Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - American Realty Capital Global Trust II, Inc. | v446277_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - American Realty Capital Global Trust II, Inc. | v446277_ex99-1.htm |

| EX-3.1 - EXHIBIT 3.1 - American Realty Capital Global Trust II, Inc. | v446277_ex3-1.htm |

| EX-2.1 - EXHIBIT 2.1 - American Realty Capital Global Trust II, Inc. | v446277_ex2-1.htm |

Exhibit 99.2

American Realty Capital Global Trust II Agrees to be Acquired by Global Net Lease (NYSE: GNL)

1 A MERICAN R EALTY C APITAL G LOBAL T RUST II, I NC . IMPORTANT INFORMATION Risk Factors See the section entitled “Risk Factors ” in the most recent Annual Report on Form 10 - K for a discussion of the risks which should be considered in connection with our company . Forward - Looking Statements This presentation may contain forward - looking statements . You can identify forward - looking statements by the use of forward looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “intends,” “plans,” “projects,” “estimates,” “anticipates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases . Please review the end of this presentation and the fund’s most recent Annual Report on Form 10 - K or Quarterly Report on Form 10 - Q for a more complete list of risk factors, as well as a discussion of forward - looking statements.

2 A MERICAN R EALTY C APITAL G LOBAL T RUST II, I NC . CREATING A PREMIER, GLOBAL, SINGLE - TENANT NET LEASE REIT (1) Inclusive of net debt as of March 31, 2016 and share count as of July 31, 2016 (2) Based on share price of $8.63 per share as of August 5, 2016 Broke Escrow October 2014 Acquired High - Quality Office, Industrial, and Distribution Properties December 2014 to December 2015 Closed Non - traded Offering December 2015 Merger with Global Net Lease Q4 2016 Sale at $648 million Fixed 2.27 exchange ratio per Global II Share (1 )( 2) NYSE Ticker: GNL Market Cap: $1.47 billion (2) Target Closing: Q4 2016

3 A MERICAN R EALTY C APITAL G LOBAL T RUST II, I NC . Global Net Lease (NYSE: GNL) to acquire American Realty Capital Global Trust II (“Global II”) in a merger worth $648 million (1) • 2.27 Conversion Ratio: Based on GNL’s August 5, 2016 closing price of $8.63 per share, each share of Global II common stock owned would be exchanged for $19.59 of GNL stock • Fixed Exchange Ratio: A llows Global II shareholders the opportunity to participate in share price movement, including any upside in GNL’s stock going forward • Top Global Net Lease REIT: Further solidifies GNL as a leading global net lease REIT • Enhanced Portfolio: Combined company will have a globally diversified property portfolio of 23 million square feet in 345 assets in 7 countries, achieving needed critical scale for Global II • Full Stock Consideration: Global II shareholders will own a strong currency in GNL’s liquid publicly traded shares on the NYSE with a total Enterprise Value for the combined company of $3.3 billion (1) Strong Shareholder Protections • 45 day Go Shop process with low breakup fee • Comprehensive Go Shop process will provide potential for obtaining optimum value for Global II shareholders by allowing third parties the opportunity to submit a superior offer for a specified time period Improved common dividend strength and safety to Global II shareholders • Common Dividend will become $1.61 per converted Global II share (2) • GNL has a strong dividend yield of 8.2% • Improved safety from 106% (3) coverage of dividends from AFFO Closing expected Q4 2016 • Subject to Global II and GNL shareholder vote • Subject to SEC review and other customary closing conditions SUMMARY OF TRANSACTION (1) Inclusive of net debt as of March 31, 2016 and share count as of July 31, 2016 (2) Based on exchange ratio of 2.27 and market data as of August 5, 2016 (3) Based on GNL’s last quarter annualized dividend as of March 31, 2016

