Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GERMAN AMERICAN BANCORP, INC. | a8-kinvestorconference8x20.htm |

Symbol: GABC

August 2016

Keefe, Bruyette & Woods

Community Bank

Investor Conference

Presented By

Mark A. Schroeder

Chairman and CEO

Bradley M. Rust

Executive VP and CFO

2

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

When used in this presentation and our oral statements, the words or phrases “believe,” “will likely result,” “are

expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “plans,” or similar expressions are intended to

identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You

are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this

presentation, and we do not undertake any obligation to update any forward-looking statement to reflect circumstances

or events that occur in the future. By their nature, these statements are subject to numerous risks and uncertainties

that could cause actual results to differ materially from those anticipated in the statements.

Factors that could cause actual results and performance to vary materially from those expressed or implied by any

forward-looking statement include those that are discussed in Item 1, “Business – Forward Looking Statements and

Associated Risk,” and Item 1A, “Risk Factors,” in our Annual Report on Form 10-K for 2015 as updated and

supplemented by our other SEC reports filed from time to time.

3

NON-GAAP FINANCIAL MEASURES

These slides contain non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a

numerical measure of the registrant’s historical or future financial performance, financial position or cash flows that

excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the

most directly comparable measure calculated and presented in accordance with GAAP in the statements of income,

balance sheet or statement of cash flows (or equivalent statements) of the registrant; or includes amounts, or is

subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable

measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the

United States. Pursuant to the requirements of Regulation G, German American Bancorp, Inc. has provided

reconciliations within these slides, as necessary, of the non-GAAP financial measure to the most directly comparable

GAAP financial measure.

