Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - Zendesk, Inc. | a2016q2earningstweetsec1.htm |

| EX-99.1 - EXHIBIT 99.1 - Zendesk, Inc. | zen-ex991_7.htm |

| 8-K - 8-K - Zendesk, Inc. | zen_8-kxq2.htm |

Zendesk

August 02 2016

Second Quarter 2016 Shareholder Letter

Zendesk’s new responsive Help Center theme, “Copenhagen”

Exhibit 99.2

2Zendesk Shareholder Letter - August 02 2016

The strong second quarter results Zendesk reports today reflect solid revenue growth, year-over-year

improvement in operating margins, and neutral cash flow from operating activities—all while growing

a broader customer base of more than 81,000 paid customer accounts. During the quarter, we also

announced several new products, features, and capabilities important to our long-term strategy to have

a bigger impact in business initiatives beyond customer support.

Mikkel Svane

CEO

Elena Gomez

CFO

Marc Cabi

Investor Relations

Second quarter 2016 financial summary

(in thousands, except per share data)

Three Months Ended June 30,

GAAP results 2016 2015

Revenue $ 74,200 $ 48,227

Gross profit 51,264 32,065

Gross margin 69.1% 66.5%

Operating loss $ (26,296) $ (20,940)

Operating margin -35.4% -43.4%

Net loss $ (26,254) $ (21,482)

Net loss per share (0.28) (0.25)

Non-GAAP results

Non-GAAP gross profit $ 54,387 $ 33,851

Non-GAAP gross margin 73.3% 70.2%

Non-GAAP operating loss $ (5,632) $ (6,469)

Non-GAAP operating margin -7.6% -13.4%

Non-GAAP net loss $ (5,590) $ (7,011)

Non-GAAP net loss per share (0.06) (0.08)

For additional information regarding the “Non-GAAP results” financial measures discussed in this letter,

please see “Non-GAAP results” and “About non-GAAP financial measures”.

We continue to make progress in delivering revenue growth while improving our operating expenses as a

percentage of revenue. For the second quarter of 2016, we are pleased to report revenue of $74.2 million,

which represents 54% growth over the second quarter of 2015. While growing at a healthy annual rate, we

remain focused on scaling our operations and delivering margin improvement. For the second quarter of

2016 versus the second quarter of 2015, we expanded GAAP gross margin to 69.1% from 66.5% and GAAP

operating margin to -35.4% from -43.4%. When comparing the same periods on a non-GAAP basis, we

expanded gross margin to 73.3% from 70.2% and operating margin to -7.6% from -13.4%.

3Zendesk Shareholder Letter - August 02 2016

Introduction

Almost ten years ago, three friends in Denmark began rethinking customer

service software and started Zendesk against the backdrop of the dramatic

rise in cloud-based software, mobile technologies, and social networking.

The original Zendesk was specifically designed to address the ever-evolving

changes taking place in the marketplace.

Today, the frontiers have shifted yet again, and we are watching as our

customers embrace a new round of innovations such as artificial intelligence

and entirely new messaging and social platforms. As consumers adopt these

new channels and technologies with vigor, their expectations quickly change.

As flexible as ever, Zendesk can easily scale and adapt to meet these

evolving expectations and emerging business needs and growth. We have

helped newly signed customers scale to handle more than a million tickets

in a matter of weeks, while helping businesses move beyond transactional

relationships to develop meaningful, long-term relationships with their customers.

Our strategy for this year reflects the fast pace of change in the relationships

between organizations and their customers. We’re focused on improving

those relationships and moving into the broader space beyond traditional

support. We have developed a brand that is recognized for its ability to

innovate to stay ahead of trends, and recent product additions such as

Satisfaction Prediction, Advanced Voice, SMS, and Zendesk Message give

our customers even more powerful tools to stay competitive in the face of

constant change.

SMS Customer Service

4Zendesk Shareholder Letter - August 02 2016

In the second quarter of 2016 and more recently, we continued strong

progress in our three key strategic areas: elevating our brand, becoming

a multi-product company, and expanding our opportunity in the

mid-market and enterprise.

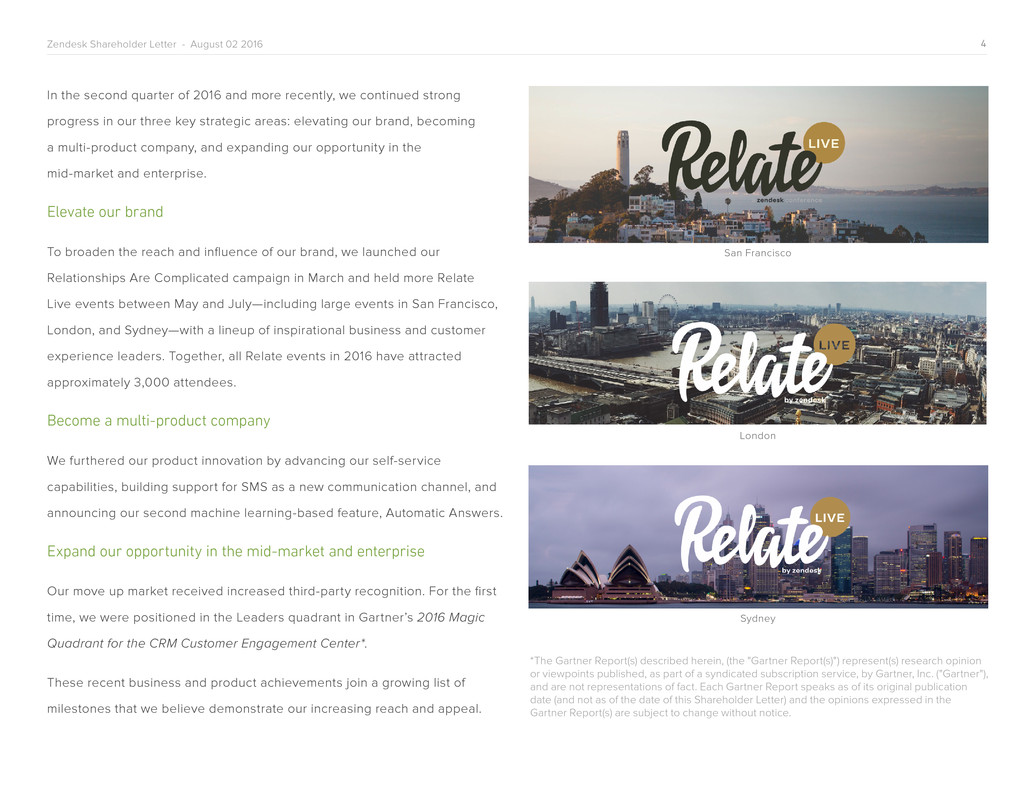

Elevate our brand

To broaden the reach and influence of our brand, we launched our

Relationships Are Complicated campaign in March and held more Relate

Live events between May and July—including large events in San Francisco,

London, and Sydney—with a lineup of inspirational business and customer

experience leaders. Together, all Relate events in 2016 have attracted

approximately 3,000 attendees.

Become a multi-product company

We furthered our product innovation by advancing our self-service

capabilities, building support for SMS as a new communication channel, and

announcing our second machine learning-based feature, Automatic Answers.

Expand our opportunity in the mid-market and enterprise

Our move up market received increased third-party recognition. For the first

time, we were positioned in the Leaders quadrant in Gartner’s 2016 Magic

Quadrant for the CRM Customer Engagement Center*.

These recent business and product achievements join a growing list of

milestones that we believe demonstrate our increasing reach and appeal.

*The Gartner Report(s) described herein, (the "Gartner Report(s)") represent(s) research opinion

or viewpoints published, as part of a syndicated subscription service, by Gartner, Inc. ("Gartner"),

and are not representations of fact. Each Gartner Report speaks as of its original publication

date (and not as of the date of this Shareholder Letter) and the opinions expressed in the

Gartner Report(s) are subject to change without notice.

