Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Guaranty Bancorp | gbnk-20160801x8k.htm |

2016 KBW Community Bank Investor Conference New York City, NY August 2-3, 2016

2016 KBW Community Bank Investor Conference New York City, NY August 2-3, 2016

This presentation contains forward-looking statements, which are included in accordance with the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “expects,” “plans,” “intends,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or “continue,” or the negative of such terms and other comparable terminology. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following: failure to maintain adequate levels of capital and liquidity to support the Company’s operations; general economic and business conditions in those areas in which the Company operates, including the impact of global and national economic conditions on our local economy; demographic changes; competition; fluctuations in interest rates; continued ability to attract and employ qualified personnel; ability to receive regulatory approval for the bank subsidiary to declare dividends to the Company; adequacy of the allowance for loan losses, changes in credit quality and the effect of credit quality on the provision for credit losses and allowance for loan losses; changes in governmental legislation or regulation, including, but not limited to, any increase in FDIC insurance premiums; changes in accounting policies and practices; changes in business strategy or development plans; failure or inability to complete mergers or other corporate transactions; failure or inability to realize fully the expected benefits of mergers or other corporate transactions; changes in the securities markets; changes in consumer spending, borrowing and savings habits; the availability of capital from private or government sources; competition for loans and deposits and failure to attract or retain loans and deposits; failure to recognize expected cost savings; changes in the financial performance and/or condition of our borrowers and the ability of our borrowers to perform under the terms of their loans and terms of other credit agreements; changes in oil and natural gas prices; political instability, acts of war or terrorism and natural disasters; and additional “Risk Factors” referenced in the Company’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission, as supplemented from time to time. When relying on forward-looking statements to make decisions with respect to the Company, investors and others are cautioned to consider these and other risks and uncertainties. The Company can give no assurance that any goal or plan or expectation set forth in any forward-looking statement can be achieved and readers are cautioned not to place undue reliance on such statements, which speak only as of the date made. The forward-looking statements are made as of the date of this presentation, and, except as may otherwise be required by law, the Company does not intend, and assumes no obligation, to update the forward-looking statements or to update the reasons why actual results could differ from those projected in the forward-looking statements. Investors and security holders are urged to read the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other documents filed by the Company with the SEC. The documents filed by the Company with the SEC may be obtained at the Company’s website at www.gbnk.com or at the SEC's website at www.sec.gov. These documents may also be obtained free of charge from the Company by directing a request to: Guaranty Bancorp, 1331 Seventeenth St., Suite 200, Denver, CO 80202, Attention: Christopher Treece/Investor Relations; Telephone 303-675-1194. Forward Looking Statements 2

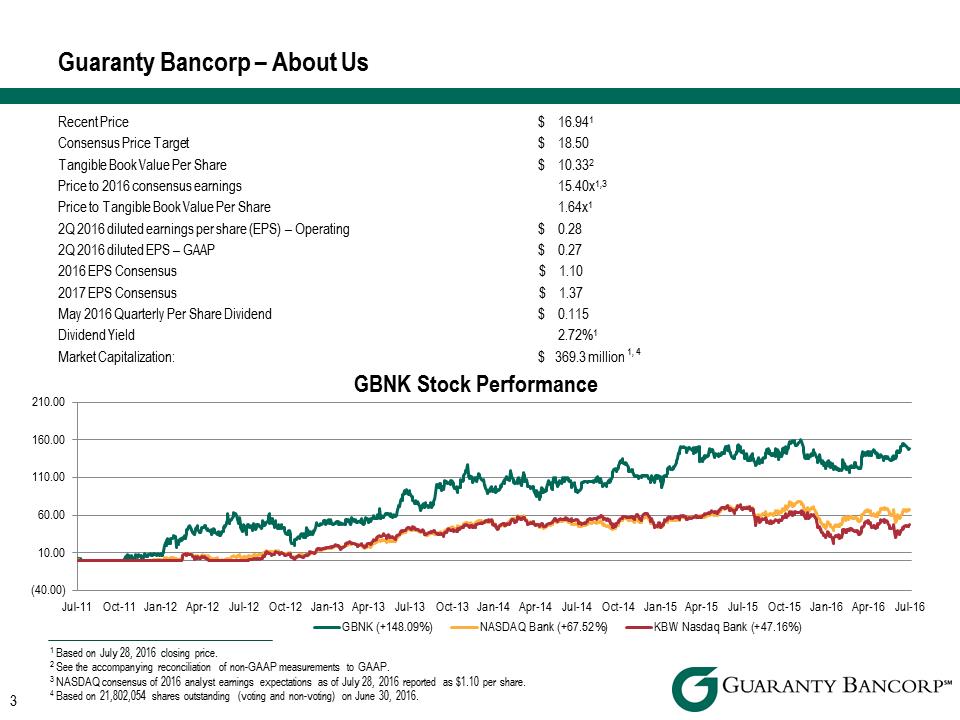

Recent Price $ 16.941 Consensus Price Target $ 18.50 Tangible Book Value Per Share $ 10.332 Price to 2016 consensus earnings 15.40x1,3 Price to Tangible Book Value Per Share 1.64x1 2Q 2016 diluted earnings per share (EPS) – Operating $ 0.28 2Q 2016 diluted EPS – GAAP $ 0.27 2016 EPS Consensus $ 1.10 2017 EPS Consensus $ 1.37 May 2016 Quarterly Per Share Dividend $ 0.115 Dividend Yield 2.72%1 Market Capitalization: $ 369.3 million 1, 4 Guaranty Bancorp – About Us 3 1 Based on July 28, 2016 closing price. 2 See the accompanying reconciliation of non-GAAP measurements to GAAP. 3 NASDAQ consensus of 2016 analyst earnings expectations as of July 28, 2016 reported as $1.10 per share. 4 Based on 21,802,054 shares outstanding (voting and non-voting) on June 30, 2016. (40.00)10.0060.00 110.00 160.00 210.00 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 Oct-13 Jan-14 Apr-14 Jul-1 Oct-14 Jan-15 Apr-15 Jul-15 Oct-15 Jan-16 Apr-16 Jul-16 GBNK Stock Performance GBNK (+148.09%) NASDAQ Bank (+67.52%) KBW Nasdaq Bank (+47.16%)

Recent Price $ 16.941 Consensus Price Target $ 18.50 Tangible Book Value Per Share $ 10.332 Price to 2016 consensus earnings 15.40x1,3 Price to Tangible Book Value Per Share 1.64x1 2Q 2016 diluted earnings per share (EPS) – Operating $ 0.28 2Q 2016 diluted EPS – GAAP $ 0.27 2016 EPS Consensus $ 1.10 2017 EPS Consensus $ 1.37 May 2016 Quarterly Per Share Dividend $ 0.115 Dividend Yield 2.72%1 Market Capitalization: $ 369.3 million 1, 4 Guaranty Bancorp – About Us 3 1 Based on July 28, 2016 closing price. 2 See the accompanying reconciliation of non-GAAP measurements to GAAP. 3 NASDAQ consensus of 2016 analyst earnings expectations as of July 28, 2016 reported as $1.10 per share. 4 Based on 21,802,054 shares outstanding (voting and non-voting) on June 30, 2016. (40.00)10.0060.00 110.00 160.00 210.00 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 Oct-13 Jan-14 Apr-14 Jul-1 Oct-14 Jan-15 Apr-15 Jul-15 Oct-15 Jan-16 Apr-16 Jul-16 GBNK Stock Performance GBNK (+148.09%) NASDAQ Bank (+67.52%) KBW Nasdaq Bank (+47.16%)

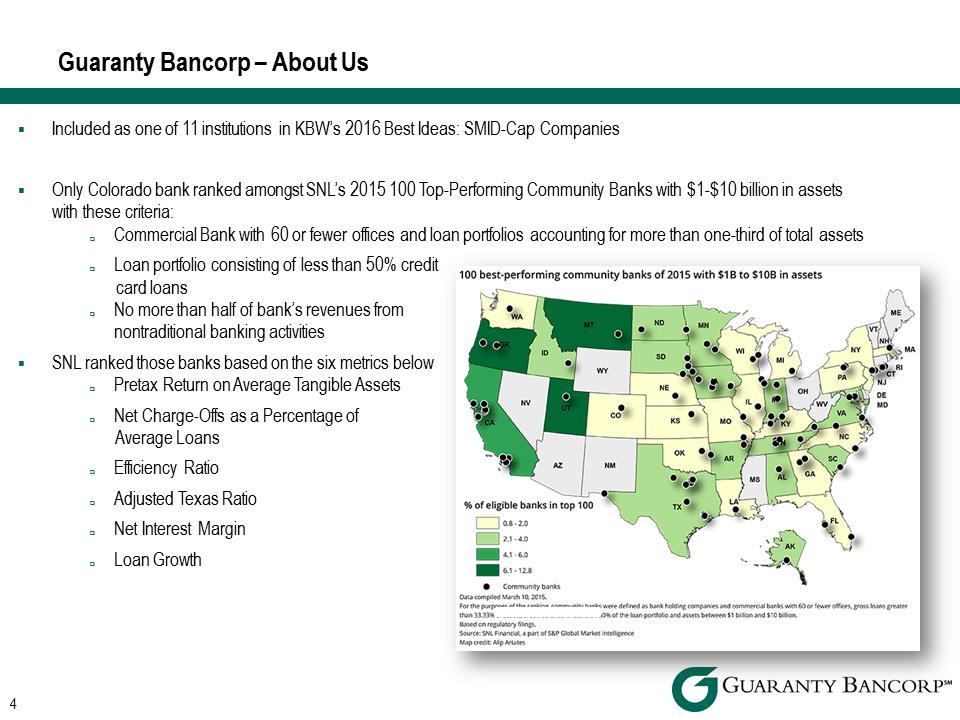

.Included as one of 11 institutions in KBW’s 2016 Best Ideas: SMID-Cap Companies .Only Colorado bank ranked amongst SNL’s 2015 100 Top-Performing Community Banks with $1-$10 billion in assets with these criteria: .Commercial Bank with 60 or fewer offices and loan portfolios accounting for more than one-third of total assets .Loan portfolio consisting of less than 50% credit card loans .No more than half of bank’s revenues from nontraditional banking activities .SNL ranked those banks based on the six metrics below .Pretax Return on Average Tangible Assets .Net Charge-Offs as a Percentage of Average Loans .Efficiency Ratio .Adjusted Texas Ratio .Net Interest Margin .Loan Growth 4 Guaranty Bancorp – About Us

.Included as one of 11 institutions in KBW’s 2016 Best Ideas: SMID-Cap Companies .Only Colorado bank ranked amongst SNL’s 2015 100 Top-Performing Community Banks with $1-$10 billion in assets with these criteria: .Commercial Bank with 60 or fewer offices and loan portfolios accounting for more than one-third of total assets .Loan portfolio consisting of less than 50% credit card loans .No more than half of bank’s revenues from nontraditional banking activities .SNL ranked those banks based on the six metrics below .Pretax Return on Average Tangible Assets .Net Charge-Offs as a Percentage of Average Loans .Efficiency Ratio .Adjusted Texas Ratio .Net Interest Margin .Loan Growth 4 Guaranty Bancorp – About Us

