Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BOK FINANCIAL CORP | a20160630pressreleaseslide.htm |

1

Second Quarter 2016

Earnings Conference Call

July 27, 2016

2

Forward-Looking Statements: This presentation contains statements that are based on management’s

beliefs, assumptions, current expectations, estimates, and projections about BOK Financial Corporation, the

financial services industry, and the economy generally. These remarks constitute forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “anticipates”,

“believes”, “estimates”, “expects”, “forecasts”, “plans”, “projects”, variations of such words, and similar

expressions are intended to identify such forward-looking statements. Management judgments relating to,

and discussion of the provision and allowance for credit losses involve judgments as to future events and are

inherently forward-looking statements. Assessments that BOK Financial’s acquisitions and other growth

endeavors will be profitable are necessary statements of belief as to the outcome of future events, based in

part on information provided by others which BOKF has not independently verified. These statements are not

guarantees of future performance and involve certain risks, uncertainties, and assumptions which are difficult

to predict with regard to timing, extent, likelihood and degree of occurrence. Therefore, actual results and

outcomes may materially differ from what is expressed, implied or forecasted in such forward-looking

statements. Internal and external factors that might cause such a difference include, but are not limited to,

changes in interest rates and interest rate relationships, demand for products and services, the degree of

competition by traditional and non-traditional competitors, changes in banking regulations, tax laws, prices,

levies, and assessments, the impact of technological advances, and trends in customer behavior as well as

their ability to repay loans. For a discussion of risk factors that may cause actual results to differ from

expectations, please refer to BOK Financial Corporation’s most recent annual and quarterly reports. BOK

Financial Corporation and its affiliates undertake no obligation to update, amend, or clarify forward-looking

statements, whether as a result of new information, future events, or otherwise.

Non-GAAP Financial Measures: This presentation may refer to non-GAAP financial measures. Additional

information on these financial measures is available in BOK Financial’s 10-Q and 10-K filings with the

Securities and Exchange Commission which can be accessed at www.BOKF.com.

All data is presented as of June 30, 2016 unless otherwise noted.

3

Steven G. Bradshaw

Chief Executive Officer

4

Second Quarter Summary:

• Noteworthy items impacting Q2 profitability:

• The energy credit environment has stabilized along with commodity prices. Loan loss provision fell

to $20 million this quarter, and should decline further in Q3 and Q4 assuming relative stability in

commodities market.

• Very strong quarter for fees and commissions income – record quarters for Brokerage and

Trading, Transaction Card, and Trust.

• Higher expenses – largely driven by higher revenue levels.

• BOKF’s core business continues to execute well and drive solid results.

• Repurchased 305,169 common shares at an average price of $58.23

Q2 2016 Q1 2016 Q2 2015

Diluted EPS $1.00 $0.64 $1.15

Net income before

taxes ($M)

$96.8 $62.4 $120.9

Net income

attributable to BOKF

shareholders ($M)

$65.8 $42.6 $79.2

$79.2

$74.9

$59.6

$42.6

$65.8

$1.15 $1.09

$0.89

$0.64

$1.00

2Q15 3Q15 4Q15 1Q16 2Q16

Net Income

Net income attributable to shareholders

Net income per share - diluted

5

Additional Details

($B)

Q2 2016

Quarterly

Growth

Annualized

Quarterly

Growth

Year over Year

Growth

Period-End Loans $16.4 2.4% 9.6% 8.5%

Average Loans $16.3 1.7% 6.8% 9.1%

Fiduciary Assets $39.9 2.1% 8.4% 3.0%

Assets Under Management

or in Custody

$73.0 1.6% 6.4% 6.4%

• Strong loan growth in Q2 driven by general C&I, healthcare, commercial real estate, and private

banking, offset in part by lower energy outstandings

• Strong continued asset gathering across the wealth management business, modest contribution from

overall market

6

Steven Nell

Chief Financial Officer

Financial Overview

7

Net Interest Revenue

Net Interest Margin

($mil)

