Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - HERC HOLDINGS INC | pressreleaseq22016.htm |

| 8-K - 8-K - HERC HOLDINGS INC | a8-kearningssecondquarter.htm |

Herc Holdings Inc.

Q2 and First Half Results

August 9, 2016

Agenda

2

Welcome and Introductions Elizabeth Higashi

Vice President, Investor Relations

Overview of Q2 and YTD Results Larry Silber

President and Chief Executive Officer

Financial Review Barbara Brasier

Senior Vice President and Chief Financial Officer

Industry Outlook Larry Silber

Q&A

Larry Silber

Barbara Brasier

Bruce Dressel

Senior Vice President and Chief Operating Officer

NYSE: HRI

Safe Harbor Statements

Basis of Presentation

The financial information included in this presentation is based upon the condensed consolidated and combined financial statements of the

Company which are presented on a basis of accounting that reflects a change in reporting entity and have been adjusted for the effects of the

spin-off from The Hertz Corporation. These financial statements and financial information represent only those operations, assets, liabilities

and equity that form Herc Holdings on a stand-alone basis. Since the spin-off occurred on June 30, 2016, the financial statements represent

the carve-out financial results for the Company for the first six months of 2016 and include all spin-off impacts through June 30, 2016. All

prior period amounts represent carve-out financial results.

Forward-Looking Statements

This presentation contains statements that are not statements of historical fact, but instead are forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995. We caution readers not to place undue reliance on these statements, which

speak only as of the date hereof. There are a number of risks, uncertainties and other important factors that could cause our actual results to

differ materially from those suggested by our forward-looking statements, including those set forth in the Information Statement which was

filed as Exhibit 99.1 to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on July 6, 2016 (the

“Information Statement”), including:

• Risks related to the spin-off and our separation from Hertz Car Rental Holdings Company, Inc. (“New Hertz”), such as: we have no

operating history as a stand-alone public company, and our historical and pro forma financial information is not necessarily

representative of the results that we would have achieved as a separate, publicly traded company and may not be a reliable indicator of

our future results, given the incremental costs are incurring; the loss of the Hertz brand and reputation; the decrease in purchasing

power we may experience and the liabilities we have assumed in connection with the spin-off; we may not achieve some or all of the

expected benefits of the spin-off and our assets and resources may not be sufficient for us to operate as a stand-alone company; if

there is a determination that any portion of the spin-off transaction is taxable for U.S. federal income tax purposes then we and our

stockholders could incur significant tax liabilities, and we could also incur indemnification liability if we are determined to have caused

the spin-off to become taxable; our ability to engage in financings, acquisitions and other strategic transactions using equity securities is

limited due to the tax treatment of the spin-off; the spin-off may be challenged by creditors as a fraudulent transfer or conveyance; and if

the spin-off is not a legal dividend, it could be held invalid by a court and have a material adverse effect on our business, financial

condition and results;

• Risks related to the restatement of financial statements previously issued by Hertz Global Holdings, Inc. (in its form prior to the spin-off,

“Hertz Holdings”), including that the restatement could expose us to additional risks that could materially adversely affect our financial

position, results of operations and cash flows; we have identified material weaknesses in our internal control over financial reporting that

may adversely affect our ability to report our financial condition and results of operations in a timely and accurate manner, which may

adversely affect investor confidence in us and, as a result, the value of our common stock; and the restatement of Hertz Holdings’

previously issued financial results has resulted in government investigations, books and records demands, and private litigation and

could result in government enforcement actions and private litigation that could have a material adverse impact on our results of

operations, financial condition, liquidity and cash flows;

3NYSE: HRI

Safe Harbor Statements - Continued

• Risks related to the securities market and ownership of our stock, including that an active trading market for our common stock may not be

sustained and the market price of our common stock may fluctuate significantly; our accounting and other management systems and

resources may not be adequately prepared to meet the ongoing financial reporting and other requirements; and the market price of our

common stock could decline as a result of the sale or distribution of a large number of shares of our common stock or the perception that a

sale or distribution could occur;

