Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - METLIFE INC | d235576dex992.htm |

| 8-K - 8-K - METLIFE INC | d235576d8k.htm |

Exhibit 99.1

Description of Video Second Quarter 2016 Financial Update

From Chief Financial Officer John Hele

This exhibit (video transcript and slides) contains forward-looking statements. Forward-looking statements give expectations or forecasts of future events and use words such as “anticipate,” “estimate,” “expect,” “project” and other terms of similar meaning, or that are tied to future periods. Any or all forward-looking statements may turn out to be wrong, and actual results could differ materially from those expressed or implied in the forward-looking statements. Predictions of future performance are inherently difficult and are subject to numerous risks and uncertainties, including those identified in the “Risk Factors” section of MetLife, Inc.’s filings with the U.S. Securities and Exchange Commission. The company is not required to publicly correct or update any forward-looking statement if it later becomes aware that such statement is not likely to be achieved.

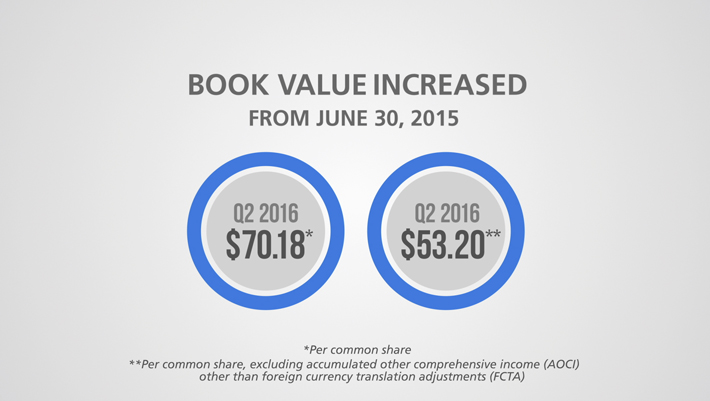

This exhibit (video transcript and slides) also contains measures that are not calculated based on accounting principles generally accepted in the United States of America, also known as GAAP. Information regarding those non-GAAP financial measures and the reconciliations of the non-GAAP financial measures to the most directly comparable GAAP measures, including net income per share of $0.06 and book value per share of $70.18 for the quarter ended June 30, 2016, is provided in the company’s second quarter 2016 Financial Supplement, and/or the company’s earnings news release dated August 3, 2016 for the three months ended June 30, 2016. This exhibit (video transcript and slides) and the tables accompanying the earnings news release are each exhibits to the company’s Current Report on Form 8-K, dated August 4, 2016.

Video Transcript and Description:

[Shows slide 1 below]

[MetLife Executive Vice President & CFO John Hele speaks from a studio at MetLife’s corporate headquarters in New York City]

Hi, I’m John Hele and I am joining you from MetLife’s global headquarters in New York City. Before I discuss our second quarter 2016 results, I’d like to take a moment to touch on the expense initiative outlined by CEO Steve Kandarian on our earnings conference call.

As Steve mentioned, the persistent low interest rate environment will continue to put pressure on MetLife’s earnings. In addition, our Accelerating Value work has highlighted the need to bring our cost base in line with our revenue base to allow us to compete more effectively.

In light of these factors, we have announced 1 billion dollars in pre-tax run-rate expense savings by the end of 2019.

Our approach is to focus on unit costs. For every dollar of revenue we take in, we will determine how much can be spent on various functions based on rigorous benchmarking against best-in-class peers.

The savings MetLife will achieve from this initiative will serve two vital purposes.

First, they will enable us to meet the free cash flow generation targets we have set as part of Accelerating Value.

And second, they will fund MetLife’s growth in the most attractive markets. Both of these are critical to achieving our goal of being a top-third financial performer in our industry.

With that, I’ll turn to our second quarter results…

MetLife had a challenging second quarter of 2016, including the impact of two significant notable items.

First is the outcome of our U.S. variable annuity assumption review, which was accelerated due to the company’s plan to separate a substantial portion of our U.S. Retail business. Second is modeling improvements in the reserving process, mainly in our Retail business, which resulted in reserve adjustments.

Net income for the quarter was 64 million dollars, including a 2 billion dollar after-tax non-cash charge related to the annual variable annuity actuarial assumption review that I just mentioned. Approximately 1.5 billion dollars of the after-tax non-cash charge is attributable to changes in variable annuity policyholder behavior and the remainder is related to changes in economic and other actuarial assumptions.

Operating earnings for the quarter were 924 million dollars, down 48 percent when compared to the second quarter of 2015. On a per share basis, operating earnings were 83 cents, down 47 percent.

In the Americas, we reported first quarter operating earnings of 835 million dollars, down 42 percent on a reported basis and down 41 percent on a constant currency basis, primarily due to the reserve adjustments from modeling improvements in the reserving process and the annual variable annuity actuarial assumption review that I previously mentioned. [Shows slides 2 and 3 below]

In Asia, second quarter operating earnings were 259 million dollars, down 39 percent on a reported basis and down 41 percent on a constant currency basis. Volume growth was offset by unfavorable tax-related adjustments in Japan, an adjustment to reinsurance receivables in Australia and lower fixed annuity surrenders. [Shows slides 4 and 5 below]

In EMEA, we achieved operating earnings of 64 million dollars, up 28 percent on a reported basis and up 36 percent on a constant currency basis, driven by lower expenses and volume growth. [Shows slides 6 and 7 below]

Book value per common share was up 5 percent to 53 dollars and 20 cents. [Shows slide 8 below]

While we continue to face challenging macroeconomic conditions, we are committed to managing our risk and our expenses in order to drive improvements for our customers and to enhance value for shareholders.

Thank you for watching.

[Shows slide 9 below]

Slide 1

Slide 2

Slide 3

Slide 4

Slide 5

Slide 6

Slide 7

Slide 8

Slide 9