Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - People's United Financial, Inc. | d230483dex991.htm |

| 8-K - FORM 8-K - People's United Financial, Inc. | d230483d8k.htm |

Exhibit 99.2

People’s United®

Financial, Inc.

Second Quarter 2016 Results

NASDAQ: PBCT July 21, 2016

Forward-Looking Statement

Certain statements contained in this release are forward-looking in nature. These include all statements about People’s United Financial’s plans,

objectives, expectations and other statements that are not historical facts, and usually use words such as “expect,” “anticipate,” “believe,” “should” and similar expressions. Such statements represent

management’s current beliefs, based upon information available at the time the statements are made, with regard to the matters addressed. All forward-looking statements are subject to risks and uncertainties that could cause People’s

United Financial’s actual results or financial condition to differ materially from those expressed in or implied by such statements. Factors of particular importance to People’s United Financial include, but are not limited to: (1) changes

in general, national or regional economic conditions; (2) changes in interest rates; (3) changes in loan default and charge-off rates; (4) changes in deposit levels; (5) changes in levels of income and expense in non-interest income and expense

related activities; (6) changes in accounting and regulatory guidance applicable to banks; (7) price levels and conditions in the public securities markets generally; (8) competition and its effect on pricing, spending, third-party relationships and

revenues; and (9) changes in regulation resulting from or relating to financial reform legislation. People’s United Financial does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new

information, future events or otherwise.

People’s United®

Financial,

Inc. 1

Second Quarter 2016 Overview

(Comparisons versus first quarter 2016)

