Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - KEMET CORP | fy2017_q1xex991xearningsre.htm |

| 8-K - 8-K - KEMET CORP | fy2017_q1x8kxearningsrelea.htm |

Earnings Conference Call

July 28, 2016

Quarter Ended June 30, 2016

Cautionary Statement

Certain statements included herein contain forward-looking statements within the meaning of federal securities laws about

KEMET Corporation's (the "Company") financial condition and results of operations that are based on management's current

expectations, estimates and projections about the markets in which the Company operates, as well as management's beliefs and

assumptions. Words such as "expects," "anticipates," "believes," "estimates," variations of such words and other similar expressions are

intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain

risks, uncertainties and assumptions, which are difficult to predict. Therefore, actual outcomes and results may differ materially from

what is expressed or forecasted in, or implied by, such forward-looking statements. Readers are cautioned not to place undue reliance

on these forward-looking statements, which reflect management's judgment only as of the date hereof. The Company undertakes no

obligation to update publicly any of these forward-looking statements to reflect new information, future events or otherwise.

Factors that may cause actual outcomes and results to differ materially from those expressed in, or implied by, these forward-looking

statements include, but are not necessarily limited to the following: (i) adverse economic conditions could impact our ability to realize

operating plans if the demand for our products declines, and such conditions could adversely affect our liquidity and ability to continue to

operate; (ii) continued net losses could impact our ability to realize current operating plans and could materially adversely affect our

liquidity and our ability to continue to operate; (iii) adverse economic conditions could cause the write down of long-lived assets or

goodwill; (iv) an increase in the cost or a decrease in the availability of our principal or single-sourced purchased materials; (v) changes

in the competitive environment; (vi) uncertainty of the timing of customer product qualifications in heavily regulated industries;

(vii) economic, political, or regulatory changes in the countries in which we operate; (viii) difficulties, delays or unexpected costs in

completing the restructuring plans; (ix) equity method investment in NEC TOKIN exposes us to a variety of risks; (x) acquisitions and

other strategic transactions expose us to a variety of risks; (xi) possible acquisition of NEC TOKIN may not achieve all of the anticipated

results; (xii) our business could be negatively impacted by increased regulatory scrutiny and litigation; (xiii) inability to attract, train and

retain effective employees and management; (xiv) inability to develop innovative products to maintain customer relationships and offset

potential price erosion in older products; (xv) exposure to claims alleging product defects; (xvi) the impact of laws and regulations that

apply to our business, including those relating to environmental matters; (xvii) the impact of international laws relating to trade, export

controls and foreign corrupt practices; (xviii) volatility of financial and credit markets affecting our access to capital; (xix) the need to

reduce the total costs of our products to remain competitive; (xx) potential limitation on the use of net operating losses to offset possible

future taxable income; (xxi) restrictions in our debt agreements that limit our flexibility in operating our business; (xxii) failure of our

information technology systems to function properly or our failure to control unauthorized access to our systems may cause business

disruptions; (xxiii) additional exercise of the warrant by K Equity which could potentially result in the existence of a significant stockholder

who could seek to influence our corporate decisions; and (xxiv) fluctuation in distributor sales could adversely affect our results of

operations.

2

Income Statement Highlights

U.S. GAAP (Unaudited)

3

For the Quarters Ended

(Amounts in thousands, except percentages and per share data) Jun 2016 Mar 2016 Jun 2015

Net sales $ 184,935 $ 183,926 $ 187,590

Gross margin $ 42,523 $ 42,013 $ 39,713

Gross margin as a percentage of net sales 23.0 % 22.8 % 21.2 %

Selling, general and administrative $ 25,914 $ 25,790 $ 30,430

SG&A as a percentage of net sales 14.0 % 14.0 % 16.2 %

Operating income (loss) $ 8,898 $ 8,603 $ 1,243

Net income (loss) $ (12,205 ) $ (15,173 ) $ (37,050 )

Per Basic and Diluted Share Data:

Net income (loss) per basic and diluted share $ (0.26 ) $ (0.33 ) $ (0.81 )

Weighted avg. shares - basic 46,349 46,160 45,552

Weighted avg. shares - diluted 46,349 46,160 45,552

Financial Trends

Net Sales & Gross Margin % (Unaudited)

4

Net Income (Loss) Excluding NEC TOKIN Option

Non-GAAP (Unaudited)

5

For the Quarters Ended

(Amounts in thousands) Jun 2016 Mar 2016 Jun 2015

Net income (loss) $ (12,205 ) $ (15,173 ) $ (37,050 )

Adjustment:

Change in value of NEC TOKIN option 12,000 — 29,200

Net income (loss) excluding change in value

of NEC TOKIN option $ (205 ) $ (15,173 ) $ (7,850 )

Net income (loss) excluding change in value of NEC TOKIN

option per basic and diluted share $ — $ (0.33 ) $ (0.17 )

Weighted avg. shares - basic 46,349 46,160 45,552

Weighted avg. shares - diluted 46,349 46,160 45,552

Supplemental Information:

