Attached files

| file | filename |

|---|---|

| 8-K - 8-K CH SALE - TALMER BANCORP, INC. | a8kaugust16investorpresent.htm |

Creating a Preeminent Midwest

Community Bank

August 2, 2016

KBW Community Bank Investor Conference

David B. Ramaker

Chief Executive Officer

Chemical Financial Corporation

Dennis Klaeser

Chief Financial Officer

Talmer Bancorp, Inc.

2

Forward – Looking Statements

This presentation contains forward‐looking statements regarding the outlook and expectations of Chemical Financial Corporation (“Chemical” or “CHFC”) and Talmer Bancorp, Inc.

(“Talmer” or “TLMR”) with respect to their planned strategic partnership, including the benefits of the transaction, the expected costs to be incurred and cost savings to be realized in

connection with the transaction, the expected impact of the transaction on Chemical's future financial performance (including anticipated accretion to earnings per share, tangible book

value earn‐back period and internal rate of return), the assumed purchase accounting adjustments, credit marks, and intangibles and other key transaction assumptions, anticipated

regulatory cost, timing of closing of the transaction, and consequences of Talmer’s integration into Chemical. Words such as "anticipated," "estimated," "expected," "projected,"

"assumed," "approximately," "continued," "should," "will" and variations of such words and similar expressions are intended to identify such forward‐looking statements. The Pro forma

financial information is not a guarantee of future results and is presented for informational purposes only.

Forward‐looking statements are not guarantees of future financial performance and are subject to risks, uncertainties and assumptions ("risk factors") that are difficult to predict with

regard to timing, extent, likelihood and degree of occurrence. Therefore, actual results and outcomes may materially differ from what may be expressed or forecasted in such forward‐

looking statements. Neither Chemical nor Talmer undertakes any obligation to update, amend or clarify forward‐looking statements, whether as a result of new information, future

events or otherwise. Risk factors relating both to the transaction and the integration of Talmer into Chemical after closing include, without limitation:

• Completion of the transaction is dependent on, among other things, receipt of regulatory approvals, the timing of which cannot be predicted with precision at this point and which

may not be received at all.

• The impact of the completion of the transaction on Chemical's and Talmer’s financial statements will be affected by the timing of the transaction.

• The transaction may be more expensive to complete and the anticipated benefits, including anticipated cost savings and strategic gains, may be significantly harder or take longer to

achieve than expected or may not be achieved in their entirety as a result of unexpected factors or events.

• The integration of Talmer's business and operations into Chemical, which will include conversion of Talmer’s operating systems and procedures, may take longer than anticipated or

be more costly than anticipated or have unanticipated adverse results relating to Talmer’s or Chemical's existing businesses.

• Chemical’s ability to achieve anticipated results from the transaction is dependent on the state of the economic and financial markets going forward. Specifically, Chemical may

incur more credit losses than expected and customer and employee attrition may be greater than expected.

• The outcome of pending or threatened litigation, whether currently existing or commencing in the future, including litigation related to the merger.

• The effect of divestitures that may be required by regulatory authorities in certain markets in which Chemical and Talmer compete.

• The challenges of integrating, retaining and hiring key personnel.

• Failure to attract new customers and retain existing customers in the manner anticipated.

In addition, risk factors include, but are not limited to, the risk factors described in Item 1A of each of Chemical's and Talmer’s Annual Report on Form 10‐K for the year ended December

31, 2015. These and other factors are representative of the risk factors that may emerge and could cause a difference between an ultimate actual outcome and a forward‐looking

statement.

Non‐GAAP Financial Measures

This presentation contains certain non‐GAAP financial measures that are not in accordance with U.S. generally accepted accounting principles (GAAP). Chemical and Talmer use certain

non‐GAAP financial measures to provide meaningful, supplemental information regarding their operational results and to enhance investors’ overall understanding of Chemical’s and

Talmer’s financial performance. The limitations associated with non‐GAAP financial measures include the risk that persons might disagree as to the appropriateness of items comprising

these measures and that different companies might calculate these measures differently. These disclosures should not be considered an alternative to Chemical’s and Talmer’s GAAP

results. For a reconciliation of these non‐GAAP financial measures to the most comparable GAAP measure, see non‐GAAP reconciliation slides located in Appendix I and Appendix II.

3

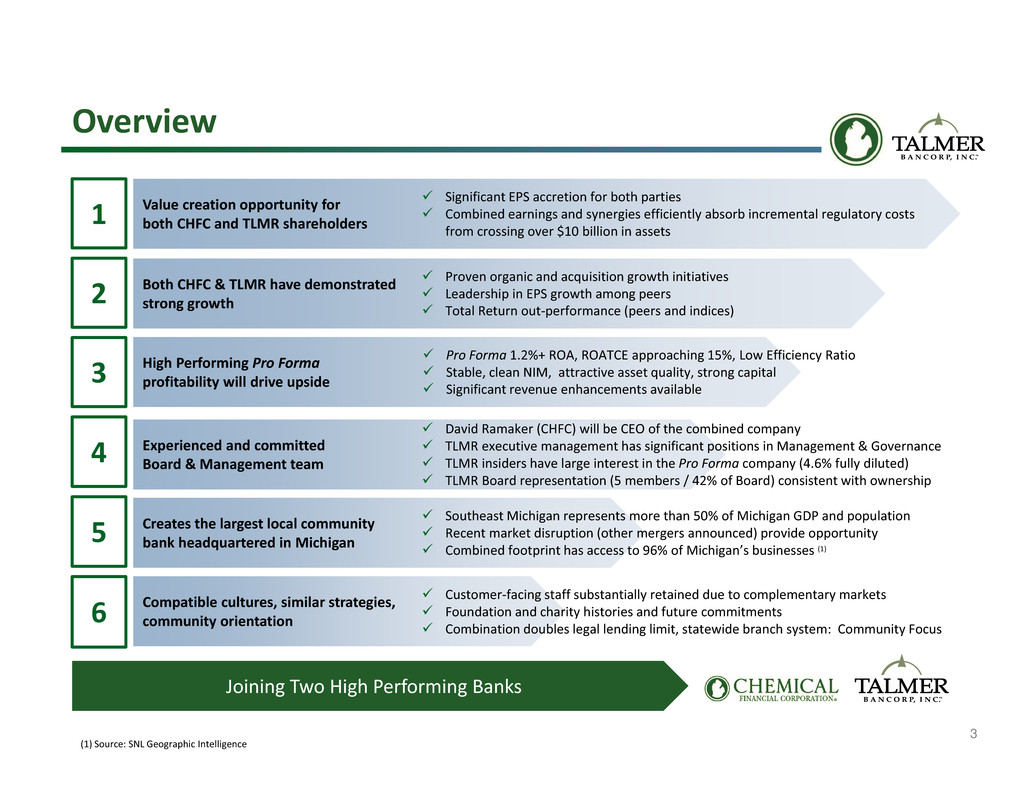

Overview

Joining Two High Performing Banks

Value creation opportunity for

both CHFC and TLMR shareholders

5

6

4

1

Both CHFC & TLMR have demonstrated

strong growth2

High Performing Pro Forma

profitability will drive upside3

Experienced and committed

Board & Management team

Creates the largest local community

bank headquartered in Michigan

Compatible cultures, similar strategies,

community orientation

Significant EPS accretion for both parties

Combined earnings and synergies efficiently absorb incremental regulatory costs

from crossing over $10 billion in assets

Customer‐facing staff substantially retained due to complementary markets

Foundation and charity histories and future commitments

Combination doubles legal lending limit, statewide branch system: Community Focus

Proven organic and acquisition growth initiatives

Leadership in EPS growth among peers

Total Return out‐performance (peers and indices)

Pro Forma 1.2%+ ROA, ROATCE approaching 15%, Low Efficiency Ratio

Stable, clean NIM, attractive asset quality, strong capital

Significant revenue enhancements available

David Ramaker (CHFC) will be CEO of the combined company

TLMR executive management has significant positions in Management & Governance

TLMR insiders have large interest in the Pro Forma company (4.6% fully diluted)

TLMR Board representation (5 members / 42% of Board) consistent with ownership

Southeast Michigan represents more than 50% of Michigan GDP and population

Recent market disruption (other mergers announced) provide opportunity

Combined footprint has access to 96% of Michigan’s businesses (1)

(1) Source: SNL Geographic Intelligence

4

High Performing, Complementary Banks

Source: SNL Financial and Company documents

(1) Core efficiency ratio for CHFC excludes merger related expenses; core efficiency ratio for TLMR defined as noninterest expense divided by total revenue, adjusted for (expense)/benefit due to change in the fair

value of loan servicing rights, FDIC loss sharing income, transaction and integration related costs and net loss on early termination of FDIC loss share and warrant agreements and bargain purchase gains

(2) Includes impact of Durbin Amendment and other expenses associated with crossing $10 billion asset size threshold

(3) As of June 30, 2016

Creating a Preeminent Midwest Bank

• Largest bank headquartered in Michigan

• $16 billion in total assets

• Largest MI headquartered branch distribution

system

• Significant market share in nearly all markets of

operation

• High Performing Pro Forma ROA, ROE, NIM and

Efficiency (1)(2)

Detroitt ittr itt it

Pittsburghittittitt

Clevelandl ll ll l

Milwaukeeililil

Chicagoiii

IndianapolisI i liI i liI i li Columbuslll

Chemical

Talmer

● $6.9 billion bank holding company

‐ Headquartered in Troy, MI

(Greater Detroit MSA)

● A high performing Midwest Bank

‐ Built through organic growth & successful

acquisitions

● Recapitalized and retooled banking platforms

after the distress of the previous credit crisis

‐ Completed 8 acquisitions since 2010

‐ (~$6.0 billion in assets acquired)

● Strong mortgage banking platform producing

$1.4 billion in originations in 2015

● Strong operating performance

‐ Attractive NIM (ex. Excess Accretable Yield)

‐ Core efficiency ratio of 58.4%(1) in 2Q’16

‐ Low cost deposit funding

● 11.7% YoY net loan growth ($524 million)

● Total return since IPO(3): 48.9%

● $9.5 billion financial holding company

‐ Headquartered in Midland, MI

● Preeminent MI franchise outside of Detroit MSA

‐ Capitalizing on and contributing to Michigan’s

vibrant economy

‐ Recent strategic acquisitions have enhanced

organization’s market presence, lending

capacity and earnings power

● Proven ability to increase market share in core

markets through:

‐ Strong organic loan growth ($1.7 billion) over

prior 3 years

‐ Approximately $3.1 billion in assets acquired

through open bank M&A since 2010

● Significant trust and wealth management

operations (AUM of $5.0 billion)

● Strong operating performance history through

cycles, including

‐ Attractive NIM

‐ Core efficiency ratio of 55.1%(1) in 2Q’16

‐ Low cost deposit funding

‐ Strong asset quality through cycles

● 9% YoY organic loan growth ($613 million)

● 3yr Total Return(3) : 57.5% (vs. KRX: 23.0%)

5

Rationale: Logical Fit

Both Banks…

Focus on community bank lending

Emphasize building relationships with high caliber talent

Know their markets, what works, what doesn’t

Built via organic & acquisition efforts

Exhibit strong organic loan growth

Maintain strong and clean credit cultures

Delivering strong earnings and growth momentum

Strong expense controls (not “flashy” organizations)

Focus on Risk Management, Safety and Soundness

Complementary branch networks, low redundancy

CHFC market – Michigan except for Greater Detroit MSA

TLMR market ‐ Greater Detroit MSA ‐ renaissance continues

TLMR business philosophy is consistent with CHFC

TLMR becomes the Southeast MI and Northern OH Regions within CHFC

Core Rationale / Fit

6

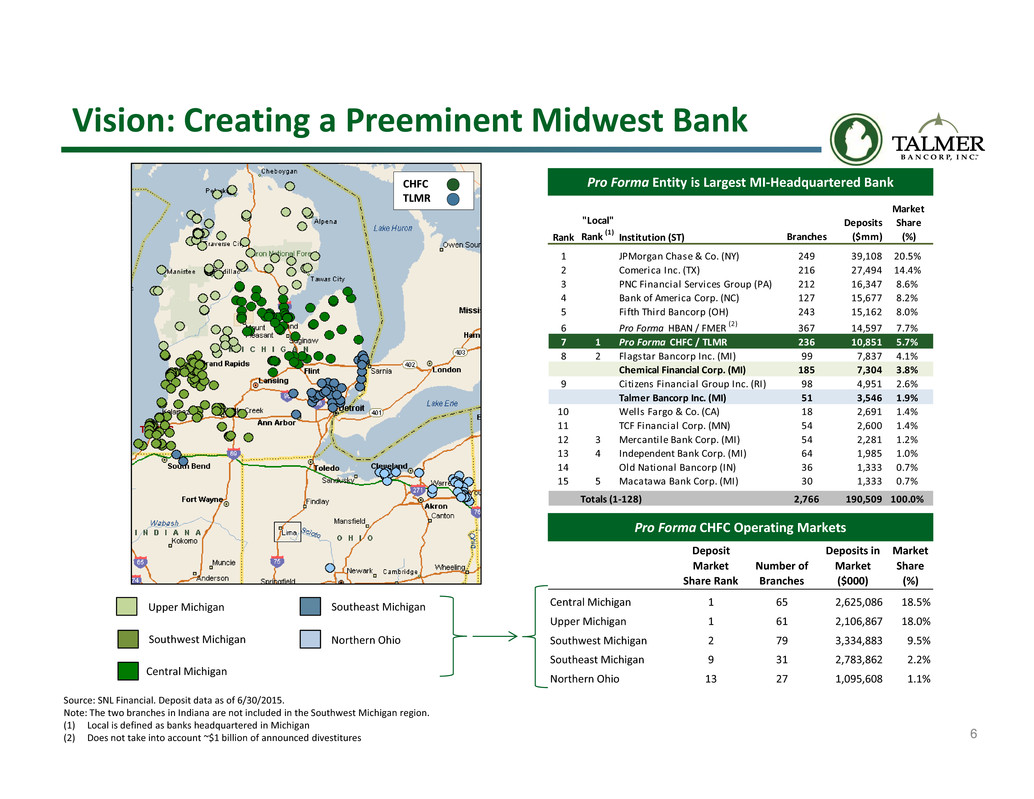

Vision: Creating a Preeminent Midwest Bank

Pro Forma Entity is Largest MI‐Headquartered Bank

Pro Forma CHFC Operating Markets

Source: SNL Financial. Deposit data as of 6/30/2015.

