Attached files

| file | filename |

|---|---|

| 8-K - CTBI 2016 KBW INVESTOR PRESENTATION 8-K - COMMUNITY TRUST BANCORP INC /KY/ | ctbi2016kbwinvpres8k.htm |

Exhibit 99.1

Keefe, Bruyette & Woods2016 Community Bank Investor ConferencePresentation

Cautionary Statement Information provided herein by CTBI contains “forward-looking” information. CTBI cautions that any forward-looking statements made are not guarantees of future performance and that actual results may differ materially from those in the forward-looking statements. Please refer to CTBI’s 2015 Annual Report on Form 10-K, Cautionary Statement Regarding Forward Looking Statements for additional information. 2

Total Assets $3.9 billionMarket Capitalization $608.6 millionCash Dividend Yield 3.58%P/E Ratio 13.1xPrice to Book Value 1.2xPrice to Tangible Book Value 1.4xTangible Common Equity Ratio 11.17%Competitive Position2nd largest Kentucky domiciled bank holding company #1 in Kentucky in deposit market share of all Kentucky domiciled FDIC insured institutions 6th largest bank in Kentucky in terms of deposit market share of all FDIC insured institutions Financial data as of June 30, 2016 3 Key Metrics

4 1903 Pikeville National bank formed1987-2005 Acquired 14 banks and purchased 17 branch locations1997 Changed name to Community Trust Bancorp, Inc.2010 Acquired LaFollette First National CorporationPresently Two operational subsidiaries~ Community Trust Bank, Inc. and Community Trust and Investment Company Corporate History

Serving customers in 80 branch locations in 35 counties throughout Kentucky, Tennessee, and West Virginia, including 5 trust offices in Kentucky and Tennessee 5 Our Banking Franchise

Central Region Eastern Region Northeastern RegionLoans - $638 million Loans - $900 million Loans - $347 millionDeposits - $745 million Deposits - $1.4 billion Deposits - $487 million• Danville • Floyd/Knott/Johnson • Advantage Valley• Lexington • Hazard • Ashland• Mt. Sterling • Pikeville • Flemingsburg• Richmond • Tug Valley • Summersville• Versailles • Whitesburg• Winchester South Central Region CTICLoans - $620 million Assets Under Management - $2.0 billion (including $0.6 bill CTB)Deposits - $685 million Revenues - $13.6 million annualized• Campbellsville • Ashland• LaFollette • LaFollette• Middlesboro • Lexington• Mt. Vernon • Pikeville• Williamsburg • Versailles Financial data as of June 30, 2016 6 Our Banking Franchise

Assets in billionsRevenue in millions 7 Includes CTB portfolio Jun ‘16 annualized Trust Assets Under Management &Trust Revenue