• Business risks could have a material adverse effect on our business, results of operations, financial condition and/or liquidity, including the

cyclicality of our business, a slowdown in economic conditions or adverse changes in the economic factors specific to the industries in

which we operate, such as recent declines in oil prices further negatively impacting the upstream oil and gas industry and extending to

other markets we service; intense competition in the industry, including from our own suppliers; any decline in our relations with our key

national account or industrial account customers or the amount of equipment they rent from us; any occurrence that disrupts rental activity

during our peak periods (given the seasonality of the business, especially in the construction industry); any inability to accurately estimate

future levels of rental activity and adjust the size and mix of our fleet accordingly; any inability to purchase adequate supplies of

competitively priced equipment or to collect on contracts with customers; our equipment rental fleet is subject to residual value risk upon

disposition and may not sell at the prices we expect; we may not be successful implementing our strategy of further reducing operating

costs and our cost reduction initiatives may have adverse consequences; an impairment of our goodwill or our indefinite lived intangible

assets could have a material non-cash adverse impact; doing business in foreign countries exposes us to additional risks; we may be

unable to protect our trade secrets and other intellectual property rights; we may fail to respond adequately to changes in technology and

customer demands; our business is heavily reliant upon communications networks and centralized information technology systems and the

concentration of our systems creates risks for us; failure to maintain, upgrade and consolidate our information technology networks could

adversely affect us; the misuse or theft of information we possess, including as a result of cyber security breaches, could harm our brand,

reputation or competitive position; our success as an independent company will depend on our new senior management team, the ability of

other new employees to learn their new roles, our ability to retain key members of our senior management team and other key personnel

and to attract key personnel; we may face issues with our union employees; strategic transactions could be difficult to identify and

implement; some or all of our deferred tax assets could expire if we experience an “ownership change” as defined in the Internal Revenue

Code; we may experience fluctuations in our tax obligations and effective tax rate; changes to accounting rules or regulations may

adversely affect our financial position and results of operations; we are exposed to a variety of claims and losses arising from our

operations, and our insurance may not cover all or any portion of such claims; environmental, health and safety laws and regulations could

materially adversely affect us; and decreases in government spending may have an adverse effect on us;

• Risks related to our substantial indebtedness, such as: our substantial level of indebtedness could materially adversely affect our financial

condition and ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry or

materially adversely affect our results, liquidity and ability to compete; and the secured nature of our indebtedness, which is secured by

substantially all of our consolidated assets, could materially adversely affect our business and holders of our debt and equity; and

• Other risks and uncertainties set forth in the Information Statement under “Risk Factors.”

• All forward-looking statements are expressly qualified in their entirely by such cautionary statements. We do not undertake any obligation

to release publicly any update or revision to any of the forward-looking statements.

4NYSE: HRI

Reconciliation to GAAP

In addition to results calculated according to accounting principles generally accepted in the United States (“GAAP”), the Company has

provided certain information in this release which is not calculated according to GAAP (“non-GAAP”), such as Adjusted EBITDA and certain

revenue results excluding certain items. Management uses these non-GAAP measures to evaluate the operational performance of the

Company, and believes that investors will likewise find these non-GAAP measures useful in evaluating the Company’s performance. These

measures are frequently used by security analysts, institutional investors and other interested parties in the evaluation of companies in our

industry.

Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and,

as calculated, may not be comparable to similarly titled measures of other companies. For the definitions of these terms, further information

about management’s use of these measures as well as a reconciliation of these non-GAAP measures to the most comparable GAAP

financial measures, please see the Appendix to this presentation.

Herc Holdings does not provide forward-looking guidance for certain financial measures on a GAAP basis or a reconciliation of forward-

looking non-GAAP financial measures to the most directly comparable GAAP reported financial measures on a forward-looking basis

because it is unable to predict certain items contained in the GAAP measures without unreasonable efforts. Certain items that impact net

income (loss) cannot be predicted with reasonable certainty, such as restructuring and restructuring related charges, special tax items,

borrowing levels (which affect interest expense), gains and losses from asset sales, the ultimate outcome of pending litigation and spin-

related costs.

5NYSE: HRI

We aspire to be the

supplier, employer and

investment of choice in

our industry.