San Francisco

London

Sydney

5Zendesk Shareholder Letter - August 02 2016

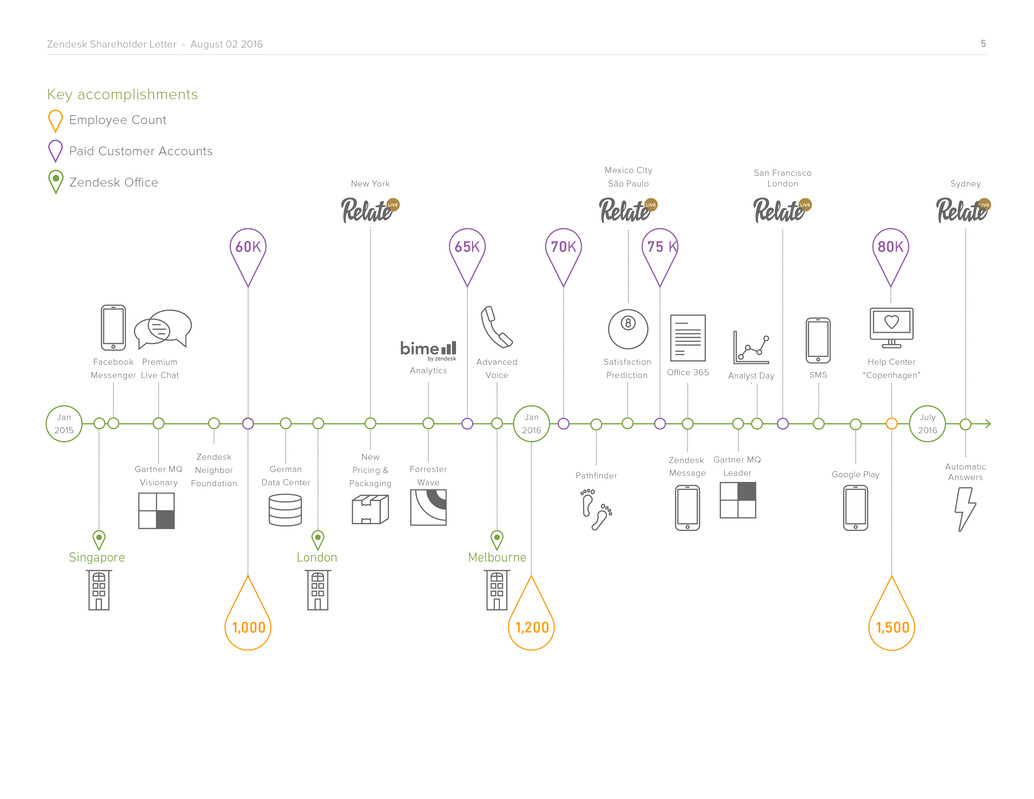

Key accomplishments

Employee Count

Paid Customer Accounts

Zendesk Office

Jan

2015

Zendesk

Neighbor

Foundation

German

Data Center

Facebook

Messenger

Analyst Day

Zendesk

Message

Analytics

Gartner MQ

Visionary

Forrester

Wave

Pathfinder

Gartner MQ

Leader

Automatic

Answers

65K 75 K 80K

New Yo rk

London

Advanc ed

Vo ice

Singapore

1, 000

July

2016

New

Pricin g &

Packaging

1, 500

70K

Mexico City

São Paulo

Satisfaction

Prediction

San Francisco

London Sydney

1, 200

Jan

2016

60K

Melbourne

Premium

Live Chat SMS

Google Play

Help Center

“Copenhagen”Of_f_ice 365

6Zendesk Shareholder Letter - August 02 2016

Brand Investment

Broadening our brand awareness and appeal is a

major focus as we seek to build on our customer

service foundation to more broadly address the

entire customer relationship with our products.

A key initiative in this area is the Relate brand

we launched late last year. Relate serves as an

online publication and event series that inspires

and educates customer service and experience

leaders while exposing them to Zendesk.

We held our latest Relate Live events in San

Francisco, London, and Sydney, and the Relate

website crossed a milestone of 50,000 monthly

unique visitors in June. We also launched Relate

Education, a new content channel on the site

focused on leadership guides, video resources,

and educational material for customer service

and experience managers.

Relate is also a natural platform for sharing our

vision of better customer relationships. The

event content closely tracked to the three big

trends we believe are fundamentally reshaping

customer relationships:

• The popularity of new business models,

including subscription- and convenience-based

businesses, requires organizations to focus on

long-term customer relationships and loyalty

rather than transactions.

• The promoter economy, led by a shift of

influence toward consumers wielding the vast

reach of social media and mobile technology,

means that a customer can now be a business’s

most influential promoter and most efficient

marketing vehicle.

• Today’s conscious consumers, especially

millennials, prefer to do business with companies

with strong and genuine records of social

responsibility, requiring organizations to become

transparent and responsive to the outside world

and to empower their stakeholders and employees.

Conscious Consumer

Promoter Economy

New Business Models

7Zendesk Shareholder Letter - August 02 2016

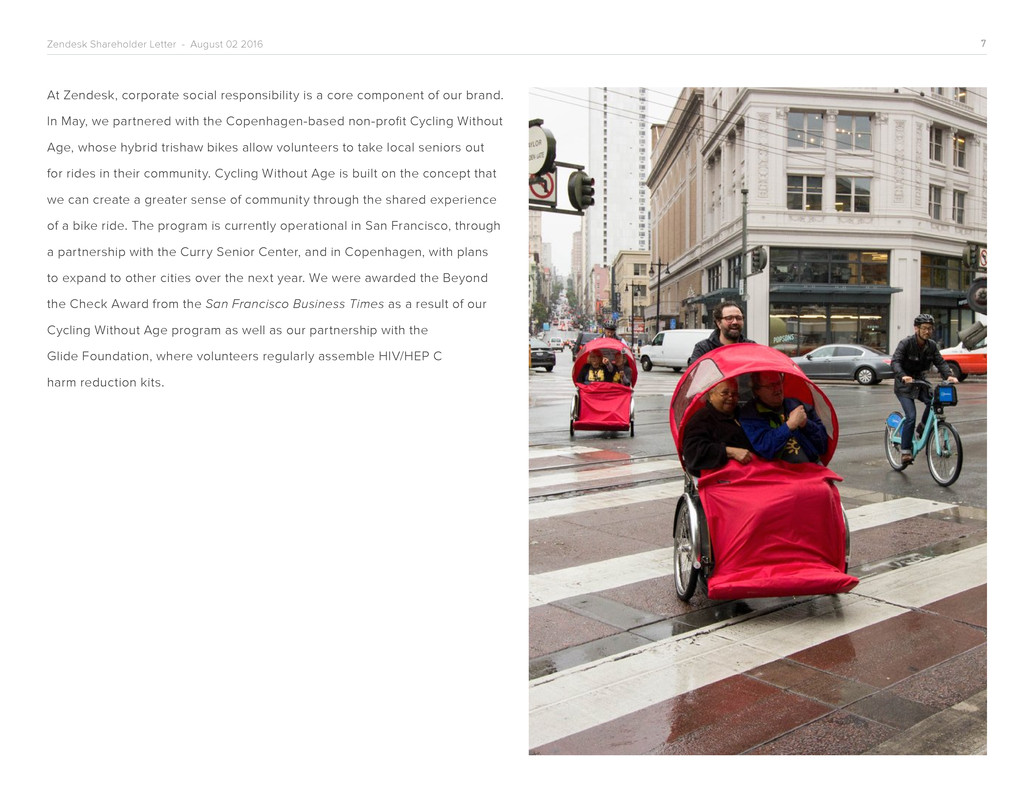

At Zendesk, corporate social responsibility is a core component of our brand.

In May, we partnered with the Copenhagen-based non-profit Cycling Without

Age, whose hybrid trishaw bikes allow volunteers to take local seniors out

for rides in their community. Cycling Without Age is built on the concept that

we can create a greater sense of community through the shared experience

of a bike ride. The program is currently operational in San Francisco, through

a partnership with the Curry Senior Center, and in Copenhagen, with plans

to expand to other cities over the next year. We were awarded the Beyond

the Check Award from the San Francisco Business Times as a result of our

Cycling Without Age program as well as our partnership with the

Glide Foundation, where volunteers regularly assemble HIV/HEP C

harm reduction kits.

8Zendesk Shareholder Letter - August 02 2016

Product Initiatives

As we move to become a multi-product company,

we also continue to invest in product innovations

that apply machine learning and artificial

intelligence to customer relationships, address

emerging consumer communication channels, and

advance self-service.

• We announced our second machine learning-

based feature, Automatic Answers. Available

in an early access program, it automatically

responds to customer inquiries with relevant

knowledge base articles, helping resolve

inquiries before they ever reach an agent.

• We introduced SMS as a native channel for

support (now available in early access) so

businesses globally can receive and respond to

customer text messages within Zendesk.

• Delivering self-service through our Help Center

product is a core customer service strategy

among our customers, and in the second

quarter of 2016 we launched a series of

self-service advancements. We introduced

profiles in Help Center that allow community

members to share relevant information about

themselves and to showcase their recent

activity and contributions. We also launched a

new design theme, named “Copenhagen,” built

from the ground up to be responsive across a

wide range of devices.

• The power of cloud computing is transforming

the infrastructure of business communications,

as evidenced by the success of companies

like Twilio, creating opportunities to disrupt

the market for call center software that has

historically relied on legacy architectures.

Twilio is the technology that powers Zendesk

Voice, which continues to gain traction with

greater penetration of our installed base and

more agents per Advanced Voice customer on

average than in the first quarter of 2016. For

the second quarter of 2016, our quarter-over-

quarter overall Voice subscription revenue

growth rate was the highest of all our products.