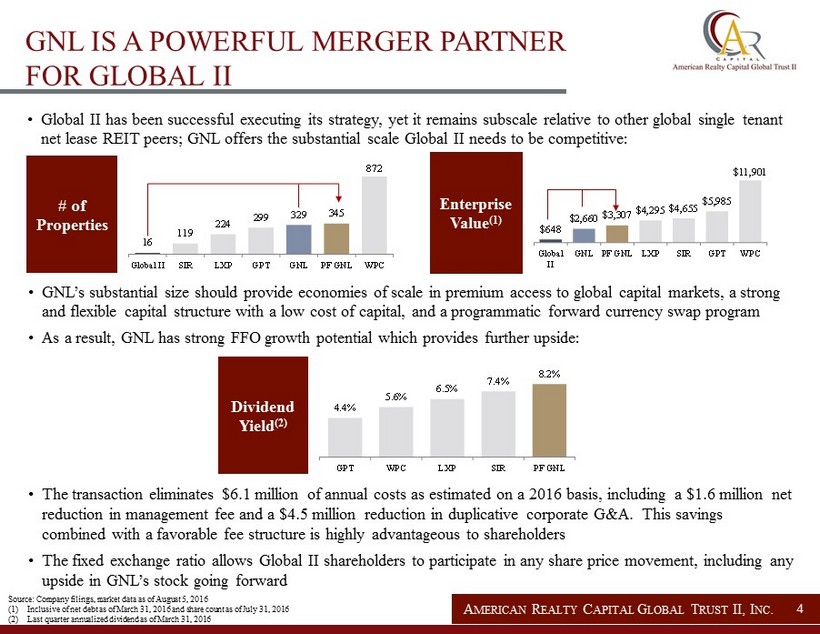

4 A MERICAN R EALTY C APITAL G LOBAL T RUST II, I NC . • GNL’s substantial size should provide economies of scale in premium access to global capital markets, a strong and flexible capital structure with a low cost of capital, and a programmatic forward currency swap program • As a result, GNL has strong FFO growth potential which provides further upside: • The transaction eliminates $6.1 million of annual costs as estimated on a 2016 basis, including a $1.6 million net reduction in management fee and a $4.5 million reduction in duplicative corporate G&A. This savings combined with a favorable fee structure is highly advantageous to shareholders • The fixed exchange ratio allows Global II shareholders to participate in any share price movement, including any upside in GNL’s stock going forward 16 119 224 299 329 345 872 Global II SIR LXP GPT GNL PF GNL WPC 4.4% 5.6% 6.5% 7.4% 8.2% GPT WPC LXP SIR PF GNL GNL IS A POWERFUL MERGER PARTNER FOR GLOBAL II Source: Company filings, market data as of August 5, 2016 (1) Inclusive of net debt as of March 31, 2016 and share count as of July 31, 2016 (2) Last quarter annualized dividend as of March 31, 2016 • Global II has been successful executing its strategy, yet it remains subscale relative to other global single tenant net lease REIT peers; GNL offers the substantial scale Global II needs to be competitive: # of Properties Dividend Yield (2) $648 $2,660 $3,307 $4,295 $4,655 $5,985 $11,901 Global II GNL PF GNL LXP SIR GPT WPC Enterprise Value (1)