Net income of $68.5 million, an increase of 9%

- Earnings per share of $0.23, an increase of $0.02

Net interest income1 of

$240 million, no change

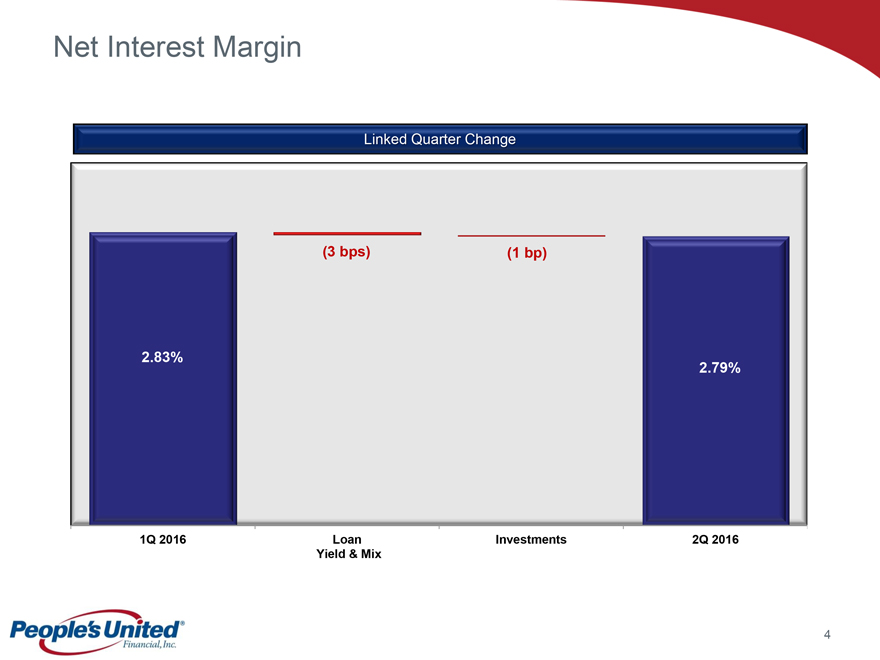

Net interest margin of 2.79%, a decrease of 4 basis points

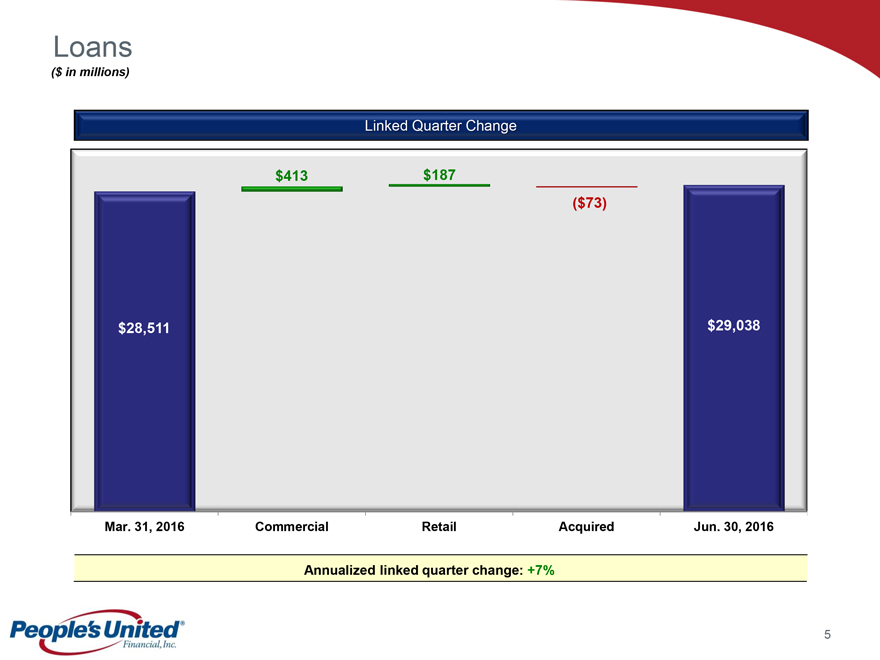

Loan growth of $528 million, 7% annualized growth rate

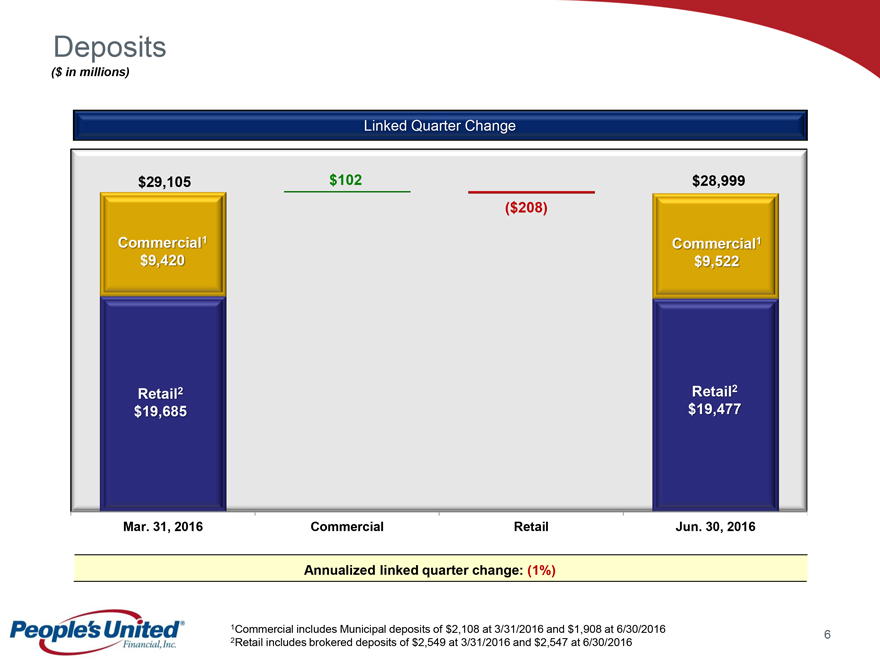

Deposits decreased $106 million, (1%)

annualized rate

- Seasonal decline in municipal deposits unfavorably impacted balances by $200 million