Note: The two branches in Indiana are not included in the Southwest Michigan region.

(1) Local is defined as banks headquartered in Michigan

(2) Does not take into account ~$1 billion of announced divestitures

Upper Michigan Southeast Michigan

Southwest Michigan

CHFC

TLMR

Central Michigan

Northern Ohio

Deposit

Market

Share Rank

Number of

Branches

Deposits in

Market

($000)

Market

Share

(%)

Central Michigan 1 65 2,625,086 18.5%

Upper Michigan 1 61 2,106,867 18.0%

Southwest Michigan 2 79 3,334,883 9.5%

Southeast Michigan 9 31 2,783,862 2.2%

Northern Ohio 13 27 1,095,608 1.1%

Rank

"Local"

Rank (1) Institution (ST) Branches

Deposits

($mm)

Market

Share

(%)

1 JPMorgan Chase & Co. (NY) 249 39,108 20.5%

2 Comerica Inc. (TX) 216 27,494 14.4%

3 PNC Financial Services Group (PA) 212 16,347 8.6%

4 Bank of America Corp. (NC) 127 15,677 8.2%

5 Fifth Third Bancorp (OH) 243 15,162 8.0%

6 Pro Forma HBAN / FMER (2) 367 14,597 7.7%

7 1 Pro Forma CHFC / TLMR 236 10,851 5.7%

8 2 Flagstar Bancorp Inc. (MI) 99 7,837 4.1%

Chemical Financial Corp. (MI) 185 7,304 3.8%

9 Citizens Financial Group Inc. (RI) 98 4,951 2.6%

Talmer Bancorp Inc. (MI) 51 3,546 1.9%

10 Wells Fargo & Co. (CA) 18 2,691 1.4%

11 TCF Financial Corp. (MN) 54 2,600 1.4%

12 3 Mercantile Bank Corp. (MI) 54 2,281 1.2%

13 4 Independent Bank Corp. (MI) 64 1,985 1.0%

14 Old National Bancorp (IN) 36 1,333 0.7%

15 5 Macatawa Bank Corp. (MI) 30 1,333 0.7%

Totals (1‐128) 2,766 190,509 100.0%

7

All Major MI Markets & OH Growth Opportunity

96% of businesses / 97% of population is within Pro Forma MI footprint (3)

Overlapping Michigan Markets New Michigan & Ohio MarketsOther Markets

CHFC: Deposits / Rank $3.2 #3

TLMR: Deposits / Rank $0.2 #28

CHFC: Deposits / Rank $2.1 #2

TLMR: Deposits / Rank $0.6 #9

CHFC: Deposits / Rank $0.0

TLMR: Deposits / Rank $2.8 #9

CHFC: Deposits / Rank $0.0

TLMR: Deposits / Rank $1.1 #15

CHFC: Deposits / Rank $2.1 #1

TLMR: Deposits / Rank $0.0 #31

Southwest MI Central MI Southeast MI Northern OHNorthern MI

Southeast Michigan represents more than 50% of Michigan GDP and population – a huge opportunity with recent market disruption

(1) Source: USDOC’s Bureau of Economic Analysis. Considered the largest Metropolitan Statistical Area for each region. The Upper Michigan region does not have a Metropolitan Statistical Area as defined by the

Bureau of Economic Analysis

(2) State Deposits are in billions

(3) Source: SNL Geographic Intelligence

Pro Forma Footprint By State & Regional Market

State Overlapping Markets Other New Markets Market Access

MI OH

Southwest

MI

Central

MI

Upper

MI

Southeast

MI

Northern

OH

Michigan

Penetration

Chemical Presence

Talmer Presence

Combined Franchise

Pro Forma Depos i ts ($B) $10.9 $1.1 $3.3 $2.6 $2.1 $2.8 $1.1

Market Share Rank 7 24 2 1 1 9 13

Depos i t Market Share (%) 5.7% 0.4% 9.5% 18.5% 18.0% 2.2% 1.1%

Market Information (as a % of):

% of State ($B) GDP

(1) 12% 2% ‐ 53% 22%

% of State Depos i ts

(2) 18% 7% 6% 66% 35% 98%

% of State Bus inesses

(3) 25% 13% 11% 46% 38% 96%

% of State Population

(3) 25% 13% 9% 49% 37% 97%

8

Rationale: Clear Opportunities

Complementary Franchises & Enhances Our Respective Strategies

High industrial logic in truly creating a preeminent Midwest Bank

– The leading independent bank in Michigan

– Material scale in communities throughout Michigan

– Meaningful scale in Northern Ohio

Scale Benefits:

– Regional scale to compete for any Michigan clients including increased lending limits

– Platform efficiencies give advantage afforded low cost provider

– Broader customer access and reach

– Broadens product capabilities

– $16b Pro Forma scale will mitigate the costs of crossing $10b

Complementary business lines – transportable into each other’s markets

– Mortgage origination (TLMR platform)

– Wealth management (CHFC platform)

– Consumer lending (CHFC platform)

Wide range of “back‐fill” acquisition opportunities in Michigan

Wide range of “bolt‐on” acquisition opportunities in adjacent markets (Indiana, Ohio)

9

Economic Momentum in Michigan

Michigan ranks 6th in the country for its

creation of nearly 450,000 jobs since late

2010 (1)

Unemployment has dropped from 14.9%

in June 2009 to 4.7% in May 2016 (2)

Michigan GDP growth outpaced the

nation from 2009‐2014 with growth of

13.4% to 9.4% (3)

Ranks as 7th most competitive state for

new business investment by Site Selection

Magazine (4)

New investment from global companies

has grown by $8.4 billion since 2010 (5)

From 2nd worst to 13th best corporate tax

climate as rated by Tax Foundation

10th largest state by population

8th ranked state in number of skilled trade

workers (2)

Top ranked state in the country for

electrical, mechanical and industrial

engineers (2)

A $1.5 billion structural budget deficit has

been eliminated (6)

Extensive recent investment in

infrastructure

Passage of Right‐to‐Work legislation and

other pro‐innovation policies in recent

years

Recent Performance Assets for Future Growth

1) Michigan Economic Development Corporation

2) US Bureau of Labor Statistics

3) Michigan Economic Development Corporation

4) January 2016

5) FDImarkets.com

6) Michigan Department of Technology, Management and Budget

10

Preeminent Midwest Bank for All Constituencies

Shareholders

Local Communities

▲ EPS accretion to all shareholders, leading growth rate

▲ Material dividend accretion to TLMR shareholders

▲ Potential Market Value Creation (P/E lift, new peer group)

▲ Diversification in earnings

▲ Efficiently deploy capital in low premium merger

▲ Improves already strong operating metrics, inclusive of Durbin costs

▲ Upstream buyer field is likely to expand on net basis (coherent franchise)

▲ Potential attractive target bank opportunity field expands

► Temporary hiatus in acquisition plans and share repurchases

▲ CHFC’s & TLMR’s commitment and strength in community banking

▲ In‐state Headquarters (largest bank headquartered in Michigan)

▲ CHFC’s regional organization brings local lending authorities

▲ Pro Forma CHFC+TLMR may de‐emphasize out‐of‐market lending and

reallocate resources (loans/employees) to combined footprint

▲ Foundation and charity histories and future commitments

▲ CHFC local tax‐credit unit offers unique financing options for

challenging projects in TLMR markets

▲ CHFC Cares Days (in‐community works)

Borrowers / Depositors

▲ Primary core funded bank allows sustained lending through cycles

▲ CHFC’s credit quality history offers evidence of lending through cycles

▲ Statewide locations make banking with TLMR+CHFC easier

▲ Greater legal lending limit provides greater lending capacities

▲ Wider product suite (treasury, wealth mgmt., enhanced mortgage)

▲ Ability to offer more products per customer relationship

▲ CHFC brings consumer (auto) lending

Employees / Culture

▲ Up‐tiered size increases public identity and recruiting capacities

▲ CHFC’s community banking model fits with TLMR culture

▲ TLMR employees have significant roles in Pro Forma company

▲ Combined management and governance line‐up provides integration

benefits and guidance

▲ TLMR & CHFC customer‐facing employees substantially retained due to

complementary market presence

► Target cost savings achievement predicated upon elimination of

redundant positions within TLMR+CHFC, creating some employee

displacement

11

Integration Progress

Proceeding on Schedule

$52 million cost savings opportunities have been identified and on track for full

realization in 2017

Company wide organization charts have been created utilizing the strengths of

both organizations

Core systems have been selected and integration planning has begun in earnest

Planning for comprehensive DFAST implementation has been initiated

Recruiting efforts underway to hire additional sales talent in middle market

commercial lending and wealth management

Integration management team featuring leaders from both organizations meeting

weekly to recognize opportunities and manage progress

— Holding company merger expected during the third quarter of 2016

— System conversions expected in November 2016

— Core competency for both organizations

12

Financial Metrics

Combined Company Positioned for Significant Upside

Note: CHFC and TLMR financial figures based on June 30, 2016 financials; peer figures are for the most recent quarter available and the source is SNL Financial.

(1) The Pro Forma profitability figures are presented for 2017 and balance sheet at June 30, 2016 . Includes purchase accounting; assumes fully phased in transaction adjustments

(2) Peers include mainland public banks and thrifts with total assets between $10 billion and $25 billion and ROATCE greater than 10.00%; peer data as of January 29, 2016

(3) CHFC and TLMR EPS stand alone estimates are FactSet Consensus estimates prior to announcement of the merger