Equity (income) loss from NEC TOKIN $ (223 ) $ 11,648 $ (1,585 )

Income Statement Highlights

Non-GAAP (Unaudited)

6

For the Quarters Ended

(Amounts in thousands, except percentages and per share data) Jun 2016 Mar 2016 Jun 2015

Net sales $ 184,935 $ 183,926 $ 187,590

Adjusted gross margin $ 43,215 $ 42,751 $ 40,321

Adjusted gross margin as a percentage of net sales 23.4 % 23.2 % 21.5 %

Adjusted selling, general and administrative $ 21,980 $ 23,499 $ 23,964

Adjusted SG&A as a percentage of net sales 11.9 % 12.8 % 12.8 %

Adjusted operating income (loss) $ 14,362 $ 12,907 $ 10,106

Adjusted net income (loss) $ 3,306 $ 1,812 $ 660

Adjusted EBITDA $ 24,272 $ 23,042 $ 20,156

Per share data:

Adjusted net income (loss) - basic $ 0.07 $ 0.04 $ 0.01

Adjusted net income (loss) - diluted $ 0.06 $ 0.04 $ 0.01

Weighted avg. shares - basic 46,349 46,160 45,552

Weighted avg. shares - diluted 52,097 50,056 52,276

Financial Highlights

(Unaudited)

(1) Calculated as accounts receivable, net, plus inventories, net, less accounts payable.

(2) Current quarter's accounts receivable divided by annualized current quarter’s Net sales multiplied

by 365.

(3) Current quarter's accounts payable divided by annualized current quarter's cost of goods sold

multiplied by 365.

7

(Amounts in millions, except DSO and DPO) Jun 2016 Mar 2016 FX Impact

Cash, cash equivalents $ 52.9 $ 65.0 $ (0.4 )

Capital expenditures $ 6.2 $ 6.3

Short-term debt $ — $ 2.0

Long-term debt 386.9 386.9

Debt premium and issuance costs (0.9 ) (1.1 )

Total debt $ 386.0 $ 387.8 $ —

Equity $ 88.4 $ 112.5 $ 6.4

Net working capital (1) $ 190.2 $ 191.1 $ (1.1 )

Days in receivables (DSO)(2) 44 46

Days in payables (DPO)(3) 43 46

Financial Trends

Cash and Cash Equivalents (Unaudited)

8

(in millions)

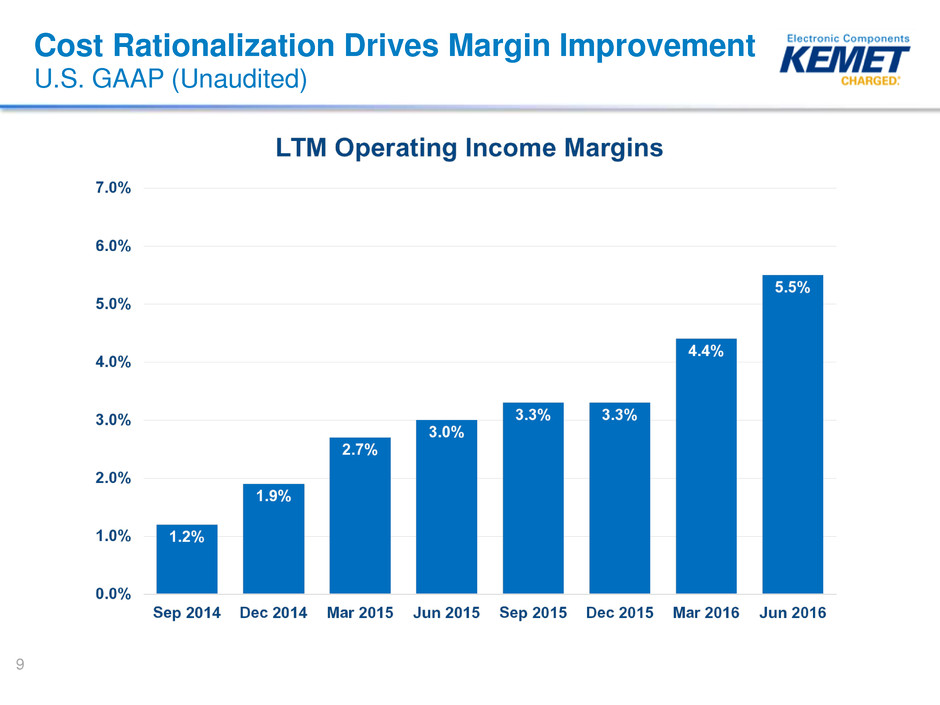

Cost Rationalization Drives Margin Improvement

U.S. GAAP (Unaudited)

9

Cost Rationalization Drives Margin Improvement

Non-GAAP (Unaudited)

10

Gross Margin & Operating Income (Loss) - U.S. GAAP

Solid Capacitors (Unaudited)

