Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - CPI AEROSTRUCTURES INC | cvu-8k_080416.htm |

Exhibit 99.1

A Premier Supplier of Aircraft Structures andSystems NYSE MKT:CVU Q2’2016ResultsPresentation August 4,2016 Speakers: Douglas McCrosson, President & Chief Executive Officer Vincent Palazzolo, Chief FinancialOfficer

2 Disclosure Statement Forward-LookingStatements Thispresentationcontainsforward-lookingstatementsthatinvolverisksanduncertainties.Allstatements,other thanstatementsofhistoricalfact, includedinthispresentation,includingwithoutlimitation,statementsregarding projections,futurefinancingneeds,andstatementsregarding future plans andobjectives of the Company,are forward-looking statements. Wordssuch as "believes,""expects," "anticipates," "intends," "plans,""estimates" andsimilarexpressionsareintendedtoidentifyforward-lookingstatements.Theseforward-lookingstatements arebased uponthecurrentexpectationsofmanagementandcertainassumptionsthataresubjecttorisksand uncertainties.Accordingly,therecanbeno assurancethatsuchrisksanduncertaintieswillnotaffectthe accuracyoftheforward-lookingstatementscontainedhereinorthatouractual resultswillnotdiffermaterially fromtheresultsanticipatedinsuchforward-lookingstatements.Suchfactorsinclude,butarenotlimitedto,the following: the cyclicality ofthe aerospacemarket,the levelofU.S. defensespending,productionrates for commercialandmilitary aircraft programs,competitivepricingpressures,start-upcostsfornewprograms, technologyandproductdevelopmentrisksanduncertainties,product performance,increasingconsolidationof customersandsuppliersintheaerospaceindustryandcostsresultingfromchangestoandcompliance with applicableregulatoryrequirements.Theinformationcontainedinthispresentationisqualifiedinitsentiretyby cautionarystatementsand riskfactorsdisclosedintheCompany'sSecuritiesandExchangeCommissionfilings, includingitsAnnualReportonForm10-KfiledonMarch28, 2016andasamendedonApril29,2016,andquarterlyreportonForm10-QfiledonMay10,2016,availableathttp://www.sec.gov. Wecautionreadersnottoplaceunduerelianceonanyforward-lookingstatements,whichspeakonlyasofthe datehereofandforwhichthe Companyassumesnoobligationtoupdateorrevisetheforward-looking statementsherein. CPIAEROisaregisteredtrademarkofCPIAerostructures,Inc.Allothertrademarksreferencedhereinarethe propertyoftheirrespective owners. Non-GAAPFinancialData AdjustedEarnings(arrivedatbyeliminatingtheCompany'sA-10ProgramwithBoeingfromreportedresults)isnotderivedinaccordancewith generallyacceptedaccountingprinciples(“GAAP”).AdjustedearningsisakeymetricCPIAerohasusedinevaluatingitsfinancialperformance. Adjustedearningsisconsideredanon-GAAPfinancialmeasureasdefinedbyRegulationGpromulgatedbytheSECundertheSecuritiesActof 1933,asamended.CPIAeroconsidersAdjustedEarningsimportantinevaluatingitsfinancialperformanceonaconsistentbasisacrossvarious periods.Duetothesignificanceofthenon-cashandnon-recurringchangeinestimaterecognizedinthesixmonthsendedMarch31,2016, AdjustedEarningsenablestheCompany'sBoardofDirectorsandmanagementtomonitorandevaluatethebusinessonaconsistentbasis.CPI AerousesAdjustedEarningsasameasure,amongothers,toanalyzeandevaluatefinancialandstrategicplanningdecisionsregardingfuture operatingdecisionsandinvestments.ThepresentationofAdjustedEarningsshouldnotbeconstruedasaninferencethatCPIAero'sfuture resultswillbeunaffectedbyunusualornon-recurringitemsorbynon-cashitems,suchaschangesinestimates.AdjustedEarningsshouldbe consideredinadditionto,ratherthanasasubstitutefor,pre-taxincome,netincomeandcashflowsfromoperatingactivities.

3 RecentHighlights DouglasMcCrosson President & Chief ExecutiveOfficer

4 Backlog Funded 24% / Unfunded 76% Defense 74% / Commercial 26% Consolidated Backlog at 06/30/2016: $395.4 Million 1 $95.7M $299.7M Funded Unfunded Unfunded backlog represents remaining potential value of long term agreements $291.5M $103.9M Defense Commercial 1 Backlog at 6/30/16 does not include Raytheon NGJPods order ($4.0MFunded; $27MUnfunded) announced subsequent to 6/30/2016