13

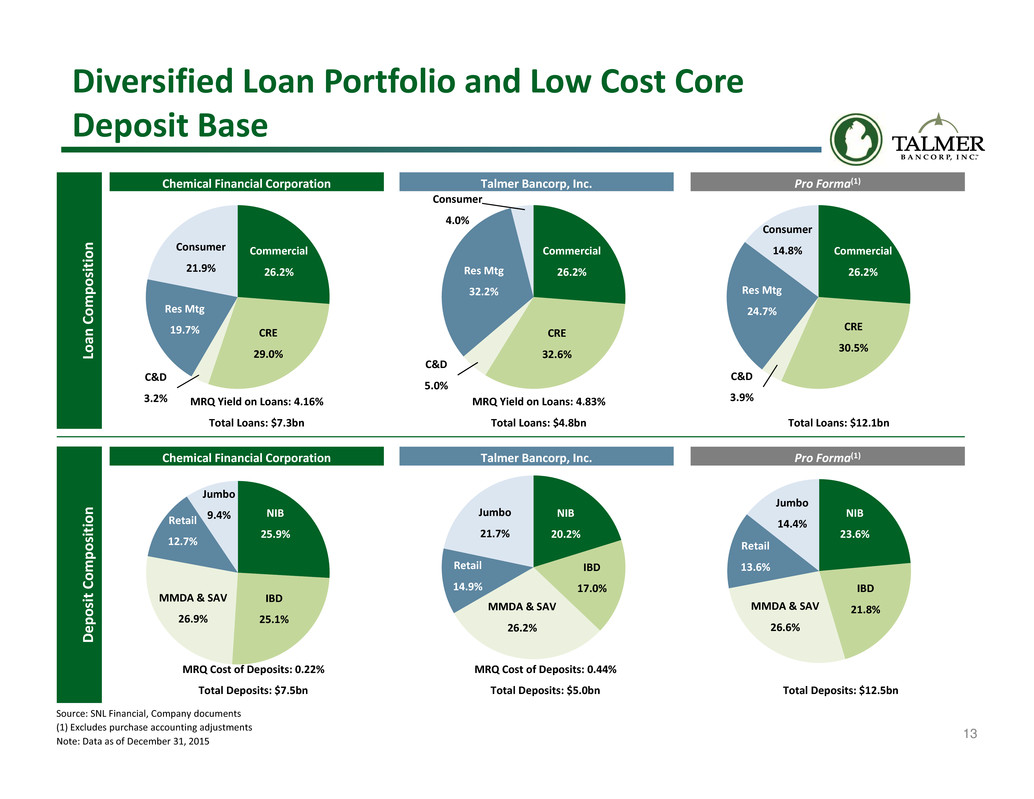

Diversified Loan Portfolio and Low Cost Core

Deposit Base

Source: SNL Financial, Company documents

(1) Excludes purchase accounting adjustments

Note: Data as of December 31, 2015

Commercial

26.2%

CRE

32.6%

C&D

5.0%

Res Mtg

32.2%

Jumbo

9.4% NIB

25.9%

IBD

25.1%

MMDA & SAV

26.9%

Retail

12.7%

Jumbo

21.7%

NIB

20.2%

IBD

17.0%

MMDA & SAV

26.2%

Retail

14.9%

Jumbo

14.4%

NIB

23.6%

IBD

21.8%MMDA & SAV

26.6%

Retail

13.6%

MRQ Yield on Loans: 4.16%

Total Loans: $7.3bn

MRQ Yield on Loans: 4.83%

Total Loans: $4.8bn Total Loans: $12.1bn

MRQ Cost of Deposits: 0.22%

Total Deposits: $7.5bn

MRQ Cost of Deposits: 0.44%

Total Deposits: $5.0bn Total Deposits: $12.5bn

Consumer

4.0%

Commercial

26.2%

CRE

29.0%

C&D

3.2%

Res Mtg

19.7%

Consumer

21.9%

Commercial

26.2%

CRE

30.5%

C&D

3.9%

Res Mtg

24.7%

Consumer

14.8%

L

o

a

n

C

o

m

p

o

s

i

t

i

o

n

Chemical Financial Corporation Talmer Bancorp, Inc. Pro Forma(1)

D

e

p

o

s

i

t

C

o

m

p

o

s

i

t

i

o

n

Chemical Financial Corporation Talmer Bancorp, Inc. Pro Forma(1)

14

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

0.80

0.90

$

P

e

r

S

h

a

r

e

Performance & Expectations

SNL Core EPS Common Dividend

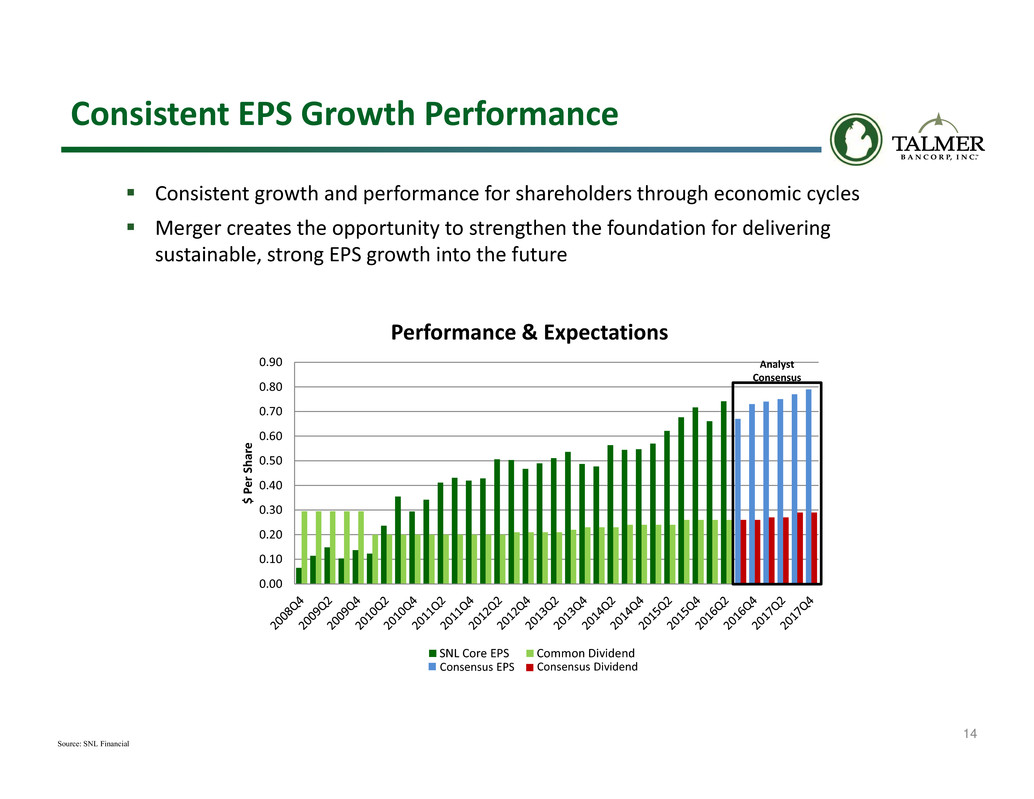

Consistent EPS Growth Performance

Analyst

Consensus

Consistent growth and performance for shareholders through economic cycles

Merger creates the opportunity to strengthen the foundation for delivering

sustainable, strong EPS growth into the future

Source: SNL Financial

Consensus EPS Consensus Dividend

15

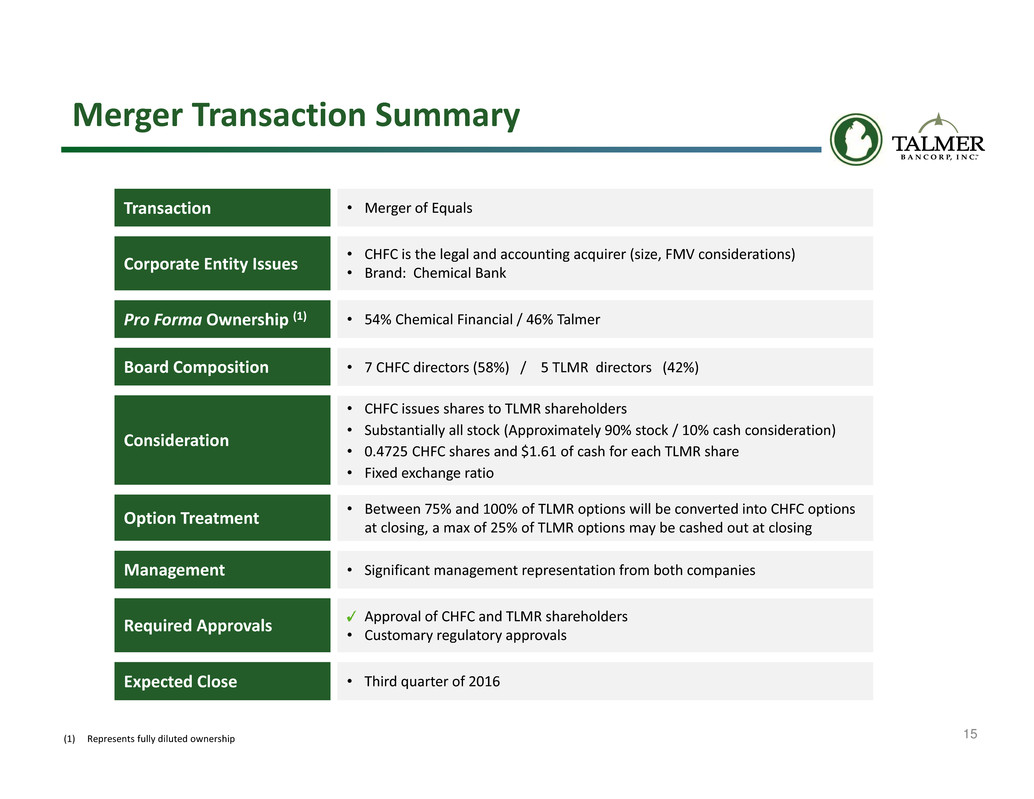

Merger Transaction Summary

Corporate Entity Issues

Consideration

Management

Board Composition

Required Approvals

Expected Close • Third quarter of 2016

Approval of CHFC and TLMR shareholders

• Customary regulatory approvals

• 7 CHFC directors (58%) / 5 TLMR directors (42%)

• Significant management representation from both companies

Option Treatment

• Between 75% and 100% of TLMR options will be converted into CHFC options

at closing, a max of 25% of TLMR options may be cashed out at closing

• CHFC issues shares to TLMR shareholders

• Substantially all stock (Approximately 90% stock / 10% cash consideration)

• 0.4725 CHFC shares and $1.61 of cash for each TLMR share

• Fixed exchange ratio

• CHFC is the legal and accounting acquirer (size, FMV considerations)

• Brand: Chemical Bank

(1) Represents fully diluted ownership

Transaction • Merger of Equals

Pro Forma Ownership (1) • 54% Chemical Financial / 46% Talmer

Closing Remarks and Questions

KBW Community Bank Investor Conference

Appendix I

Chemical Financial Corporation

2016 Second Quarter

Earnings Results

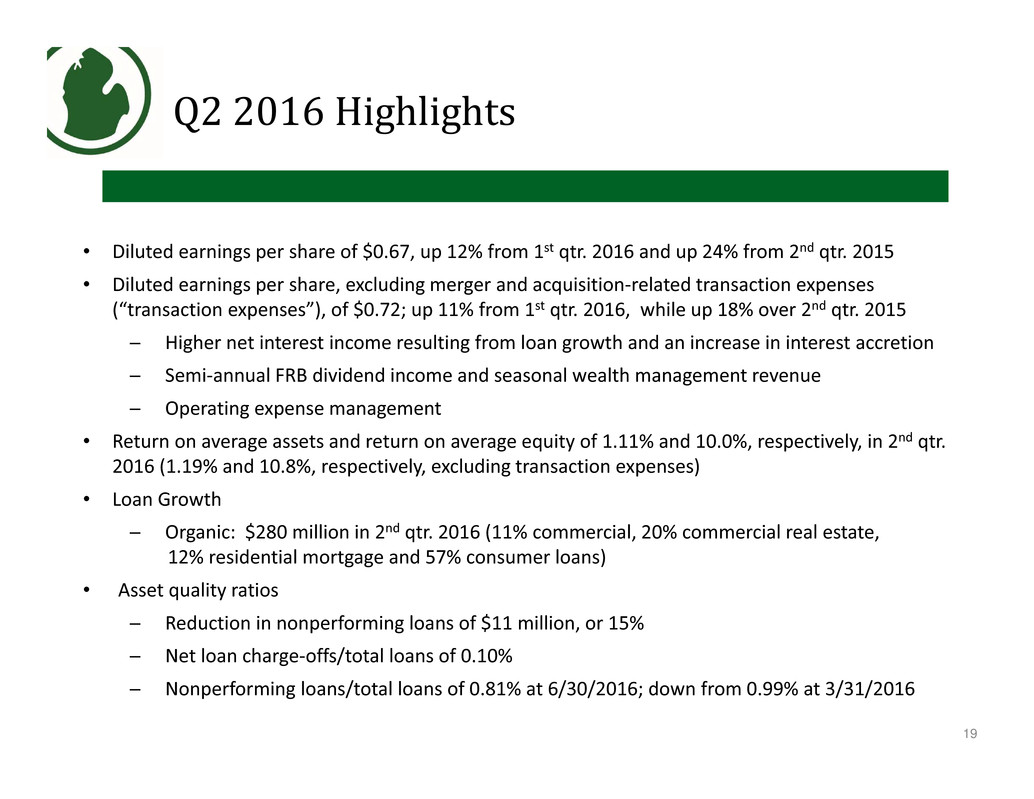

Q2 2016 Highlights

19

• Diluted earnings per share of $0.67, up 12% from 1st qtr. 2016 and up 24% from 2nd qtr. 2015

• Diluted earnings per share, excluding merger and acquisition‐related transaction expenses

(“transaction expenses”), of $0.72; up 11% from 1st qtr. 2016, while up 18% over 2nd qtr. 2015

─ Higher net interest income resulting from loan growth and an increase in interest accretion

─ Semi‐annual FRB dividend income and seasonal wealth management revenue

─ Operating expense management

• Return on average assets and return on average equity of 1.11% and 10.0%, respectively, in 2nd qtr.