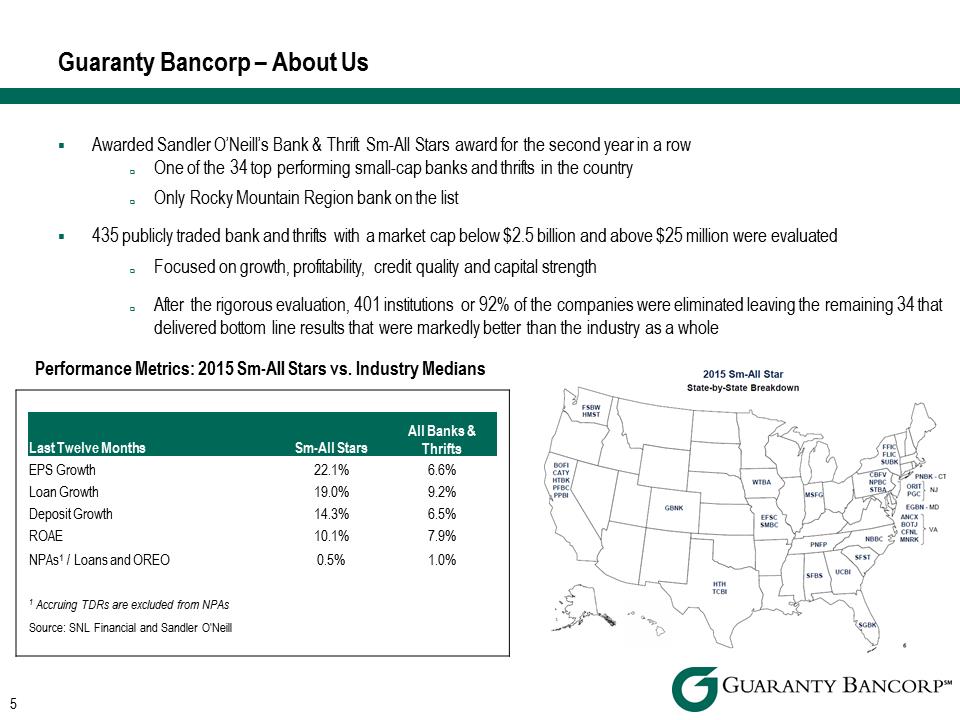

Awarded Sandler O’Neill’s Bank & Thrift Sm-All Stars award for the second year in a row .One of the 34 top performing small-cap banks and thrifts in the country .Only Rocky Mountain Region bank on the list .435 publicly traded bank and thrifts with a market cap below $2.5 billion and above $25 million were evaluated .Focused on growth, profitability, credit quality and capital strength .After the rigorous evaluation, 401 institutions or 92% of the companies were eliminated leaving the remaining 34 that delivered bottom line results that were markedly better than the industry as a whole Performance Metrics: 2015 Sm-All Stars vs. Industry Medians Last Twelve Months Sm-All Stars All Banks & Thrifts EPS Growth 22.1% 6.6% Loan Growth 19.0% 9.2% Deposit Growth 14.3% 6.5% ROAE 10.1% 7.9% NPAs1 / Loans and OREO 0.5% 1.0% 1 Accruing TDRs are excluded from NPAs Source: SNL Financial and Sandler O'Neill 5 Guaranty Bancorp – About Us

Awarded Sandler O’Neill’s Bank & Thrift Sm-All Stars award for the second year in a row .One of the 34 top performing small-cap banks and thrifts in the country .Only Rocky Mountain Region bank on the list .435 publicly traded bank and thrifts with a market cap below $2.5 billion and above $25 million were evaluated .Focused on growth, profitability, credit quality and capital strength .After the rigorous evaluation, 401 institutions or 92% of the companies were eliminated leaving the remaining 34 that delivered bottom line results that were markedly better than the industry as a whole Performance Metrics: 2015 Sm-All Stars vs. Industry Medians Last Twelve Months Sm-All Stars All Banks & Thrifts EPS Growth 22.1% 6.6% Loan Growth 19.0% 9.2% Deposit Growth 14.3% 6.5% ROAE 10.1% 7.9% NPAs1 / Loans and OREO 0.5% 1.0% 1 Accruing TDRs are excluded from NPAs Source: SNL Financial and Sandler O'Neill 5 Guaranty Bancorp – About Us

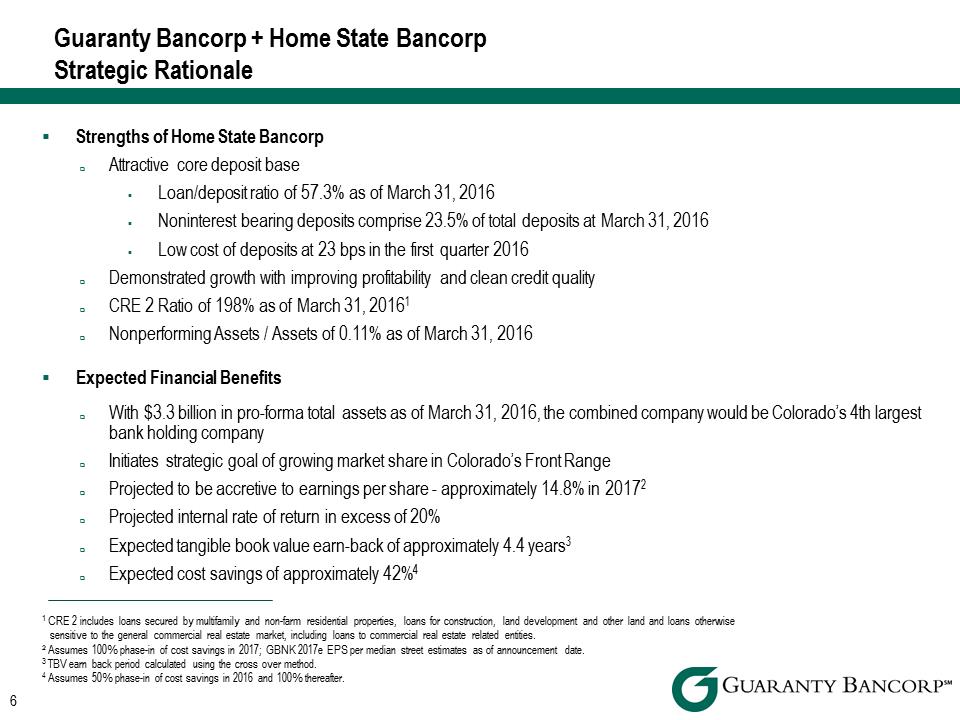

Strengths of Home State Bancorp .Attractive core deposit base .Loan/deposit ratio of 57.3% as of March 31, 2016 .Noninterest bearing deposits comprise 23.5% of total deposits at March 31, 2016 .Low cost of deposits at 23 bps in the first quarter 2016 .Demonstrated growth with improving profitability and clean credit quality .CRE 2 Ratio of 198% as of March 31, 20161 .Nonperforming Assets / Assets of 0.11% as of March 31, 2016 .Expected Financial Benefits .With $3.3 billion in pro-forma total assets as of March 31, 2016, the combined company would be Colorado’s 4th largest bank holding company .Initiates strategic goal of growing market share in Colorado’s Front Range .Projected to be accretive to earnings per share - approximately 14.8% in 20172 .Projected internal rate of return in excess of 20% .Expected tangible book value earn-back of approximately 4.4 years3 .Expected cost savings of approximately 42% 4 Guaranty Bancorp + Home State Bancorp Strategic Rationale 6 1 CRE 2 includes loans secured by multifamily and non-farm residential properties, loans for construction, land development and other land and loans otherwise sensitive to the general commercial real estate market, including loans to commercial real estate related entities. 2 Assumes 100% phase-in of cost savings in 2017; GBNK 2017e EPS per median street estimates as of announcement date. 3 TBV earn back period calculated using the cross over method. 4 Assumes 50% phase-in of cost savings in 2016 and 100% thereafter.

Strengths of Home State Bancorp .Attractive core deposit base .Loan/deposit ratio of 57.3% as of March 31, 2016 .Noninterest bearing deposits comprise 23.5% of total deposits at March 31, 2016 .Low cost of deposits at 23 bps in the first quarter 2016 .Demonstrated growth with improving profitability and clean credit quality .CRE 2 Ratio of 198% as of March 31, 20161 .Nonperforming Assets / Assets of 0.11% as of March 31, 2016 .Expected Financial Benefits .With $3.3 billion in pro-forma total assets as of March 31, 2016, the combined company would be Colorado’s 4th largest bank holding company .Initiates strategic goal of growing market share in Colorado’s Front Range .Projected to be accretive to earnings per share - approximately 14.8% in 20172 .Projected internal rate of return in excess of 20% .Expected tangible book value earn-back of approximately 4.4 years3 .Expected cost savings of approximately 42% 4 Guaranty Bancorp + Home State Bancorp Strategic Rationale 6 1 CRE 2 includes loans secured by multifamily and non-farm residential properties, loans for construction, land development and other land and loans otherwise sensitive to the general commercial real estate market, including loans to commercial real estate related entities. 2 Assumes 100% phase-in of cost savings in 2017; GBNK 2017e EPS per median street estimates as of announcement date. 3 TBV earn back period calculated using the cross over method. 4 Assumes 50% phase-in of cost savings in 2016 and 100% thereafter.

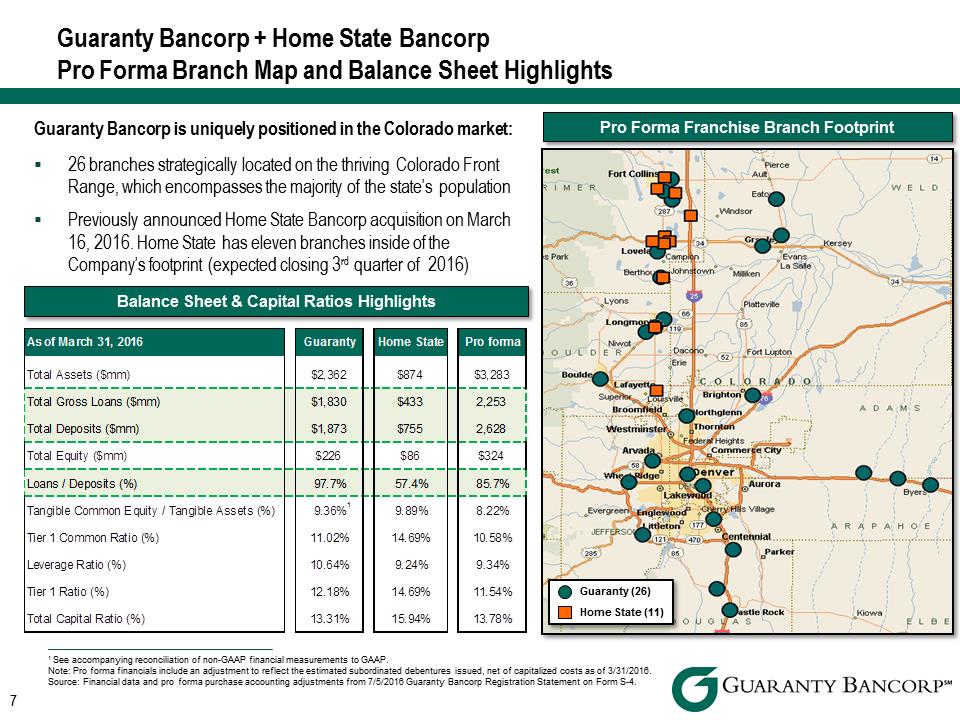

Guaranty Bancorp is uniquely positioned in the Colorado market: .26 branches strategically located on the thriving Colorado Front Range, which encompasses the majority of the state’s population .Previously announced Home State Bancorp acquisition on March 16, 2016. Home State has eleven branches inside of the Company’s footprint (expected closing 3rd quarter of 2016) 7 Guaranty (26) Home State (11) Pro Forma Franchise Branch Footprint 1 See accompanying reconciliation of non-GAAP financial measurements to GAAP. Note: Pro forma financials include an adjustment to reflect the estimated subordinated debentures issued, net of capitalized costs as of 3/31/2016. Source: Financial data and pro forma purchase accounting adjustments from 7/5/2016 Guaranty Bancorp Registration Statement on Form S-4. As of March 31, 2016GuarantyHome StatePro formaTotal Assets ($mm) $2,362 $874 $3,283 Total Gross Loans ($mm)$1,830$4332,253 Total Deposits ($mm)$1,873$7552,628 Total Equity ($mm) $226 $86 $324 Loans / Deposits (%)97.7% 57.4% 85.7% Tangible Common Equity / Tangible Assets (%) 9.36% 9.89% 8.22%Tier 1 Common Ratio (%) 11.02% 14.69% 10.58% Leverage Ratio (%) 10.64% 9.24% 9.34% Tier 1 Ratio (%) 12.18% 14.69% 11.54% Total Capital Ratio (%) 13.31% 15.94% 13.78% Balance Sheet & Capital Ratios Highlights 1 Guaranty Bancorp + Home State Bancorp Pro Forma Branch Map and Balance Sheet Highlights

