Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Hilton Worldwide Holdings Inc. | d228913d8k.htm |

| Exhibit 99.1

|

Lender Presentation

August 2, 2016

|

|

Disclaimer

This presentation and information contained herein constitutes confidential information and is provided to you on the condition that you will hold it in strict confidence and not reproduce, disclose, forward or distribute it in whole or in part without the prior written consent of Hilton Worldwide Holdings Inc. (“Hilton”).

This presentation is not an offer to sell or the solicitation of an offer to buy any securities of the company, nor will there be any sales of securities of the company in any jurisdiction in which theoffer, solicitation or salewould beunlawful prior to registration or qualification under the securities laws of any such jurisdiction.

This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements related to our expectations regarding the performance of our business, our financial results, our liquidity and capital resources, the proposed spin-offs and other non-historical statements. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “approximately,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties, including, among others, risks inherent to the hospitality, lodging real estate and timeshare industries, risks related to financing transactions expected to be consummated in connection with the spin-offs, macroeconomic factors beyond our control, competition for hotel guests, management and franchise agreements and timeshare sales, risks related to doing business with third-party hotel owners, our significant investments in owned and leased real estate, performance of our information technology systems, growth of reservation channels outside of our system, risks of doing business outside of the United States and our indebtedness, as well as those described under the section entitled “Risk Factors” in Hilton Worldwide Holdings Inc.’s Annual Report on Form 10-K for the year ended December 31, 2015, as such factors may be updated from time to time in our periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this presentation and in our filings with the SEC. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

This presentation includes certain non-GAAP financial measures, including Adjusted earnings before interest expense, taxes, depreciation and amortization (“Adj. EBITDA”), Adj. EBITDA Margin, Net Debt, Net Debt / Adj. EBITDA and unlevered free cash flow. Non-GAAP financial measures Adj. EBITDA, Adj. EBITDA Margin, Net Debt, Net Debt / Adj. EBITDA and unlevered free cash flow should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with U.S. GAAP. Please refer to the Appendix and footnotes of this presentation for a reconciliation of the historical non-GAAP financial measures included in this presentation to the most directly comparable financial measures prepared in accordance with U.S. GAAP.

This presentation includes certain pro forma information for Hilton RemainCo after giving effect to completion of the proposed spin-off of Park Hotels & Resorts (“Park”) and Hilton Grand Vacations (“HGV”). Hilton RemainCo pro forma LTM 6/30/2016 financial information represents pro forma results for Hilton RemainCo for FY 2015, plus pro forma results for Hilton RemainCo for the six months ended June 30, 2016, minus pro forma results for Hilton RemainCo for the six months ended June 30, 2015. The pro forma results for the six months ended June 30, 2015 represents the simple summation of results for Hilton, minus results for Park and HGV, and adjusted as described in the Appendix to this presentation. This calculation does not represent pro forma results prepared in accordance with Regulation S-X and does not include all adjustments that might be required under Regulation S-X, and actual pro forma results could differ materially. Accordingly, results for the six months ended June 30, 2015 are not necessarily comparable to results set out above on pro forma basis for other periods, and investors should not place undue reliance on these numbers

Slide 15 in this presentation includes certain Adj. EBITDA amounts that are used only for illustrative purposes to present illustrative Adj. EBITDA amounts by applying assumptions to existing room pipeline and other fees, increases of in-place rates and increases in RevPAR, as applicable, in each case based on twelve months ended (“LTM”) 6/30/2016 information. LTM information represents results for FY 2015 plus results for the six months ended June 30, 2016, minus results for the six months ended June 30, 2015. These amounts do not represent projections of future results and may not be realized. Value information on such slides that is derived from such illustrative Adj. EBITDA amounts is indicative only, based upon a number of assumptions, and does not reflect actual valuation. Please review carefully the detailed footnotes in this presentation.

