Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MIDDLEFIELD BANC CORP | d220968d8k.htm |

Thomas G. Caldwell President and CEO Donald L. Stacy Treasurer and CFO Investor Presentation June 25, 2014 Middlefield Banc Corp. Nasdaq: MBCN 2016 Second Quarter Investor Presentation Exhibit 99

Forward Looking Statements This presentation contains forward-looking statements within the meaning of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995 concerning Middlefield Banc Corp.’s plans, strategies, objectives, expectations, intentions, financial condition and results of operations. These forward-looking statements reflect management’s current views and intentions and are subject to known and unknown risks, uncertainties, assumptions and other factors that could cause the actual results to differ materially from those contemplated by the statements. The significant risks and uncertainties related to Middlefield Banc Corp. of which management is aware are discussed in detail in the periodic reports that Middlefield Banc Corp. files with the Securities and Exchange Commission (the “SEC”), including in the “Risk Factors” section of its Annual Report on Form 10-K and its Quarterly Report on Form 10-Q. Investors are urged to review Middlefield Banc Corp.’s periodic reports, which are available at no charge through the SEC’s website at www.sec.gov and through Middlefield Banc Corp.’s website at www.middlefieldbank.bank on the “Investor Relations” page. Middlefield Banc Corp. assumes no obligation to update any of these forward-looking statements to reflect a change in its views or events or circumstances that occur after the date of this presentation. Other Information In connection with the proposed reorganization, Middlefield will file with the SEC a Registration Statement on Form S-4 that will include a proxy statement and a prospectus, as well as other relevant documents concerning the proposed transaction. Middlefield Banc Corp. shareholders, Liberty Bank shareholders, and other investors are urged to read carefully the proxy statement/prospectus to be included in the Form S-4 registration statement, because the proxy statement/prospectus will contain important information about Middlefield Banc Corp., Liberty Bank, the proposed merger, the persons soliciting proxies for the proposed merger, their interests in the proposed merger, and related matters. The respective directors and executive officers of Middlefield and Liberty and other persons may be deemed to be participants in the solicitation of proxies from Liberty shareholders with respect to the proposed Merger. Information regarding the directors and executive officers of Middlefield is available in its proxy statement filed with the SEC on April 4, 2016. Liberty Bank is a private company, but limited information about its executive officers is available on Liberty Bank's website at www.libertybankna.com/about-us. Other information regarding the participants in the solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus to be included in the Form S-4 Registration Statement and other relevant materials to be filed with the SEC. Investors and security holders will be able to obtain free copies of the Form S-4 Registration Statement (when available) and other documents filed with the SEC by Middlefield Banc Corp. through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Middlefield Banc Corp. are available free of charge on Middlefield's website at www.middlefieldbank.bank. www.middlefieldbank.bank

Middlefield: A community bank that is safe, strong and committed www.middlefieldbank.bank Bank established 1901/HC established 1988 Strong brand recognition in core markets #3 overall within its core NE Ohio market Cleveland MSA and Columbus MSA have a combined population of more than 4.0 million Strong leadership team - Average tenure of eight executive officers: At MBCN is over 15 years Within industry is over 26 years $76 Mil. Market Cap $1.08 (3.2%) Div. & Yield $760 Mil. Assets $628 Deposits $3.60 TTM EPS 9.4x P/TTM EPS *Stock Data at July 29, 2016 and Financial Data at June 30, 2016 Overview Rankings and Awards SNL Financial(3) Achieved the 10th highest ROAE out of public community banks with under $1 billion in assets. KBW(2) Named one of 25 U.S. banking institutions to KBW’s coveted “Bank Honor Roll” of superior performers. American Banker(1) Ranked 38th in American Banker’s Annual List of the Top 200 Publicly Traded Community Banks. Sources:(1) American Banker April 28, 2015; (2) KBW April 13, 2015; (3) SNL June 16, 2014

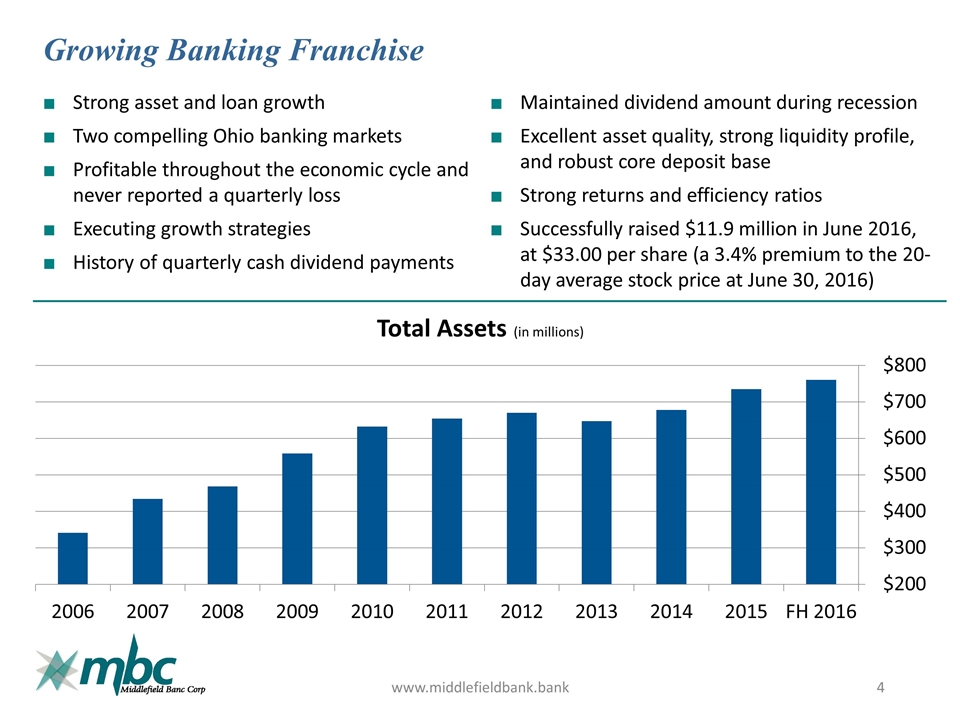

Growing Banking Franchise www.middlefieldbank.bank Strong asset and loan growth Two compelling Ohio banking markets Profitable throughout the economic cycle and never reported a quarterly loss Executing growth strategies History of quarterly cash dividend payments Maintained dividend amount during recession Excellent asset quality, strong liquidity profile, and robust core deposit base Strong returns and efficiency ratios Successfully raised $11.9 million in June 2016, at $33.00 per share (a 3.4% premium to the 20-day average stock price at June 30, 2016)