Q2

2016

Q1

2016

Q4

2015

Q3

2015

Q2

2015

Net Interest Revenue $182.6 $182.6 $181.3 $178.6 $175.7

Provision For Credit Losses $ 20.0 $ 35.0 $ 22.5 $ 7.5 $ 4.0

Net Interest Revenue After Provision $162.6 $147.6 $158.8 $171.1 $171.7

Net Interest Margin * 2.63% 2.65% 2.64% 2.61% 2.61%

• Full quarter’s impact of nonaccrual loans negatively impacted NIR by $300,000

• Yield on AFS securities was 2.04%, down 4 basis points sequentially but up 10 basis points year over year

• Loan yields were 3.58%, up 1 basis point compared to the first quarter

* Note: 12 basis points of NIM dilution due to FHLB/Fed trade

8

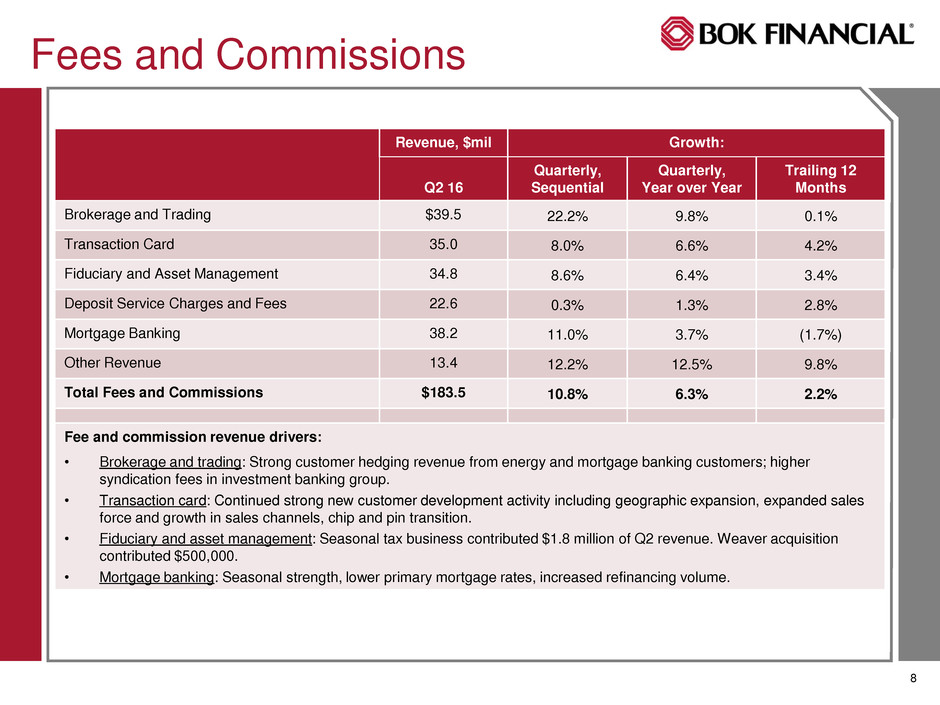

Fees and Commissions

Revenue, $mil Growth:

Q2 16

Quarterly,

Sequential

Quarterly,

Year over Year

Trailing 12

Months

Brokerage and Trading $39.5 22.2% 9.8% 0.1%

Transaction Card 35.0 8.0% 6.6% 4.2%

Fiduciary and Asset Management 34.8 8.6% 6.4% 3.4%

Deposit Service Charges and Fees 22.6 0.3% 1.3% 2.8%

Mortgage Banking 38.2 11.0% 3.7% (1.7%)

Other Revenue 13.4 12.2% 12.5% 9.8%

Total Fees and Commissions $183.5 10.8% 6.3% 2.2%

Fee and commission revenue drivers:

• Brokerage and trading: Strong customer hedging revenue from energy and mortgage banking customers; higher

syndication fees in investment banking group.

• Transaction card: Continued strong new customer development activity including geographic expansion, expanded sales

force and growth in sales channels, chip and pin transition.

• Fiduciary and asset management: Seasonal tax business contributed $1.8 million of Q2 revenue. Weaver acquisition

contributed $500,000.

