Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Ally Financial Inc. | lendingandriskmanagementco.htm |

1

Ally Financial Inc. - Auto Lending and Risk Management

Ally Financial Inc.

Auto Lending and Risk Management

August 4, 2016

2

Ally Financial Inc. - Auto Lending and Risk Management

Forward-Looking Statements and Additional Information

The following should be read in conjunction with the financial statements, notes and other information contained in the Company’s Annual Reports

on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K.

In the presentation that follows and related comments by Ally Financial Inc. (“Ally”) management, the use of the words “expect,” “anticipate,”

“estimate,” “forecast,” “initiative,” “objective,” “plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “explore,” “positions,” “intend,” “evaluate,”

“pursue,” “seek,” “may,” “would, ” “could, ” “should, ” “believe, ” “potential, ” “continue,” or the negative of these words, or similar expressions is

intended to identify forward-looking statements. All statements herein and in related management comments, other than statements of historical

fact, including without limitation, statements about future events and financial performance, are forward-looking statements that involve certain

risks and uncertainties. While these statements represent our current judgment on what the future may hold, and we believe these judgments are

reasonable, these statements are not guarantees of any events or financial results, and Ally’s actual results may differ materially due to numerous

important factors that are described in the most recent reports on SEC Forms 10-K and 10-Q for Ally, each of which may be revised or

supplemented in subsequent reports filed with the SEC. Such factors include, among others, the following: maintaining the mutually beneficial

relationship between Ally and General Motors (“GM”), and Ally and Chrysler Group LLC (“Chrysler”); our ability to maintain relationships with

automotive dealers; our ability to realize the anticipated benefits associated with being a financial holding company, and the significant regulation

and restrictions that we are now subject to; the potential for deterioration in the residual value of off-lease vehicles; disruptions in the market in

which we fund our operations, with resulting negative impact on our liquidity; changes in our accounting assumptions that may require or that

result from changes in the accounting rules or their application, which could result in an impact on earnings; changes in the credit ratings of Ally,

Chrysler, or GM; changes in economic conditions, currency exchange rates or political stability in the markets in which we operate; and changes in

the existing or the adoption of new laws, regulations, policies or other activities of governments, agencies and similar organizations (including as a

result of the Dodd-Frank Act and Basel III).

Investors are cautioned not to place undue reliance on forward-looking statements. Ally undertakes no obligation to update publicly or otherwise

revise any forward-looking statements, whether as a result of new information, future events or other such factors that affect the subject of these

statements, except where expressly required by law. Certain non-GAAP measures are provided in this presentation which are important to the

reader of the Consolidated Financial Statements but should be supplemental and not a substitute for primary U.S. GAAP measures. Reconciliation

of non-GAAP financial measures are included within this presentation.

Use of the term “loans” describes products associated with direct and indirect lending activities of Ally’s operations. The specific products include

retail installment sales contracts, lines of credit, leases or other financing products. The term “originate” refers to Ally’s purchase, acquisition or

direct origination of various “loan” products.

3

Ally Financial Inc. - Auto Lending and Risk Management

Key Messages

Ally has a competitively advantaged business model for optimizing

origination of assets, capital allocation and risk-adjusted returns(1)

Deliberate adjustments made to our origination strategy to

successfully capture better risk-adjusted returns(1)

− Key driver of Ally’s ROE trajectory

Expect solid performance through all business cycles

− Moderate volatility of auto loans

− Robust risk management practices embedded across the company

− Strong feedback loop

Ally executing “self-help” drivers for strong future EPS growth

(1) Risk-adjusted returns or estimated risk-adjusted retail auto yield is a forward-looking non-GAAP financial measure that management believes is helpful to readers in evaluating the estimated profitability of loan originations during the period. There

is no comparable GAAP measure as the yield and loss components are both estimates. See page 25 for calculation methodology and details.