4

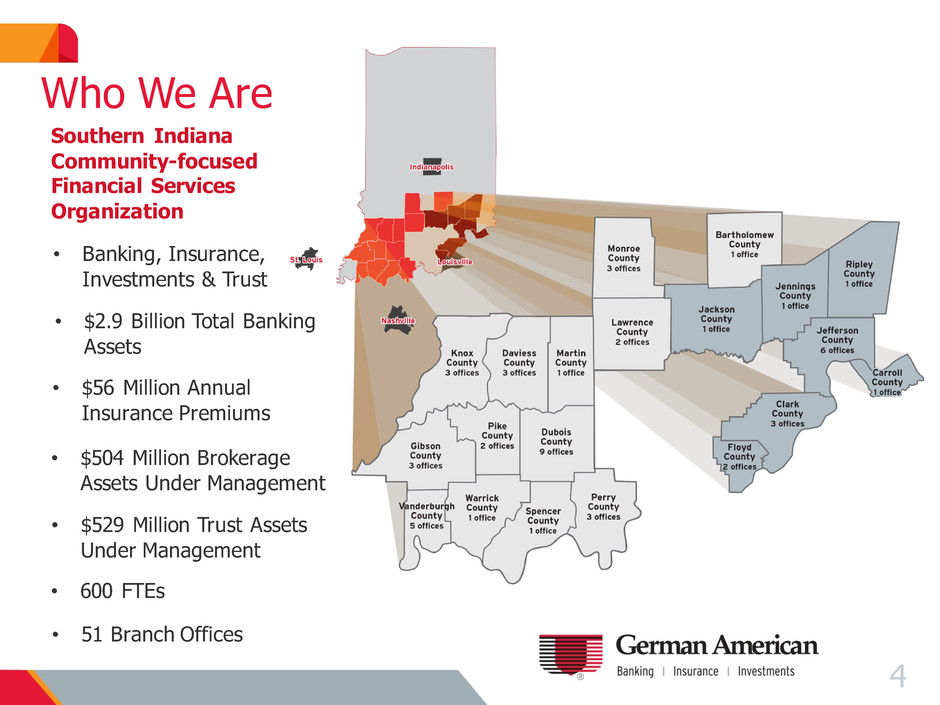

Southern Indiana

Community-focused

Financial Services

Organization

• $2.9 Billion Total Banking

Assets

• $504 Million Brokerage

Assets Under Management

• $56 Million Annual

Insurance Premiums

• Banking, Insurance,

Investments & Trust

• $529 Million Trust Assets

Under Management

Who We Are

• 600 FTEs

• 51 Branch Offices

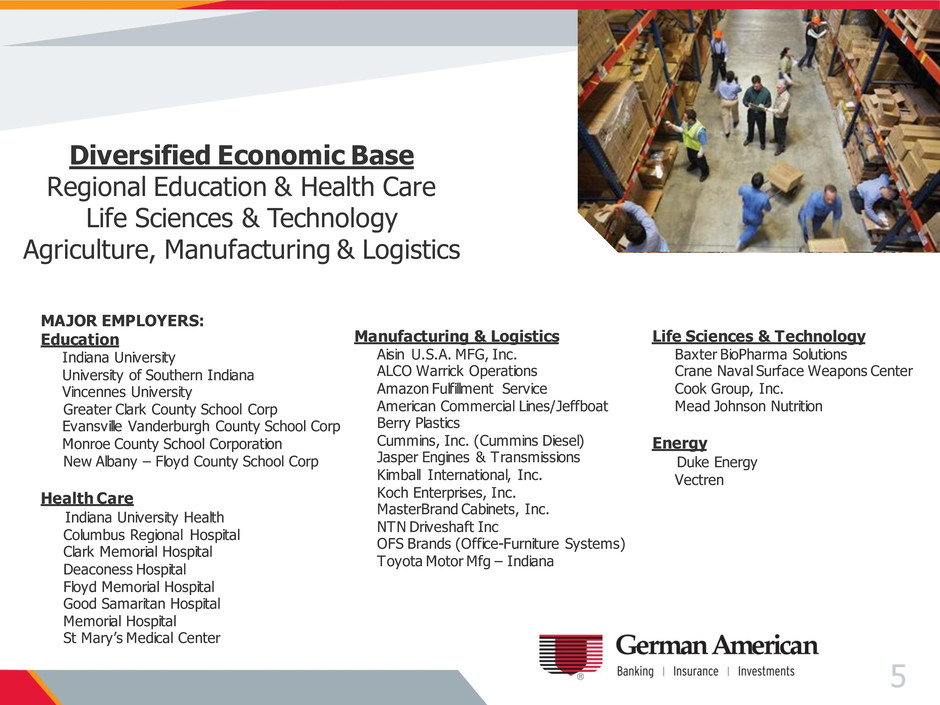

Diversified Economic Base

Regional Education & Health Care

Life Sciences & Technology

Agriculture, Manufacturing & Logistics

MAJOR EMPLOYERS:

Education

Indiana University

University of Southern Indiana

Vincennes University

Greater Clark County School Corp

Evansville Vanderburgh County School Corp

Monroe County School Corporation

New Albany – Floyd County School Corp

Health Care

Indiana University Health

Columbus Regional Hospital

Clark Memorial Hospital

Deaconess Hospital

Floyd Memorial Hospital

Good Samaritan Hospital

Memorial Hospital

St Mary’s Medical Center

Manufacturing & Logistics

Aisin U.S.A. MFG, Inc.

ALCO Warrick Operations

Amazon Fulfillment Service

American Commercial Lines/Jeffboat

Berry Plastics

Cummins, Inc. (Cummins Diesel)

Jasper Engines & Transmissions

Kimball International, Inc.

Koch Enterprises, Inc.

MasterBrand Cabinets, Inc.

NTN Driveshaft Inc

OFS Brands (Office-Furniture Systems)

Toyota Motor Mfg – Indiana

5

Life Sciences & Technology

Baxter BioPharma Solutions

Crane Naval Surface Weapons Center

Cook Group, Inc.