AUTOMATIC ANSWERS

The magic of

automatic

Conscious Consumer

9Zendesk Shareholder Letter - August 02 2016

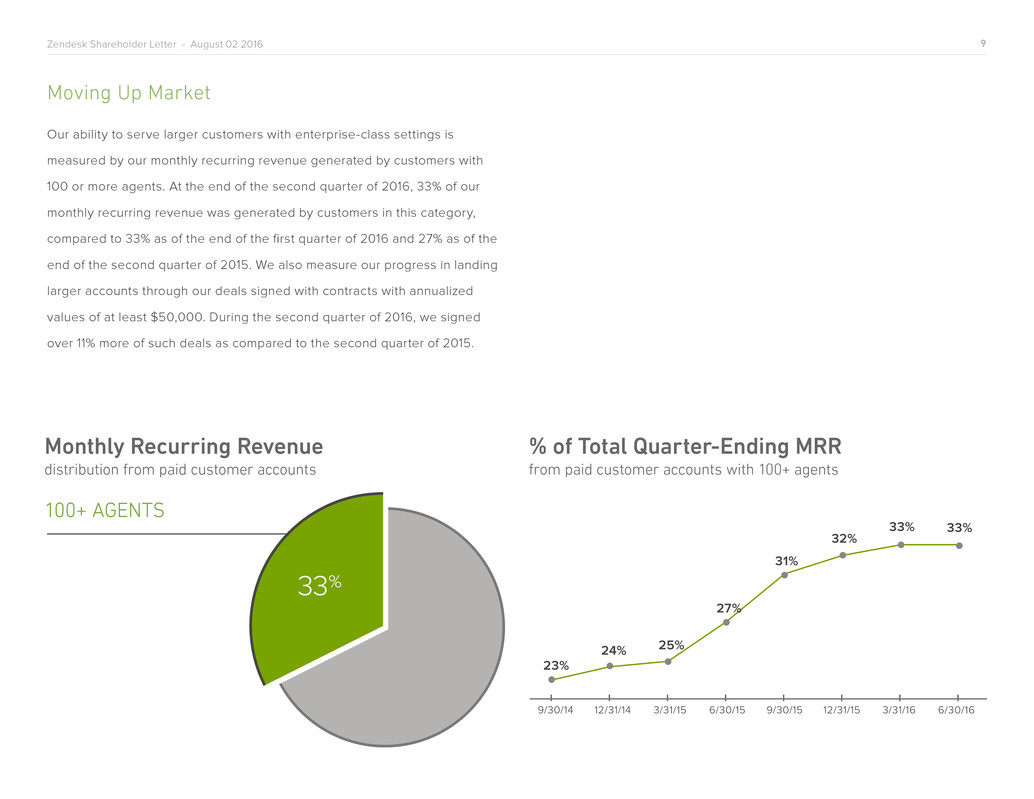

Moving Up Market

Our ability to serve larger customers with enterprise-class settings is

measured by our monthly recurring revenue generated by customers with

100 or more agents. At the end of the second quarter of 2016, 33% of our

monthly recurring revenue was generated by customers in this category,

compared to 33% as of the end of the first quarter of 2016 and 27% as of the

end of the second quarter of 2015. We also measure our progress in landing

larger accounts through our deals signed with contracts with annualized

values of at least $50,000. During the second quarter of 2016, we signed

over 11% more of such deals as compared to the second quarter of 2015.

% of Total Quarter-Ending MRR

from paid customer accounts with 100+ agents

Monthly Recurring Revenue

distribution from paid customer accounts

100+ AGENTS

33%

10Zendesk Shareholder Letter - August 02 2016

Our movement up market into the mid-market and enterprise space has

garnered increased attention from industry analysts. Zendesk was positioned

in the Leaders quadrant in Gartner's May 2016 Magic Quadrant for the CRM

Customer Engagement Center*. We were also the fastest-growing among

the top 20 CRM vendors, based on Gartner’s 2015 CRM software revenue

worldwide for respective players in its May 2016 Market Share Analysis:

Customer Relationship Management Software, Worldwide, 2015 report.

Customers

Notable success stories from our customers in the second quarter of 2016

include an ROI award for our customer Trustpilot, an international provider

of user-generated reviews of online businesses since 2007. Trustpilot

established an international support desk that was scalable, accommodated

multiple languages, and supported the company’s continued growth. Agents

can now switch easily between live chat, voice, and email. In June, Trustpilot

was selected from more than 200 nominations as a winner of the Nucleus

Research 2016 ROI Awards. The company’s selection was based on its

support team’s implementation of Zendesk and the 1,272% ROI that Trustpilot

realized with the project, as assessed by the Nucleus analyst team.

Other noteworthy customers that recently joined us or expanded with us include:

• Venmo, the popular mobile payment service

• DoorDash, delivering food from your favorite restaurants

• Vimeo, the video-sharing website with more than 170 million worldwide viewers

• WNYC, New York’s flagship public radio station

• Colorado State University - Global Campus, America’s first independent

100% online state university

• Bleacher Report, a popular digital media company covering sports news

• Procura, a provider of innovative healthcare information technology solutions

*Gartner does not endorse any vendor, product or service depicted in its research publications,

and does not advise technology users to select only those vendors with the highest ratings or other

designation. Gartner research publications consist of the opinions of Gartner's research organization

and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or

implied, with respect to this research, including any warranties of merchantability or fitness for a

particular purpose.

11Zendesk Shareholder Letter - August 02 2016

Partnerships

Our efforts to build partnerships with leading Internet and software platforms

are an important part of our strategy for extending Zendesk into new

channels and use cases within companies. Building on previously announced

product integrations, in the second quarter of 2016 we invested in our

relationship with Google across several of their properties, notably Google

for Work and Google Play Store.

In June, Google for Work selected Zendesk as a ‘New & Notable’ app in the

Google Apps Marketplace. The selection was prompted by upgrades that

enable businesses to easily set up a new Zendesk account and quickly add

agents and admins from their Google directory. With more than two million

businesses using Google for Work, our inclusion helped drive new Zendesk

customers and trials for our low-touch, online sales model.

Separately, we announced in May an integration allowing Zendesk customers

to automatically convert Google Play Store reviews into support tickets

when the review contains customer service issues requiring assistance.

Some of our most innovative customers participated in the beta, including

game developer Halfbrick, investment platform Robinhood, and project

management software company Wrike. In the first two months, more than

300 customers integrated their Zendesk platform with Google Play, bringing

a total of more than 440,000 reviews into Zendesk as tickets.

Infrastructure

Cloud infrastructure solutions like Amazon Web Services (AWS) offer Zendesk

solid performance, flexibility, and scale. Earlier this year we launched our first

service on AWS to serve Asia, which proved to be effective and scalable to

suit our needs. Based on our experience in Asia, we accelerated our plans to

use cloud infrastructure solutions in conjunction with our investment in our

colocation data centers. Specifically, during the second half of this year, we

plan to expand our use of cloud infrastructure solutions to serve customers

in the Americas.

Financials

We are pleased to report strong second quarter 2016 results as we deliver

on our mission to achieve solid growth and operating performance versus

our prior year results.

For the second quarter of 2016, we reported revenue of $74.2 million, which

represents growth of 54% over the second quarter of 2015. During the

quarter, we saw good revenue growth across all regions. As is typical during

the first half of the year, we saw strong performance in sales to SMBs and

departments within larger organizations. During the quarter, revenue from our

newer products, namely Voice and Chat, continued to grow at high rates from

a smaller base. Over the year, we will continue to invest in our expanded

multi-product strategy, building a foundation for success. We expect revenue

from these new products to grow and contribute more meaningfully to our

overall results over future quarters.

12Zendesk Shareholder Letter - August 02 2016

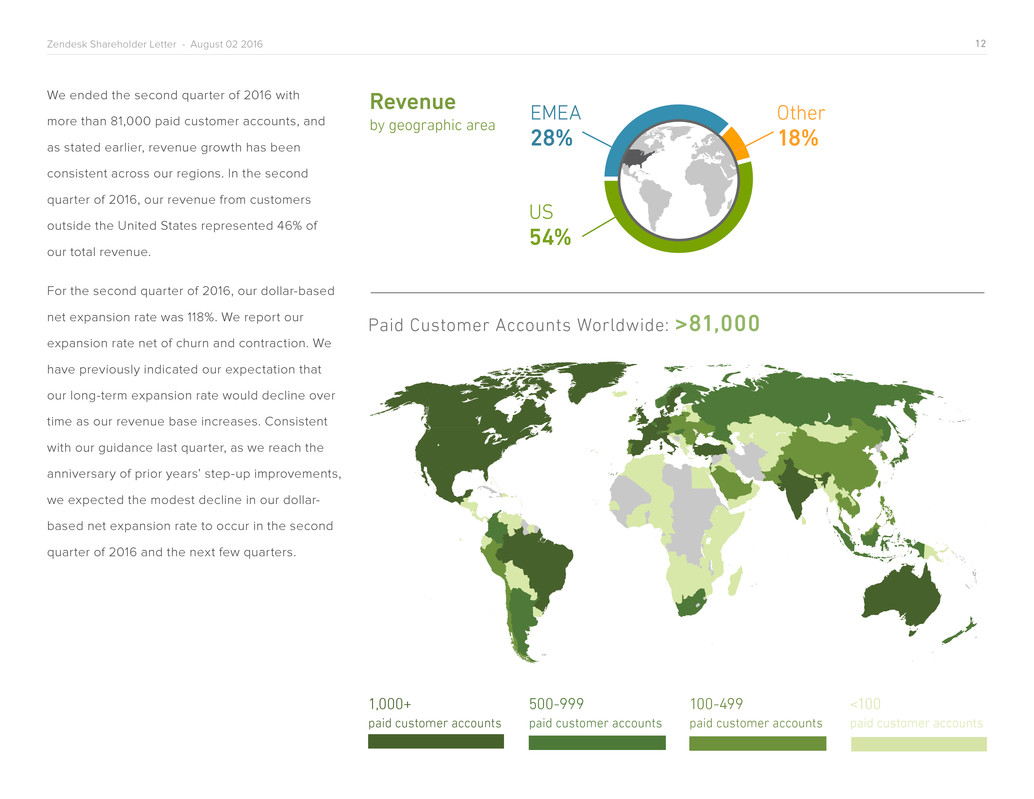

We ended the second quarter of 2016 with

more than 81,000 paid customer accounts, and

as stated earlier, revenue growth has been

consistent across our regions. In the second

quarter of 2016, our revenue from customers

outside the United States represented 46% of

our total revenue.

