial Performance

7 Source: SNL Financial, Company documents

LCNB Corp. Calendar Year Ended LTM Quarter Ended

LCNB 2011 2012 2013 2014 2015 6/30/16 9/30/15 12/31/15 3/31/16 6/30/16

Total Assets 791,570 788,637 932,338 1,108,066 1,280,531 1,312,635 1,275,171 1,280,531 1,285,922 1,312,635

Gross Loans 461,262 453,783 574,354 698,956 770,938 800,465 762,833 770,938 778,714 800,465

Reserves 2,931 3,437 3,588 3,121 3,129 3,373 2,958 3,129 3,150 3,373

Deposits 663,562 671,471 785,761 946,205 1,087,160 1,124,698 1,103,513 1,087,160 1,120,208 1,124,698

Total Equity 77,960 82,006 118,873 125,695 140,108 145,710 140,851 140,108 142,933 145,710

Common Equity 77,960 82,006 118,873 125,695 140,108 145,710 140,851 140,108 142,933 145,710

Loans / Deposits 69.51 67.58 73.10 73.87 70.91 71.17 69.13 70.91 69.52 71.17

Total Equity / Assets 9.85 10.40 12.75 11.34 10.94 11.10 11.05 10.94 11.12 11.10

Tangible Equity / Tangible Assets 9.16 9.71 11.18 8.72 8.43 8.69 8.51 8.43 8.64 8.69

Common Equity / Assets 9.85 10.40 12.75 11.34 10.94 11.10 11.05 10.94 11.12 11.10

Tangible Common Equity / Tangible Assets 9.16 9.71 11.18 8.72 8.43 8.69 8.51 8.43 8.64 8.69

Tier 1 Capital Ratio 13.93 15.13 18.03 13.92 13.46 12.89 13.54 13.46 13.13 12.89

Total Risk-Based Capital Ratio 14.54 15.86 18.65 14.38 13.85 13.29 13.92 13.85 13.52 13.29

Leverage Ratio 8.51 8.98 11.10 8.53 8.62 8.56 8.60 8.62 8.60 8.56

Net Income ($000) 8,115 8,270 8,780 9,869 11,474 11,449 2,633 2,884 2,964 2,968

Core ROAA 0.85 0.89 0.98 0.99 0.98 0.89 0.88 0.90 0.89 0.89

Core ROAE 9.05 8.84 9.49 9.01 8.83 8.07 8.02 8.19 7.99 8.07

ROATCE 11.90 11.08 10.96 11.06 11.68 11.18 10.63 11.29 11.49 11.30

Net Interest Margin 3.70 3.52 3.57 3.66 3.64 3.40 3.40 3.50 3.47 3.39

Efficiency Ratio 63.35 62.85 63.10 61.77 60.60 63.74 64.03 63.11 64.94 62.91

NPAs / Assets 2.53 2.26 2.10 1.92 1.27 1.31 1.36 1.27 1.41 1.31

NPAs-Ex-TDRs / Assets 0.67 0.57 0.47 0.63 0.20 0.26 0.27 0.20 0.32 0.26

NPLs / Loans 3.99 3.44 3.15 2.84 2.00 2.07 2.12 2.00 2.22 2.07

NCOs / Average Loans 0.39 0.18 0.08 0.21 0.18 0.08 0.08 0.11 0.04 0.09

Reserves / Gross Loans 0.64 0.76 0.62 0.45 0.41 0.42 0.39 0.41 0.40 0.42

Reserves / NPLs 15.92 22.00 19.81 15.71 20.26 20.39 18.33 20.26 18.23 20.39

Common Shares Outstanding 6,704,723 6,731,900 9,287,536 9,311,318 9,925,547 9,937,262 9,903,294 9,925,547 9,931,788 9,937,262

Book Value Per Share 11.63 12.18 12.80 13.50 14.12 14.66 14.22 14.12 14.39 14.66

Tangible Book Value Per Share 10.73 11.29 11.02 10.08 10.58 11.17 10.66 10.58 10.88 11.17