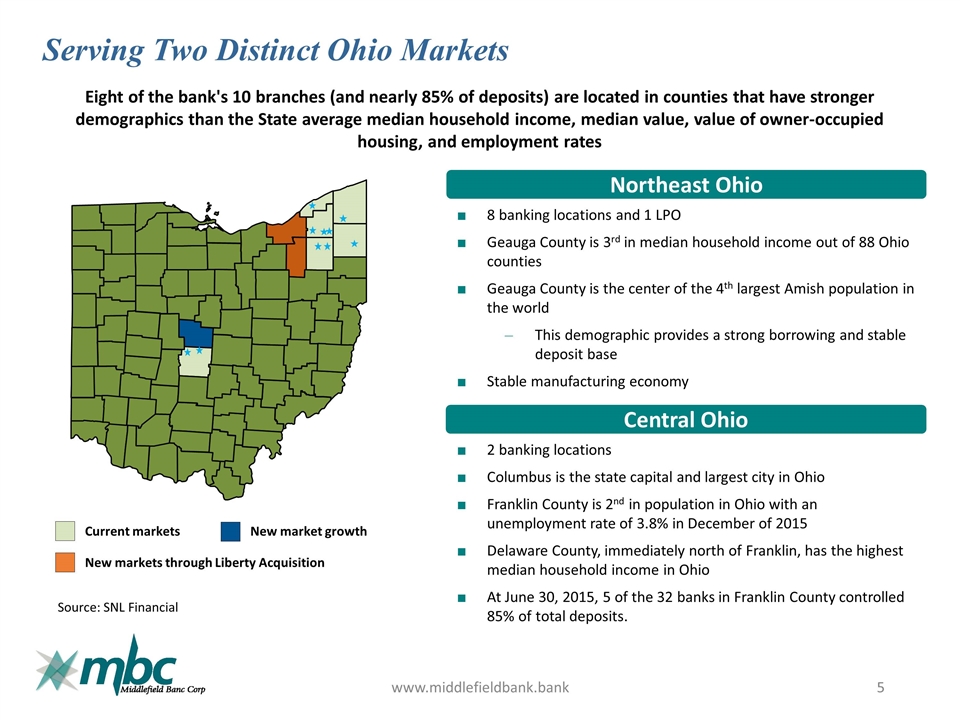

Serving Two Distinct Ohio Markets www.middlefieldbank.bank Northeast Ohio Central Ohio 2 banking locations Columbus is the state capital and largest city in Ohio Franklin County is 2nd in population in Ohio with an unemployment rate of 3.8% in December of 2015 Delaware County, immediately north of Franklin, has the highest median household income in Ohio At June 30, 2015, 5 of the 32 banks in Franklin County controlled 85% of total deposits. 8 banking locations and 1 LPO Geauga County is 3rd in median household income out of 88 Ohio counties Geauga County is the center of the 4th largest Amish population in the world This demographic provides a strong borrowing and stable deposit base Stable manufacturing economy Current markets New market growth New markets through Liberty Acquisition Source: SNL Financial Eight of the bank's 10 branches (and nearly 85% of deposits) are located in counties that have stronger demographics than the State average median household income, median value, value of owner-occupied housing, and employment rates

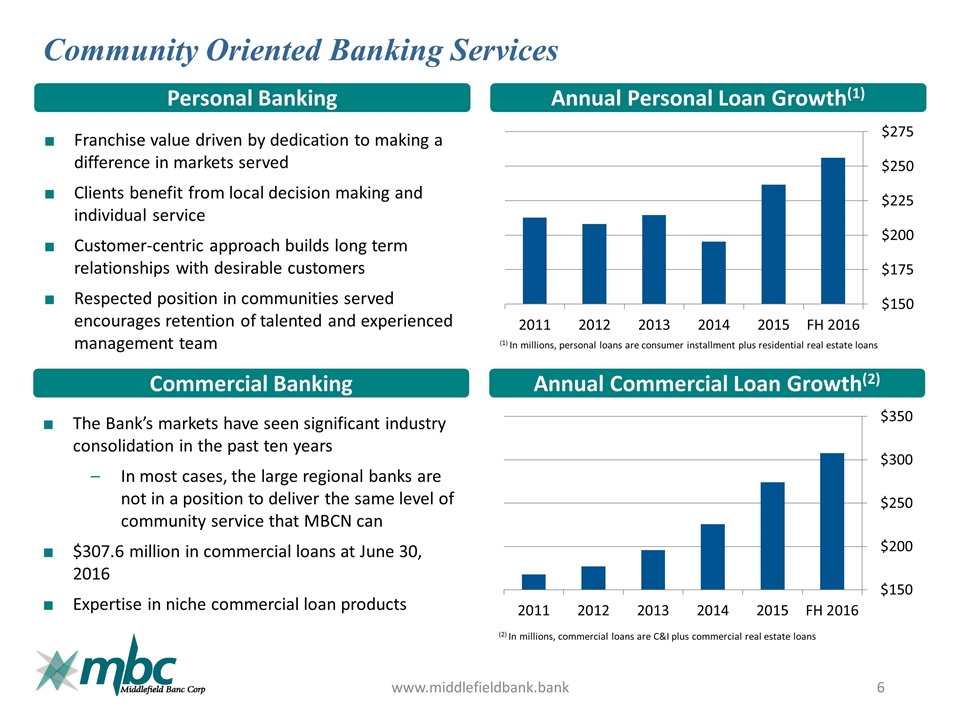

Community Oriented Banking Services www.middlefieldbank.bank Personal Banking Annual Personal Loan Growth(1) Commercial Banking Annual Commercial Loan Growth(2) Franchise value driven by dedication to making a difference in markets served Clients benefit from local decision making and individual service Customer-centric approach builds long term relationships with desirable customers Respected position in communities served encourages retention of talented and experienced management team The Bank’s markets have seen significant industry consolidation in the past ten years In most cases, the large regional banks are not in a position to deliver the same level of community service that MBCN can $307.6 million in commercial loans at June 30, 2016 Expertise in niche commercial loan products (2) In millions, commercial loans are C&I plus commercial real estate loans (1) In millions, personal loans are consumer installment plus residential real estate loans