Spin Accomplished

• Herc Rentals separated from Hertz’s rental car

business on June 30, 2016 in a tax-free

transaction and began trading on the NYSE on

July 1, 2016

• As part of the transaction, Herc Rentals issued

$1.235 billion in Senior Secured Seco d Priority

Notes

• Herc Rentals entered into a $1.75 billion ABL

Revolving Credit Facility

6

NYSE:

HRI

NYSE: HRI

Transformation in Process

Implementing initiatives

to improve operating efficiencies

and drive revenue growth

Built an organization

to support stand alone public

company requirements

Positioned organization for

transformation

7NYSE: HRI

Q2 2016 Results

8

Equipment Rental

Revenue

• Reported $327.9 million in the quarter

• Excluding operations in France & Spain and

impact of foreign currency translation:

o + 0.1% overall

o + 8.1% in key markets1, which represented

84% of total

Pricing • +0.5% YoY

$ Utilization • 33.5%, a decrease of 50 bps YoY

Revenue Earning

Equipment – First

Half

• Acquisitions: $305.5 million

• Disposals (at estimated OEC): $170 million

NYSE: HRI

1 Key markets refer to those outside of the upstream oil and gas markets.

Q2 2016 and YTD Highlights

Continued to right size fleet in upstream oil

and gas markets and reduced non-premium

brands

Made strategic changes to deemphasize low

margin new equipment sales, including

eliminating certain equipment

distributorships

Opened four North America locations to

support our urban market strategy

Implemented new rental equipment training

programs to support our ProSolutions™ and

ProContractor™ gear

Continued to make headway to reduce FUR:

12.6% average in Q2 2016

9NYSE: HRI

18.6% 18.1%

14.7%

13.3% 12.6%

10.0%

2013 2014 2015 Q1'16 Q2'16 Target

Average Fleet Unavailable for Rent (FUR)

Continuing to Integrate New Technologies

Optimus

- Pricing tool gaining acceptance and traction

Mobile App launched July 1

−More than 8,000 registered users (to date)

Salesforce.com

− Fully deployed throughout the North America

organization

−Qualified leads are pushed to sales teams

− Provides platform for increasing collaboration

across the sales organization

Herc Rentals Telematics (ProControl™)

−Enhancement of telematics program

underway

10NYSE: HRI

Financial Overview

11

Q2 and YTD 2016 GAAP Summary

12NYSE: HRI

$ in millions, except EPS Three months ended June 30, Six months ended June 30,

2016 2015 2016 2015

Rental revenue $ 327.9 $ 347.7 $ 635.7 $ 679.3

Total revenue 380.4 422.7 746.0 824.0

Adjusted EBITDA 130.6 147.3 238.4 276.7

Net income (loss) (8.0) 10.6 (9.5) 12.3

Earnings (loss) per share

(diluted) $ (0.28) $ 0.35 $ (0.34) $ 0.40

1 For a reconciliation to the closest GAAP equivalent, see Appendix beginning on slide 25.

Q2 and YTD 2016 Equipment Rental Revenues

(excluding France and Spain and Foreign Currency Translation)1

13

Q2 Equipment Rental Revenue

$ in millions

$643.8

$641.6

0

100

200

300

400

500

600

700

800

900

2015 2016

YTD Equipment Rental Revenue

Key markets represented

84% of total rental revenue

Rental revenue in key

markets increased 8.1%

Better-than-market revenue

growth in key markets offset

weakness in upstream oil

and gas markets

Pricing increased 0.5%

YoY

Key markets represented

82% of total rental revenue

Rental revenue in key

markets increased 9.9%

YTD

Continued weakness in

upstream oil and gas

markets eroded growth in

key markets

Q2 Equipment Rental Revenue Bridge

YTD Equipment Rental Revenue Bridge

NYSE: HRI

328

328

328

329

329

329

329

329

330

330

330

2015 2016

$329.8

$329.4

$20.8

$47.4

0.1%

YoY

(0.3%)

YoY

329.8

$20.4

$329.4

2015 Key Markets Oil and Gas 2016

$ 641.6

$49.6

$643.8

0

100

200

300

400

500

600

700

2015 Key Markets Oil and Gas 2016

Q2 Highlights

YTD Highlights

Q2 and YTD 2016 Total Revenues

(excluding France and Spain and Foreign Currency Translation)1

14NYSE: HRI

YTD rental revenues were

about flat

Used equipment sales

declined YoY because the

amount of fleet ready for

disposal was lower

New equipment sales were

also lower due to focus on

higher margin rental

activities rather than sales

$406.7

$382.8

0

100

200

300

400

500

600

700

800

900

2015 2016

Q2 Total Revenues

$406.7

Q2 Total Revenue Bridge

$783.5

$753.3

0

100

200

300

400

500

600

700

800

900

2015 2016

YTD Total Revenues

$783.5

YTD Total Revenue Bridge

$ in millions

(5.9%)

