Attached files

| file | filename |

|---|---|

| EX-99.1 - Q2 2016 EARNINGS RELEASE - CINCINNATI BELL INC | earningsreleaseq22016.htm |

| 8-K - CINCINNATI BELL INC. 8-K - CINCINNATI BELL INC | a8-kearningsreleaseshellq2.htm |

Cincinnati Bell

Second Quarter 2016 Results

August 4, 2016

Today's Agenda

Highlights, Segment Results and Financial Overview

Ted Torbeck, President & Chief Executive Officer

Question & Answer

2

Safe Harbor

This presentation and the documents incorporated by reference herein contain forward-looking statements regarding

future events and our future results that are subject to the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1995. All statements, other than statements of historical facts, are statements that could be

deemed forward-looking statements. These statements are based on current expectations, estimates, forecasts, and

projections about the industries in which we operate and the beliefs and assumptions of our management. Words

such as “expects,” “anticipates,” “predicts,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,”

“continues,” “endeavors,” “strives,” “may,” variations of such words and similar expressions are intended to identify

such forward-looking statements. In addition, any statements that refer to projections of our future financial

performance, our anticipated growth and trends in our businesses, and other characterizations of future events or

circumstances are forward-looking statements. Readers are cautioned these forward-looking statements are based

on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual

results to differ materially and adversely from those reflected in the forward-looking statements. Factors that could

cause or contribute to such differences include, but are not limited to, those discussed in this release and those

discussed in other documents we file with the Securities and Exchange Commission (SEC). More information on

potential risks and uncertainties is available in our recent filings with the SEC, including Cincinnati Bell’s Form 10-K

report, Form 10-Q reports and Form 8-K reports. Actual results may differ materially and adversely from those

expressed in any forward-looking statements. We undertake no obligation to revise or update any forward-looking

statements for any reason.

3

Non-GAAP Financial Measures

This presentation contains information about adjusted earnings before interest, taxes, depreciation and amortization

(Adjusted EBITDA), Adjusted EBITDA margin, net debt and free cash flow. These are non-GAAP financial measures

used by Cincinnati Bell management when evaluating results of operations and cash flow. Management believes

these measures also provide users of the financial statements with additional and useful comparisons of current

results of operations and cash flows with past and future periods. Non-GAAP financial measures should not be

construed as being more important than comparable GAAP measures. Detailed reconciliations of Adjusted EBITDA,

net debt and free cash flow (including the Company’s definition of these terms) to comparable GAAP financial

measures can be found in the earnings release on our website at www.cincinnatibell.com within the Investor

Relations section.

4

Ted Torbeck

President & Chief Executive Officer

5

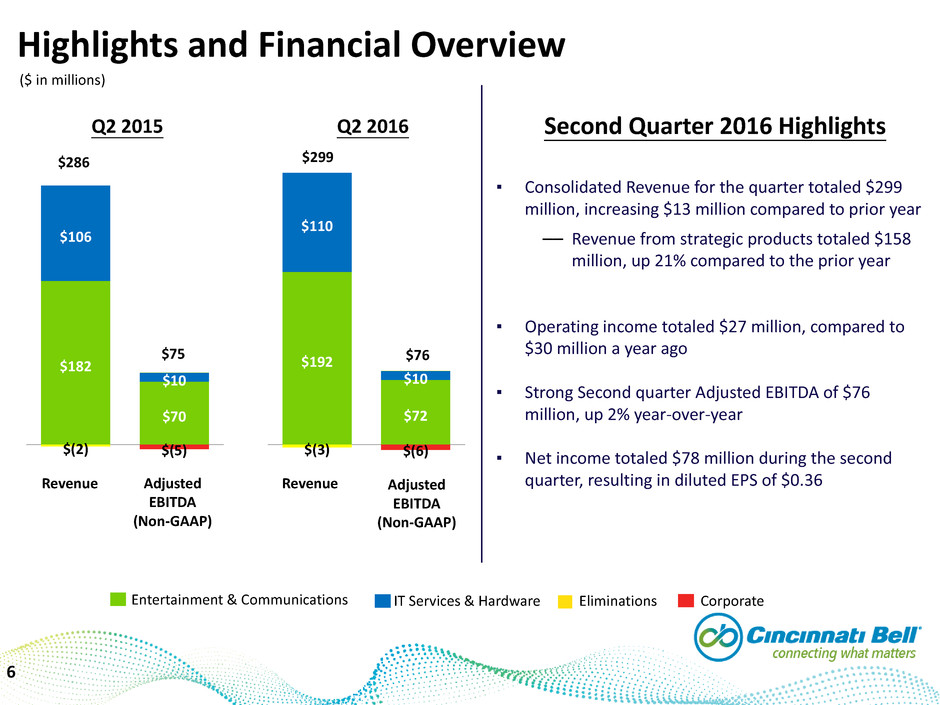

Highlights and Financial Overview

$182

$70

$106

$10

$(5)$(2)