EPS after Extra 1.20 1.22 1.10 1.05 1.17 1.14 0.26 0.29 0.30 0.29

Dividends Paid 0.64 0.64 0.64 0.64 0.64 0.64 0.16 0.16 0.16 0.16

Dividend Payout Ratio 53.33 52.46 58.18 60.95 54.70 56.14 61.54 55.17 53.33 55.17

Pe

r S

ha

re

D

ata

($)

Ba

lan

ce

S

he

et

($0

00

)

Ca

pit

al

Ra

tio

s

(%

)

Pr

of

ita

bil

ity

(%

)

As

se

t Q

ua

lity

(%

)

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

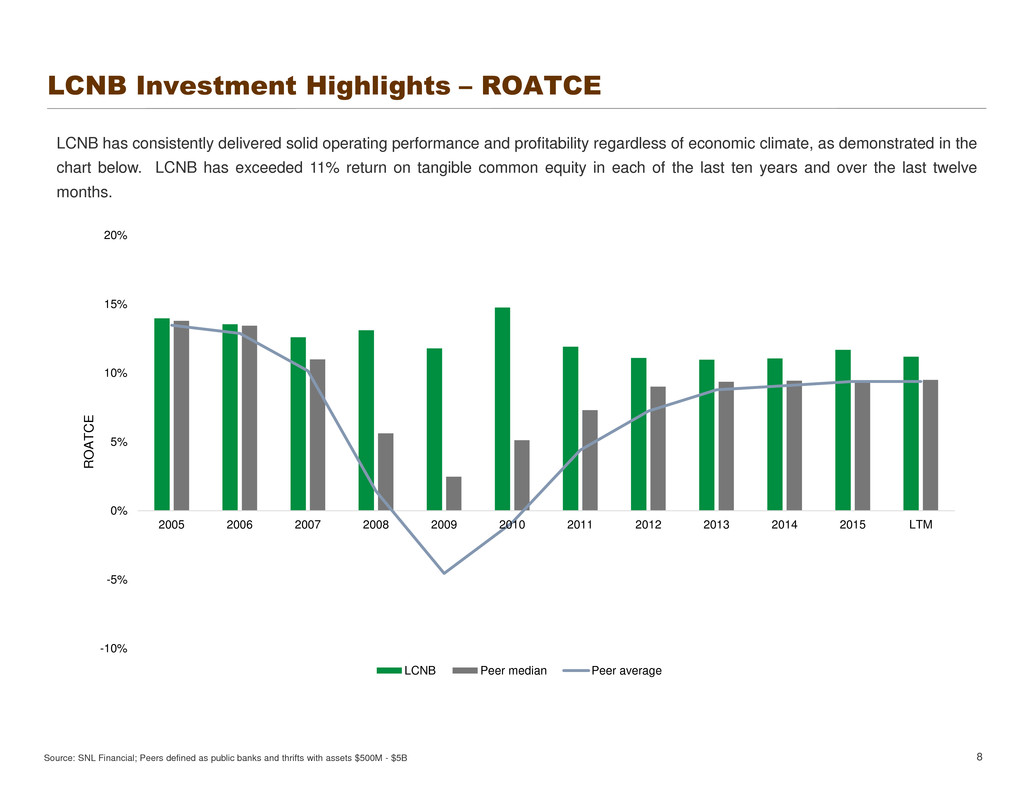

LCNB Investment Highlights – ROATCE

8 Source: SNL Financial; Peers defined as public banks and thrifts with assets $500M - $5B

LCNB has consistently delivered solid operating performance and profitability regardless of economic climate, as demonstrated in the

chart below. LCNB has exceeded 11% return on tangible common equity in each of the last ten years and over the last twelve

months.