4

Ally Financial Inc. - Auto Lending and Risk Management

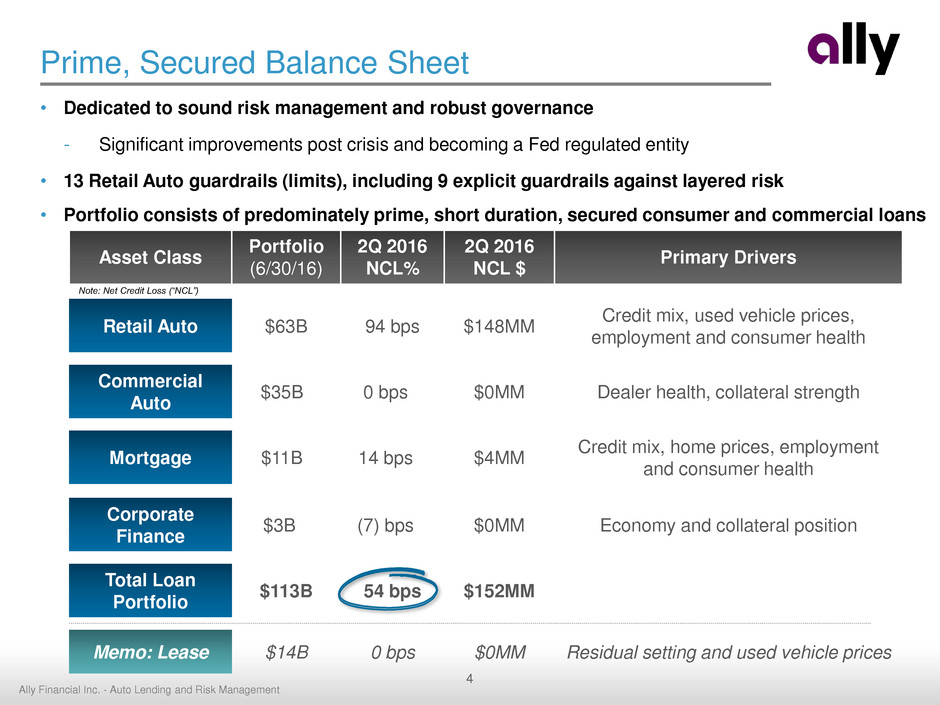

Prime, Secured Balance Sheet

• Dedicated to sound risk management and robust governance

- Significant improvements post crisis and becoming a Fed regulated entity

• 13 Retail Auto guardrails (limits), including 9 explicit guardrails against layered risk

• Portfolio consists of predominately prime, short duration, secured consumer and commercial loans

Asset Class

Portfolio

(6/30/16)

2Q 2016

NCL%

2Q 2016

NCL $

Primary Drivers

Retail Auto $63B 94 bps $148MM

Credit mix, used vehicle prices,

employment and consumer health

Commercial

Auto

$35B 0 bps $0MM Dealer health, collateral strength

Mortgage $11B 14 bps $4MM

Credit mix, home prices, employment

and consumer health

Corporate

Finance

$3B (7) bps $0MM Economy and collateral position

Total Loan

Portfolio

$113B 54 bps $152MM

Memo: Lease $14B 0 bps $0MM Residual setting and used vehicle prices

Note: Net Credit Loss (“NCL”)

5

Ally Financial Inc. - Auto Lending and Risk Management

Competitively-Advantaged Auto Finance Business

Relentless Ally for our Dealers; Dealers are Relentless Allies for us

− Strong dealer-client relationships with over 18,000 active retail relationships

− Superior service model with significant scale and technology benefits

− Delivered by automotive experts in local markets

− Full suite of valuable capabilities to provide point of sale financing of vehicles

− Full-spectrum credit provider as critical core competency (maximizes dealer relationship)

P

• Improving risk-adjusted returns(1)

− Better yields while only marginally increasing expected losses (cost of credit)

− 48 bps improvement YoY in estimated risk-adjusted retail auto yields(1) for YTD 2016

P

Experts at assessing risk and translating into cost of credit

− Data is collected and analyzed for expected loss at a 99% accuracy(2)

− Benefit of decisioning approximately 10 million applications per year

− Residual and remarketing team uses over 100 million data points for used vehicle values for

severity estimates (key differentiator)

− Granular performance monitoring of payments; SmartAuction for used vehicle values

P

(1) Risk-adjusted returns or estimated risk-adjusted retail auto yield is a forward-looking non-GAAP financial measure. See page 25 for calculation methodology and details.

(2) Based on 2013-2015 auto originations. See page 14 for more details.