For the second quarter of 2016, our dollar-based

net expansion rate was 118%. We report our

expansion rate net of churn and contraction. We

have previously indicated our expectation that

our long-term expansion rate would decline over

time as our revenue base increases. Consistent

with our guidance last quarter, as we reach the

anniversary of prior years’ step-up improvements,

we expected the modest decline in our dollar-

based net expansion rate to occur in the second

quarter of 2016 and the next few quarters.

Paid Customer Accounts Worldwide: >81,000

1,000+

paid customer accounts

500-999

paid customer accounts

100-499

paid customer accounts

<100

paid customer accounts

EMEA

28%

Other

18%

US

54%

Revenue

by geographic area

13Zendesk Shareholder Letter - August 02 2016

Financial Measures and Cash Flow

Our mission to demonstrate scale through year-over-year margin

improvement continued during the second quarter of 2016. During this

quarter, we achieved gross margin expansion based primarily on more

efficient use of our data center capacity. GAAP gross margin increased to

69.1% in the second quarter of 2016 compared to 68.6% in the first quarter

of 2016. GAAP gross margin in the second quarter of 2015 was 66.5%.

Non-GAAP gross margin increased to 73.3% in the second quarter of 2016

compared to 73.0% in the first quarter of 2016. Non-GAAP gross margin in

the second quarter of 2015 was 70.2%.

GAAP operating loss for the second quarter of 2016 was $26.3 million

compared to GAAP operating loss for the first quarter of 2016 of $26.7

million. GAAP operating loss for the second quarter of 2015 was $20.9

million. Non-GAAP operating loss for the second quarter of 2016 was $5.6

million, which was better than our outlook for the quarter, and compares to

non-GAAP operating loss for the first quarter of 2016 of $6.8 million. Non-

GAAP operating loss for the second quarter of 2015 was $6.5 million.

Our GAAP operating margin improvement is attributed to overall productivity

gains in sales and marketing and administrative costs, including better

utilization of our office space. GAAP operating margin improved to -35.4%

in the second quarter of 2016 from -39.0% in the first quarter of 2016 and

-43.4% in the second quarter of 2015. Non-GAAP operating margin improved

to -7.6% in the second quarter of 2016 from -9.9% in the first quarter of 2016

and -13.4% in the second quarter of 2015.

Our GAAP net loss was $26.3 million or $0.28 per share for the second

quarter of 2016 compared to GAAP net loss of $27.2 million or $0.30 per

share for the first quarter of 2016. GAAP net loss was $21.5 million and $0.25

per share for the second quarter of 2015.

Our non-GAAP net loss was $5.6 million or $0.06 per share for the second

quarter of 2016 compared to non-GAAP net loss of $7.3 million or $0.08 per

share for the first quarter of 2016. Non-GAAP net loss was $7.0 million or

$0.08 per share for the second quarter of 2015. Weighted average shares

used to compute both GAAP and non-GAAP net loss per share for the

second quarter of 2016 was 92.2 million.

Non-GAAP results for the second quarter of 2016 exclude $19.7 million in

share-based compensation and related expenses (including $0.7 million

of employer tax related to employee stock transactions and $0.4 million of

amortized share-based compensation capitalized in internal-use software)

and $1.0 million of amortization of purchased intangibles. Non-GAAP

results for the first quarter of 2016 exclude $19.0 million in share-based

compensation and related expenses (including $0.8 million of employer tax

related to employee stock transactions and $0.5 million of amortized share-

based compensation capitalized in internal-use software) and $0.9 million

of amortization of purchased intangibles. Non-GAAP results for the second

quarter of 2015 exclude $14.0 million in share-based compensation and

related expenses (including $0.4 million of employer tax related to employee

stock transactions and $0.3 million of amortized share-based compensation

capitalized in internal-use software) and $0.4 million of amortization of

purchased intangibles.

During the second quarter of 2016, net cash from operating activities was

-$0.03 million. We ended the second quarter of 2016 with $118.0 million of

cash and equivalents, and we had an additional $106.1 million of short-term

marketable securities.

14Zendesk Shareholder Letter - August 02 2016

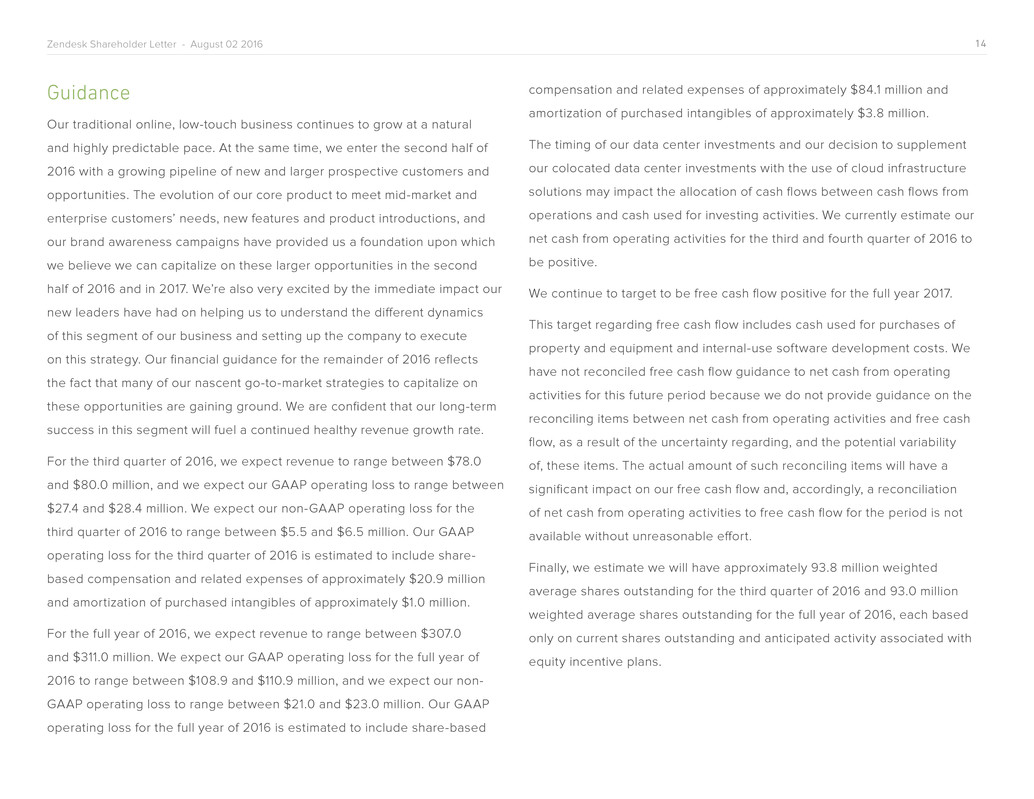

Guidance

Our traditional online, low-touch business continues to grow at a natural

and highly predictable pace. At the same time, we enter the second half of

2016 with a growing pipeline of new and larger prospective customers and

opportunities. The evolution of our core product to meet mid-market and

enterprise customers’ needs, new features and product introductions, and

our brand awareness campaigns have provided us a foundation upon which

we believe we can capitalize on these larger opportunities in the second

half of 2016 and in 2017. We’re also very excited by the immediate impact our

new leaders have had on helping us to understand the different dynamics

of this segment of our business and setting up the company to execute

on this strategy. Our financial guidance for the remainder of 2016 reflects

the fact that many of our nascent go-to-market strategies to capitalize on

these opportunities are gaining ground. We are confident that our long-term

success in this segment will fuel a continued healthy revenue growth rate.

For the third quarter of 2016, we expect revenue to range between $78.0

and $80.0 million, and we expect our GAAP operating loss to range between

$27.4 and $28.4 million. We expect our non-GAAP operating loss for the

third quarter of 2016 to range between $5.5 and $6.5 million. Our GAAP

operating loss for the third quarter of 2016 is estimated to include share-

based compensation and related expenses of approximately $20.9 million

and amortization of purchased intangibles of approximately $1.0 million.

For the full year of 2016, we expect revenue to range between $307.0

and $311.0 million. We expect our GAAP operating loss for the full year of

2016 to range between $108.9 and $110.9 million, and we expect our non-

GAAP operating loss to range between $21.0 and $23.0 million. Our GAAP

operating loss for the full year of 2016 is estimated to include share-based

compensation and related expenses of approximately $84.1 million and

amortization of purchased intangibles of approximately $3.8 million.

The timing of our data center investments and our decision to supplement

our colocated data center investments with the use of cloud infrastructure

solutions may impact the allocation of cash flows between cash flows from

operations and cash used for investing activities. We currently estimate our

net cash from operating activities for the third and fourth quarter of 2016 to

be positive.

We continue to target to be free cash flow positive for the full year 2017.

This target regarding free cash flow includes cash used for purchases of

property and equipment and internal-use software development costs. We

have not reconciled free cash flow guidance to net cash from operating

activities for this future period because we do not provide guidance on the

reconciling items between net cash from operating activities and free cash

flow, as a result of the uncertainty regarding, and the potential variability

of, these items. The actual amount of such reconciling items will have a

significant impact on our free cash flow and, accordingly, a reconciliation

of net cash from operating activities to free cash flow for the period is not

available without unreasonable effort.

