Attached files

| file | filename |

|---|---|

| 8-K - BOOT BARN HOLDINGS, INC. 8-K - Boot Barn Holdings, Inc. | a51397532.htm |

Exhibit 99.1

August 8, 2016

FORWARD LOOKING STATEMENTS Forward-Looking Statements This presentation contains forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact included in this presentation are forward-looking statements. You can identify forward-looking statements by the fact that they generally include words such as "anticipate," "estimate," "expect," "project," "plan,“ "intend," "believe," “outlook” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events but not all forward-looking statements contain these identifying words. These forward-looking statements are based on assumptions that the Company’s management has made in light of their industry experience and on their perceptions of historical trends, current conditions, expected future developments and other factors they believe are appropriate under the circumstances. As you consider this presentation, you should understand that these statements are not guarantees of performance or results. They involve risks, uncertainties (some of which are beyond the Company’s control) and assumptions. These risks, uncertainties and assumptions include, but are not limited to, the following: the failure to realize the anticipated synergies from the Sheplers acquisition and other risks of integration, declines in consumer spending or changes in consumer preferences and the Company’s ability to effectively execute on its growth strategy; to maintain and enhance its strong brand image; to compete effectively; to maintain good relationships with its key suppliers; and to improve and expand its exclusive product offerings. The Company discusses the foregoing risks and other risks in greater detail under the heading “Risk factors” in the periodic reports filed by the Company with the Securities and Exchange Commission. Although the Company believes that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect the Company’s actual financial results and cause them to differ materially from those anticipated in the forward-looking statements. Because of these factors, the Company cautions that you should not place undue reliance on any of these forward-looking statements. New risks and uncertainties arise from time to time, and it is impossible for the Company to predict those events or how they may affect the Company. Further, any forward-looking statement speaks only as of the date on which it is made. Except as required by law, the Company does not intend to update or revise the forward-looking statements in this presentation after the date of this presentation. Industry and Market InformationStatements in this presentation concerning our industry and the markets in which we operate, including our general expectations and competitive position, business opportunity and market size, growth and share, are based on information from independent industry organizations and other third-party sources, data from our internal research and management estimates. Management estimates are derived from publicly available information and the information and data referred to above, and are based on assumptions and calculations made by us based upon our interpretation of such information and data. The information and data referred to above are imprecise and may prove to be inaccurate because the information cannot always be verified with complete certainty due to the limitations on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. As a result, please be aware that the data and statistical information in this presentation may differ from information provided by our competitors or from information found in current or future studies conducted by market research institutes, consultancy firms or independent sources. Non-GAAP Financial Measures The Company presents Adjusted EBITDA and Adjusted EBIT because they are important financial measures that its management, board of directors and lenders use to assess the Company’s operating performance. However, Adjusted EBITDA and Adjusted EBIT are non-GAAP financial measures and should not be considered in isolation or as an alternative to net income or any other measure of financial performance calculated and presented in accordance with GAAP. The Company defines Adjusted EBITDA as earnings before interest, income tax, depreciation and amortization, or EBITDA, adjusted to exclude non-cash stock-based compensation, the non-cash accrual for future award redemptions, recapitalization expenses, acquisition expenses, acquisition-related integration and reorganization costs, amortization of inventory fair value adjustment, loss on disposal of assets and contract termination costs, secondary offering costs, and other unusual or non-recurring expenses. Adjusted EBIT is defined as Adjusted EBITDA less depreciation and amortization. Since Adjusted EBITDA and Adjusted EBIT are non-GAAP financial measures, they are susceptible to varying calculations and the Company’s Adjusted EBITDA and Adjusted EBIT may not be comparable to similarly titled measures of other companies, including companies in its industry. See the Appendix to this presentation for a reconciliation of Adjusted EBITDA to Net Income.

OVERVIEW OF BOOT BARN STRATEGIC INITIATIVES FINANCIAL UPDATE AGENDA

Boot barn snapshot SALES composition1 Footwear51% Hats, Accessories & Other17% Apparel32% Illustrative Store 1Note: Fiscal year ended March 26, 2016, including the sales results of the Sheplers business for the 9 months subsequent to the acquisition. Sales by End User1 Kids’5% Unisex9%

everyday merchandise assortment RUGGED FOOTWEAR OUTERWEAR OVERALLS PANTS SHIRTS WORK Low fashion quotient minimizes markdown exposure BOOTS DENIM WESTERN SHIRTS COWBOY HATS BELTS / BELT BUCKLES WESTERN

COMPREHENSIVE ASSORTMENT OF BRANDS AND STYLES = Private brands Western Work / Other

