Attached files

| file | filename |

|---|---|

| EX-23.1 - Mr. Amazing Loans Corp | ex23-1.htm |

| EX-10.9 - Mr. Amazing Loans Corp | ex10-9.htm |

| EX-8.1 - Mr. Amazing Loans Corp | ex8-1.htm |

| EX-5.1 - Mr. Amazing Loans Corp | ex5-1.htm |

As filed with the Securities and Exchange Commission July 29 , 2016

Registration Statement No. 333-211636

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1/A

(Amendment No. 2 )

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

IEG Holdings Corporation

(Exact name of registrant as specified in its charter)

| Florida | 6141 | 90-1069184 | ||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

6160 West Tropicana Ave., Suite E-13

Las Vegas, NV 89103

(702) 227-5626

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Paul Mathieson

Chief

Executive Officer

IEG Holdings Corporation

6160 West Tropicana Ave., Suite E-13

Las Vegas, NV 89103

(702) 227-5626

(Name, address and telephone number of agent for service)

With copies to:

Laura Anthony, Esq. Legal & Compliance, LLC 330 Clematis Street, Suite 217 West Palm Beach, FL 33401 (800) 341-2684 |

Spencer

G. Feldman, Esq. Olshan Frome Wolosky LLP 1325 Avenue of the Americas New York, NY 10019 (212) 451-2300 |

Approximate date of proposed sale to public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on the Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering: [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering: [ ]

Indicate by check mark whether registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [X] (Do not check if a smaller reporting company) | Smaller reporting company | [ ] |

CALCULATION OF REGISTRATION FEE

| Title of Class of Securities to be Registered | Amount to

be Registered (1) | Estimated

Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | |||||||||

| Subscription rights to purchase common stock | — | — | — | (2) | ||||||||

| Shares of common stock underlying the subscription rights to purchase common stock | 95,319,741 | $ | 95,319,741 | (3) | $ | 9,598.70 | ||||||

| Total | $ | 9,598.70 | ||||||||||

| (1) | This registration statement relates to (a) the subscription rights to purchase common stock, and (b) the shares of common stock deliverable upon the exercise of such subscription rights. | |

| (2) | The rights are being issued without consideration. Pursuant to Rule 457(g), no separate registration fee is payable with respect to the rights being offered hereby since the rights are being registered in the same registration statement as the securities to be offered pursuant thereto. | |

| (3) | Estimated solely for purposes of calculating the registration fee under Rule 457(o) of the Securities Act of 1933, as amended. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a) may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED JULY 29 , 2016 |

IEG HOLDINGS CORPORATION

Subscription Rights to Purchase

Up

to 95,319,741 Shares of Common Stock at a Price per Share of $ 1.00 ,

Subject to a Maximum Offering of $ 95,319,741

IEG Holdings Corporation is distributing, at no charge, to holders of our common stock non-transferable subscription rights to purchase up to 95,319,741 shares of our common stock (“Stock Subscription Rights”). You will receive one Stock Subscription Right for each share of common stock owned at 5:00 p.m., Eastern time, on August 15, 2016.

Each Stock Subscription Right will entitle you to purchase one share of our common stock at a subscription price equal to $ 1.00 , subject to a maximum offering of $ 95,319,741 . We refer to this as the basic subscription privilege. The price was determined by our board of directors after a review of recent historical trading prices of our common stock and the closing sales price of our common stock on July 28 , 2016. Our common stock is quoted on the OTCQX® marketplace under the symbol “IEGH.” On July 28 , 2016, the last reported sale price of our common stock on the OTCQX was $ 1.67 per share. If you fully exercise your basic subscription privilege and other stockholders do not fully exercise their basic subscription privileges, you may also exercise an over-subscription right to purchase additional shares that remain unsubscribed at the expiration of the rights offering, subject to the availability and pro rata allocation of shares among stockholders exercising this over-subscription right. If all the rights are exercised, the total purchase price of the shares offered in the rights offering would be approximately $ 95,319,741 .

We are conducting the offering to raise capital that we intend to use to fund new loan originations and for general corporate purposes. See “Use of Proceeds.”

Paul Mathieson, our Chief Executive Officer and a member of our board of directors, owns approximately 72.4% of our outstanding common stock. Mr. Mathieson has indicated his intention not to participate in the rights offering.

The Stock Subscription Rights will expire if they are not exercised by 5:00 p.m., Eastern time, on August 29 , 2016, unless we extend the rights offering period. We have the option to extend the rights offering and the period for exercising your Stock Subscription Rights for a period not to exceed 30 days, although we do not presently intend to do so. You should carefully consider whether to exercise your Stock Subscription Rights prior to the expiration of the rights offering. All exercises of Stock Subscription Rights are irrevocable, even if the rights offering is extended for 30 days by our board of directors. However, if we amend the rights offering to allow for an extension of the rights offering for a period of more than 30 days or make a fundamental change to the terms of the rights offering set forth in this prospectus, you may cancel your subscription and receive a refund of any money you have advanced. If the rights offering is not fully subscribed following expiration of the rights offering and the 30-day extension, Source Capital Group, Inc. (“Source Capital”) has agreed to use its best efforts to place any unsubscribed shares of common stock as part of this rights offering at the subscription price for an additional period of up to 45 days. The number of shares that may be sold by us during this period will depend upon the number of shares of common stock that are subscribed for pursuant to the exercise of rights by our shareholders. No assurance can be given that any unsubscribed shares will be sold during this period.

In the event that the exercise by a stockholder of the basic subscription privilege or the over-subscription privilege could, as determined by us in our sole discretion, potentially result in a limitation on our ability to use net operating losses, tax credits and other tax attributes, which we refer to as the “Tax Attributes,” under the Internal Revenue Code of 1986, as amended (the “Code”), and rules promulgated by the Internal Revenue Service (the “IRS”), we may, but are under no obligation to, reduce the exercise by such stockholder of the basic subscription privilege or the over-subscription privilege to such number of shares of common stock as we, in our sole discretion, shall determine to be advisable in order to preserve our ability to use the Tax Attributes.

Our board of directors is making no recommendation regarding your exercise of the Stock Subscription Rights. The Stock Subscription Rights may not be sold, transferred or assigned and will not be listed for trading on any stock exchange or market or on the OTC Market.

Our board of directors may cancel the rights offering at any time prior to the expiration of the rights offering for any reason. In the event the rights offering is cancelled, all subscription payments received by the subscription agent will be returned promptly, without interest.