2016 (1.19% and 10.8%, respectively, excluding transaction expenses)

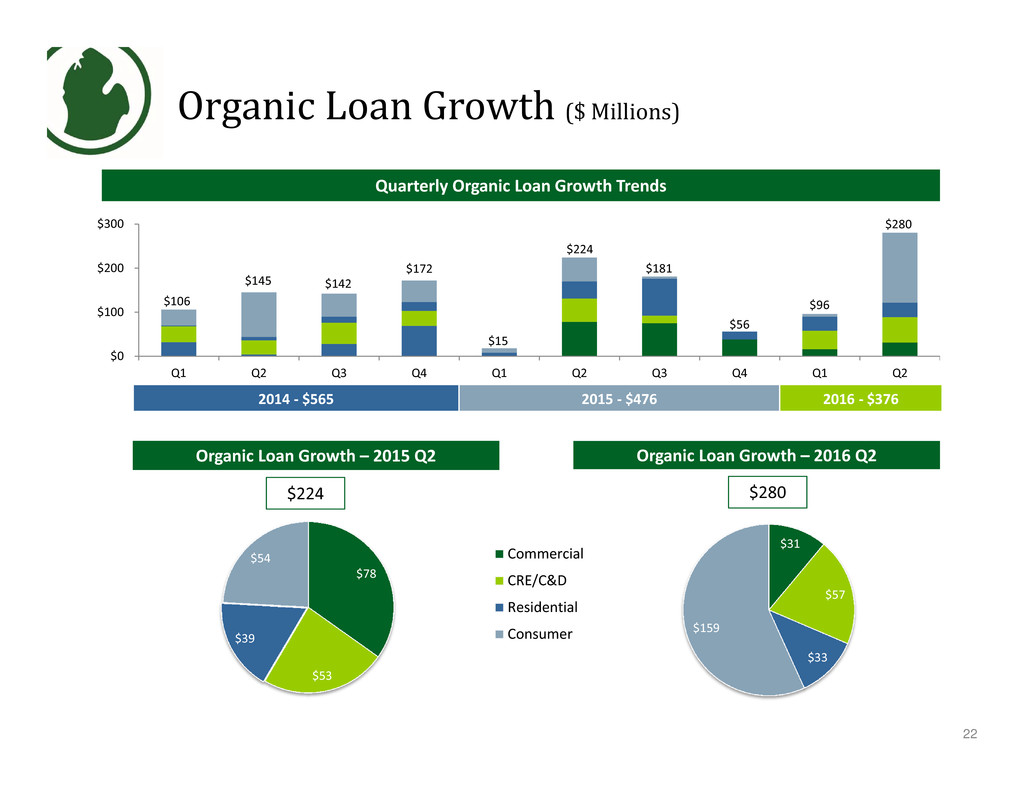

• Loan Growth

─ Organic: $280 million in 2nd qtr. 2016 (11% commercial, 20% commercial real estate,

12% residential mortgage and 57% consumer loans)

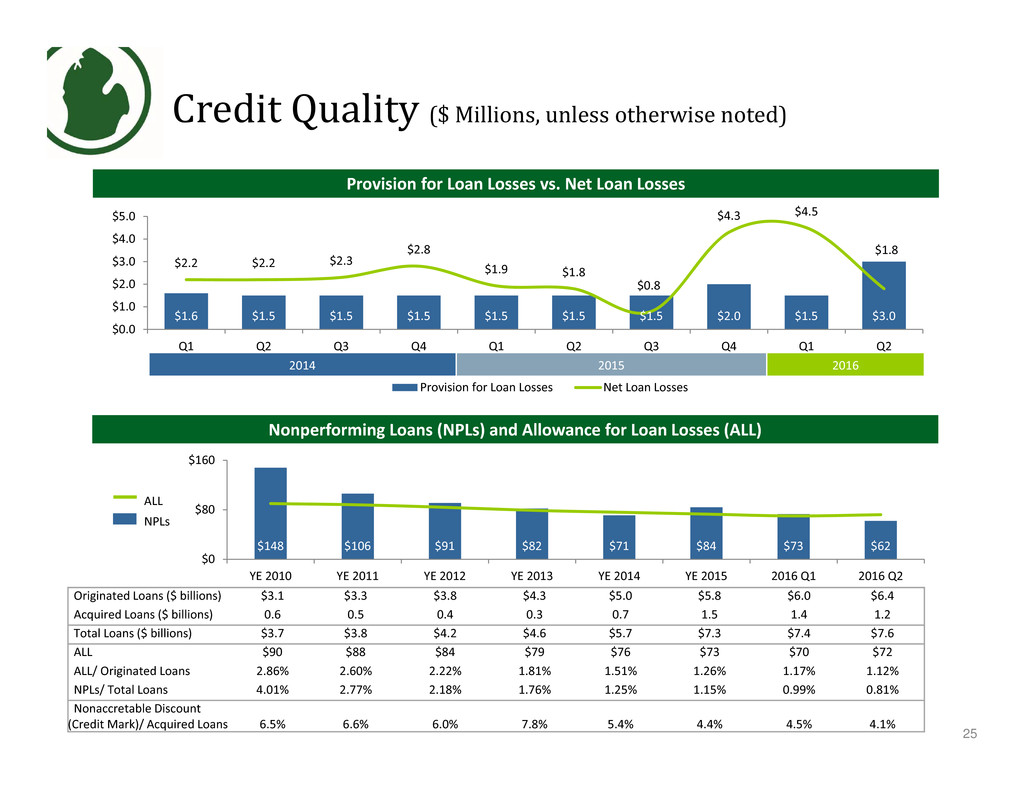

• Asset quality ratios

─ Reduction in nonperforming loans of $11 million, or 15%

─ Net loan charge‐offs/total loans of 0.10%

─ Nonperforming loans/total loans of 0.81% at 6/30/2016; down from 0.99% at 3/31/2016

(in thousands except

per share data)

2016

2nd Qtr.

2016

1st Qtr.

2015

2nd Qtr.

Net interest income $77,495 $74,330 $65,735

Provision for loan losses 3,000 1,500 1,500

Noninterest income 20,897 19,419 20,674

Operating expenses(1) 56,031 56,293 53,328

Transaction expenses 3,054 2,594 3,457

Net income 25,707 23,262 19,024

Net Income, excl. transaction expenses 27,692 24,948 21,683

Diluted EPS 0.67 0.60 0.54

Diluted EPS, excl. transaction expenses 0.72 0.65 0.61

Avg. Diluted Shares Outstanding 38,600 38,521 35,397

Return on Avg. Assets 1.11% 1.01% 0.94%

Return on Avg. Shareholders’ Equity 10.0% 9.2% 8.6%

Efficiency Ratio 55.1% 58.8% 60.5%

Tangible Equity/Total Assets 8.2% 8.2% 7.8%

Tangible Book Value/Share $19.68 $19.20 $17.89

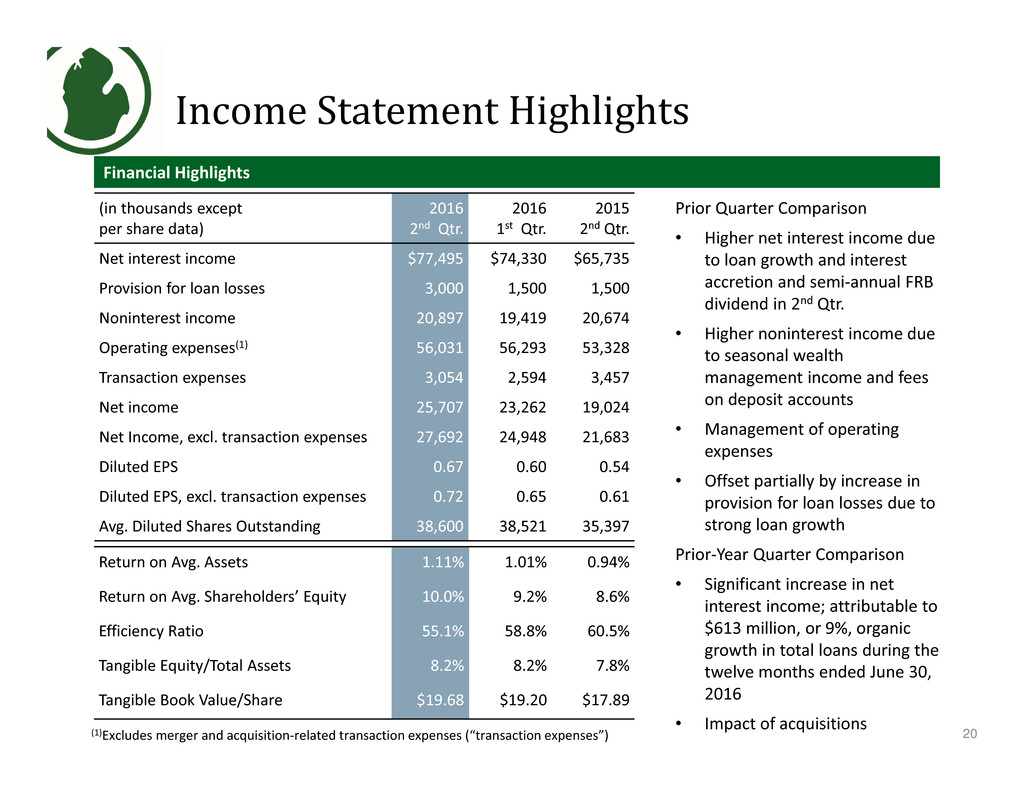

Income Statement Highlights

Financial Highlights

20

Prior Quarter Comparison

• Higher net interest income due

to loan growth and interest

accretion and semi‐annual FRB

dividend in 2nd Qtr.

• Higher noninterest income due

to seasonal wealth

management income and fees

on deposit accounts

• Management of operating

expenses

• Offset partially by increase in

provision for loan losses due to

strong loan growth

Prior‐Year Quarter Comparison

• Significant increase in net

interest income; attributable to

$613 million, or 9%, organic

growth in total loans during the

twelve months ended June 30,

2016

• Impact of acquisitions

(1)Excludes merger and acquisition‐related transaction expenses (“transaction expenses”)

$13.8 $16.2

$16.8 $15.3 $17.8

$19.0

$24.5

$25.5

$23.3

$25.7$0.47

$0.72

$0.00

$0.50

$1.00

$0.0

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

EP

S

N

e

t

I

n

c

o

m

e

Transaction Expenses (after‐tax)

Net Income

EPS, Excluding Transaction Expenses

Net Income

2014 2015 2016

Net Income Trending Upward ($ Millions, except EPS data)

21

(1)Net Income

(2)Net Income, excluding transaction expenses (Non‐GAAP)

2015 Total: $86.8(1); $92.3(2)2014 Total: $62.1(1); $66.7(2) 2016 YTD: $49.0(1); $52.6(2)

$21.7

$27.7

$24.9

$16.7

$78

$53

$39

$54

$31

$57

$33

$159

Commercial

CRE/C&D

Residential

Consumer

$0

$100

$200

$300

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

Organic Loan Growth ($ Millions)

22

Quarterly Organic Loan Growth Trends

Organic Loan Growth – 2016 Q2Organic Loan Growth – 2015 Q2

2014 ‐ $565 2015 ‐ $476 2016 ‐ $376

$106

$145 $142

$15

$172

$224

$181

$280

$56

$280$224

$96

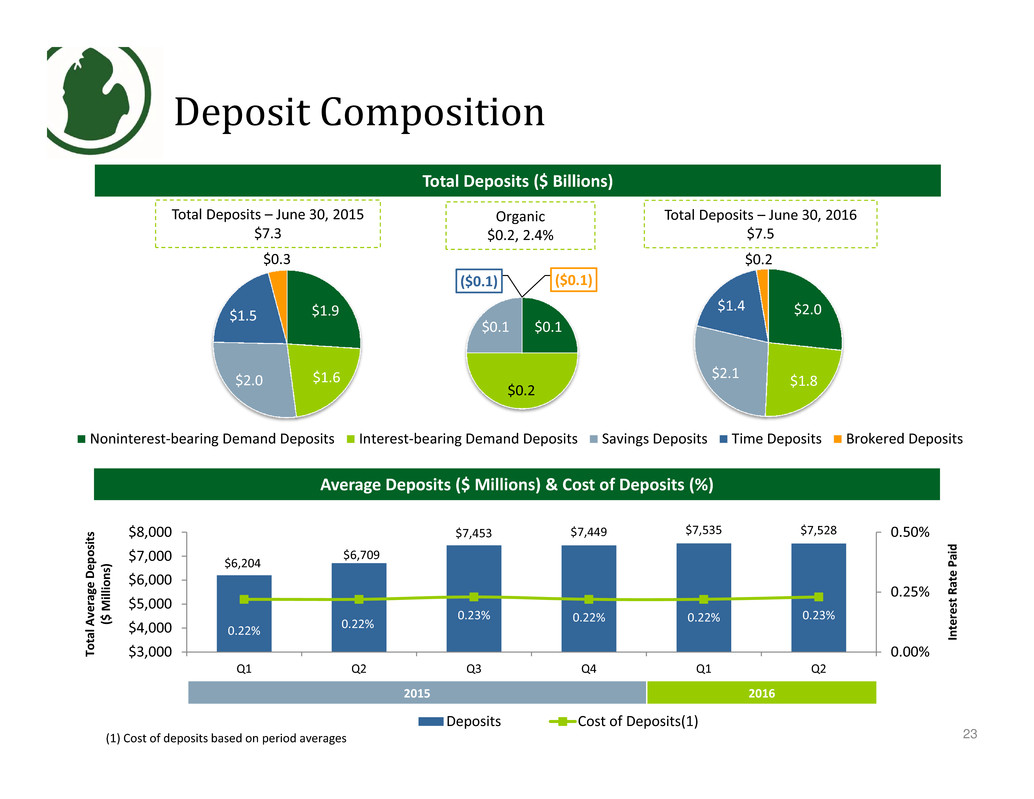

$2.0

$1.8 $2.1

$1.4

$0.2

Noninterest‐bearing Demand Deposits Interest‐bearing Demand Deposits Savings Deposits Time Deposits Brokered Deposits

