Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Element Solutions Inc | a8kearningsreleaseex991201.htm |

| 8-K - 8-K - Element Solutions Inc | a8kearningsrelease2016630.htm |

Second Quarter 2016

August 8, 2016

2

Safe Harbor

Please note that in this presentation, we may discuss events or results that have not yet occurred or been realized, commonly referred

to as forward-looking statements. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking

statements made by or on behalf of the Company. Such discussion and statements will often contain words such as “expect,”

“anticipate,” “believe,” “intend,” “plan” and “estimate,” and include, without limitations, statements regarding the Company's adjusted

EBITDA and adjusted diluted earnings per share, expected or estimated revenue, meeting financial goals, segment earnings, net

interest expense, income tax provision, cash flow from operations, full year cash taxes, capital expenditures, restructuring costs and

other non-cash charges, the outlook for the Company's markets and the demand for its products, consistent profitable growth, free

cash flows, future revenues, gross, operating and EBITDA margin requirements and expansion, organic net sales growth, performance

trends, bank leverage ratios, the success of new product introductions, growth in costs and expenses, the impact of commodities and

currencies costs, the Company's ability to manage its risk in these areas, the Company’s ability to identify, hire and retain executives

and other qualified employees, the Company’s assessment over its internal control over financial reporting, and the impact of

acquisitions, divestitures, restructurings, and other unusual items, including the Company's ability to raise new debt and equity and to

integrate and obtain the anticipated results and synergies from its consummated acquisitions. These projections and statements are

based on management's estimates and assumptions with respect to future events and financial performance and are believed to be

reasonable, though are inherently uncertain and difficult to predict. Actual results could differ materially from those projected as a result

of certain factors. A discussion of factors that could cause results to vary is included in the Company's periodic and other reports filed

with the Securities and Exchange Commission. The Company undertakes no obligation to update any forward-looking statement,

whether as a result of new information, future events or otherwise.

This presentation also contains unaudited “comparable” financial information which assumes full period contribution of Alent plc and

the Electronic Chemicals and Photomasks businesses of OM Group, Inc. acquired in Q4 2015; and OMG Electronic Chemicals (M)

SdnBhd acquired in 2016. This combined information is provided for informational purposes only and is not necessarily, and should

not be assumed to be, an indication of the results that would have been achieved had the Company’s acquisitions been completed as

of the dates indicated, or that may be achieved in the future. Historical financial results and information included herein relating to

these acquired businesses were derived from public filings, when applicable, and/or information provided by management of these

businesses prior to their acquisitions by the Company. Although we believe it is reliable, this information has not been verified,

internally or independently. In addition, financial information for some of these acquired businesses was historically prepared in

accordance with non-GAAP accounting methods, and may or may not be comparable to the Company’s financial statements.

Consequently, there is no assurance that the financial results and information for these legacy businesses included herein are

accurate or complete, or representative in any way of the Company’s actual or future results as a consolidated company.

3

Non-GAAP Information

To supplement the financial measures prepared in accordance with generally accepted accounting principles in the United States

(“GAAP”), the Company uses the following non-GAAP financial measures: comparable adjusted diluted earnings per share,

comparable sales, adjusted EBITDA, adjusted EBITDA margin, adjusted EBITDA guidance, comparable adjusted EBITDA,

comparable adjusted EBITDA margin and organic sales. The Company also evaluates and presents its results of operations on a

constant currency and comparable constant currency basis.

The reconciliations of these non-GAAP measures to the most directly comparable financial measures calculated and presented in

accordance with GAAP can be found in this presentation and the tables included in the Company’s earnings release dated August 8,

2016 (the “earnings release”), a copy of which can be found on the Company’s website at www.platformspecialtyproducts.com. This

presentation should be read in conjunction with the earnings release. The Company only provides guidance on a non-GAAP basis and

does not provide reconciliations of such forward-looking non-GAAP measure to GAAP, due to the inherent difficulty in forecasting and

quantifying certain amounts that are necessary for such reconciliations, including adjustments that could be made for restructuring,

integration and acquisition-related expenses, share-based compensation amounts, adjustments to inventory and other charges

reflected in our reconciliation of historic numbers, the amount of which, based on historical experience, could be significant.