We have engaged Source Capital as dealer-manager for this offering. See “Plan of Distribution.”

| Subscription Price | Dealer Manager Fee (1) | Proceeds, Before Expenses, to Us | ||||||||||

| Per share of common stock | $ | 1.00 | $ | 0.08 | $ | 0.92 | ||||||

| Total (2) | $ | 95,319,741.00 | $ | 7,625,579.28 | $ | 87,694,161.72 | ||||||

(1) We have agreed to pay Source Capital, the dealer-manager for this rights offering, a dealer-manager fee equal to 6% of the dollar amount received by us from any gross proceeds received from cash exercises of the Stock Subscription Rights issued to stockholders in the rights offering, which commission will not exceed $6,000,000 in the aggregate. We have also agreed to pay Source Capital a non-accountable expense allowance of 1.8% of the gross proceeds of this offering, which non-accountable expense fee shall not exceed $1,800,000 in the aggregate, as well an out-of-pocket accountable expense allowance of 0.2% of the gross proceeds of this offering, which accountable expense allowance shall not exceed $200,000 in the aggregate. For any unsubscribed shares of common stock placed by Source Capital after the conclusion of the rights offering, we have agreed to pay Source Capital a placement fee equal to 6%, in lieu of the dealer-manager fee, along with continuing non-accountable and accountable expense allowances of 1.8% and 0.2%, respectively, with such placement fee and expenses to be calculated in respect of the total gross proceeds paid to and received by us for subscriptions accepted by us from investors in connection with such placement and such placement fee and expenses not to exceed the aggregate amounts that would have been otherwise received by Source Capital if the rights offering were fully subscribed. Neither the placement fee or expense allowances in connection with the placement shall be payable with respect to any securities purchased as result of the exercise of any basic subscription privilege or oversubscription privilege in the rights offering.

(2) Assumes that the rights offering is fully subscribed and that the maximum aggregate offering amount of $95,319,741 is received by us.

We are an “emerging growth company,” as such term is defined in Section 2(a)(19) of the Securities Act of 1933, as amended, and are subject to reduced public reporting requirements. See “Emerging Growth Company Status.”

The exercise of your Stock Subscription Rights involves risks. See “Risk Factors” beginning on page 10 of this prospectus to read about important factors you should consider before exercising your Stock Subscription Rights.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Persons effecting transactions in the securities should confirm the registration of these securities under the securities laws of the states in which transactions occur or the existence of applicable exemptions from such registration.

Dealer-Manager

The date of this prospectus is ________________, 2016.

| 1 |

TABLE OF CONTENTS

No dealer, salesperson or other individual has been authorized to give any information or to make any representation other than those contained in this prospectus in connection with the offer made by this prospectus and, if given or made, such information or representations must not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so, or to any person to whom it is unlawful to make such offer or solicitation. Neither the delivery of this prospectus nor any sale made hereunder shall, under any circumstances, create any implication that there has been no change in our affairs or that information contained herein is correct as of any time subsequent to the date hereof.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves, and observe any restrictions relating to, the offering of the shares of our common stock and the distribution of this prospectus outside the United States.

| 2 |

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes “forward-looking statements” within the meaning of the federal securities laws that involve risks and uncertainties. Forward-looking statements include statements we make concerning our plans, objectives, goals, strategies, future events, future revenues or performance, capital expenditures, financing needs and other information that is not historical information. Some forward-looking statements appear under the headings “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” When used in this prospectus, the words “estimates,” “expects,” “anticipates,” “projects,” “forecasts,” “plans,” “intends,” “believes,” “foresees,” “seeks,” “likely,” “may,” “might,” “will,” “should,” “goal,” “target” or “intends” and variations of these words or similar expressions (or the negative versions of any such words) are intended to identify forward-looking statements. All forward-looking statements are based upon information available to us on the date of this prospectus.

These forward-looking statements are subject to risks, uncertainties and other factors, many of which are outside of our control, that could cause actual results to differ materially from the results discussed in the forward-looking statements, including, among other things, the matters discussed in this prospectus in the sections captioned “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” Some of the factors that we believe could affect our results include:

| ● | limitations on our ability to continue operations and implement our business plan; |

| ● | our history of operating losses; |

| ● | the timing of and our ability to obtain financing on acceptable terms; |

| ● | the effects of changing economic conditions; |

| ● | the loss of members of the management team or other key personnel; |

| ● | competition from larger, more established companies with greater economic resources than we have; |

| ● | costs and other effects of legal and administrative proceedings, settlements, investigations and claims, which may not be covered by insurance; |

| ● | costs and damages relating to pending and future litigation; |

| ● | the impact of additional legal and regulatory interpretations and rulemaking and our success in taking action to mitigate such impacts; |

| ● | control by our principal equity holders; and |

| ● | the other factors set forth herein, including those set forth under “Risk Factors.” |

There are likely other factors that could cause our actual results to differ materially from the results referred to in the forward-looking statements. All forward-looking statements attributable to us in this prospectus apply only as of the date of this prospectus and are expressly qualified in their entirety by the cautionary statements included in this prospectus. We undertake no obligation to publicly update or revise forward-looking statements to reflect events or circumstances after the date made or to reflect the occurrence of unanticipated events, except as required by law. You are advised to consult any further disclosures we make on related subjects in the reports we file with the SEC pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

We are responsible for the disclosure in this prospectus. However, this prospectus includes industry data that we obtained from internal surveys, market research, publicly available information and industry publications. The market research, publicly available information and industry publications that we use generally state that the information contained therein has been obtained from sources believed to be reliable. The information therein represents the most recently available data from the relevant sources and publications and we believe remains reliable. We did not fund and are not otherwise affiliated with any of the sources cited in this prospectus. Forward-looking information obtained from these sources is subject to the same qualifications and additional uncertainties regarding the other forward-looking statements in this prospectus.

| 3 |

This summary highlights material information concerning our business and this offering. This summary does not contain all of the information that you should consider before making your investment decision. You should carefully read the entire prospectus and the information incorporated by reference into this prospectus, including the information presented under the section entitled “Risk Factors” and the financial data and related notes, before making an investment decision. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from future results contemplated in the forward-looking statements as a result of factors such as those set forth in “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements.” All historical information in this prospectus has been adjusted to reflect (i) the 1-for-6 reverse stock split of our outstanding common stock that was effective February 22, 2013, and (ii) the 1-for-100 reverse stock split of our outstanding common stock that was effective June 17, 2015.

In this prospectus, unless the context indicates otherwise, “IEG Holdings,” the “Company,” “we,” “our,” “ours” or “us” refer to IEG Holdings Corporation, a Florida corporation, and its subsidiaries.

Our Company

We provide unsecured online consumer loans under the brand name “Mr. Amazing Loans” via our website and online application portal at www.mramazingloans.com. We started our business and opened our first office in Las Vegas, Nevada in 2010. From March 2013 to mid-2015, we provided unsecured consumer loans ranging from $2,000 to $10,000, and since then we only offer $5,000 consumer loans that mature in five years. We are currently licensed and originating direct consumer loans in 17 states – Alabama, Arizona, California, Florida, Georgia, Illinois, Kentucky, Louisiana, Missouri, Nevada, New Jersey, New Mexico, Oregon, Pennsylvania, Texas, Utah and Virginia. We provide loans to residents of these states through our online application portal, with all loans originated, processed and serviced out of our centralized Las Vegas head office, which eliminates the need for physical offices in all of these states.