History of solid growth Note: Fiscal year ends March. FY13 includes 29 stores acquired from RCC with 7 month net sales of $35.5 million. FY14 includes 30 stores acquired from Baskins with 10 month net sales of $63.4 million. Sheplers was acquired June 29, 2015, the beginning of Q2 FY16. ¹ The period from April 3, 2011 to December 11, 2011 is presented separately as the ‘‘Predecessor Period’’ and the period from December 12, 2011 to March 31, 2012 is presented separately as the ‘‘Successor Period’’ in the Company’s SEC filings. References to fiscal 2012 in this presentation represent the sum of the results of the Predecessor Period and Successor Period and do not reflect any pro forma or other adjustments. 2 Defined as Adjusted EBITDA less depreciation and amortization. Store Count Net sales ($MM) ADJUSTED EBIT ($MM)2 Adjusted EBITDA ($MM) 1 1 1 1

COMPETITIVE LANDSCAPE Western Wear Chains (Estimated STORE COUNT)1 Other Competitors 3x as many stores as closest competitor National Regional (Mostly Texas) Geographic presence Independent retailers Regional (Western Canada) Arizona North & South Carolina 1 Store count as of July 27, 2016. We are the largest western and work wear retailer in the U.S. Thousands Farm supply storesMass merchandisersOnline 210

Boot barn strategic positioning Genuine lifestyle retail brand Clear national leader in a large and fragmented market niche Significant new store growth opportunity Great omni-channel brand…plus…leading pure play e-commerce brand Long history of same store sales growth Strong portfolio of exclusive private brands Loyal customer base Experienced management team and passionate organization 9

OVERVIEW OF BOOT BARN STRATEGIC INITIATIVES FINANCIAL UPDATE AGENDA

1 EXPAND OUR STORE BASE 2 3 4 DRIVE SAME STORE SALES GROWTH BUILD OUT PRIVATE BRAND PORTFOLIO GROW E-COMMERCE AND OMNI CHANNEL EXPERIENCE STRATEGIC INITIATIVES

Opportunity exists to double current store count FY12 86 stores8 states FY13 117 stores21 states 152 stores23 states FY14 Compelling new store economics Current Boot barn 210 stores29 states 1 GOALS Store Size (sq. ft.) 10,000 Year 1 Net Sales $1.7mm Net Cash Investment1 $0.8mm Cash on Cash Return (Yr. 1) 31.5% Payback Period ~3 Years Time between LOI & Opening 6 months 1 Includes capital expenditures plus inventory (net of payables).

History of positive same store sales growth 2 same store sales has grown >8% on average for 7 years

SSs Growth: Merchandising Initiatives Broadening men’s western boots to include moccasins and other western styles Expanding performance work boots Naming country music star Kelsea Ballerini as the face of Shyanne Introducing new festival wear 2

SSS Growth: other initiatives Growing Commercial Accounts Upgrading our Ecommerce Platforms Enhancing Customer Relationship Management Improving Sales Training Store associates educating customers on commercial account opportunitiesAn expanded work assortment and offeringImproved work boot signage Identify, segment & target new and core customer segments Continue to cultivate customer loyalty through B RewardedStreamline communications with customer base Focus on maximizing merchandise add-onsProvide better customer serviceEducate and engage the customerEncourage B Rewarded sign-ups 2

Highly successful private brands Private brands account for approximately 13% of store sales 3 Core Boot Barn Private Brand Penetration 1 1 Excludes rebranded Sheplers stores.