Guaranty Bancorp is uniquely positioned in the Colorado market: .26 branches strategically located on the thriving Colorado Front Range, which encompasses the majority of the state’s population .Previously announced Home State Bancorp acquisition on March 16, 2016. Home State has eleven branches inside of the Company’s footprint (expected closing 3rd quarter of 2016) 7 Guaranty (26) Home State (11) Pro Forma Franchise Branch Footprint 1 See accompanying reconciliation of non-GAAP financial measurements to GAAP. Note: Pro forma financials include an adjustment to reflect the estimated subordinated debentures issued, net of capitalized costs as of 3/31/2016. Source: Financial data and pro forma purchase accounting adjustments from 7/5/2016 Guaranty Bancorp Registration Statement on Form S-4. As of March 31, 2016GuarantyHome StatePro formaTotal Assets ($mm) $2,362 $874 $3,283 Total Gross Loans ($mm)$1,830$4332,253 Total Deposits ($mm)$1,873$7552,628 Total Equity ($mm) $226 $86 $324 Loans / Deposits (%)97.7% 57.4% 85.7% Tangible Common Equity / Tangible Assets (%) 9.36% 9.89% 8.22%Tier 1 Common Ratio (%) 11.02% 14.69% 10.58% Leverage Ratio (%) 10.64% 9.24% 9.34% Tier 1 Ratio (%) 12.18% 14.69% 11.54% Total Capital Ratio (%) 13.31% 15.94% 13.78% Balance Sheet & Capital Ratios Highlights 1 Guaranty Bancorp + Home State Bancorp Pro Forma Branch Map and Balance Sheet Highlights

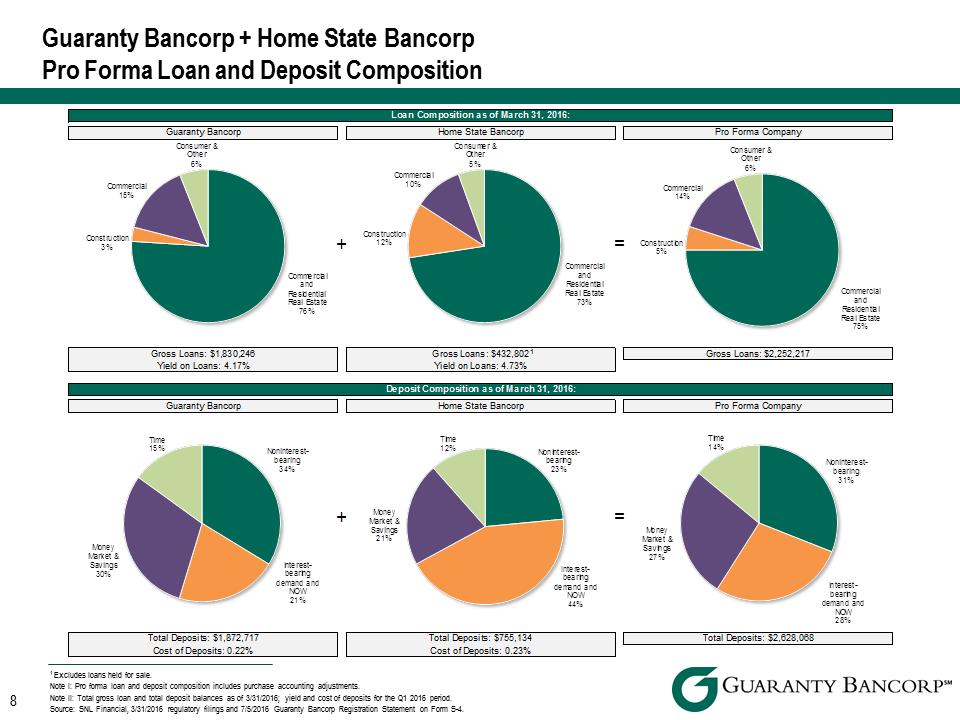

1 Excludes loans held for sale. Note I: Pro forma loan and deposit composition includes purchase accounting adjustments. Note II: Total gross loan and total deposit balances as of 3/31/2016; yield and cost of deposits for the Q1 2016 period.Source: SNL Financial, 3/31/2016 regulatory filings and 7/5/2016 Guaranty Bancorp Registration Statement on Form S-4. 8 += Total Deposits: $1,872,717 Total Deposits: $755,134 Total Deposits: $2,628,068 Cost of Deposits: 0.22% Cost of Deposits: 0.23% Yield on Loans: 4.17% Yield on Loans: 4.73% Deposit Composition as of March 31, 2016:Guaranty BancorpHome State BancorpPro Forma CompanyGross Loans: $1,830,246 Gross Loans: $432,802 Gross Loans: $2,252,217 Loan Composition as of March 31, 2016:Guaranty BancorpHome State BancorpPro Forma CompanyNoninterest-bearing 23% Interest-bearing demand and NOW 44% Money Market & Savings 21% Time 12% Noninterest-bearing 34% Interest-bearing demand and NOW 21% Money Market & Savings 30% Time 15% Noninterest-bearing 31% Interest-bearing demand and NOW 28% Money Market & Savings 27% Time 14% Commercial and Residential Real Estate 73% Construction 12% Commercial10% Consumer & Other 5%Commercial and Residential Real Estate 76% Construction 3% Commercial 15% Consumer & Other 6% Commercial and Residential Real Estate 75% Construction5% Commercial 14% Consumer & Other 6% 1 Guaranty Bancorp + Home State Bancorp Pro Forma Loan and Deposit Composition

1 Excludes loans held for sale. Note I: Pro forma loan and deposit composition includes purchase accounting adjustments. Note II: Total gross loan and total deposit balances as of 3/31/2016; yield and cost of deposits for the Q1 2016 period.Source: SNL Financial, 3/31/2016 regulatory filings and 7/5/2016 Guaranty Bancorp Registration Statement on Form S-4. 8 += Total Deposits: $1,872,717 Total Deposits: $755,134 Total Deposits: $2,628,068 Cost of Deposits: 0.22% Cost of Deposits: 0.23% Yield on Loans: 4.17% Yield on Loans: 4.73% Deposit Composition as of March 31, 2016:Guaranty BancorpHome State BancorpPro Forma CompanyGross Loans: $1,830,246 Gross Loans: $432,802 Gross Loans: $2,252,217 Loan Composition as of March 31, 2016:Guaranty BancorpHome State BancorpPro Forma CompanyNoninterest-bearing 23% Interest-bearing demand and NOW 44% Money Market & Savings 21% Time 12% Noninterest-bearing 34% Interest-bearing demand and NOW 21% Money Market & Savings 30% Time 15% Noninterest-bearing 31% Interest-bearing demand and NOW 28% Money Market & Savings 27% Time 14% Commercial and Residential Real Estate 73% Construction 12% Commercial10% Consumer & Other 5%Commercial and Residential Real Estate 76% Construction 3% Commercial 15% Consumer & Other 6% Commercial and Residential Real Estate 75% Construction5% Commercial 14% Consumer & Other 6% 1 Guaranty Bancorp + Home State Bancorp Pro Forma Loan and Deposit Composition

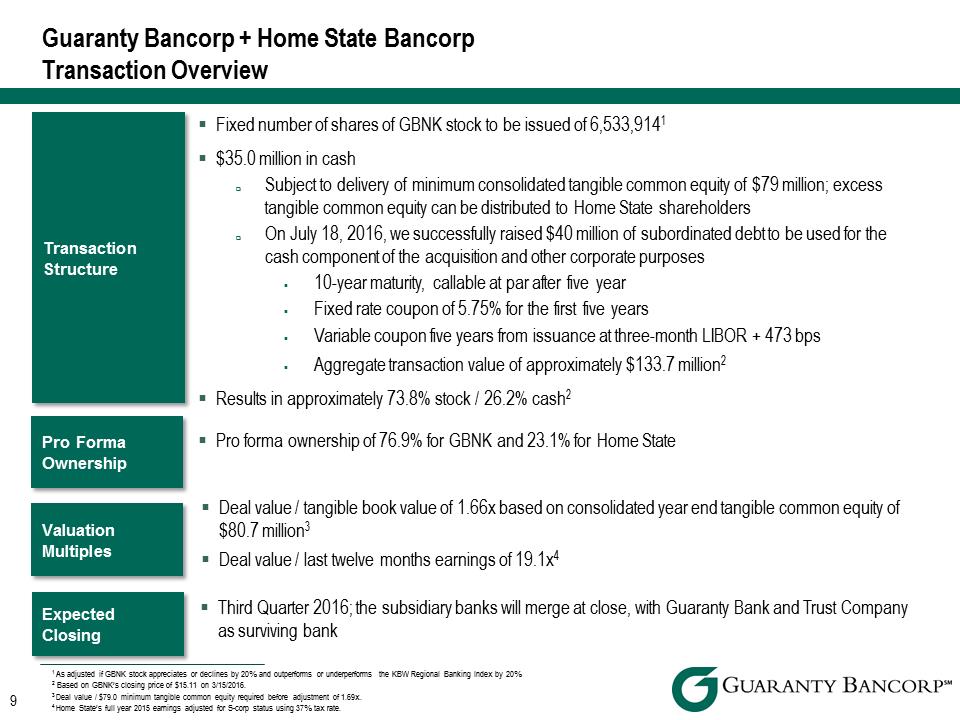

9 Transaction Structure .Fixed number of shares of GBNK stock to be issued of 6,533,914 1 .$35.0 million in cash .Subject to delivery of minimum consolidated tangible common equity of $79 million; excess tangible common equity can be distributed to Home State shareholders .On July 18, 2016, we successfully raised $40 million of subordinated debt to be used for the cash component of the acquisition and other corporate purposes .10-year maturity, callable at par after five year .Fixed rate coupon of 5.75% for the first five years .Variable coupon five years from issuance at three-month LIBOR + 473 bps .Aggregate transaction value of approximately $133.7 million2 .Results in approximately 73.8% stock / 26.2% cash2 Pro Forma Ownership .Pro forma ownership of 76.9% for GBNK and 23.1% for Home State Valuation Multiples Expected Closing .Third Quarter 2016; the subsidiary banks will merge at close, with Guaranty Bank and Trust Company as surviving bank Guaranty Bancorp + Home State Bancorp Transaction Overview 1 As adjusted if GBNK stock appreciates or declines by 20% and outperforms or underperforms the KBW Regional Banking Index by 20% 2 Based on GBNK’s closing price of $15.11 on 3/15/2016. 3 Deal value / $79.0 minimum tangible common equity required before adjustment of 1.69x. 4 Home State’s full year 2015 earnings adjusted for S-corp status using 37% tax rate. .Deal value / tangible book value of 1.66x based on consolidated year end tangible common equity of $80.7 million3 .Deal value / last twelve months earnings of 19.1x4

9 Transaction Structure .Fixed number of shares of GBNK stock to be issued of 6,533,914 1 .$35.0 million in cash .Subject to delivery of minimum consolidated tangible common equity of $79 million; excess tangible common equity can be distributed to Home State shareholders .On July 18, 2016, we successfully raised $40 million of subordinated debt to be used for the cash component of the acquisition and other corporate purposes .10-year maturity, callable at par after five year .Fixed rate coupon of 5.75% for the first five years .Variable coupon five years from issuance at three-month LIBOR + 473 bps .Aggregate transaction value of approximately $133.7 million2 .Results in approximately 73.8% stock / 26.2% cash2 Pro Forma Ownership .Pro forma ownership of 76.9% for GBNK and 23.1% for Home State Valuation Multiples Expected Closing .Third Quarter 2016; the subsidiary banks will merge at close, with Guaranty Bank and Trust Company as surviving bank Guaranty Bancorp + Home State Bancorp Transaction Overview 1 As adjusted if GBNK stock appreciates or declines by 20% and outperforms or underperforms the KBW Regional Banking Index by 20% 2 Based on GBNK’s closing price of $15.11 on 3/15/2016. 3 Deal value / $79.0 minimum tangible common equity required before adjustment of 1.69x. 4 Home State’s full year 2015 earnings adjusted for S-corp status using 37% tax rate. .Deal value / tangible book value of 1.66x based on consolidated year end tangible common equity of $80.7 million3 .Deal value / last twelve months earnings of 19.1x4

Loan growth momentum .Last twelve month net loan growth of $229.9 million or 13.8% .Strong asset quality (ratios as of June 30, 2016) .Nonperforming assets to total assets of 0.58% .Classified asset ratio of 10.55% .Texas ratio of 5.17% .Allowance to total loans of 1.21% .Nominal direct exposure to energy ($0.8 million in Energy Loans outstanding as of June 30, 2016) .Strong core deposit mix .Noninterest bearing deposits comprised 34.5% of total deposits at June 30, 2016 .Last twelve month net deposit growth of $105.4 million or 6.0% .Time deposits comprised 15.3% of total deposits at June 30, 2016 .Cost of deposits1 remained low at 23 bps during the second quarter 2016 10 1 Including noninterest-bearing deposits. Guaranty Bancorp - Investment Considerations