© 2016 Hilton Confidential and Proprietary

|

|

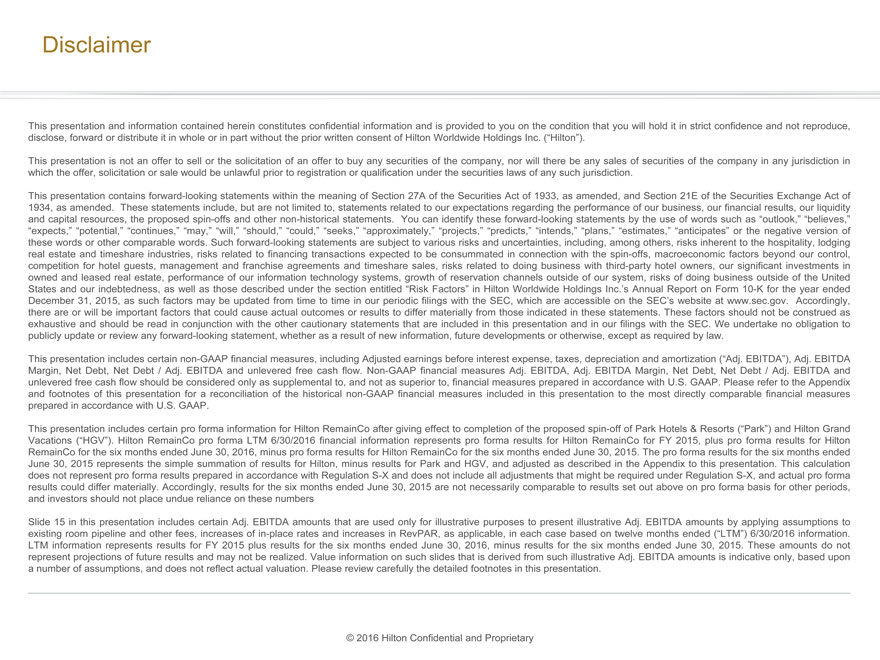

Hilton RemainCo is a market-leading fee-based business

At Hilton RemainCo’s scale, incremental Management & Franchise units are essentially at 100% margin with minimal capital investment

• Following completion of the spin-offs, approximately 90% of Hilton RemainCo’s pro forma Adjusted EBITDA expected to come from fees

• 90% of fees are top-line driven franchise and base management fees, resulting in more stable cash flows

• Hilton’s 13 brands each drive their respective categories, targeting a clear market segment and customer at scale

• As a result, Hilton expects to continue leading the industry in organic net unit growth as a percentage of installed base without significant use of capital

• In order to protect brand tenure in select international markets, Hilton RemainCo has maintained certain assets that generated less than 10% of LTM 6/30/2016 pro forma Adjusted EBITDA

Pro Forma Aggregate Segment Adjusted EBITDA(a)

($ in millions)

$2,400

$2,000 $1,947 $1,909 $187 $200 $1,697

$1,600 $1,513 $203 $206

$1,200

$1,709 $1,760 $800 $1,494 $1,307

$400

$0

2013 2014 2015 LTM 6/30/2016 (b)

Management & Franchise ranchise Ownership

(a) Excludes corporate and other.

(b) LTM information represents results for FY 2015 plus results for the six months ended June 30, 2016, minus results for the six months ended June 30, 2015. See “Disclaimers” at the beginning of this presentation for important limitations on the information with 11 respect to Hilton RemainCo pro forma results for the six months ended June 30, 2015, as well as the Appendix to this presentation for an explanation of this calculation.