Management uses these non-GAAP measures as key metrics in the monitoring and evaluation of the Company’s performance and

consolidated financial results and, in part, in the determination of cash bonuses for its executive officers. The Company believes that

these non-GAAP measures provide useful information to investors by excluding certain items that we believe are not representative of

the Company’s business and including other items that the Company believes are useful in evaluating its business; thereby providing a

more complete understanding of the Company’s operational results and a meaningful comparison of the Company’s performance

between periods and to its peers. When reconciled to the corresponding GAAP measures, these non-GAAP measures also help our

investors to understand the long-term profitability trends of our businesses. Finally, these non-GAAP measures address questions the

Company routinely receives from securities analysts, investors and other interested parties in the evaluation of companies in our

industry and, in order to assure that all investors have access to similar data, the Company has determined that it is appropriate to

make this data available to all. Non-GAAP financial measures are however not prepared in accordance with GAAP, as they exclude

certain items as described herein, and may not be indicative of the results that the Company expects to recognize for future periods. In

addition, these non-GAAP financial measures may differ from measures that other companies may use. As a result, these non-GAAP

financial measures should be considered in addition to, and not a substitute for, financial information prepared in accordance with

GAAP. Investors are encouraged to review the reconciliation of these non-GAAP measures to their most directly comparable GAAP

financial measure included herein and in the earnings release.

Please see the Appendix to this presentation for a more detailed description of each non-GAAP financial measure used by the

Company, including the adjustments reflected in each such non-GAAP measure and the reason why we believe such non-GAAP

measures are useful to investors.

4

Q2 2016 Highlights

1. Comparable, on this chart and subsequent charts, assumes full period contribution of all businesses acquired in 2015 and 2016

2. Constant currency, on this chart and subsequent charts, refers to the financial results of the current period restated at the prior period exchange rates

3. Organic sales, on this chart and subsequent charts, excludes the impact of currency, metal prices, divestitures

* THE FINANCIAL MEASURES IN THIS SECTION AND ON SUBSEQUENT CHARTS ARE NOT IN ACCORDANCE WITH GAAP. FOR DEFINITIONS OF THESE NON-GAAP

MEASURES, DISCUSSIONS OF ADJUSTMENTS AND RECONCILIATIONS, PLEASE REFER TO THE APPENDICES OF THIS PRESENTATION

Actual Comparable1* Comparable Constant Currency2* Organic3*

($ in millions) Q2 2016 Q2 2015 YoY% Q2 2016 Q2 2015 YoY% Q2 2016 Q2 2015 YoY% YoY%

Revenue $922 $675 37% $922 $951 (3)% $956 $951 1% 1%

EPS $(0.04) $(0.06) nm

Adj. EBITDA* 193 168 15% 193 213 (10)% 200 213 (6)%

Adj. EBITDA

Margin* 21% 25% 21% 22% 21% 22%

Adj. EPS* $0.16 $0.25 (36)%

• Revenue increased 37% primarily from impact of acquisitions while comparable revenue declined primarily

driven by persisting U.S. dollar strength

• EPS was less negative compared to a year ago period, due partially to higher overall earnings from acquisitions

• Organic sales increased 1% in the quarter

• Strong growth in Latin America and AME Ag despite weak commodity prices

• Declines in North America Ag driven by low farmer incomes, high channel inventories and limited pest

pressure

• Strength in automotive units partially offset by broad softness in electronics and oil and gas markets

• Comparable constant currency adj. EBITDA declined 6% in the quarter

• Year-over-year investment in enterprise development of ~$8 million

• $13 million of incremental synergies realized in the quarter

• Excluding corporate cost adj. EBITDA margins on a comparable basis would have been ~flat year-over-year

5

Performance Solutions Q2 Results

Actual Comparable Comparable Constant Currency Organic

($ in millions) Q2 2016 Q2 2015 YoY% Q2 2016 Q2 2015 YoY% YoY%

Revenue $438 $458 (4)% $448 $458 (2)% (2)%

Adj. EBITDA 98 98 0% 102 98 4%

Adj. EBITDA Margin 22% 21% 23% 21%

Adj. EBITDA ex-corp costs 105 101 4% 109 101 8%

Adj. EBITDA margin ex-corp costs 24% 22% 24% 22%

• Revenue over the comparable 2015 period was impacted by currency as well as continued softness in Asia

electronics and oil and gas end-markets

• Organic sales declined 2% in the quarter

• Sales into the oil and gas markets were the primary driver of the organic decline