• Mortgage banking: Seasonal strength, lower primary mortgage rates, increased refinancing volume.

9

Expenses

($mil)

Q2 2016

Q1 2016

Q2 2015

%Incr.

Seq.

%Incr.

YOY

Personnel Expense $142.5 $135.8 $132.7 4.9% 7.4%

Other Operating Expense $112.2 $109.1 $ 94.4 2.8% 18.9%

Total Operating Expense $254.7 $244.9 $227.1 4.0% 12.2%

• Increase in personnel expense largely due to higher variable compensation costs tied to revenue levels

• Increase in other operating expenses driven by mobank acquisition, increased FDIC expense, additional

mortgage banking expenses, and accounting adjustments related to a merchant banking acquisition.

• Overall, expenses are growing in line with revenue.

0

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

100,000

150,000

200,000

250,000

300,000

350,000

400,000

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

Total Revenue Personnel Expense

40,000

50,000

60,000

70,000

80,000

90,000

100,000

110,000

120,000

100,000

150,000

200,000

250,000

300,000

350,000

400,000

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

Total Revenue Total non-personnel expense

10

Other Balance Sheet Statistics

Q2 2016 Q1 2016 Q2 2015

Period End AFS Securities $8.8 billion $8.9 billion $9.0 billion

Average AFS securities $8.9 billion $9.0 billion $9.1 billion

Period End Deposits $20.8 billion $20.4 billion $21.1 billion

Average Deposits $20.5 billion $20.6 billion $21.1 billion

Common Equity Tier 1 11.9% 12.0% 13.0%

Tier 1 11.9% 12.0% 13.0%

Total Capital Ratio 13.5% 13.2% 14.1%

Leverage Ratio 9.1% 9.1% 9.8%

Tangible Common Equity Ratio 9.3% 9.3% 9.7%

Tangible Book Value per Share $44.68 $43.73 $42.70

• BOK Financial remains extremely well capitalized at quarter end.

• Balance sheet effectively neutral from an interest rate risk perspective at 6/30/16

• Completed $150 million subordinated debt offering in June 2016.

• 40 year ‘non-call 5’ structure at 5.375%

• Bond offering proceeds add 60 basis points to total capital ratio

11

2016 Assumptions

Mid-single-digit loan growth for the full year

No plans to materially reduce securities portfolio due to achievement of neutral balance sheet

Stable NIM

Increasing NII

Loan loss provision of $8-$12 million per quarter for balance of 2016

Total net chargeoffs in 2016 expected to be comfortably below the full year loan loss

provision amount

Mid-single-digit revenue growth from fee-generating businesses on a trailing twelve month basis

Revenue growth should continue to outpace core expense growth

Capital deployment through organic growth, acquisitions, dividends, and stock buybacks

Close MBT Bancshares acquisition before year end

$6 - $8 million of pretax consolidation-related charges post closing

12

Stacy Kymes

EVP-Corporate Banking

13

Loan Portfolio by Geography

($mil)

Jun 30

2016

Mar 31

2016

Seq.

Loan

Growth

Jun 30

2015

YOY

Loan

Growth

OK $6,141.6 $6,019.3 2.0% $5,749.0 6.8%

TX 5,668.9 5,576.8 1.7% 5,281.7 7.3%

NM 846.2 853.6 (0.9)% 819.6 3.2%

AR 164.3 154.6 6.3% 197.3 (16.7)%

CO 1,408.7 1,326.9 6.2% 1,333.7 5.6%

AZ 1,373.2 1,320.6 4.0% 1,094.9 25.4%

KC 803.8 770.8 4.3% 647.9 24.1%

Total $16,406.7 $16,022.6 2.4% $15,124.1 8.5%

• Healthy sequential and year-over-year growth in 7 of 8 geographies – strong

economy and share gain all across footprint

14

Commercial Loan Growth

($mil)

Jun 30

2016

Mar 31

2016

Seq.