Mead Johnson Nutrition

Energy

Duke Energy

Vectren

6

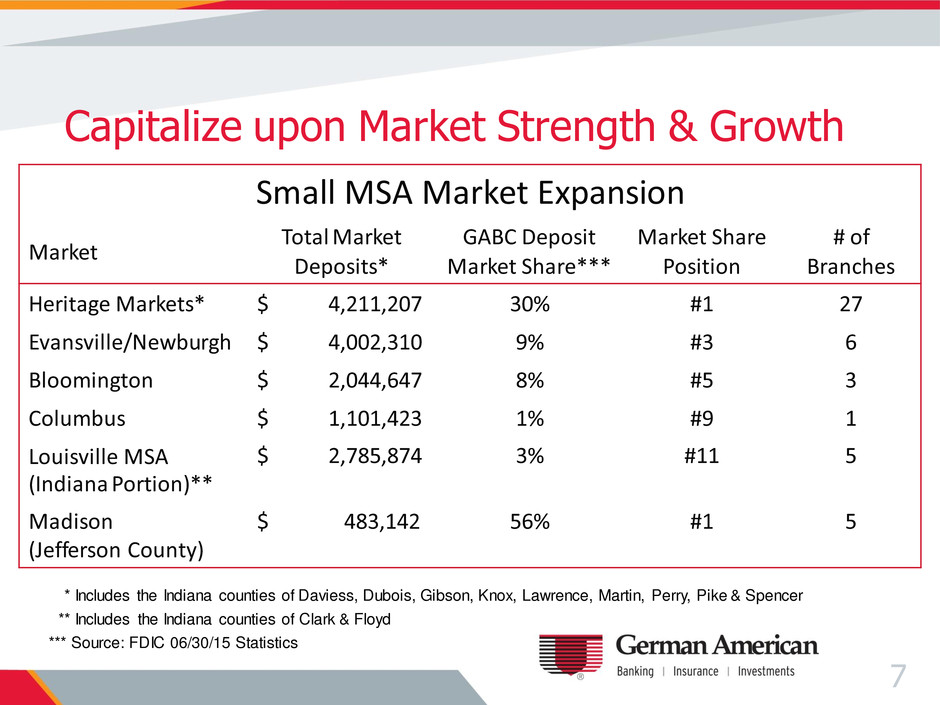

Small MSA Market Expansion

Market

Total Market

Deposits*

GABC Deposit

Market Share***

Market Share

Position

# of

Branches

Heritage Markets* $ 4,211,207 30% #1 27

Evansville/Newburgh $ 4,002,310 9% #3 6

Bloomington $ 2,044,647 8% #5 3

Columbus $ 1,101,423 1% #9 1

Louisville MSA

(Indiana Portion)**

$ 2,785,874 3% #11 5

Madison

(Jefferson County)

$ 483,142 56% #1 5

7

* Includes the Indiana counties of Daviess, Dubois, Gibson, Knox, Lawrence, Martin, Perry, Pike & Spencer

** Includes the Indiana counties of Clark & Floyd

Capitalize upon Market Strength & Growth

*** Source: FDIC 06/30/15 Statistics

*Heritage Markets 2015 2005

2015 # of

Offices

(millions) Deposits Share Deposits Share Increase

1 German American $ 1,257 29.8% $ 700 19.3% 79.6% 27

2 Old National Bank $ 929 22.0% $ 1,336 37.7% - 30.5% 17

3 Fifth Third Bank $ 465 11.0% $ 393 10.8% 18.3% 10

Market Total $ 4,211 $ 3,623 16.2%

8

Heritage Markets include the Indiana counties of Daviess, Dubois, Gibson, Knox, Lawrence, Martin, Perry, Pike & Spencer

* 2005 Deposits adjusted to include branches subsequently acquired by surviving banks

** Source: FDIC 06/30/15 Statistics

Capitalize upon Market Strength & Growth

History of Superior Financial Performance

9

2010 through 2015 Six Years of Consecutive Record Earnings

Performance

Double-Digit Return on Equity for Past 11 Consecutive Fiscal

Years (13%+ROE 2012 through 2014)

2009 through 2011 and 2013 through 2015 Highest

Performing (Return on Equity) among Indiana-Domiciled

Exchange-Traded Financial Institutions (Second Highest

Performing in 2012)