• Excluding corporate allocations, comparable constant currency adj. EBITDA increased 8%

• Driven by favorable product mix and successful synergy capture

• Tailwinds:

• Continued global automotive strength

• Strength in Graphics segment demand

• Continued business efficiency improvements

• Headwinds:

• Electronics demand weakness in Asia

• Impact of low energy prices on offshore drilling and PET recycling markets

• Currency

6

Agricultural Solutions Q2 Results

Actual Comparable Comparable Constant Currency Organic

($ in millions) Q2 2016 Q2 2015 YoY% Q2 2016 Q2 2015 YoY% YoY%

Revenue $484 $494 (2)% $508 $494 3% 5%

Adj. EBITDA 95 116 (18)% 99 116 (15)%

Adj. EBITDA Margin 20% 23% 19% 23%

Adj. EBITDA ex-corp costs 103 119 (14)% 106 119 (11)%

Adj. EBITDA margin ex-corp costs 21% 24% 21% 24%

• Revenue over the 2015 period was negatively impacted by year-over-year currency headwinds ($24

million) and divestitures ($9 million)

• Organic sales increased 5%

• Significant organic growth in Latin America and AME driven by both volume and price

• North America experienced demand softness due to continued distributor channel inventory

corrections and reduced pest pressure

• Excluding corporate allocations, comparable constant currency adj. EBITDA decreased 11%

• Driven by negative regional and product mix shift

• Tailwinds:

• Strong demand for niche products in Latin America, particularly Brazil

• Strong demand in specialty markets, particularly fruits, vegetables and cocoa in AME

• End to El Niño conditions in Asia

• Headwinds:

• Negative regional mix shift

• High channel inventory and low pest pressure in North America

• Currency

7

Ag Regional Performance

Q2’16 Organic

Sales Growth

% of Ag Sales

(Q2’15)

% of Ag Sales

(Q2’16)

North America ~(40)% ~20% ~10%

Rest of World ~15% ~80% ~90%

Total 5%

• Excluding North America, the Ag business had a strong quarter with each region showing positive sales and

earnings growth

• North America performance declined materially due to high channel inventories and lack of pest pressure

• Actions Platform took in 2015 to improve the channel were partially offset by a declining market –

particularly in cereals

• On the ground product sales continue at a rate above that of Platform’s sales to the channel –

albeit more slowly than expected given the weak market

• This year saw the lowest levels of mite infestation in over 35 years driving materially slower sales of

specialty crop pesticide portfolio

• Weak North America sales negatively impacts overall Ag margins, as it is a higher margin business

• A robust North American turnaround strategy is underway premised on:

• Normalization of channel inventory levels for key products driven by market improvement

• Significant organizational changes to salesforce to align with customers

• Share gains in seed treatment and biostimulants already successfully sold in other regions

8

~10

722

600

620

640

660

680

700

720

740

760

780

800

1H Annualized 2H Incremental

Synergies

Organic Growth FX Tailwind

(net of price)

2016 Guidance

775

735

Bridging to Updated Guidance

1H 2016 2016 Outlook 2H Expectation

Organic Growth ~Flat Low single digit growth

Continued growth in Ag and recovery to

positive growth in Performance

Solutions

Synergies ~$25 million ~$40 million Continued cost opportunities

FX Translation ~$18 million headwind

Modest headwind at current

rates

Improvement in Brazil and decline in

China. Expect BRL benefit to be

moderated by price reductions in Ag

Updating Lower-end of 2016 Adjusted EBITDA1 guidance to $735 - $775 million2

~$23 million to mid-point

1. For a definition of non-gaap measures, discussions of adjustments and reconciliations, please refer to the appendices of this presentation

2. Based on June 30, 2016 exchange rates

9

Performance SolutionsAgricultural Solutions

$3

$11$7

$20

$0

$5

$10

$15

$20

$25

Q1 Q2 1H 2016 Target

$8

$14$6

$20

$0

$5

$10

$15

$20

$25

Q1 Q2 1H 2016 Target

$ in millions $ in millions

Realized YoY Cost Synergies

$21

$12 $33

$70

$0

$20

$40

$60

$80

Q1 '16 Run Rate of

New Actions

Q2 '16 Total

Estimate

$ in millions $ in millions

$59

$10 $69

$80

$0

$20

$40

$60

$80

$100

Q1 '16 Run Rate of

New Actions

Q2 '16 Total

Estimate

Annualized Run-Rate Annualized Run-Rate

$13 million of new cost synergies realized in Q2

Cost Synergies (Non-GAAP)