11

For the Quarters Ended

(Amounts in thousands) Jun 2016 Mar 2016 Jun 2015

Net sales $ 141,944 $ 140,042 $ 139,677

Gross margin 40,945 40,811 35,877

Gross margin as a percentage of net sales 28.8 % 29.1 % 25.7 %

Operating income (loss) $ 35,079 $ 34,538 $ 30,033

Adjusted Gross Margin & Operating Income (Loss) - Non-GAAP

Solid Capacitors (Unaudited)

12

For the Quarters Ended

(Amounts in thousands) Jun 2016 Mar 2016 Jun 2015

Net sales $ 141,944 $ 140,042 $ 139,677

Adjusted gross margin 41,209 40,992 36,273

Adjusted gross margin as a percentage of net sales 29.0 % 29.3 % 26.0 %

Adjusted operating income (loss) $ 35,571 $ 35,586 $ 30,842

Gross Margin & Operating Income (Loss) - U.S. GAAP

Film & Electrolytics (Unaudited)

13

For the Quarters Ended

(Amounts in thousands) Jun 2016 Mar 2016 Jun 2015

Net sales $ 42,991 $ 43,884 $ 47,913

Gross margin 1,578 1,202 3,836

Gross margin as a percentage of net sales 3.7 % 2.7 % 8.0 %

Operating income (loss) $ (1,467 ) $ (1,230 ) $ 712

Adjusted Gross Margin & Operating Income (Loss) - Non-GAAP

Film & Electrolytics (Unaudited)

14

For the Quarters Ended

(Amounts in thousands) Jun 2016 Mar 2016 Jun 2015

Net sales $ 42,991 $ 43,884 $ 47,913

Adjusted gross margin 2,005 1,759 4,047

Adjusted gross margin as a percentage of net sales 4.7 % 4.0 % 8.4 %

Adjusted operating income (loss) $ (491 ) $ (440 ) $ 1,968

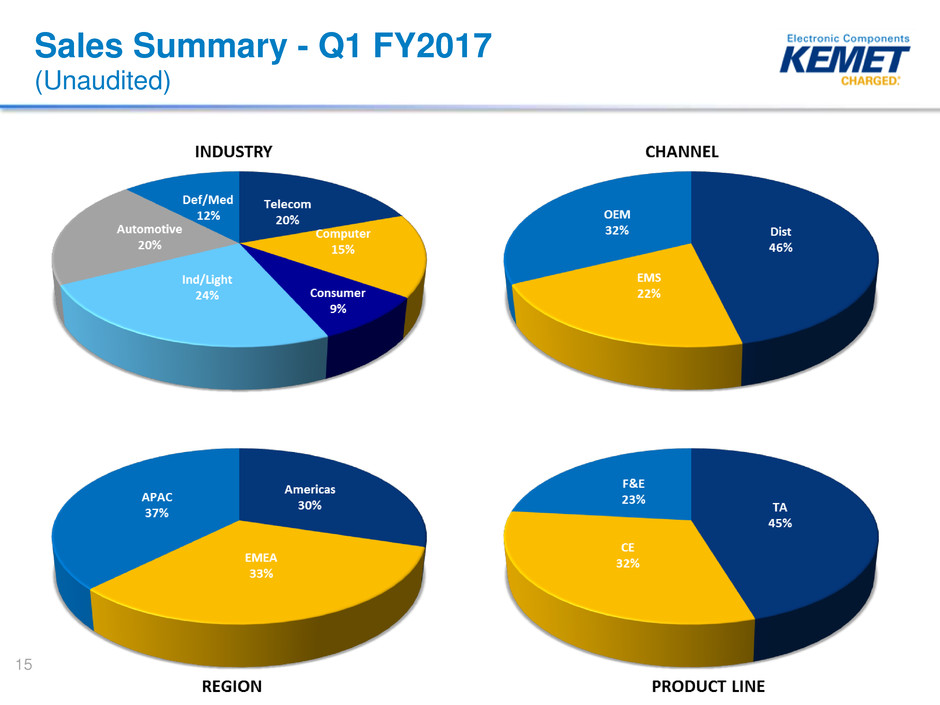

Sales Summary - Q1 FY2017

(Unaudited)

15

Appendix

Adjusted Gross Margin

Non-GAAP (Unaudited)

17

For the Quarters Ended

(Amounts in thousands, except percentages) Jun 2016 Mar 2016 Jun 2015

Net Sales $ 184,935 $ 183,926 $ 187,590

Gross Margin (U.S. GAAP) $ 42,523 $ 42,013 $ 39,713

Gross margin as a percentage of net sales 23.0 % 22.8 % 21.2 %

Adjustments:

Plant start-up costs 308 319 195

Stock-based compensation expense 384 278 413

Plant shut-down costs — 141 —

Adjusted Gross margin (non-GAAP) $ 43,215 $ 42,751 $ 40,321

Adjusted gross margin as a percentage of net sales 23.4 % 23.2 % 21.5 %

Adjusted Selling, General & Administrative Expenses

Non-GAAP (Unaudited)

