Attached files

| file | filename |

|---|---|

| EX-99.5 - EX-99.5 - Fleetmatics Group Ltd | d198190dex995.htm |

| EX-99.3 - EX-99.3 - Fleetmatics Group Ltd | d198190dex993.htm |

| EX-99.2 - EX-99.2 - Fleetmatics Group Ltd | d198190dex992.htm |

| EX-99.1 - EX-99.1 - Fleetmatics Group Ltd | d198190dex991.htm |

| EX-10.1 - EX-10.1 - Fleetmatics Group Ltd | d198190dex101.htm |

| EX-2.1 - EX-2.1 - Fleetmatics Group Ltd | d198190dex21.htm |

| 8-K - FORM 8-K - Fleetmatics Group Ltd | d198190d8k.htm |

Exhibit 99.4

Special Town Hall Meeting

August 1, 2016

Employee Meeting August 1, 2016 Company Confidential

JIM TRAVERS

Chairman

& Chief Executive Officer

Verizon Announces Acquisition of Fleetmatics for $2.4B

Employee Meeting August 1, 2016 Company Confidential 2

Verizon Announces Acquisition of Fleetmatics

Verizon is acquiring Fleetmatics for $60.00 per share, or $2.4 billion, in a move to fulfill Verizon’s mission to become the world’s largest mobile workforce management

company

verizon

This acquisition immediately creates a best-in-class provider

of SaaS-based fleet management solutions

Fleetmatics

While this is a big

change for us, and a new way to grow, we are excited by the value, promise and opportunity that the combination brings

Employee Meeting August 1, 2016 Company

Confidential 3

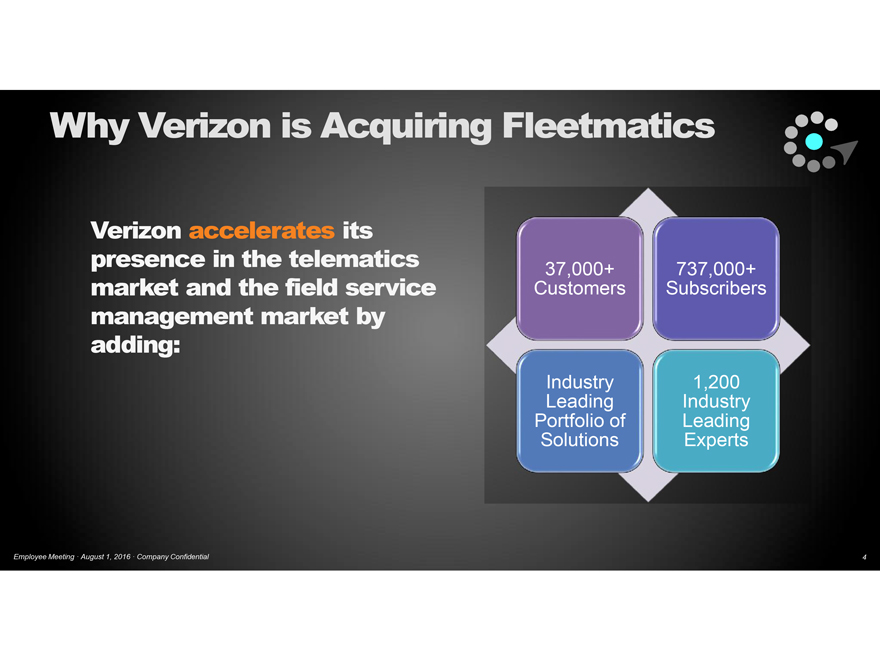

Why Verizon is Acquiring Fleetmatics

Verizon accelerates its presence in the telematics market and the field service management market by adding:

37,000+ Customers

737,000+ Subscribers

Industry Leading Portfolio of Solutions

1,200 Industry Leading Experts

Employee Meeting August 1, 2016 Company Confidential 4

Building the #1 Mobile Workforce Management Company

The combination of Verizon Telematics, Telogis and Fleetmatics creates the #1 mobile workforce management company