$192

$72

$110

$10

$(6)$(3)

6

Entertainment & Communications IT Services & Hardware Eliminations Corporate

Revenue RevenueAdjusted

EBITDA

(Non-GAAP)

Adjusted

EBITDA

(Non-GAAP)

$286 $299

$75 $76

Q2 2015 Q2 2016

▪ Consolidated Revenue for the quarter totaled $299

million, increasing $13 million compared to prior year

Revenue from strategic products totaled $158

million, up 21% compared to the prior year

▪ Operating income totaled $27 million, compared to

$30 million a year ago

▪ Strong Second quarter Adjusted EBITDA of $76

million, up 2% year-over-year

▪ Net income totaled $78 million during the second

quarter, resulting in diluted EPS of $0.36

Second Quarter 2016 Highlights

($ in millions)

__

Revenue Adj. EBITDA (Non-GAAP) Adj. EBITDA Margin (Non-GAAP)

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

$182 $185 $188 $190 $192

$70 $68 $69 $72 $72

39%

37% 37%

38% 38%

Entertainment & Communications Revenue and Adjusted EBITDA

7

▪ Strategic revenues for the quarter totaled $111

million, up 26% year-over-year

▪ Operating income totaled $27 million in the

quarter, compared to $30 million in the prior year

▪ Adjusted EBITDA totaled $72 million in the second

quarter, resulting in Adjusted EBITDA margins of

38%

▪ Total internet subscribers of 296,700 at the end of the

second quarter, up 21,600 subs compared to a year ago

▪ Voice line loss was 2% – improved from 5% in the prior year

Business lines increased 2%

Residential line decreased 7%

__

__

($ in millions)

Legacy IntegrationStrategic

[1]

8

Q2 2015 Q2 2016

$42 $49

$56 $48

Entertainment & Communications Business & Consumer Markets

$99 $97

Business & Carrier Market Revenue

Entertainment & Communications Business Integration revenue totaled $1 million in Q2 2015

Entertainment & Communications Consumer Integration revenue totaled $1 million in Q2 2015 and Q2 2016

[1]

Consumer Market Revenue

Q2 2015 Q2 2016

$46

$62

$36

$32

$83

$95

▪ Fioptics revenue growth continues to more than offset legacy

declines

▪ Business revenue totaled $71 million, consistent with the prior

year

▪ Carrier revenue was $26 million, down $2 million from 2015

due to lower switched access revenue and one-time projects

completed in the prior year

($ in millions)

Y/Y

(14)%

16%

Y/Y

(11)%

36%

9

Q2 2015 Q2 2016

$23

$31

$16

$24$6

$7

$45

$62

Fioptics Update

Fioptics Revenue Total Fioptics Subscribers

Video Internet Voice

▪ Fioptics monthly ARPU for the quarter was up approximately

6% from 2015. Q2 2016 ARPUs are as follows:

Video – $83, Internet – $47, Voice – $28

__

__

__

($ in millions)

Y/Y

17%

49%

35%

Q2 2015 Q2 2016

102

127132

175

69

87

▪ Fioptics is available to 479 thousand addresses, or 60% of

Greater Cincinnati

Passed 25 thousand new addresses in Q2 2016

▪ Fioptics Penetration:

Video – 27%, Internet – 37%, Voice – 18%

▪ Total video churn was 2.5% for the quarter

Single-family churn was 2.1%

Apartment churn was 4.9%

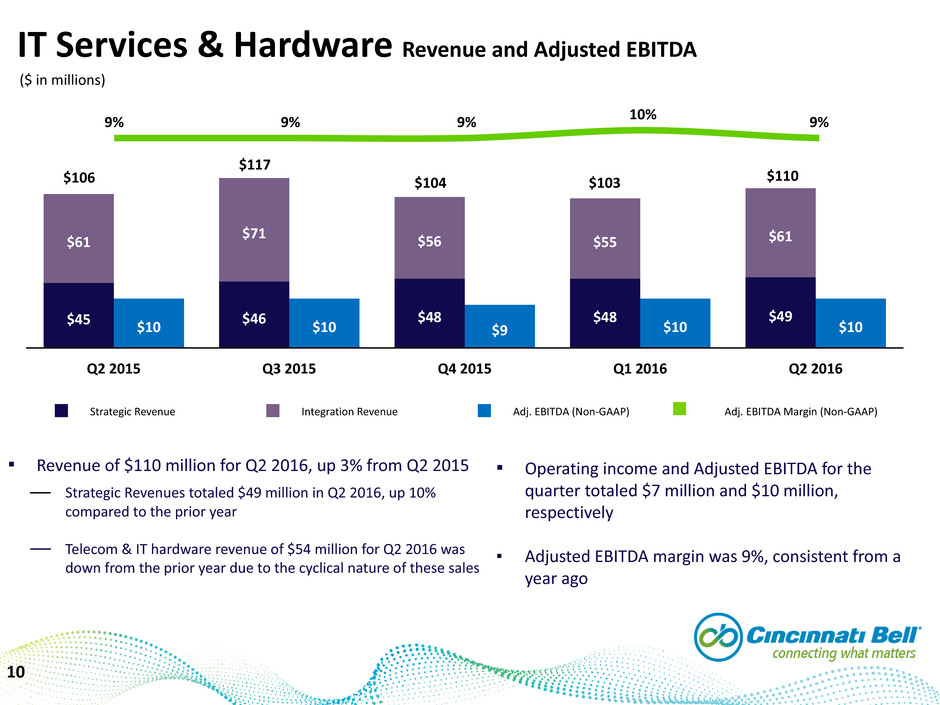

Strategic Revenue Integration Revenue Adj. EBITDA (Non-GAAP) Adj. EBITDA Margin (Non-GAAP)

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

$45 $46 $48 $48 $49

$61 $71 $56 $55 $61

$10 $10 $9 $10 $10

9% 9% 9% 10% 9%

IT Services & Hardware Revenue and Adjusted EBITDA

10

▪ Revenue of $110 million for Q2 2016, up 3% from Q2 2015

Strategic Revenues totaled $49 million in Q2 2016, up 10%

compared to the prior year

Telecom & IT hardware revenue of $54 million for Q2 2016 was

down from the prior year due to the cyclical nature of these sales

▪ Operating income and Adjusted EBITDA for the

quarter totaled $7 million and $10 million,

respectively

▪ Adjusted EBITDA margin was 9%, consistent from a

year ago

$106

$117

$104 $103 $110

__

__

($ in millions)

Q2 2016 Cash Flow and Capital Expenditures

Free Cash Flow (Non-GAAP)

Capital Expenditures

Q2 2016 YTD 2016

Adjusted EBITDA (Non-GAAP) $ 76 $ 153

Interest Payments (34) (42)

Capital Expenditures (60) (122)

Pension and OPEB Payments (2) (5)

Dividends from CyrusOne 3 5

Working Capital and Other (9) (7)

Free Cash Flow (Non-GAAP) $ (26) $ (18)

Selected 2016 Free Cash Flow Items

▪ CyrusOne dividends ~ $8 million

▪ Capital expenditures: $265 - $275 million

▪ Interest payments ~ $75 million

▪ Pension and OPEB payments ~ $12 million

Q2 2016 YTD 2016

Construction $ 20 $ 37

Installation 8 21

Value Added 4 11

Total Fioptics $ 32 $ 69

Other Strategic 15 32

Discretionary Investments 47 101

Maintenance 13 21

$ 60 $ 122

11

($ in millions)

Cash Flow

Q2 2016 YTD 2016

Operating Activities $ 32 $ 98

Investing Activities 86 25

Financing Activities (116) (121)

Change in Cash 2 2

2016 Guidance

2016 Guidance

Revenue $ 1.2 billion

Adjusted EBITDA $303 million*

* Plus or minus 2 percent

12

Appendix

13

Consolidated Results

($ in millions, except per share amounts)

Three Months Ended Six Months Ended

June 30, June 30,

2016 2015 2016 2015

Revenue $ 299.2 $ 285.8 $ 588.1 $ 578.7

Costs and expenses

Cost of services and products 170.8 162.2 333.5 328.4

Selling, general and administrative 56.2 57.0 109.4 109.2

Depreciation and amortization 44.8 34.0 88.2 66.6

Other — 2.9 — 7.7

Operating Income 27.4 29.7 57.0 66.8

Interest expense 19.9 28.0 40.2 60.7

Gain on extinguishment of debt 5.2 13.5 2.8 13.5

Gain on sale of CyrusOne investment (118.6) (295.2) (118.6) (295.2)