18

For the Quarters Ended

(Amounts in thousands, except percentages) Jun 2016 Mar 2016 Jun 2015

Net sales $ 184,935 $ 183,926 $ 187,590

Selling, general and administrative expenses (U.S. GAAP) $ 25,914 $ 25,790 $ 30,430

Selling, general, and administrative as a percentage of net sales 14.0 % 14.0 % 16.2 %

Less adjustments:

ERP integration/IT transition costs 1,768 859 4,369

Legal expenses related to antitrust class actions 1,175 482 718

NEC TOKIN investment-related expenses 206 265 224

Stock-based compensation expense 785 685 843

Pension plan adjustment — — 312

Adjusted selling, general and administrative expenses

(non-GAAP) $ 21,980 $ 23,499 $ 23,964

Adjusted selling, general, and administrative as a percentage of net sales 11.9 % 12.8 % 12.8 %

Adjusted Operating Income (Loss)

Non-GAAP (Unaudited)

19

For the Quarters Ended

(Amounts in thousands) Jun 2016 Mar 2016 Jun 2015

Operating income (loss) (U.S. GAAP) $ 8,898 $ 8,603 $ 1,243

Adjustments:

Restructuring charges 688 617 1,824

Stock-based compensation expense 1,228 1,013 1,279

ERP integration/IT transition costs 1,768 859 4,369

Legal expenses related to antitrust class actions 1,175 482 718

Plant start-up costs 308 319 195

Plant shut-down costs — 141 —

NEC TOKIN investment-related expenses 206 265 224

Pension plan adjustment — — 312

Net (gain) loss on sales and disposals of assets 91 608 (58 )

Adjusted operating income (loss) (non-GAAP) $ 14,362 $ 12,907 $ 10,106

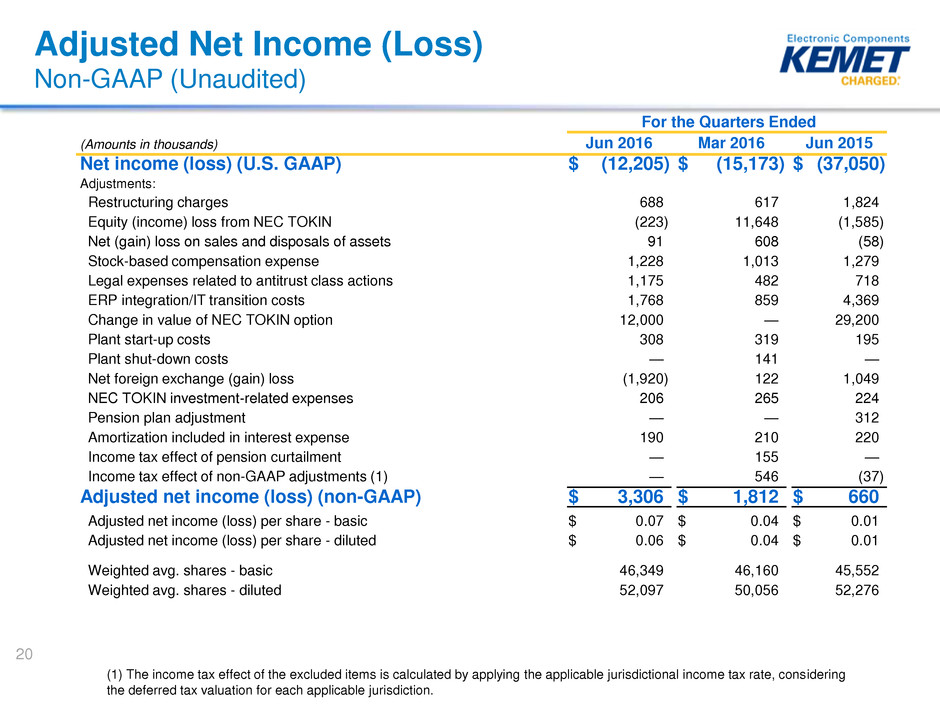

Adjusted Net Income (Loss)

Non-GAAP (Unaudited)

For the Quarters Ended

(Amounts in thousands) Jun 2016 Mar 2016 Jun 2015

Net income (loss) (U.S. GAAP) $ (12,205 ) $ (15,173 ) $ (37,050 )

Adjustments:

Restructuring charges 688 617 1,824

Equity (income) loss from NEC TOKIN (223 ) 11,648 (1,585 )

Net (gain) loss on sales and disposals of assets 91 608 (58 )

Stock-based compensation expense 1,228 1,013 1,279

Legal expenses related to antitrust class actions 1,175 482 718

ERP integration/IT transition costs 1,768 859 4,369

Change in value of NEC TOKIN option 12,000 — 29,200

Plant start-up costs 308 319 195

Plant shut-down costs — 141 —

Net foreign exchange (gain) loss (1,920 ) 122 1,049

NEC TOKIN investment-related expenses 206 265 224

Pension plan adjustment — — 312

Amortization included in interest expense 190 210 220

Income tax effect of pension curtailment — 155 —

Income tax effect of non-GAAP adjustments (1) — 546 (37 )