6

Ally Financial Inc. - Auto Lending and Risk Management

Improving Business Results Through Diversification

• Successfully transitioned from GM and Chrysler exclusive subvention contracts

- Business is won at the dealer level from 18,000 active retail relationships

- 37% of originations from outside GM and Chrysler

• 40%+ Used business dramatically reduces sensitivity to new vehicle sales

• Lease decline reduces volatility to used vehicle prices

See page 26 for definitions

Ally’s transformation has resulted in a diversified business across channel and segment

Consumer Auto Originations

49%

21%

34%

22%

9%

7%

28%

32%

5%

13%

9%

25%

44%

2006 2012 YTD 2016

New Exclusive Subvented Lease New GM & Chrysler New Growth Used

7

Ally Financial Inc. - Auto Lending and Risk Management

Full Spectrum & Higher Quality = Lower Volatility

• Ally, JPM, WFC, BBT and COF originate across the full spectrum but with a focus on higher

credit quality

- Long history of balancing risk-reward trade-offs over the credit cycles

- Produces lower volatility in credit and financial performance

• Not shown in Ally stats below is the very low risk (0 bps of loss) $35 billion commercial auto

lending business, which further reduces the volatility of results

Retail Auto Net Charge-off Rate Peer Comparison

Source: Company filings

(1) BBT net charge-off rate (NCO%) is the 2Q 2016 NCO% from earnings release materials

(2) GMF NCO% represents North America operations

2015 Retail auto net charge-off rates

0.23% 0.38%

0.72% 0.95%

1.5%

1.69%

2.6%

6.4%

7.3%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

HBAN JPM WFC ALLY BBT COF GMF CPSS SC

(2) (1)

8

Ally Financial Inc. - Auto Lending and Risk Management

Retail Auto Originations

YTD 2016

Volume

($ billions) % Total

Credit

Tier

Average

FICO

Originated

yield(1) NAALR(2)

Risk-adjusted

Yield(3)

$5.2 31% S 757 3.15% 0.13% 3.01%

7.2 43% A 668 5.36% 0.79% 4.57%

3.3 20% B 641 8.96% 2.61% 6.36%

0.9 5% C 606 13.12% 5.14% 7.98%

$16.7 100% Total 685 5.84% 1.20% 4.63%

YTD 2015

Volume

($ billions) % Total

Credit

Tier

Average

FICO

Originated

yield(1) NAALR(2)

Risk-adjusted

Yield(3)

$6.1 34% S 752 2.76% 0.15% 2.60%0%

6.9 38% A 674 4.67% 0.81% 3.85%0%

3.6 20% B 636 8.13% 2.21% 5.92%0%

1.2 7% C 600 11.86% 3.82% 8.04%

$18.0 100% Total 686 5.27% 1.12% 4.15%

YoY ∆

0.57% 0.08% 0.48%

Prudently Increasing Overall Returns on Originations

• Increased originated yields(1) 57 bps YoY, while adding 8 bps of expected loss (NAALR)(2) for a net

improvement of 48 bps

• Generating higher revenues, adjusted for risk, and utilizing less capital

Originated Risk-Adjusted Yields

(1) Originated yield represents the estimated average annualized yield for loans originated during the period, using yield expectations at origination

(2) Estimated net average annualized loss rate (“NAALR”) on originations at the time of booking

(3) Risk-adjusted returns or estimated risk-adjusted retail auto yield is a forward-looking non-GAAP financial measure. See page 25 for calculation methodology and details.

(4) Note numbers may not foot due to rounding

(5) Includes D and E tier which represent <1% of retail auto originations

(4)

(5)

(5)

9

Ally Financial Inc. - Auto Lending and Risk Management

Retail Portfolio Yield %

5.26% 5.24% 5.26%

5.31%

5.47%

2Q 15 3Q 15 4Q 15 1Q 16 2Q 16

5.84% Yield(1) on YTD 2016 Originations

View of Increased Yields

• Improving retail auto yields driven by:

- Better yielding originations

- Loan sales of low yielding loans

Receiving ongoing servicing fees

• Origination yields(1) impact future revenues

quickly (portfolio turns ~2.5 years)

- 2016 vintage will account for approximately

40% of 2017 revenues

- 2016 and 2017 vintages will account for over

60% of 2017 revenues

Higher Revenue from Higher Yields

Retail Auto Portfolio Yield Migration

(1) Originated yield represents the estimated average annualized yield for loans originated during the period, using yield

expectations at origination. See page 25 for more details.