Middlefield’s Market Share (not including Liberty Acquisition) www.middlefieldbank.bank Source: FDIC Ashtabula, Geauga, Portage & Trumbull Counties June 30, 2015 Rank Institution Branches Deposits in Market ($000) Market Share 1 Huntington National Bank 36 1,527,712 20.01 2 JP Morgan Chase 17 953,647 12.49 3 The Middlefield Banking Co. 8 566,536 7.42 4 PNC Bank 11 544,320 7.13 5 Key Bank 15 508,154 6.66 6 Talmer Bank and Trust 9 460,744 6.04 7 Cortland Savings & Banking 10 398,416 5.22 8 First Merit Bank 11 370,365 4.85 Total for institutions in market 181 7,633,504 Franklin County June 30, 2015 Rank Institution Branches Deposits in Market ($000) Market Share 1 Huntington National Bank 65 16,565,127 33.51 2 JP Morgan Chase 53 11,105,577 22.46 3 PNC Bank 42 5,234,881 10.59 4 Nationwide Bank 2 5,125,785 10.37 5 Fifth Third Bank 47 4,156,250 8.41 25 The Middlefield Banking Co. 2 58,070 0.12 26 First City Bank 1 43,911 0.09 27 Citizens Bank 2 31,159 0.06 Total for institutions in market 345 49.436,992 Strong Market Share in Northeastern Ohio Market Opportunities To Increase Market Share in Central Ohio

Recent Events and Growth Strategies www.middlefieldbank.bank Executing Growth Oriented Strategic Plan Expand Ohio De Novo Growth Focus on high growth markets, with favorable demographics Grow Market Share Increased advertising budget Exploit changing market dynamics Generate Fee Income Secondary mortgages Financial services Enhance Team New Central Ohio President Invest in new lending officers Invest in Technology Enhance online banking Grow mobile Seek Attractive Acquisitions Accelerate growth in similar markets Generate strong payback

Organic Growth www.middlefieldbank.bank Sunbury, Ohio Mentor, Ohio LPO 11th full-service banking location and third office in Central Ohio. Immediately north of Middlefield's existing Central Ohio branches Delaware County is the fastest growing suburban county in the State of Ohio 20 miles north of Columbus Highest median household income in Ohio Expected to be completed in 2016 third quarter Opened October, 2015 Focused on commercial banking in Lake and Geauga Counties Mentor is home to approximately 5,000 businesses Major manufacturers include ABB Inc., Avery Dennison Corp., Lincoln Electric Holding Inc., and STERIS Corp. Lake county has over 94,000 household with a median household income of $56,018 Source: Ohio County Profiles Lake County Source: Delaware County

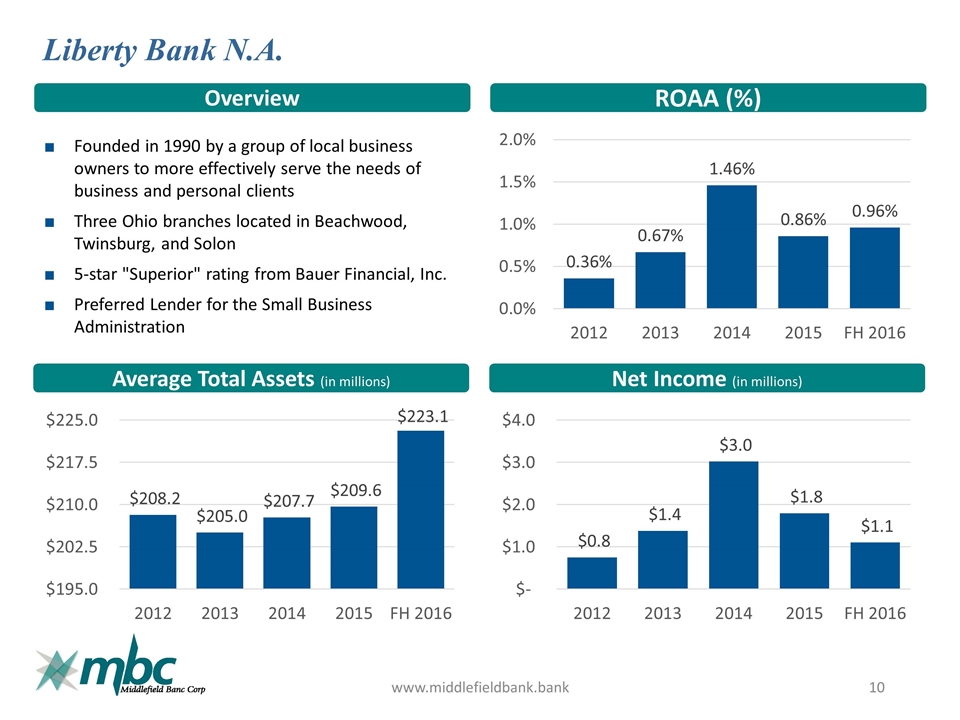

Liberty Bank N.A. www.middlefieldbank.bank Overview ROAA (%) Average Total Assets (in millions) Net Income (in millions) Founded in 1990 by a group of local business owners to more effectively serve the needs of business and personal clients Three Ohio branches located in Beachwood, Twinsburg, and Solon 5-star "Superior" rating from Bauer Financial, Inc. Preferred Lender for the Small Business Administration