© 2016 Hilton Confidential and Proprietary

|

|

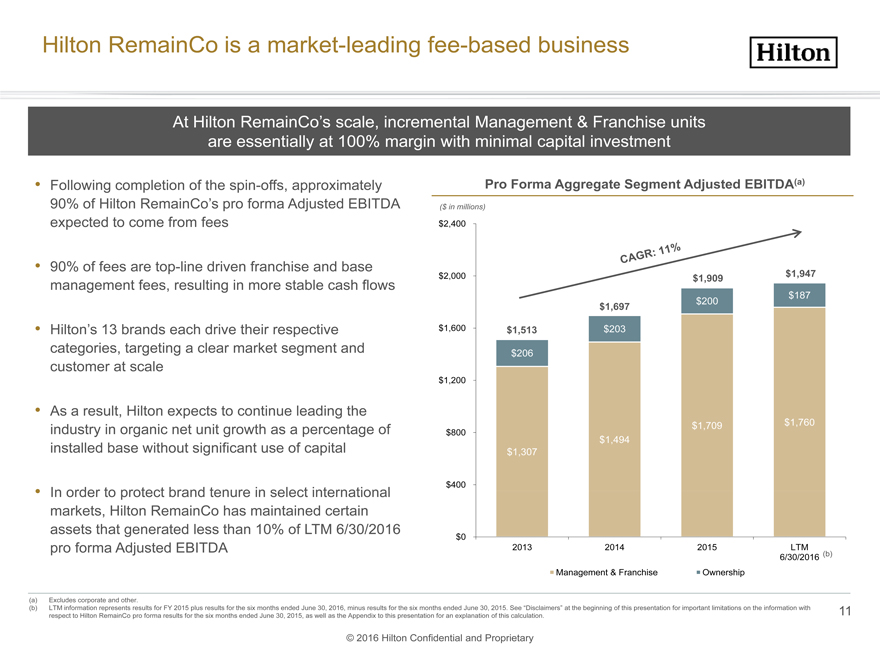

Scalable and growing capital light M&F platform

The Management and Franchise (M&F) hotel business model is highly attractive, with significant growth opportunities, stable cash flows and relatively limited capital investment required

• Management and Franchise segment (4,584 hotels and 718,000 rooms) generated LTM 6/30/2016 Adjusted EBITDA of $1,760 million, representing 90% of pro forma RemainCo’s LTM 6/30/2016 Adjusted EBITDA(a)

• Average contract length is 20 years, resulting in more stable, long-term cash flows

• Very limited capital investment required by company as RevPAR premiums drive investment from hotel owners

($ in millions) Hilton RemainCo Pro Forma Management and Franchise Adjusted EBITDA

$2,000 $1,760 $1,709 $1,494 $196 $201 $1,600 $1,307 $188 $357 $351 $1,200 $162 $336 $315 $800 $1,162 $1,202 $970 $400 $830

$0

2013 2014 2015 LTM

(a)

6/30/2016 Franchise Base and other ma agement Incentive management

(a) LTM information represents results for FY 2015 plus results for the six months ended June 30, 2016, minus results for the six months ended June 30, 2015. See “Disclaimers” at the beginning of this presentation for important limitations on the information with respect to Hilton RemainCo pro forma results for the six months ended June 30, 2015, as well as the Appendix to this presentation for an explanation of this calculation. 13