$6,204

$6,709

$7,453 $7,449 $7,535 $7,528

0.22% 0.22%

0.23% 0.22% 0.22% 0.23%

0.00%

0.25%

0.50%

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

Q1 Q2 Q3 Q4 Q1 Q2

I

n

t

e

r

e

s

t

R

a

t

e

P

a

i

d

T

o

t

a

l

A

v

e

r

a

g

e

D

e

p

o

s

i

t

s

(

$

M

i

l

l

i

o

n

s

)

Deposits Cost of Deposits(1)

$1.9

$1.6 $2.0

$1.5

$0.3

Deposit Composition

23(1) Cost of deposits based on period averages

Average Deposits ($ Millions) & Cost of Deposits (%)

Total Deposits ($ Billions)

2015 2016

Total Deposits – June 30, 2015

$7.3

Total Deposits – June 30, 2016

$7.5

$0.1

$0.2

$0.1

($0.1) ($0.1)

Organic

$0.2, 2.4%

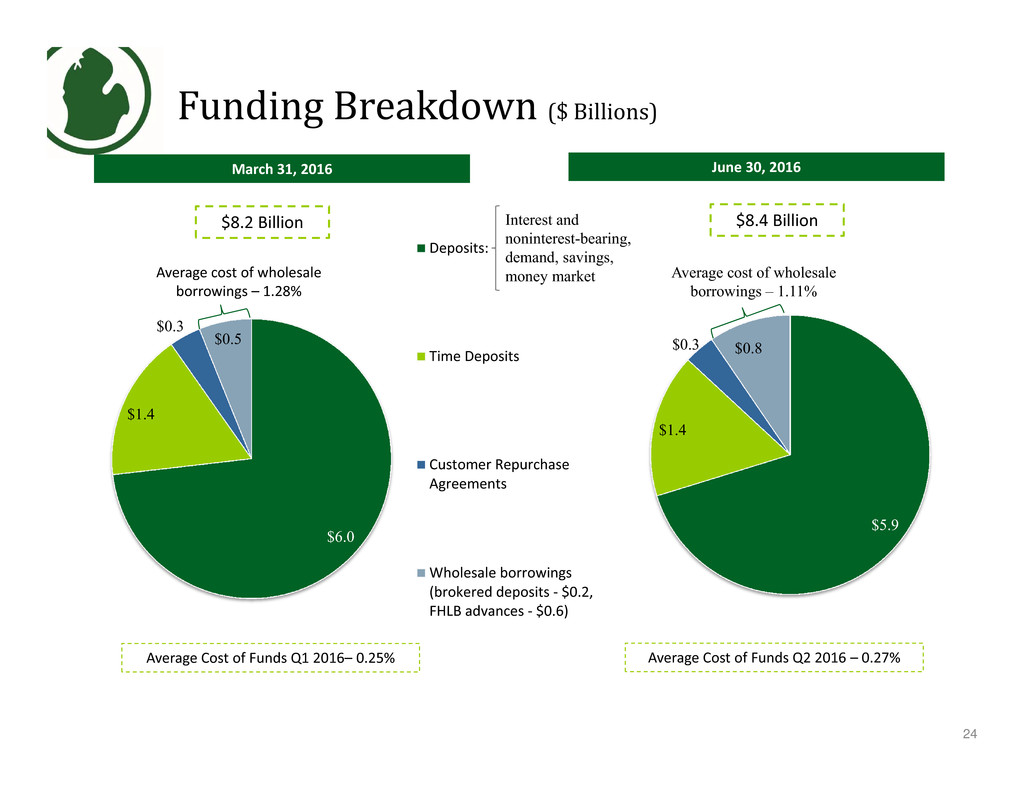

Funding Breakdown ($ Billions)

24

+11.3%

March 31, 2016 June 30, 2016

Average Cost of Funds Q2 2016 – 0.27%Average Cost of Funds Q1 2016– 0.25%

$8.2 Billion $8.4 Billion

$6.0

$1.4

$0.3

$0.5

$5.9

$1.4

$0.3 $0.8

Deposits:

Time Deposits

Customer Repurchase

Agreements

Wholesale borrowings

(brokered deposits ‐ $0.2,

FHLB advances ‐ $0.6)

Interest and

noninterest-bearing,

demand, savings,

money market Average cost of wholesale

borrowings – 1.11%

Average cost of wholesale

borrowings – 1.28%

$1.6 $1.5 $1.5 $1.5 $1.5 $1.5 $1.5 $2.0 $1.5 $3.0

$2.2 $2.2 $2.3

$2.8

$1.9 $1.8

$0.8

$4.3 $4.5

$1.8

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

Provision for Loan Losses Net Loan Losses

$148 $106 $91 $82 $71 $84 $73 $62

$0

$80

$160

YE 2010 YE 2011 YE 2012 YE 2013 YE 2014 YE 2015 2016 Q1 2016 Q2

Credit Quality ($ Millions, unless otherwise noted)

Provision for Loan Losses vs. Net Loan Losses

25

Nonperforming Loans (NPLs) and Allowance for Loan Losses (ALL)

ALL

NPLs

2014 2015 2016

Originated Loans ($ billions) $3.1 $3.3 $3.8 $4.3 $5.0 $5.8 $6.0 $6.4

Acquired Loans ($ billions) 0.6 0.5 0.4 0.3 0.7 1.5 1.4 1.2

Total Loans ($ billions) $3.7 $3.8 $4.2 $4.6 $5.7 $7.3 $7.4 $7.6

ALL $90 $88 $84 $79 $76 $73 $70 $72

ALL/ Originated Loans 2.86% 2.60% 2.22% 1.81% 1.51% 1.26% 1.17% 1.12%

NPLs/ Total Loans 4.01% 2.77% 2.18% 1.76% 1.25% 1.15% 0.99% 0.81%

Nonaccretable Discount

(Credit Mark)/ Acquired Loans 6.5% 6.6% 6.0% 7.8% 5.4% 4.4% 4.5% 4.1%

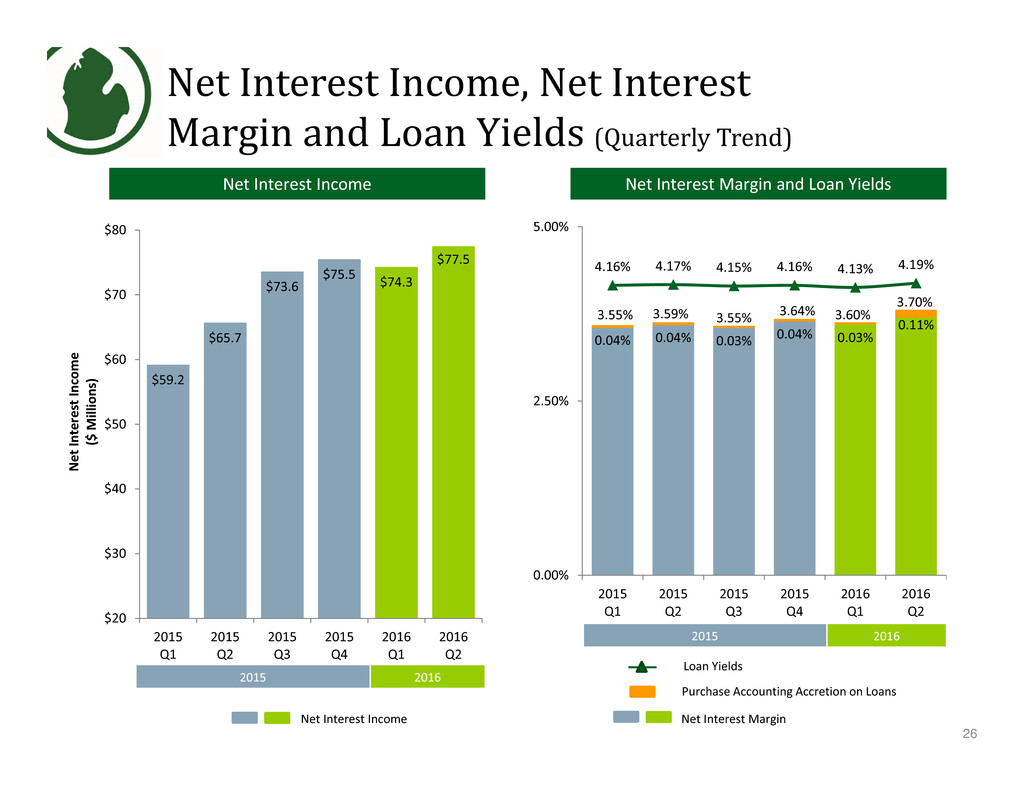

Net Interest Income, Net Interest

Margin and Loan Yields (Quarterly Trend)

Net Interest Income

26

3.55% 3.59% 3.55% 3.64% 3.60%

3.70%

0.04% 0.04% 0.03% 0.04% 0.03%

0.11%

4.16% 4.17% 4.15% 4.16% 4.13% 4.19%

0.00%

2.50%

5.00%

2015

Q1

2015

Q2

2015

Q3

2015

Q4

2016

Q1

2016

Q2

Net Interest Margin and Loan Yields

Net Interest Margin

Purchase Accounting Accretion on Loans

Loan Yields

$59.2

$65.7

$73.6

$75.5 $74.3

$77.5

$20

$30

$40

$50

$60

$70

$80

2015

Q1

2015

Q2

2015

Q3

2015

Q4

2016

Q1

2016

Q2

N

e

t

I

n

t

e

r

e

s

t

I

n

c

o

m

e

(

$

M

i

l

l

i

o

n

s

)

2015 2016

2015 2016

Net Interest Income

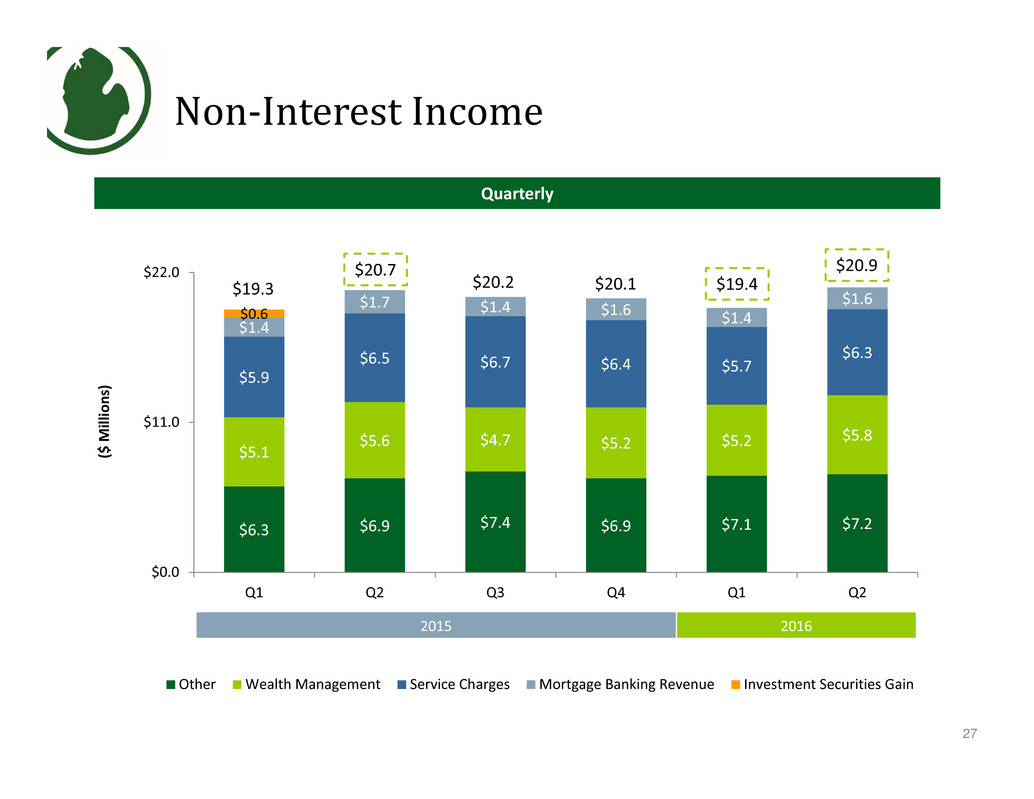

$6.3 $6.9 $7.4 $6.9 $7.1 $7.2

$5.1

$5.6 $4.7 $5.2 $5.2 $5.8

$5.9

$6.5 $6.7 $6.4 $5.7

$6.3

$1.4

$1.7 $1.4 $1.6 $1.4

$1.6

$0.6

$0.0

$11.0

$22.0

Q1 Q2 Q3 Q4 Q1 Q2

Other Wealth Management Service Charges Mortgage Banking Revenue Investment Securities Gain