Realized YoY Cost Synergies

10

• Completion of initial global product rationalization and margin improvement initiatives

• First phase facility consolidation plans approved and execution underway

• Expected savings in early 2017

• $12 million of new run-rate cost synergy actions in Q2

• Significant back-office actions near quarter-end

• $7 million of realized synergies in Q2 2016 – on track to achieve an estimated $20 million target in 2016

• Continued revenue synergy development with targeted regional sales initiatives

Performance Solutions

Agricultural Solutions

• Legal entity consolidation initiatives continue to progress smoothly

• $10 million of new run-rate cost synergy actions in Q2

• Regulatory and supply chain synergy priority continues

• $6 million increase in synergies vs. Q2 2015 – on track to achieve an estimated $20 million target in 2016

• Significant progress in growth strategy development

• Certain business rationalization initiatives being evaluated as part of broader strategy plans

Integration Update – Q2 2016

Total

• Improved adj. EBITDA by $63 million of synergies to-date across both integrations

• Run-rate synergies of over $100 million

11

Financial Performance

12

Q2 Financial Overview

($ in millions) 1H 2016 2016 Outlook

Organic Growth ~Flat Low single digit growth

Cash Interest $183 ~$360

Cash Taxes $54 $100 - 125

Capex3 $38 ~$100

1. For a definition of non-gaap measures, discussions of adjustments and reconciliations, please refer to the appendices of this presentation

2. Based on June 30, 2016 exchange rates

3. Capex includes investments in fixed assets as well as investments in product registrations

Updating Lower-end of 2016 Adjusted EBITDA1 guidance to $735 - $775 million2

• Negative YTD cash flow driven by Q1 seasonal

working capital build in Ag – moderated by Q2 release

• Expectation for modest improvement in working

capital balances in Q3

• Full-year outlook unchanged

Cash Flow Seasonality

Actual Comparable Comparable Constant Currency Organic

($ in millions) Q2 2016 Q2 2015 YoY% Q2 2016 Q2 2015 YoY% Q2 2016 Q2 2015 YoY% YoY%

Revenue $922 $675 37% $922 $951 (3)% $956 $951 1% 1%

EPS $(0.04) $(0.06) nm

Adj. EBITDA* 193 168 15% 193 213 (10)% 200 213 (6)%

Adj. EBITDA

Margin* 21% 25% 21% 22% 21% 22%

Adj. EPS* $0.16 $0.25 (36)%

13

(9)

(34) (9)

1

22

458 448 438

494

461 484

0

100

200

300

400

500

600

700

800

900

1,000

2Q15

Comparable

Divestitures Metals FX Headwind 2Q15

Normalized

Pricing Volume / Mix 2Q16

Performance Solutions Agricultural Solutions

2Q 2015 to 2Q 2016 Sales Bridge (Non-GAAP)

Sales Bridge

951

922

Organic

sales

growth

of 1%

908

$ in millions

14

(7)

(17)

(23)

(8)

22

13

98 98

116

95

0

50

100

150

200

250

2Q15

Comparable

FX

Translational

Headwind

FX

Transactional

Headwind

Pricing Synergies Volume / Mix Increase in

Corporate

Costs

2Q16

Performance Solutions Agricultural Solutions

2Q 2015 to 2Q 2016 Adjusted EBITDA

Bridge (Non-GAAP)