Loan growth momentum .Last twelve month net loan growth of $229.9 million or 13.8% .Strong asset quality (ratios as of June 30, 2016) .Nonperforming assets to total assets of 0.58% .Classified asset ratio of 10.55% .Texas ratio of 5.17% .Allowance to total loans of 1.21% .Nominal direct exposure to energy ($0.8 million in Energy Loans outstanding as of June 30, 2016) .Strong core deposit mix .Noninterest bearing deposits comprised 34.5% of total deposits at June 30, 2016 .Last twelve month net deposit growth of $105.4 million or 6.0% .Time deposits comprised 15.3% of total deposits at June 30, 2016 .Cost of deposits1 remained low at 23 bps during the second quarter 2016 10 1 Including noninterest-bearing deposits. Guaranty Bancorp - Investment Considerations

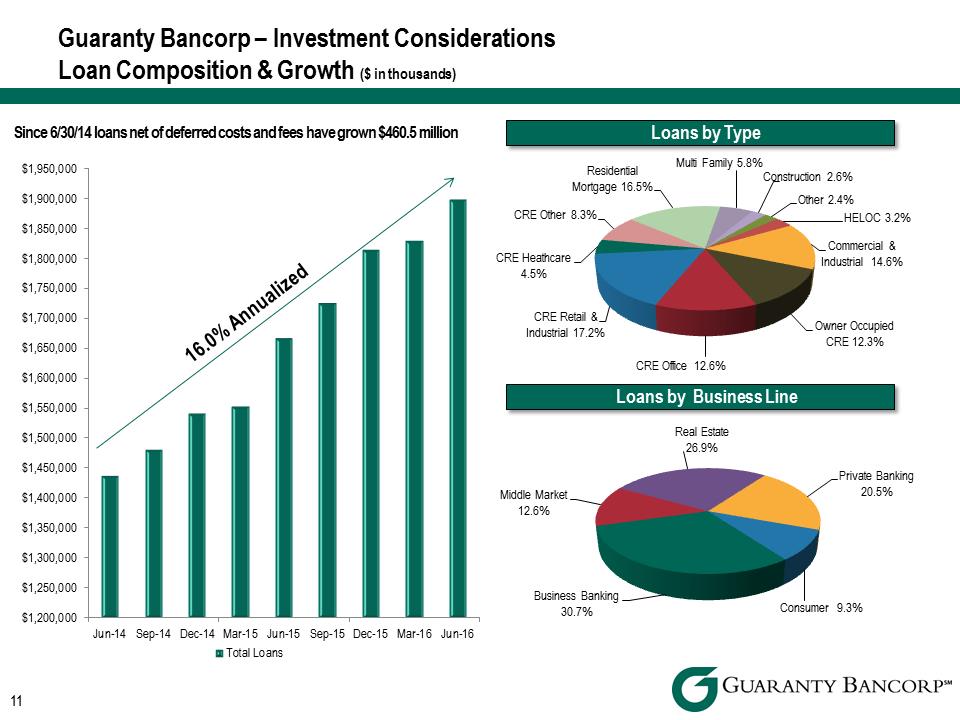

Guaranty Bancorp – Investment Considerations Loan Composition & Growth ($ in thousands) 11 Since 6/30/14 loans net of deferred costs and fees have grown $460.5 million Commercial & Industrial 14.6% Owner Occupied CRE 12.3% CRE Office 12.6% CRE Retail & Industrial 17.2% CRE Heathcare 4.5% CRE Other 8.3% Residential Mortgage 16.5% Multi Family 5.8% Construction 2.6% Other 2.4% HELOC 3.2% - Loans by Type - Consumer 9.3% Business Banking 30.7% Middle Market 12.6% Real Estate 26.9% Private Banking 20.5% _____ _ __Loans by Business Line_ ______ $1,200,000 $1,250,000 $1,300,000 $1,350,000 $1,400,000 $1,450,000 $1,500,000 $1,550,000 $1,600,000 $1,650,000 $1,700,000 $1,750,000 $1,800,000 $1,850,000 $1,900,000 $1,950,000 Jun-14 Sep-14 Dec-14 Mar-15 Jun-15 Sep-15 Dec-15 Mar-16 Jun-16 Total Loans 16.0% Annualized

Guaranty Bancorp – Investment Considerations Loan Composition & Growth ($ in thousands) 11 Since 6/30/14 loans net of deferred costs and fees have grown $460.5 million Commercial & Industrial 14.6% Owner Occupied CRE 12.3% CRE Office 12.6% CRE Retail & Industrial 17.2% CRE Heathcare 4.5% CRE Other 8.3% Residential Mortgage 16.5% Multi Family 5.8% Construction 2.6% Other 2.4% HELOC 3.2% - Loans by Type - Consumer 9.3% Business Banking 30.7% Middle Market 12.6% Real Estate 26.9% Private Banking 20.5% _____ _ __Loans by Business Line_ ______ $1,200,000 $1,250,000 $1,300,000 $1,350,000 $1,400,000 $1,450,000 $1,500,000 $1,550,000 $1,600,000 $1,650,000 $1,700,000 $1,750,000 $1,800,000 $1,850,000 $1,900,000 $1,950,000 Jun-14 Sep-14 Dec-14 Mar-15 Jun-15 Sep-15 Dec-15 Mar-16 Jun-16 Total Loans 16.0% Annualized

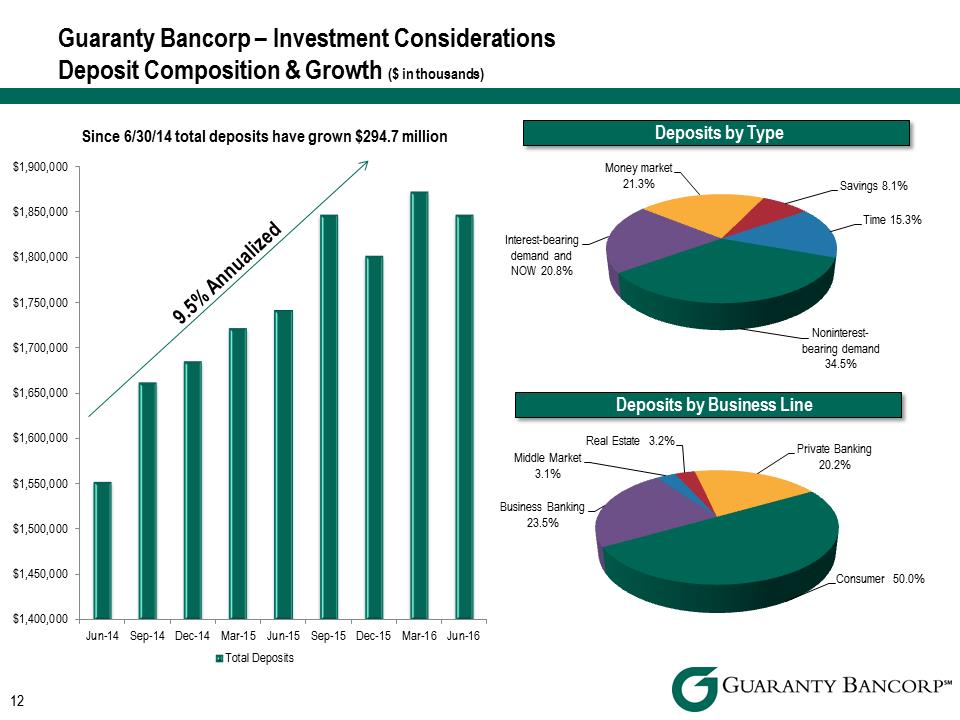

12 Since 6/30/14 total deposits have grown $294.7 million Consumer 50.0% Business Banking 23.5% Middle Market 3.1% Real Estate 3.2% Private Banking 20.2% _____ _ _ __Deposits by Business Line ______ $1,400,000 $1,450,000 $1,500,000 $1,550,000 $1,600,000 $1,650,000 $1,700,000 $1,750,000 $1,800,000 $1,850,000 $1,900,000 Jun-14 Sep-14 Dec-14 Mar-15 Jun-15 Sep-15 Dec-15 Mar-16 Jun-16 Total Deposits 9.5% Annualized Noninterest-bearing demand 34.5% Interest-bearing demand and NOW 20.8% Money market 21.3% Savings 8.1% Time 15.3% - Deposits by Type - Guaranty Bancorp – Investment Considerations Deposit Composition & Growth ($ in thousands)

12 Since 6/30/14 total deposits have grown $294.7 million Consumer 50.0% Business Banking 23.5% Middle Market 3.1% Real Estate 3.2% Private Banking 20.2% _____ _ _ __Deposits by Business Line ______ $1,400,000 $1,450,000 $1,500,000 $1,550,000 $1,600,000 $1,650,000 $1,700,000 $1,750,000 $1,800,000 $1,850,000 $1,900,000 Jun-14 Sep-14 Dec-14 Mar-15 Jun-15 Sep-15 Dec-15 Mar-16 Jun-16 Total Deposits 9.5% Annualized Noninterest-bearing demand 34.5% Interest-bearing demand and NOW 20.8% Money market 21.3% Savings 8.1% Time 15.3% - Deposits by Type - Guaranty Bancorp – Investment Considerations Deposit Composition & Growth ($ in thousands)

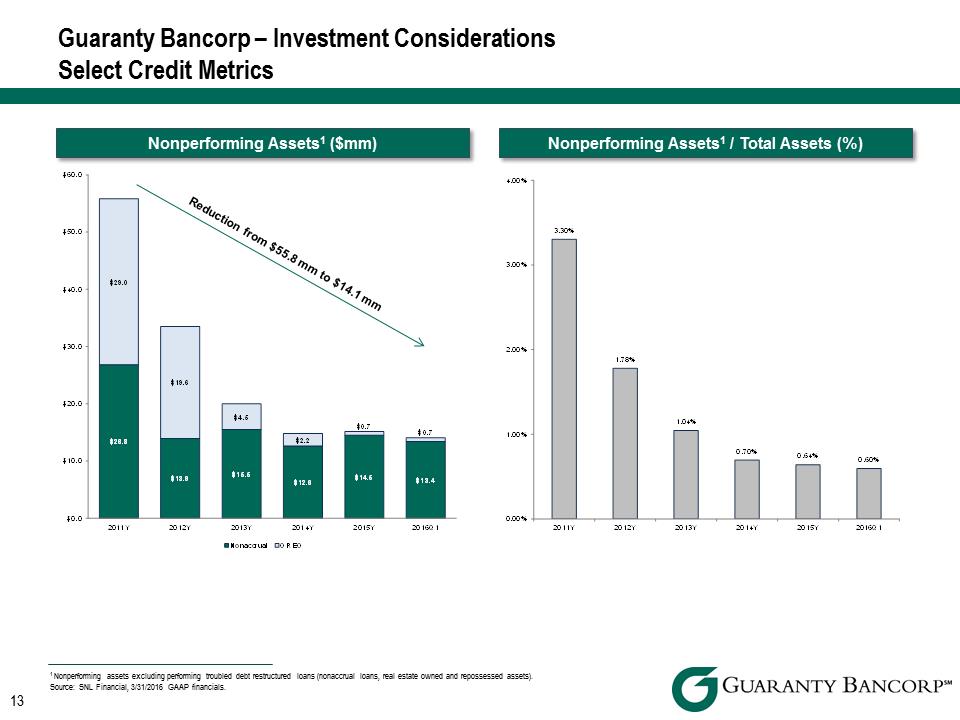

13 Guaranty Bancorp – Investment Considerations Select Credit Metrics Nonperforming Assets1 ($mm) Nonperforming Assets1 / Total Assets (%) $26.8 $13.9 $15.5 $12.6 $14.5 $13.4 $29.0 $19.6 $4.5 $2.2$0.7 $0.7 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 2011 Y 2012 Y 2013 Y 2014 Y 2015 Y 2016 Q1 Nonaccrual OREO 3.30% 1.78% 1.04% 0.70% 0.64% 0.60% 0.00% 1.00% 2.00% 3.00% 4.00% 2011 Y 2012 Y 2013 Y 2014 Y 2015 Y 2016 Q1 1 Nonperforming assets excluding performing troubled debt restructured loans (nonaccrual loans, real estate owned and repossessed assets). Source: SNL Financial, 3/31/2016 GAAP financials. Reduction from $55.8 mm to $14.1 mm