© 2016 Hilton Confidential and Proprietary

|

|

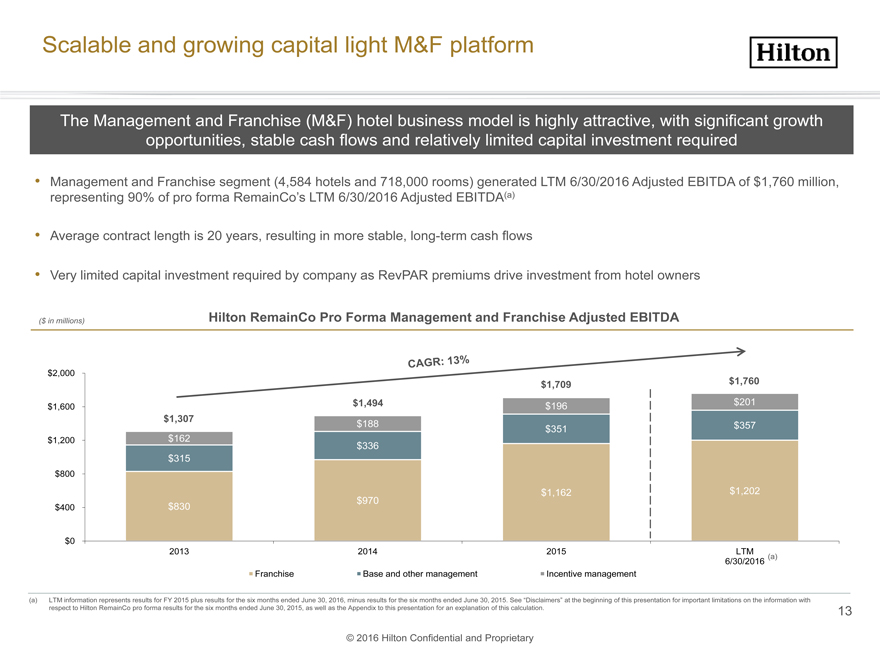

Historical financial summary

Hilton RemainCo

Hilton RemainCo has experienced strong financial performance

($ in millions) Pro Forma Adjusted EBITDA

$2,100

$1,800 $1,715 $1,681

$1,500 $1,443

$1,228 $1,200

$900 $600 $300

$0

2013 2014 2015 LTM (b) 6/30/2016

Pro Forma Unlevered Free Cash Flow(a)

$2,100

$1,800

$1,476 $1,500 $1,351

$1,200 $1,096

$900 $853 $600 $300

$0

2013 2014 2015 LTM (b) 6/30/2016

(a) Pro forma unlevered free cash flow calculated as EBITDA less capital expenditures.

(b) LTM information represents results for FY 2015 plus results for the six months ended June 30, 2016, minus results for the six months ended June 30, 2015. See “Disclaimers” at the beginning of this presentation for important limitations on the information with 26 respect to Hilton RemainCo pro forma results for the six months ended June 30, 2015, as well as the Appendix to this presentation for an explanation of this calculation.

© 2016 Hilton Confidential and Proprietary

|

|

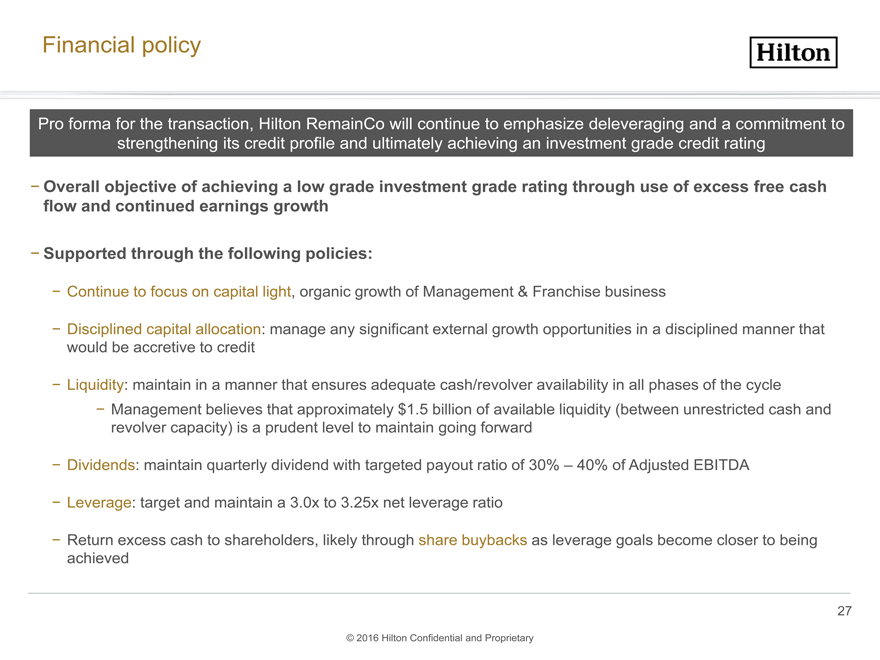

Financial policy

Pro forma for the transaction, Hilton RemainCo will continue to emphasize deleveraging and a commitment to strengthening its credit profile and ultimately achieving an investment grade credit rating