Adjusted EBITDA Bridge

213

193

Primarily Ag

$ in millions

15

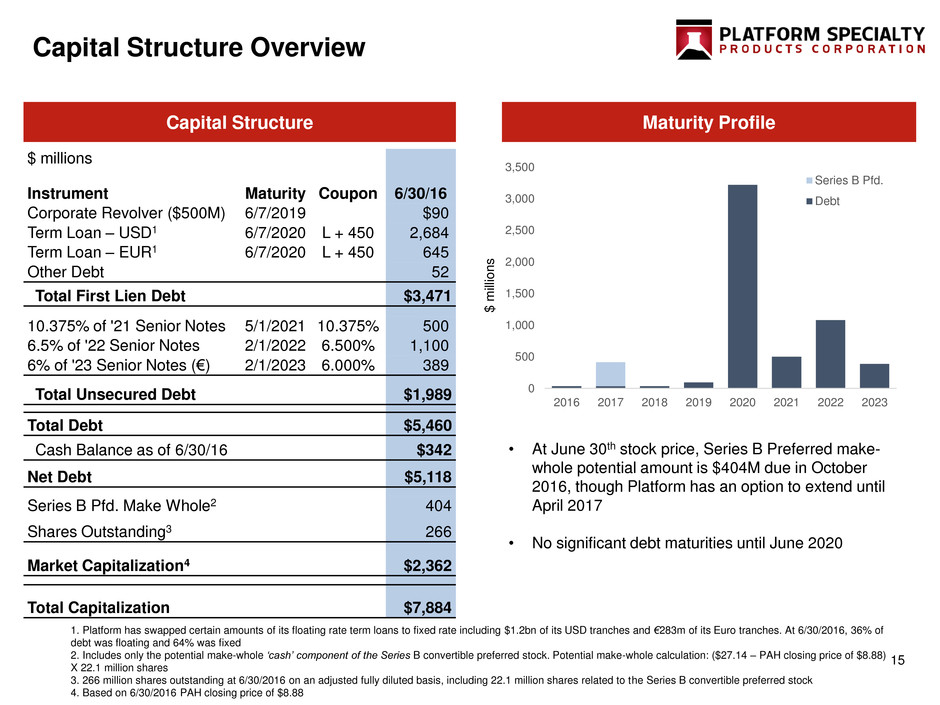

Capital Structure Overview

1. Platform has swapped certain amounts of its floating rate term loans to fixed rate including $1.2bn of its USD tranches and €283m of its Euro tranches. At 6/30/2016, 36% of

debt was floating and 64% was fixed

2. Includes only the potential make-whole ‘cash’ component of the Series B convertible preferred stock. Potential make-whole calculation: ($27.14 – PAH closing price of $8.88)

X 22.1 million shares

3. 266 million shares outstanding at 6/30/2016 on an adjusted fully diluted basis, including 22.1 million shares related to the Series B convertible preferred stock

4. Based on 6/30/2016 PAH closing price of $8.88

$ millions

Instrument Maturity Coupon 6/30/16

Corporate Revolver ($500M) 6/7/2019 $90

Term Loan – USD1 6/7/2020 L + 450 2,684

Term Loan – EUR1 6/7/2020 L + 450 645

Other Debt 52

Total First Lien Debt $3,471

10.375% of '21 Senior Notes 5/1/2021 10.375% 500

6.5% of '22 Senior Notes 2/1/2022 6.500% 1,100

6% of '23 Senior Notes (€) 2/1/2023 6.000% 389

Total Unsecured Debt $1,989

Total Debt $5,460

Cash Balance as of 6/30/16 $342

Net Debt $5,118

Series B Pfd. Make Whole2 404

Shares Outstanding3 266

Market Capitalization4 $2,362

Total Capitalization $7,884

Capital Structure Maturity Profile

0

500

1,000

1,500

2,000

2,500

3,000

3,500

2016 2017 2018 2019 2020 2021 2022 2023

Series B Pfd.

Debt

• At June 30th stock price, Series B Preferred make-

whole potential amount is $404M due in October

2016, though Platform has an option to extend until

April 2017

• No significant debt maturities until June 2020

$

m

ill

io

n

s

16

Seasonality of Financial Performance (Non-GAAP)

>50%

<50%

53%

48%

53%

47%

20% 40% 60%

Q4

Q3

3rd Quarter

• Seasonally slow Ag quarter

• Ramp of Latin American season

• Slow quarter for rest of world

• Expectation for sequential growth in Performance Solutions

business driven by electronics demand and synergy actions

4th Quarter

• Strongest Ag quarter

• Southern hemisphere growing season

• North America seasonal buying behavior

• Q4’15 adj. EBITDA negatively impacted by change in

channel strategy

• Expectation for Performance Solutions growth vs first half due

to already secured new business

• Full benefit of Q1 to Q3 2016 synergy actions in the quarter

Key Drivers of 2016 vs 2015 Seasonality% of 2H Comparable Adj. EBITDA

2015

2014

2016E

2014

2015

2016E

17

Conclusions – 2016 Priorities

Integration and Synergy Realization

Focus Commercial Efforts on Fast Growing Niches

Establish Operating Rhythm and Momentum

Generate Free Cash Flow

18

Appendix

19

Covenant Overview

Our capital structure is subject to only one quarterly

maintenance test - 6.25x First Lien Net Debt to

Covenant EBITDA

Covenant EBITDA is defined as LTM comparable adj.