Our strategy is to address the funding needs of “under-banked” consumers that tend to be ignored by mainstream institutional credit providers such as traditional banks and credit unions, and charged high advanced fees and interest by fringe lenders such as payday lenders. In the current economic environment, we believe there is a substantial need for the small personal loans that we offer.

All of our personal loans are offered at less than prevailing maximum statutory rates with fixed repayments and no prepayment penalties. We conduct full underwriting on all applications, including credit checks and review of bank statements to ensure customers have the capacity to repay their loans.

We plan to continue expanding our state coverage in 2016 by obtaining state lending licenses in an additional eight states, including New York and Ohio, increasing our coverage to 25 states. As soon as we receive new state licenses, we are prepared to re-focus our existing online marketing and distribution channel resources to those states, which we expect will continue to lower our average customer acquisition cost.

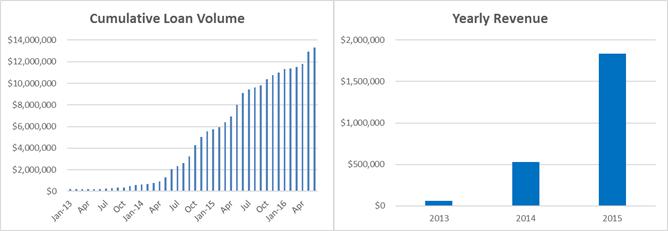

For the years ended December 31, 2015 and 2014, we generated revenue of $1,835,165 and $529,225, respectively, and had net losses of $5,698,198 and $5,401,754, respectively. For the six months ended June 30 , 2016 and 2015, we generated revenue of $1,070,328 and $797,062 , respectively, and had net losses of $2,201,211 and $2,819,019 , respectively.

We were organized as a Florida corporation on January 21, 1999, originally under the name Interact Technologies, Inc. In February 2013, we changed our name to IEG Holdings Corporation. We have two wholly-owned subsidiaries, Investment Evolution Corporation (“IEC”), our U.S. operating entity that holds all of our state licenses, leases, employee contracts and other operating and administrative assets, and IEC SPV, LLC (“IEC SPV”), a bankruptcy remote special purpose entity that holds our U.S. loan receivables.

Our principal office is located at 6160 West Tropicana Avenue, Suite E-13, Las Vegas, Nevada 89103 and our phone number is (702) 227-5626. Our corporate website address is www.investmentevolution.com. Information contained on, or accessible through, our website is not a part of, and is not incorporated by reference into, this prospectus.

Emerging Growth Company Status

We are an “emerging growth company” as defined in Section 2(a)(19) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We elected to take advantage of all of these exemptions.

| 4 |

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards, and delay compliance with new or revised accounting standards until those standards are applicable to private companies. We have elected to take advantage of the benefits of this extended transition period.

We will be an emerging growth company until the last day of the first fiscal year following the fifth anniversary of our first common equity offering, although we will lose that status earlier if our annual revenues exceed $1.0 billion, if we issue more than $1.0 billion in non-convertible debt in any three-year period or if we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act.

The Offering

| Issuer | IEG Holdings Corporation | ||

| Securities offered by us | We are distributing, at no charge, to holders of our common stock as of the record date for the rights offering non-transferrable Stock Subscription Rights to purchase up to 95,319,741 shares of our common stock. | ||

You will receive one Stock Subscription Right for each share of common stock owned at 5:00 p.m., Eastern time, on August 15, 2016, which is the record date for the rights offering. | |||

| Basic subscription privilege | The basic subscription privilege of each Stock Subscription Right will entitle you to purchase one share of our common stock. | ||

| Over-subscription privilege | With respect to your Stock Subscription Right, if you fully exercise your basic subscription privilege and other stockholders do not fully exercise their basic subscription privileges, you may also exercise an over-subscription right to purchase additional shares of common stock that remain unsubscribed at the expiration of the rights offering, subject to the availability and pro rata allocation of the securities among stockholders exercising the over-subscription right. To the extent the number of the unsubscribed securities is not sufficient to satisfy all of the properly exercised over-subscription rights requests, then the available common stock will be prorated among those who properly exercised over-subscription rights based on the amount of securities each rights holder subscribed for under the basic subscription right. If this pro rata allocation results in any stockholder receiving a greater number of securities than the stockholder subscribed for pursuant to the exercise of the over-subscription privilege, then such stockholder will be allocated only that number of securities for which the stockholder oversubscribed, and the remaining shares of common stock will be allocated among all other stockholders exercising the over-subscription privilege on the same pro rata basis described above. The proration process will be repeated until all shares of common stock have been allocated or all over-subscription exercises have been fulfilled, whichever occurs earlier. | ||

| 5 |

| Limitations on exercise | In the event that the exercise by a stockholder of the basic subscription privilege or the over-subscription privilege could, as determined by us in our sole discretion, potentially result in a limitation on our ability to use the Tax Attributes under the Code and rules promulgated by the IRS, we may, but are under no obligation to, reduce the exercise by such stockholder of the basic subscription privilege or the over-subscription privilege to such number of securities as we in our sole discretion shall determine to be advisable in order to preserve our ability to use the Tax Attributes. | |

| Record date | 5:00 p.m., Eastern time, on August 15, 2016. | |

| Expiration of the rights offering | 5:00 p.m., Eastern time, on August 29 , 2016, subject to extension as noted below. | |

| Common stock subscription price | Each Stock Subscription Right will entitle you to purchase one share of our common stock at a subscription price equal to $1.00 , subject to a maximum offering of $95,319,741 . | |

| Use of proceeds | We are conducting the offering to raise capital that we intend to use to fund new loan originations and for general corporate purposes. See “Use of Proceeds.” | |

| Non-transferability of rights | The subscription rights may not be sold, transferred or assigned and will not be listed for trading on any stock exchange or market or on the OTC Market. | |

| No board recommendation | Although our directors may invest their own money in the rights offering, our board of directors is making no recommendation regarding your exercise of the Stock Subscription Rights. You are urged to make your decision based on your own assessment of our business and the rights offering. Please see “Risk Factors” for a discussion of some of the risks involved in investing in our securities. Mr. Mathieson, our Chief Executive Officer and a member of our board of directors, owns approximately 72.4% of our outstanding common stock. Mr. Mathieson has indicated his intention not to participate in the rights offering. As a group, our officers and directors beneficially own approximately 72.5% of our outstanding common stock as of July 28 , 2016. As of the date of this prospectus, none of our officers or directors has determined whether to participate in the rights offering. We cannot assure that any of our officers or directors will exercise their basic or over-subscription rights to purchase any shares issued in connection with this offering and there is no minimum amount required to be raised in this offering. As a result, the offering may be undersubscribed and proceeds may not be sufficient to meet the objectives we state in this prospectus or other corporate milestones that we may set. | |

| No revocation | All exercises of Stock Subscription Rights are irrevocable, even if you later learn information that you consider to be unfavorable to the exercise of your Stock Subscription Rights, and even if the rights offering is extended for 30 days by our board of directors. However, if we amend the rights offering to allow for an extension of the rights offering for a period of more than 30 days or make a fundamental change to the terms of the rights offering set forth in this prospectus, you may cancel your subscription and receive a refund of any money you have advanced. You should not exercise your Stock Subscription Rights unless you are certain that you wish to purchase the securities at the subscription price. |