Consistent Achievement of Superior Asset Quality

Financial Trends

10

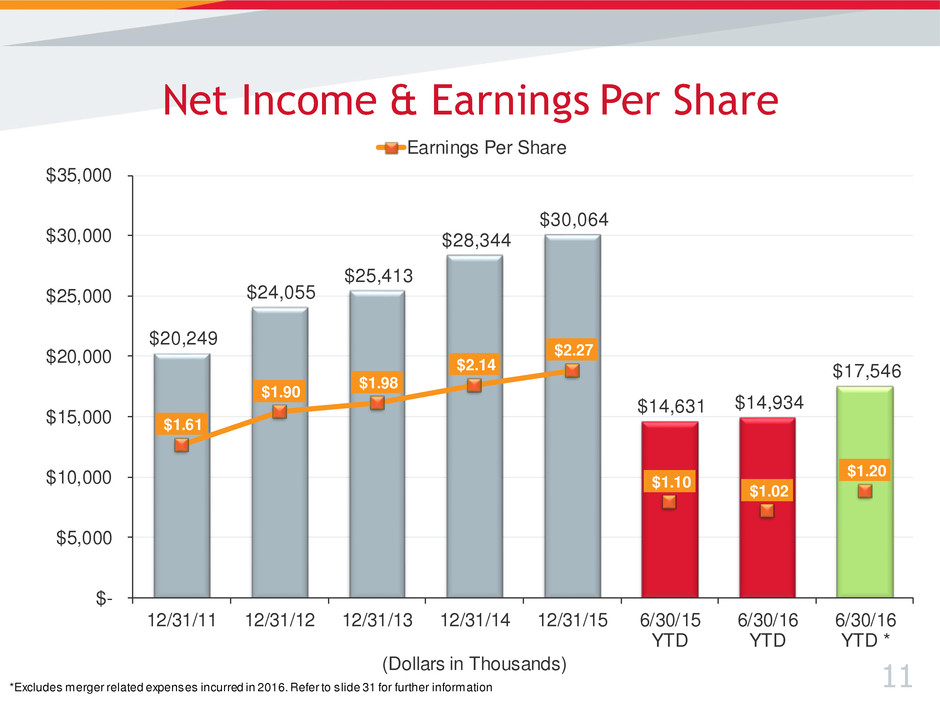

$20,249

$24,055

$25,413

$28,344

$30,064

$14,631 $14,934

$17,546

$1.61

$1.90

$1.98

$2.14

$2.27

$1.10

$1.02

$1.20

$-

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

$35,000

12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 6/30/15

YTD

6/30/16

YTD

6/30/16

YTD *

(Dollars in Thousands)

Net Income & Earnings Per Share

Earnings Per Share

11 *Excludes merger related expenses incurred in 2016. Refer to slide 31 for further information

$1,874

$2,006

$2,164 $2,237

$2,374

$2,916

1.11%

1.24% 1.25%

1.31% 1.33%

1.10%

$-

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 6/30/16

YTD

(Dollars in Thousands)

Total Assets

Annualized Return on Assets

12

$1,121

$1,205

$1,382

$1,448

$1,564

$1,961

81%

83%

81% 81% 82% 81%

$-

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

$2,000

$2,200

12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 6/30/16

YTD

(Dollars in Millions)