-10%

-5%

0%

5%

10%

15%

20%

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 LTM

R

O

A

T

C

E

LCNB Peer median Peer average

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

18.00%

20.00%

1

9

7

5

1

9

7

7

1

9

7

9

1

9

8

1

1

9

8

3

1

9

8

5

1

9

8

7

1

9

8

9

1

9

9

1

1

9

9

3

1

9

9

5

1

9

9

7

1

9

9

9

2

0

0

1

2

0

0

3

2

0

0

5

2

0

0

7

2

0

0

9

2

0

1

1

2

0

1

3

2

0

1

5

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

1.60%

1.80%

1

9

7

5

1

9

7

7

1

9

7

9

1

9

8

1

1

9

8

3

1

9

8

5

1

9

8

7

1

9

8

9

1

9

9

1

1

9

9

3

1

9

9

5

1

9

9

7

1

9

9

9

2

0

0

1

2

0

0

3

2

0

0

5

2

0

0

7

2

0

0

9

2

0

1

1

2

0

1

3

2

0

1

5

LCNB has had an average ROAA of 1.24% and an average ROAE of 12.98% for the last 41 years, including

the duration of the last financial crisis

LCNB Investment Highlights – Consistent Profitability

9

ROAA ROAE

LCNB 41-Yr. Avg.: 1.24%

LCNB 41-Yr. Avg.: 12.98%

Avg. of U.S. public banks:

0.60%

Avg. of U.S. public banks:

6.18%

107%

Higher

110%

Higher

Source: SNL Financial, Company documents.

1 Average calculated from 1990-2016Q1, the longest time period for which public data are available.

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

Transaction

9.6%

[CATEGORY

NAME]

[PERCENTAG

E]

[CATEGORY

NAME]

[PERCENTAG

E]

Time > $100k

6.7%

LCNB Investment Highlights – Deposits and Loans

10

Deposit Composition at 6/30/16 Loan Breakdown at 6/30/16

YTD Cost of Deposits: 0.30% YTD Yield on Loans: 4.50%

1-4 Family

29.1%

Multifamily +

CRE

49.6%

C&I

5.6%

Other

Consumer

2.3%

HELOC

4.3%

Construction

2.3%

Farm + Ag.

Production

[PERCENTAG

E]

Source: SNL Financial

Note: Regulatory filings capture some transaction accounts as MMDA

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

LCNB Investment Highlights – NCOs / Avg. Loans

11 Source: SNL Financial; Peers defined as public banks and thrifts with assets $500M - $5B; LTM as of 6/30/16

0.0%

0.2%

0.4%

0.6%

0.8%

1.0%

1.2%

1.4%

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 LTM

LCNB Peer median Peer average

LCNB has achieved consistently strong profitability without reaching for growth or compromising its credit standards. On the

contrary, LCNB’s intimate knowledge of its communities and its customers has resulted in minimal credit losses throughout and since

the recession.