Finally, we estimate we will have approximately 93.8 million weighted

average shares outstanding for the third quarter of 2016 and 93.0 million

weighted average shares outstanding for the full year of 2016, each based

only on current shares outstanding and anticipated activity associated with

equity incentive plans.

15Zendesk Shareholder Letter - August 02 2016

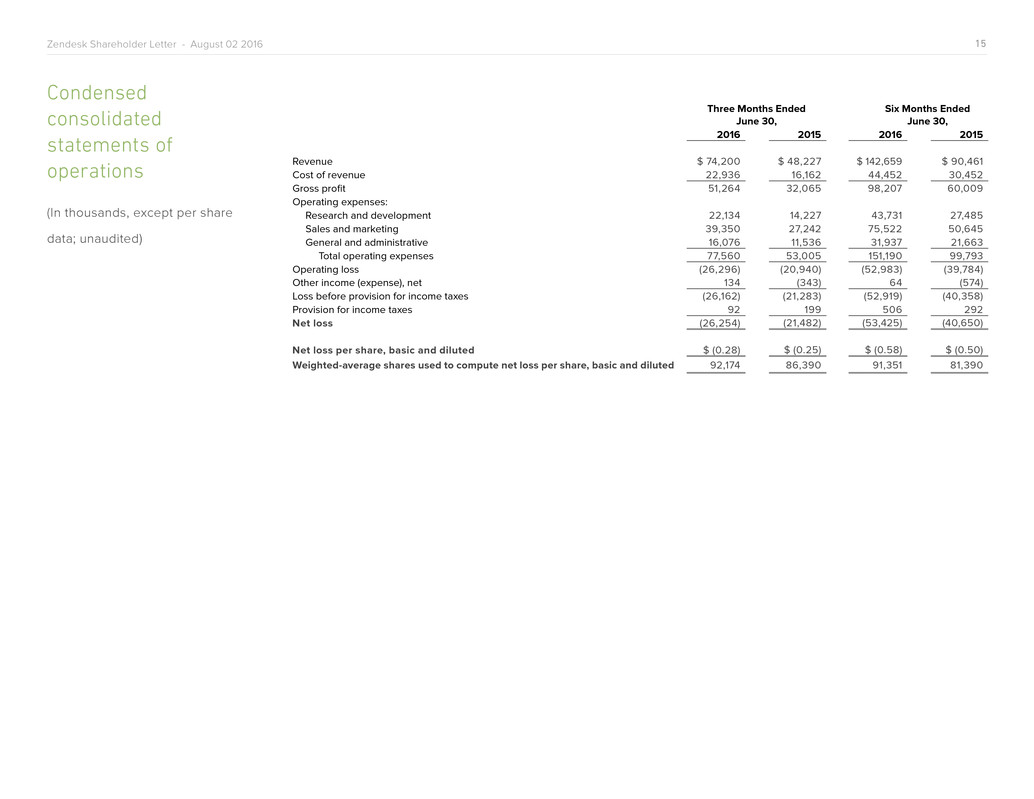

Condensed

consolidated

statements of

operations

(In thousands, except per share

data; unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2016 2015 2016 2015

Revenue $ 74,200 $ 48,227 $ 142,659 $ 90,461

Cost of revenue 22,936 16,162 44,452 30,452

Gross profit 51,264 32,065 98,207 60,009

Operating expenses:

Research and development 22,134 14,227 43,731 27,485

Sales and marketing 39,350 27,242 75,522 50,645

General and administrative 16,076 11,536 31,937 21,663

Total operating expenses 77,560 53,005 151,190 99,793

Operating loss (26,296) (20,940) (52,983) (39,784)

Other income (expense), net 134 (343) 64 (574)

Loss before provision for income taxes (26,162) (21,283) (52,919) (40,358)

Provision for income taxes 92 199 506 292

Net loss (26,254) (21,482) (53,425) (40,650)

Net loss per share, basic and diluted $ (0.28) $ (0.25) $ (0.58) $ (0.50)

Weighted-average shares used to compute net loss per share, basic and diluted 92,174 86,390 91,351 81,390

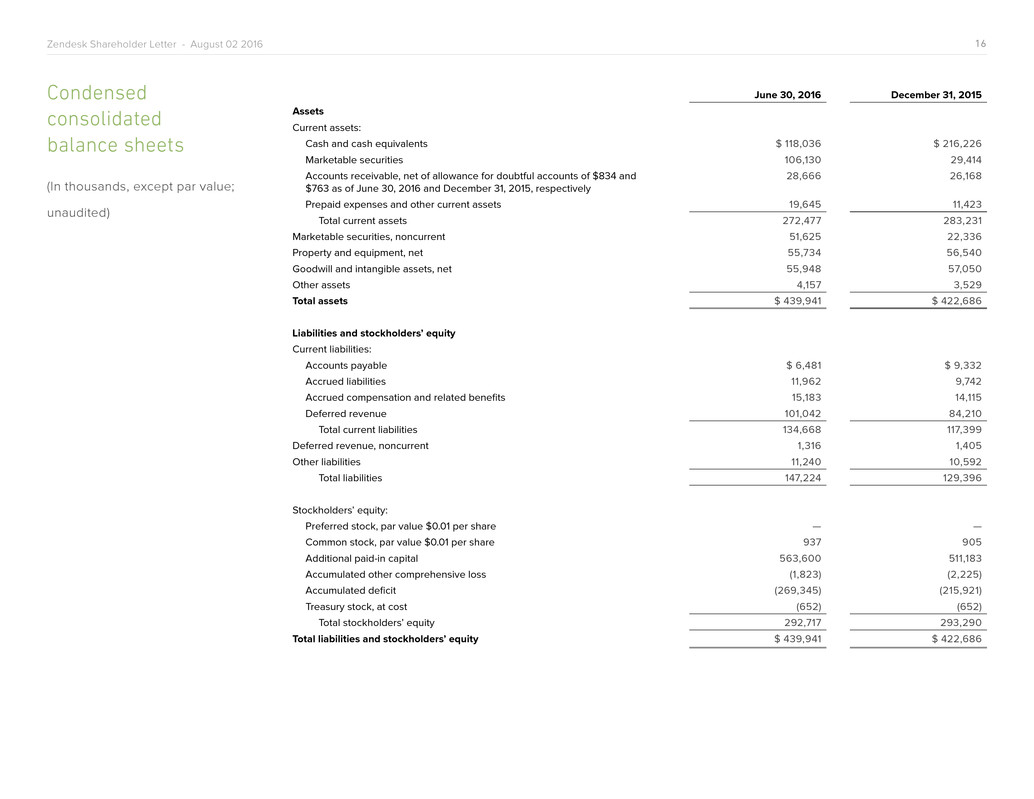

16Zendesk Shareholder Letter - August 02 2016

June 30, 2016 December 31, 2015

Assets

Current assets:

Cash and cash equivalents $ 118,036 $ 216,226

Marketable securities 106,130 29,414

Accounts receivable, net of allowance for doubtful accounts of $834 and

$763 as of June 30, 2016 and December 31, 2015, respectively

28,666 26,168

Prepaid expenses and other current assets 19,645 11,423

Total current assets 272,477 283,231

Marketable securities, noncurrent 51,625 22,336

Property and equipment, net 55,734 56,540

Goodwill and intangible assets, net 55,948 57,050

Other assets 4,157 3,529

Total assets $ 439,941 $ 422,686

Liabilities and stockholders’ equity

Current liabilities:

Accounts payable $ 6,481 $ 9,332

Accrued liabilities 11,962 9,742

Accrued compensation and related benefits 15,183 14,115

Deferred revenue 101,042 84,210

Total current liabilities 134,668 117,399

Deferred revenue, noncurrent 1,316 1,405

Other liabilities 11,240 10,592

Total liabilities 147,224 129,396

Stockholders’ equity:

Preferred stock, par value $0.01 per share — —

Common stock, par value $0.01 per share 937 905

Additional paid-in capital 563,600 511,183

Accumulated other comprehensive loss (1,823) (2,225)

Accumulated deficit (269,345) (215,921)

Treasury stock, at cost (652) (652)

Total stockholders’ equity 292,717 293,290

Total liabilities and stockholders’ equity $ 439,941 $ 422,686

Condensed

consolidated

balance sheets

(In thousands, except par value;

unaudited)