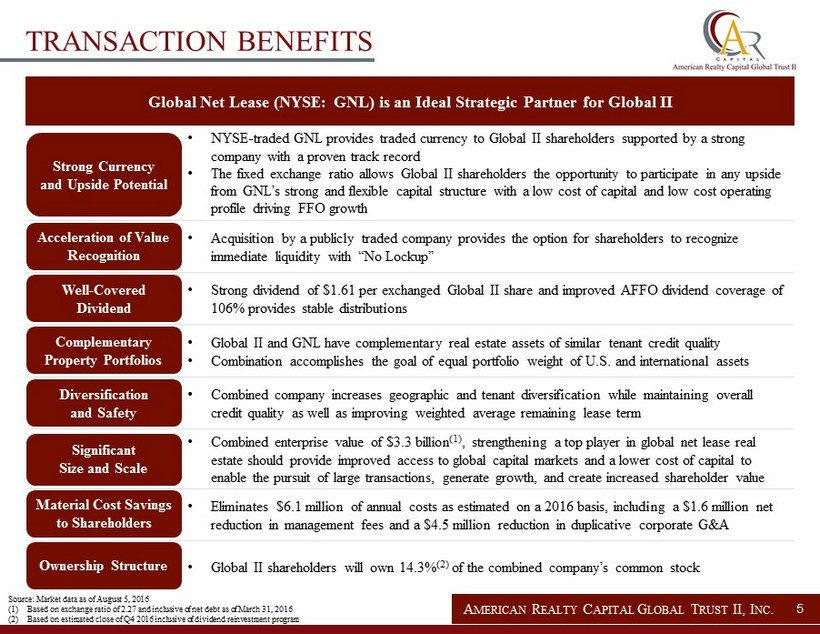

5 A MERICAN R EALTY C APITAL G LOBAL T RUST II, I NC . • NYSE - traded GNL provides traded currency to Global II shareholders supported by a strong company with a proven track record • The fixed exchange rati o allows Global II shareholders the opportunity to participate in any upside from GNL’s strong and flexible capital structure with a low cost of capital and low cost operating profile driving FFO growth • Acquisition by a publicly traded company provides the option for shareholders to recognize immediate liquidity with “No Lockup” • Strong dividend of $1.61 per exchanged Global II share and improved AFFO dividend coverage of 106% provides stable distributions • Global II and GNL have complementary real estate assets of similar tenant credit quality • Combination accomplishes the goal of equal portfolio weight of U.S. and international assets • Combined company increases geographic and tenant diversification while maintaining overall credit quality as well as improving weighted average remaining lease term • Combined enterprise value of $3.3 billion (1) , strengthening a top player in global net lease real estate should provide improved access to global capital markets and a lower cost of capital to enable the pursuit of large transactions, generate growth, and create increased shareholder value • Eliminates $6.1 million of annual costs as estimated on a 2016 basis, including a $1.6 million net reduction in management fees and a $4.5 million reduction in duplicative corporate G&A • Global II shareholders will own 14.3% (2) of the combined company’s common stock Global Net Lease (NYSE: GNL) is an Ideal Strategic Partner for Global II TRANSACTION BENEFITS Complementary Property Portfolios Acceleration of Value Recognition Significant Size and Scale Strong Currency a nd Upside Potential Diversification and Safety Source: Market data as of August 5, 2016 (1) Based on exchange ratio of 2.27 and inclusive of net debt as of March 31, 2016 (2) Based on estimated close of Q4 2016 inclusive of dividend reinvestment program Ownership Structure Well - Covered Dividend Material Cost Savings to Shareholders

6 A MERICAN R EALTY C APITAL G LOBAL T RUST II, I NC . • 100% stock consideration in Global Net Lease (NYSE: GNL) • Fixed exchange ratio of 2.27 shares of GNL per share of Global II stock • Each Global II share would be exchanged for $19.59 of GNL stock based on GNL’s closing price of $8.63 per share as of August 5, 2016 • GNL currently pays a dividend of $0.71 per share • Based on the 2.27 exchange ratio, Global II shareholders will receive an implied dividend of $1.61 per exchanged share • No Lockup • No applicable incentive fee • Post transaction, Global II shareholders will own 14.3% (1) of the combined company • The combined company will have a five member board of directors, four of whom will be independent. • 45 day Go Shop process with low breakup fee • $1.2 million during the Go Shop period, and $6.0 million thereafter, plus expenses shall be reimbursed (up to a maximum of $5 million) • Anticipated closing in Q4 2016 TRANSACTION DETAILS Consideration Board Representation Dividends Lockup Pro Forma Ownership Go Shop Breakup Fee Timing Incentive Fee (1) Based on estimated close of Q4 2016 inclusive of dividend reinvestment program

7 A MERICAN R EALTY C APITAL G LOBAL T RUST II, I NC . Number of Properties 16 329 345 Number of Tenants 14 86 99 Square Footage 4.2 million 18.7 million 23.0 million Countries 6 5 7 Remaining Lease Term (1) 8.8 years 11.0 years 10.6 years O ccupancy 99.9% 100% 100% Top 10 Tenant Concentration (2) 94% 37% 35% % of Investment Grade Tenants (3) 71.7% 70.1% 70.4% Weighted Average Interest Rate (4) 4.5% 2.5% 3.0% PREMIER GLOBAL NET LEASE PORTFOLIO (1) Weighted average remaining lease term based on square footage as of March 31, 2016 (2) Based on TTM GAAP NOI (3) PF GNL includes investment grade, implied investment grade, and subsidiaries of investment grade parent companies; credit ratings as of August 1, 2016 (4) Based on balance sheet data as of March 31, 2016 Merger Strengthens Global II by Increasing Tenant and Geographical Diversification, Lengthening Remaining Lease Term, and Improving Cost of Capital