Non‐Interest Income

2015 2016

Quarterly

(

$

M

i

l

l

i

o

n

s

)

27

$20.7

$19.3 $19.4$20.1$20.2

$20.9

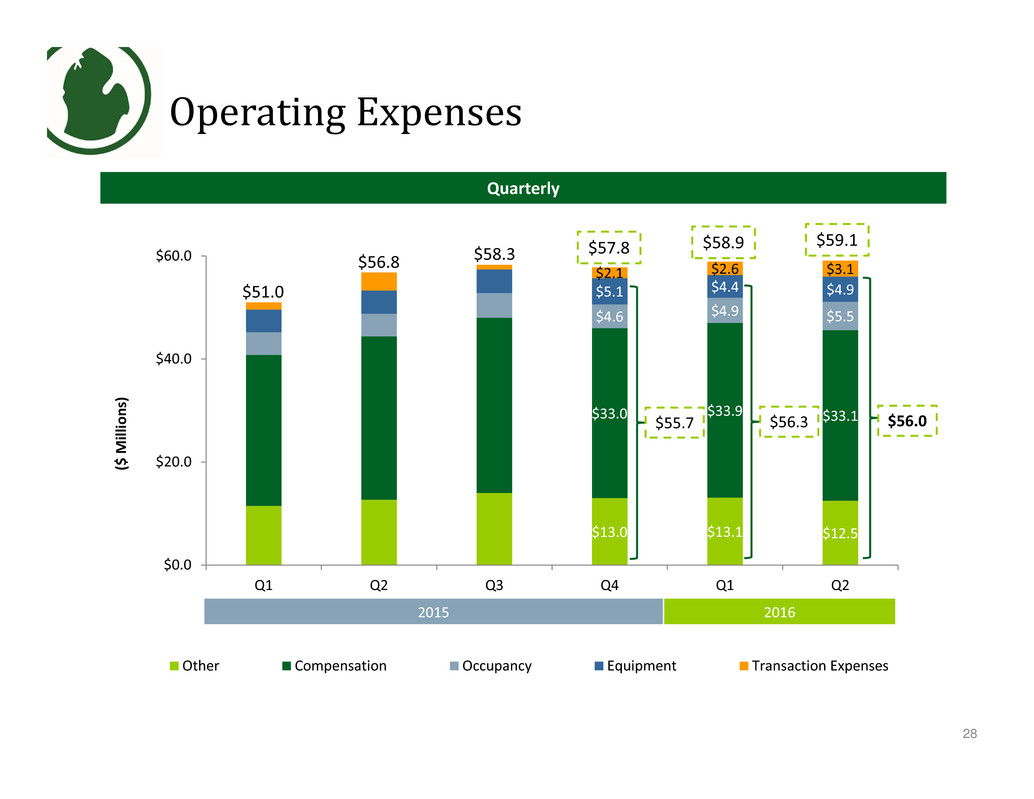

$13.0 $13.1 $12.5

$33.0 $33.9 $33.1

$4.6 $4.9 $5.5

$5.1 $4.4 $4.9

$2.1 $2.6 $3.1

$0.0

$20.0

$40.0

$60.0

Q1 Q2 Q3 Q4 Q1 Q2

Other Compensation Occupancy Equipment Transaction Expenses

Operating Expenses

2015 2016

Quarterly

28

(

$

M

i

l

l

i

o

n

s

)

$56.8

$51.0

$58.3

$56.0

$57.8 $59.1

$56.3

$58.9

$55.7

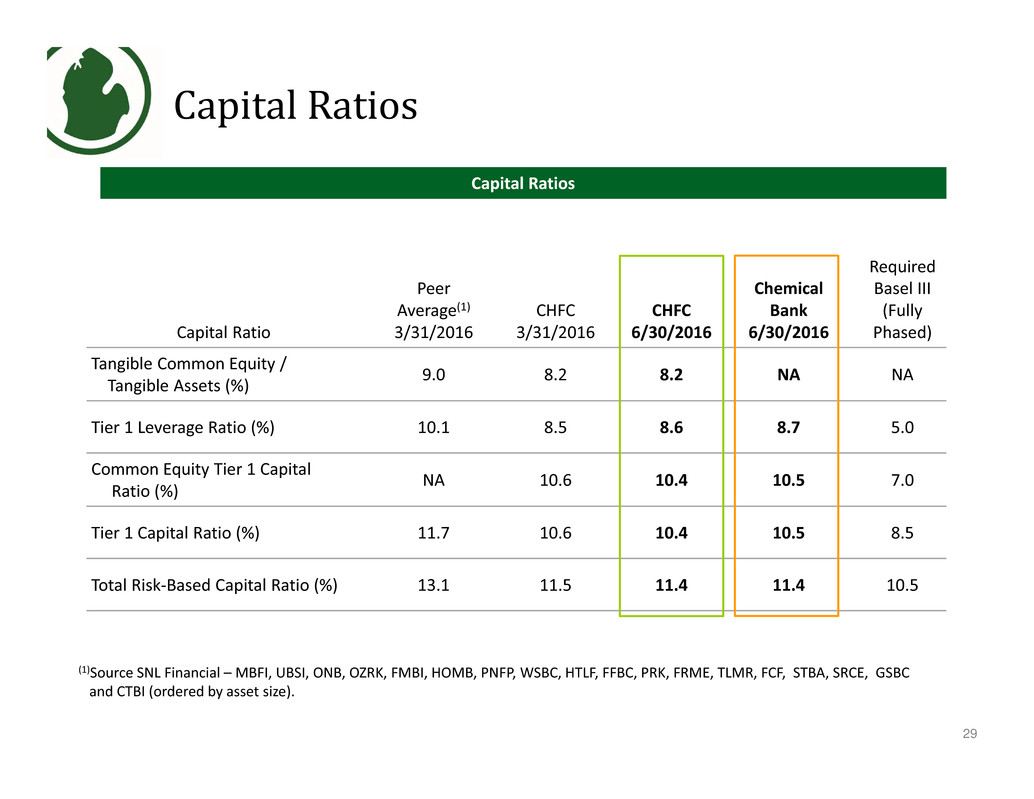

Capital Ratio

Peer

Average(1)

3/31/2016

CHFC

3/31/2016

CHFC

6/30/2016

Chemical

Bank

6/30/2016

Required

Basel III

(Fully

Phased)

Tangible Common Equity /

Tangible Assets (%)

9.0 8.2 8.2 NA NA

Tier 1 Leverage Ratio (%) 10.1 8.5 8.6 8.7 5.0

Common Equity Tier 1 Capital

Ratio (%)

NA 10.6 10.4 10.5 7.0

Tier 1 Capital Ratio (%) 11.7 10.6 10.4 10.5 8.5

Total Risk‐Based Capital Ratio (%) 13.1 11.5 11.4 11.4 10.5

Capital Ratios

29

Capital Ratios

(1)Source SNL Financial – MBFI, UBSI, ONB, OZRK, FMBI, HOMB, PNFP, WSBC, HTLF, FFBC, PRK, FRME, TLMR, FCF, STBA, SRCE, GSBC

and CTBI (ordered by asset size).

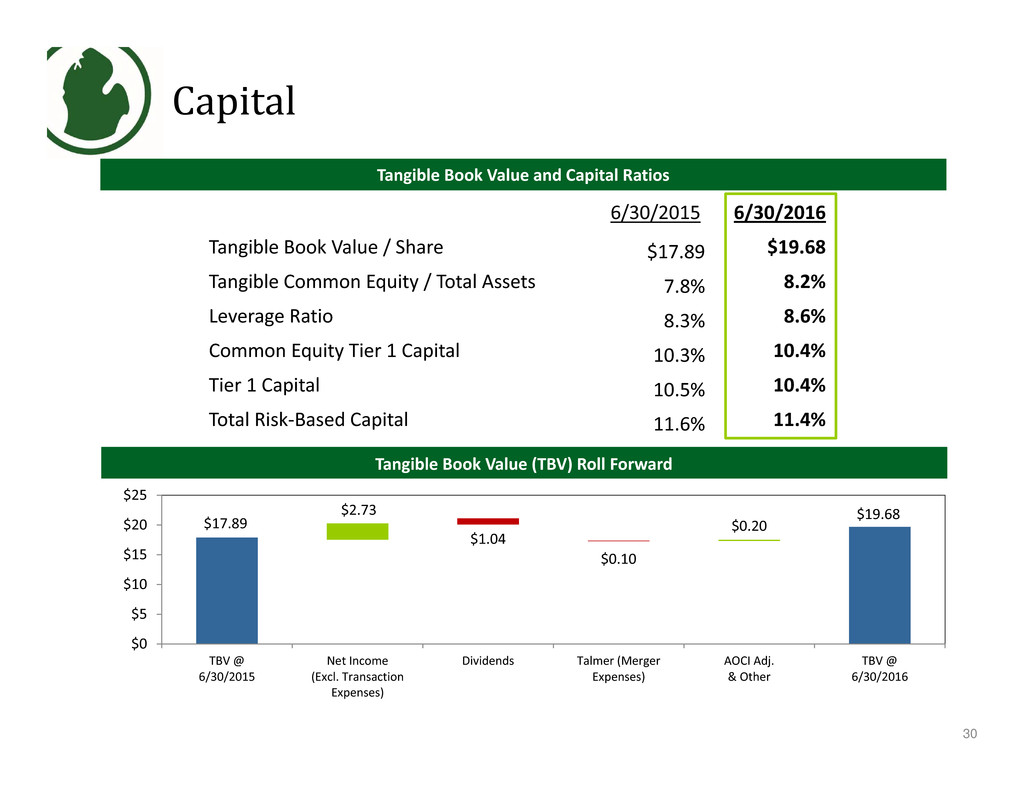

6/30/2015 6/30/2016

Tangible Book Value / Share $17.89 $19.68

Tangible Common Equity / Total Assets 7.8% 8.2%

Leverage Ratio 8.3% 8.6%

Common Equity Tier 1 Capital 10.3% 10.4%

Tier 1 Capital 10.5% 10.4%

Total Risk‐Based Capital 11.6% 11.4%

Capital

$19.68

$1.04

$0.10

$17.89

$2.73

$0.20

$0

$5

$10

$15

$20

$25

TBV @

6/30/2015

Net Income

(Excl. Transaction

Expenses)

Dividends Talmer (Merger

Expenses)

AOCI Adj.