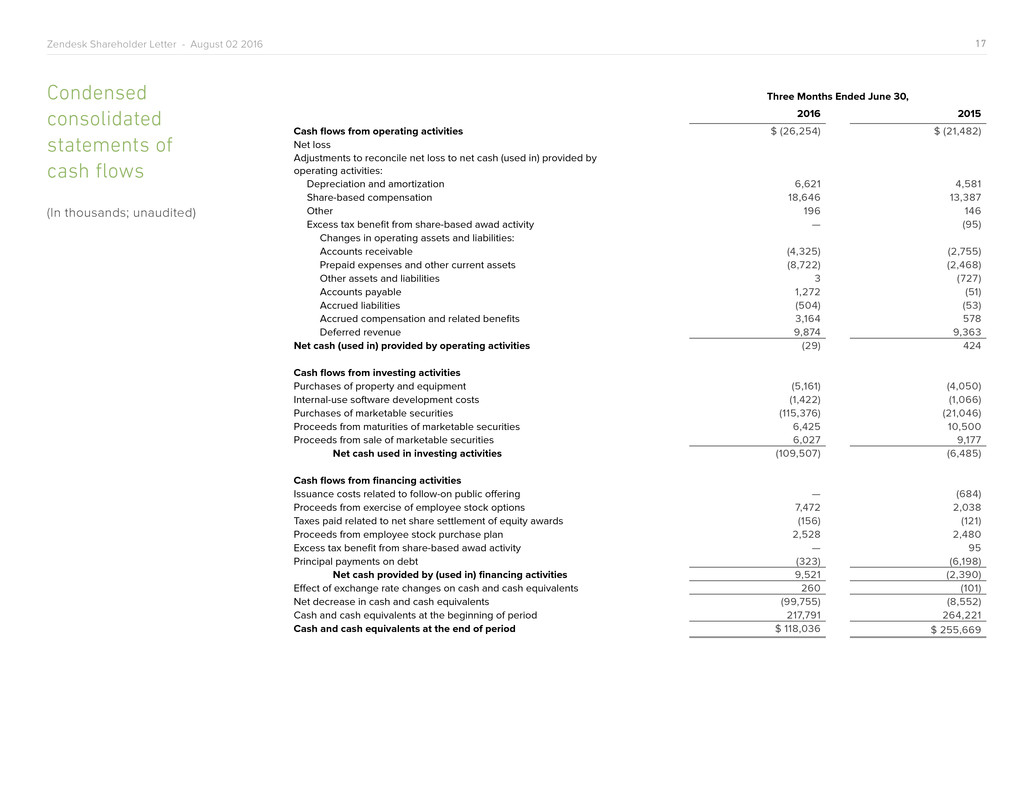

17Zendesk Shareholder Letter - August 02 2016

Condensed

consolidated

statements of

cash flows

(In thousands; unaudited)

Three Months Ended June 30,

2016 2015

Cash flows from operating activities $ (26,254) $ (21,482)

Net loss

Adjustments to reconcile net loss to net cash (used in) provided by

operating activities:

Depreciation and amortization 6,621 4,581

Share-based compensation 18,646 13,387

Other 196 146

Excess tax benefit from share-based awad activity — (95)

Changes in operating assets and liabilities:

Accounts receivable (4,325) (2,755)

Prepaid expenses and other current assets (8,722) (2,468)

Other assets and liabilities 3 (727)

Accounts payable 1,272 (51)

Accrued liabilities (504) (53)

Accrued compensation and related benefits 3,164 578

Deferred revenue 9,874 9,363

Net cash (used in) provided by operating activities (29) 424

Cash flows from investing activities

Purchases of property and equipment (5,161) (4,050)

Internal-use software development costs (1,422) (1,066)

Purchases of marketable securities (115,376) (21,046)

Proceeds from maturities of marketable securities 6,425 10,500

Proceeds from sale of marketable securities 6,027 9,177

Net cash used in investing activities (109,507) (6,485)

Cash flows from financing activities

Issuance costs related to follow-on public offering — (684)

Proceeds from exercise of employee stock options 7,472 2,038

Taxes paid related to net share settlement of equity awards (156) (121)

Proceeds from employee stock purchase plan 2,528 2,480

Excess tax benefit from share-based awad activity — 95

Principal payments on debt (323) (6,198)

Net cash provided by (used in) financing activities 9,521 (2,390)

Effect of exchange rate changes on cash and cash equivalents 260 (101)

Net decrease in cash and cash equivalents (99,755) (8,552)

Cash and cash equivalents at the beginning of period 217,791 264,221

Cash and cash equivalents at the end of period $ 118,036 $ 255,669

18Zendesk Shareholder Letter - August 02 2016

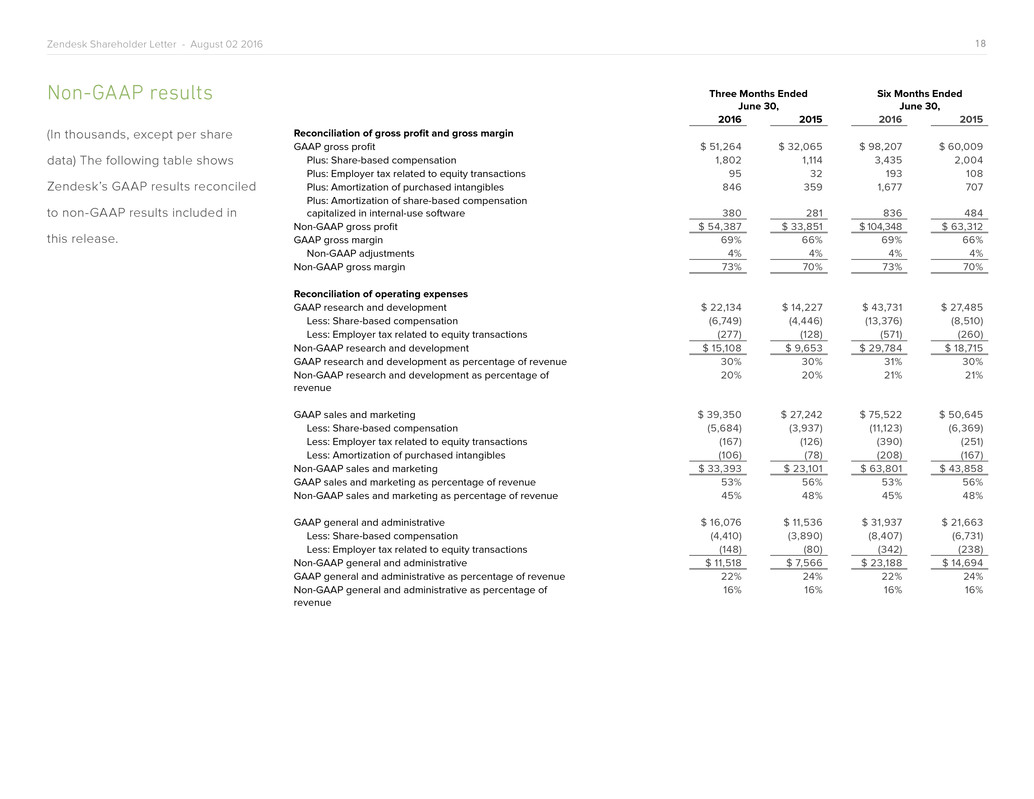

Non-GAAP results

(In thousands, except per share

data) The following table shows

Zendesk’s GAAP results reconciled

to non-GAAP results included in

this release.

Three Months Ended

June 30,

Six Months Ended

June 30,

2016 2015 2016 2015

Reconciliation of gross profit and gross margin

GAAP gross profit $ 51,264 $ 32,065 $ 98,207 $ 60,009

Plus: Share-based compensation 1,802 1,114 3,435 2,004

Plus: Employer tax related to equity transactions 95 32 193 108

Plus: Amortization of purchased intangibles 846 359 1,677 707

Plus: Amortization of share-based compensation

capitalized in internal-use software 380 281 836 484

Non-GAAP gross profit $ 54,387 $ 33,851 $ 104,348 $ 63,312

GAAP gross margin 69% 66% 69% 66%

Non-GAAP adjustments 4% 4% 4% 4%

Non-GAAP gross margin 73% 70% 73% 70%

Reconciliation of operating expenses

GAAP research and development $ 22,134 $ 14,227 $ 43,731 $ 27,485

Less: Share-based compensation (6,749) (4,446) (13,376) (8,510)

Less: Employer tax related to equity transactions (277) (128) (571) (260)

Non-GAAP research and development $ 15,108 $ 9,653 $ 29,784 $ 18,715

GAAP research and development as percentage of revenue 30% 30% 31% 30%

Non-GAAP research and development as percentage of

revenue

20% 20% 21% 21%

GAAP sales and marketing $ 39,350 $ 27,242 $ 75,522 $ 50,645

Less: Share-based compensation (5,684) (3,937) (11,123) (6,369)

Less: Employer tax related to equity transactions (167) (126) (390) (251)

Less: Amortization of purchased intangibles (106) (78) (208) (167)

Non-GAAP sales and marketing $ 33,393 $ 23,101 $ 63,801 $ 43,858

GAAP sales and marketing as percentage of revenue 53% 56% 53% 56%

Non-GAAP sales and marketing as percentage of revenue 45% 48% 45% 48%

GAAP general and administrative $ 16,076 $ 11,536 $ 31,937 $ 21,663

Less: Share-based compensation (4,410) (3,890) (8,407) (6,731)

Less: Employer tax related to equity transactions (148) (80) (342) (238)