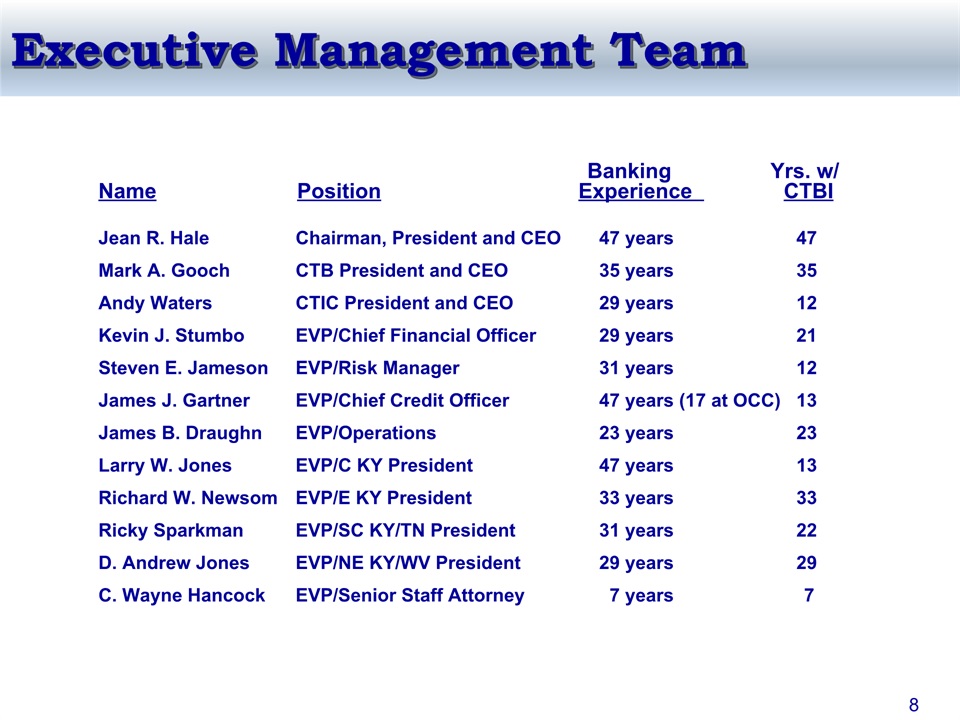

8 Banking Yrs. w/Name Position Experience CTBIJean R. Hale Chairman, President and CEO 47 years 47Mark A. Gooch CTB President and CEO 35 years 35Andy Waters CTIC President and CEO 29 years 12Kevin J. Stumbo EVP/Chief Financial Officer 29 years 21Steven E. Jameson EVP/Risk Manager 31 years 12James J. Gartner EVP/Chief Credit Officer 47 years (17 at OCC) 13James B. Draughn EVP/Operations 23 years 23Larry W. Jones EVP/C KY President 47 years 13Richard W. Newsom EVP/E KY President 33 years 33Ricky Sparkman EVP/SC KY/TN President 31 years 22D. Andrew Jones EVP/NE KY/WV President 29 years 29C. Wayne Hancock EVP/Senior Staff Attorney 7 years 7 Executive Management Team

9 Traditional community banking business modelExecutive management and board of director commitment to corporate governanceDecentralized decision making and centralized operations and risk managementStrong loan portfolio risk management processSpecialized product offeringsMaintain a strong tangible equity positionOrganic growth expectations combined with de novo branching and acquisitionConsistent long-term performance Operational Philosophy

10 YTD 2016 2015 2014 2013 2012 EPS $1.32 $2.66 $2.50 $2.63 $2.64ROAA 1.20% 1.23% 1.18% 1.24% 1.23%ROAE 9.54% 9.97% 9.94% 11.05% 11.52%Net Int. Margin 3.74% 3.81% 3.92% 4.03% 3.99%Efficiency Ratio 59.31% 58.20% 59.12% 59.33% 57.93%Nonperforming Loans 0.84% 1.00% 1.42% 1.67% 1.41%Net Charge-offs 0.28% 0.25% 0.31% 0.30% 0.37%% of Average Assets:Noninterest Income 1.17% 1.24% 1.23% 1.35% 1.26%Noninterest Expense 2.76% 2.78% 2.88% 3.02% 2.84% All information is for the year ended December 31 except YTD 2016 which is for the six months ended June 30. Consistent Financial Performance