Other (income) expense, net (1.1) 1.3 (1.1) 4.8

Income from continuing operations before income taxes 122.0 282.1 133.7 283.0

Income tax expense 44.4 101.4 49.1 102.0

Income from continuing operations 77.6 180.7 84.6 181.0

Income from discontinued operations, net of tax — 10.9 — 59.8

Net income 77.6 191.6 84.6 240.8

Preferred stock dividends 2.6 2.6 5.2 5.2

Net income applicable to common shareholders $ 75.0 $ 189.0 $ 79.4 $ 235.6

Basic and diluted net earnings per common share

Earnings from continuing operations $ 0.36 $ 0.85 $ 0.38 $ 0.84

Earnings from discontinued operations — 0.05 — 0.29

Basic and diluted net earnings per common share $ 0.36 $ 0.90 $ 0.38 $ 1.13

.

14

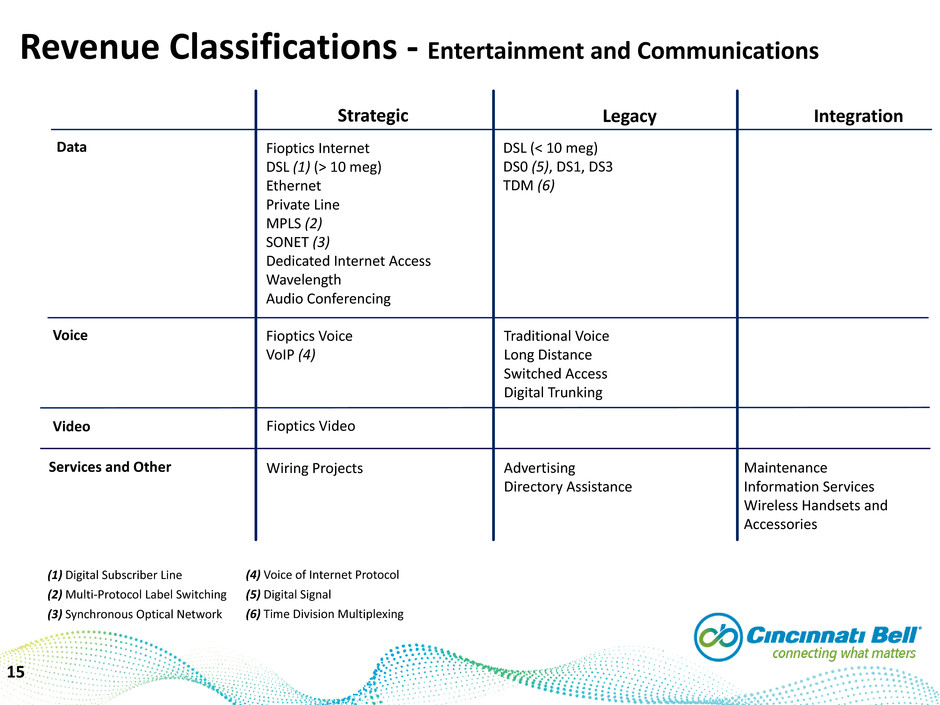

Revenue Classifications - Entertainment and Communications

Strategic Legacy Integration

Data

Voice

Video

Services and Other

Fioptics Internet

DSL (1) (> 10 meg)

Ethernet

Private Line

MPLS (2)

SONET (3)

Dedicated Internet Access

Wavelength

Audio Conferencing

Fioptics Voice

VoIP (4)

Fioptics Video

Wiring Projects

DSL (< 10 meg)

DS0 (5), DS1, DS3

TDM (6)