8 A MERICAN R EALTY C APITAL G LOBAL T RUST II, I NC . Global II Properties GNL Properties UNITED STATES FRANCE GERMANY FINLAND U.K. NETHERLANDS. LUXEMBOURG SIGNIFICANT DIVERSIFIED PORTFOLIO Tenant Creditworthiness (2) Tenant Industries Asset Locations Source: Company filings (1) Pro forma portfolio statistics based on TTM GAAP NOI as of March 31, 2016 (2) PF GNL includes investment grade, implied investment grade, and subsidiaries of investment grade parent companies; credit ratings as of August 1, 2016 Pro Forma Portfolio Map 49% 23% 8% 7% 6% 5% 2% United States United Kingdom Germany Netherlands Finland France 35.5% 34.9% 29.6% Investment Grade Implied Investment Grade Non-Investment Grade Pro Forma Portfolio Statistics (1) Combined portfolio of 345 properties deepens global reach in 7 countries Highly diversified industry mix with no industry above 14% of TTM NOI Majority investment - grade tenancy provides cash flow stability and dividend coverage Accomplishes goal of equal portfolio weight of U.S. and international assets 14% 7% 7% 6% 6% 5% 5% 5% 5% 5% 35% Financial Services Discount Retail Technology Aerospace Telecommunications Energy Utilities Automotive Healthcare Engineering Other

9 A MERICAN R EALTY C APITAL G LOBAL T RUST II, I NC . Tenant % of NOI Tenant Industry Description 4.8% Engineering A subsidiary of Foster Wheeler AG 4.3% Freight Leading North American provider of delivery services 4.3% Utilities One of Europe’s main utilities providers 3.6% Government Services United States Government affiliates 3.5% Aerospace Flag carrier and largest airline of Finland 3.5% Discount Retail Regional chain of variety stores in the United States 3.2% Financial Services Leading multinational financial service provider 2.9% Publishing Scottish printing company founded in 1819 2.5% Healthcare One of the largest biomedical companies in the U.S. 2.3% Discount Retail Market leading discount retailer in Finland 70% leased to investment grade or implied investment tenants (2) IMPROVED TENANT DIVERSIFICATION Long Dated Remaining Lease Term (3) Source: Company filings (1) Tenant concentration percentage based on TTM GAAP NOI as of March 31, 2016 for GNL and Global II (2) Based on credit ratings as of August 1, 2016 (3) Based on pro forma square footage Indicates Legacy Global II tenant Increased tenant diversification with top 10 tenants comprising just 35% (1) of TTM NOI in the combined company 0.6% 0.3% 4.8% 8.7% 11.4% 12.6% 4.5% 3.0% 13.5% 35.8% 4.8% -- 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030+ GNL and Global II hold similar portfolios in terms of tenant industries and credit worthiness Long dated remaining lease term of over 10 years with no significant near - term lease roll (1)

10 A MERICAN R EALTY C APITAL G LOBAL T RUST II, I NC . IG, 39.1% IG, 32.8% 58% 30% 12% Enterprise Value ($mm) $3,307 (1) $4,295 $4,655 $5,985 $11,901 Portfolio SF (mm) 23.0 42.2 44.7 62.1 989.3 # of Properties 345 224 119 299 872 % Investment Grade Tenants (2) % International (3) 51% -- -- 17% 37% Weighted Average Remaining Lease Term (years) (4) 10.6 12.7 10.4 7.4 9.0 2% 50% 30% 17% Retail Industrial Office Other 63% 37% IG, 43.0% 5% 54% 41% IG, 21.4% 16% 29% 25% 30% IG, 35.5% Implied IG, 34.9% , 29.6% WELL POSITIONED AMONG NET LEASE REITS Source: Company filings, market data as of August 5, 2016 (1) Based on exchange ratio of 2.27 and inclusive of net debt as of March 31, 2016 (2) PF GNL includes investment grade, implied investment grade, and subsidiaries of investment grade parent companies; credit ratings as of August 1, 2016. LXP based on GAAP rent, SIR, GPT, and WPC based on annualized base rent for the quarter as of March 31, 2016 (3) PF GNL based on TTM NOI as of March 31, 2016; LXP, SIR, GPT, WPC based on square footage as of March 31, 2016 (4) PF GNL weighted average remaining lease term as of March 31, 2016 based on square footage; LXP based on cash basis rent, SIR based on annualized revenue, GPT, WPC based on annualized base rent for the quarter as of March 31, 2016 Select Income Lexington Realty Trust W.P. Carey Gramercy Property Trust PF Global Net Lease NOI by Property Type