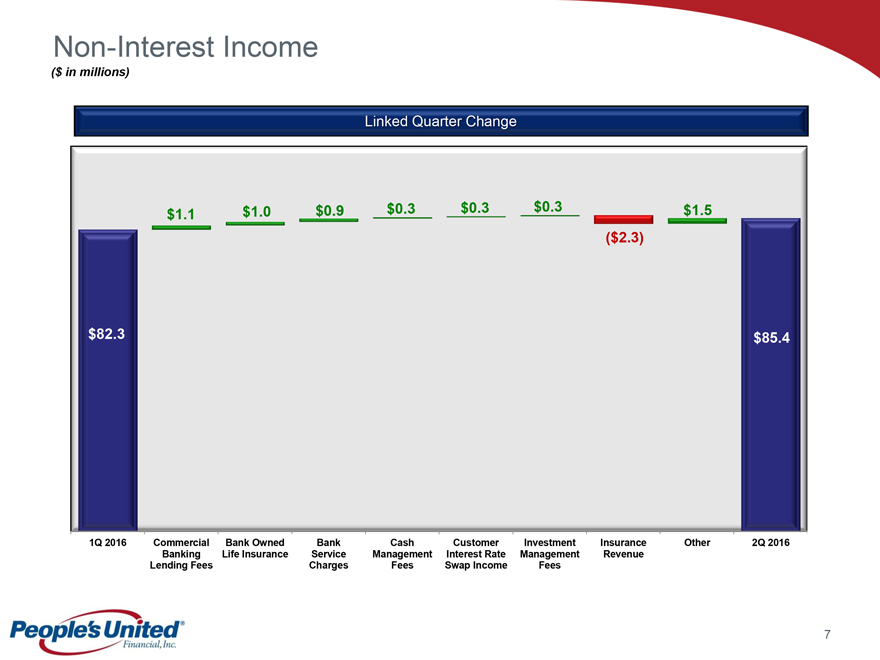

Non-interest income of $85 million, an increase of 4%

Total non-interest expenses of $213

million, a decrease of 2%

Efficiency ratio of 60.4%, a decrease of 230 basis points

Net loan charge-offs of 0.07%, a decrease of 2 basis points

1 Net interest income on a fully

taxable equivalent basis for 1Q 2016 and 2Q 2016 was $247 million and $248 million, respectively.

People’s United®

Financial, Inc. 2

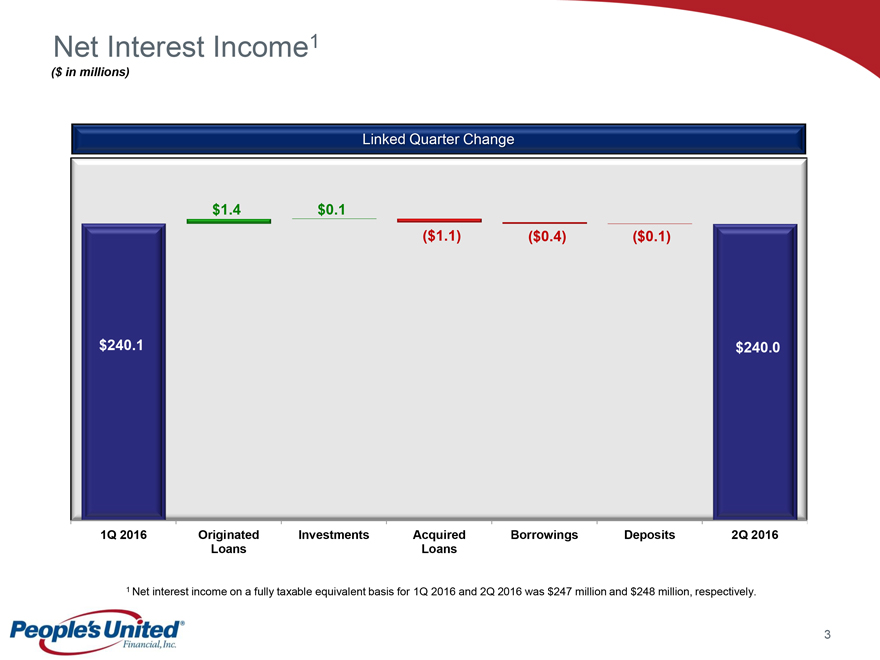

Net Interest Income1

($

in millions)

Linked Quarter Change

$1.4 $0.1

($1.1) ($0.4) ($0.1)

$240.1 $240.0

1Q 2016 Originated Loans Investments Acquired Loans Borrowings Deposits 2Q 2016

1 Net interest

income on a fully taxable equivalent basis for 1Q 2016 and 2Q 2016 was $247 million and $248 million, respectively.