Liberty Acquisition www.middlefieldbank.bank A Compelling Strategic and Financial Opportunity Creates Leading Northeast Ohio Franchise(1) Based on loans, the combined bank will be (at June 30, 2016): 5th largest in Northeast Ohio 15th largest in State of Ohio Based on deposits, the combined bank will be (at June 30, 2016): 5th largest in Northeast Ohio 15th largest in State of Ohio Strong Business and Cultural Fit Middlefield will have 13 branches in Ohio among a seven county operating footprint Branch network will expand in the Cleveland MSA by adding Liberty’s three offices located in Beachwood, Twinsburg, and Solon Operates similar businesses in attractive, core and contiguous markets to Middlefield Compatible culture with Middlefield Focused on clients and communities Treat customers like individuals Significant Long-Term Value Creation(2) Liberty operates in suburbs of Cleveland market, allowing for Middlefield to offer compelling financial products and community banking values to a market area that is used to a big banking culture Approximately 75% of Cuyahoga County deposits are at top five institutions Only 24 institutions in Cuyahoga County(3) Liberty is 15th largest based on deposits Middlefield has a larger lending limit, allowing for increased customer penetration Meaningful long-term operating synergies (1) According to SNL at July 29, 2016, Northeastern Ohio includes area codes 216, 330, and 440 (2) According to FDIC data at June 30, 2015 (3) According to SNL at July 29, 2016,

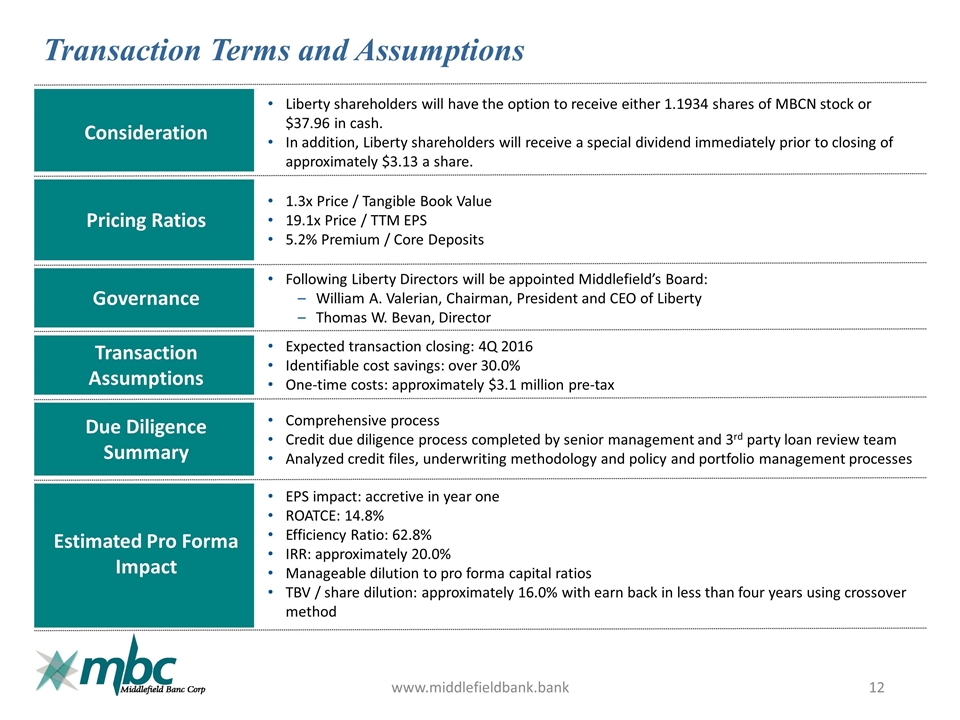

Transaction Terms and Assumptions www.middlefieldbank.bank Consideration Liberty shareholders will have the option to receive either 1.1934 shares of MBCN stock or $37.96 in cash. In addition, Liberty shareholders will receive a special dividend immediately prior to closing of approximately $3.13 a share. Pricing Ratios 1.3x Price / Tangible Book Value 19.1x Price / TTM EPS 5.2% Premium / Core Deposits Governance Following Liberty Directors will be appointed Middlefield’s Board: William A. Valerian, Chairman, President and CEO of Liberty Thomas W. Bevan, Director Transaction Assumptions Expected transaction closing: 4Q 2016 Identifiable cost savings: over 30.0% One-time costs: approximately $3.1 million pre-tax Due Diligence Summary Comprehensive process Credit due diligence process completed by senior management and 3rd party loan review team Analyzed credit files, underwriting methodology and policy and portfolio management processes Estimated Pro Forma Impact EPS impact: accretive in year one ROATCE: 14.8% Efficiency Ratio: 62.8% IRR: approximately 20.0% Manageable dilution to pro forma capital ratios TBV / share dilution: approximately 16.0% with earn back in less than four years using crossover method