EBITDA plus synergies expected to be realized based

on actions to be taken over the next 12 months1

We have significant headroom under the maintenance

covenant

The Gross First Lien Leverage ratio only limits our ability

to incur debt if we would not satisfy a 2x Fixed Charge

Coverage Ratio test, tested at the time of incurrence

LTM Comparable adj. EBITDA $713

(+) Announced Synergies 150

(-) Realized Synergies (63)

(+) Synergy Adjustment 87

Covenant EBITDA $800

Covenant Calculations3

Leverage Covenants

as of

6/30/16 Covenant

EBITDA

Headroom Headroom %

Maintenance Covenant:

Net First Lien Leverage 3.91x < 6.25x $299 37%

Incurrence Covenants:

Gross First Lien Leverage 4.34x < 4.50x $29 4%

Total Net Leverage 6.40x < 6.75x – 7.00x2 $42 – $69 5% - 9%

Covenant EBITDA

Note: All $ amounts in millions

1. Synergy credit is limited to 15% of underlying EBITDA; See definition of Consolidated EBITDA in the Company’s Credit Agreement dated April 12, 2007, as amended and/or

restated

2. This covenant varies based on use of proceeds – 6.75x applies to acquisitions while 7.00x applies to other uses of debt

3. The covenants do not reflect the impact of any potential Series B preferred make-whole payment

20

Organic Sales Reconciliation

Performance

Solutions

Agricultural

Solutions Total

(amounts I n millions) Q2 2016 YoY% Q2 2016 YoY% Q2 2016 YoY%

Change in net comparable sales $(20) (4.3)% $(10) (2.1)% $(30) (3.1)%

Dispositions - - 9 1.9 9 1.0

Foreign exchange impacts 10 2.3 24 5.0 34 3.7

Impact of metal prices (1) (0.2) - - (1) (0.1)

