Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EL PASO ELECTRIC CO /TX/ | form8k06-30x16.htm |

| EX-99.01 - EARNINGS PRESS RELEASE - EL PASO ELECTRIC CO /TX/ | exh99016-30x2016.htm |

Second Quarter 2016

Earnings Conference Call

August 3, 2016

2

Safe Harbor Statement

A

A

a

This presentation includes statements that may constitute forward-looking statements made pursuant to the safe harbor provisions within

the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. This information often involves risks and uncertainties that could cause actual results to differ materially from such forward-

looking statements. The statements in this presentation that are not historical statements and any other statements regarding EE's future

expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts, are

forward-looking statements within the meaning of the federal securities laws. Additional information concerning factors that could cause

actual results to differ materially from those expressed in forward-looking statements is contained in EE's most recently filed periodic

reports and in other filings made by EE with the U.S. Securities and Exchange Commission (the "SEC"), and includes, but is not limited

to:

Uncertainty regarding the actions and timing of matters in the Company’s Texas rate case pending before the PUCT

Increased prices for fuel and purchased power and the possibility that regulators may not permit EE to pass through all such

increased costs to customers or to recover previously incurred fuel costs in rates

Full and timely recovery of capital investments and operating costs through rates in Texas and New Mexico

Uncertainties and instability in the general economy and the resulting impact on EE’s sales and profitability

Changes in customers’ demand for electricity as a result of energy efficiency initiatives and emerging competing services and

technologies, including distributed generation

Unanticipated increased costs associated with scheduled and unscheduled outages of generating plant

The size of our construction program and our ability to complete construction on budget and on time

Potential delays in our construction schedule due to legal challenges or other reasons

Costs at Palo Verde

Deregulation and competition in the electric utility industry

Possible increased costs of compliance with environmental or other laws, regulations and policies

Possible income tax and interest payments as a result of audit adjustments proposed by the IRS or state taxing authorities

Uncertainties and instability in the financial markets and the resulting impact on EE’s ability to access the capital and credit markets

Possible physical or cyber attacks, intrusions or other catastrophic events

Other factors of which we are currently unaware or deem immaterial

EE’s filings are available from the SEC or may be obtained through EE’s website, http://www.epelectric.com. Any such forward-looking

statement is qualified by reference to these risks and factors. EE cautions that these risks and factors are not exclusive. Management

cautions against putting undue reliance on forward-looking statements or projecting any future results based on such statements or

present or prior earnings levels. Forward-looking statements speak only as of the date of this news release, and EE does not undertake

to update any forward-looking statement contained herein.