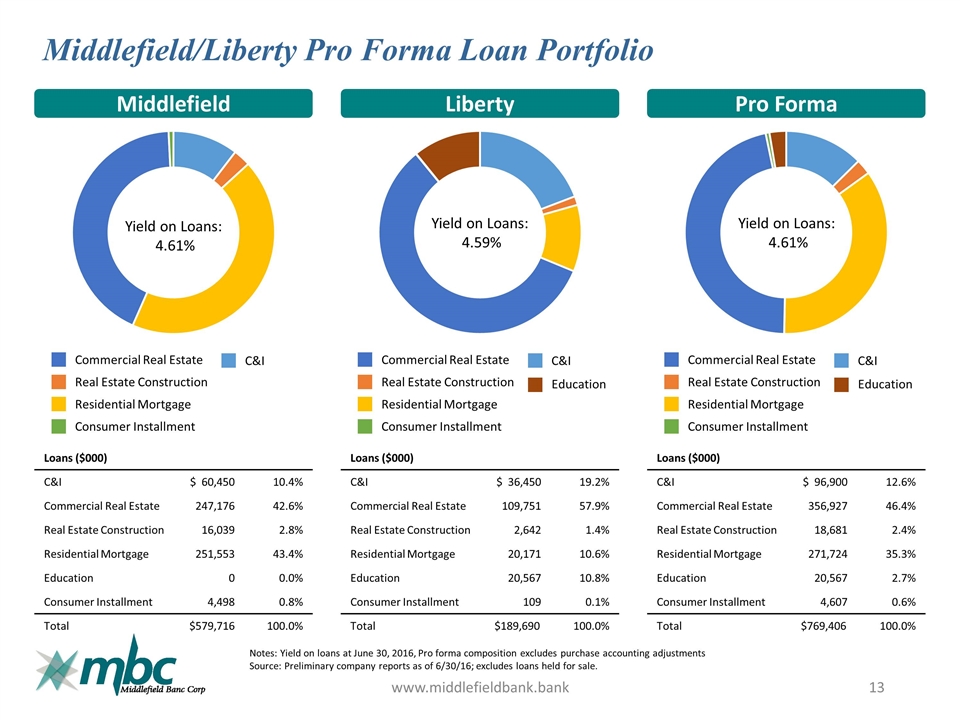

Middlefield/Liberty Pro Forma Loan Portfolio www.middlefieldbank.bank Notes: Yield on loans at June 30, 2016, Pro forma composition excludes purchase accounting adjustments Source: Preliminary company reports as of 6/30/16; excludes loans held for sale. Middlefield Liberty Pro Forma C&I Real Estate Construction Residential Mortgage Commercial Real Estate Consumer Installment C&I Real Estate Construction Residential Mortgage Commercial Real Estate Consumer Installment Education C&I Real Estate Construction Residential Mortgage Commercial Real Estate Consumer Installment Loans ($000) C&I $ 36,450 19.2% Commercial Real Estate 109,751 57.9% Real Estate Construction 2,642 1.4% Residential Mortgage 20,171 10.6% Education 20,567 10.8% Consumer Installment 109 0.1% Total $189,690 100.0% Education Loans ($000) C&I $ 60,450 10.4% Commercial Real Estate 247,176 42.6% Real Estate Construction 16,039 2.8% Residential Mortgage 251,553 43.4% Education 0 0.0% Consumer Installment 4,498 0.8% Total $579,716 100.0% Yield on Loans: 4.61% Yield on Loans: 4.59% Yield on Loans: 4.61% Loans ($000) C&I $ 96,900 12.6% Commercial Real Estate 356,927 46.4% Real Estate Construction 18,681 2.4% Residential Mortgage 271,724 35.3% Education 20,567 2.7% Consumer Installment 4,607 0.6% Total $769,406 100.0%

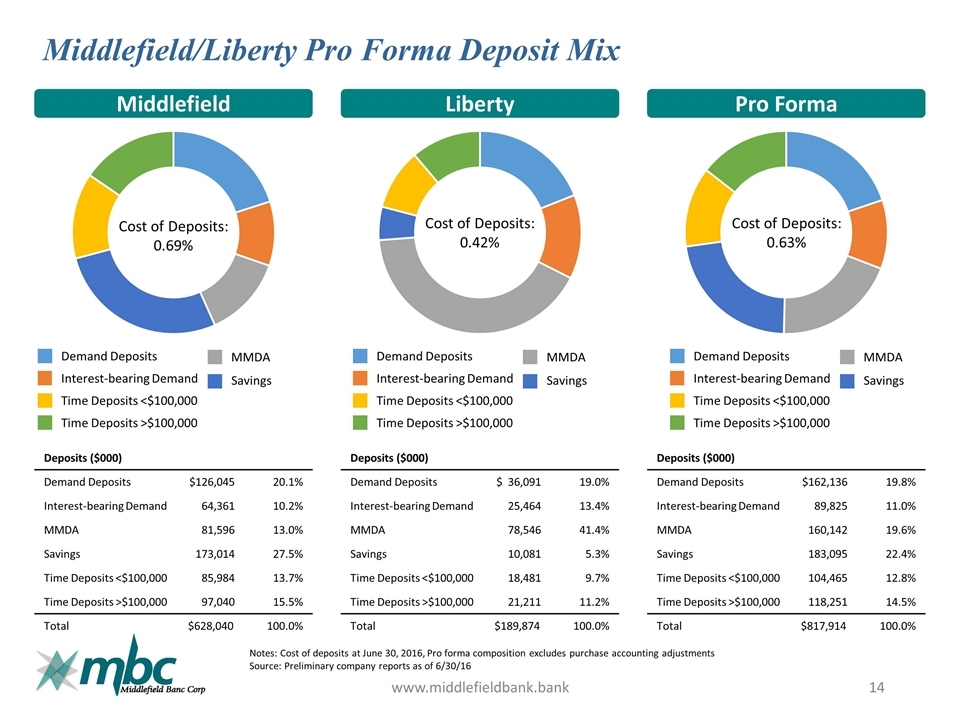

Middlefield/Liberty Pro Forma Deposit Mix www.middlefieldbank.bank Notes: Cost of deposits at June 30, 2016, Pro forma composition excludes purchase accounting adjustments Source: Preliminary company reports as of 6/30/16 Middlefield Liberty Pro Forma Deposits ($000) Demand Deposits $ 36,091 19.0% Interest-bearing Demand 25,464 13.4% MMDA 78,546 41.4% Savings 10,081 5.3% Time Deposits <$100,000 18,481 9.7% Time Deposits >$100,000 21,211 11.2% Total $189,874 100.0% Deposits ($000) Demand Deposits $126,045 20.1% Interest-bearing Demand 64,361 10.2% MMDA 81,596 13.0% Savings 173,014 27.5% Time Deposits <$100,000 85,984 13.7% Time Deposits >$100,000 97,040 15.5% Total $628,040 100.0% Cost of Deposits: 0.69% Cost of Deposits: 0.42% Cost of Deposits: 0.63% Deposits ($000) Demand Deposits $162,136 19.8% Interest-bearing Demand 89,825 11.0% MMDA 160,142 19.6% Savings 183,095 22.4% Time Deposits <$100,000 104,465 12.8% Time Deposits >$100,000 118,251 14.5% Total $817,914 100.0% MMDA Interest-bearing Demand Time Deposits <$100,000 Demand Deposits Time Deposits >$100,000 Savings MMDA Interest-bearing Demand Time Deposits <$100,000 Demand Deposits Time Deposits >$100,000 Savings MMDA Interest-bearing Demand Time Deposits <$100,000 Demand Deposits Time Deposits >$100,000 Savings