13 Guaranty Bancorp – Investment Considerations Select Credit Metrics Nonperforming Assets1 ($mm) Nonperforming Assets1 / Total Assets (%) $26.8 $13.9 $15.5 $12.6 $14.5 $13.4 $29.0 $19.6 $4.5 $2.2$0.7 $0.7 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 2011 Y 2012 Y 2013 Y 2014 Y 2015 Y 2016 Q1 Nonaccrual OREO 3.30% 1.78% 1.04% 0.70% 0.64% 0.60% 0.00% 1.00% 2.00% 3.00% 4.00% 2011 Y 2012 Y 2013 Y 2014 Y 2015 Y 2016 Q1 1 Nonperforming assets excluding performing troubled debt restructured loans (nonaccrual loans, real estate owned and repossessed assets). Source: SNL Financial, 3/31/2016 GAAP financials. Reduction from $55.8 mm to $14.1 mm

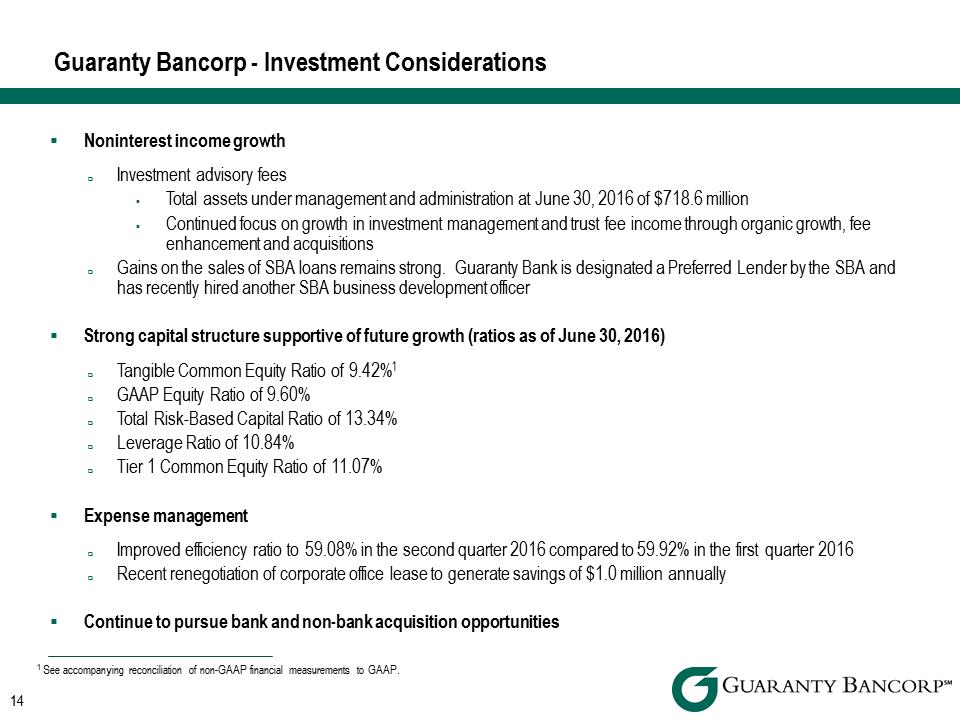

Noninterest income growth .Investment advisory fees .Total assets under management and administration at June 30, 2016 of $718.6 million .Continued focus on growth in investment management and trust fee income through organic growth, fee enhancement and acquisitions .Gains on the sales of SBA loans remains strong. Guaranty Bank is designated a Preferred Lender by the SBA and has recently hired another SBA business development officer .Strong capital structure supportive of future growth (ratios as of June 30, 2016) .Tangible Common Equity Ratio of 9.42%1 .GAAP Equity Ratio of 9.60% .Total Risk-Based Capital Ratio of 13.34% .Leverage Ratio of 10.84% .Tier 1 Common Equity Ratio of 11.07% .Expense management .Improved efficiency ratio to 59.08% in the second quarter 2016 compared to 59.92% in the first quarter 2016 .Recent renegotiation of corporate office lease to generate savings of $1.0 million annually .Continue to pursue bank and non-bank acquisition opportunities 4 1 See accompanying reconciliation of non-GAAP financial measurements to GAAP. Guaranty Bancorp - Investment Considerations

Noninterest income growth .Investment advisory fees .Total assets under management and administration at June 30, 2016 of $718.6 million .Continued focus on growth in investment management and trust fee income through organic growth, fee enhancement and acquisitions .Gains on the sales of SBA loans remains strong. Guaranty Bank is designated a Preferred Lender by the SBA and has recently hired another SBA business development officer .Strong capital structure supportive of future growth (ratios as of June 30, 2016) .Tangible Common Equity Ratio of 9.42%1 .GAAP Equity Ratio of 9.60% .Total Risk-Based Capital Ratio of 13.34% .Leverage Ratio of 10.84% .Tier 1 Common Equity Ratio of 11.07% .Expense management .Improved efficiency ratio to 59.08% in the second quarter 2016 compared to 59.92% in the first quarter 2016 .Recent renegotiation of corporate office lease to generate savings of $1.0 million annually .Continue to pursue bank and non-bank acquisition opportunities 4 1 See accompanying reconciliation of non-GAAP financial measurements to GAAP. Guaranty Bancorp - Investment Considerations

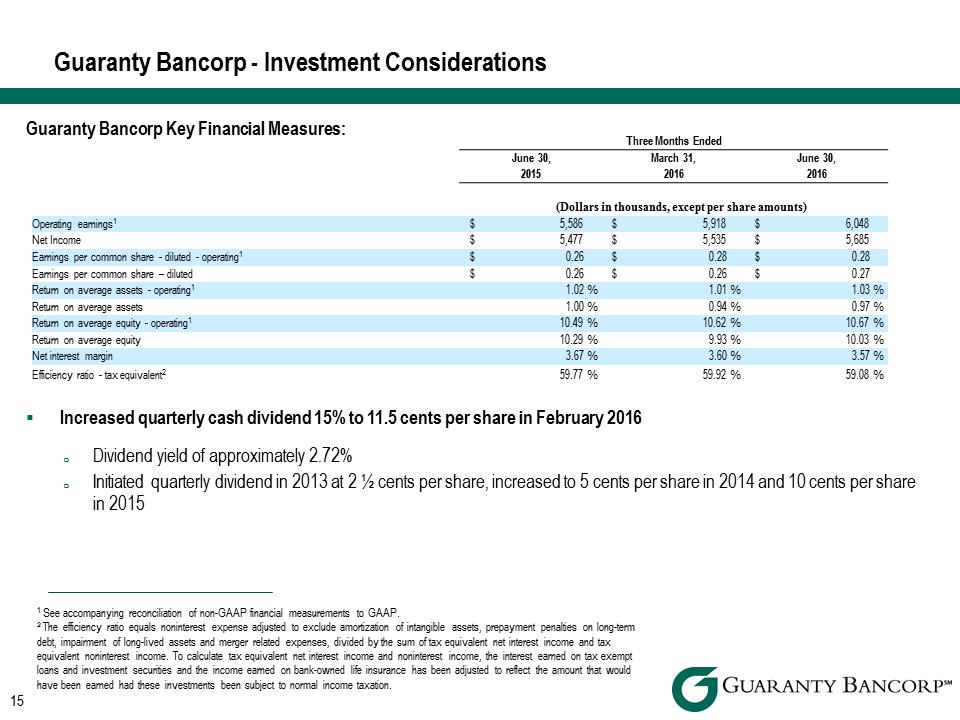

Guaranty Bancorp Key Financial Measures: .Increased quarterly cash dividend 15% to 11.5 cents per share in February 2016 .Dividend yield of approximately 2.72% .Initiated quarterly dividend in 2013 at 2 ½ cents per share, increased to 5 cents per share in 2014 and 10 cents per share in 2015 Guaranty Bancorp - Investment Considerations 15 1 See accompanying reconciliation of non-GAAP financial measurements to GAAP. 2 The efficiency ratio equals noninterest expense adjusted to exclude amortization of intangible assets, prepayment penalties on long-term debt, impairment of long-lived assets and merger related expenses, divided by the sum of tax equivalent net interest income and tax equivalent noninterest income. To calculate tax equivalent net interest income and noninterest income, the interest earned on tax exempt loans and investment securities and the income earned on bank-owned life insurance has been adjusted to reflect the amount that would have been earned had these investments been subject to normal income taxation. Three Months Ended June 30, March 31, June 30, 2015 2016 2016 (Dollars in thousands, except per share amounts) Operating earnings1 $5,586 $5,918 $6,048 Net Income $5,477 $5,535 $5,685 Earnings per common share - diluted - operating1 $0.26 $0.28 $0.28 Earnings per common share – diluted $0.26 $0.26 $0.27 Return on average assets - operating1 1.02% 1.01% 1.03% Return on average assets 1.00% 0.94% 0.97% Return on average equity - operating1 10.49% 10.62% 10.67% Return on average equity 10.29% 9.93% 10.03% Net interest margin 3.67% 3.60% 3.57% Efficiency ratio - tax equivalent2 59.77% 59.92% 59.08%

Guaranty Bancorp Key Financial Measures: .Increased quarterly cash dividend 15% to 11.5 cents per share in February 2016 .Dividend yield of approximately 2.72% .Initiated quarterly dividend in 2013 at 2 ½ cents per share, increased to 5 cents per share in 2014 and 10 cents per share in 2015 Guaranty Bancorp - Investment Considerations 15 1 See accompanying reconciliation of non-GAAP financial measurements to GAAP. 2 The efficiency ratio equals noninterest expense adjusted to exclude amortization of intangible assets, prepayment penalties on long-term debt, impairment of long-lived assets and merger related expenses, divided by the sum of tax equivalent net interest income and tax equivalent noninterest income. To calculate tax equivalent net interest income and noninterest income, the interest earned on tax exempt loans and investment securities and the income earned on bank-owned life insurance has been adjusted to reflect the amount that would have been earned had these investments been subject to normal income taxation. Three Months Ended June 30, March 31, June 30, 2015 2016 2016 (Dollars in thousands, except per share amounts) Operating earnings1 $5,586 $5,918 $6,048 Net Income $5,477 $5,535 $5,685 Earnings per common share - diluted - operating1 $0.26 $0.28 $0.28 Earnings per common share – diluted $0.26 $0.26 $0.27 Return on average assets - operating1 1.02% 1.01% 1.03% Return on average assets 1.00% 0.94% 0.97% Return on average equity - operating1 10.49% 10.62% 10.67% Return on average equity 10.29% 9.93% 10.03% Net interest margin 3.67% 3.60% 3.57% Efficiency ratio - tax equivalent2 59.77% 59.92% 59.08%

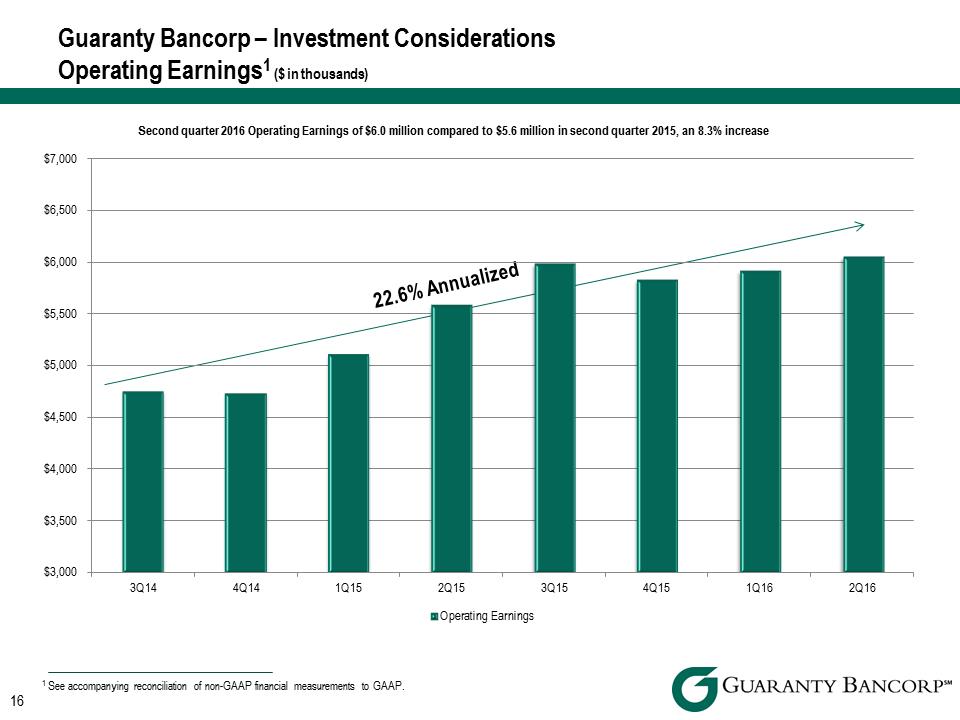

16 Guaranty Bancorp – Investment Considerations Operating Earnings1 ($ in thousands) 1 See accompanying reconciliation of non-GAAP financial measurements to GAAP. Second quarter 2016 Operating Earnings of $6.0 million compared to $5.6 million in second quarter 2015, an 8.3% increase 22.6% Annualized $3,000 $3,500 $4,000 $4,500 $5,000 $5,500 $6,000 $6,500 $7,000 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 Operating Earnings