Note: Interest income generation based on average assets

Retail auto portfolio yield includes fair value adjustments for loans in hedge accounting relationship

Retail Auto Interest Income Generation by Vintage ($MM)

$186 $156 $130 $107 $85

$163 $143 $126 $108 $92

$266

$236

$213

$187

$163

$184 $299 $398

$394

$347

$71

$189

$799 $834

$866 $866 $877

2Q '15 3Q '15 4Q '15 1Q '16 2Q '16

<=2012 2013 2014 2015 2016

23%

33%

20%

23%

40%

19%

10%

10%

22%

10

Ally Financial Inc. - Auto Lending and Risk Management

Current NAALR(2)

2012 2013 2014 2015 YTD 2016

Booked NAALR(1) 0.91% 1.00% 1.00% 1.11% 1.20%

% Super Prime (FICO 740+) 33% 29% 29% 23% 20%

% Nonprime (FICO <620) 11% 12% 11% 14% 12%

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

<.2% .2-1% 1-3% 3-5% 5%+

%

of

To

tal

R

eta

il O

rig

ina

tio

ns

View of Increased NAALR

• Ally’s expected losses on newer vintages (NAALR)(1) has been increasing due to deliberate

origination strategy

- Decrease in super prime originations due to low, commoditized returns

- Increase in near prime, with high value to clients and good risk-adjusted returns

- Modest changes in nonprime originations which continue to represent less than 15%

Cost of Credit Distribution Over time, NCO rate

drifts closer to

NAALR(1) as older

vintages run-off and

newer vintages make

up a bigger portion of

current losses

Retail Auto Annual Net charge-off rate vs. NAALR(1)

YTD 2016 NAALR(1)

0.72%

0.87%

0.95%

1.00% 1.00%

1.11%

1.20%

2013 2014 2015

NCO % NAALR

(1)

(1) Estimated net average annualized loss rate (“NAALR”) on originations at the time of booking

(2) Current NAALR restates historical vintages using most recent version of loss model

11

Ally Financial Inc. - Auto Lending and Risk Management

Scale Positions Ally for Success

• Large diversified lender - Ally buys loans from over 18,000 dealers

- Represent a very broad range of the US consumer

• Technology enabled for access, speed and efficient delivery at point of sale

- Anywhere, anytime, any means (digital and in-person) service model

• Positions Ally service professionals to deliver expert-level service to the Auto Retailing industry

We buy loans from dealers in all 50 states Diversified across the credit spectrum

(1) Unscored is primarily business customers originated by the Commercial Services Group (CSG). Average annualized credit

losses of 40-45 bps on CSG loans.

~900k applications

per month

Number of Dealers per State (as of 6/30/16)

2Q 2016 Retail Auto Originations

New

13%

Used

8%

New

19% Used

18%

New

12%

Used

14%

New

5%

Used

7%

New

4%

Near Prime

26%

Prime 37%

Super Prime

21%

CSG (1)

6% Non Prime

11%

12

Ally Financial Inc. - Auto Lending and Risk Management

Risk Management Philosophy and Process

Risk & Pricing

Models

Source

Applications

Credit / Risk

Models

Credit

Decision

Feedback

Loop

• Retail / Lease

• Term

• New / Used

• Other

• Credit Bureau Information

• LTV

• PTI

• Other

Approval / Qualify /

Decline

Risk Ranking /

Custom Score Pricing

• Detailed segment review by vintage

• Dealer and geography review

• Track versus expectations

• Monitor exceptions

(~30% Automatic Decision) (~16,000+ Price Points)

Analyze a borrower’s willingness and ability to repay loan

13

Ally Financial Inc. - Auto Lending and Risk Management

• Employment and other consumer health metrics:

− Losses impacted by unexpected life events: job loss, medical bills, divorce, etc.