| 6 |

| U.S. federal income tax considerations | We believe that our distribution and any stockholder’s receipt and exercise of Stock Subscription Rights will not be taxable to our stockholders. You are urged to consult your own tax advisor as to your particular tax consequences resulting from the receipt and exercise of Stock Subscription Rights and the receipt, ownership and disposition of our securities. For further information, please see “Material U.S. Federal Income Tax Consequences”. | |

| Extension, cancelation and amendment |

We have the option to extend the rights offering and the period for exercising your Stock Subscription Rights for a period not to exceed 30 days, although we do not presently intend to do so. If we elect to extend the expiration of the rights offering, we will issue a press release announcing such extension no later than 9:00 a.m., Eastern time, on the next business day after the most recently announced expiration time of the rights offering. We will extend the duration of the rights offering as required by applicable law or regulation and may choose to extend it if we decide to give investors more time to exercise their Stock Subscription Rights in the rights offering. If we elect to extend the rights offering for a period of more than 30 days, then holders who have subscribed for rights may cancel their subscriptions and receive a refund of all money advanced.

If the rights offering is not fully subscribed following expiration of the rights offering and the 30-day extension, Source Capital has agreed to use its best efforts to place any unsubscribed shares of common stock as part of this rights offering at the subscription price for an additional period of up to 45 days. The number of shares that may be sold by us during this period will depend upon the number of shares of common stock that are subscribed for pursuant to the exercise of rights by our shareholders. No assurance can be given that any unsubscribed shares will be sold during this period.

Our board of directors may cancel the rights offering at any time prior to the expiration of the rights offering for any reason. In the event that the rights offering is cancelled, we will issue a press release notifying stockholders of the cancellation and all subscription payments received by the subscription agent will be returned promptly, without interest or penalty.

Our board of directors also reserves the right to amend or modify the terms of the rights offering. If we should make any fundamental changes to the terms of the rights offering set forth in this prospectus, we will file a post-effective amendment to the registration statement in which this prospectus is included, offer potential purchasers who have subscribed for rights the opportunity to cancel such subscriptions and issue a refund of any money advanced by such stockholder and recirculate an updated prospectus after the post-effective amendment is declared effective by the SEC. In addition, upon such event, we may extend the expiration date of the rights offering to allow holders of rights ample time to make new investment decisions and for us to recirculate updated documentation. Promptly following any such occurrence, we will issue a press release announcing any changes with respect to the rights offering and the new expiration date. The terms of the rights offering cannot be modified or amended after the expiration date of the rights offering. Although we do not presently intend to do so, we may choose to amend or modify the terms of the rights offering for any reason, including, without limitation, in order to increase participation in the rights offering. Such amendments or modifications may include a change in the subscription price, although no such change is presently contemplated. | |

| Procedures for exercise |

To exercise your Stock Subscription Rights, you must complete the applicable rights certificate and deliver it to the subscription agent, Computershare Inc., together with full payment for all of the Stock Subscription Rights you elect to exercise under the basic subscription privilege and over-subscription privilege. You may deliver the documents and payments by mail or commercial carrier. If regular mail is used for this purpose, we recommend using registered mail, properly insured, with return receipt requested.

If you cannot deliver your rights certificate to the subscription agent prior to the expiration of the rights offering, you may follow the guaranteed delivery procedures described under “The Rights Offering—Guaranteed Delivery Procedures.” |

| 7 |

| No minimum | No minimum aggregate subscription amount is required to complete the rights offering. Therefore proceeds may be insufficient to meet our objectives, thereby increasing the risk to investors in this offering. Proceeds from this rights offering may not be sufficient to meet the objectives we state in this prospectus or other corporate milestones that we may set. Shareholders should not rely on the success of the rights offering to address our need for funding. | |

| Subscription agent | Computershare Inc. | |

| Information agent | Georgeson LLC | |

| Dealer-manager | Source Capital Group, Inc. | |

| Risk factors | You should carefully read and consider the risk factors contained in our annual report on Form 10-K for the fiscal year ended December 31, 2015, and in the “Risk Factors” section beginning on page 10 of this prospectus, together with all of the other information included in this prospectus, before you decide to exercise your Stock Subscription Rights and/or Note Subscription Rights to purchase our securities. | |

| Fees and expenses | We will pay all fees charged by the subscription agent and the information agent in connection with the rights offering. We will also pay the fees charged by Source Capital acting as the dealer-manager. You are responsible for paying any other commissions, fees, taxes or other expenses incurred in connection with the exercise of the Stock Subscription Rights. | |

| Distribution arrangements |

Source Capital will act as dealer-manager for this rights offering. Under the terms and subject to the conditions contained in the dealer-manager agreement, the dealer-manager will provide marketing assistance in connection with this offering. We have agreed to pay Source Capital a dealer-manager fee equal to 6% of the dollar amount received by us from any gross proceeds received from cash exercises of the Stock Subscription Rights issued to stockholders in this rights offering, which commission will not exceed $6,000,000 in the aggregate. We have also agreed to pay Source Capital a non-accountable expense allowance of 1.8% of the gross proceeds of this offering, which non-accountable expense fee shall not exceed $1,800,000 in the aggregate, as well as an out-of-pocket accountable expense allowance of 0.2% of the gross proceeds of this offering, which accountable expense allowance shall not exceed $200,000 in the aggregate. For any unsubscribed shares of common stock placed by Source Capital after the conclusion of the rights offering, we have agreed to pay Source Capital a placement fee equal to 6%, in lieu of the dealer-manager fee, along with continuing non-accountable and accountable expense allowances of 1.8% and 0.2%, respectively, with such placement fee and expenses to be calculated in respect of the total gross proceeds paid to and received by us for subscriptions accepted by us from investors in connection with such placement and such placement fee and expenses not to exceed the aggregate amounts that would have been otherwise received by Source Capital if the rights offering were fully subscribed. Neither the placement fee or expense allowances in connection with the placement shall be payable with respect to any securities purchased as result of the exercise of any basic subscription privilege or oversubscription privilege in the rights offering.