verizon

Verizon Telematics

Leading across all customer segments

Broad portfolio of product and services

Wide distribution platform

Iconic brand recognition

Presence throughout North America, EMEA and APAC

Employee Meeting August 1, 2016 Company

Confidential 5

|

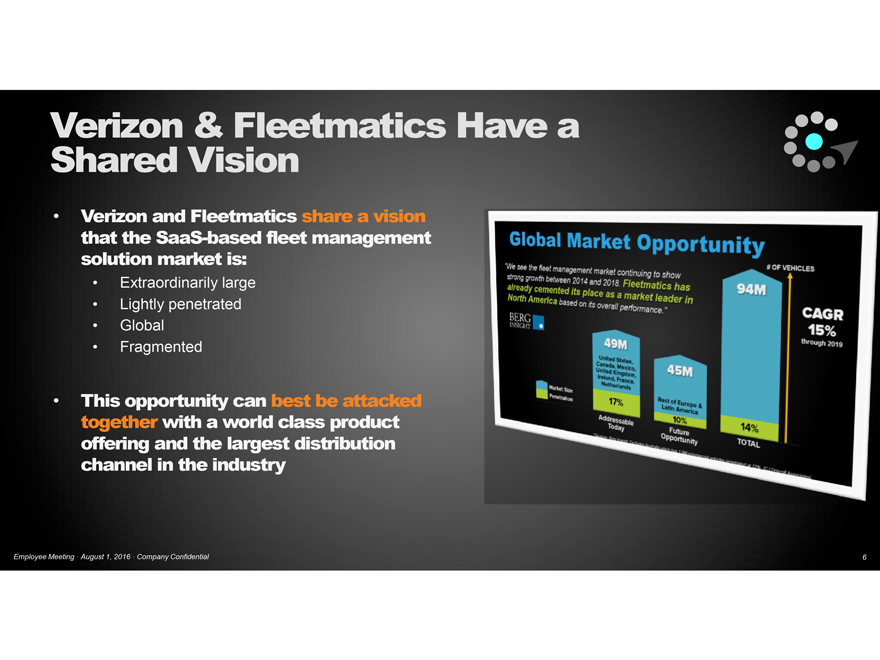

Verizon & Fleetmatics Have a Shared Vision

Verizon and Fleetmatics share a vision that the SaaS-based fleet management solution market is:

Extraordinarily large

Lightly penetrated

Global

Fragmented

This opportunity can best be attacked together with a world class product offering and the largest distribution channel in the industry

Global Market Opportunity

“We see the fleet management market continuing to show strong

growth between 2014 and 2018. Fleetmatics has already cemented its place as a market leader in North America based on its overall performance.”

BERG

INSIGHT

Market Size

Penetration

49M

United States, Canada, Mexico, United Kingdom, Ireland, France, Netherlands

17%

Addressable Today

45M

Rest of Europe & Latin America

10%

Future Opportunity

94M

14%

TOTAL

# OF VEHICLES

CAGR 15% through 2019

Employee Meeting · August 1, 2016 · Company Confidential 6

|

The Path To This Point…

We started in 2004 with

a simple but profound mission of helping one small business at a time operate more effectively

Over the last 12 years, we have become a leader in the SaaS-based

fleet management solution market

We have begun to aggressively expand globally and cross sell other applications to our rapidly growing customer base

We’ve done this with a strong portfolio of products and the largest and most talented team of employees focused on this problem set

Along the way, we have built one of the best performing SaaS companies in the world – delivering tremendous value to our customers, employees and shareholders

Employee Meeting · August 1, 2016 · Company Confidential 7

|

Where Do We Fit?

Fleetmatics will become part of

Verizon’s Telematics Group which is in the Product and New Business (PNB) division

verizon

PNB is responsible for accelerating Verizon’s overall growth objectives and developing and growing Verizon’s emerging businesses, like the IoT, digital media, and

telematics

Employee Meeting · August 1, 2016 · Company Confidential 8

|

The Road Ahead…

Over the next decade, we are

increasingly excited by the growth prospects of our core market which remains extraordinarily large, underpenetrated, global and fragmented

We are in a race with

many companies to capture this opportunity and we plan to do that in a bold and accelerated way

The combined entity is very well positioned with industry leading

solutions, brand recognition and distribution capabilities giving customers, employees and shareholders the best opportunity to win this race

We have a shared

vision of the SaaS-based fleet management space and it has become very clear that we are better together in our pursuit of the market opportunity