− Borrowers typically work to keep their vehicle if they maintain employment

− Losses also affected by levels of consumer leverage

• Used vehicle prices:

− Drives recoveries and loss severity

Ally SmartAuction reduces recovery time and enhances proceeds

− More impactful for higher loss frequency portfolios (i.e., subprime)

• Portfolio mix across multiple dimensions:

− Ally’s losses have been increasing predominately due to purposeful shifts in

average portfolio mix

− Borrower attributes, such as credit bureau data, as well as transaction

structure are important predictors of loss

Determining Cost of Credit

• Cost of credit (NAALR)(1) is a key driver of pricing decisions

• Three primary factors drive NAALR(1):

Portfolio

Mix

Vehicle

Prices

Economic

&

Consumer

Backdrop

(1) Estimated net average annualized loss rate (“NAALR”) on originations at the time of booking

14

Ally Financial Inc. - Auto Lending and Risk Management

2013 - 2015 Vintage Performance

1/1/2013

2/1/2013

3/1/2013

4/1/2013

5/1/2013

6/1/2013

7/1/2013

8/1/2013

9/1/2013

10/1/2013

11/1/2013

12/1/2013

1/1/2014

2/1/2014

3/1/2014

4/1/2014

5/1/2014

6/1/2014

7/1/2014

8/1/2014

9/1/2014

10/1/2014

11/1/2014

12/1/2014

1/1/2015

2/1/2015

3/1/2015

4/1/2015

5/1/2015

6/1/2015

7/1/2015

8/1/2015

9/1/2015

0.0%

0.3%

0.5%

0.8%

1.0%

1.3%

1.5%

1.8%

2.0%

2.3%

2.5%

2.8%

3.0%

0 2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72

Priced Loss Expectation Restated based on actual performance thru June 2016

Are We Able to Predict Losses?

• Recent vintages have performed at 99% of priced expectations on average

- Granular portfolio underwriting

- Strong servicing

- Continual monitoring and feedback

Predictable, Granular Asset Class

Months on book:

Dashed black line

Average of actual and forecasted loss performance

(i.e., as of June 2016, a June 2013 origination has been on book for 36

months of actual performance and includes 6 months of forecasted

performance, a June 2014 origination has been on book for 24 months

and includes 18 months of forecasted performance)

Dashed grey line

Forecasted loss performance

(i.e., as of June 2016, no actual loss performance exists for any

origination from January 2013 forward)

2013-2015 vintages have performed at 99% of

priced loss expectations (i.e., dashed black line

tracking with solid blue line)

L

if

e

ti

m

e

L

o

ss

P

e

rf

o

rm

a

n

c

e

Note: Forecasted loss performance is revised lifetime loss and therefore does not represent a current GAAP loss measure or an annualized loss expectation.

15

Ally Financial Inc. - Auto Lending and Risk Management

3.00%

3.50%

4.00%

4.50%

5.00%

5.50%

6.00% Priced Loss Expectation

80% Priced Loss Expectation

125% Priced Loss Expectation

150% Priced Loss Expectation

Priced Loss Expectation (Avg. 2014-2015)

2Q 16 2Q 15

Originated yield(1) 5.83% 5.28%

Priced NAALR(2) -1.24% -1.12%

Risk-adjusted yield(3) 4.60% 4.16%

125% Priced NAALR(2) -1.54%

Pro forma Risk-adjusted yield(3) 4.29%

2Q 16

4.60%

Optimizing Risk-Adjusted Yields(3)

Estimated Risk-Adjusted Retail Auto Yield(3)

• Proactive and deliberate portfolio management

- Higher yields (due to mix, pricing actions, risk adjustments, etc.) have more than offset higher

expected loss rates, even if losses increase beyond expectations

- We price loans to remain profitable over the life of the loan - even in a Great Recession type stress

1.25x higher than expected losses still provide

higher risk-adjusted returns(3) vs. prior year

(1) Originated yield represents the estimated average annualized yield for loans originated during the period, using yield expectations at origination

(2) Estimated net average annualized loss rate (“NAALR”) on originations at the time of booking

(3) Risk-adjusted returns or estimated risk-adjusted retail auto yield is a forward-looking non-GAAP financial measure. See page 25 for calculation methodology and details.