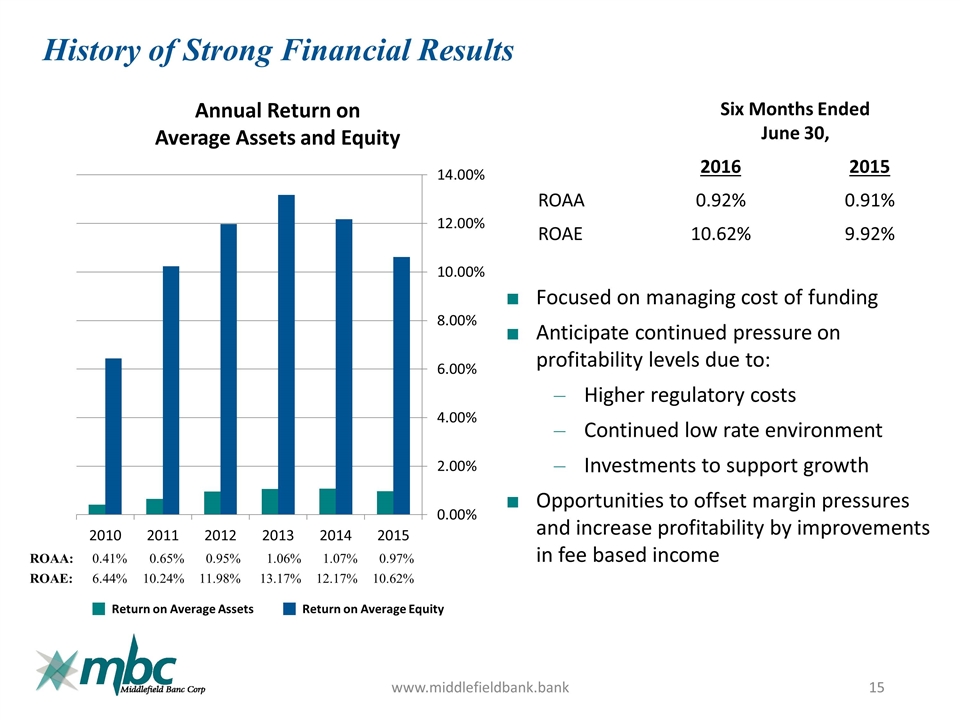

History of Strong Financial Results www.middlefieldbank.bank ROAA: 0.41% 0.65% 0.95% 1.06% 1.07% 0.97% ROAE: 6.44% 10.24% 11.98% 13.17% 12.17% 10.62% Return on Average Assets Return on Average Equity Focused on managing cost of funding Anticipate continued pressure on profitability levels due to: Higher regulatory costs Continued low rate environment Investments to support growth Opportunities to offset margin pressures and increase profitability by improvements in fee based income Six Months Ended June 30, 2016 2015 ROAA 0.92% 0.91% ROAE 10.62% 9.92% Annual Return on Average Assets and Equity

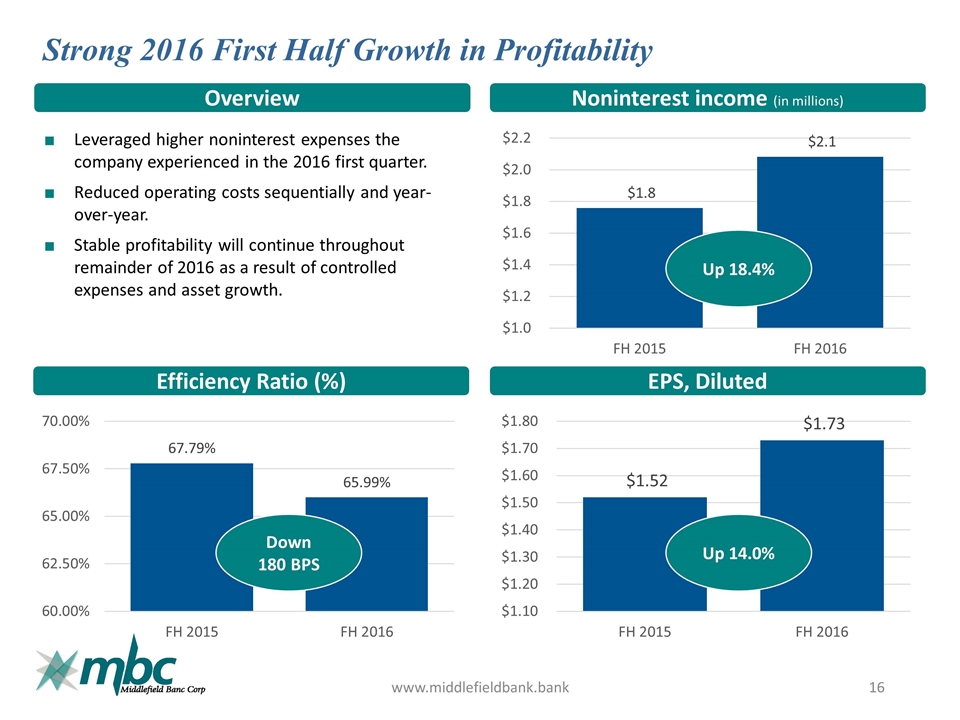

Strong 2016 First Half Growth in Profitability www.middlefieldbank.bank Overview Noninterest income (in millions) Efficiency Ratio (%) EPS, Diluted Up 18.4% Up 14.0% Down 180 BPS Leveraged higher noninterest expenses the company experienced in the 2016 first quarter. Reduced operating costs sequentially and year-over-year. Stable profitability will continue throughout remainder of 2016 as a result of controlled expenses and asset growth.