Employee Meeting

· August 1, 2016 · Company Confidential 9

|

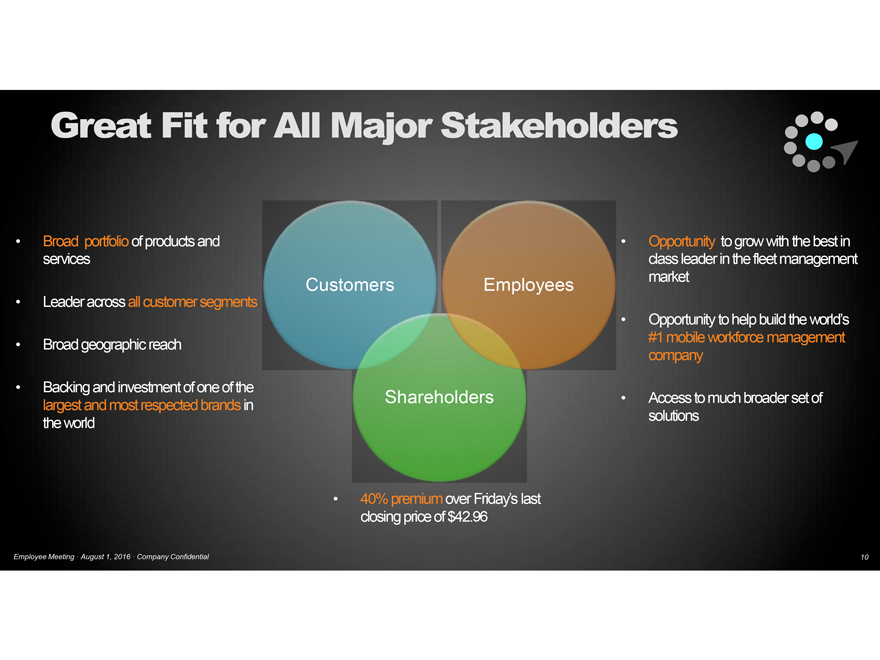

Great Fit for All Major Stakeholders

Broad portfolio

of products and services

Leader across all customer segments

Broad geographic

reach

Backing and investment of one of the largest and most respected brands in the world

Customers

Employees

Shareholders

Opportunity to grow with the best in class leader in the fleet management market

Opportunity to help build the world’s #1 mobile workforce management company

Access to much broader set of solutions

40%premium over Friday’s last closing price of

$42.96

Employee Meeting · August 1, 2016 · Company Confidential 10

What’s Next?

•

The transaction is expected to close in fourth quarter of 2016

• Until the acquisition closes, we will operate “business as usual”, meaning we will

continue to bring the power of our products and services to the market for prospects and customers, and compete to win against all competitors

• Executives

from both Verizon Telematics and Fleetmatics will be hosting a series of town hall meetings over the next several weeks in all of our major office locations

Employee Meeting • August 1, 2016 • Company Confidential 11

Where You Can Get More Information

• More information will be available on Fleetbeat

• Press Release, FAQs, Slide

Decks, etc.

• Check back often as information will be updated regularly

• We will continue to host regular town hall meetings to provide updates

Employee Meeting • August 1, 2016 • Company Confidential 12

Special Town Hall Meeting

August 1, 2016

Employee Meeting • August 1, 2016 • Company

Confidential 13

Cautionary Statement Regarding Forward-Looking Statements

This information contained in this document contains forward-looking statements. These statements are based on estimates and Assumptions and are subject to risks and uncertainties.

Forward-looking statements include estimated or anticipated future results, or other non-historical facts concerning Fleetmatics Group PLC (the “Company”) and its subsidiaries. Forward-looking statements also include those preceded or

followed by the words “will”, “may”, “could”, “would”, “to be”, “might”, “believe”, “anticipate”, “expect”, “plan”, “estimate”,

“forecast”, “future”, “positioned”, “potential”, “intend”, “continue”, “remain”, “scheduled”, “outlook”, “set to”, “subject to”,

“upcoming”, “target” or similar expressions. For those statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. These

forward-looking statements are based on management’s current expectations and beliefs about future events. As with any projection or forecast, they are inherently susceptible to uncertainty and changes in circumstances. Except as required by

law, we are under no obligation to, and expressly disclaim any obligation to, update or alter any forward-looking statements whether as a result of such changes, new information, subsequent events or otherwise. Various factors could adversely affect

our operations, business or financial results in the future and cause our actual results to differ materially from those contained in the forward-looking statements, including those factors discussed in detail in the Company’ filings with the

Securities and Exchange Commission (“SEC”), including those discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015 and Amendment No. 1 thereto under the heading “Risk Factors,” as updated

from time to time by the Company’s Quarterly Reports on Form 10-Q and other documents of the Company on file with the SEC or in the proxy statement on Schedule 14A that will be filed with the SEC by the Company. There may be additional risks

that neither the Company nor Verizon Communications Inc. (“Verizon”) presently know or that the Company and Verizon currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking

statements. In addition, forward-looking statements provide the Company’s and Verizon’s expectations, plans or forecasts of future events and views as of the date of this report. The Company and Verizon anticipate that subsequent events

and developments will cause the Company’s and Verizon’s assessments to change. However, while the Company and Verizon may elect to update these forward- looking statements at some point in the future, the Company and Verizon specifically

disclaim any obligation to do so. These forward- looking statements should not be relied upon as representing the Company’s and Verizon’s assessments as of any date subsequent to the date of this report.