YoY

(3.9%)

YoY

1 For a reconciliation to the closest GAAP equivalent, see Appendix beginning on slide 25.

$753.3

$2.2

$22.2 $4.9 $0.9

$783.5

2015 Equipment

rental

revenue

Sales of

revenue

earning

equipment

Sales of

new

equipment

Other 2016

$382.8

$0.4

$19.4 $4.3 $0.6

$406.7

2015 Equipment

rental

revenue

Sales of

revenue

earning

equipment

Sales of

new

equipment

Other 2016

Q2 and YTD Highlights

Q2 and YTD 2016 Adjusted EBITDA

(excluding France and Spain and Foreign Currency Translation) 1

15NYSE: HRI

Q2 Adjusted EBITDA

YTD Adjusted EBITDA

$267.3

$239.7

$9.4

0

50

100

150

200

250

300

350

400

2015 2016

$147.3

Higher proportion of sales

through auction channels

Oversupply of certain

categories of used

equipment

$ in millions

$131.1

2015 2016

$142.2

$267.3

Q2 Adjusted EBITDA Bridge

YTD Adjusted EBITDA Bridge

$131.1

$11.6

$11.8

$10.0 $1.3

$142.2

0

20

40

60

80

100

120

140

160

2015 Gain (loss)

on sales of

revenue

earning

equipment

Key

Markets

Oil and Gas Other 2016

(7.8%)

YoY

(10.3%)

YoY

1 For a reconciliation to the closest GAAP equivalent, see Appendix beginning on slide 25.

$239.7

$25.0

$24.8

$28.0

$0.6

$267.3

100

120

140

160

180

200

220

240

260

280

300

2015 Gain (loss)

on sales of

revenue

earning

equipment

Key

Markets

Oil and Gas Other 2016

Q2 and YTD Highlights

Revenue Earning Equipment

16

Average fleet original equipment cost (OEC).

NYSE: HRI

Herc Rentals acquired $305.5 million of OEC in the first half of 2016 compared to $437.3

million in 2015

Additions were managed prudently as we improved FUR and absorbed oil and gas fleet

while continuing to add fleet for ProSolutions™ and ProContractor™ equipment to improve

our fleet and customer mix and $ utilization going forward

Proceeds from disposals of equipment amounted to $62.8 million (approximately $170

million OEC) in the first half of 2016 as we continued to right size our upstream oil and gas

fleet and dispose of non-premium brands of gear that increased our FUR

2016 2015 $ Variance

Acquisition of revenue earning equipment $ 305.5 $ 437.3 $ 131.8

Proceeds from disposal of revenue earning

equipment $ (62.8) $ (100.7) $ (37.9)