11 A MERICAN R EALTY C APITAL G LOBAL T RUST II, I NC . UK Properties Average Remaining Lease Term (1) 9.3 Years 12.7 Years % UK NOI Exposure 42% 23% % of UK NOI from Investment Grade Tenants 36% 70% RESILIENT GLOBAL PLATFORM Source: Company filings (1) Based on square footage as of March 31, 2016 The Pro Forma Company is Well Positioned to Respond to any P ost - Referendum Volatility • GNL uses a currency hedging program complementary to Global II’s that mitigates its exposure to fluctuations in pound sterling and euro exchange rates Prudently hedged portfolio properly protects combined company

12 A MERICAN R EALTY C APITAL G LOBAL T RUST II, I NC . SIGNIFICANT SAVINGS FROM REDUCED FEES • 0.75% of lesser of asset and cost fair value • 0.40 – 0.75%, subject to AUM and peer set G&A load • 0.40 – 0.75% • None • 1.25% • 1.25% • 15% over a 6% hurdle • 15% over a 7% hurdle • 25% over a 9% hurdle • Capped at 1.25% AUM • 15% over a 7% hurdle • 25% over a 9% hurdle • Capped at 1.25% AUM • 1.50% • None • Eliminated • 2.00% • None • Eliminated • 0.75% • None • Eliminated • One year term; unlimited one year renewals unless terminated • 20 year initial term • Automatically renewable for 5 year terms • 20 year initial term • Automatically renewable for 5 year terms Incentive Fee Disposition Fees (% of selling price) Acquisition Fee (% of price) Asset Management Fee (% of AUM) Financing Fees (% of financing amt.) Equity Raising Fee (% of equity raised) Global II GNL Combined Company Best - in - Class External Management Agreement Due to Cost Synergies and Controls Provided to Independent Directors Length of Advisory Agreement

13 A MERICAN R EALTY C APITAL G LOBAL T RUST II, I NC . 7.4 8.8 9.0 10.4 10.6 11.0 12.7 GPT Global II WPC SIR PF GNL GNL LXP 16 119 224 299 329 345 872 Global II SIR LXP GPT GNL PF GNL WPC $648 $2,660 $3,307 $4,295 $4,655 $5,985 $11,901 Global II GNL PF GNL LXP SIR GPT WPC 21.4% 32.8% 39.1% 43.0% 36.6% 35.5% 31.0% 70.1% 70.4% 71.7% WPC LXP SIR GPT GNL PF GNL Global II 0% 0% 17% 37% 40% 51% 96% LXP SIR GPT WPC GNL PF GNL Global II FAVORABLE POSITIONING AMONG NET LEASE REITS Enterprise Value (1) Remaining Lease Term (2) # of Properties % Investment Grade (3) % International (4) Dividend Yield (5) Source: Company filings, market data as of August 5 , 2016 (1) Based on exchange ratio 2.27 and inclusive of net debt as of March 31, 2016 and share count as of July 31, 2016 (2) PF GNL weighted average remaining lease term as of March 31, 2016 based on square footage; LXP based on cash basis rent, SIR based on annualized revenue, GPT, WPC based on annualized base rent for the quarter as of March 31, 2016 (3) PF GNL includes investment grade, implied investment grade, and subsidiaries of investment grade parent companies; credit ratings as of August 1, 2016. LXP based on GAAP rent, SIR, GPT, and WPC based on annualized base rent for the quarter as of March 31, 2016 (4 ) PF GNL based on TTM GAAP NOI ; LXP, SIR, GPT, WPC based on square footage as of March 31, 2016 ( 5 ) Last quarter annualized dividend as of March 31, 2016 4.4% 5.6% 6.5% 7.4% 8.2% GPT WPC LXP SIR PF GNL Implied IG

14 A MERICAN R EALTY C APITAL G LOBAL T RUST II, I NC . GNL IS THE IDEAL PARTNER FOR GLOBAL II x Allows Global II to achieve critical scale x Access to global capital markets and low cost of capital x Significant synergies drive low cost operations x Premier management team x Room for growth and further upside