People’s United®

Financial, Inc. 3

Net Interest Margin

Linked Quarter Change

(3 bps) (1 bp)

2.83%

2.79%

1Q 2016 Loan Yield & Mix Investments 2Q 2016

People’s United®

Financial, Inc. 4

Loans

($ in millions)

Linked Quarter Change

$413 $187

($73)

$28,511 $29,038

Mar. 31, 2016 Commercial Retail Acquired Jun. 30, 2016

Annualized linked quarter change: +7%

People’s United®

Financial, Inc. 5

Deposits

($ in millions)

Linked Quarter Change

$29,105 $102 $28,999

($208)

Commercial1 Commercial1

$9,420 $9,522

Retail2 Retail2

$19,685 $19,477

Mar. 31, 2016 Commercial Retail Jun. 30, 2016

Annualized linked quarter change: (1%)

1Commercial includes Municipal deposits of $2,108 at

3/31/2016 and $1,908 at 6/30/2016

People’s United®

Financial, Inc. 6

2Retail includes brokered deposits of $2,549 at 3/31/2016 and $2,547 at 6/30/2016

Non-Interest Income

($ in

millions)

Linked Quarter Change

$1.1 $1.0 $0.9 $0.3 $0.3 $0.3 $1.5

($2.3)

$82.3 $85.4

1Q 2016 Commercial Bank Owned Bank Cash Customer Investment Insurance Other 2Q 2016

Banking

Life Insurance Service Management Interest Rate Management Revenue

Lending Fees Charges Fees Swap Income Fees

People’s United®

Financial, Inc. 7

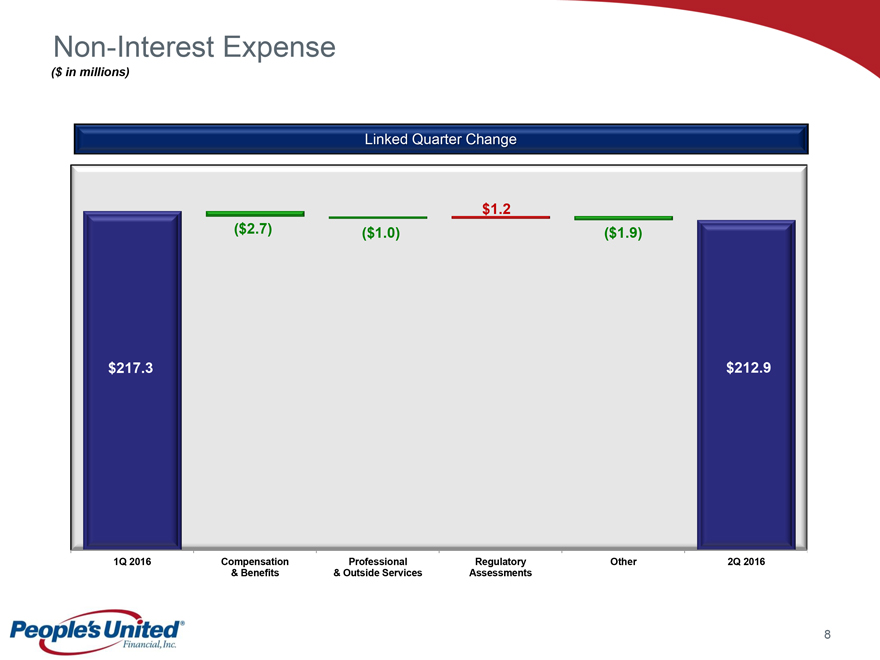

Non-Interest Expense

($

in millions)

Linked Quarter Change

$1.2

($2.7) ($1.0) ($1.9)