11 Earnings Review

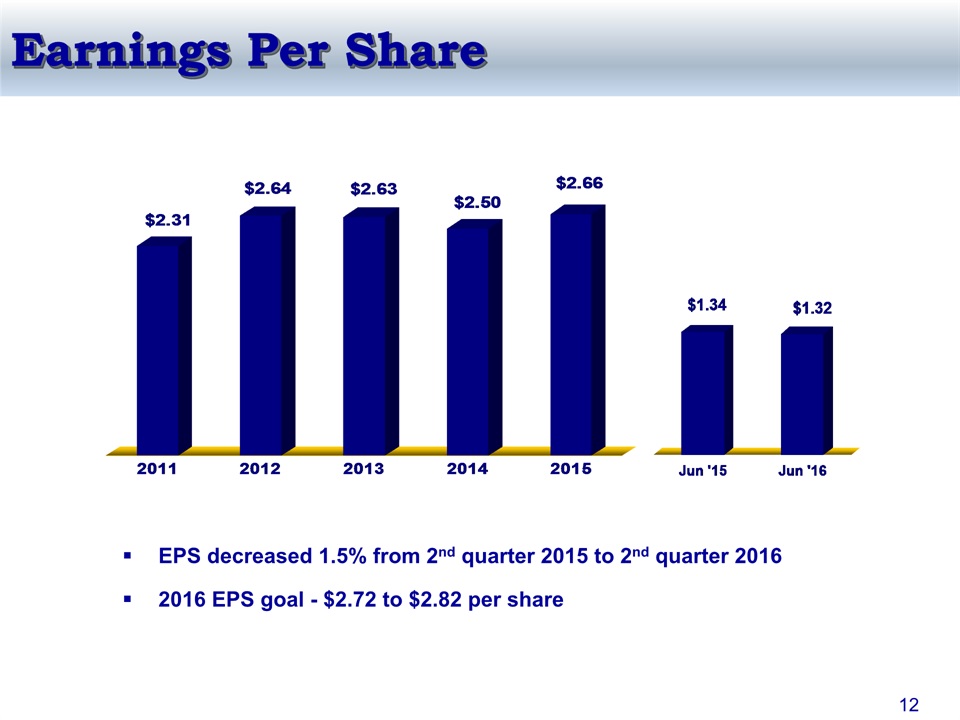

EPS decreased 1.5% from 2nd quarter 2015 to 2nd quarter 20162016 EPS goal - $2.72 to $2.82 per share 12 Earnings Per Share

(in millions) Net income decreased 0.7% from 2nd quarter 2015 to 2nd quarter 20162016 goal for net income - $48.0 to $49.2 million 13 Net Income

(in millions) Revenues increased 0.1% from 2nd quarter 2015 to 2nd quarter 20162016 goal for revenues - $183.0 to $189.6 million 14 Jun ‘16 annualized Revenues

Noninterest income decreased 1.0% from 2nd quarter 2015 to 2nd quarter 2016Decreases in gains on sales of loans and loan related fees partially offset by increased deposit service charges and insurance commissions2016 goal for noninterest revenue – 26.0% to 26.5% of total revenue Noninterest Incomeas a % of Total Revenue (in millions) 15 Jun ‘16 annualized

Net interest revenue increased by 0.4% from prior year 2nd quarterNet interest margin decreased 13 basis pointsAverage earning assets increased $130.4 million, or 3.7% (in millions) Net Interest Revenue 16 Jun ‘16 annualized