Non-GAAP general and administrative $ 11,518 $ 7,566 $ 23,188 $ 14,694

GAAP general and administrative as percentage of revenue 22% 24% 22% 24%

Non-GAAP general and administrative as percentage of

revenue

16% 16% 16% 16%

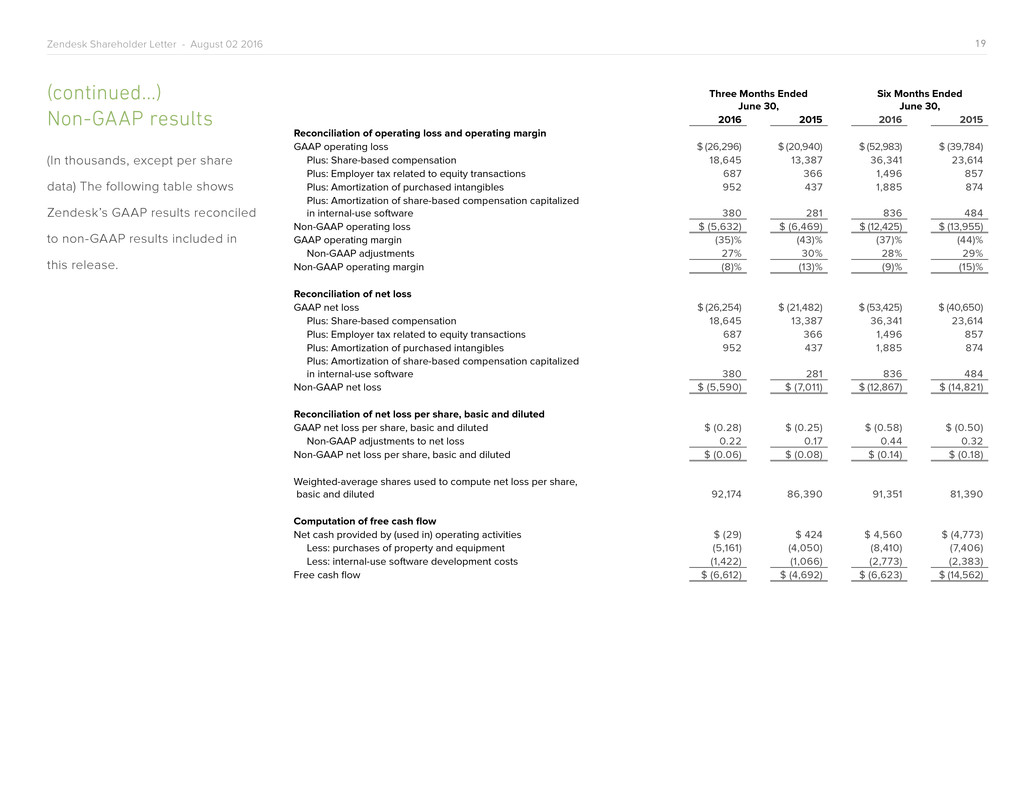

19Zendesk Shareholder Letter - August 02 2016

Three Months Ended

June 30,

Six Months Ended

June 30,

2016 2015 2016 2015

Reconciliation of operating loss and operating margin

GAAP operating loss $ (26,296) $ (20,940) $ (52,983) $ (39,784)

Plus: Share-based compensation 18,645 13,387 36,341 23,614

Plus: Employer tax related to equity transactions 687 366 1,496 857

Plus: Amortization of purchased intangibles 952 437 1,885 874

Plus: Amortization of share-based compensation capitalized

in internal-use software 380 281 836 484

Non-GAAP operating loss $ (5,632) $ (6,469) $ (12,425) $ (13,955)

GAAP operating margin (35)% (43)% (37)% (44)%

Non-GAAP adjustments 27% 30% 28% 29%

Non-GAAP operating margin (8)% (13)% (9)% (15)%

Reconciliation of net loss

GAAP net loss $ (26,254) $ (21,482) $ (53,425) $ (40,650)

Plus: Share-based compensation 18,645 13,387 36,341 23,614

Plus: Employer tax related to equity transactions 687 366 1,496 857

Plus: Amortization of purchased intangibles 952 437 1,885 874

Plus: Amortization of share-based compensation capitalized

in internal-use software 380 281 836 484

Non-GAAP net loss $ (5,590) $ (7,011) $ (12,867) $ (14,821)

Reconciliation of net loss per share, basic and diluted

GAAP net loss per share, basic and diluted $ (0.28) $ (0.25) $ (0.58) $ (0.50)

Non-GAAP adjustments to net loss 0.22 0.17 0.44 0.32

Non-GAAP net loss per share, basic and diluted $ (0.06) $ (0.08) $ (0.14) $ (0.18)

Weighted-average shares used to compute net loss per share,

basic and diluted 92,174 86,390 91,351 81,390

Computation of free cash flow

Net cash provided by (used in) operating activities $ (29) $ 424 $ 4,560 $ (4,773)

Less: purchases of property and equipment (5,161) (4,050) (8,410) (7,406)

Less: internal-use software development costs (1,422) (1,066) (2,773) (2,383)

Free cash flow $ (6,612) $ (4,692) $ (6,623) $ (14,562)

(continued...)

Non-GAAP results

(In thousands, except per share

data) The following table shows

Zendesk’s GAAP results reconciled

to non-GAAP results included in

this release.

20Zendesk Shareholder Letter - August 02 2016

About non-GAAP financial measures

To provide investors and others with additional information regarding

Zendesk’s results, the following non-GAAP financial measures were

disclosed: non-GAAP gross profit and gross margin, non-GAAP operating

expenses, non-GAAP operating loss and operating margin, non-GAAP

net loss attributable to common stockholders, non-GAAP net loss per

share attributable to common stockholders, basic and diluted, non-GAAP

weighted-average shares used to compute net loss per share attributable to

common stockholders, basic and diluted, and free cash flow.

Specifically, Zendesk excludes the following from its historical and

prospective non-GAAP financial measures, as applicable:

Share-based Compensation and Amortization of Share-based Compensation

Capitalized in Internal-use Software: Zendesk utilizes share-based

compensation to attract and retain employees. It is principally aimed at

aligning their interests with those of its stockholders and at long-term

retention, rather than to address operational performance for any particular

period. As a result, share-based compensation expenses vary for reasons

that are generally unrelated to financial and operational performance in any

particular period.

Employer Tax Related to Employee Stock Transactions: Zendesk views

the amount of employer taxes related to its employee stock transactions

as an expense that is dependent on its stock price, employee exercise

and other award disposition activity, and other factors that are beyond

Zendesk’s control. As a result, employer taxes related to its employee stock

transactions vary for reasons that are generally unrelated to financial and

operational performance in any particular period.

Amortization of Purchased Intangibles and Acquisition Related Expenses:

Zendesk views amortization of purchased intangible assets, including the

amortization of the cost associated with an acquired entity’s developed

technology, as items arising from pre-acquisition activities determined at

the time of an acquisition. While these intangible assets are evaluated for

impairment regularly, amortization of the cost of purchased intangibles is

an expense that is not typically affected by operations during any particular

period. Zendesk views acquisition related expenses as events that are

not necessarily reflective of operational performance during a period. In

particular, Zendesk believes the consideration of measures that exclude

such expenses can assist in the comparison of operational performance in

different periods which may or may not include such expenses.

Zendesk provides disclosures regarding its free cash flow, which is defined

as net cash from operating activities, less purchases of property and

equipment and internal-use software development costs. Zendesk uses free

cash flow, among other measures, to evaluate the ability of its operations to

generate cash that is available for purposes other than capital expenditures

and capitalized software development costs. Zendesk believes that

information regarding free cash flow provides investors with an important

perspective on the cash available to fund ongoing operations.

Zendesk uses non-GAAP financial information to evaluate its ongoing

operations and for internal planning and forecasting purposes. Zendesk's

management does not itself, nor does it suggest that investors should,

consider such non-GAAP financial measures in isolation from, or as a

substitute for, financial information prepared in accordance with GAAP.

Zendesk presents such non-GAAP financial measures in reporting its

financial results to provide investors with an additional tool to evaluate

Zendesk's operating results. Zendesk believes these non-GAAP financial

measures are useful because they allow for greater transparency with

respect to key metrics used by management in its financial and operational

decision-making. This allows investors and others to better understand

and evaluate Zendesk’s operating results and future prospects in the same

manner as management.

Zendesk's management believes it is useful for itself and investors to review,

as applicable, both GAAP information that may include items such as share-

based compensation expense, amortization of share-based compensation

capitalized in internal-use software, amortization of purchased intangibles,

transaction costs related to acquisitions, and the non-GAAP measures that

exclude such information in order to assess the performance of Zendesk's

business and for planning and forecasting in subsequent periods. When

Zendesk uses such a non-GAAP financial measure with respect to historical

periods, it provides a reconciliation of the non-GAAP financial measure to

the most closely comparable GAAP financial measure. When Zendesk uses

such a non-GAAP financial measure in a forward-looking manner for future

periods and a reconciliation is not determinable without unreasonable effort,

Zendesk provides the reconciling information that is determinable without

unreasonable effort and identifies the information that would need to be

added or subtracted from the non-GAAP measure to arrive at the most

directly comparable GAAP measure. Investors are encouraged to review the

related GAAP financial measures and the reconciliation of these non-GAAP

financial measures to their most directly comparable GAAP financial measure

as detailed above.

21Zendesk Shareholder Letter - August 02 2016

About operating metrics

Zendesk reviews a number of operating metrics to evaluate its business,

measure performance, identify trends, formulate business plans, and make

strategic decisions. These include the number of paid customer accounts

for its customer service platform and live chat software, dollar-based net

expansion rate, monthly recurring revenue represented by its churned

customers, and the percentage of its monthly recurring revenue originating

from customers with more than 100 agents.

Zendesk defines the number of paid customer accounts at the end of any

particular period as the sum of the number of accounts on its customer

service platform, exclusive of its Starter plan, free trials or other free

services, and the number of accounts using its live chat software, exclusive

of free trials or other free services, each as of the end of the period and

as identified by a unique account identifier. Use of Zendesk’s customer

service platform and live chat software requires separate subscriptions and

each of these accounts are treated as a separate paid customer account.