Total Loans, Net of Unearned Income

Commercial & Agricultural Loans as % of Total Loans

13

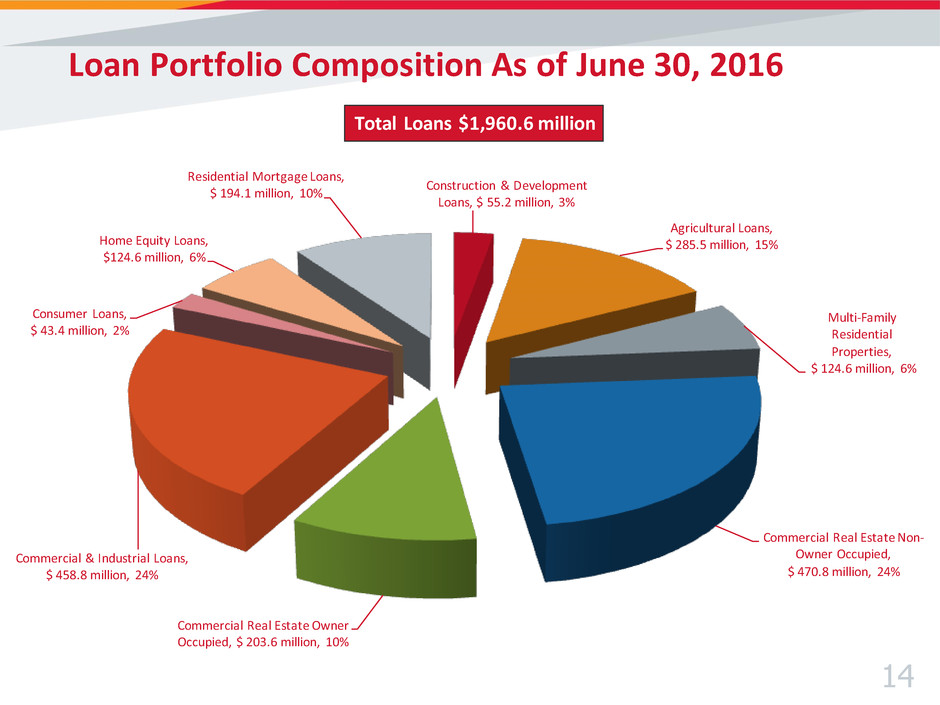

Construction & Development

Loans, $ 55.2 million, 3%

Agricultural Loans,

$ 285.5 million, 15%

Multi-Family

Residential

Properties,

$ 124.6 million, 6%

Commercial Real Estate Non-

Owner Occupied,

$ 470.8 million, 24%

Commercial Real Estate Owner

Occupied, $ 203.6 million, 10%

Commercial & Industrial Loans,

$ 458.8 million, 24%

Consumer Loans,

$ 43.4 million, 2%

Home Equity Loans,

$124.6 million, 6%

Residential Mortgage Loans,

$ 194.1 million, 10%

Total Loans $1,960.6 million

Loan Portfolio Composition As of June 30, 2016

14

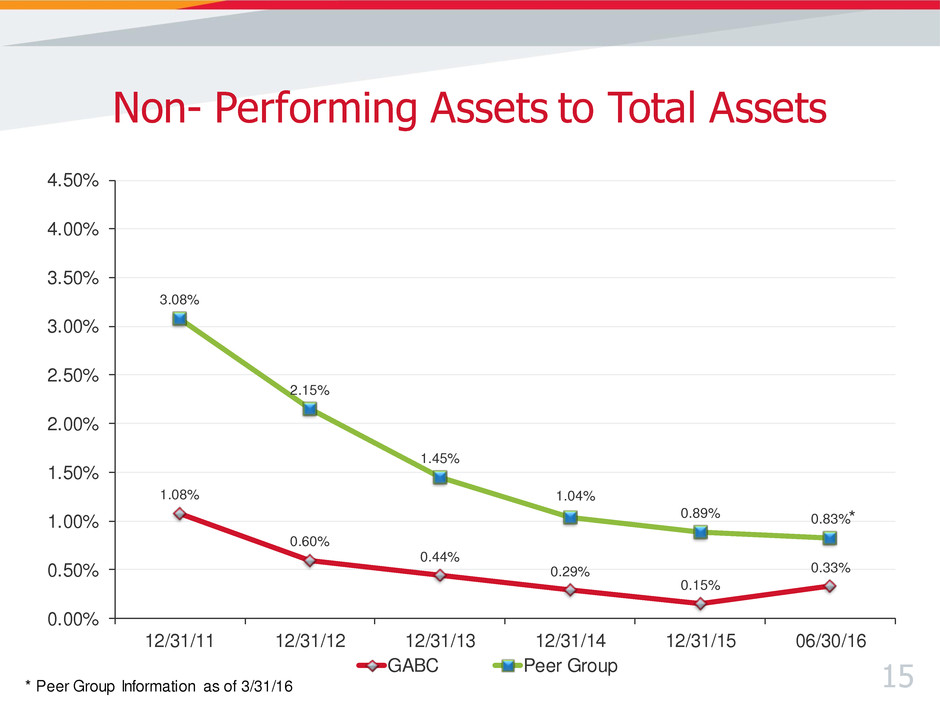

1.08%

0.60%

0.44%

0.29%

0.15%

0.33%

3.08%

2.15%

1.45%

1.04%

0.89% 0.83%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 06/30/16

Non- Performing Assets to Total Assets

GABC Peer Group 15 * Peer Group Information as of 3/31/16

*

0.43%

0.19%

0.10%

-0.01%

0.03%

0.04%

0.88%

0.59%

0.25%

0.15%

0.08%

0.07%

-0.05%

0.20%

0.45%

0.70%

0.95%

1.20%

1.45%

12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 06/30/16

Net Charge-offs to Average Loans

GABC Peer Group 16 * Peer Group Information as of 3/31/16

*

$1,556

$1,641

$1,812 $1,780 $1,826

$2,277

76%

80% 81% 81%

83% 83%

$-

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

$2,000

$2,200

$2,400

$2,600

12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 06/30/16

(Dollars in Millions)