$217.3 $212.9

1Q 2016 Compensation Professional Regulatory Other 2Q 2016

& Benefits & Outside

Services Assessments

People’s United®

Financial, Inc. 8

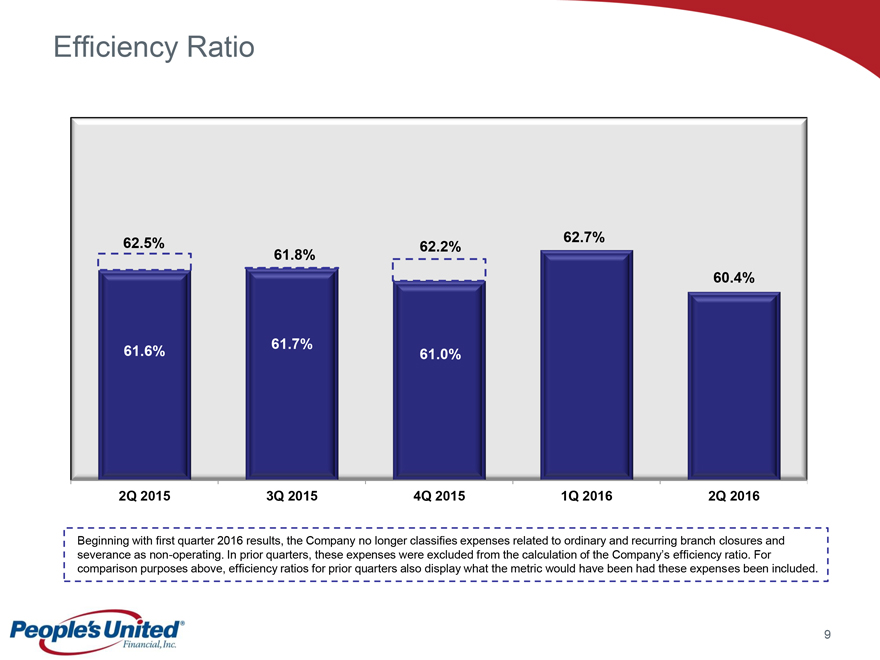

Efficiency Ratio

62.5%

61.8%

62.2%

62.7%

60.4%

61.6%

61.7%

61.0%

2Q 2015

3Q 2015

4Q 2015

1Q 2016

2Q 2016

Beginning with first quarter 2016 results, the Company no longer classifies expenses related to ordinary and recurring branch closures and severance as non-operating. In prior

quarters, these expenses were excluded from the calculation of the Company’s efficiency ratio. For comparison purposes above, efficiency ratios for prior quarters also display what the metric would have been had these expenses been included.

People’s United®

Financial, Inc.