Loan

Growth

Jun 30

2015

YOY

Loan

Growth

Energy $2,818.6 $3,029.4 (7.0)% $2,902.1 (2.9)%

Services 2,830.9 2,728.9 3.7% 2,681.1 5.6%

Healthcare 2,051.1 1,995.4 2.8% 1,646.0 24.6%

Wholesale/retail 1,533.0 1,451.8 5.6% 1,533.7 (0.1)%

Manufacturing 595.4 600.6 (0.9)% 579.6 2.7%

Other 527.4 482.2 9.4% 433.2 21.8%

Total Commercial $10,356.4 $10,288.4 0.7% $9,775.7 5.9%

• Energy loan outstandings down as expected

• Balance of commercial business continues to post healthy growth

15

Oil & Gas

Producers

79%

Midstream

& Other

12%

Energy

Services

9%

Energy

At 6/30/16:

$4.9 billion commitments and $2.8 billion O/S

$254 million new commitments booked in 2016

~60/40 split between oil and gas

E&P line utilization 60%, down from 64% in Q1

Allowance for credit losses to period end loans: 3.58%, or

over $100 million

Q2 energy chargeoffs $7.1 million

Cumulative chargeoffs in the 2014-2016 commodity cycle: $34 million

($M)

As of Sep 30,

2015

As of Dec 31,

2015

As of Mar 31,

2016

As of Jun 30,

2016

Pass Performing Loans 2,527.6 89.1% 2,580.7 83.3% 2,197.9 72.6% 2,032.1 72.1%

Spec. Mention 196.3 6.9% 325.7 10.5% 269.0 8.9% 197.5 7.0%

Potential Problem Loans 96.4 3.4% 129.8 4.2% 403.0 13.3% 421.0 14.9%

Nonaccrual Loans 17.9 0.6% 61.2 2.0% 159.5 5.3% 168.1 6.0%

Total Energy Loans $2,838.2 $3,097.3 $3,029.4 $2,818.7

16

Commercial Real Estate

($mil)

Jun 30

2016

Mar 31

2016

Seq.

Loan

Growth

Jun 30

2015

YOY

Loan

Growth

Residential Construction

and Land Development

$157.6 $171.9 (8.3%) $148.6 6.1%

Retail 795.4 810.5 (1.9%) 688.4 15.5%

Office 769.1 695.6 10.6% 563.1 36.6%

Multifamily 787.2 733.7 7.3% 711.3 10.7%

Industrial 645.6 564.5 14.4% 488.1 32.3%

Other CRE 427.1 394.3 8.3% 434.0 (1.6%)

Total CRE $3,582.0 $3,370.5 6.3% $3,033.5 18.1%

• Continued strong growth across the CRE business

• 50 percent of year over year growth outside of traditional BOKF footprint

17

Key Credit Quality Metrics

$84.1

$71.5

$85.9 $82.2 $79.1

$61.2

$159.6 $168.1

$90.9 $89.3

$147.1

$241.8

$247.2

$-

$50.0

$100.0

$150.0

$200.0

$250.0

2Q15 3Q15 4Q15 1Q16 2Q16

Nonaccrual Loans

Other Non-Accruals Energy Non-Accruals

Energy credit migration

has stabilized…

…and there are no signs

of credit weakness in

other lending areas

1.34%

1.35%

1.43%

1.50%

1.54%

1.20%

1.25%

1.30%

1.35%

1.40%

1.45%

1.50%

1.55%

1.60%

2Q15 3Q15 4Q15 1Q16 2Q16

Combined Allowance for Credit Losses

to Period End Loans

0.04% 0.03%

0.02%

-0.18%

-0.22%

-1.00%

-0.50%

0.00%

0.50%

1.00%

2Q15 3Q15 4Q15 1Q16 2Q16

TTM Net Recoveries (Charge Offs) to

Average Loans

Note: Long term NCO norm is 35-50 bps

Stable credit environment in Q2

No signs of contagion/spillover of energy issues to

other lending areas

61% of nonaccrual borrowers are current and are

paying as agreed

74% of energy nonaccruals current and are

paying as agreed

18

Steven G. Bradshaw

Chief Executive Officer

Closing Remarks

19

Question and Answer Session