16 Guaranty Bancorp – Investment Considerations Operating Earnings1 ($ in thousands) 1 See accompanying reconciliation of non-GAAP financial measurements to GAAP. Second quarter 2016 Operating Earnings of $6.0 million compared to $5.6 million in second quarter 2015, an 8.3% increase 22.6% Annualized $3,000 $3,500 $4,000 $4,500 $5,000 $5,500 $6,000 $6,500 $7,000 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 Operating Earnings

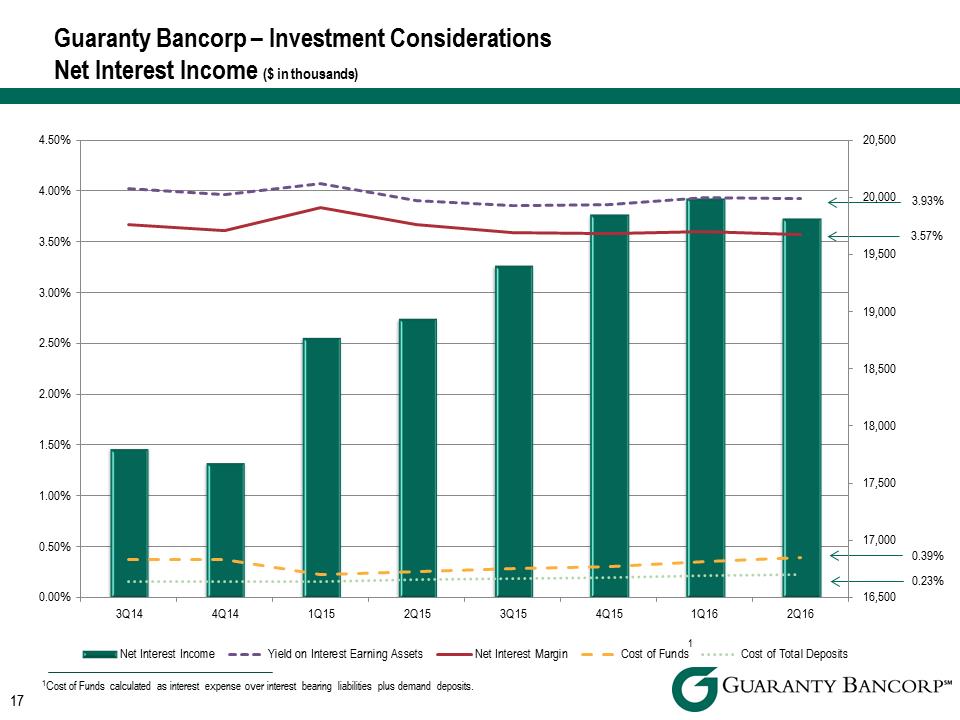

Guaranty Bancorp – Investment Considerations Net Interest Income ($ in thousands) 17 1Cost of Funds calculated as interest expense over interest bearing liabilities plus demand deposits. 3.93% 3.57% 0.23% 0.39% 1 16,500 17,000 17,500 18,000 18,500 19,000 19,500 20,000 20,500 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 Net Interest Income Yield on Interest Earning Assets Net Interest Margin Cost of Funds Cost of Total Deposits

Guaranty Bancorp – Investment Considerations Net Interest Income ($ in thousands) 17 1Cost of Funds calculated as interest expense over interest bearing liabilities plus demand deposits. 3.93% 3.57% 0.23% 0.39% 1 16,500 17,000 17,500 18,000 18,500 19,000 19,500 20,000 20,500 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 Net Interest Income Yield on Interest Earning Assets Net Interest Margin Cost of Funds Cost of Total Deposits

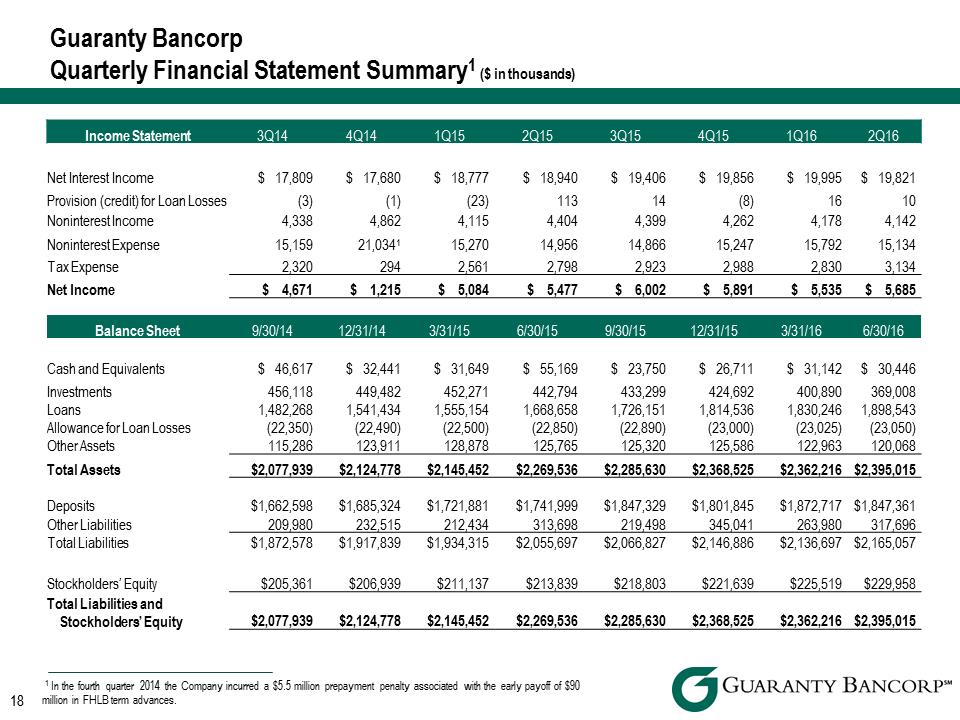

Income Statement 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 Net Interest Income $17,809 $ 7,680 $18,777 $18,940 $19,406 $19,856 $19,995 $19,821 Provision (credit) for Loan Losses (3) (1) (23) 113 14 (8) 16 10 Noninterest Income 4,338 4,862 4,115 4,404 4,399 4,262 4,178 4,142 Noninterest Expense 15,159 21,0341 15,270 14,956 14,866 15,247 15,792 15,134 Tax Expense 2,320 294 2,561 2,798 2,923 2,988 2,830 3,134 Net Income $4,671 $1,215 $5,084 $5,477 $6,002 $5,891 $5,535 $5,685 Balance Sheet 9/30/14 12/31/14 3/31/15 6/30/15 9/30/15 12/31/15 3/31/16 6/30/16 Cash and Equivalents $46,617 $32,441 $31,649 $55,169 $23,750 $26,711 $31,142 $30,446 Investments 456,118 449,482 452,271 442,794 433,299 424,692 400,890 369,008 Loans 1,482,268 1,541,434 1,555,154 1,668,658 1,726,151 1,814,536 1,830,246 1,898,543 Allowance for Loan Losses (22,350) (22,490) (22,500) (22,850) (22,890) (23,000) (23,025) (23,050) Other Assets 115,286 123,911 128,878 125,765 125,320 125,586 122,963 120,068 Total Assets $2,077,939 $2,124,778 $2,145,452 $2,269,536 $2,285,630 $2,368,525 $2,362,216 $2,395,015 Deposits $1,662,598 $1,685,324 $1,721,881 $1,741,999 $1,847,329 $1,801,845 $1,872,717 $1,847,361 Other Liabilities 209,980 232,515 212,434 313,698 219,498 345,041 263,980 317,696 Total Liabilities $1,872,578 $1,917,839 $1,934,315 $2,055,697 $2,066,827 $2,146,886 $2,136,697 $2,165,057 Stockholders’ Equity $205,361 $206,939 $211,137 $213,839 $218,803 $221,639 $225,519 $229,958 Total Liabilities and Stockholders’ Equity $2,077,939 $2,124,778 $2,145,452 $2,269,536 $2,285,630 $2,368,525 $2,362,216 $2,395,015 Guaranty Bancorp Quarterly Financial Statement Summary1 ($ in thousands) 18 1 In the fourth quarter 2014 the Company incurred a $5.5 million prepayment penalty associated with the early payoff of $90 million in FHLB term advances.

Income Statement 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 Net Interest Income $17,809 $ 7,680 $18,777 $18,940 $19,406 $19,856 $19,995 $19,821 Provision (credit) for Loan Losses (3) (1) (23) 113 14 (8) 16 10 Noninterest Income 4,338 4,862 4,115 4,404 4,399 4,262 4,178 4,142 Noninterest Expense 15,159 21,0341 15,270 14,956 14,866 15,247 15,792 15,134 Tax Expense 2,320 294 2,561 2,798 2,923 2,988 2,830 3,134 Net Income $4,671 $1,215 $5,084 $5,477 $6,002 $5,891 $5,535 $5,685 Balance Sheet 9/30/14 12/31/14 3/31/15 6/30/15 9/30/15 12/31/15 3/31/16 6/30/16 Cash and Equivalents $46,617 $32,441 $31,649 $55,169 $23,750 $26,711 $31,142 $30,446 Investments 456,118 449,482 452,271 442,794 433,299 424,692 400,890 369,008 Loans 1,482,268 1,541,434 1,555,154 1,668,658 1,726,151 1,814,536 1,830,246 1,898,543 Allowance for Loan Losses (22,350) (22,490) (22,500) (22,850) (22,890) (23,000) (23,025) (23,050) Other Assets 115,286 123,911 128,878 125,765 125,320 125,586 122,963 120,068 Total Assets $2,077,939 $2,124,778 $2,145,452 $2,269,536 $2,285,630 $2,368,525 $2,362,216 $2,395,015 Deposits $1,662,598 $1,685,324 $1,721,881 $1,741,999 $1,847,329 $1,801,845 $1,872,717 $1,847,361 Other Liabilities 209,980 232,515 212,434 313,698 219,498 345,041 263,980 317,696 Total Liabilities $1,872,578 $1,917,839 $1,934,315 $2,055,697 $2,066,827 $2,146,886 $2,136,697 $2,165,057 Stockholders’ Equity $205,361 $206,939 $211,137 $213,839 $218,803 $221,639 $225,519 $229,958 Total Liabilities and Stockholders’ Equity $2,077,939 $2,124,778 $2,145,452 $2,269,536 $2,285,630 $2,368,525 $2,362,216 $2,395,015 Guaranty Bancorp Quarterly Financial Statement Summary1 ($ in thousands) 18 1 In the fourth quarter 2014 the Company incurred a $5.5 million prepayment penalty associated with the early payoff of $90 million in FHLB term advances.