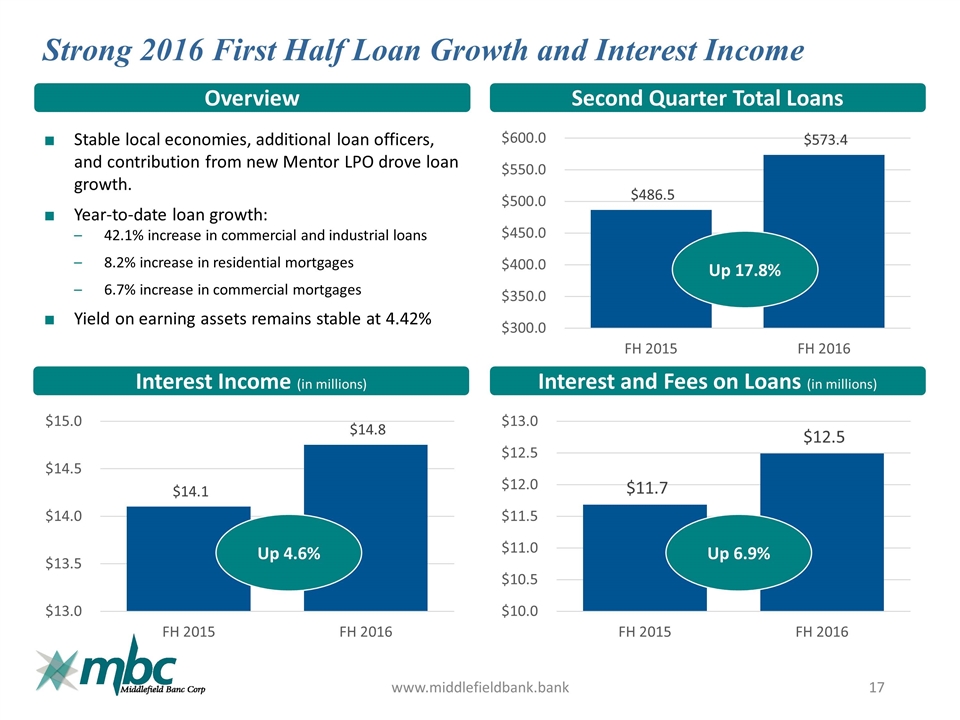

Strong 2016 First Half Loan Growth and Interest Income www.middlefieldbank.bank Overview Second Quarter Total Loans Interest Income (in millions) Interest and Fees on Loans (in millions) Up 6.9% Up 4.6% Up 17.8% Stable local economies, additional loan officers, and contribution from new Mentor LPO drove loan growth. Year-to-date loan growth: 42.1% increase in commercial and industrial loans 8.2% increase in residential mortgages 6.7% increase in commercial mortgages Yield on earning assets remains stable at 4.42%

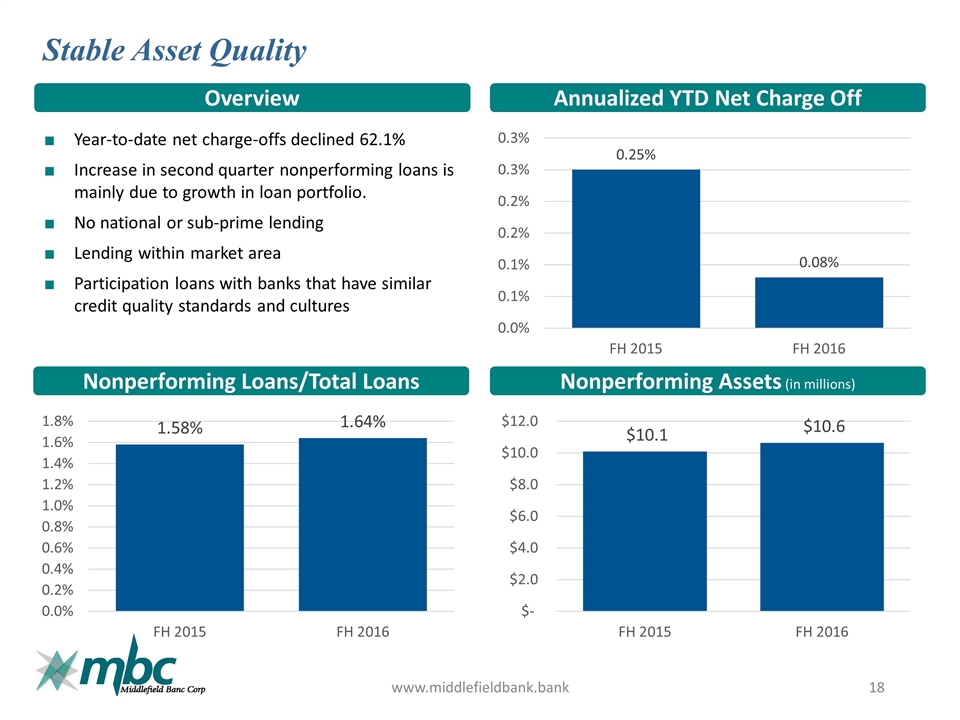

Stable Asset Quality www.middlefieldbank.bank Overview Annualized YTD Net Charge Off Nonperforming Loans/Total Loans Nonperforming Assets (in millions) Year-to-date net charge-offs declined 62.1% Increase in second quarter nonperforming loans is mainly due to growth in loan portfolio. No national or sub-prime lending Lending within market area Participation loans with banks that have similar credit quality standards and cultures