Total Deposits

Non-Maturity Deposit Accounts as % of Total Deposits

17

Non-Interest Bearing Demand,

$506.5 million, 22%

Interest Bearing Demand,

Savings & Money Market,

$1,380.1 million, 61%

Time Deposits, $390.8 million,

17%

18

Total Deposit Composition as of June 30, 2016

Cost of Funds

2011 0.95%

2012 0.60%

2013 0.37%

2014 0.30%

2015 0.28%

6/30/16 YTD 0.32%

Total Deposits $2,277.4 million

$168

$185

$200

$229

$252

$332

12.67% 13.57% 13.40% 13.21%

12.47%

9.79%

$-

$50

$100

$150

$200

$250

$300

$350

12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 6/30/16

YTD

(Dollars in Millions)

Total Shareholders’ Equity

Annualized Return on Equity

19

$65,202

$67,819

$70,319

$76,991

$79,072

$38,882

$47,602

3.84%

3.74%

3.67%

3.76%

3.70% 3.72%

3.75%

$-

$10,000

$20,000

$30,000

$40,000

$50,000

$60,000

$70,000

$80,000

$90,000

12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 6/30/15

YTD

6/30/16

YTD

(Dollars in Thousands)

Net Interest Income (Tax-Equivalent)

Net Interest Margin

20

$21,576 $21,811

$23,615 $23,937

$27,444

$13,263

$15,272

25%

24%

25%

24%

26%

25% 24%

$-

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 6/30/15

YTD

6/30/16

YTD

(Dollars in Thousands)

Non-Interest Income

Non-Interest Income as % of Total Revenue

21

$50,782 $50,923

$54,905

$57,713

$61,326

$29,148

$38,579

$34,450

58.5%

56.8%

58.5%

57.2% 57.6%

55.9%

61.4%

54.8%

$-

$10,000

$20,000

$30,000

$40,000

$50,000

$60,000

$70,000

12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 6/30/15

YTD

6/30/16

YTD

6/30/16

YTD*

(Dollars in Thousands)

Non-Interest Expense

Efficiency Ratio

22

*Excludes merger related expenses incurred in 2016. Refer to slide 31 for further information

$20,249

$24,055

$25,413

$28,344

$30,064

$14,631 $14,934

$17,546

$1.61

$1.90

$1.98

$2.14

$2.27

$1.10

$1.02

$1.20

$-

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

$35,000

12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 6/30/15

YTD

6/30/16

YTD

6/30/16

YTD *

(Dollars in Thousands)

Net Income & Earnings Per Share

Earnings Per Share

23 *Excludes merger related expenses incurred in 2016. Refer to slide 31 for further information

Why Invest in GABC?