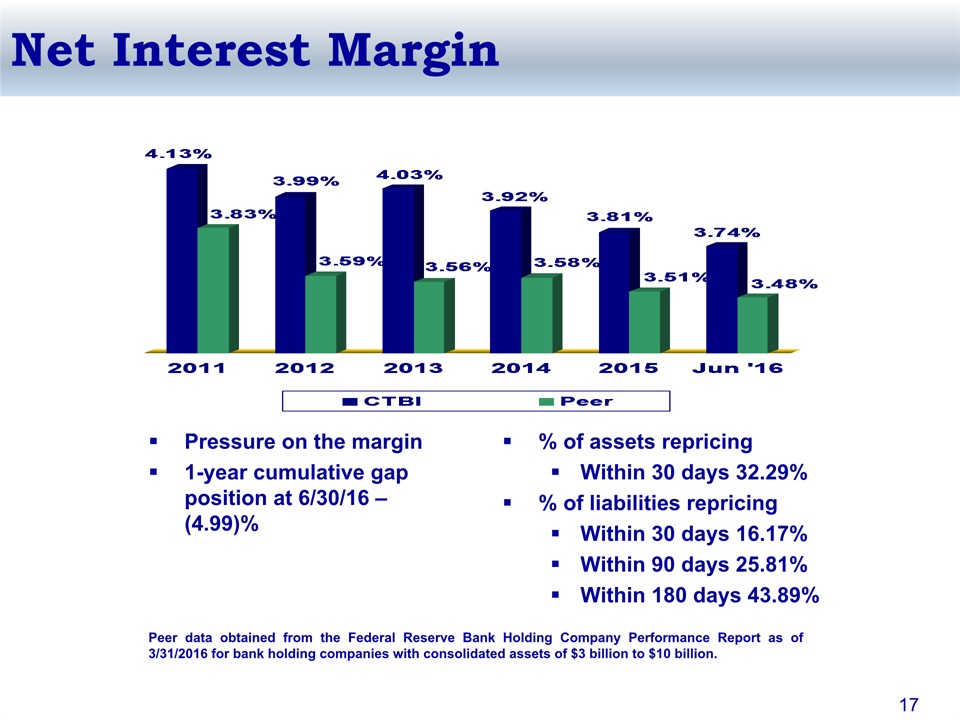

Net Interest Margin Pressure on the margin1-year cumulative gap position at 6/30/16 – (4.99)% % of assets repricingWithin 30 days 32.29%% of liabilities repricing Within 30 days 16.17%Within 90 days 25.81%Within 180 days 43.89% Peer data obtained from the Federal Reserve Bank Holding Company Performance Report as of 3/31/2016 for bank holding companies with consolidated assets of $3 billion to $10 billion. 17

Net Noninterest Expenseas a % of Average Earning Assets Noninterest Expense & Efficiency Ratio (in millions) (in millions) Peer data obtained from the Federal Reserve Bank Holding Company Performance Report as of 3/31/2016 for bank holding companies with consolidated assets of $3 billion to $10 billion. 18 Jun ‘16 annualized

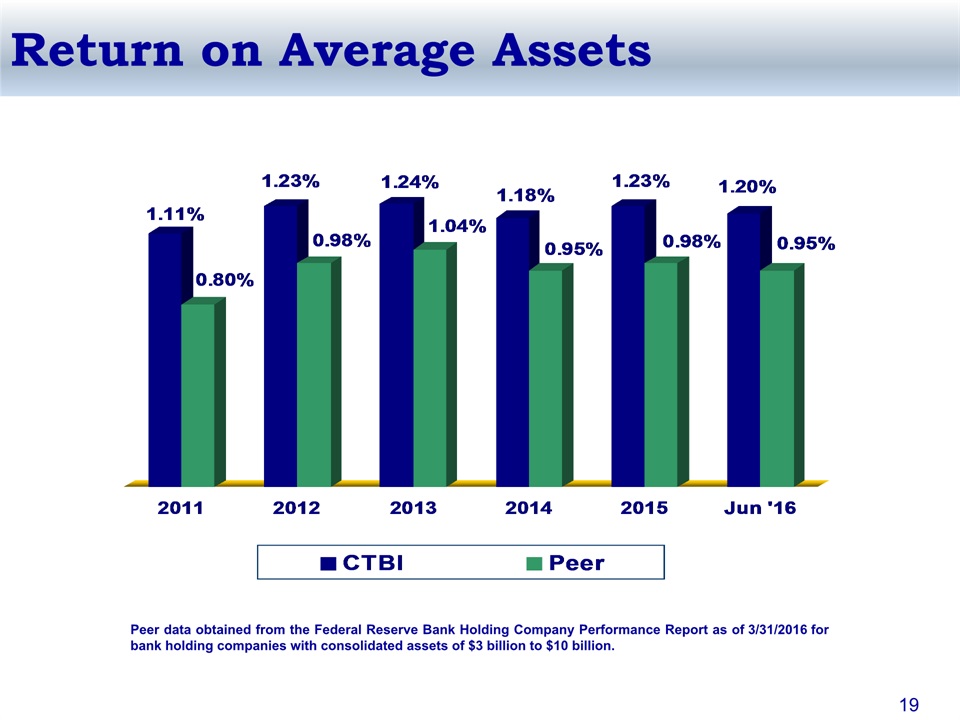

Return on Average Assets Peer data obtained from the Federal Reserve Bank Holding Company Performance Report as of 3/31/2016 for bank holding companies with consolidated assets of $3 billion to $10 billion. 19