& Other

TBV @

6/30/2016

30

Tangible Book Value and Capital Ratios

Tangible Book Value (TBV) Roll Forward

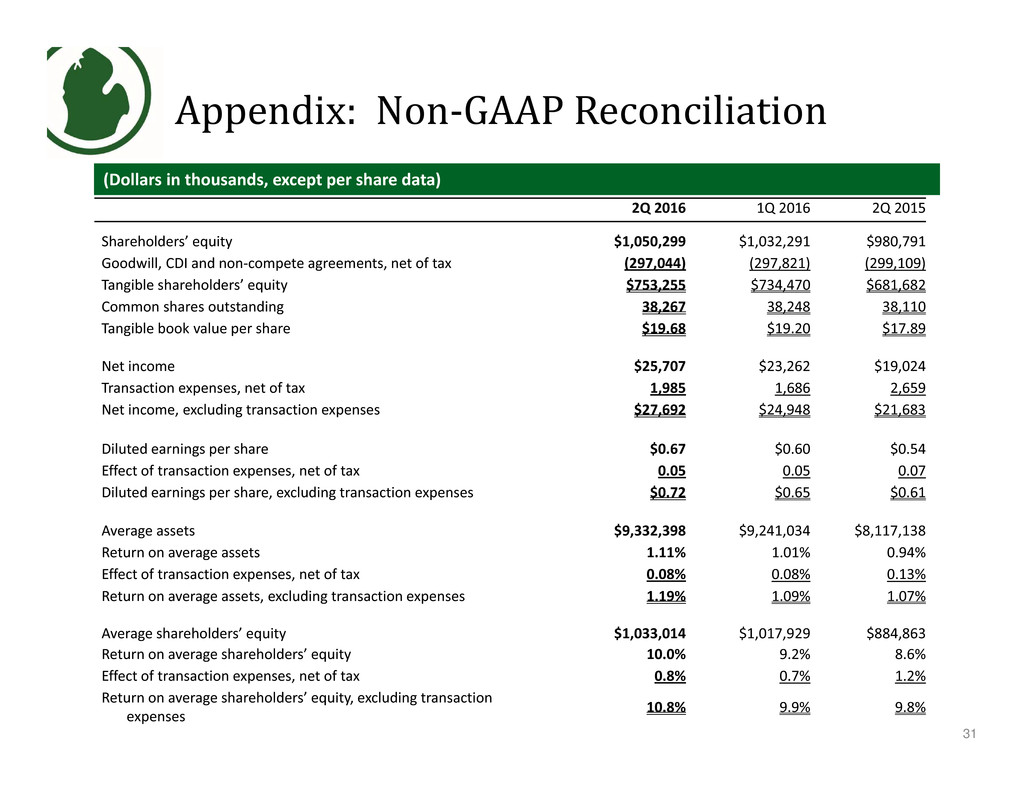

Appendix: Non‐GAAP Reconciliation

(Dollars in thousands, except per share data)

2Q 2016 1Q 2016 2Q 2015

Shareholders’ equity $1,050,299 $1,032,291 $980,791

Goodwill, CDI and non‐compete agreements, net of tax (297,044) (297,821) (299,109)

Tangible shareholders’ equity $753,255 $734,470 $681,682

Common shares outstanding 38,267 38,248 38,110

Tangible book value per share $19.68 $19.20 $17.89

Net income $25,707 $23,262 $19,024

Transaction expenses, net of tax 1,985 1,686 2,659

Net income, excluding transaction expenses $27,692 $24,948 $21,683

Diluted earnings per share $0.67 $0.60 $0.54

Effect of transaction expenses, net of tax 0.05 0.05 0.07

Diluted earnings per share, excluding transaction expenses $0.72 $0.65 $0.61

Average assets $9,332,398 $9,241,034 $8,117,138

Return on average assets 1.11% 1.01% 0.94%

Effect of transaction expenses, net of tax 0.08% 0.08% 0.13%

Return on average assets, excluding transaction expenses 1.19% 1.09% 1.07%

Average shareholders’ equity $1,033,014 $1,017,929 $884,863

Return on average shareholders’ equity 10.0% 9.2% 8.6%

Effect of transaction expenses, net of tax 0.8% 0.7% 1.2%

Return on average shareholders’ equity, excluding transaction

expenses

10.8% 9.9% 9.8%

31

Appendix II

Talmer Bancorp

2016 Second Quarter

Earnings Results

(1) Denotes a non-GAAP financial measure, see section entitled “Reconciliation of Non-GAAP Financial Measures”

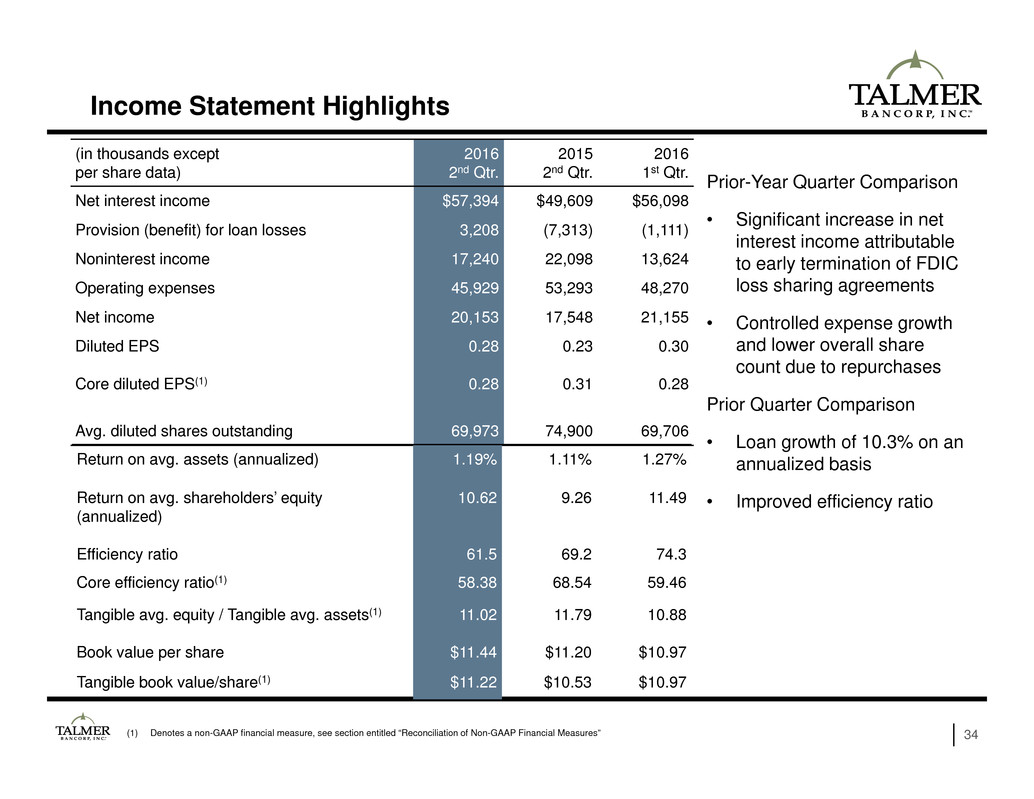

Income Statement Highlights

34

(in thousands except

per share data)

2016

2nd Qtr.

2015

2nd Qtr.

2016

1st Qtr.

Net interest income $57,394 $49,609 $56,098

Provision (benefit) for loan losses 3,208 (7,313) (1,111)

Noninterest income 17,240 22,098 13,624

Operating expenses 45,929 53,293 48,270

Net income 20,153 17,548 21,155

Diluted EPS

Core diluted EPS(1)

0.28

0.28

0.23

0.31

0.30

0.28

Avg. diluted shares outstanding 69,973 74,900 69,706

Return on avg. assets (annualized) 1.19% 1.11% 1.27%

Return on avg. shareholders’ equity

(annualized)

Efficiency ratio

10.62

61.5

9.26

69.2

11.49

74.3

Core efficiency ratio(1) 58.38 68.54 59.46

Tangible avg. equity / Tangible avg. assets(1)

Book value per share

11.02

$11.44

11.79

$11.20

10.88

$10.97

Tangible book value/share(1) $11.22 $10.53 $10.97

Prior-Year Quarter Comparison

• Significant increase in net

interest income attributable

to early termination of FDIC

loss sharing agreements

• Controlled expense growth

and lower overall share

count due to repurchases

Prior Quarter Comparison

• Loan growth of 10.3% on an

annualized basis

• Improved efficiency ratio

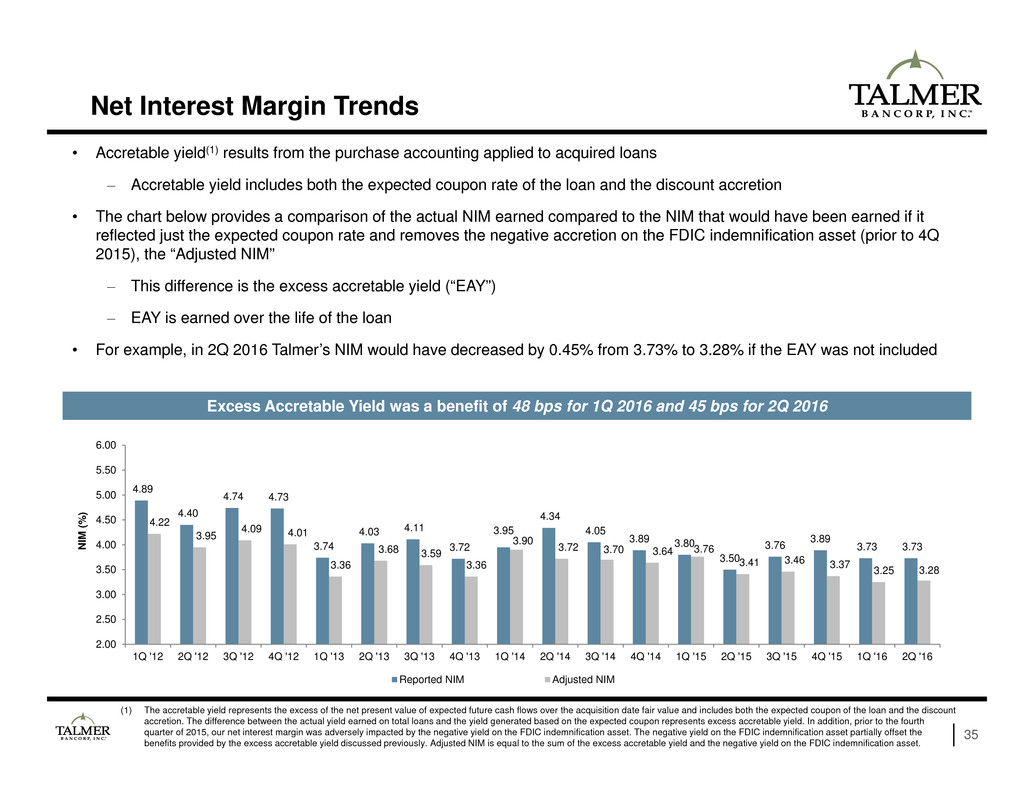

• Accretable yield(1) results from the purchase accounting applied to acquired loans

– Accretable yield includes both the expected coupon rate of the loan and the discount accretion

• The chart below provides a comparison of the actual NIM earned compared to the NIM that would have been earned if it

reflected just the expected coupon rate and removes the negative accretion on the FDIC indemnification asset (prior to 4Q

2015), the “Adjusted NIM”

– This difference is the excess accretable yield (“EAY”)

– EAY is earned over the life of the loan

• For example, in 2Q 2016 Talmer’s NIM would have decreased by 0.45% from 3.73% to 3.28% if the EAY was not included

Net Interest Margin Trends

35

Excess Accretable Yield was a benefit of 48 bps for 1Q 2016 and 45 bps for 2Q 2016

(1) The accretable yield represents the excess of the net present value of expected future cash flows over the acquisition date fair value and includes both the expected coupon of the loan and the discount

accretion. The difference between the actual yield earned on total loans and the yield generated based on the expected coupon represents excess accretable yield. In addition, prior to the fourth

quarter of 2015, our net interest margin was adversely impacted by the negative yield on the FDIC indemnification asset. The negative yield on the FDIC indemnification asset partially offset the

benefits provided by the excess accretable yield discussed previously. Adjusted NIM is equal to the sum of the excess accretable yield and the negative yield on the FDIC indemnification asset.