16

Ally Financial Inc. - Auto Lending and Risk Management

• Ally analyzes its portfolio segments across multiple economic scenarios

- Having a wide range of scenarios provides insight to help pricing and underwriting decisions

• Portfolio as a whole will be less volatile than any given vintage

- That is, older vintages have already passed peak losses (i.e., typically 12-36 months on book)

Portfolio Sensitivity to Stress

Percent Change in Remaining Lifetime Net Loss

(for current outstanding portfolio relative to baseline expectations)

For additional details on the various stress scenarios please see page 25

The % change is representative

of Ally’s current outstanding

portfolio being stressed in a given

economic scenario and the

projected lifetime net loss impact

0%

5%

10%

15%

20%

25%

30%

35%

40%

Weaker

Growth

Mild

Recession

No

Growth Adverse

Severely

Adverse

17

Ally Financial Inc. - Auto Lending and Risk Management

Focus on

avoiding

layered risk

• Board established origination guardrails and tighter underwriting parameters

- 84 month only available to Ally’s top three credit tiers (S/A/B; 708 WA FICO)

- Also, more stringent max vehicle age, mileage, LTV, PTI, and minimum FICO

• Pricing model assumes incremental loss on 84 month loan vs. 72 month

• Average life of 84 month loan not significantly different than 72 month

• Asset quality in line with expectations

How Does Ally Consider Longer Term Loans?

While the auto industry has been migrating to longer terms, Ally places tighter

policy parameters on extended term loans to mitigate risk

After testing for ~3 years, Ally rolled out an 84 month loan product

nationally in February 2015

2011 2012 2013 2014 2015

Product was

designed and

approved by

Ally’s New

Product

Committee in Oct.

Starting in Feb.,

product tested in

21 states

Ongoing

assessment of

market reception

and credit

performance

Expanded to 10

more states in

Dec.

National rollout

in Feb. after Ally

BOD review and

portfolio limits

established

18

Ally Financial Inc. - Auto Lending and Risk Management

Collateral Protection

Example LTV Drivers at Origination

• Ally is first and foremost a secured lender

• Ally is solely lending to facilitate a vehicle purchase – no cash out financing

• LTVs over 100% are typically driven by financing tax, title and license and certain insurance

products (e.g., extended warranty)

- Unused portion of warranty is rebated to lender upon default (i.e., financed but represents limited

economic exposure)

• New vehicle original LTVs are typically lower given significant upfront depreciation

Note: Loan-to-value (“LTV”)

Ally lends against

wholesale value and

not sales price or retail

value

(i.e., lower denominator

for LTV calculation)

100%

105%

5%

-14% 14%

Wholesale

Value

Dealer

Profit

Cash Down,

Trade-in Equity,

Rebates

Tax, Title, License

Vehicle Protection

products

LTV

19

Ally Financial Inc. - Auto Lending and Risk Management

~45% of the outstanding

balance at year-end is made

up of current year originations

% of Retail Auto Outstandings by Origination Year

5% 4% 3% 2% 1% 1%

13%

10% 9% 7% 6% 4% 3%

25%

21%

18%

16%

13%

10% 9% 7% 6%

34%

30%

27%

23%

19%

16%

14%

12%

10%

24%

35%

43%

38%

33%

27%

24%

21%

18%

14%

28%

41%

49%

44%

39%

13%

25%

2Q 14 3Q 14 4Q 14 1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16

2010 & prior 2011 2012 2013 2014 2015 2016

Monitoring Risk – Constant Feedback Loop

• Very granular monitoring of vintage performance

• Early performance indicators are predictive of vintage cumulative losses

• Various mechanisms for monitoring risk:

− Robust Quality Control / Quality Assurance

− Early payment delinquency indicators

− Monitor composition of new bookings

− Dealer monitoring

− Robust Governance

Monthly Automotive Risk Committee

New Product Committee

Reporting to Board Risk Committee

− Daily Collections / Servicing metrics

− Loan Review and Internal Audit

We reprice risk assumptions and adjust underwriting on a continual basis

Short Duration Asset = Quick Portfolio Turn

Origination Year

Based on end-of-period balances

20

Ally Financial Inc. - Auto Lending and Risk Management

How Auto Lending Differs from the Mortgage Bubble

• Borrowers do not buy a vehicle as a speculative investment and understand it is a depreciating

asset

• Ally’s policy is to finance borrowers so they can buy an affordable vehicle to utilize as part of

their lifestyle and livelihood (i.e., transportation to their job)