24

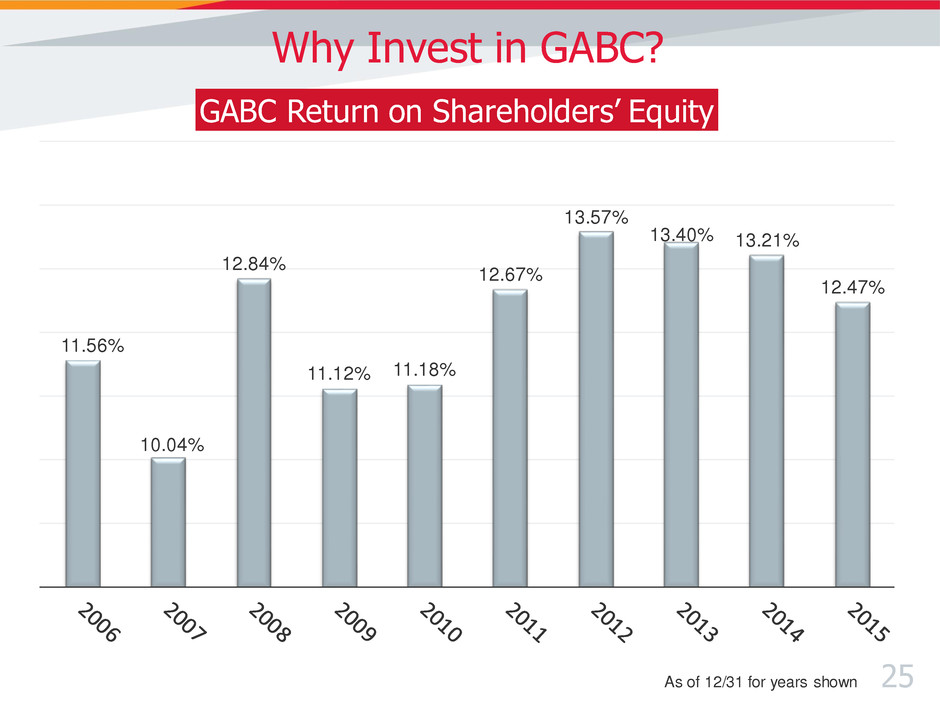

11.56%

10.04%

12.84%

11.12% 11.18%

12.67%

13.57%

13.40% 13.21%

12.47%

GABC Return on Shareholders’ Equity

Why Invest in GABC?

25 As of 12/31 for years shown

$0.93 $0.85

$1.16 $1.10

$1.21

$1.61

$1.90 $1.98

$2.14

$2.27

GABC Earnings Per Share Growth

26 As of 12/31 for years shown

Why Invest in GABC?

$9.14

$9.82

$11.47

$12.94

$13.38

$15.60

$17.36

GABC Tangible Book Value Per Share

Why Invest in GABC?

As of 12/31 for years shown 27

$16.25

$18.42 $18.19

$21.72

$28.42

$30.52

$33.32

GABC Stock Price Appreciation

Why Invest in GABC?

As of 12/31 for years shown 28

Focus on increasing long-term institutional ownership

• Proven Executive Management Team

• Track Record of Consistent Top Quartile Financial Performance

• Experienced in Operating Plan Execution and M & A

Transitions

• Potential Growth within New Market Areas – Small MSA Focus

• Existing Platform for Operating Efficiency

• Infrastructure in Place for Perpetuating Ongoing EPS Growth

and Tangible Book Value per Share Growth

• Consistent Strong Dividend Yield and Dividend Pay-out

Capacity

Why Invest in GABC?

29

2015

ROE

≥ 12%

3 Institutions

(including

German American)

Source: SNL Financial. Financial data is as of December 31, 2015.

All U.S. Exchange-Traded Depositories

422

Institutions

ROE ≥ 10%

for the past 10 years

11

Institutions

Consecutive

increases

in EPS for

past 5 years

3

Institutions

30

Why Invest

in GABC?

31

German American Bancorp, Inc.

Non-GAAP Disclosure Reconciliation

These materials contain certain financial measures determined by methods other than in accordance with accounting principles

generally accepted in the United States of America (“GAAP”). The slide presentation furnished herewith uses the non -GAAP

financial measures of net income, fully diluted earnings per share, non-interest expenses and efficiency ratio excluding merger

expenses incurred in the first six months of 2016 related to the River Valley Bancorp merger. The Corporation believes that these

non-GAAP financial measures presented with these adjustments best reflects the Corporation’s ongoing performance and business

operations during the periods presented and is useful to investors for comparative purposes.

The following tables reconcile Net Income, Fully Diluted EPS, Non-Interest Expenses and Efficiency Ratio (dollars in thousands except per share data):

Six Month Ended EPS

6/30/2016 Impact

Net Income, as reported Six Months Ended 6/30/2016 14,934$ 1.02$

Merger Related Expenses, Net of Tax 2,612 0.18

Net Income, as adjusted 17,546$ 1.20$

Net Income, as reported Six Months Ended 6/30/2015 14,631$ 1.10$

Difference 2,915$ 0.10$

Fully Diluted Weighted Average Shares Outstanding, as reported Six Months Ended 6/30/2016 14,593,076

Six Months Ended

6/30/2016

Non-interest Expense, as reported Six Months Ended 6/30/2016 38,579$

Merger Related Expenses (4,129)

Non-interest Expense, as adjusted 34,450$

Non-interest Expense, as reported Six Months ended 6/30/2015 29,148$

Difference 5,302$

Six Months Ended

6/30/2016

Efficiency R ti , reported Six Months Ended 6/30/2016 61.4%

Merger Related Expenses impact on Efficiency Ratio 6.6%

Efficency Ratio, as adjusted 54.8%

Non-interest Expense, as reported Six Months Ended 6/30/2015 55.9%

Difference -1.1%

Mark A. Schroeder, Chairman and CEO

(812) 482-0701

mark.schroeder@germanamerican.com

32

Bradley M. Rust, Executive VP and CEO

(812) 482-0718

brad.rust@germanamerican.com