-Overall objective of achieving a low grade investment grade rating through use of excess free cash flow and continued earnings growth

-Supported through the following policies:

- Continue to focus on capital light, organic growth of Management & Franchise business

- Disciplined capital allocation: manage any significant external growth opportunities in a disciplined manner that would be accretive to credit

- Liquidity: maintain in a manner that ensures adequate cash/revolver availability in all phases of the cycle

- Management believes that approximately $1.5 billion of available liquidity (between unrestricted cash and revolver capacity) is a prudent level to maintain going forward

- Dividends: maintain quarterly dividend with targeted payout ratio of 30% – 40% of Adjusted EBITDA

- Leverage: target and maintain a 3.0x to 3.25x net leverage ratio

- Return excess cash to shareholders, likely through share buybacks as leverage goals become closer to being achieved

27

© 2016 Hilton Confidential and Proprietary

|

|

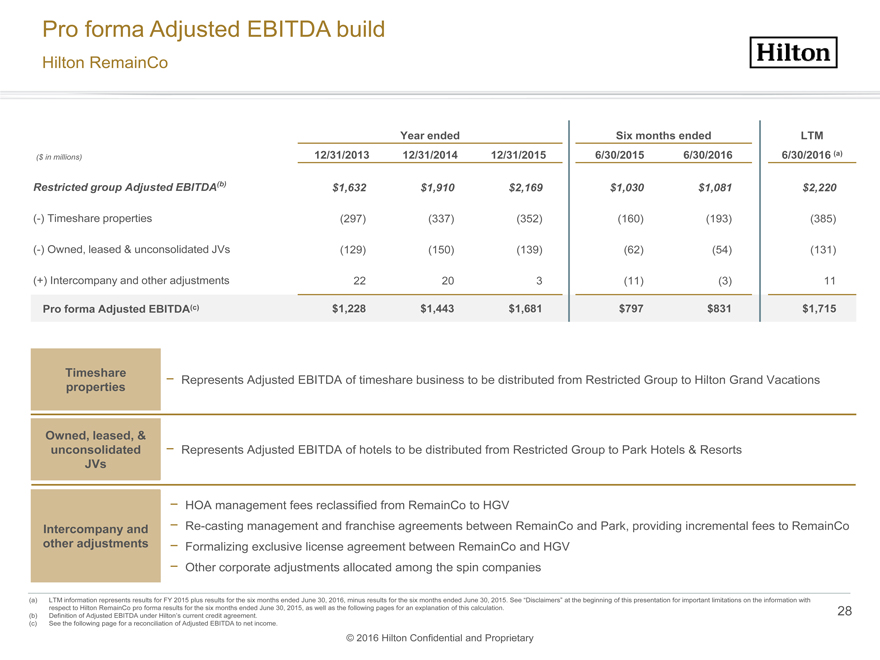

Pro forma Adjusted EBITDA build

Hilton RemainCo

Year endedSix months endedLTM

($ in millions) 12/31/2013 12/31/201412/31/20156/30/20156/30/20166/30/2016 (a)

Restricted group Adjusted EBITDA(b) $1,632$1,910$2,169$1,030$1,081$2,220

(-) Timeshare properties (297)(337)(352)(160)(193)(385)

(-) Owned, leased & unconsolidated JVs (129)50)(139)(62)(54)(131)

(+) Intercompany and other adjustments 22203(11)(3)11

Pro forma Adjusted EBITDA(c) $1,228$1,443$1,681$797$831$1,715

Timeshare - Represents Adjusted EBITDA of timeshare business to be distributed from Restricted Group to Hilton Grand Vacations

properties

Owned, leased, &

unconsolidated - Represents Adjusted EBITDA of hotels to be distributed from Restricted Group to Park Hotels & Resorts