Adjusted net income (loss) (non-GAAP) $ 3,306 $ 1,812 $ 660

Adjusted net income (loss) per share - basic $ 0.07 $ 0.04 $ 0.01

Adjusted net income (loss) per share - diluted $ 0.06 $ 0.04 $ 0.01

Weighted avg. shares - basic 46,349 46,160 45,552

Weighted avg. shares - diluted 52,097 50,056 52,276

20

(1) The income tax effect of the excluded items is calculated by applying the applicable jurisdictional income tax rate, considering

the deferred tax valuation for each applicable jurisdiction.

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

21

For the Quarters Ended

(Amounts in thousands) Jun 2016 Mar 2016 Jun 2015

Net income (loss) (U.S. GAAP) $ (12,205 ) $ (15,173 ) $ (37,050 )

Interest expense, net 9,920 9,925 10,010

Income tax expense (benefit) 1,800 2,056 (248 )

Depreciation and amortization 9,436 10,160 9,917

EBITDA (non-GAAP) 8,951 6,968 (17,371 )

Excluding the following items:

Restructuring charges 688 617 1,824

Legal expenses related to antitrust class actions 1,175 482 718

Equity (income) loss from NEC TOKIN (223 ) 11,648 (1,585 )

Net (gain) loss on sales and disposals of assets 91 608 (58 )

Stock-based compensation expense 1,228 1,013 1,279

ERP integration/IT transition costs 1,768 859 4,369

Change in value of NEC TOKIN option 12,000 — 29,200

Plant start-up costs 308 319 195

Plant shut-down costs — 141 —

Net foreign exchange (gain) loss (1,920 ) 122 1,049

NEC TOKIN investment-related expenses 206 265 224

Pension plan adjustment — — 312

Adjusted EBITDA (non-GAAP) $ 24,272 $ 23,042 $ 20,156

Adjusted Gross Margin - Non-GAAP

Solid Capacitors (Unaudited)

22

For the Quarters Ended

(Amounts in thousands) Jun 2016 Mar 2016 Jun 2015

Net sales $ 141,944 $ 140,042 $ 139,677

Gross margin (U.S. GAAP) 40,945 40,811 35,877

Gross margin as a percentage of net sales 28.8 % 29.1 % 25.7 %

Adjustments:

Stock-based compensation expense 264 181 359

Plant start-up costs — — 37

Adjusted gross margin (non-GAAP) $ 41,209 $ 40,992 $ 36,273

Adjusted gross margin as a percentage of net sales 29.0 % 29.3 % 26.0 %

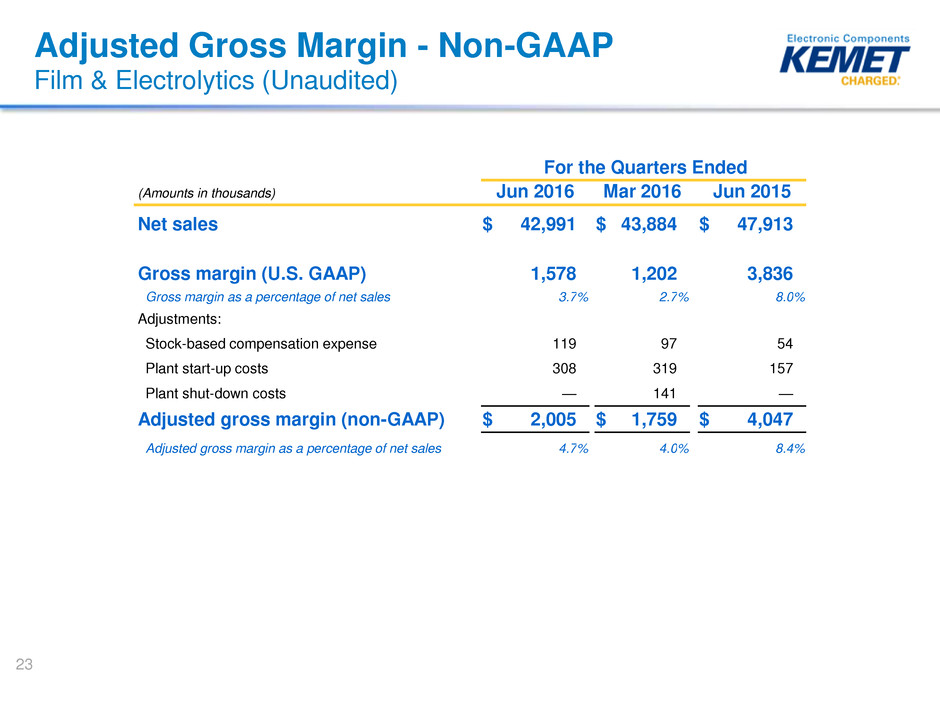

Adjusted Gross Margin - Non-GAAP

Film & Electrolytics (Unaudited)