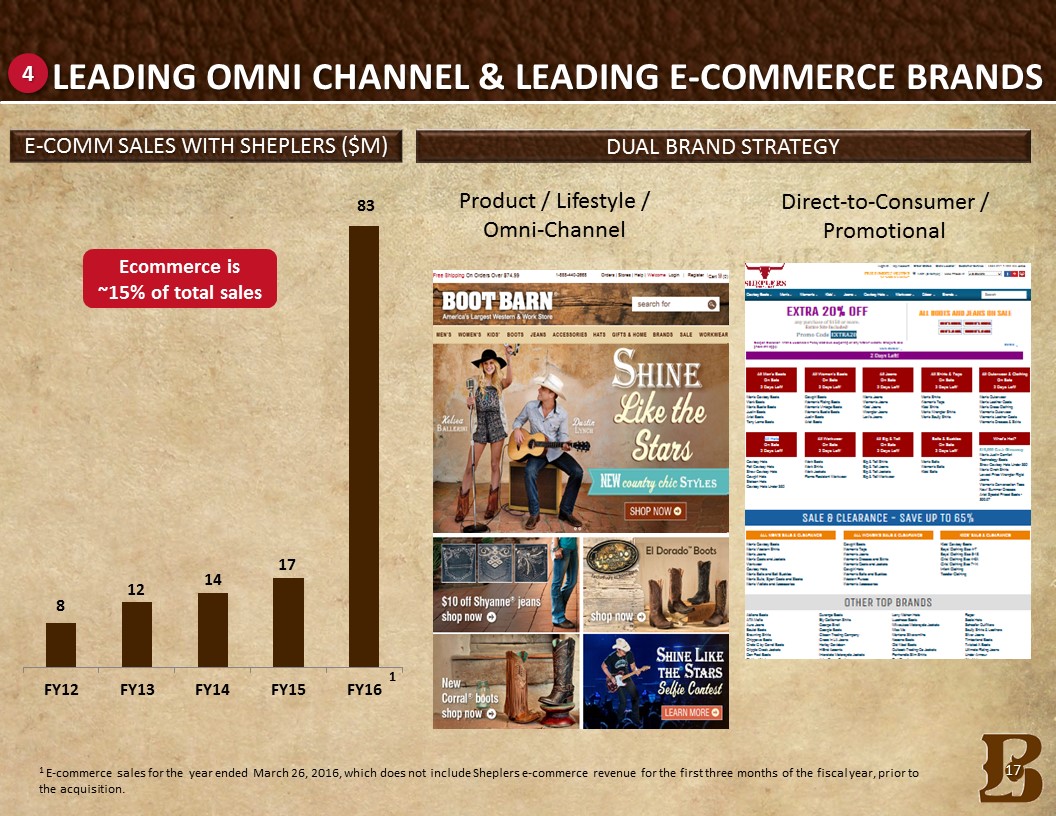

LEADING omni channel & leading e-commerce brands DUAL BRAND STRATEGY Product / Lifestyle / Omni-Channel Direct-to-Consumer / Promotional 1 E-commerce sales for the year ended March 26, 2016, which does not include Sheplers e-commerce revenue for the first three months of the fiscal year, prior to the acquisition. 4 E-comm sales with sheplers ($M) 1 83 Ecommerce is ~15% of total sales

E-COMMERCE TRAFFIC BY direct COMPETITOR FY ‘15 FY ‘16 Visitors (Millions) Estimated Traffic based on Alexa data FY ‘17 -58% -68% +5% +7% +8% +20% -4% -10% + Sheplers and Boot Barn growing online traffic while direct competitors decline 4

OVERVIEW OF BOOT BARN STRATEGIC INITIATIVES FINANCIAL UPDATE AGENDA

Q1 FY2017 results 1Presumes that the availability on the revolver totals $125 million. Net sales increased 39% to $133.4 million. Consolidated same store sales increased 0.4%. Net income was $0.6 million, or $0.02 per diluted share, compared to $2.3 million, or $0.08 per diluted share in the prior-year period. The Company opened two new stores. Inventories: Average inventory per store was flat compared to June 27, 2015.Total debt: $253.5 millionLine of credit: $60.2 million outstanding on revolving credit facility1

APPENDIX

Adjusted ebitda reconciliation (a) Represents non-cash compensation expenses related to stock options, restricted stock awards and restricted stock units granted to certain of our employees and directors. (b) Represents the non-cash accrual for future award redemptions in connection with our customer loyalty program. (c) Represents non-capitalized costs associated with the recapitalization with Freeman Spogli & Co. on December 12, 2011. (d) Includes direct costs and fees related to the acquisitions of RCC, Baskins and Sheplers, which we acquired in August 2012, May 2013 and June 2015, respectively.(e) Represents certain store integration, remerchandising, inventory obsolescence and corporate consolidation costs incurred in connection with the integration of RCC, Baskins and Sheplers, which we acquired in August 2012, May 2013 and June 2015, respectively. Fiscal 2016 includes an adjustment to normalize the gross margin impact of sales of discontinued inventory from Sheplers, which was sold at a discount or written off. The adjustment assumes such inventory was sold at Sheplers’ normalized margin rate.(f) Represents the amortization of purchase-accounting adjustments that adjusted the value of inventory acquired to its fair value. (g) Represents loss on disposal of assets and contract termination costs from store closures and unused office and warehouse space.(h) Represents professional fees and expenses incurred in connection with a Form S-1 Registration Statement filing in July 2015 and withdrawn in November 2015, and a secondary offering held in February 2015.(i) Represents professional fees and expenses incurred in connection with a prior due diligence process of Sheplers.