Net Fleet Expenditures $ 242.7 $ 336.6 $ 93.9

First half 2016 OEC is approximately $3.5 billion, up about 3% versus the first

half of 2015

Six months ended June, 30$ in millions

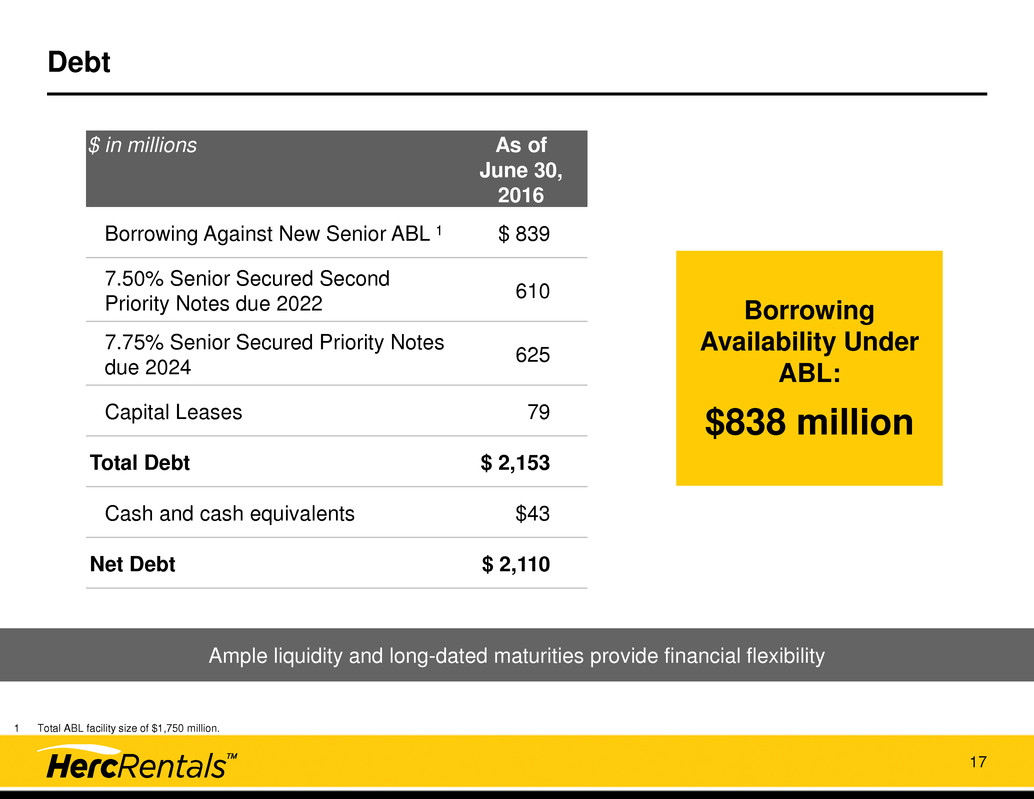

Debt

Ample liquidity and long-dated maturities provide financial flexibility

1 Total ABL facility size of $1,750 million.

$ in millions As of

June 30,

2016

Borrowing Against New Senior ABL 1 $ 839

7.50% Senior Secured Second

Priority Notes due 2022 610

7.75% Senior Secured Priority Notes

due 2024 625

Capital Leases 79

Total Debt $ 2,153

Cash and cash equivalents $43

Net Debt $ 2,110

17

Borrowing

Availability Under

ABL:

$838 million

Updated Full Year 2016 Guidance*

Adjusted EBITDA:

$520 million to $560 million

Net Fleet Capital Expenditures

(Revenue earning equipment expenditures

less proceeds from disposals of such equipment):

$375 million to $400 million

18NYSE: HRI

Herc Holdings does not provide forward-looking guidance for certain financial measures on a GAAP basis or a

reconciliation of forward-looking non-GAAP financial measures to the most directly comparable GAAP reported financial

measures on a forward-looking basis because it is unable to predict certain items contained in the GAAP measures without

unreasonable efforts. Certain items that impact net income (loss) cannot be predicted with reasonable certainty, such as

restructuring and restructuring related charges, special tax items, borrowing levels (which affect interest expense), gains

and losses from asset sales, the ultimate outcome of pending litigation and spin-related costs.

*

Equipment Rental Industry Update

Equipment Rental Industry Update

Strong market growth and further penetration of rental solutions expected to continue

1 IHS Global Insight as of July 2016, excludes Party & Event data.

2 Source: As reported by RER 100 in May 2016: Top Rental Equipment Companies of 2015 ranked by revenue.

$36 $38 $38

$31 $32

$35

$38 $41

$44 $47

$49 $52

$54 $57

06 07 08 09 10 11 12 13 14 15 16E 17E 18E 19E

($ in billions)

• IHS outlook for 2016 equipment rental

market declines to $49 billion from $50

billion projection1

• The projected CAGR through 2019

dropped to 4.9% from 5.3%1

• 2016 Non-Residential Starts slowing – but

still positive

• The ABI Index remains above 50 at 52.6 as

of June 2016

• Rental penetration versus purchase trends

continue to grow

North American Equipment Rental Market 1

$4,949

$2,790

$1,411

$639 $559 $550 $450 $443 $442 $440

U

ni

te

d

R

en

ta

ls

S

un

be

lt

R

en

ta

ls

H

om

e

D

ep

ot

B

lu

eL

in

e

R

en

ta

ls

M

ax

im

C

ra

ne

R

en

ta

l C

or

p

S

un

st

at

e

E

qu

ip

m

en

t

H

&

E

E

qu

ip

m

en

t

S

er

vi

ce

s

A

he

rn

R

en

ta

ls

A

gg

re

ko

N

or

th

A

m

er

ic

a

Economic and Industry Outlook

($ in millions)

20NYSE: HRI

2

as of July 2016

as of May 2016

Construction and Industrial Outlook

Construction and industrial markets expected to grow

Non-Residential Starts 1 Construction Put in Place 2 Architecture Billings Index 3