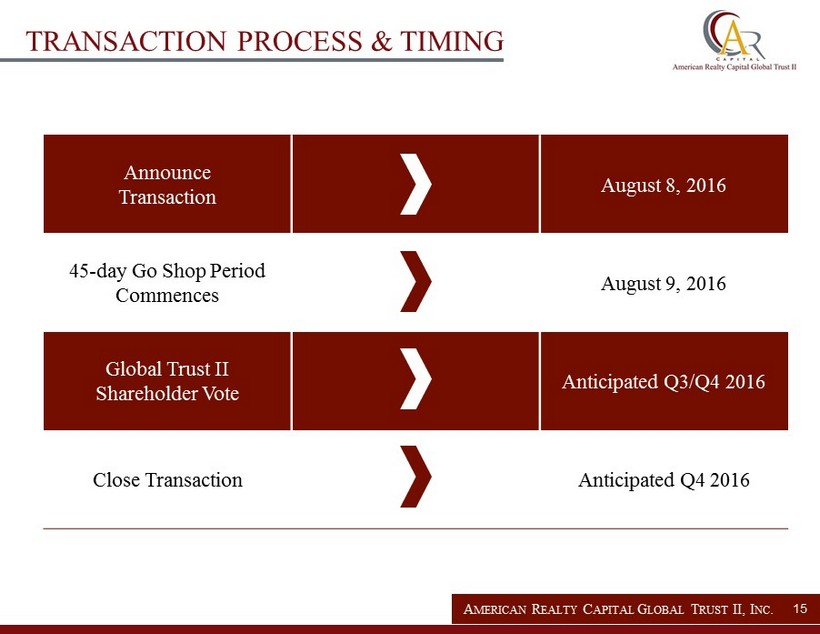

15 A MERICAN R EALTY C APITAL G LOBAL T RUST II, I NC . Announce Transaction August 8, 2016 45 - day Go Shop Period Commences August 9, 2016 Global Trust II Shareholder Vote Anticipated Q3/Q4 2016 Close Transaction Anticipated Q4 2016 TRANSACTION PROCESS & TIMING

16 A MERICAN R EALTY C APITAL G LOBAL T RUST II, I NC . Additional Information About the Proposed Transaction and Where to Find It This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed transaction, GNL and Global II intend to file relevant materials with the Securities and Exchange Commission (the "SEC"), including a joint proxy statement/prospectus. BOTH GNL AND GLOBAL II STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors may obtain free copies of the proxy statement/prospectus and other relevant documents filed by GNL and Global II with the SEC (if and when they become available) through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by GNL and Global II with the SEC are also available free of charge on GNL’s website at www.globalnetlease.com and copies of the documents filed by Global II with the SEC are available free of charge on Global II’s website at www.arcglobal2.com. GNL and Global II and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from both companies’ stockholders in respect of the proposed transaction. Information regarding GNL’s directors and executive officers can be found in GNL’s definitive proxy statement filed with the SEC on April 29, 2016. Information regarding Global II's directors and executive officers can be found in the Global II's definitive proxy statement filed with the SEC on April 29, 2016. Additional information regarding the interests of such potential participants will be included in the joint proxy statement and other relevant documents filed with the SEC in connection with the proposed transaction if and when they become available. These documents are available free of charge on the SEC’s website and from GNL and Global II, as applicable using the sources indicated above. DISCLOSURE

17 A MERICAN R EALTY C APITAL G LOBAL T RUST II, I NC . Certain statements made in this presentation are “forward - looking statements” (as defined in Section 21E of the Exchange Act), which reflect the expectations of GNL and Global II regarding future events. The forward - looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those contained in the forward - looking statements. Such forward - looking statements include, but are not limited to, whether and when the transactions contemplated by the Agreement and Plan of Merger (the “Merger Agreement”) between GNL and Global II, among others, will be consummated, the new combined company’s plans, market and other expectations, objectives, intentions, as well as any expectations or projections with respect to the combined company, including regarding future dividends and market valuations, and other statements that are not historical facts. The following additional factors, among others, could cause actual results to differ from those set forth in the forward - looking statements: the approval by Global II’s stockholders of the transactions contemplated in the Merger Agreement; market volatility; unexpected costs or unexpected liabilities that may arise from the transaction, whether or not consummated; continuation or deterioration of current market conditions; future regulatory or legislative actions that could adversely affect the companies; and the business plans of the tenants of the respective parties. Additional factors that may affect future results are contained in the Company’s and Global II’s filings with the SEC, which are available at the SEC’s website at www.sec.gov. The GNL and Global II disclaim any obligation to update and revise statements contained in these materials based on new information or otherwise. FORWARD LOOKING STATEMENTS

18 A MERICAN R EALTY C APITAL G LOBAL T RUST II, I NC . American Realty Capital Global Trust II, Inc. ARCGlobalTrust2.com ▪ For account information, including balances and the status of submitted paperwork, please call us at (866) 902 - 0063 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.ar - global.com