Colorado Market 19

Colorado Market 19

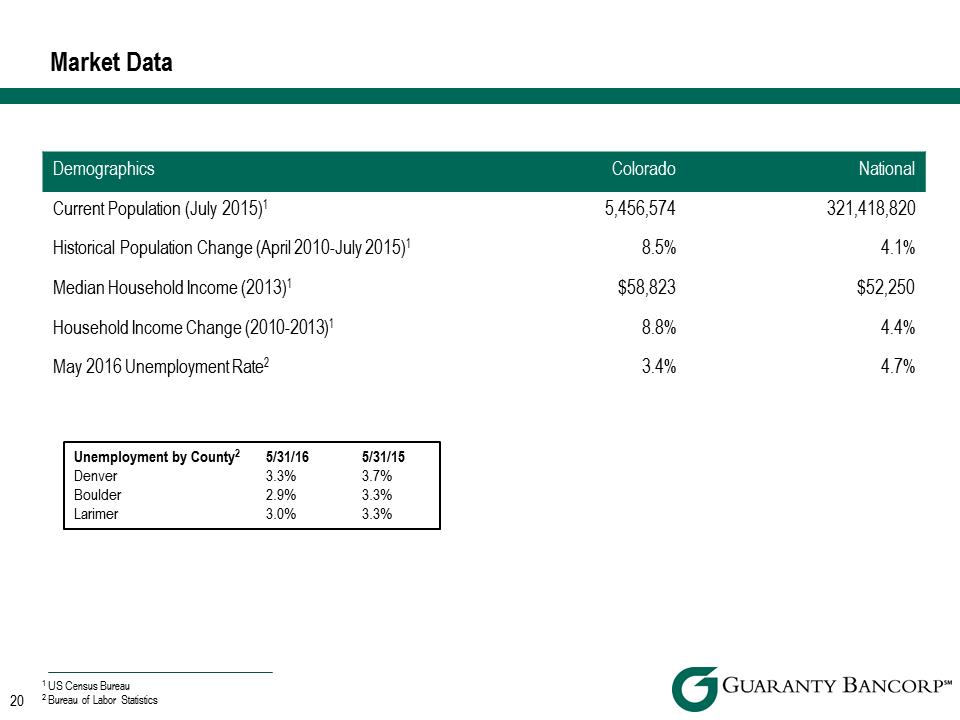

Demographics Colorado National Current Population (July 2015)1 5,456,574 321,418,820 Historical Population Change (April 2010-July 2015)1 8.5% 4.1% Median Household Income (2013)1 $58,823 $52,250 Household Income Change (2010-2013)1 8.8% 4.4% May 2016 Unemployment Rate2 3.4% 4.7% Market Data 20 1 US Census Bureau 2 Bureau of Labor Statistics Unemployment by County2 5/31/16 5/31/15 Denver 3.3% 3.7% Boulder 2.9% 3.3% Larimer 3.0% 3.3%

Demographics Colorado National Current Population (July 2015)1 5,456,574 321,418,820 Historical Population Change (April 2010-July 2015)1 8.5% 4.1% Median Household Income (2013)1 $58,823 $52,250 Household Income Change (2010-2013)1 8.8% 4.4% May 2016 Unemployment Rate2 3.4% 4.7% Market Data 20 1 US Census Bureau 2 Bureau of Labor Statistics Unemployment by County2 5/31/16 5/31/15 Denver 3.3% 3.7% Boulder 2.9% 3.3% Larimer 3.0% 3.3%

.Business Climate .Colorado ranks as the nation’s 3rd best state for business – CNBC 2016 .Colorado’s economy ranks as the 2nd strongest in the nation – CNBC 2016 .Denver ranked 1st for economic success in Area Development’s 2015 Leading Locations study .Denver has the best commercial real estate market in the country – Coldwell Banker 2015 .Denver is the best city for investment in residential real estate – HomeVestors 2015 .Colorado ranks 4th in the country for the number of new businesses created – Entrepreneur 2015 .Growth .Colorado ranked 3rd in the nation for job growth in 2014 – U.S. Bureau of Labor Statistics 2015 .Denver ranks 1st in Best Places to Live Rankings – U.S. News and World Report 2016 .Colorado’s population is projected to grow by 13.4% from 2010 through 2020 versus an estimated national growth rate of 7.1% - USA Today 2015 .Denver ranks 1st among big cities in economic and job growth – Area Development 2015 .Highly Educated Workforce .Colorado ranks 1st for its high quality workforce – CNBC 2016 .Colorado ranks as the nation’s 2nd most highly educated state – U.S. Census Bureau 2015 .Boulder ranks 3rd for college graduates in STEM (Science, Technology, Engineering, Math) – NerdWallet 2015 Market Data 21

.Business Climate .Colorado ranks as the nation’s 3rd best state for business – CNBC 2016 .Colorado’s economy ranks as the 2nd strongest in the nation – CNBC 2016 .Denver ranked 1st for economic success in Area Development’s 2015 Leading Locations study .Denver has the best commercial real estate market in the country – Coldwell Banker 2015 .Denver is the best city for investment in residential real estate – HomeVestors 2015 .Colorado ranks 4th in the country for the number of new businesses created – Entrepreneur 2015 .Growth .Colorado ranked 3rd in the nation for job growth in 2014 – U.S. Bureau of Labor Statistics 2015 .Denver ranks 1st in Best Places to Live Rankings – U.S. News and World Report 2016 .Colorado’s population is projected to grow by 13.4% from 2010 through 2020 versus an estimated national growth rate of 7.1% - USA Today 2015 .Denver ranks 1st among big cities in economic and job growth – Area Development 2015 .Highly Educated Workforce .Colorado ranks 1st for its high quality workforce – CNBC 2016 .Colorado ranks as the nation’s 2nd most highly educated state – U.S. Census Bureau 2015 .Boulder ranks 3rd for college graduates in STEM (Science, Technology, Engineering, Math) – NerdWallet 2015 Market Data 21

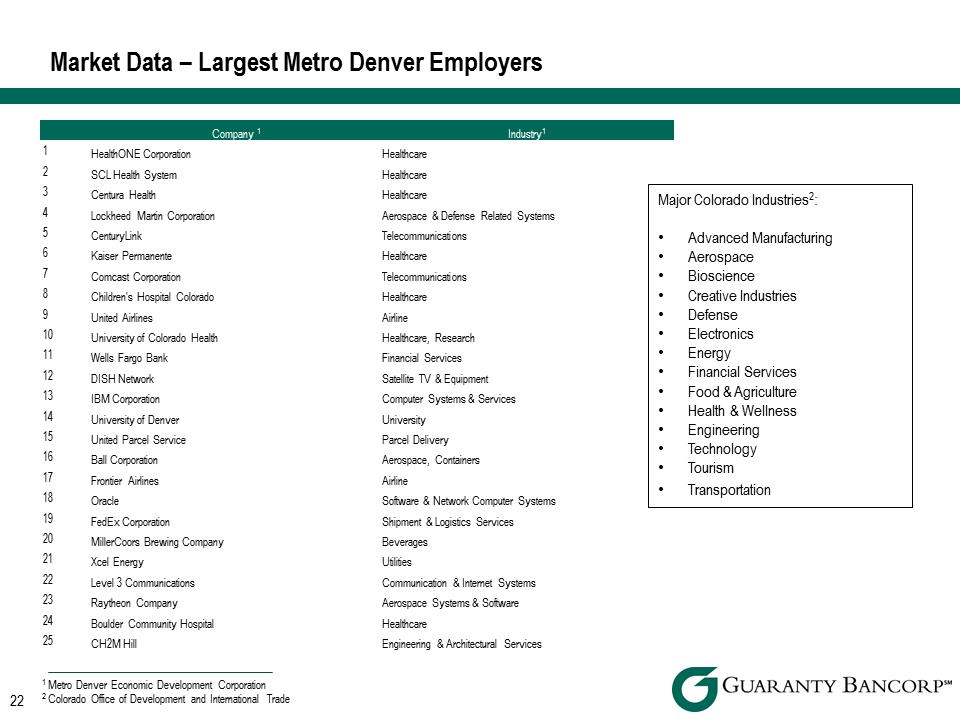

22 Market Data – Largest Metro Denver Employers Company 1 Industry1 1 HealthONE Corporation Healthcare 2 SCL Health System Healthcare 3 Centura Health Healthcare 4 Lockheed Martin Corporation Aerospace & Defense Related Systems 5 CenturyLink Telecommunications 6 Kaiser Permanente Healthcare 7 Comcast Corporation Telecommunications 8 Children's Hospital Colorado Healthcare 9 United Airlines Airline 10 University of Colorado Health Healthcare, Research 11 Wells Fargo Bank Financial Services 12 DISH Network Satellite TV & Equipment 13 IBM Corporation Computer Systems & Services 14 University of Denver University 15 United Parcel Service Parcel Delivery 16 Ball Corporation Aerospace, Containers 17 Frontier Airlines Airline 18 Oracle Software & Network Computer Systems 19 FedEx Corporation Shipment & Logistics Services 20 MillerCoors Brewing Company Beverages 21 Xcel Energy Utilities 22 Level 3 Communications Communication & Internet Systems 23 Raytheon Company Aerospace Systems & Software 24 Boulder Community Hospital Healthcare 25 CH2M Hill Engineering & Architectural Services 1 Metro Denver Economic Development Corporation 2 Colorado Office of Development and International Trade Major Colorado Industries2: •Advanced Manufacturing •Aerospace •Bioscience •Creative Industries •Defense •Electronics •Energy •Financial Services •Food & Agriculture •Health & Wellness •Engineering •Technology •Tourism •Transportation

22 Market Data – Largest Metro Denver Employers Company 1 Industry1 1 HealthONE Corporation Healthcare 2 SCL Health System Healthcare 3 Centura Health Healthcare 4 Lockheed Martin Corporation Aerospace & Defense Related Systems 5 CenturyLink Telecommunications 6 Kaiser Permanente Healthcare 7 Comcast Corporation Telecommunications 8 Children's Hospital Colorado Healthcare 9 United Airlines Airline 10 University of Colorado Health Healthcare, Research 11 Wells Fargo Bank Financial Services 12 DISH Network Satellite TV & Equipment 13 IBM Corporation Computer Systems & Services 14 University of Denver University 15 United Parcel Service Parcel Delivery 16 Ball Corporation Aerospace, Containers 17 Frontier Airlines Airline 18 Oracle Software & Network Computer Systems 19 FedEx Corporation Shipment & Logistics Services 20 MillerCoors Brewing Company Beverages 21 Xcel Energy Utilities 22 Level 3 Communications Communication & Internet Systems 23 Raytheon Company Aerospace Systems & Software 24 Boulder Community Hospital Healthcare 25 CH2M Hill Engineering & Architectural Services 1 Metro Denver Economic Development Corporation 2 Colorado Office of Development and International Trade Major Colorado Industries2: •Advanced Manufacturing •Aerospace •Bioscience •Creative Industries •Defense •Electronics •Energy •Financial Services •Food & Agriculture •Health & Wellness •Engineering •Technology •Tourism •Transportation

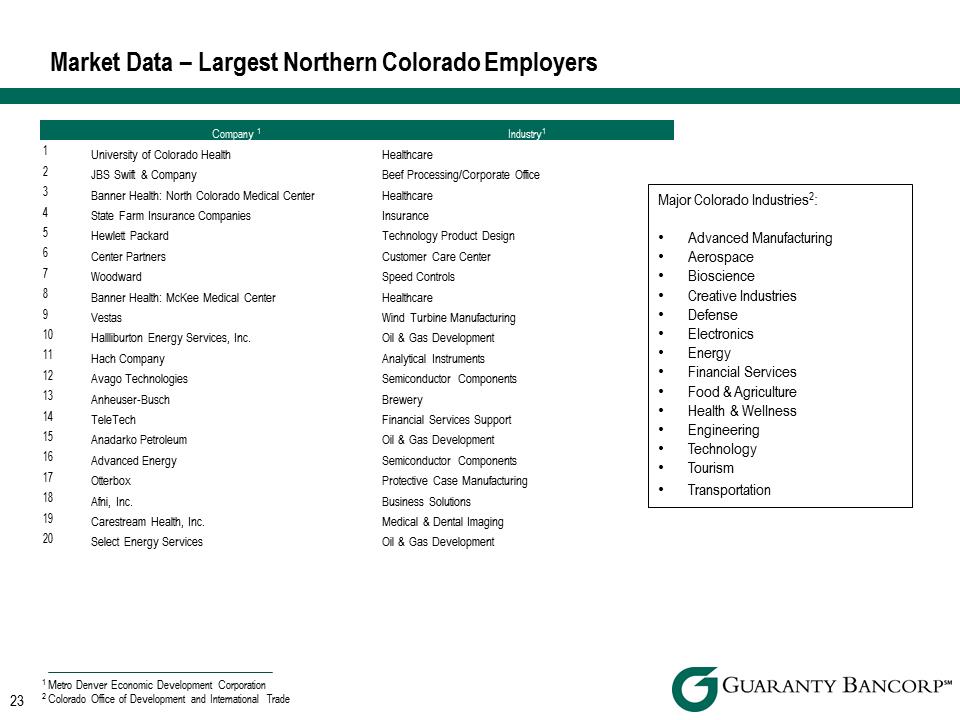

23 Market Data – Largest Northern Colorado Employers Company 1 Industry1 1 University of Colorado Health Healthcare 2 JBS Swift & Company Beef Processing/Corporate Office 3 Banner Health: North Colorado Medical Center Healthcare 4 State Farm Insurance Companies Insurance 5 Hewlett Packard Technology Product Design 6 Center Partners Customer Care Center 7 Woodward Speed Controls 8 Banner Health: McKee Medical Center Healthcare 9 Vestas Wind Turbine Manufacturing 10 Hallliburton Energy Services, Inc. Oil & Gas Development 11 Hach Company Analytical Instruments 12 Avago Technologies Semiconductor Components 13 Anheuser-Busch Brewery 14 TeleTech Financial Services Support 15 Anadarko Petroleum Oil & Gas Development 16 Advanced Energy Semiconductor Components 17 Otterbox Protective Case Manufacturing 18 Afni, Inc. Business Solutions 19 Carestream Health, Inc. Medical & Dental Imaging 20 Select Energy Services Oil & Gas Development 1 Metro Denver Economic Development Corporation 2 Colorado Office of Development and International Trade Major Colorado Industries2: •Advanced Manufacturing •Aerospace •Bioscience •Creative Industries •Defense •Electronics •Energy •Financial Services •Food & Agriculture •Health & Wellness •Engineering •Technology •Tourism •Transportation