20 Balance Sheet Review

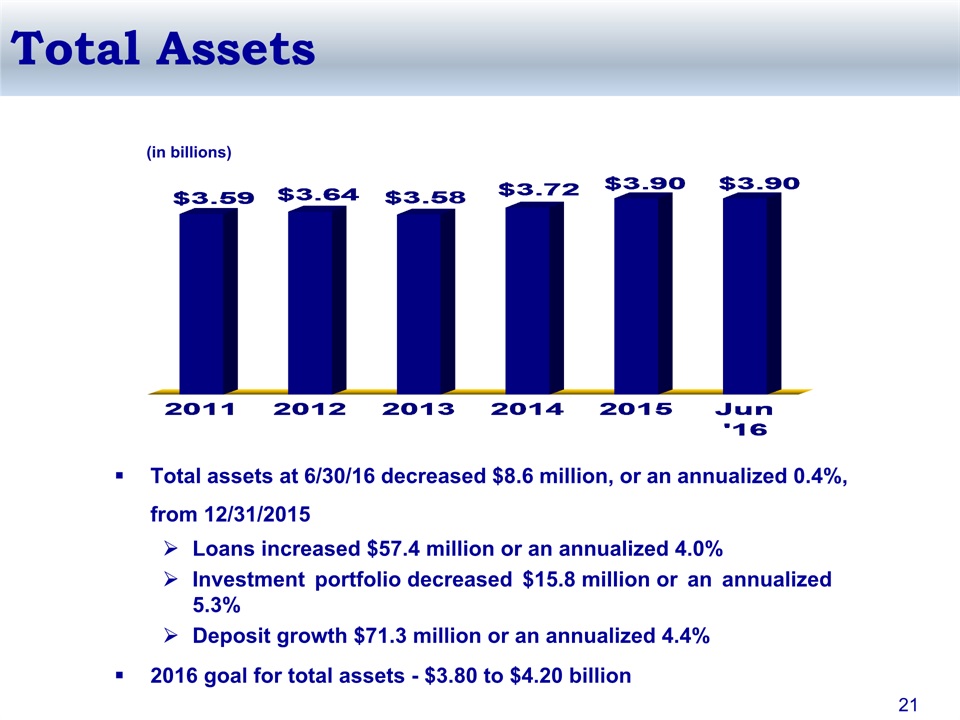

Total assets at 6/30/16 decreased $8.6 million, or an annualized 0.4%, from 12/31/2015Loans increased $57.4 million or an annualized 4.0%Investment portfolio decreased $15.8 million or an annualized 5.3%Deposit growth $71.3 million or an annualized 4.4%2016 goal for total assets - $3.80 to $4.20 billion (in billions) Total Assets 21

(in billions) Total Loans Loans increased $57.4 million or 2.0% from 12/31/152016 goal for total loans - $2.90 to $3.1 billion June 30, 2016 Loan PortfolioMix 22