We have agreed to indemnify Source Capital and their respective affiliates against certain liabilities arising under the Securities Act of 1933, as amended (the “Securities Act”). The dealer-manager agreement also provides that Source Capital will not be subject to any liability to us in rendering the services contemplated by the dealer-manager agreement except for any act of gross negligence, bad faith or willful misconduct of Source Capital. Source Capital and its affiliates may provide to us from time to time in the future in the ordinary course of their business certain financial advisory, investment banking and other services for which they will be entitled to receive customary fees. Source Capital does not make any recommendation with respect to whether you should exercise the basic subscription or over-subscription rights or to otherwise invest in our company. | |

| OTCQX symbol | IEGH | |

| Questions | If you have any questions about the rights offering, including questions about subscription procedures and requests for additional copies of this prospectus or other documents, please contact the subscription agent, Computershare Inc., or the information agent, Georgeson LLC, as follows: |

Subscription Agent: By Mail: Computershare c/o Voluntary Corporate Actions P.O. Box 43011 Providence, RI 02940-3011

By Overnight Courier: Computershare c/o Voluntary Corporate Actions Suite V 250 Royall Street Canton, MA 02021 |

Information Agent: Georgeson 1290 Avenue of the Americas 9th Floor New York, NY 10104 (888) 680-1528 (toll free) IEGH@Georgeson.com

|

| 8 |

Risk Factors

Before you invest in the offering, you should be aware that there are risks associated with your investment, including the risks described in the section entitled “Risk Factors” beginning on page 10 of this prospectus and the risks set forth in our annual report on Form 10-K for our fiscal year ended December 31, 2015. You should carefully read and consider the risk factors contained in our annual report on Form 10-K and in this prospectus, together with all of the other information included in this prospectus, before you decide to exercise your Stock Subscription Rights to purchase our securities.

SUMMARY HISTORICAL FINANCIAL DATA

The following table presents our summary historical financial data for the periods indicated. The summary historical financial data for the years ended December 31, 2015 and 2014 and the balance sheet data as of December 31, 2015 and 2014 are derived from the audited financial statements. The summary historical financial data for the six months ended June 30 , 2016 and 2015 and the balance sheet data as of June 30 , 2016 and 2015 are derived from our unaudited financial statements.

Historical results are included for illustrative and informational purposes only and are not necessarily indicative of results we expect in future periods, and results of interim periods are not necessarily indicative of results for the entire year. You should read the following summary financial data in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes appearing elsewhere in this prospectus.

Year Ended December 31, | Six Months Ended June 30 , | |||||||||||||||

| 2015 | 2014 | 2016 | 2015 | |||||||||||||

| (Unaudited) | ||||||||||||||||

| Statement of Operations Data | ||||||||||||||||

| Total revenues | $ | 1,835,165 | $ | 529,225 | $ | 1,070,328 | $ | 797,062 | ||||||||

| Total operating expenses | 7,012,609 | 5,381,671 | 3,283,289 | 3,142,103 | ||||||||||||

| Loss from operations | (5,177,444 | ) | (4,852,446 | ) | ( 2,212,961 | ) | ( 2,345,041 | ) | ||||||||

| Total other income (expense) | (520,754 | ) | (549,308 | ) | 11,750 | ( 473,978 | ) | |||||||||

| Net loss | $ | (5,698,198 | ) | $ | (5,401,754 | ) | $ | ( 2,201,211 | ) | $ | ( 2,819,019 | ) | ||||

| Net loss per share, basic and diluted | $ | (0.25 | ) | $ | (0.42 | ) | $ | ( 0.04 | ) | $ | ( 0.14 | ) | ||||

| Balance Sheet Data (at period end) | ||||||||||||||||

| Cash and cash equivalents | $ | 485,559 | $ | 433,712 | $ | 174,080 | $ | 933,620 | ||||||||

| Working capital (1) | 1,581,100 | 719,602 | 1,442,170 | (451,952 | ) | |||||||||||

| Total assets | 7,758,149 | 4,929,120 | 8,017,651 | 7,869,725 | ||||||||||||

| Total liabilities | 107,963 | 2,537,156 | 162,082 | 2,423,046 | ||||||||||||

| Stockholders’ equity | 7,650,186 | 2,391,964 | 7,855,569 | 5,446,679 | ||||||||||||

(1) Working capital represents total current assets less total current liabilities.

| 9 |

Investment in our securities involves a number of substantial risks. You should not invest in our securities unless you are able to bear the complete loss of your investment. In addition to the risks and investment considerations discussed elsewhere in this prospectus, the following factors should be carefully considered by anyone purchasing the securities offered through this prospectus. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. If any of the following risks actually occur, our business could be harmed. In such case, the trading price of our common stock could decline and investors could lose all or a part of their investment.

Risks Related to Our Business and Industry

Our limited operating history and our failure since inception to achieve an operating profit makes our future prospects and financial performance unpredictable, and the current scale of our operations is insufficient to achieve profitability.

We commenced operations in 2010 and as a result, we have a limited operating history upon which a potential investor can evaluate our prospects and the potential value of an investment in our company. In addition, we have not made an operating profit since our incorporation. We remain subject to the risks inherently associated with new business enterprises in general and, more specifically, the risks of a new financial institution and, in particular, a new Internet-based financial institution. Our prospects are subject to the risks and uncertainties frequently encountered by companies in their early stages of development, including the risk that we will not be able to implement our business strategy. The current scale of our operations is insufficient to achieve profitability. If we are unable to implement our business strategy and grow our business, our business will be materially adversely affected.

Our accountants have raised substantial doubt regarding our ability to continue as a going concern.

As noted in our consolidated financial statements, we had an accumulated deficit of approximately $20.38 million and recurring losses and negative cash flows from operations as of December 31, 2015. We intend to fund operations through raising additional capital through debt financing and equity issuances and increased lending activities which may be insufficient to fund our capital expenditures, working capital or other cash requirements for the year ending December 31, 2016. We are continuing to seek additional funds to finance our immediate and long term operations. The successful outcome of future financing activities cannot be determined at this time and there is no assurance that if achieved, we will have sufficient funds to execute our intended business plan or generate positive operating results. These factors, among others, raise substantial doubt about our ability to continue as a going concern. The audit report of Rose, Snyder & Jacobs LLP for the fiscal years ended December 31, 2015 and 2014 contains a paragraph that emphasizes the substantial doubt as to our continuance as a going concern. This means that there is a significant risk that we may not be able to remain operational for an indefinite period of time.

Historically, we have funded our operations through equity raises and with a prior credit facility. Our inability to raise additional funds or replace our revolving credit facility would have a material adverse effect on our business.

Previously, we were dependent on our credit facility with BFG Investment Holdings, LLC (“BFG”) to execute on our growth plans and operate our business. Effective July 15, 2015, BFG converted the credit facility from a revolving facility to a term loan, and we paid off the balance of the loan in August 2015. It will be very difficult for us to find a financing source to replace the revolving credit facility. The loss of our revolving credit facility could have a material adverse effect on our business. As a result of BFG’s conversion of the revolving credit facility to a term loan, monthly principal and interest payments equal to 100% of the consumer loan proceeds were due. We have been able to raise capital through the unregistered sale of shares of preferred and common stock to fund the increase in our loan book and, as a result, have not drawn down any funds from the credit facility since September 2014. Until we are able to replace the credit facility, we intend to continue to use the proceeds from equity sales to fund our operations.

