Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Talen Energy Corp | tln008082016_8k.htm |

EXECUTION VERSION

TALEN ENERGY SUPPLY, LLC

(formerly known as PPL Energy Supply, LLC), Issuer

TO

THE BANK OF NEW YORK MELLON,

Trustee

Supplemental Indenture No. 15

Dated as of August 5, 2016

Supplemental to the Indenture

Dated as of October 1, 2001

SUPPLEMENTAL INDENTURE NO. 15, dated as of August 5, 2016, between TALEN

ENERGY SUPPLY, LLC (formerly known as PPL Energy Supply, LLC), a limited liability

company duly organized and existing under the laws of the State of Delaware (herein called the

“Company”), and THE BANK OF NEW YORK MELLON (as successor to The Chase Manhattan

Bank), a New York banking corporation, as Trustee (herein called the “Trustee”), under the Indenture

dated as of October 1, 2001 (herein called the “Original Indenture”), this Supplemental Indenture No. 15

being supplemental thereto. The Original Indenture and any and all indentures and instruments

supplemental thereto are herein sometimes collectively called the “Indenture.”

Recitals of the Company

The Original Indenture was authorized, executed and delivered by the Company to provide for

the issuance by the Company from time to time of its Securities (such term and all other capitalized terms

used herein without definition having the meanings assigned to them in the Original Indenture), to be

issued in one or more series as contemplated therein.

As contemplated by Sections 301 and 1201(f) of the Original Indenture, the Company previously

established a series of Securities designated “Senior Notes, 6.500% Series due 2025” (the “Notes”)

pursuant to Supplemental Indenture No. 13, dated as of May 19, 2015, to the Original Indenture

(“Supplemental Indenture No. 13”), such series to be limited in aggregate principal amount (except as

contemplated in Section 301(b) and the last paragraph of Section 301 of the Original Indenture) to

$600,000,000 (such series of Securities herein and in such Supplemental Indenture No. 13 sometimes

called “Series No. 11”).

The Company is a wholly owned indirect subsidiary of Talen Energy Corporation, a Delaware

corporation (“Talen”). CRJ Parent LLC, RPH Parent LLC and SPH Parent LLC (collectively, “Parent”),

RJS Merger Sub Inc. (“Merger Sub”) and Talen have entered into that certain Agreement and Plan of

Merger, dated as of June 2, 2016 (the “Merger Agreement”), pursuant to which Merger Sub, a Delaware

corporation and a wholly owned subsidiary of Parent, will merge with and into Talen (the “Merger”), with

Talen continuing as the surviving corporation and a wholly owned subsidiary of Parent. The Merger and

the other transactions contemplated by the Merger Agreement are herein referred to as the “Transactions.”

Pursuant to Supplemental Indenture No. 14, dated as of June 2, 2016, to the Original Indenture

(“Supplemental Indenture No. 14”), as contemplated by Section 1201(b) of the Original Indenture, the

Company provided that, from and after the closing date of the Transactions (the “Trigger Date”), its

subsidiaries listed on Schedule A attached hereto (the “Guarantors”) will unconditionally guarantee all of

the Company’s obligations under the Securities of Series No. 11 (the “Guarantees”).

The Company desires to revise certain provisions of the Guarantees as set forth in this

Supplemental Indenture No. 15. The Company and the Guarantors have duly authorized the execution

and delivery of this Supplemental Indenture No. 15. All acts necessary to make this Supplemental

Indenture No. 15 a valid agreement of the Company and the Guarantors have been performed.

NOW, THEREFORE, THIS SUPPLEMENTAL INDENTURE NO. 15 WITNESSETH:

For and in consideration of the premises set forth herein and in order to enhance the Securities of

Series No. 11, it is mutually covenanted and agreed, for the equal and proportionate benefit of all Holders

of the Securities of Series No. 11, as follows:

ARTICLE ONE

Amendment to Supplement Indenture No. 14

Section 1. Article One, Section 3(b) of Supplemental Indenture No. 14 is hereby amended

and restated in its entirety to read as follows:

(b) Notwithstanding the foregoing and in addition to its other rights hereunder and under the

Original Indenture, Supplemental Indenture No. 13 and the Securities of Series No. 11, the

Company may elect, in its sole discretion, to release any or all of the Guarantors from their

obligations hereunder upon receipt of consent to such release by Holders of the Securities of

Series No. 11 constituting at least a majority in aggregate principal amount of the Securities of

Series No. 11 then outstanding.

ARTICLE TWO

Miscellaneous Provisions

Section 1. This Supplemental Indenture No. 15 is a supplement to the Original Indenture,

Supplemental Indenture No. 13 and Supplemental Indenture No. 14. As supplemented by this

Supplemental Indenture No. 15, the Indenture is in all respects ratified, approved and confirmed, and the

Original Indenture and this Supplemental Indenture No. 15 shall together constitute one and the same

instrument.