23

For the Quarters Ended

(Amounts in thousands) Jun 2016 Mar 2016 Jun 2015

Net sales $ 42,991 $ 43,884 $ 47,913

Gross margin (U.S. GAAP) 1,578 1,202 3,836

Gross margin as a percentage of net sales 3.7 % 2.7 % 8.0 %

Adjustments:

Stock-based compensation expense 119 97 54

Plant start-up costs 308 319 157

Plant shut-down costs — 141 —

Adjusted gross margin (non-GAAP) $ 2,005 $ 1,759 $ 4,047

Adjusted gross margin as a percentage of net sales 4.7 % 4.0 % 8.4 %

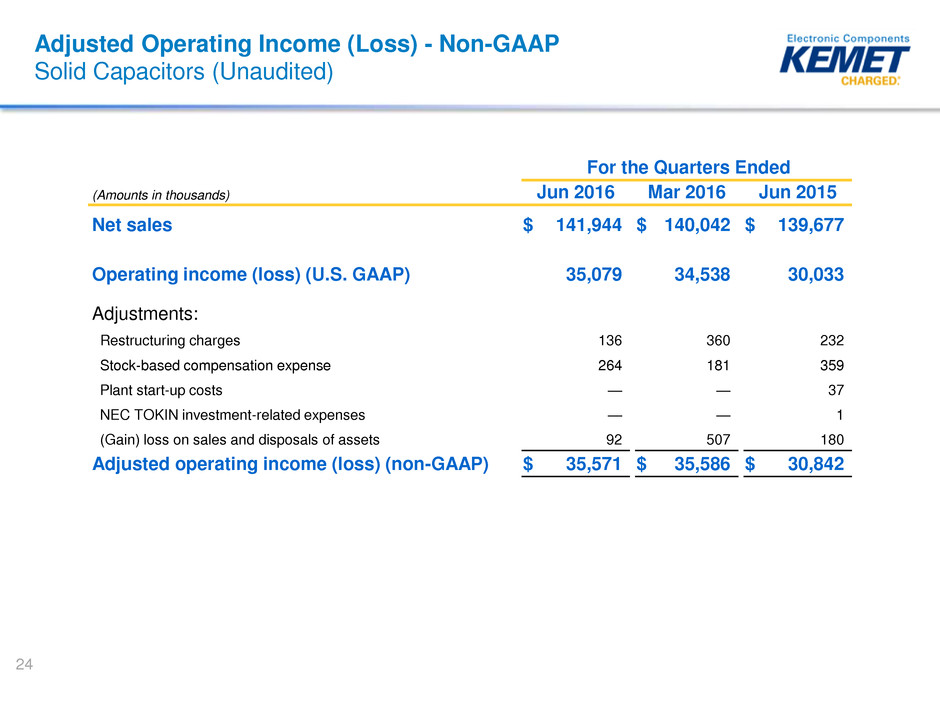

Adjusted Operating Income (Loss) - Non-GAAP

Solid Capacitors (Unaudited)

24

For the Quarters Ended

(Amounts in thousands) Jun 2016 Mar 2016 Jun 2015

Net sales $ 141,944 $ 140,042 $ 139,677

Operating income (loss) (U.S. GAAP) 35,079 34,538 30,033

Adjustments:

Restructuring charges 136 360 232

Stock-based compensation expense 264 181 359

Plant start-up costs — — 37

NEC TOKIN investment-related expenses — — 1

(Gain) loss on sales and disposals of assets 92 507 180

Adjusted operating income (loss) (non-GAAP) $ 35,571 $ 35,586 $ 30,842

Adjusted Operating Income (Loss) - Non-GAAP

Film & Electrolytics (Unaudited)

25

For the Quarters Ended

(Amounts in thousands) Jun 2016 Mar 2016 Jun 2015

Net sales $ 42,991 $ 43,884 $ 47,913

Operating income (loss) (U.S. GAAP) (1,467 ) (1,230 ) 712

Adjustments:

Restructuring charges 549 190 1,286

Stock-based compensation expense 119 97 54

Plant start-up costs 308 319 157

Plant shut-down costs — 141 —

(Gain) loss on sales and disposals of assets — 43 (241 )