Traditional Voice

Long Distance

Switched Access

Digital Trunking

Advertising

Directory Assistance

Maintenance

Information Services

Wireless Handsets and

Accessories

15

(1) Digital Subscriber Line

(2) Multi-Protocol Label Switching

(3) Synchronous Optical Network

(4) Voice of Internet Protocol

(5) Digital Signal

(6) Time Division Multiplexing

Revenue Classifications - IT Services and Hardware

Professional Services

Unified Communications

Cloud Services

Monitoring and Management

Telecom & IT Hardware

Strategic Integration

Consulting

Staff Augmentation

Voice Monitoring

Managed IP Telephony Solutions

Virtual Data Centers

Storage

Backup

Network Monitoring/Management

Security

Installation

Maintenance

Hardware

Software Licenses

16

Revenue – MD&A Strategic, Legacy and Integration

($ in millions) Q2 2016

Entertainment and

Communications

IT Services and

Hardware Total Eliminations Total

Strategic

Data $ 60.8 $ —

Voice 17.9 —

Video 30.9 —

Services and other 1.4 —

Professional services — 23.1

Management and monitoring — 7.9

Unified communications — 7.3

Cloud services — 10.8

Total Strategic 111.0 49.1 160.1 (2.4) 157.7

Legacy

Data $ 26.0 $ —

Voice 51.2 —

Services and other 2.8 —

Total Legacy 80.0 — 80.0 (0.1) 79.9

Integration

Services and other $ 1.5 $ —

Professional services — 4.1

Unified communications — 2.8

Telecom and IT hardware — 53.8

Total Integration 1.5 60.7 62.2 (0.6) 61.6

$ 192.5 $ 109.8 $ 302.3 $ (3.1) $ 299.2

Eliminations 0.2 2.9 3.1

Total Revenue $ 192.3 $ 106.9 $ 299.2

17

Revenue – MD&A Strategic, Legacy and Integration

($ in millions) Q2 2015

Entertainment and

Communications

IT Services and

Hardware Total Eliminations Total

Strategic

Data $ 47.9 $ —

Voice 15.5 —

Video 22.9 —

Services and other 1.5 —

Professional services — 23.5

Management and monitoring — 7.6

Unified communications — 6.5

Cloud services — 7.0

Total Strategic 87.8 44.6 132.4 (2.2) 130.2

Legacy

Data $ 30.9 $ —

Voice 58.0 —

Services and other 3.4 —

Total Legacy 92.3 — 92.3 (0.1) 92.2

Integration

Services and other $ 2.3 $ —

Professional services — 3.5

Unified communications — 2.6

Telecom and IT hardware — 55.6

Total Integration 2.3 61.7 64.0 (0.6) 63.4

$ 182.4 $ 106.3 $ 288.7 $ (2.9) $ 285.8

Eliminations 0.4 2.5 2.9

Total Revenue $ 182.0 $ 103.8 $ 285.8

18

Revenue – MD&A Strategic, Legacy and Integration

($ in millions) YTD Q2 2016

Entertainment and

Communications

IT Services and

Hardware Total Eliminations Total

Strategic

Data $ 118.9 $ —

Voice 35.1 —

Video 59.9 —

Services and other 2.7 —

Professional services — 45.4

Management and monitoring — 16.0

Unified communications — 14.8

Cloud services — 21.0

Total Strategic 216.6 97.2 313.8 (4.6) 309.2

Legacy

Data $ 53.1 $ —

Voice 104.2 —

Services and other 5.9 —

Total Legacy 163.2 — 163.2 (0.4) 162.8

Integration

Services and other $ 3.0 $ —

Professional services — 8.0

Unified communications — 5.4

Telecom and IT hardware — 101.7

Total Integration 3.0 115.1 118.1 (2.0) 116.1

$ 382.8 $ 212.3 $ 595.1 $ (7.0) $ 588.1

Eliminations 0.6 6.4 7.0

Total Revenue $ 382.2 $ 205.9 $ 588.1

19

Revenue – MD&A Strategic, Legacy and Integration

($ in millions) YTD Q2 2015

Entertainment and

Communications

IT Services and

Hardware Total Eliminations Total

Strategic

Data $ 96.3 $ —

Voice 30.2 —

Video 44.3 —

Services and other 3.2 —

Professional services — 44.1

Management and monitoring — 14.9

Unified communications — 13.2

Cloud services — 13.1

Total Strategic 174.0 85.3 259.3 (4.3) 255.0

Legacy

Data $ 63.7 $ —

Voice 119.0 —

Services and other 7.2 —

Total Legacy 189.9 — 189.9 (0.3) 189.6

Integration

Services and other $ 6.6 $ —

Professional services — 7.0

Unified communications — 5.5

Telecom and IT hardware — 116.1

Total Integration 6.6 128.6 135.2 (1.1) 134.1

$ 370.5 $ 213.9 $ 584.4 $ (5.7) $ 578.7

Eliminations 0.7 5.0 5.7

Total Revenue $ 369.8 $ 208.9 $ 578.7

20