• Franchised dealers are the primary channel for obtaining loans

− Ally has had relationships for decades with many dealers

− Dealers maintaining access to financing partners are critical to staying in business

• Collateral values are more homogenous and verified by independent third parties (e.g., Dealer

Invoice, NADA or Kelly Blue Book)

Crisis Era Problem Mortgage Lending Ally's Auto Lending

Collateral value Assumed to appreciate Assumed to significantly decline

N gative amortization Yes No

In erest nly periods Yes No

Cash out refinance Yes No

Ease of enforcing collateral Difficult / Lengthy Average 8-10 day turnaround

Lending philosophy Originate-to-sell Originate-to-hold

Purchase rationale Sometimes speculative investment Utility / transportation

21

Ally Financial Inc. - Auto Lending and Risk Management

Ally Index Average Used Price Change YoY (2Q 2016 vs 2Q 2015)

-4%

1%

-2%

-8%

-4%

0%

4%

Cars Trucks / SUV Total

Lease Dynamics

• Competitive advantage in assessing vehicle prices

- In-house team of experts and proprietary index

- SmartAuction

• A 5% annual decline in used vehicle prices is already

incorporated into our residuals and NAALR forecasts

• Ally’s lease portfolio and sensitivity to used vehicle

residual prices is declining (1% ∆ in proceeds below):

- 2016 - 2017: $40-50 million annual lease gains

- 2018: ~$20 million annual lease gains

Lease Portfolio Balance Vehicle Segment Value YoY Change

Per Unit Lease Gains

($ billions)

$20

$16

$14

$12

$8

Ally outstanding lease mix:

• 64% SUV / Truck

• 36% Car

$705

$1,067

$1,686

$1,611

$979

$700

$1,126

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

90,000

4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

Termination Units Net Accounting Gains

22

Ally Financial Inc. - Auto Lending and Risk Management

How will Ally drive EPS growth through a cycle?

• Strongest players with expertise and scale can typically drive pricing

• Participate across the spectrum to identify best risk return in both new and used vehicle lending

• Ally has the benefit of several “self help” strategies for delivering EPS growth

Capital

Optimization

Deposit

Growth

Product

Expansion

• Optimizing size and returns of auto finance business

• Increased focus given capital deployment alternatives

• Deposits continue to grow at a steady pace

• Still have over $55 billion of capital markets funding that could be

replaced over time

• Thoughtful and gradual expansion of customer products

• Strengthens franchise, creates stickier relationships and drives

incremental diversification and revenue

23

Ally Financial Inc. - Auto Lending and Risk Management

How is EPS impacted by various drivers?

• Multiple variables outside of retail credit losses can impact EPS

• Based on current auto originations, yield is expected to increase significantly more than losses

Illustrative Annual EPS Impact

Note: Assumes $63 billion of retail auto loans, 450 million average shares outstanding, deposit rate of 1.11% and unsecured funding rate of 4.8%

(1) Based on 2017 lease portfolio expectations

+ / - EPS

8 bps change in NCOs 0.07

57 bps change in Retail Loan Yield 0.52

Preferred Dividend Savings ('16 vs. '17) 0.07

Ally vehicle prices decline 4% instead of 5%(1) 0.07

$700 million of share repurchases 0.16

Replacing $2 billion of unsecured debt with deposits 0.11

24 CONFIDENTIAL

Supplemental

25

Ally Financial Inc. - Auto Lending and Risk Management

Notes on non-GAAP and other financial measures

Supplemental

Estimated risk-adjusted retail auto yield is a forward-looking non-GAAP financial measure that management believes is helpful to readers in evaluating

the estimated profitability of loan originations during the period. Estimated risk-adjusted retail auto yield is determined by calculating the estimated

average annualized yield less the estimated net average annualized loss rate (NAALR) for loans originated during the period, using yield and loss

expectations at origination. We believe this metric, and the changes to this metric, are also useful to investors in assessing the pricing of loans originated

during the period and in comparing the profitability of loan originations across periods and against the overall current portfolio of loans.