On August 21, 2015, we, through certain of our wholly owned subsidiaries, paid an aggregate of $1,676,954, representing all principal and accrued interest under the Loan and Security Agreement, as amended (the “Loan Agreement”), among BFG and certain of our wholly owned subsidiaries. As a result, there is currently no outstanding balance under the Loan Agreement. However, the Loan Agreement continues in effect and we are subject to a net profit interest under which we are required to pay BFG 20% of the “Net Profit” of its subsidiary, IEC SPV, until 10 years from the date the loan is repaid in full. Net Profit is defined as the gross revenue less (i) interest paid on the loan, (ii) payments on any other debt incurred as a result of refinancing the loan through a third party, as provided in the Loan Agreement, (iii) any costs, fees or commissions paid on the existing credit facility, and (iv) charge-offs to bad debt resulting from consumer loans. The Net Profit arrangement can be terminated by us upon a payment of $3,000,000 to BFG.

| 10 |

We may not be able to implement our plans for growth successfully, which could adversely affect our future operations.

Since January 1, 2014, the amount we have lent to borrowers (our loan book) has grown 2,168% from $587,000 to $13,314,023 as of June 30, 2016. We expect to continue to grow our loan book and number of customers at an accelerated rate following completion of this offering. Our future success will depend in part on our continued ability to manage our growth. We may not be able to achieve our growth plans, or sustain our historical growth rates or grow at all. Various factors, such as economic conditions, regulatory and legislative considerations and competition, may also impede our ability to expand our market presence. If we are unable to grow as planned, our business and prospects could be adversely affected.

Our inability to manage our growth could harm our business.

We anticipate that our loan book and customer base will continue to grow significantly over time. To manage the expected growth of our operations and personnel, we will be required to, among other things:

| ● | improve existing and implement new transaction processing, operational and financial systems, procedures and controls; | |

| ● | maintain effective credit scoring and underwriting guidelines; and | |

| ● | increase our employee base and train and manage this growing employee base. |

If we are unable to manage growth effectively, our business, prospects, financial condition and results of operations could be adversely affected.

We may need to raise additional capital that may not be available, which could harm our business.

Our growth will require that we generate additional capital either through retained earnings or the issuance of additional debt or equity securities. Additional capital may not be available on terms acceptable to us, if at all. Any equity financings could result in dilution to our stockholders or reduction in the earnings available to our common stockholders. If adequate capital is not available or the terms of such capital are not attractive, we may have to curtail our growth and our business, and our business, prospects, financial condition and results of operations could be adversely affected.

As an online consumer loan company whose principal means of delivering personal loans is the Internet, we are subject to risks particular to that method of delivery.

We are predominantly an online consumer loan company and there are a number of unique factors that Internet-based loan companies face. These include concerns for the security of personal information, the absence of personal relationships between lenders and customers, the absence of loyalty to a conventional hometown branch, customers’ difficulty in understanding and assessing the substance and financial strength of an online loan company, a lack of confidence in the likelihood of success and permanence of online loan companies and many individuals’ unwillingness to trust their personal details and financial future to a relatively new technological medium such as the Internet. As a result, some potential customers may be unwilling to establish a relationship with us.

Conventional “brick and mortar” consumer loan companies, in growing numbers, are offering the option of Internet-based lending to their existing and prospective customers. The public may perceive conventional established loan companies as being safer, more responsive, more comfortable to deal with and more accountable as providers of their lending needs. We may not be able to offer Internet-based lending that has sufficient advantages over the Internet-based lending services and other characteristics of conventional “brick and mortar” consumer loan companies to enable us to compete successfully.

We may not be able to make technological improvements as quickly as some of our competitors, which could harm our ability to compete with our competitors and adversely affect our results of operations, financial condition and liquidity.

Both the Internet and the financial services industry are undergoing rapid technological changes, with frequent introductions of new technology-driven products and services. In addition to improving the ability to serve customers, the effective use of technology increases efficiency and enables financial institutions to reduce costs. Our future success will depend in part upon our ability to address the needs of our customers by using technology to provide products and services that will satisfy customer demands, as well as to create additional efficiencies in our operations. We may not be able to effectively implement new technology-driven products and services or be successful in marketing these products and services to our customers. If we are unable, for technical, legal, financial or other reasons, to adapt in a timely manner to changing market conditions, customer requirements or emerging industry standards, our business, prospects, financial condition and results of operations could be adversely affected.

A significant disruption in our computer systems or a cyber security breach could adversely affect our operations.

We rely extensively on our computer systems to manage our loan origination and other processes. Our systems are subject to damage or interruption from power outages, computer and telecommunications failures, computer viruses, cyber security breaches, vandalism, severe weather conditions, catastrophic events and human error, and our disaster recovery planning cannot account for all eventualities. If our systems are damaged, fail to function properly or otherwise become unavailable, we may incur substantial costs to repair or replace them, and may experience loss of critical data and interruptions or delays in our ability to perform critical functions, which could adversely affect our business and results of operations. Any compromise of our security could also result in a violation of applicable privacy and other laws, significant legal and financial exposure, damage to our reputation, loss or misuse of the information and a loss of confidence in our security measures, which could harm our business.

| 11 |

Our ability to protect the confidential information of our borrowers and investors may be adversely affected by cyber-attacks, computer viruses, physical or electronic break-ins or similar disruptions.

We process certain sensitive data from our borrowers and investors. While we have taken steps to protect confidential information that we receive or have access to, our security measures could be breached. Any accidental or willful security breaches or other unauthorized access to our systems could cause confidential borrower and investor information to be stolen and used for criminal purposes. Security breaches or unauthorized access to confidential information could also expose us to liability related to the loss of the information, time-consuming and expensive litigation and negative publicity. If security measures are breached because of third-party action, employee error, malfeasance or otherwise, or if design flaws in our software are exposed and exploited, our relationships with borrowers and investors could be severely damaged, and we could incur significant liability.

Because techniques used to sabotage or obtain unauthorized access to systems change frequently and generally are not recognized until they are launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures. In addition, federal regulators and many federal and state laws and regulations require companies to notify individuals of data security breaches involving their personal data. These mandatory disclosures regarding a security breach are costly to implement and often lead to widespread negative publicity, which may cause borrowers and investors to lose confidence in the effectiveness of our data security measures. Any security breach, whether actual or perceived, would harm our reputation, we could lose borrowers and investors and our business and operations could be adversely affected.

Any significant disruption in service on our platform or in our computer systems, including events beyond our control, could prevent us from processing or posting payments on loans, reduce the attractiveness of our marketplace and result in a loss of borrowers or investors.

In the event of a system outage and physical data loss, our ability to perform our servicing obligations, process applications or make loans available would be materially and adversely affected. The satisfactory performance, reliability and availability of our technology are critical to our operations, customer service, reputation and our ability to attract new and retain existing borrowers and investors.

Any interruptions or delays in our service, whether as a result of third-party error, our error, natural disasters or security breaches, whether accidental or willful, could harm our relationships with our borrowers and investors and our reputation. Additionally, in the event of damage or interruption, our insurance policies may not adequately compensate us for any losses that we may incur. Our disaster recovery plan has not been tested under actual disaster conditions, and we may not have sufficient capacity to recover all data and services in the event of an outage. These factors could prevent us from processing or posting payments on the loans, damage our brand and reputation, divert our employees’ attention, reduce our revenue, subject us to liability and cause borrowers and investors to abandon our marketplace, any of which could adversely affect our business, financial condition and results of operations.