JVs

- HOA management fees reclassified from RemainCo to HGV

Intercompany and - Re-casting management and franchise agreements between RemainCo and Park, providing incremental fees to RemainCo

other adjustments - Formalizing exclusive license agreement between RemainCo and HGV

- Other corporate adjustments allocated among the spin companies

(a) LTM information represents results for FY 2015 plus results for the six months ended June 30, 2016, minus results for the six months ended June 30, 2015. See “Disclaimers” at the beginning of this presentation for important limitations on the information with

respect to Hilton RemainCo pro forma results for the six months ended June 30, 2015, as well as the following pages for an explanation of this calculation. 28

(b) Definition of Adjusted EBITDA under Hilton’s current credit agreement.

(c) See the following page for a reconciliation of Adjusted EBITDA to net income.

© 2016 Hilton Confidential and Proprietary

|

|

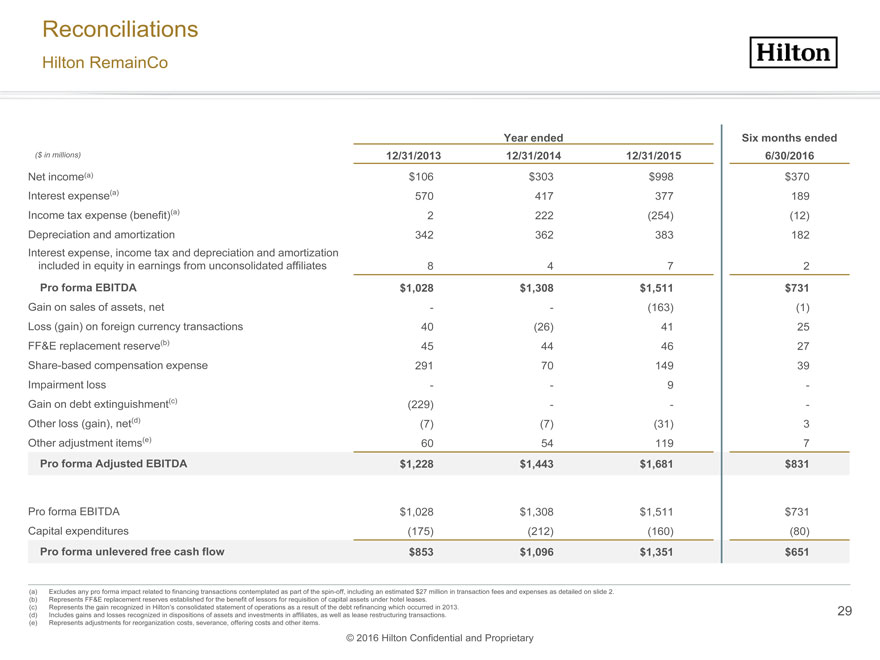

Reconciliations

Hilton RemainCo

Year endedSix months ended

($ in millions) 12/31/201312/31/201412/31/20156/30/2016

Net income(a) $106$303$998$370

Interest expense(a) 570417377189

Income tax expense (benefit)(a) 2222(254)(12)

Depreciation and amortization 342362383182

Interest expense, income tax and depreciation and amortization

included in equity in earnings from unconsolidated affiliates 8472

Pro forma EBITDA $1,028$1,308$1,511$731

Gain on sales of assets, net --(163)(1)

Loss (gain) on foreign currency transactions 40(26)4125

FF&E replacement reserve(b) 45444627

Share-based compensation expense 2917014939

Impairment loss --9-

Gain on debt extinguishment(c) (229)—-

Other loss (gain), net(d) (7)(7)(31)3

Other adjustment items(e) 60541197

Pro forma Adjusted EBITDA $1,228$1,443$1,681$831

Pro forma EBITDA $1,028$1,308$1,511$731

Capital expenditures (175)(212)(160)(80)

Pro forma unlevered free cash flow $853$1,096$1,351$651

(a) Excludes any pro forma impact related to financing transactions contemplated as part of the spin-off, including an estimated $27 million in transaction fees and expenses as detailed on slide 2.