Organic Sales Growth $(10) (2.2)% $23 4.8% $13 1.4%

21

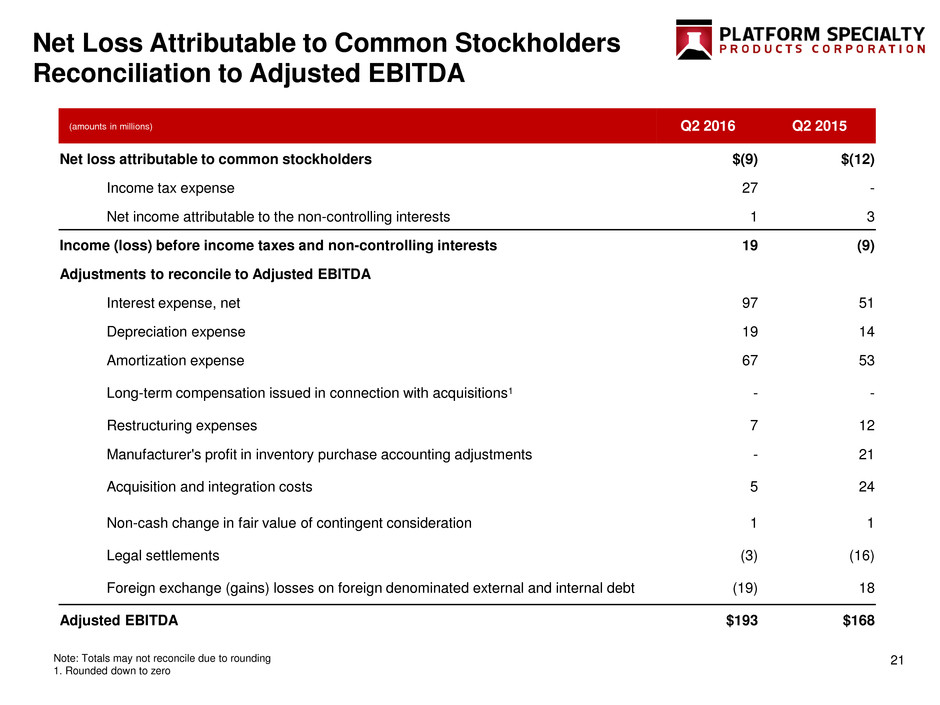

Net Loss Attributable to Common Stockholders

Reconciliation to Adjusted EBITDA

(amounts in millions) Q2 2016 Q2 2015

Net loss attributable to common stockholders $(9) $(12)

Income tax expense 27 -

Net income attributable to the non-controlling interests 1 3

Income (loss) before income taxes and non-controlling interests 19 (9)

Adjustments to reconcile to Adjusted EBITDA

Interest expense, net 97 51

Depreciation expense 19 14

Amortization expense 67 53

Long-term compensation issued in connection with acquisitions1 - -

Restructuring expenses 7 12

Manufacturer's profit in inventory purchase accounting adjustments - 21

Acquisition and integration costs 5 24

Non-cash change in fair value of contingent consideration 1 1

Legal settlements (3) (16)

Foreign exchange (gains) losses on foreign denominated external and internal debt (19) 18

Adjusted EBITDA $193 $168

Note: Totals may not reconcile due to rounding

1. Rounded down to zero

22

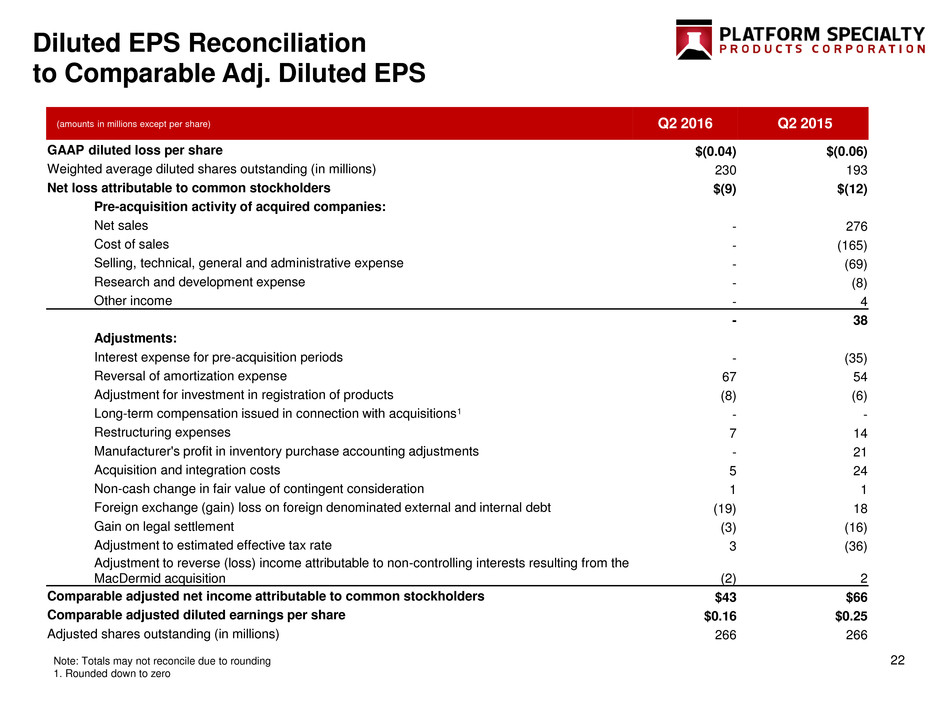

Diluted EPS Reconciliation

to Comparable Adj. Diluted EPS

(amounts in millions except per share) Q2 2016 Q2 2015

GAAP diluted loss per share $(0.04) $(0.06)

Weighted average diluted shares outstanding (in millions) 230 193

Net loss attributable to common stockholders $(9) $(12)

Pre-acquisition activity of acquired companies:

Net sales - 276

Cost of sales - (165)

Selling, technical, general and administrative expense - (69)

Research and development expense - (8)

Other income - 4

- 38

Adjustments:

Interest expense for pre-acquisition periods - (35)