3

Recent Highlights

Became a coal-free utility on July 6, 2016, which will reduce one

billion pounds of carbon dioxide from our annual emissions

Addition of large-scale solar resources has prevented another one

billion pounds of carbon dioxide from being emitted into the

atmosphere

Set a new native peak record of 1,892 MW on July 14, 2016

Obtained a Final Order for the New Mexico Rate Case on June 8,

2016

Filed an unopposed settlement with the Public Utility Commission of

Texas (PUCT) for our Texas rate case on July 21, 2016

Construction of Montana Power Station Unit 4 remains on schedule

for September 2016 in-service date

Started working with the union to negotiate a new collective

bargaining agreement

4

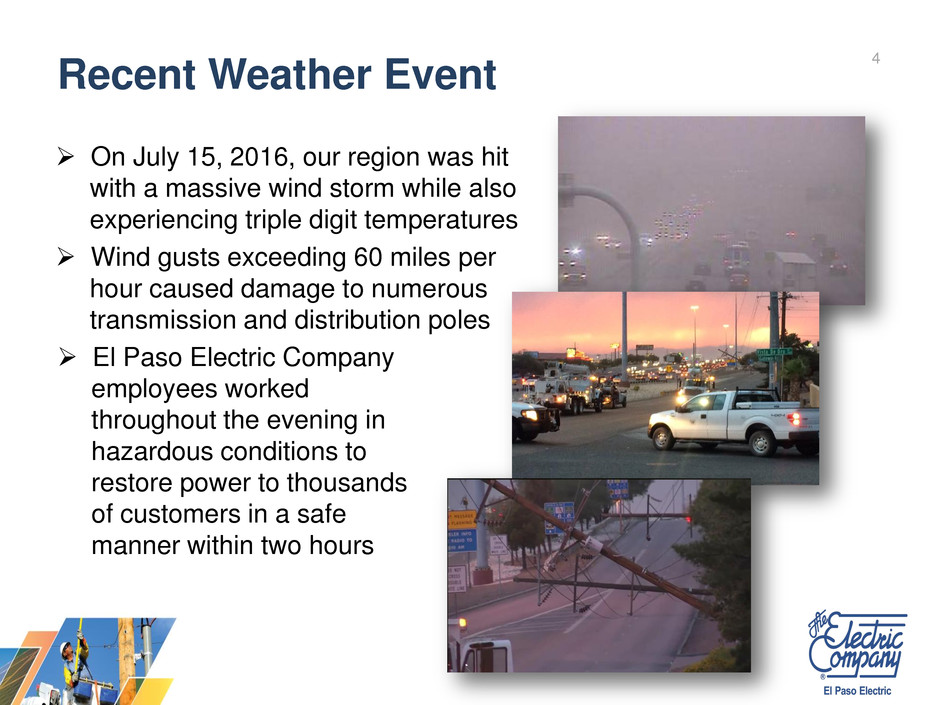

On July 15, 2016, our region was hit

with a massive wind storm while also

experiencing triple digit temperatures

Wind gusts exceeding 60 miles per

hour caused damage to numerous

transmission and distribution poles

Recent Weather Event

El Paso Electric Company

employees worked

throughout the evening in

hazardous conditions to

restore power to thousands

of customers in a safe

manner within two hours

5 Texas Rate Case Update

(Docket No. 44941)

On July 21, 2016, EE filed an unopposed settlement with the PUCT

containing the following terms

A non-fuel base rate increase of $37mm

An additional non-fuel base rate increase of $3.7mm for Four Corners revenue

requirement

Lower annual depreciation expense of approximately $8.5mm

Return on Equity of 9.7% for AFUDC purposes

Substantially all new plant in service included in rate base

Recovery for most of the rate case expenses up to a date certain

Removal of the separate treatment for residential customers with solar generation

Non-fuel base rates will relate back to January 12, 2016

A proposed final order is scheduled to be considered by the PUCT on

August 18, 2016

Approval of the settlement by the PUCT would resolve the rate case,

including the revenue requirement issue for Four Corners and rate case

expenses

6 New Mexico Rate Case Update

(Case No. 15-00127-UT)

On June 8th the NMPRC issued a final order approving an annual

increase of approximately $1.1mm. Key terms include:

100% of plant in service deemed reasonable and necessary

Reduction in rate base for the pension & benefits liability*

Return on Equity of 9.48%

Disallowance of several smaller cost of service items

Non-fuel base rates were effective July 1, 2016

* Under a separate case number (Case No. 16-00138-UT), EE is required to provide

additional information on the unfunded liability for other post-employment benefits.

7

Potential Timeline – Next Rate Cases

New Mexico

Texas

May Jul Sep Nov

Jan

2017

Mar May Jul Sep Nov

Jan

2018 2018

Final Order

Q1 2018

Final Order

4Q 2017

Effective Date of Rates(2)

3Q 2017

File Rate Case(1)

1Q 2017

File Rate Case (1)

1Q 2017 MPS Unit 4 In-Service

MPS Unit 4 In-Service

Historical Test Year End

Sep 2016

Historical Test Year End

Sep 2016

MPS Unit 3 In-Service

May 2016

MPS Unit 3 In-Service

May 2016

2016

(1) New Mexico and Texas Rate Case filings will use a historical test year ended September 2016 and include MPS units 3

& 4 in requested rate base.

(2) Section 36.211 of the Texas Utilities Code, which was added by House Bill 1535 in 2015, allows for rates to relate back

to the 155th day after a rate case is filed. For financial reporting purposes the revenues and other impacts will be

recognized when a resolution is reached in the Texas rate case.