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

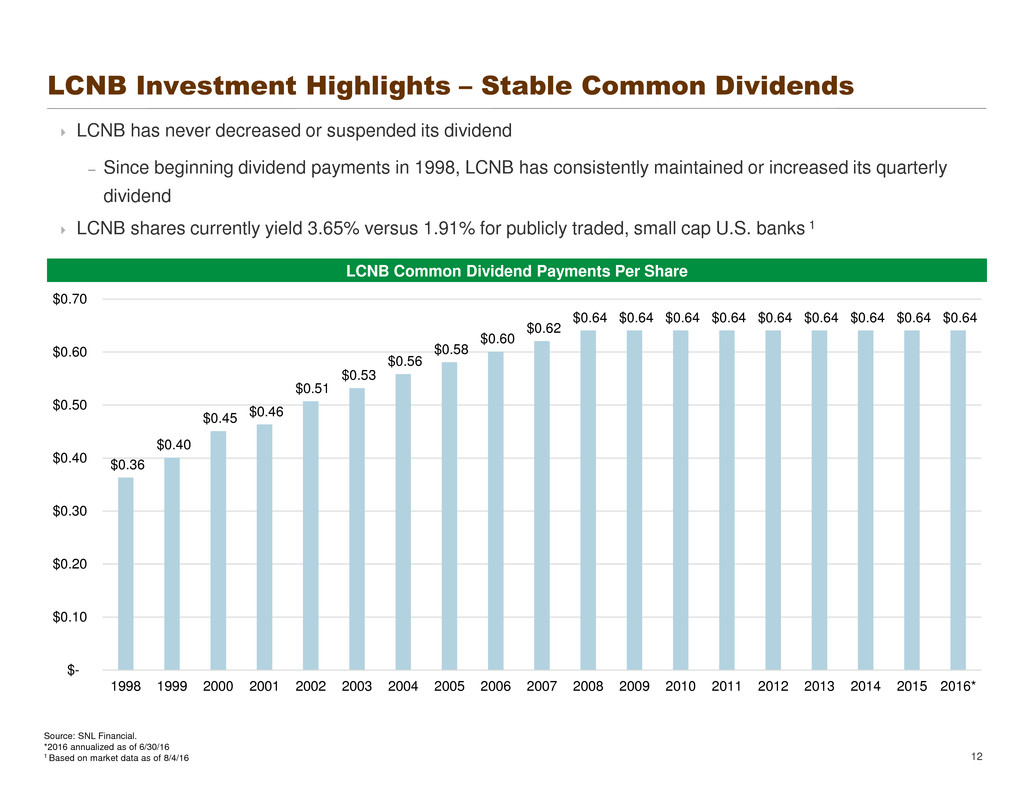

LCNB Investment Highlights – Stable Common Dividends

12

LCNB Common Dividend Payments Per Share

LCNB has never decreased or suspended its dividend

– Since beginning dividend payments in 1998, LCNB has consistently maintained or increased its quarterly

dividend

LCNB shares currently yield 3.65% versus 1.91% for publicly traded, small cap U.S. banks 1

$0.36

$0.40

$0.45 $0.46

$0.51

$0.53

$0.56

$0.58

$0.60

$0.62

$0.64 $0.64 $0.64 $0.64 $0.64 $0.64 $0.64 $0.64 $0.64

$-

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

$0.70

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016*

Source: SNL Financial.