www.middlefieldbank.bank Supplemental Data

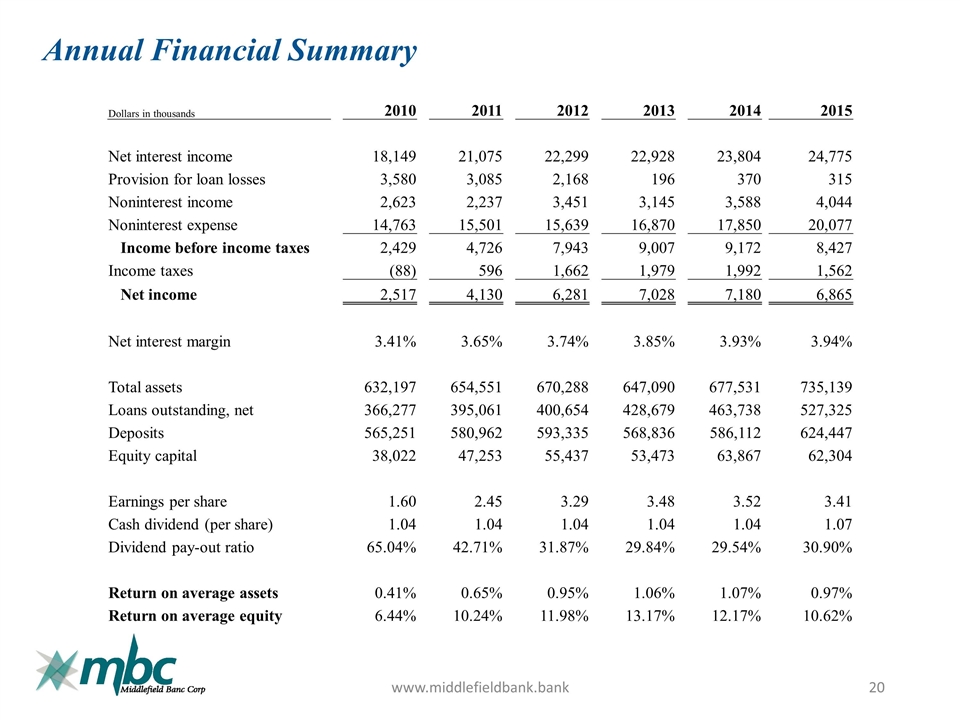

Annual Financial Summary www.middlefieldbank.bank Dollars in thousands 2010 2011 2012 2013 2014 2015 Net interest income 18,149 21,075 22,299 22,928 23,804 24,775 Provision for loan losses 3,580 3,085 2,168 196 370 315 Noninterest income 2,623 2,237 3,451 3,145 3,588 4,044 Noninterest expense 14,763 15,501 15,639 16,870 17,850 20,077 Income before income taxes 2,429 4,726 7,943 9,007 9,172 8,427 Income taxes (88) 596 1,662 1,979 1,992 1,562 Net income 2,517 4,130 6,281 7,028 7,180 6,865 Net interest margin 3.41% 3.65% 3.74% 3.85% 3.93% 3.94% Total assets 632,197 654,551 670,288 647,090 677,531 735,139 Loans outstanding, net 366,277 395,061 400,654 428,679 463,738 527,325 Deposits 565,251 580,962 593,335 568,836 586,112 624,447 Equity capital 38,022 47,253 55,437 53,473 63,867 62,304 Earnings per share 1.60 2.45 3.29 3.48 3.52 3.41 Cash dividend (per share) 1.04 1.04 1.04 1.04 1.04 1.07 Dividend pay-out ratio 65.04% 42.71% 31.87% 29.84% 29.54% 30.90% Return on average assets 0.41% 0.65% 0.95% 1.06% 1.07% 0.97% Return on average equity 6.44% 10.24% 11.98% 13.17% 12.17% 10.62%

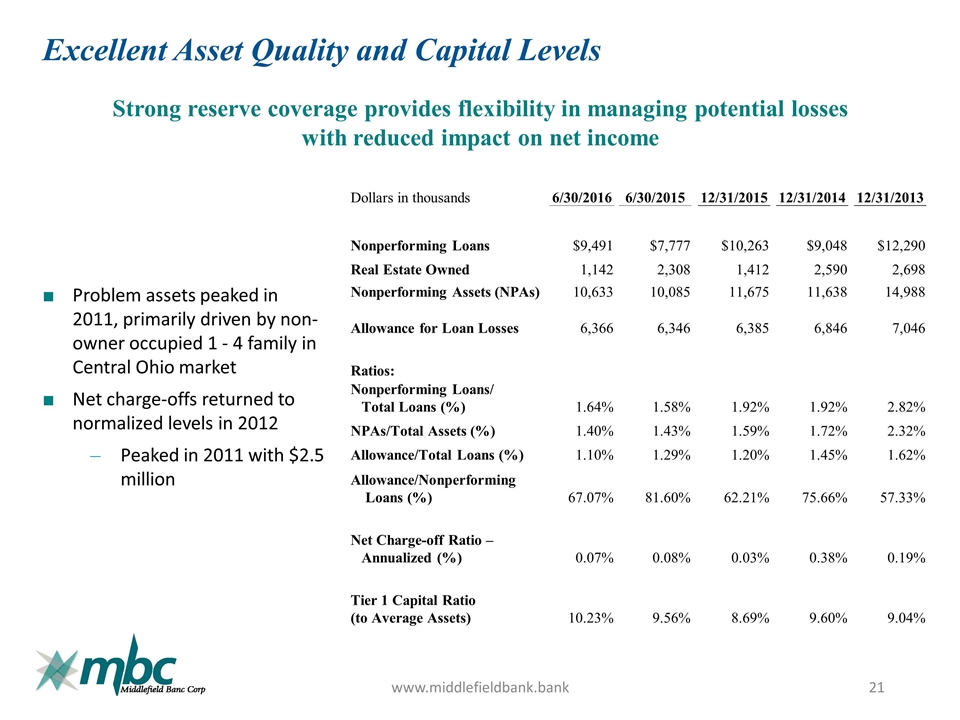

Excellent Asset Quality and Capital Levels www.middlefieldbank.bank Dollars in thousands 6/30/2016 6/30/2015 12/31/2015 12/31/2014 12/31/2013 Nonperforming Loans $9,491 $7,777 $10,263 $9,048 $12,290 Real Estate Owned 1,142 2,308 1,412 2,590 2,698 Nonperforming Assets (NPAs) 10,633 10,085 11,675 11,638 14,988 Allowance for Loan Losses 6,366 6,346 6,385 6,846 7,046 Ratios: Nonperforming Loans/ Total Loans (%) 1.64% 1.58% 1.92% 1.92% 2.82% NPAs/Total Assets (%) 1.40% 1.43% 1.59% 1.72% 2.32% Allowance/Total Loans (%) 1.10% 1.29% 1.20% 1.45% 1.62% Allowance/Nonperforming Loans (%) 67.07% 81.60% 62.21% 75.66% 57.33% Net Charge-off Ratio – Annualized (%) 0.07% 0.08% 0.03% 0.38% 0.19% Tier 1 Capital Ratio (to Average Assets) 10.23% 9.56% 8.69% 9.60% 9.04% Strong reserve coverage provides flexibility in managing potential losses with reduced impact on net income Problem assets peaked in 2011, primarily driven by non-owner occupied 1 - 4 family in Central Ohio market Net charge-offs returned to normalized levels in 2012 Peaked in 2011 with $2.5 million