23 Market Data – Largest Northern Colorado Employers Company 1 Industry1 1 University of Colorado Health Healthcare 2 JBS Swift & Company Beef Processing/Corporate Office 3 Banner Health: North Colorado Medical Center Healthcare 4 State Farm Insurance Companies Insurance 5 Hewlett Packard Technology Product Design 6 Center Partners Customer Care Center 7 Woodward Speed Controls 8 Banner Health: McKee Medical Center Healthcare 9 Vestas Wind Turbine Manufacturing 10 Hallliburton Energy Services, Inc. Oil & Gas Development 11 Hach Company Analytical Instruments 12 Avago Technologies Semiconductor Components 13 Anheuser-Busch Brewery 14 TeleTech Financial Services Support 15 Anadarko Petroleum Oil & Gas Development 16 Advanced Energy Semiconductor Components 17 Otterbox Protective Case Manufacturing 18 Afni, Inc. Business Solutions 19 Carestream Health, Inc. Medical & Dental Imaging 20 Select Energy Services Oil & Gas Development 1 Metro Denver Economic Development Corporation 2 Colorado Office of Development and International Trade Major Colorado Industries2: •Advanced Manufacturing •Aerospace •Bioscience •Creative Industries •Defense •Electronics •Energy •Financial Services •Food & Agriculture •Health & Wellness •Engineering •Technology •Tourism •Transportation

Reconciliation of Non-GAAP Financial Measures 24

Reconciliation of Non-GAAP Financial Measures 24

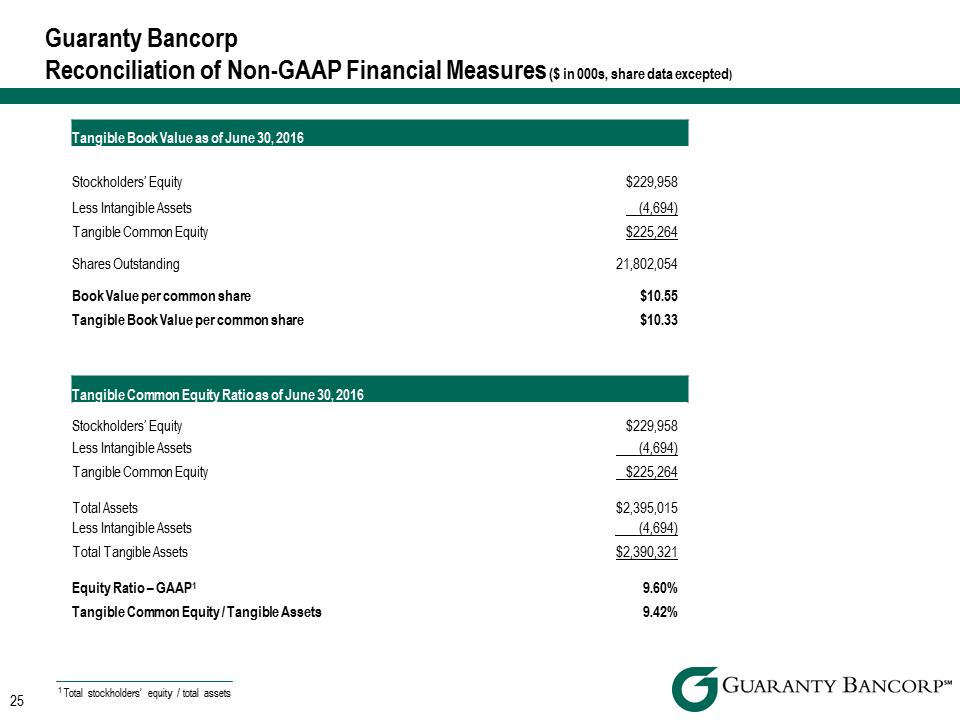

Tangible Book Value as of June 30, 2016 Stockholders’ Equity $229,958 Less Intangible Assets (4,694) Tangible Common Equity $225,264 Shares Outstanding 21,802,054 Book Value per common share $10.55 Tangible Book Value per common share $10.33 Tangible Common Equity Ratio as of June 30, 2016 Stockholders’ Equity $229,958 Less Intangible Assets (4,694) Tangible Common Equity $225,264 Total Assets $2,395,015 Less Intangible Assets (4,694) Total Tangible Assets $2,390,321 Equity Ratio – GAAP1 9.60% Tangible Common Equity / Tangible Assets 9.42% 1 Total stockholders’ equity / total assets Guaranty Bancorp Reconciliation of Non-GAAP Financial Measures ($ in 000s, share data excepted) 25

Tangible Book Value as of June 30, 2016 Stockholders’ Equity $229,958 Less Intangible Assets (4,694) Tangible Common Equity $225,264 Shares Outstanding 21,802,054 Book Value per common share $10.55 Tangible Book Value per common share $10.33 Tangible Common Equity Ratio as of June 30, 2016 Stockholders’ Equity $229,958 Less Intangible Assets (4,694) Tangible Common Equity $225,264 Total Assets $2,395,015 Less Intangible Assets (4,694) Total Tangible Assets $2,390,321 Equity Ratio – GAAP1 9.60% Tangible Common Equity / Tangible Assets 9.42% 1 Total stockholders’ equity / total assets Guaranty Bancorp Reconciliation of Non-GAAP Financial Measures ($ in 000s, share data excepted) 25

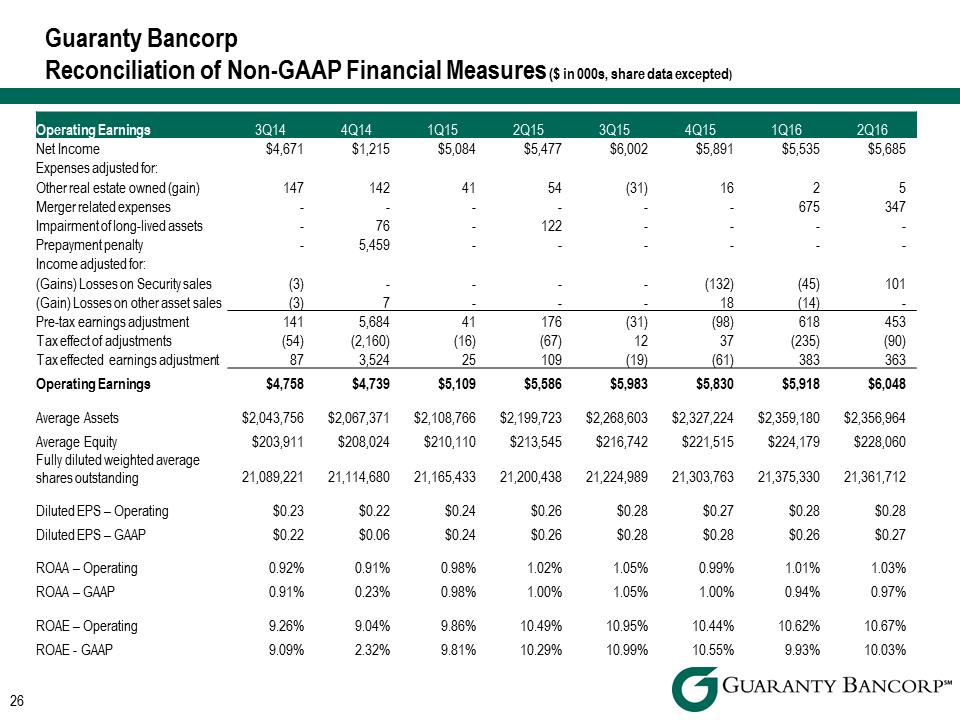

Operating Earnings 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 Net Income $4,671 $1,215 $5,084 $5,477 $6,002 $5,891 $5,535 $5,685 Expenses adjusted for: Other real estate owned (gain) 147 142 41 54 (31) 16 2 5 Merger related expenses - - - - - - 675 347 Impairment of long-lived assets - 76 - 122 - - - - Prepayment penalty - 5,459 - - - - - - Income adjusted for: (Gains) Losses on Security sales (3) - - - - (132) (45) 101 (Gain) Losses on other asset sales (3) 7 - - - 18 (14) - Pre-tax earnings adjustment 141 5,684 41 176 (31) (98) 618 453 Tax effect of adjustments (54) (2,160) (16) (67) 12 37 (235) (90) Tax effected earnings adjustment 87 3,524 25 109 (19) (61) 383 363 Operating Earnings $4,758 $4,739 $5,109 $5,586 $5,983 $5,830 $5,918 $6,048 Average Assets $2,043,756 $2,067,371 $2,108,766 $2,199,723 $2,268,603 $2,327,224 $2,359,180 $2,356,964 Average Equity $203,911 $208,024 $210,110 $213,545 $216,742 $221,515 $224,179 $228,060 Fully diluted weighted average shares outstanding 21,089,221 21,114,680 21,165,433 21,200,438 21,224,989 21,303,763 21,375,330 21,361,712 Diluted EPS – Operating $0.23 $0.22 $0.24 $0.26 $0.28 $0.27 $0.28 $0.28 Diluted EPS – GAAP $0.22 $0.06 $0.24 $0.26 $0.28 $0.28 $0.26 $0.27 ROAA – Operating 0.92% 0.91% 0.98% 1.02% 1.05% 0.99% 1.01% 1.03% ROAA – GAAP 0.91% 0.23% 0.98% 1.00% 1.05% 1.00% 0.94% 0.97% ROAE – Operating 9.26% 9.04% 9.86% 10.49% 10.95% 10.44% 10.62% 10.67% ROAE - GAAP 9.09% 2.32% 9.81% 10.29% 10.99% 10.55% 9.93% 10.03% 26 Guaranty Bancorp Reconciliation of Non-GAAP Financial Measures ($ in 000s, share data excepted)

Operating Earnings 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 Net Income $4,671 $1,215 $5,084 $5,477 $6,002 $5,891 $5,535 $5,685 Expenses adjusted for: Other real estate owned (gain) 147 142 41 54 (31) 16 2 5 Merger related expenses - - - - - - 675 347 Impairment of long-lived assets - 76 - 122 - - - - Prepayment penalty - 5,459 - - - - - - Income adjusted for: (Gains) Losses on Security sales (3) - - - - (132) (45) 101 (Gain) Losses on other asset sales (3) 7 - - - 18 (14) - Pre-tax earnings adjustment 141 5,684 41 176 (31) (98) 618 453 Tax effect of adjustments (54) (2,160) (16) (67) 12 37 (235) (90) Tax effected earnings adjustment 87 3,524 25 109 (19) (61) 383 363 Operating Earnings $4,758 $4,739 $5,109 $5,586 $5,983 $5,830 $5,918 $6,048 Average Assets $2,043,756 $2,067,371 $2,108,766 $2,199,723 $2,268,603 $2,327,224 $2,359,180 $2,356,964 Average Equity $203,911 $208,024 $210,110 $213,545 $216,742 $221,515 $224,179 $228,060 Fully diluted weighted average shares outstanding 21,089,221 21,114,680 21,165,433 21,200,438 21,224,989 21,303,763 21,375,330 21,361,712 Diluted EPS – Operating $0.23 $0.22 $0.24 $0.26 $0.28 $0.27 $0.28 $0.28 Diluted EPS – GAAP $0.22 $0.06 $0.24 $0.26 $0.28 $0.28 $0.26 $0.27 ROAA – Operating 0.92% 0.91% 0.98% 1.02% 1.05% 0.99% 1.01% 1.03% ROAA – GAAP 0.91% 0.23% 0.98% 1.00% 1.05% 1.00% 0.94% 0.97% ROAE – Operating 9.26% 9.04% 9.86% 10.49% 10.95% 10.44% 10.62% 10.67% ROAE - GAAP 9.09% 2.32% 9.81% 10.29% 10.99% 10.55% 9.93% 10.03% 26 Guaranty Bancorp Reconciliation of Non-GAAP Financial Measures ($ in 000s, share data excepted)