14

| Important Additional Information to be Filed with the SEC |

The Company, Verizon and Verizon Business International Holdings B.V. (“Bidco”) are parties to a Transaction Agreement, dated

July 30, 2016 (the “Transaction Agreement”). In connection with the Acquisition (as defined in the Transaction Agreement), the Company will file with the SEC and mail or otherwise provide to its shareholders a proxy statement

regarding the proposed transaction. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING THE SCHEME DOCUMENT) AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY

WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, THE ACQUISITION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the proxy statement (including the Scheme Document) and other documents filed by the

Company with the SEC at www.sec.gov. In addition, investors and shareholders will be able to obtain free copies of the proxy statement (including the Scheme Document) and other documents filed by the Company at ir.fleetmatics.com or by calling

781.577.4657.

15

| Participants in the Solicitation |

The Company and its directors, officers and employees may be considered participants in the solicitation of proxies from the Company

shareholders in respect of the transactions contemplated by this report. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the Company shareholders in connection with the proposed

transactions, including names, affiliations and a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement and other relevant materials to be filed with the SEC. Information

concerning the interests of the Company’s participants in the solicitation, which may, in some cases, be different than those of the Company’s shareholders generally, is set forth in the materials filed by the Company with the SEC,

including in the proxy statement for the Company’s 2016 Annual General Meeting of Shareholders, which was filed with the SEC on June 22, 2016, as supplemented by other Company filings with the SEC, and will be set forth in the proxy statement

relating to the transaction when it becomes available.

16

| Statements Required by the Irish Takeover Rules |

The Company’s directors accept responsibility for the information contained in this document relating to the Company and its

subsidiaries and its directors and members of their immediate families, related trusts and persons connected with them. To the best of the knowledge and belief of the Company’s directors (who have taken all reasonable care to ensure such is the

case), the information contained in this document for which they accept responsibility is in accordance with the facts and does not omit anything likely to affect the import of such information.

The information contained in this document is for information purposes only and is not intended to, and does not, constitute or form any part of any offer or invitation, or the

solicitation of an offer, to purchase or otherwise acquire, subscribe for, sell or otherwise dispose of any securities or the solicitation of any vote or approval in any jurisdiction pursuant to the Acquisition or otherwise, nor shall there be any

sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. The Acquisition will be made solely by means of the Scheme Document (or, if applicable, the Takeover Offer Document, each as defined in the Transaction

Agreement), which will contain the full terms and conditions of the Acquisition, including details of how to vote in respect of the Acquisition. Any decision in respect of, or other response to, the Acquisition, should be made only on the basis of

the information contained in the Scheme Document (or, if applicable, the Takeover Offer Document).

The information contained in this document does not constitute a

prospectus or a prospectus equivalent document.

17

| Disclosure Requirements of the Irish Takeover Rules |

Under the provisions of Rule 8.3 of the Irish Takeover Rules, if any person is, or becomes, “interested” (directly or indirectly)

in, 1% or more of any class of “relevant securities” of the Company, all “’dealings” in any “relevant securities” of the Company (including by means of an option in respect of, or a derivative referenced to, any

such “relevant securities”) must be publicly disclosed by not later than 3:30 pm (Irish time) on the “business” day following the date of the relevant transaction. This requirement will continue until the date on which the

“offer period” ends. If two or more persons co-operate on the basis of any agreement, either express or tacit, either oral or written, to acquire an “interest” in “relevant securities” of the Company, they will be

deemed to be a single person for the purpose of Rule 8.3of the Irish Takeover Rules.

Under the provisions of Rule 8.1of the Irish Takeover Rules, all

“dealings” in “relevant securities’” of the Company by Verizon or Bidco, or by any party acting in concert with either of them, must also be disclosed by no later than 12 noon (Irish time) on the “business” day

following the date of the relevant transaction.

A disclosure table, giving details of the companies in whose “relevant securities” “dealings”

should be disclosed, can be found on the Irish Takeover Panel’s website at www.irishtakeoverpanel.ie.

“Interests in securities” arise, in summary,

when a person has long economic exposure, whether conditional or absolute, to changes in the price of securities. In particular, a person will be treated as having an “interest” by virtue of the ownership or control of securities, or by

virtue of any option in respect of, or derivative referenced to, securities.

Terms in quotation marks are defined in the Irish Takeover Rules, which can also be

found on the Irish Takeover Panel’s website. If you are in any doubt as to whether or not you are required to disclose a dealing under Rule 8, please consult the Irish Takeover Panel’s website at www.irishtakeoverpanel.ie or contact the

Irish Takeover Panel on telephone number +353 1 678 9020 or fax number +353 1 678 9289.

18