*2016 annualized as of 6/30/16

1 Based on market data as of 8/4/16

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

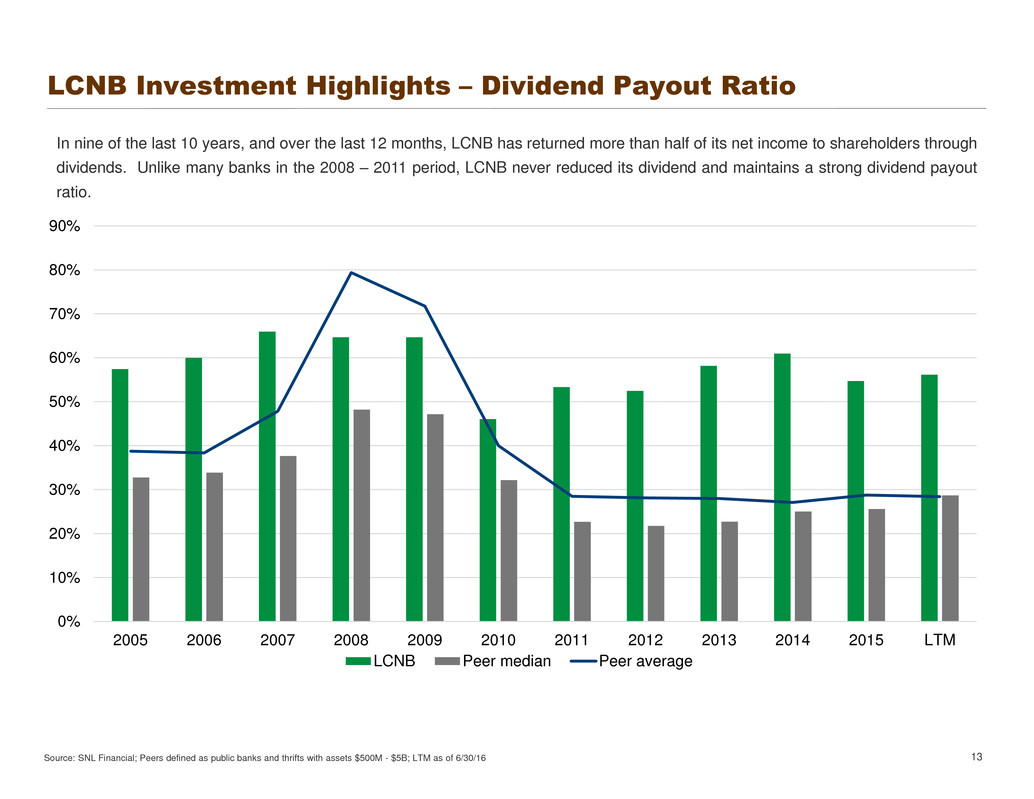

LCNB Investment Highlights – Dividend Payout Ratio

13 Source: SNL Financial; Peers defined as public banks and thrifts with assets $500M - $5B; LTM as of 6/30/16

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 LTM

LCNB Peer median Peer average

In nine of the last 10 years, and over the last 12 months, LCNB has returned more than half of its net income to shareholders through

dividends. Unlike many banks in the 2008 – 2011 period, LCNB never reduced its dividend and maintains a strong dividend payout

ratio.