Adjusted operating income (loss) (non-GAAP) $ (491 ) $ (440 ) $ 1,968

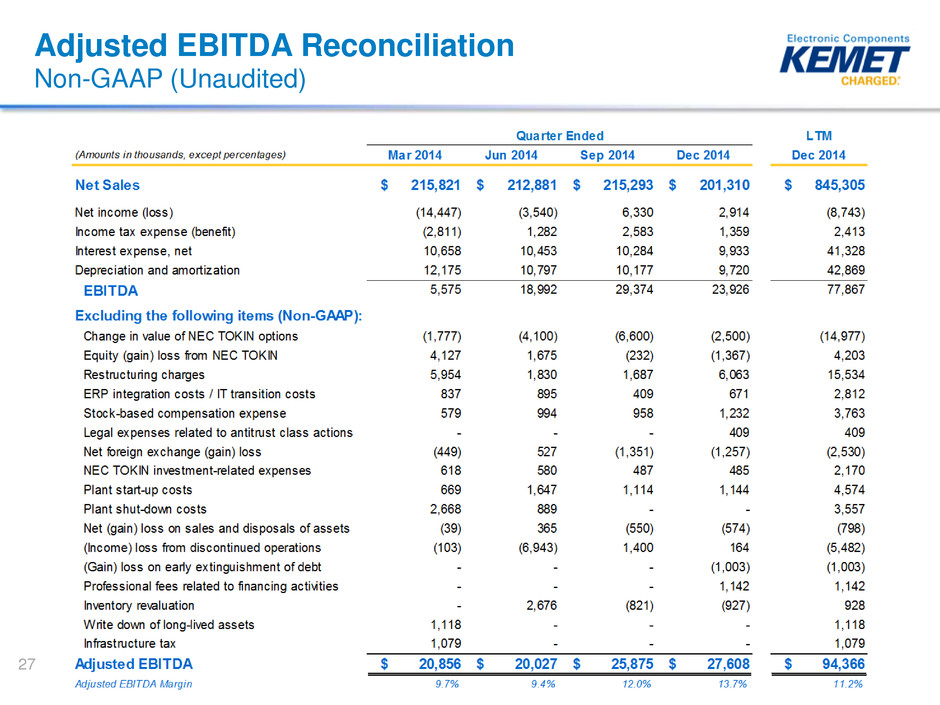

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

26

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

27

28

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

29

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

30

31

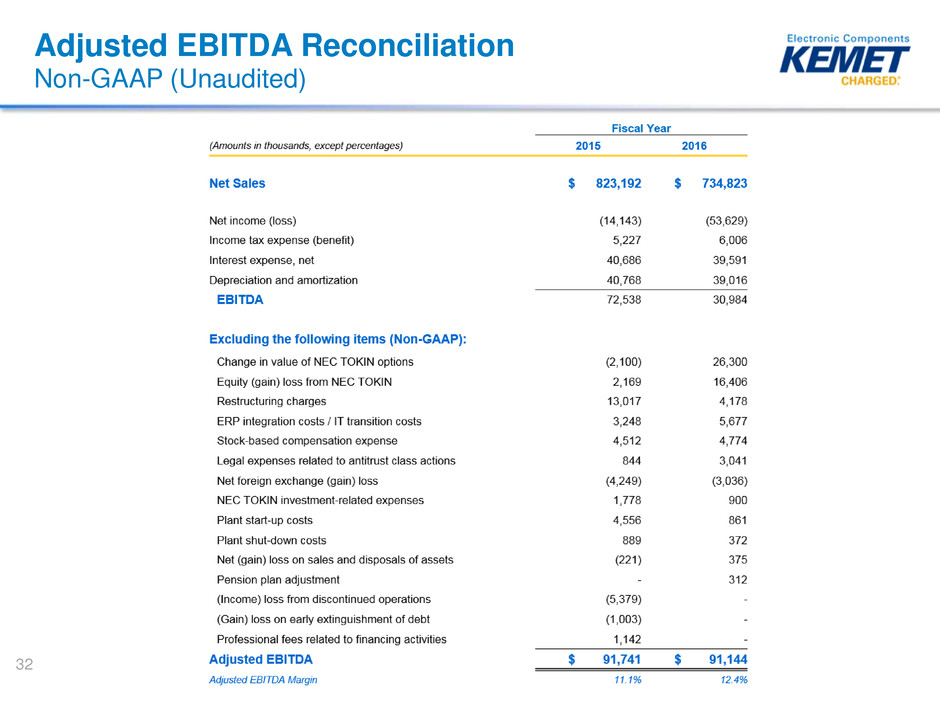

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

32

Non-GAAP Financial Measures

Non-GAAP Financial Measures

Included in this presentation are certain non-GAAP financial measures designed to complement the financial information presented

in accordance with generally accepted accounting principles in the United States of America because management believes such

measures are useful to investors for the reasons described below.

Adjusted gross margin

Adjusted gross margin represents net sales less cost of sales excluding adjustments which are outlined in the quantitative

reconciliation provided earlier in this presentation. Management uses Adjusted gross margin to facilitate our analysis and

understanding of our business operations by excluding the items outlined in the quantitative reconciliation provided earlier in this

presentation which might otherwise make comparisons of our ongoing business with prior periods more difficult and obscure trends

in ongoing operations. The Company believes that Adjusted gross margin is useful to investors because it provides a supplemental

way to understand the underlying operating performance of the Company. Adjusted gross margin should not be considered as an

alternative to gross margin or any other performance measure derived in accordance with GAAP.