(b) Represents FF&E replacement reserves established for the benefit of lessors for requisition of capital assets under hotel leases.

(c) Represents the gain recognized in Hilton’s consolidated statement of operations as a result of the debt refinancing which occurred in 2013. 29 (d) Includes gains and losses recognized in dispositions of assets and investments in affiliates, as well as lease restructuring transactions.

(e) Represents adjustments for reorganization costs, severance, offering costs and other items.

© 2016 Hilton Confidential and Proprietary

|

|

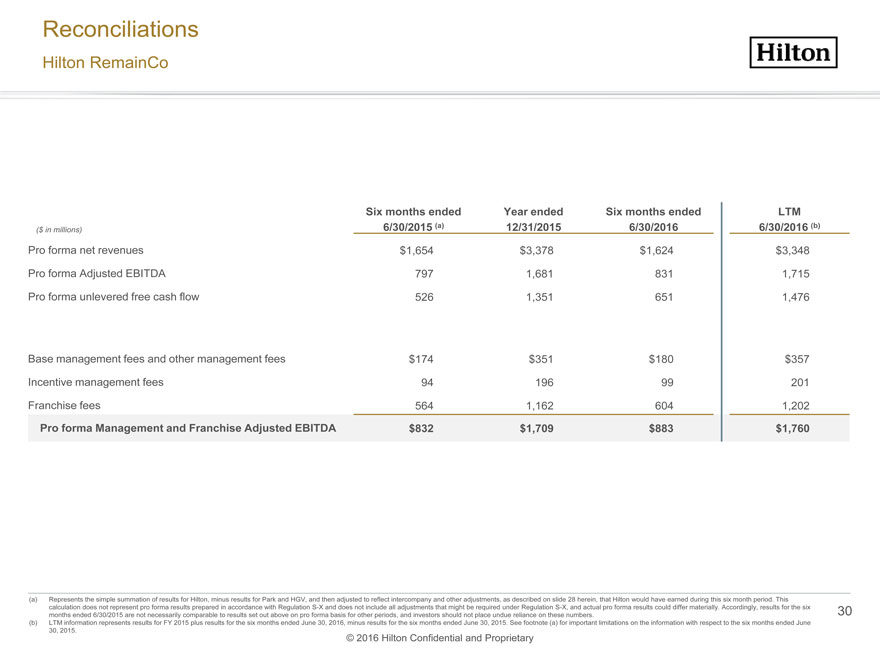

Reconciliations

Hilton RemainCo

Six months endedYear endedSix months endedLTM

($ in millions) 6/30/2015 (a)12/31/20156/30/20166/30/2016 (b)

Pro forma net revenues $1,6544$3,378$1,6244$3,3488

Pro forma Adjusted EBITDA 7971,6818311,715

Pro forma unlevered free cash flow 5261,3516511,476

Base management fees and other management fees $174$351$180$357

Incentive management fees 9419699201

Franchise fees 5641,1626041,202

Pro forma Management and Franchise Adjusted EBITDA $832$1,709$883$1,760

(a) Represents the simple summation of results for Hilton, minus results for Park and HGV, and then adjusted to reflect intercompany and other adjustments, as describedon slide 28 herein, that Hilton would have earned during this six month period. This calculation does not represent pro forma results prepared in accordance with Regulation S-X and does not include all adjustments that might be required under Regulation S-X, and actual pro forma results could differ materially. Accordingly, results for the six 30 months ended 6/30/2015 are not necessarily comparable to results set out above on pro forma basis for other periods, and investors should not place undue reliance on these numbers.

(b) LTM information represents results for FY 2015 plus results for the six months ended June 30, 2016, minus results for the six months ended June 30, 2015. See footnote (a) for important limitations on the information with respect to the six months ended June

30, 2015. © 2016 Hilton Confidential and Proprietary