4.89

4.40

4.74 4.73

3.74

4.03 4.11

3.72

3.95

4.34

4.05

3.89 3.80

3.50

3.76 3.89 3.73 3.73

4.22

3.95

4.09 4.01

3.36

3.68 3.59

3.36

3.90 3.72 3.70 3.64 3.76

3.41 3.46 3.37 3.25 3.28

2.00

2.50

3.00

3.50

4.00

4.50

5.00

5.50

6.00

1Q '12 2Q '12 3Q '12 4Q '12 1Q '13 2Q '13 3Q '13 4Q '13 1Q '14 2Q '14 3Q '14 4Q '14 1Q '15 2Q '15 3Q '15 4Q '15 1Q '16 2Q '16

N

I

M

(

%

)

Reported NIM Adjusted NIM

36

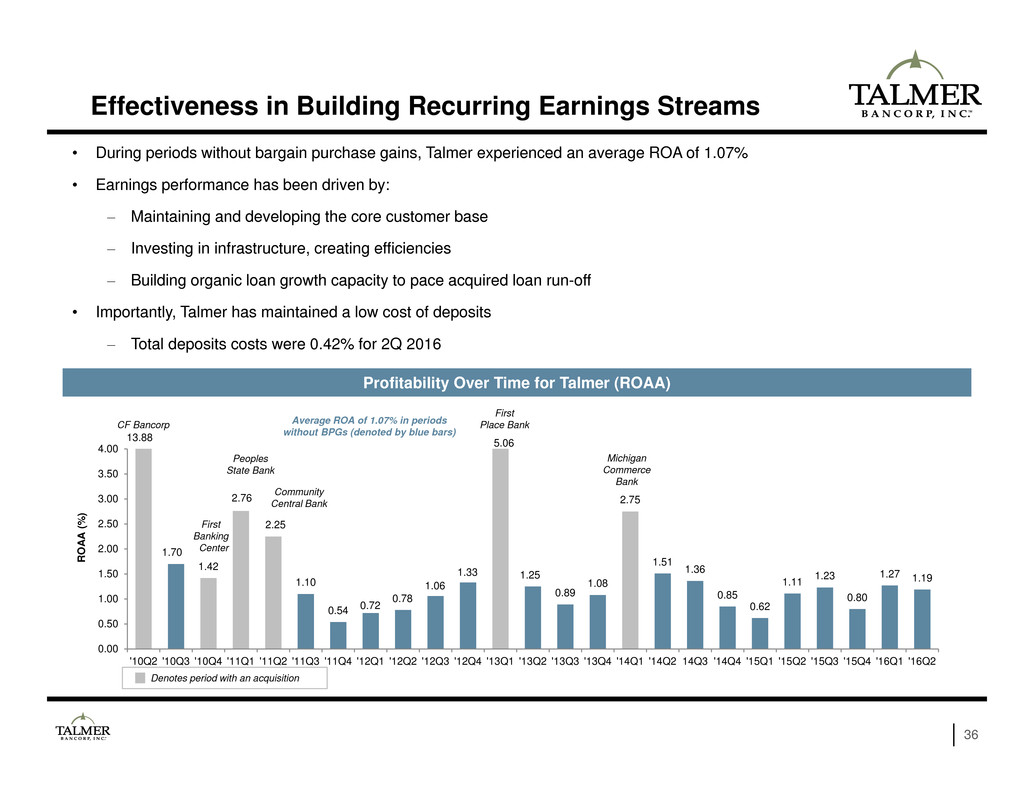

Effectiveness in Building Recurring Earnings Streams

• During periods without bargain purchase gains, Talmer experienced an average ROA of 1.07%

• Earnings performance has been driven by:

– Maintaining and developing the core customer base

– Investing in infrastructure, creating efficiencies

– Building organic loan growth capacity to pace acquired loan run-off

• Importantly, Talmer has maintained a low cost of deposits

– Total deposits costs were 0.42% for 2Q 2016

Profitability Over Time for Talmer (ROAA)

13.88

Average ROA of 1.07% in periods

without BPGs (denoted by blue bars)

CF Bancorp

First

Banking

Center

Peoples

State Bank

Community

Central Bank

First

Place Bank

5.06

Michigan

Commerce

Bank

Denotes period with an acquisition

1.70

1.42

2.76

2.25

1.10

0.54 0.72

0.78

1.06

1.33 1.25

0.89

1.08

2.75

1.51

1.36

0.85

0.62

1.11 1.23

0.80

1.27 1.19

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

'10Q2 '10Q3 '10Q4 '11Q1 '11Q2 '11Q3 '11Q4 '12Q1 '12Q2 '12Q3 '12Q4 '13Q1 '13Q2 '13Q3 '13Q4 '14Q1 '14Q2 14Q3 '14Q4 '15Q1 '15Q2 '15Q3 '15Q4 '16Q1 '16Q2

R

O

A

A

(

%

)

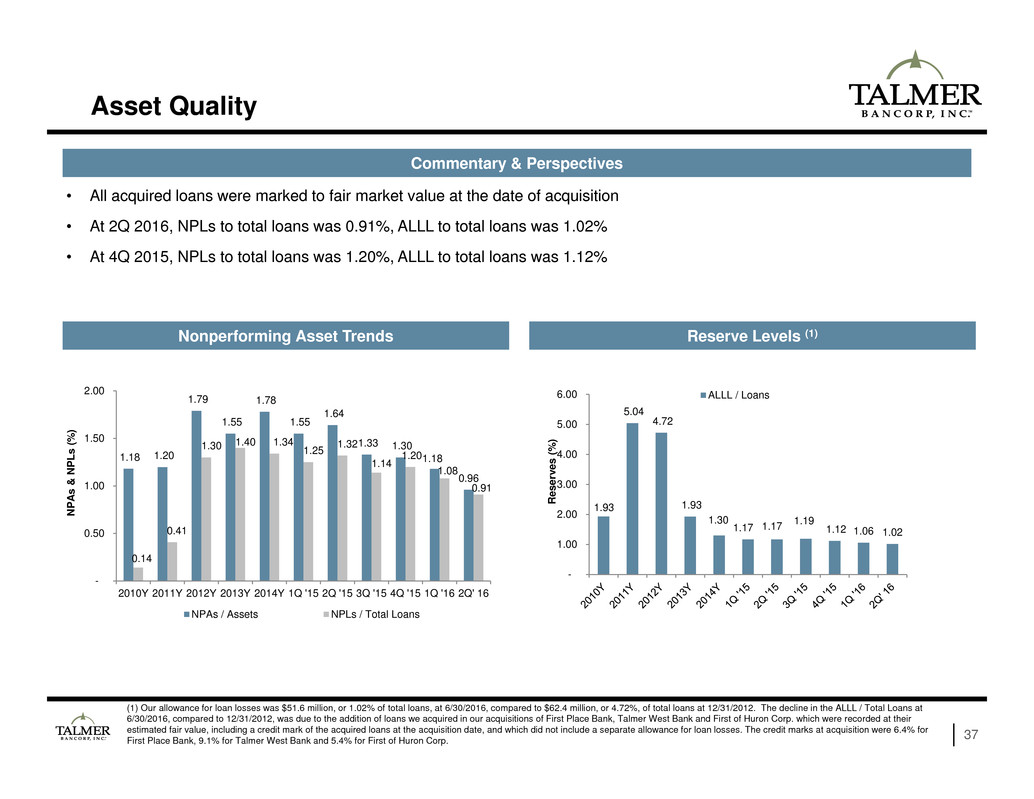

(1) Our allowance for loan losses was $51.6 million, or 1.02% of total loans, at 6/30/2016, compared to $62.4 million, or 4.72%, of total loans at 12/31/2012. The decline in the ALLL / Total Loans at

6/30/2016, compared to 12/31/2012, was due to the addition of loans we acquired in our acquisitions of First Place Bank, Talmer West Bank and First of Huron Corp. which were recorded at their

estimated fair value, including a credit mark of the acquired loans at the acquisition date, and which did not include a separate allowance for loan losses. The credit marks at acquisition were 6.4% for

First Place Bank, 9.1% for Talmer West Bank and 5.4% for First of Huron Corp. 37

Asset Quality

• All acquired loans were marked to fair market value at the date of acquisition

• At 2Q 2016, NPLs to total loans was 0.91%, ALLL to total loans was 1.02%

• At 4Q 2015, NPLs to total loans was 1.20%, ALLL to total loans was 1.12%

Commentary & Perspectives

Nonperforming Asset Trends Reserve Levels (1)

1.18 1.20

1.79

1.55

1.78

1.55

1.64

1.33 1.30

1.18

0.96

0.14

0.41

1.30 1.40 1.34 1.25

1.32

1.14

1.20

1.08

0.91

-

0.50

1.00

1.50

2.00

2010Y 2011Y 2012Y 2013Y 2014Y 1Q '15 2Q '15 3Q '15 4Q '15 1Q '16 2Q' 16

N

P

A

s

&

N

P

L

s

(

%

)

NPAs / Assets NPLs / Total Loans

1.93

5.04

4.72

1.93

1.30

1.17 1.17

1.19

1.12 1.06 1.02

-

1.00

2.00

3.00

4.00

5.00

6.00

R

e

s

e

r

v

e

s

(

%

)

ALLL / Loans

38

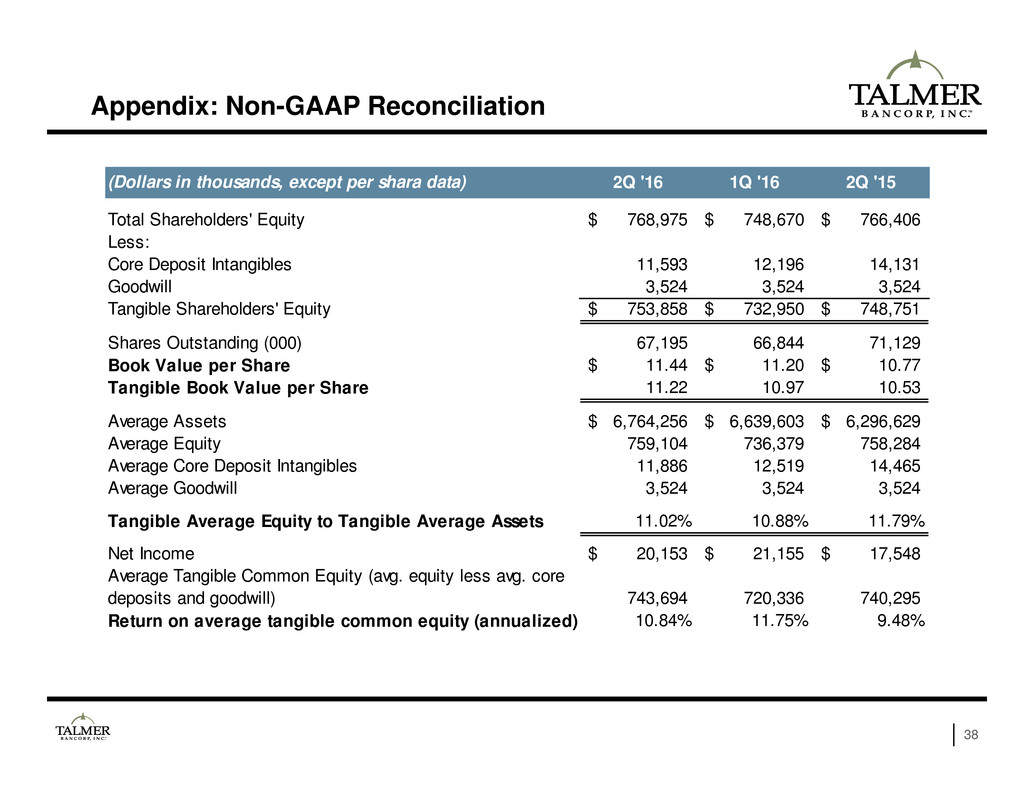

Appendix: Non-GAAP Reconciliation

(Dollars in thousands, except per shara data) 2Q '16 1Q '16 2Q '15

Total Shareholders' Equity 768,975$ 748,670$ 766,406$

Less:

Core Deposit Intangibles 11,593 12,196 14,131

Goodwill 3,524 3,524 3,524

Tangible Shareholders' Equity 753,858$ 732,950$ 748,751$

Shares Outstanding (000) 67,195 66,844 71,129

Book Value per Share 11.44$ 11.20$ 10.77$

Tangible Book Value per Share 11.22 10.97 10.53

Average Assets 6,764,256$ 6,639,603$ 6,296,629$

Average Equity 759,104 736,379 758,284

Average Core Deposit Intangibles 11,886 12,519 14,465

Average Goodwill 3,524 3,524 3,524

Tangible Average Equity to Tangible Average Assets 11.02% 10.88% 11.79%

Net Income 20,153$ 21,155$ 17,548$

Average Tangible Common Equity (avg. equity less avg. core

deposits and goodwill) 743,694 720,336 740,295

Return on average tangible common equity (annualized) 10.84% 11.75% 9.48%

39

Appendix: Non-GAAP Reconciliation

(Dollars in thousands, except per shara data) 2Q '16 1Q '16 2Q '15

Net interest income 57,394$ 56,098$ 49,609$

Noninterest income 17,240 13,624 22,098

Total revenue 74,634 69,722 71,707

Less:

(Expense)/benefit due to change in the fair value of loan

servicing rights (3,499) (6,625) 3,146

FDIC loss sharing income - - (5,928)

Total core revenue 78,133$ 76,347$ 74,489$

Total noninterest expense 45,929 48,270 53,293

Less:

Transaction and integration related costs 312 2,874 419

Property efficiency review - - 1,820

Total core noninterest expense 45,617$ 45,396$ 51,054$

Efficiency ratio 61.5% 69.2% 74.3%

Core efficiency ratio 58.4% 59.5% 68.5%

Diluted EPS available to common shareholders 0.28$ 0.30$ 0.23$

Impact to pre-tax net income due to non-core items listed above (3,811)$ (9,499)$ (5,021)$

Estimated income tax impact of above non-core items 1,212 3,022 1,597

Excess tax benefit realized 2,612 1,472 -

Benefit due to finaliztion of IRS settlement - 4,306

After-tax impact of non-core items 13 (699) (3,424)

Portion of non-core items applicable to common shareholders - (21) (34)

Impact of non-core items applicable to common shareholders 13 (720) (3,458)

Weighted average common shares outstanding - diluted 70,026 69,706 74,900

Impact to diluted EPS of non-core items -$ (0.01)$ (0.05)$

Core diluted EPS of non-core items 0.28$ 0.31$ 0.28$