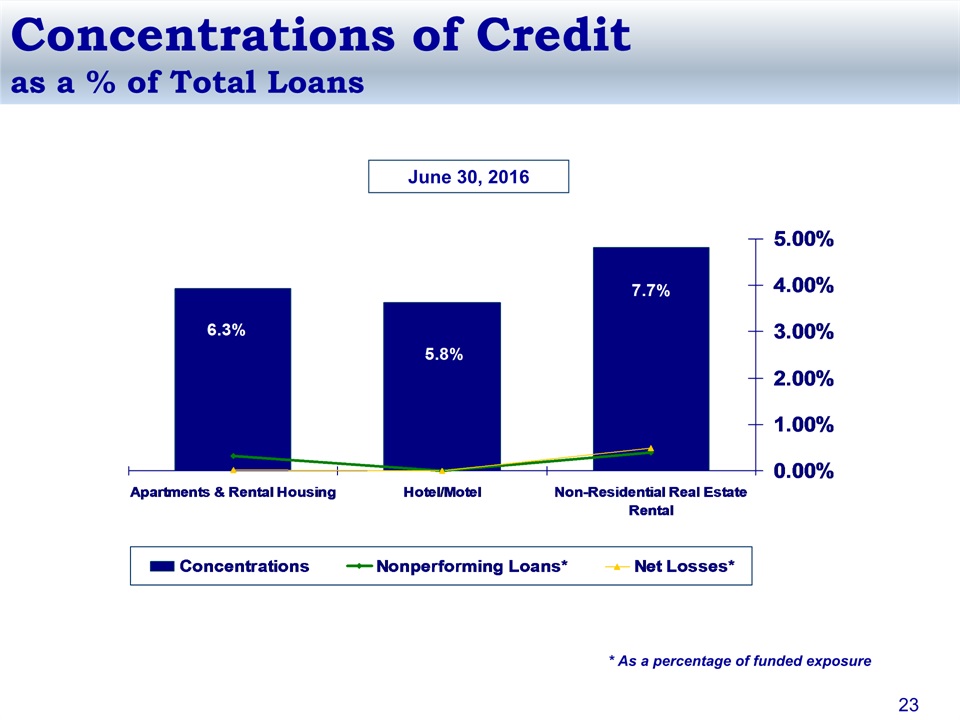

Concentrations of Creditas a % of Total Loans June 30, 2016 * As a percentage of funded exposure 23

Net Charge-offsas a % of Average Loans NonperformingLoansas a % of Total Loans Peer data obtained from the Federal Reserve Bank Holding Company Performance Report as of 3/31/2016 for bank holding companies with consolidated assets of $3 billion to $10 billion. June 30, 2016 24

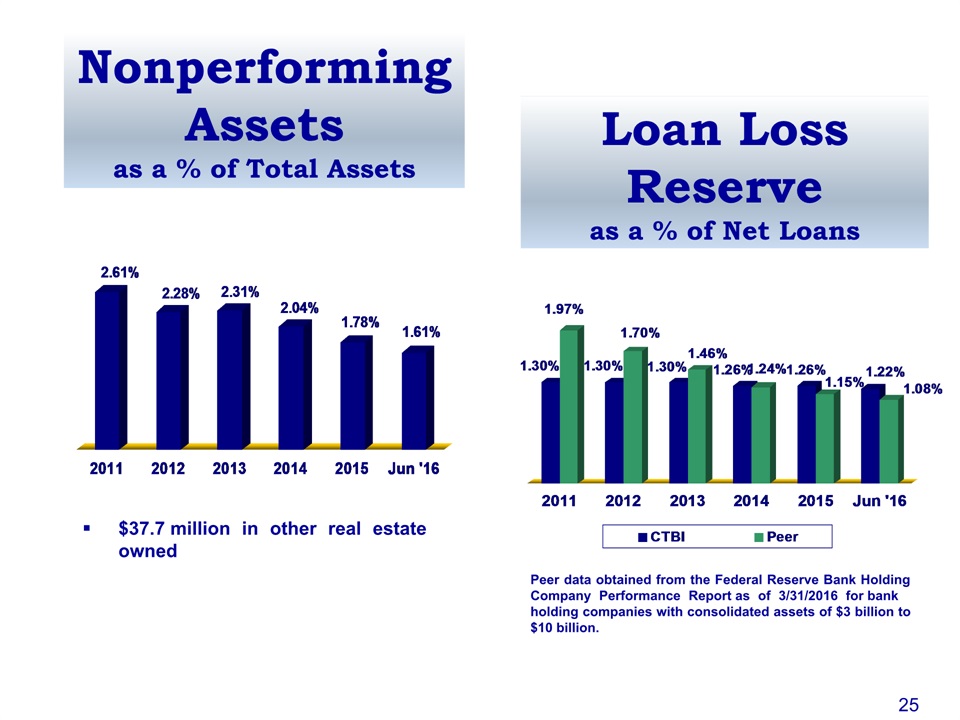

Nonperforming Assetsas a % of Total Assets Loan Loss Reserveas a % of Net Loans $37.7 million in other real estate owned Peer data obtained from the Federal Reserve Bank Holding Company Performance Report as of 3/31/2016 for bank holding companies with consolidated assets of $3 billion to $10 billion. 25