5 Driven By Renewed Strength in Defense Business Recent wins adding $250+ million in backlog until 2022 Contract Period 2013 -2021 Contract Period 2016 -2019 Contract Period 2015 -2021 Contract Period 2014 -2022 Contract Period 2015 -2021 Announced November 2014 Announced January 2016 Announced February 2015 Announced November 2014 Announced July 2015 $86.1M $25-30M $49M E-2D Advanced Hawkeye/C-2A Greyhound T-38C Talon Trainer $53.5M F-35A $10.6M Japan E-2D Hawkeye F-16 Falcon Raytheon Next Generation Jammer Pod $30+M Announced July 2016 Contract Period 2016 –2022+

6 Financial Highlights Vincent Palazzolo Chief Financial Officer

7 Recent Financial Highlights ($ in Millions, except per share data) 2016 2015 2016 2015 Revenue $22.3 $21.9 $19.8 16.3 Cost of sales 17.3 18.1 14.8 12.4 Gross profit 5.0 3.8 5.0 3.8 Selling, general and administrative expenses 1.9 2.0 1.9 2.0 Income from operations 3.2 1.8 3.2 1.8 Income before provision for income taxes 2.8 1.5 2.8 1.5 Net income 1.8 1.0 1.8 1.0 Income per common share – diluted $0.21 $0.12 $0.21 $0.12 GAAP as Reported Adjusted Earnings For the 3M Ended June 30, For the 3M Ended June 30, (Unaudited) (Unaudited)

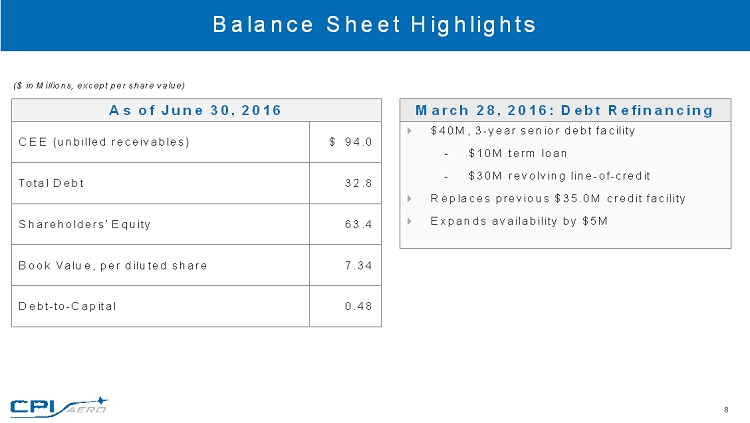

8 Balance Sheet Highlights Total Debt Total Debt Credit Facility Shareholders’ Equity Book Value Debt-to-Capital As of June 30, 2016 CEE (unbilled receivables) $ 94.0 Total Debt 32.8 Shareholders’ Equity 63.4 Book Value,per diluted share 7.34 Debt-to-Capital 0.48 ($ in Millions, except per share value) March 28, 2016: Debt Refinancing $40M, 3-year senior debt facility - $10M term loan - $30M revolving line-of-credit Replacesprevious $35.0M credit facility Expandsavailability by $5M

9 2016 Financial Guidance Reaffirmed Revenue Pre-tax Income NetIncome Effective Tax Rate •$82.5M–$88.5M •Reduces all projected A-10 program revenue from forecast Adjusted Revenue •$9.8M–$10.5M •Adds back the $15.3 million charge recorded in 1Q16related to A-10 program Adjusted Pre-tax Income •Approximately 37% Effective Tax Rate

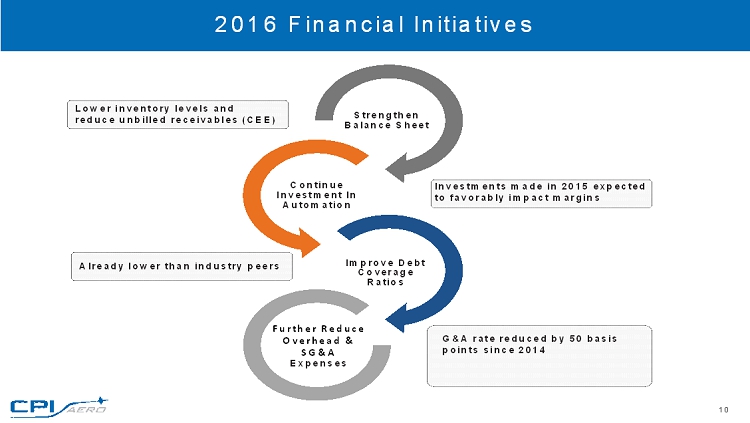

10 Strengthen Balance Sheet Continue Investment In Automation Improve Debt Coverage Ratios Further Reduce Overhead & SG&A Expenses 2016 Financial Initiatives Lower inventory levels and reduce unbilled receivables (CEE) Already lower than industry peers Investments made in 2015 expected to favorably impact margins G&A rate reduced by 50 basis points since 2014