Existing customers may also expand their utilization of our customer

service platform or live chat software by adding new accounts and a single

consolidated organization or customer may have multiple accounts across

each of Zendesk’s customer service platform and live chat software to

service separate subsidiaries, divisions, or work processes. Each of these

accounts is also treated as a separate paid customer account. Zendesk

does not currently incorporate accounts using its analytics software into

the determination of the number of paid customer accounts. Accounts that

subscribe to Zendesk’s Essential plan are included in the determination of

the number of paid customer accounts.

Zendesk’s dollar-based net expansion rate provides a measurement of

its ability to increase revenue across its existing customer base through

expansion of authorized agents associated with a paid customer account,

upgrades in subscription plan, and the purchase of additional features on

Zendesk’s customer service platform, such as voice subscriptions, as offset

by churn, contraction in authorized agents associated with a paid customer

account, and downgrades in subscription plans. Zendesk’s dollar-based

net expansion rate is based upon monthly recurring revenue for a set of

paid customer accounts on its customer service platform and live chat

software. Monthly recurring revenue for a paid customer account is a legal

and contractual determination made by assessing the contractual terms

of each paid customer account, as of the date of determination, as to the

revenue Zendesk expects to generate in the next monthly period for that

paid customer account, assuming no changes to the subscription and without

taking into account any one-time discounts or any platform usage above

the subscription base, if any, that may be applicable to such subscription.

Monthly recurring revenue is not determined by reference to historical

revenue, deferred revenue or any other United States generally accepted

accounting principles, or GAAP, financial measure over any period. It is

forward-looking and contractually derived as of the date of determination.

Zendesk calculates its dollar-based net expansion rate by dividing the

retained revenue net of contraction and churn by Zendesk’s base revenue.

Zendesk defines its base revenue as the aggregate monthly recurring

revenue of the paid customer accounts on Zendesk’s customer service

platform and live chat software as of the date one year prior to the date of

calculation. Zendesk defines the retained revenue net of contraction and

churn as the aggregate monthly recurring revenue of the same customer

base included in the measure of base revenue at the end of the annual

period being measured. The dollar-based net expansion rate is also

adjusted to eliminate the effect of certain activities that we identify involving

the transfer of agents between paid customer accounts, consolidation

of customer accounts, or the split of a single paid customer account into

multiple paid customer accounts. In addition, the dollar-based net expansion

rate is adjusted to include paid customer accounts in the customer base

used to determine retained revenue net of contraction and churn that share

common corporate information with customers in the customer base that

is used to determine the base revenue. Giving effect to this consolidation

results in Zendesk’s dollar-based net expansion rate being calculated

across approximately 70,900 customers, as compared to the approximately

81,500 total paid customer accounts as of June 30, 2016. To the extent

that Zendesk can determine that the underlying customers do not share

common corporate information, Zendesk does not aggregate paid customer

accounts associated with reseller and other similar channel arrangements for

the purposes of determining its dollar-based net expansion rate. While not

material, Zendesk believes the failure to account for these activities would

otherwise skew the dollar-based net expansion metrics associated with

customers that maintain multiple paid customer accounts on its customer

service platform or live chat software and paid customer accounts associated

with reseller and other similar channel arrangements.

Starting in the quarter ended March 31, 2016, Zendesk began incorporating

operating metrics associated with its live chat software into its dollar-based

net expansion rate. Zendesk does not currently incorporate operating

metrics associated with its analytics software into its measurement of dollar-

based net expansion rate.

22Zendesk Shareholder Letter - August 02 2016

For a more detailed description of how Zendesk calculates its dollar-based

net expansion rate, please refer to Zendesk’s periodic reports filed with the

Securities and Exchange Commission.

Zendesk calculates its monthly recurring revenue represented by its churned

customers on an annualized basis by dividing base revenue associated with

paid customer accounts on Zendesk’s customer service platform that churn,

either by termination of the subscription or failure to renew, during the annual

period being measured, by Zendesk’s base revenue. Zendesk’s monthly

recurring revenue represented by its churned customers excludes expansion

or contraction associated with paid customer accounts on Zendesk’s

customer service platform and the effect of upgrades or downgrades in

subscription plan. The monthly recurring revenue represented by its churned

customers is adjusted to exclude paid customer accounts that churned from

the customer base used that share common corporate information with

customer accounts that did not churn from the customer base during the

annual period being measured. While not material, Zendesk believes the

failure to make this adjustment could otherwise skew the monthly recurring

revenue represented by its churned customers as a result of customers that

maintain multiple paid customer accounts on its customer service platform.

Zendesk’s percentage of monthly recurring revenue that is generated by

customers with 100 or more agents is determined by dividing the monthly

recurring revenue for paid customer accounts with more than 100 agents on

its customer service platform as of the measurement date by the monthly

recurring revenue for all paid customer accounts on its customer service

platform as of the measurement date. Zendesk determines the customers

with 100 or more agents as of the measurement date based on the number

of activated agents at the measurement date and includes adjustments to

aggregate paid customer accounts that share common corporate information.

Zendesk determines the annualized value of a contract by annualizing the

monthly recurring revenue for such contract.

Zendesk does not currently incorporate operating metrics associated with its

live chat software or its analytics software into its measurement of monthly

recurring revenue represented by its churned customers or percentage of

monthly recurring revenue that is generated by customers with 100 or more

agents.

Zendesk’s freemium plans include its Starter plan for its customer service

platform, its Lite plan for its live chat software, and its Inbox service for

facilitating and simplifying email collaboration on group email aliases.

Zendesk believes these services provide exposure to its brand and

establish a relationship that can facilitate further adoption of its customer

service platform and live chat software as organizations grow in size and

their service needs grow more complex. A customer account on Zendesk’s

freemium plans is considered active based on whether functionality of

the service has been utilized within the 90-day period preceding the

measurement date. A single consolidated organization or customer may have

multiple freemium customer accounts across each of Zendesk’s customer

service platform, live chat software, Inbox service. Each of these accounts is

treated as a separate customer account on our freemium products.

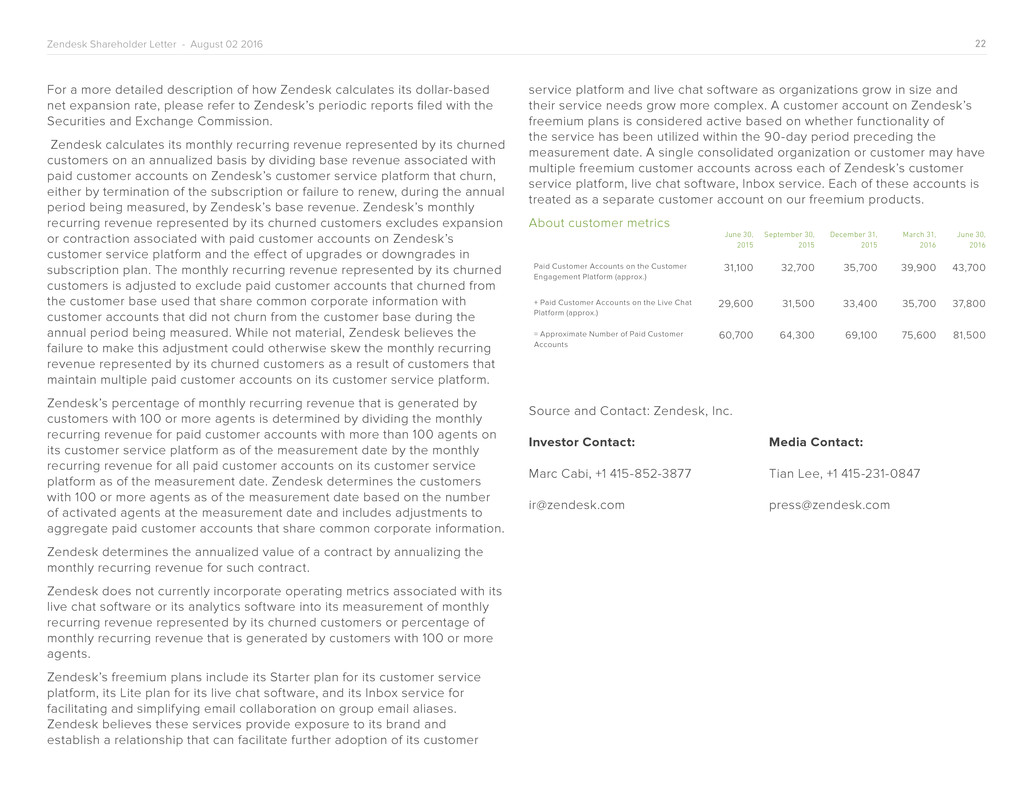

About customer metrics

Source and Contact: Zendesk, Inc.

Investor Contact:

Marc Cabi, +1 415-852-3877

ir@zendesk.com

June 30,

2015

September 30,

2015

December 31,

2015

March 31,

2016

June 30,

2016

Paid Customer Accounts on the Customer

Engagement Platform (approx.)

31,100 32,700 35,700 39,900 43,700

+ Paid Customer Accounts on the Live Chat

Platform (approx.)

29,600 31,500 33,400 35,700 37,800

= Approximate Number of Paid Customer

Accounts

60,700 64,300 69,100 75,600 81,500

Media Contact:

Tian Lee, +1 415-231-0847

press@zendesk.com