Total Other Real Estate Owned Sales of foreclosed properties for the six months ended 6/30/16 totaled $6.0 millionNew bookings in the first six months of 2016 totaled $3.3 millionProperties under contract to sell were $2.3 million (in millions) 26

(in billions) Total Depositsincluding Repurchase Agreements 2016 goal for total deposits including repurchase agreements - $3.20 to $3.40 billion Total Depositsincluding Repurchase Agreements June 30, 2016 27

28 Our Hoops CD product has been offered for over 19 years100 basis point increase in rate in 1996, 1998, and 2012 with the University of Kentucky’s NCAA Basketball Championships$182 million in Hoops CDs as of 6/30/16 12 Month Certificate of Deposit: April 10th through maturity, rate paid is adjusted by 1 basis point for each University of Kentucky win; bonus 100 basis points added to rate for National Championship win.

29 Shareholder Value

Dividends Per Share 2015 cash dividends increased 3.3%Dividend payout ratio at June 30, 2016 was 46.90%Desired level between 40% and 50%June 30, 2016 cash dividend yield was 3.58%Cash dividend increased to $0.32 per share effective October 1, 2016 30 * 2016 is projected DPS

Shareholders’ Equity (in millions) Shareholders’ equity has increased 29.6% during the past five years7.0% compound growth rate for the past five years2016 goal for shareholders’ equity - $485 to $520 million 7.0% 31

Book ValuePer Share Tangible Common Equity/Assets 32

All data is as of year-end except 2016 which is as of June 30, 2016. Peer data not available as of June 30, 2016.Peer data obtained from SNL Financial; peer group consists of publicly traded regional bank holding companies with an average asset size of $3.9 billion, as defined in our Proxy Statement. (in millions) Price to Tangible Book Value 2011 2012 2013 2014 2015 6/30/16 CTBI 1.51x 1.53x 2.06x 1.67x 1.50x 1.42x Peer 1.19x 1.39x 1.72x 1.72x 1.71x N/A 33 Total Market Capitalization

5 Year Cumulative Total ReturnComparison of CTBI, NASDAQ Stock Market (U.S.), and NASDAQ Bank Stocks An investment in CTBI stock on December 31, 2010 would have outperformed the NASDAQ Bank Stocks Index but not the NASDAQ Stock Market (U.S.) at December 31, 2015. 34

Comparison to Russell 2000 Indexof Small Cap Companies Return to Investors 3-, 5-, and 10-year total returns annualized June 30, 2016 35

Core Value Long-Term Investment 12 stock splits and 10 stock dividends36 years of consecutive increases in cash dividends5-year compound growth rate of cash dividends 2.1%Stock included in the NASDAQ Global Select Market, NASDAQ Dividend Achievers Index, and NASDAQ Bank Stock IndexRecognized as one of “America’s 50 Most Trustworthy Financial Companies” for two consecutive years and ranked 1st and 2nd in the “Small Cap” category in the years 2014 and 2015, respectivelyCTBI shareholders include159 institutional investors (including CTIC – 11.0%) hold 9.7 million shares (53.6%)210 mutual funds hold 4.2 million shares (23.8%) Data as of June 30, 2016 36

37 Key Strategic Initiatives

Operational Priorities Build core earnings capacityQuality loan growthLow cost deposit growthMaintain net interest margin Operational efficiencyExpense controlNoninterest revenue growthCompliance managementIncrease noninterest incomeWealth managementBrokerageLife insuranceContinuing focus on improving asset quality Liquidation of other real estate owned 38

CTBI’s Franchise Value History of solid investor returnsHistorically strong capital positionInvestor focused dividend policyDividend Achievers IndexConsistent financial performanceCommunity banking strategyEconomic diversity in the markets we serveStrong experienced management team and over 1,000 dedicated employeesOur shareholders 39