8

2nd Quarter Financial Results

2nd Quarter 2016 net income of $22.3 million or $0.55

per share, compared to 2nd Quarter 2015 net income

of $21.1 million or $0.52 per share

9

2nd Quarter Key Earnings Drivers

Basic EPS Description

June 30, 2015 0.52$

Changes In:

Retail non-fuel base revenues 0.05

Increased primarily due to an increase in residential and small

commercial customers served and warmer weather.

Investment and interest income 0.04

Increased due to higher realized gains on securities sold from

EE's Palo Verde decommissioning trust fund portfolio.

Interest on long-term debt (0.03)

Increased due to the interest accrued on $150 million aggregate

principal amount of senior notes issued in March 2016.

Depreciation and amortization (0.01)

Increased primarily due to an increase in depreciable plant,

including MPS Unit 3 which was placed in service in May 2016,

partially offset by a change in the estimated useful life of certain

software assets.

Changes in the effective tax rate (0.02)

Increased due to the reduction of the domestic production

manufacturing deduction and changes in state taxes.

June 30, 2016 0.55$

10

2nd Quarter Retail Revenues and Sales

Non-Fuel Base

Revenues

(000's)

Percent

Change *

MWH

Percent

Change *

Residential 62,679$ 5.5% 679,035 5.9%

C&I Small 54,707 1.6% 633,714 1.1%

C&I Large 9,489 (3.9%) 270,908 (2.8%)

Public Authorities 24,672 (2.5%) 405,277 (3.5%)

Total R t il 151,547$ 2.1% 1,988,934 1.1%

Cooling Degree Days 965 3.9%

Average Retail Customers 407,967 1.5%

* Percent Change expressed as change from Q2 2016 over Q2 2015

11

Historical Weather Summary

824

1,008 1,013 995

1,169 1,178 1,138

1,095

929

965

0

200

400

600

800

1,000

1,200

1,400

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

2nd Quarter Cooling Degree Day’s (CDD’s)

10-Yr CDD

Average – 1,031

2nd Quarter CDD’s

• 6.4% Below 10-Year Average

• 3.9% Above 2nd Quarter 2015

12

Capital Requirements & Liquidity

Expended $102.8mm for additions to utility plant for the

six months ended June 30, 2016

On July 21, 2016, the Board declared a quarterly cash

dividend of $0.31 per share payable on September 30,

2016 to shareholders of record as of September 14, 2016

EE made $24.5mm in dividend payments for the six

months ended June 30, 2016

On June 30, 2016, EE had liquidity of $207.5mm

including a cash balance of $9.6mm and unused capacity

under the revolving credit facility

Capital expenditures for utility plant in 2016 are

anticipated to be approximately $234mm

13 2016 Earnings Guidance

2015 EPS Actual 2016 Earnings Guidance

Earnings Guidance

$2.03

$2.50

$2.20

The middle of the range assumes

normal weather and rate relief for:

Texas - based on unopposed settlement in

Docket No. 44941 (rates relate back to

January 12, 2016)(2) :

• $40.7mm non-fuel base rate increase,

which includes $3.7mm for Four

Corners revenue requirement

• $8.5mm lower annual depreciation

expense

• ROE of 9.7% for AFUDC purposes

New Mexico - $1.1mm non-fuel base rate

increase based on final order in Case No.

15-00127-UT (effective July 1, 2016)

Initiating an earnings guidance range of $2.20 to $2.50 per share

(1) Assumes normal operating conditions for the remainder of 2016

(2) Assumes PUCT approves the unopposed settlement during the second half of 2016

(1)

14

2016 Earnings Drivers

Positive

Year over

Year

Impact on

EPS

Drivers

Negative

Year over

Year

Impact on

EPS

Rate relief

Customer growth

Depreciation (1)

Effective Tax Rate (estimated to

be ~ 36% in 2016)

Return to normal weather

Property Taxes (1)

Investment and interest income

Interest expense (1)

O&M (1)

AFUDC (1)

Other

(1) YOY decreases related to regulatory lag for MPS Units 3 & 4 equate to

approximately $0.15 per share. $0.15 per share estimate includes $0.09 per share

for interest related to $150mm of 5.0% Senior Notes issued on March 24, 2016.

In Texas, new rates

will relate back to

January 12, 2016

We believe we can

record the revenue

and other impacts

of the unopposed

settlement for

financial reporting

purposes during

the second half of

2016

15

Q & A