Reversal of amortization expense 67 54

Adjustment for investment in registration of products (8) (6)

Long-term compensation issued in connection with acquisitions1 - -

Restructuring expenses 7 14

Manufacturer's profit in inventory purchase accounting adjustments - 21

Acquisition and integration costs 5 24

Non-cash change in fair value of contingent consideration 1 1

Foreign exchange (gain) loss on foreign denominated external and internal debt (19) 18

Gain on legal settlement (3) (16)

Adjustment to estimated effective tax rate 3 (36)

Adjustment to reverse (loss) income attributable to non-controlling interests resulting from the

MacDermid acquisition (2) 2

Comparable adjusted net income attributable to common stockholders $43 $66

Comparable adjusted diluted earnings per share $0.16 $0.25

Adjusted shares outstanding (in millions) 266 266

Note: Totals may not reconcile due to rounding

1. Rounded down to zero

23

Non-GAAP Definitions

Comparable Sales:

Comparable sales is defined as sales adjusted for the sales of our acquisitions as if they had occurred on January 1, 2015. Management believes this

measure provides investors with a more complete understanding of sales trends by providing sales on a more consistent basis.

Organic Sales:

Organic sales is defined as Comparable sales excluding the impact of currency, metals price, divestitures and acquisitions, as applicable.

Management believes this measure provides investors with a more complete understanding of the underlying sales trends by providing Comparable

sales over differing periods on a consistent basis.

Constant Currency and Comparable Constant Currency:

Our constant currency presentation excludes the impact of fluctuations in foreign currency exchange rates. We believe providing constant currency

information provides valuable supplemental information regarding our results of operations, consistent with how we also evaluate our performance. We

calculate constant currency percentages by converting our current-period local currency financial results into U.S. Dollar using the prior period's

exchange rates and comparing these adjusted amounts to our prior period reported results. The comparable constant currency presentation includes

actual results adjusted to reflect acquisitions and related financings as though they had occurred on January 1, 2015 adjusted for the effects of

purchase accounting on actual results. Management believes that this presentation provides a more complete understanding of the Company's

operational results and a meaningful comparison of its performance between periods. However, this comparable financial information is provided for

informational purposes only and is not necessarily, and should not be assumed to be, an indication of the results that would have been achieved had

the Company’s acquisitions been completed as of the dates indicated, or that may be achieved in the future.

Adjusted EBITDA and Comparable Adjusted EBITDA:

Adjusted EBITDA is defined as earnings before interest, taxes, depreciation and amortization, as further adjusted for additional items included in

earnings that are not representative or indicative of our ongoing business as described in the footnotes to the non-GAAP measures reconciliations.

Comparable adjusted EBITDA is defined as Adjusted EBITDA adjusted to reflect acquisitions and the related financings as though they had occurred

on January 1, 2015 without the impact of purchase accounting. Adjusted EBITDA and comparable adjusted EBITDA are key metrics used by

management to measure operating performance and trends. In particular, the exclusion of certain expenses in calculating adjusted EBITDA and

comparable adjusted EBITDA facilitates operating performance comparisons on a period-to-period basis.

Comparable Adjusted Diluted Earnings Per Share:

Comparable adjusted diluted earnings per share is defined as net loss attributable to common stockholders adjusted to reflect acquisitions and the

related financings as though they had occurred on January 1, 2015 without the impact of purchase accounting, as well as other adjustments consistent

with our definition of Adjusted EBITDA. Additionally, we eliminate the amortization associated with (i) intangibles assets recognized in purchase

accounting for acquisitions and (ii) costs capitalized in connection with obtaining regulatory approval of our products (“registration rights”) as part of

ongoing operations and deduct capital expenditures associated with obtaining these registration rights. Further, we adjust the effective tax rate to 35%

as described in the notes to the reconciliation. The resulting comparable adjusted net income available to stockholders is divided by the number of

shares of outstanding common stock as of June 30, 2016 plus the number of shares that would be issued if convertible stock were converted to

common stock, vested stock options were exercised, and all awarded equity granted were vested as of June 30, 2016. Comparable adjusted diluted

earnings per share is a key metric used by management to measure operating performance and trends. In particular, the exclusion of certain

expenses in calculating comparable adjusted diluted earnings per share facilitates operating performance comparisons on a period-to-period basis.