Construction Employment 4 Industrial Spending 5

$302.6 $308.0

2015 2016E

Ja

n-

96

Ja

n-

00

Ja

n-

04

Ja

n-

08

Ja

n-

12

Ja

n-

16

Reading above 50 implies

expansion

$214 $218

$237

$262

2015 2016E 2017E 2018E

6.2%

7.9% 7.6%

1.5%

Total

Construction

Private Non-

Residential

Residential Public

Construction

Ja

n-

14

Fe

b-

14

M

ar

-1

4

A

pr

-1

4

M

ay

-1

4

Ju

n-

14

Ju

l-1

4

A

ug

-1

4

S

ep

-1

4

O

ct

-1

4

N

ov

-1

4

D

ec

-1

4

Ja

n-

15

Fe

b-

15

M

ar

-1

5

A

pr

-1

5

M

ay

-1

5

Ju

n-

15

Ju

l-1

5

A

ug

-1

5

S

ep

-1

5

O

ct

-1

5

N

ov

-1

5

D

ec

-1

5

Ja

n-

16

Fe

b-

16

M

ar

-1

6

A

pr

-1

6

M

ay

-1

6

Ju

n-

16

Ju

l-1

6

June 2016 YTD

1 Dodge Analytics.

2 U.S consensus, not seasonally adjusted.

3 The American Institute of Architects (AIA).

($ in billions)

4 Bureau of Labor Statistics, all construction employment.

5 Industrial information resources.

21NYSE: HRI

June

52.6

5,999

6,652

as of July 2016

as of July 2016

as of August 2016

($ in thousands)

as of August 2016

($ in millions)

Unique Opportunity to Build Value

Attractive long term industry fundamentals

Significant opportunity for operational and financial improvement

Commitment to disciplined capital management

Strong asset base including $3.5 billion of OEC

Strategically positioned to generate above market growth

Strong brand recognition and reputation – 50+ years

Industry savvy and experienced leadership team

22NYSE: HRI

Q&A

23NYSE: HRI

Appendix

24NYSE: HRI

Glossary of Terms Commonly Used in the Industry

25NYSE: HRI

OEC: Original Equipment Cost; the cost of the asset at the time it was first purchased.1

Fleet Age: The OEC weighted age of the entire fleet.

2

Net Fleet Capex: Capital expenditures of revenue earning equipment minus the proceeds from disposal of revenue

earning equipment.

3

Dollar Utilization ($ Ute): Dollar utilization means revenue derived from the rental of equipment divided by the

original cost of the equipment (OEC) including additional capitalized refurbishment costs (with the basis of refurbished

assets reset at the refurbishment date).

4

Pricing: Change in pure pricing achieved in one period vs another period. This is applied both to year-over-year and

sequentially. Rental rates are calculated based on the category class rate variance achieved either year-over-year or

sequentially for any fleet that qualifies for the fleet base and weighted by the prior year revenue mix.

5

FUR: Fleet unavailable for rent.6

Reconciliation of Net Income to EBITDA and Adjusted EBITDA

26NYSE: HRI

EBITDA and Adjusted EBITDA are not recognized terms under GAAP and do not purport to be

alternatives to the most comparable GAAP amounts. Further, since all companies do not use

identical calculations, our definition and presentation of these measures may not be comparable to

similarly titled measures reported by other companies.

EBITDA and Adjusted EBITDA - EBITDA represents the sum of net income, provision for income

taxes, interest expense, net, depreciation of revenue earning equipment and non-rental

depreciation and amortization. Adjusted EBITDA represents EBITDA plus the sum of merger and

acquisition related costs, restructuring and restructuring related charges, spin-off costs, non-cash

stock based compensation charges, loss on extinguishment of debt, and impairment charges.

Management uses EBITDA and adjusted EBITDA to evaluate operating performance and period-

over-period performance of our core business without regard to potential distortions. Additionally,

management believes that EBITDA and adjusted EBITDA help investors gain an understanding of

the factors and trends affecting our ongoing cash earnings, from which capital investments are

made and debt is serviced. However, EBITDA and adjusted EBITDA do not purport to be

alternatives to net earnings as an indicator of operating performance, nor to cash flows from

operating activities as a measure of liquidity.