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

LCNB Investment Highlights – Ownership Profile

14

Stakeholder/Insider Ownership Information Institutional Ownership Information

Holder % Owned Options Holder % Owned

LCNB National Bank 6.92 0 FMR LLC 8.21

John H. Kochensparger III 1.49 0 Kennedy Capital Management Inc. 4.77

Spencer S. Cropper 0.80 0 Jacobs Asset Management LLC 3.31

William H. Kaufman 0.73 0 American Money Management Corp. 1.18

Stephen P. Wilson 0.66 0 Cardinal Capital Management L.L.C. 0.91

George L. Leasure 0.35 0 Frank Russell Co. 0.70

Steve P. Foster 0.33 0 Clearwater Management Co. Inc 0.62

Jacobs Seymour Murray 0.23 0 Robert W. Baird & Co. Inc. 0.56

Eric J. Meilstrup 0.14 0 Renaissance Technologies LLC 0.50

Leroy F. McKay 0.10 0 Geode Capital Management LLC 0.37

Matthew P. Layer 0.09 0 Commonwealth Equity Services Inc. 0.34

Anne E. Krehbiel 0.04 0 UBS Group AG 0.32

Robert C. Haines II 0.02 0 Credit Suisse Group AG 0.32

BlackRock Inc. 0.28

Company Statistics BNY Asset Management 0.25

Ticker LCNB Regions Investment Management Inc. 0.23

Price ($) as of 8/4/16 17.43 California Public Employees' Retirement System 0.21

Total Assets (Most Recent Quarter) 1,312,635 Goldman Sachs Group Inc. 0.20

Total Float 8,755,653 Cutter & Co. Brokerage Inc. 0.19

Float (%) 88.11 California State Teachers' Retirement System 0.19

Stakeholder/Insider Ownership (%) 11.89 Millennium Management LLC 0.18

Institutional Ownership (%) 25.73

Top 10 Insider Holders (%) 11.73

Source: SNL Financial, Company documents as of 8/4/16

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

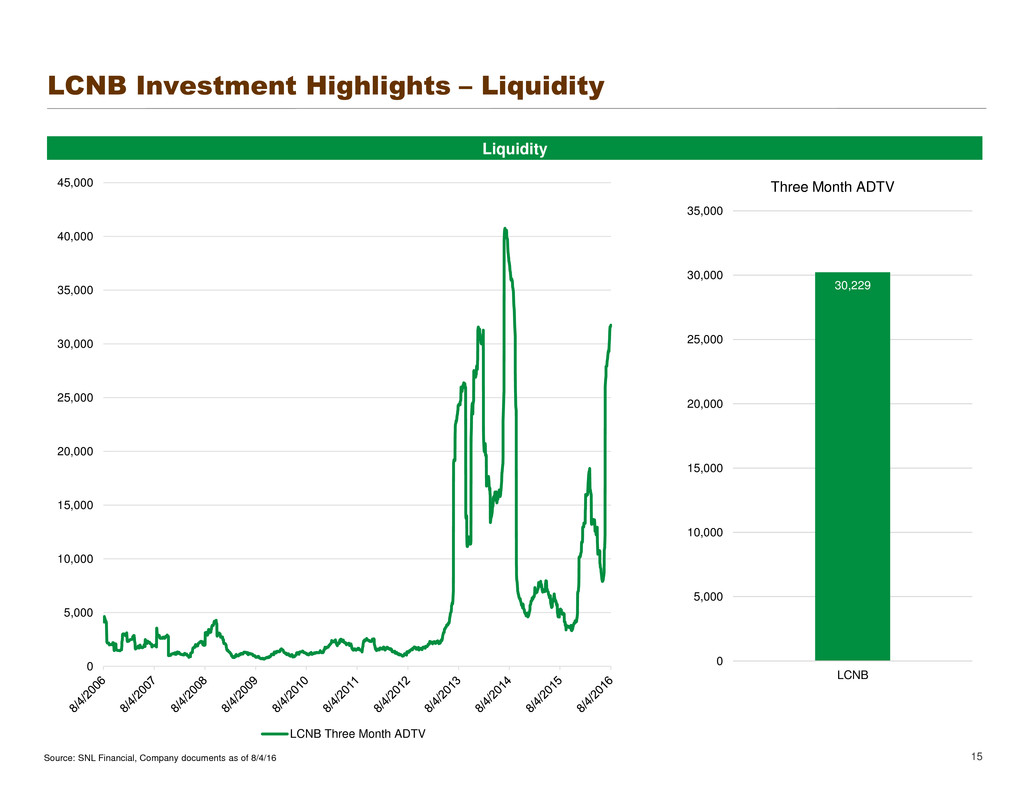

LCNB Investment Highlights – Liquidity

15

Liquidity

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

LCNB Three Month ADTV

30,229

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

LCNB

Three Month ADTV

Source: SNL Financial, Company documents as of 8/4/16

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

LCNB Investment Highlights – 10-Year Total Return

16 Source: SNL Financial as of 8/4/16

-100%

-50%

0%

50%

100%

150%

Aug-06 Aug-07 Aug-08 Aug-09 Aug-10 Aug-11 Aug-12 Aug-13 Aug-14 Aug-15

LCNB SNL U.S. Bank and Thrift

51.3%

–21.1%

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

LCNB Investment Highlights – Attractive Relative Valuation

17

Selected Peer Midwest Bank Comparison (Sorted by Market Capitalization)

Metric PRK FFBC FRME PEBO FDEF UCFC LCNB

LTM ROAA (%) 1.08 1.01 1.06 0.70 1.20 0.86 0.89

LT ROATCE (%) 12.27 13.23 12.24 9.14 13.01 6.96 11.18

LT Net Interest Margin (%) 3.45 3.68 3.82 3.56 3.76 3.17 3.40

LTM Efficiency Ratio (%) 61.55 58.55 58.86 65.76 61.70 63.42 63.74

Tang Common Equity/ Tang Assets (%) 9.07 7.86 9.43 9.18 9.52 12.15 8.69

NPA Ex-TDRs/ Total Assets (%) 1.73 0.38 0.68 0.49 0.74 1.06 0.26

Market Capitalization ($M) 1,372.6 1,311.7 1,074.8 408.4 379.6 310.6 173.2

Price/ Tangible Book (%) 205.6 206.0 171.5 144.7 170.0 123.0 156.1

Price/ LTM EPS (x) 17.3 16.3 15.1 18.1 14.0 18.5 15.3

Dividend Yield (%) 4.2 3.0 2.1 2.8 2.1 1.8 3.7

Source: SNL Financial; LTM as of 6/30/16, pricing data as of 8/4/16