Our unsecured loans generally have delinquency and default rates higher than prime and secured loans, which could result in higher loan losses.

We are in the business of originating unsecured personal loans. As of June 30, 2016, approximately 2.67 % of our customers are subprime borrowers, which we define as borrowers having credit scores below 600 on the credit risk scale developed by VantageScore Solutions, LLC. Unsecured personal loans and subprime loans generally have higher delinquency and default rates than secured loans and prime loans. Subprime borrowers are associated with lower collection rates and are subject to higher loss rates than prime borrowers. Subprime borrowers have historically been, and may in the future become, more likely to be affected, or more severely affected, by adverse macroeconomic conditions, particularly unemployment. If our borrowers default under an unsecured loan, we will bear a risk of loss of principal, which could adversely affect our cash flow from operations. Delinquency interrupts the flow of projected interest income from a loan, and default can ultimately lead to a loss. We attempt to manage these risks with risk-based loan pricing and appropriate management policies. However, we cannot assure you that such management policies will prevent delinquencies or defaults and, if such policies and methods are insufficient to control our delinquency and default risks and do not result in appropriate loan pricing, our business, financial condition, liquidity and results of operations could be harmed. If aspects of our business, including the quality of our borrowers, are significantly affected by economic changes or any other conditions in the future, we cannot be certain that our policies and procedures for underwriting, processing and servicing loans will adequately adapt to such changes. If we fail to adapt to changing economic conditions or other factors, or if such changes affect our borrowers’ capacity to repay their loans, our results of operations, financial condition and liquidity could be materially adversely affected. At June 30, 2016, we had 73 loans considered past due at 31+ days past due, representing 3.48% of the number of loans in our active portfolio. At June 30, 2016, we had 70 loans delinquent or in default (defined as 91+ days past due) representing 3.56% of the number of loans in our active portfolio. Loans become eligible for a lender to take legal action at 60 days past due.

| 12 |

If our estimates of loan receivable losses are not adequate to absorb actual losses, our provision for loan receivable losses would increase, which would adversely affect our results of operations.

We maintain an allowance for loans receivable losses. To estimate the appropriate level of allowance for loan receivable losses, we consider known and relevant internal and external factors that affect loan receivable collectability, including the total amount of loan receivables outstanding, historical loan receivable charge-offs, our current collection patterns, and economic trends. If customer behavior changes as a result of economic conditions and if we are unable to predict how the unemployment rate, housing foreclosures, and general economic uncertainty may affect our allowance for loan receivable losses, our provision may be inadequate. Our allowance for loan receivable losses is an estimate, and if actual loan receivable losses are materially greater than our allowance for loan receivable losses, our financial position, liquidity, and results of operations could be adversely affected.

Our risk management efforts may not be effective which could result in unforeseen losses.

We could incur substantial losses and our business operations could be disrupted if we are unable to effectively identify, manage, monitor, and mitigate financial risks, such as credit risk, interest rate risk, prepayment risk, liquidity risk, and other market-related risks, as well as operational risks related to our business, assets and liabilities. Our risk management policies, procedures, and techniques, including our scoring methodology, may not be sufficient to identify all of the risks we are exposed to, mitigate the risks we have identified or identify additional risks to which we may become subject in the future.

We face strong competition for customers and may not succeed in implementing our business strategy.

Our business strategy depends on our ability to remain competitive. There is strong competition for customers from personal loan companies and other types of consumer lenders, including those that use the Internet as a medium for lending or as an advertising platform. Our competitors include:

| ● | large, publicly-traded, state-licensed personal loan companies such as OneMain Financial; | |

| ● | peer-to-peer lending companies such as LendingClub Corp. and Prosper Marketplace Inc.; | |

| ● | online personal loan companies such as Avant; | |

| ● | “brick and mortar” personal loan companies, including those that have implemented websites to facilitate online lending; and | |

| ● | payday lenders, tribal lenders and other online consumer loan companies. |

Some of these competitors have been in business for a long time and have name recognition and an established customer base. Most of our competitors are larger and have greater financial and personnel resources. In order to compete profitably, we may need to reduce the rates we offer on loans, which may adversely affect our business, prospects, financial condition and results of operations. To remain competitive, we believe we must successfully implement our business strategy. Our success depends on, among other things:

| ● | having a large and increasing number of customers who use our loans for financing needs; | |

| ● | our ability to attract, hire and retain key personnel as our business grows; | |

| ● | our ability to secure additional capital as needed; | |

| ● | our ability to offer products and services with fewer employees than competitors; | |

| ● | the satisfaction of our customers with our customer service; | |

| ● | ease of use of our websites; and | |

| ● | our ability to provide a secure and stable technology platform for providing personal loans that provides us with reliable and effective operational, financial and information systems. |

If we are unable to implement our business strategy, our business, prospects, financial condition and results of operations could be adversely affected.

| 13 |

We depend on third-party service providers for our core operations including online lending and loan servicing, and interruptions in or terminations of their services could materially impair the quality of our services.

We rely substantially upon third-party service providers for our core operations, including online web lending and marketing and vendors that provide systems that automate the servicing of our loan portfolios which allow us to increase the efficiency and accuracy of our operations. These systems include tracking and accounting of our loan portfolio as well as customer relationship management, collections, funds disbursement, security and reporting. This reliance may mean that we will not be able to resolve operational problems internally or on a timely basis, which could lead to customer dissatisfaction or long-term disruption of our operations. If these service arrangements are terminated for any reason without an immediately available substitute arrangement, our operations may be severely interrupted or delayed. If such interruption or delay were to continue for a substantial period of time, our business, prospects, financial condition and results of operations could be adversely affected.

If we lose the services of any of our key management personnel, our business could suffer.

Our future success significantly depends on the continued service and performance of our Chief Executive Officer, Paul Mathieson and our Chief Operating Officer, Carla Cholewinski. Competition for these employees is intense and we may not be able to attract and retain key personnel. We do not maintain any “key man” or other related insurance. The loss of the service of our Chief Executive Officer or our Chief Operating Officer, or the inability to attract additional qualified personnel as needed, could materially harm our business.

We have incurred, and will continue to incur, increased costs as a result of being a public reporting company.

In April 2015, we became a public reporting company. As a public reporting company, we incur significant legal, accounting and other expenses that we did not incur as a non-reporting company, including costs associated with our SEC reporting requirements. We expect that the additional reporting and other obligations imposed on us under the Exchange Act, will increase our legal and financial compliance costs and the costs of our related legal, accounting and administrative activities significantly. Management estimates that compliance with the Exchange Act reporting requirements as a reporting company will cost in excess of $200,000 annually. Given our current financial resources, these additional compliance costs could have a material adverse impact on our financial position and ability to achieve profitable results. These increased costs will require us to divert money that we could otherwise use to expand our business and achieve our strategic objectives.