Section 2. The Company shall not amend, modify or supplement Supplemental Indenture

No. 14 or this Supplemental Indenture No. 15 without receipt of consent by Holders of the Securities of

Series No. 11 constituting at least a majority, in aggregate principal amount, of the Securities of Series

No. 11 then outstanding; it being understood that no such consent shall be required to effectuate any

release pursuant to Section 3(a) of Supplemental Indenture No. 14.

Section 3. The recitals contained in this Supplemental Indenture No. 15 shall be taken as the

statements of the Company and the Trustee assumes no responsibility for their correctness and makes no

representations as to the validity or sufficiency of this Supplemental Indenture No. 15.

Section 4. This Supplemental Indenture shall be governed by, and construed in

accordance with the laws of the State of New York, without regard to the provisions thereof

relating to conflict of laws.

Section 5. This instrument may be executed in any number of counterparts, each of which

so executed shall be deemed to be an original, but all such counterparts shall together constitute but one

and the same instrument.

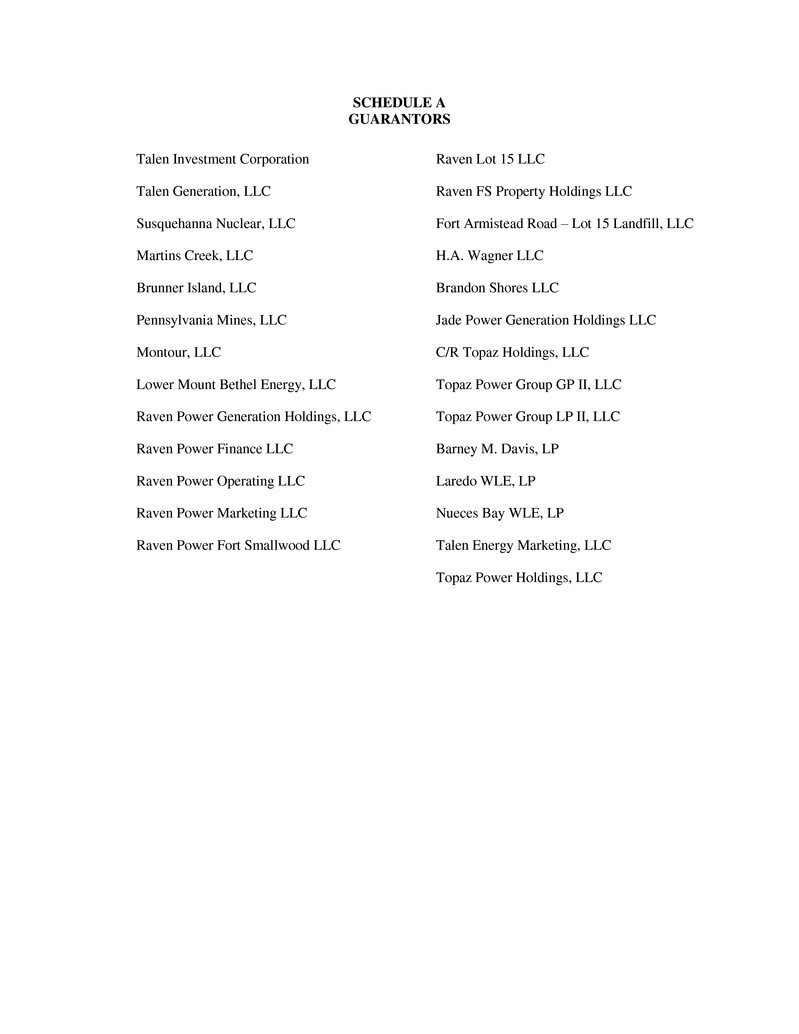

SCHEDULE A

GUARANTORS

Talen Investment Corporation Raven Lot 15 LLC

Talen Generation, LLC Raven FS Property Holdings LLC

Susquehanna Nuclear, LLC Fort Armistead Road – Lot 15 Landfill, LLC

Martins Creek, LLC H.A. Wagner LLC

Brunner Island, LLC Brandon Shores LLC

Pennsylvania Mines, LLC Jade Power Generation Holdings LLC

Montour, LLC C/R Topaz Holdings, LLC

Lower Mount Bethel Energy, LLC Topaz Power Group GP II, LLC

Raven Power Generation Holdings, LLC Topaz Power Group LP II, LLC

Raven Power Finance LLC Barney M. Davis, LP

Raven Power Operating LLC Laredo WLE, LP

Raven Power Marketing LLC Nueces Bay WLE, LP

Raven Power Fort Smallwood LLC Talen Energy Marketing, LLC

Topaz Power Holdings, LLC