Adjusted selling, general and administrative expenses

Adjusted selling, general and administrative expenses represents selling, general and administrative expenses excluding

adjustments which are outlined in the quantitative reconciliation provided earlier in this presentation. Management uses Adjusted

selling, general and administrative expenses to facilitate our analysis and understanding of our business operations by excluding

the items outlined in the quantitative reconciliation provided earlier in this presentation which might otherwise make comparisons of

our ongoing business with prior periods more difficult and obscure trends in ongoing operations. The Company believes that

Adjusted selling, general and administrative expenses is useful to investors because it provides a supplemental way to understand

the underlying operating performance of the Company. Adjusted selling, general and administrative expenses should not be

considered as an alternative to selling, general and administrative expenses or any other performance measure derived in

accordance with GAAP.

33

Non-GAAP Financial Measures

Continued

Adjusted operating income (loss)

Adjusted operating income (loss) represents operating income (loss), excluding adjustments which are outlined in the quantitative

reconciliation provided earlier in this presentation. Management uses Adjusted operating income to facilitate our analysis and

understanding of our business operations by excluding the items outlined in the quantitative reconciliation provided earlier in this

presentation which might otherwise make comparisons of our ongoing business with prior periods more difficult and obscure trends

in ongoing operations. The Company believes that Adjusted operating income is useful to investors to provide a supplemental way

to understand the underlying operating performance of the Company and monitor and understand changes in our ability to generate

income from ongoing business operations. Adjusted operating income should not be considered as an alternative to operating loss

or any other performance measure derived in accordance with GAAP.

Adjusted net income (loss) and Adjusted EPS

Adjusted net income (loss) and Adjusted EPS represent net income (loss) and EPS, excluding adjustments which are more

specifically outlined in the quantitative reconciliation provided earlier in this presentation. Management uses Adjusted net income

(loss) and Adjusted EPS to evaluate the Company's operating performance by excluding the items outlined in the quantitative

reconciliation provided earlier in this presentation which might otherwise make comparisons of our ongoing business with prior

periods more difficult and obscure trends in ongoing operations. The Company believes that Adjusted net income (loss) and

Adjusted EPS are useful to investors because they provide a supplemental way to understand the underlying operating

performance of the Company and allows investors to monitor and understand changes in our ability to generate income from

ongoing business operations. Adjusted net income (loss) and Adjusted EPS should not be considered as alternatives to net

income, operating income or any other performance measures derived in accordance with GAAP.

34

Non-GAAP Financial Measures

Continued

Adjusted EBITDA

Adjusted EBITDA represents net loss before income tax expense (benefit), interest expense, net, and depreciation and amortization

expense, excluding adjustments which are more specifically outlined in the quantitative reconciliation provided earlier in this

presentation. We present Adjusted EBITDA as a supplemental measure of our performance and ability to service debt. We also

present Adjusted EBITDA because we believe such measure is frequently used by securities analysts, investors and other

interested parties in the evaluation of companies in our industry.

We believe Adjusted EBITDA is an appropriate supplemental measure of debt service capacity, because cash expenditures on

interest are, by definition, available to pay interest, and tax expense is inversely correlated to interest expense because tax expense

goes down as deductible interest expense goes up; depreciation and amortization are non-cash charges. The other items excluded

from Adjusted EBITDA are excluded in order to better reflect our continuing operations.

In evaluating Adjusted EBITDA, you should be aware that in the future we may incur expenses similar to the adjustments in this

presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be

unaffected by these types of adjustments. Adjusted EBITDA is not a measurement of our financial performance under GAAP and

should not be considered as an alternative to net income, operating income or any other performance measures derived in

accordance with GAAP or as an alternative to cash flow from operating activities as a measure of our liquidity.

35

Non-GAAP Financial Measures

Continued

Our Adjusted EBITDA measure has limitations as an analytical tool, and you should not consider it in isolation or as a

substitute for analysis of our results as reported under GAAP. Some of these limitations are:

• it does not reflect our cash expenditures, future requirements for capital expenditures or contractual commitments;

• it does not reflect changes in, or cash requirements for, our working capital needs;

• it does not reflect the significant interest expense or the cash requirements necessary to service interest or principal

payment on our debt;

• although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often

have to be replaced in the future, and our Adjusted EBITDA measure does not reflect any cash requirements for such

replacements;

• it is not adjusted for all non-cash income or expense items that are reflected in our statements of cash flows;

• it does not reflect the impact of earnings or charges resulting from matters we consider not to be indicative of our

ongoing operations;

• it does not reflect limitations on or costs related to transferring earnings from our subsidiaries to us; and

• other companies in our industry may calculate this measure differently than we do, limiting its usefulness as a

comparative measure.

Because of these limitations, Adjusted EBITDA should not be considered as a measure of discretionary cash

available to us to invest in the growth of our business or as a measure of cash that will be available to us to meet our

obligations. You should compensate for these limitations by relying primarily on our GAAP results and using Adjusted

EBITDA only supplementally.

36