Reconciliation of Net Income to EBITDA and Adjusted EBITDA

27

$ in millions Three months ended June 30, Six months ended June 30,

2016 2015 2016 2015

Net income (loss) $ (8.0) $ 10.6 $ (9.5) $ 12.3

Provision for income taxes 5.3 9.0 5.3 14.0

Interest expense, net 13.3 9.0 19.8 18.5

Depreciation of revenue earning

equipment 84.2 86.6 166.0 169.7

Non-rental depreciation and

amortization 10.6 19.1 21.1 37.9

EBITDA 105.4 134.3 202.7 252.4

Restructuring charges 3.1 0.3 3.4 1.0

Restructuring related charges 1 2.7 5.6 2.7 6.7

Spin-off costs 17.7 6.4 26.9 15.7

Non-cash stock-based compensation

charges 1.7 0.7 2.7 0.9

Adjusted EBITDA $ 130.6 $ 147.3 $ 238.4 $ 276.7

NYSE: HRI

1 Represents incremental costs incurred directly supporting restructuring initiatives.

28

Six months ended

June 30, 2016

Actual

Sale of France and

Spain

Foreign Currency

Translation

Six months ended

June 30, 2016

Adjusted

Total revenues $ 746.0 $ 0 $ 7.3 $ 753.3

Equipment rental revenue 635.7 0 5.9 641.6

Adjusted EBITDA 238.4 0 1.3 239.7

Reconciliation to Adjust for Divestitures and Foreign Currency

Translation

NYSE: HRI

Six months ended

June 30, 2015

Actual

Sale of France and

Spain

Foreign Currency

Translation

Six months ended

June 30, 2015

Adjusted

Total revenues $ 824.0 $ (40.5) $ 0 $ 783.5

Equipment rental revenue 679.3 (35.5) 0 643.8

Adjusted EBITDA 276.7 (9.4) 0 267.3

$ in millions

Three months ended

June 30, 2016

Actual

Sale of France and

Spain

Foreign Currency

Translation

Three months ended

June 30, 2016

Adjusted

Total revenues $ 380.4 $ 0 $ 2.4 $ 382.8

Equipment rental revenue 327.9 0 1.9 329.8

Adjusted EBITDA 130.6 0 0.5 131.1

Three months ended

June 30, 2015

Actual

Sale of France and

Spain

Foreign Currency

Translation

Three months ended

June 30, 2015

Adjusted

Total revenues $ 422.7 $ (16.0) $ 0 $ 406.7

Equipment rental revenue 347.7 (18.3) 0 329.4

Adjusted EBITDA 147.3 (5.1) 0 142.2

$ in millions

$ in millions

$ in millions

$ in millions

29

Q1 2015 Q2 2015 Q3 2015 Q4 2015 Full Year

Equipment Rentals $ 331.6 $ 347.7 $ 373.1 $ 359.2 $1,411.6

France & Spain (17.2) (18.3) (17.6) (6.5) (59.6)

Equipment Rentals excluding

France & Spain operations $ 314.4 $ 329.4 $ 355.5 $ 352.7 $ 1,352.0

2015 Quarterly Reconciliation excluding France & Spain

$ in millions

Q1 2015 Q2 2015 Q3 2015 Q4 2015 Full Year

Income (loss) before income taxes $ 6.7 $ 19.6 $ 35.5 $ 95.1 $156.9

France & Spain 3.3 2.0 2.1 (49.8) (42.4)

Income (loss) before income taxes

excluding France & Spain

operations

$ 10.0 $ 21.6 $ 37.6 $ 45.3 $ 114.5

Q1 2015 Q2 2015 Q3 2015 Q4 2015 Full Year

Adjusted EBITDA $ 129.4 $ 147.3 $ 160.2 $ 163.7 $600.6

France & Spain (4.3) (5.1) (5.2) (2.1) (16.7)

Adjusted EBITDA excluding France

& Spain operations $ 125.1 $ 142.2 $ 155.0 $ 161.6 $ 583.9

NYSE: HRI

Q1 2015 Q2 2015 Q3 2015 Q4 2015 Full Year

Total Revenues $ 401.3 $ 422.7 $ 431.8 $ 422.4 $1,678.2

France & Spain (24.5) (16.0) (19.4) (9.9) (69.8)

Total Revenues excluding France &

Spain operations $ 376.8 $ 406.7 $ 412.4 $ 412.5 $ 1,608.4

1 Historical quarterly results reflect divested operations in France and Spain sold in October 2015.

30NYSE: HRI