We operate in a highly competitive market, and we cannot ensure that the competitive pressures we face will not have a material adverse effect on our results of operations, financial condition and liquidity.

The consumer finance industry is highly competitive. Our success depends, in large part, on our ability to originate consumer loan receivables. We compete with other consumer finance companies as well as other types of financial institutions that offer similar products and services in originating loan receivables. Some of these competitors may have greater financial, technical and marketing resources than we possess. Some competitors may also have a lower cost of funds and access to funding sources that may not be available to us. While banks and credit card companies have decreased their lending to non-prime customers in recent years, there is no assurance that such lenders will not resume those lending activities. Further, because of increased regulatory pressure on payday lenders, many of those lenders are starting to make more traditional installment consumer loans in order to reduce regulatory scrutiny of their practices, which could increase competition in markets in which we operate.

Negative publicity could adversely affect our business and operating results.

Negative publicity about our industry or our company, including the quality and reliability of our marketplace, effectiveness of the credit decisioning and scoring models used in the marketplace, changes to our marketplace, our ability to effectively manage and resolve borrower and investor complaints, privacy and security practices, litigation, regulatory activity and the experience of borrowers and investors with our marketplace or services, even if inaccurate, could adversely affect our reputation and the confidence in, and the use of, our marketplace, which could harm our business and operating results. Harm to our reputation can arise from many sources, including employee misconduct, misconduct by our partners, outsourced service providers or other counterparties, failure by us or our partners to meet minimum standards of service and quality, inadequate protection of borrower and investor information and compliance failures and claims.

Our business is subject to extensive regulation in the jurisdictions in which we conduct our business.

Our operations are subject to regulation, supervision and licensing under various federal, state and local statutes, ordinances and regulations. In most states in which we operate, a consumer credit regulatory agency regulates and enforces laws relating to consumer lenders such as us. These rules and regulations generally provide for licensing as a consumer lender, limitations on the amount, duration and charges, including interest rates, for various categories of loans, requirements as to the form and content of finance contracts and other documentation, and restrictions on collection practices and creditors’ rights. In certain states, we are subject to periodic examination by state regulatory authorities. Some states in which we operate do not require special licensing or provide extensive regulation of our business.

| 14 |

We are also subject to extensive federal regulation, including the Truth in Lending Act, the Equal Credit Opportunity Act and the Fair Credit Reporting Act. These laws require us to provide certain disclosures to prospective borrowers and protect against discriminatory lending and leasing practices and unfair credit practices. The principal disclosures required under the Truth in Lending Act include the terms of repayment, the total finance charge and the annual percentage rate charged on each contract or loan. The Equal Credit Opportunity Act prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, age or marital status. According to Regulation B promulgated under the Equal Credit Opportunity Act, creditors are required to make certain disclosures regarding consumer rights and advise consumers whose credit applications are not approved of the reasons for the rejection. In addition, the credit scoring system used by us must comply with the requirements for such a system as set forth in the Equal Credit Opportunity Act and Regulation B. The Fair Credit Reporting Act requires us to provide certain information to consumers whose credit applications are not approved on the basis of a report obtained from a consumer reporting agency and to respond to consumers who inquire regarding any adverse reporting submitted by us to the consumer reporting agencies. Additionally, we are subject to the Gramm-Leach-Bliley Act, which requires us to maintain the privacy of certain consumer data in our possession and to periodically communicate with consumers on privacy matters. We are also subject to the Servicemembers Civil Relief Act, which requires us, in most circumstances, to reduce the interest rate charged to customers who have subsequently joined, enlisted, been inducted or called to active military duty.

A material failure to comply with applicable laws and regulations could result in regulatory actions, lawsuits and damage to our reputation, which could have a material adverse effect on our results of operations, financial condition and liquidity.

The Consumer Financial Protection Bureau (the “CFPB”) is a new agency, and there continues to be uncertainty as to how the agency’s actions or the actions of any other new agency could impact our business.

The CFPB, which commenced operations in 2011, has broad authority over the business in which we engage. This includes authority to write regulations under federal consumer financial protection laws, such as the Truth in Lending Act and the Equal Credit Opportunity Act, and to enforce those laws against and examine financial institutions for compliance. The CFPB is authorized to prevent “unfair, deceptive or abusive acts or practices” through its regulatory, supervisory and enforcement authority. To assist in its enforcement, the CFPB maintains an online complaint system that allows consumers to log complaints with respect to various consumer finance products, including the loan products we facilitate. This system could inform future CFPB decisions with respect to its regulatory, enforcement or examination focus.

We are subject to the CFPB’s jurisdiction, including its enforcement authority, as a servicer and acquirer of consumer credit. The CFPB may request reports concerning our organization, business conduct, markets and activities. The CFPB may also conduct on-site examinations of our business on a periodic basis if the CFPB were to determine, through its complaint system, that we were engaging in activities that pose risks to consumers.

There continues to be uncertainty as to how the CFPB’s strategies and priorities, including in both its examination and enforcement processes, will impact our businesses and our results of operations going forward. Actions by the CFPB could result in requirements to alter or cease offering affected loan products and services, making them less attractive and restricting our ability to offer them.

Actions by the CFPB or other regulators against us or our competitors that discourage the use of the marketplace model or suggest to consumers the desirability of other loan products or services could result in reputational harm and a loss of borrowers or investors. Our compliance costs and litigation exposure could increase materially if the CFPB or other regulators enact new regulations, change regulations that were previously adopted, modify, through supervision or enforcement, past regulatory guidance, or interpret existing regulations in a manner different or stricter than have been previously interpreted.

If our involvement in a December 11, 2014 article published in the Examiner or any other publicity regarding our company or the offering during the waiting period, including our December 2, 2014 press release, were held to be in violation of federal or state securities laws, we could incur monetary damages, fines or other damages that could have a material adverse effect on our financial condition and prospects.

On December 11, 2014, information about our company was published in an article by the Examiner. Our chief executive officer, Mr. Mathieson, did not participate in an interview with the author of the Examiner article. Rather, the author included certain quotations from Mr. Mathieson that were contained in prior press releases by us and summarized statements previously made by Mr. Mathieson that were contained in a prior article published by the Opportunist Magazine. Prior to its publication, the author of the December 11th article provided Mr. Mathieson a copy of the article.

| 15 |

In addition, we issued a press release on December 2, 2014 in which we referenced, among other things, our intention to file a registration statement on Form S-1 and to list our securities on NASDAQ. The December 2nd press release presented certain statements about our company in isolation and did not disclose many of the related risks and uncertainties described in this prospectus.

If it were determined that the December 11th article, the December 2nd press release or any of our other publicity-related activities constituted a violation of Section 5 of the Securities Act, the SEC and relevant state regulators could impose monetary fines or other sanctions as provided under relevant federal and state securities laws. Such regulators could also require us to make a rescission offer, which is an offer to repurchase the securities, to our stockholders that purchased shares in this offering. This could also give rise to a private right of action to seek a rescission remedy under Section 12(a)(2) of the Securities Act.