Estimated risk-adjusted retail auto yield 2Q 16 1Q 16 4Q 15 3Q 15 2Q 15

sti ated originated yield 5.83% 5.85% 5.53% 5.27% 5.28%

Estim t net annualiz d average loss rate ("NAALR") -1.24 -1.17 -1.17 -1.09 -1.12

Esti ated risk-adjusted retail auto yield 4.60% 4.68% 4.36% 4.18% 4.16%

1) Portfolio sensitivity to stress scenarios:

a) Weaker Growth: The unemployment rate increases steadily until Q2-2019 and increases a total of 1.4 pp from the start of the scenario. At the fastest rate,

the unemployment rate increases 0.6 pp Y/Y. After Q2-2019, the rate starts to walk back to the baseline and reaches it by 2024. Home prices increase initially

and rise 2.0% Y/Y in the first year of the scenario. However, home values then start to decline and by Q2-2019 are 0.3% lower than the start of the scenario.

After Q2-2019, home values start to walk back to the baseline and reach the baseline by 2024. Used vehicle values experience a 10% decline by the end of

2017 and deterioration continuing an additional 3.5% by the end of 2018 for a total decline of 13.5% from current levels.

b) Mild Recession: The unemployment rate increases 1.4 pp from the start of the scenario to reach 6.3% by Q3-17 and it does not start to decline until Q3-19.

Once it starts to decline, it does so at a rate of 0.4 pp Y/Y and reaches the baseline by 2026. House values decline 3.5% peak to trough and reach the trough

in Q2-17. After which, they start to increase and regain all losses by Q4-19 and rejoin the baseline in 2026. Used vehicle values experience a 10.5% decline

by the end of 2017 with a slowdown in the decline during 2018. By the end of 2018, values down 12.5% from current levels.

c) No Growth: The unemployment rate increases steadily until Q2-2019 and increases a total of 2.8 pp from the start of the scenario. At the fastest rate, the

unemployment rate increases 1.1 pp Y/Y. After Q2-2019, the rate starts to walk back to the baseline and reaches it by 2026. Home prices decline throughout

the scenario trough Q2-2019 for a cumulative total loss of 7.7% and a maximum Y/T decline of 3.8% in Q3-2018. After Q2-2019, home values start to walk

back to the baseline and reach the baseline by 2026. Used vehicle values experience a 11.5% decline by 2017 and an additional 3.5% decline during 2018.

Total decline in Used vehicle values by the end of 2018 is 15%.

d) Adverse: The unemployment rate increases 2.5 pp six quarters after the start of the scenario and increases at a rate of 2.2 pp Y-Y at its peak. The decline in

the unemployment rate is relatively slow but starts walking back to the baseline at a rate of around 0.4% Y-Y and reaches the baseline by 2024. Home prices

lose 12% by the trough of the adverse scenario and at the fastest rate are losing 6.6% Y/Y, which occurs in Q4-2017. They start to recover on a Y/Y basis by

Q3-201, regain all losses by 2021 and reach the baseline by 2024. Based on strong declines in unemployment and GDP, vehicle values will fall by 11% by

the end of 2017 and hold steady through the end of 2018.

e) Severely Adverse: The unemployment rate increases rapidly, reaching a 4.3 pp Y-Y increase at its peak and 5.0 pp increase from the start of the scenario.

The unemployment rate peaks 7 quarters after the start of the scenario and starts to decline. It does not reach the baseline until 2026 Home prices lose 25%

of their value at the trough of the scenario, which occurs 11 quarters after the start of the scenario. At the fastest rate, house values are falling 14.3% Y/Y in

Q2-2017 and start to recover on a Y/Y basis by Q3-2019. Home values regain all losses by 2022 and catch up to the baseline by 2026. Sharp decline in

vehicle values of 13.5% by the end of 2017 before recovering 1.5% through the end of 2018.

26

Ally Financial Inc. - Auto Lending and Risk Management

Notes on non-GAAP and other financial measures

Supplemental

2) U.S. consumer auto originations

New Retail Subvented – subvented rate new vehicle loans

New Retail Standard – standard rate new vehicle loans

Lease – new vehicle lease originations

Used – used vehicle loans

Growth – total originations from non-GM/Chrysler dealers

3) Net charge-off ratios are calculated as annualized net charge-offs divided by average outstanding finance receivables and loans excluding loans measured at fair

value and loans held-for-sale.