11 Looking Ahead DouglasMcCrosson President & Chief ExecutiveOfficer

12 Continued Diversification Across Product Categories Defense opportunities are increasing Bid Pipeline (7/31/16) 67% 33% Defense Commercial 7% 5% 44% 44% Kitting MRO Aerostructures Aerosystems

13 2016 Program Opportunities Aerostructures ? Military Helos: H-92, AH-1Z, CH-53K, V-280 ? Various regional commercial aircraft (Tier 1 and Tier 2 opportunities) ? Military Fixed Wing: A-10 thick skin urgent spares kitting (TUSK), F-35 ? MRO: F-16 SLEP, BLACK HAWK Aerosystems ? ISR and EW pod structures Supply Chain Management/Kitting ? Various regional commercial aircraft (Tier 1 opportunity) ? Various business jets ? S-92 (commercial) Current opportunities:

14 Long-Term Visibility -Contracts Potential to collectively generate revenue of $395.4Mduring their remaining periods of performance (as of 6/30/16) Firm, Funded Contracts Provide Long-Term Revenue Visibility and Operating Leverage U.S. GOVERNMENT–F-16 TRIUMPH GROUP -Gulfstream G650 SIKORSKY –UH-60 Black Hawk U.S. GOVERNMENT –T-38CTalon Trainer TEXTRON - Cessna Citation X+ SIKORSKY –S-92 EMBRAER –Phenom 300 LOCKHEED –F-35A BELL HELICOPTER –AH-1ZZULU ‘08 ‘09 ’10 ’11 ’12 ’13 ‘14 ‘15 ‘16 ‘17 ‘18 ‘19 ‘20 ‘21 ‘22 ‘23 ‘24 ‘25 NORTHROP GRUMMAN –for the E-2D& C-2A NORTHROP GRUMMAN –Japan E-2D HONDA -HondaJet Defense; Commercial; *not included in backlog as of 6/30/16 UTC AEROSPACE SYSTEMS –DB-110 ISR Pod Raytheon –Next Generation Jammer Increment 1 Pod*

15 Future Opportunities T-X Trainer Foreign sales –F-16 Northrop Grumman B-21 Lockheed Martin F-35

16 Q&ASession

17 Financial Appendix

18 Adjusted Statement of Earnings Adjusted Earnings (arrived at by eliminating the Company's A-10 Program with Boeing from reported results) is not derived in accordance with generally accepted accounting principles (“GAAP”). Adjusted earnings is a key metricCPI Aero has used in evaluating its financial performance. Adjusted earnings is considered a non-GAAP financial measure as defined by Regulation G promulgated by the SEC under the Securities Act of 1933, as amended. CPI Aero considers Adjusted Earnings import antin evaluating its financial performance on a consistent basis across various periods. Due to the significance of the non-cash and non-recurring change in estimate recognized in the three months ended March 31, 2016, Adjusted Earnings enables the Company's Board of Directors and management to monitor and evaluate the business on a consistent basis. CPI Aero uses Adj usted Earnings as a measure, among others, to analyze and evaluate financial and strategic planning decisions regarding future operating decisions and investments. The presentation of Adjusted Earnings should not be construed as an inference that CPI Aero's future results will be unaffected by unusual or non-recurring items or by non-cash items, such as changes in estimates. Adjusted Earnings should be considered in addition to, rather than as a substitute for, pre-tax income, net income and cash flows from operating activities. (Unaudited) GAAP Adjusted as Reported Adjustments Earnings Revenues $22,280,964 ($2,477,316) $19,803,648 Cost of sales 17,246,963 (2,477,316) 14,769,647 Gross profit 5,034,001 5,034,001 Selling, general and administrative expenses Income from operations 3,165,214 3,165,514 Other income (expense), net Interest expense (323,634) (323,634) Income before provision for income taxes 2,841,580 2,841,580 Provision for income taxes 1,051,000 1,051,000 Net income $1,790,580 $1,790,580 Diluted Earnings per share $0.21 $0.21 For the Three Months Ended June 30, 2016 1,868,7871,868,787

19 Adjusted Statement of Earnings GAAP Adjusted as Reported Adjustments Earnings Revenues $21,944,320 ($5,683,772) $16,260,548 Cost of sales 18,095,951 (5,683,772) 12,412,179 Gross profit 3,848,369 3,848,369 2,049,793 2,049,793 Income from operations 1,798,576 1,798,576 Interest expense 270,468 270,468 1,528,108 1,528,108 538,000 538,000 Net income (loss) $990,108 $990,108 $0.12 $0.12 Income before provision for income taxes Provision for income taxes Diluted Earnings per share Selling, general and administrative expenses Other income (expense), net For the Three Months Ended June 30, 2015

20 Contact us CPI Aerostructures Vincent Palazzolo, CFO (631) 586-5200 www.cpiaero.com Investor Relations Jody Burfening& Sanjay M. Hurry (212) 838-3777 cpiaero@lhai.com www.lhai.com