9

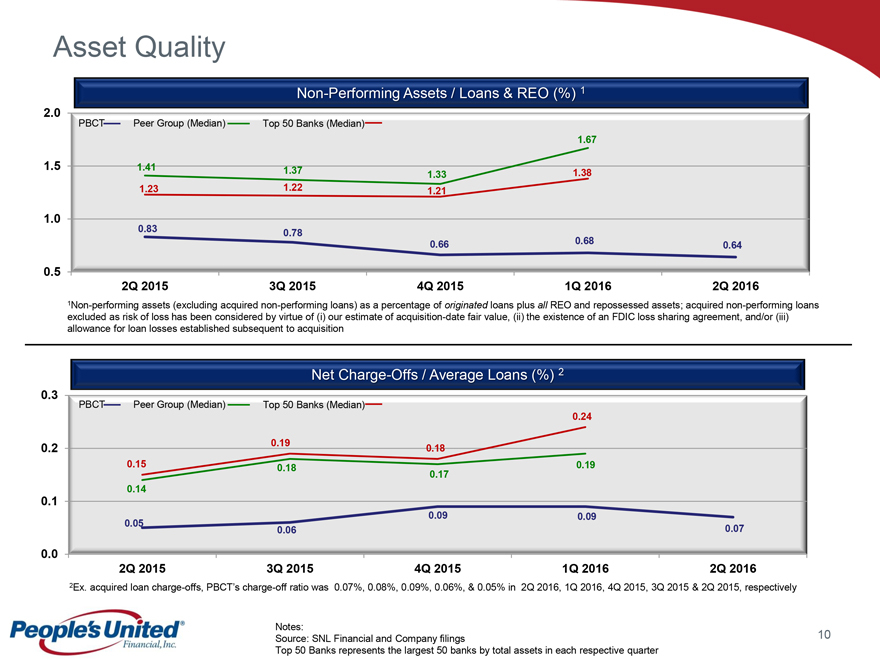

Asset Quality

Non

Performing Assets / Loans & REO (%) 1

2.0

PBCT Peer Group (Median) Top 50

Banks (Median)

1.5 1.41 1.37 1.33 1.67

1.23 1.22 1.21 1.38

1.0 0.83 0.78 0.66 0.68 0.64

0.5

2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016

1Non-performing assets (excluding acquired

non-performing loans) as a percentage of originated loans plus all REO and repossessed assets; acquired non-performing loans excluded as risk of loss has been considered by virtue of (i) our estimate of acquisition-date fair value, (ii) the

existence of an FDIC loss sharing agreement, and/or (iii) allowance for loan losses established subsequent to acquisition

Net Charge-Offs / Average Loans (%) 2

0.3

PBCT Peer Group (Median) Top 50 Banks (Median)

0.2 0.15 0.19 0.18 0.24

0.14 0.18 0.17 0.19

0.1 0.05 0.06 0.09 0.09 0.07

0.0 2Q 2015

3Q 2015

4Q 2015

1Q 2016

2Q 2016

2Ex. acquired loan charge-offs, PBCT’s charge-off ratio was 0.07%, 0.08%, 0.09%, 0.06%, & 0.05% in 2Q 2016, 1Q 2016, 4Q 2015, 3Q 2015 & 2Q 2015, respectively

Notes:

People’s United®

Financial, Inc.

Source: SNL Financial and Company filings

Top 50 Banks represents the largest 50 banks by total assets in each respective quarter

10

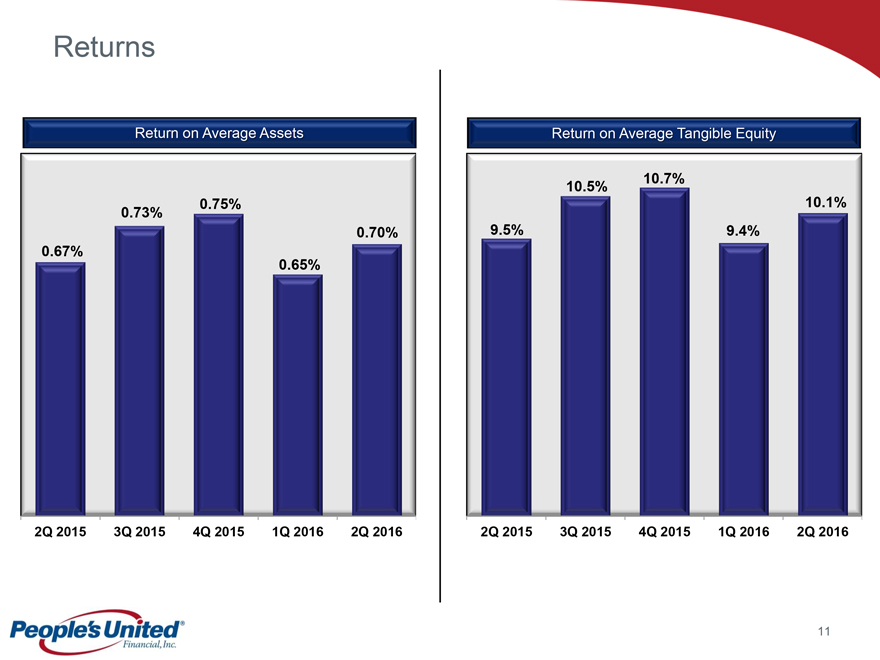

Returns

Return on Average

Assets

0.67%

0.73%

0.75%

0.70%

0.65%

2Q 2015

3Q 2015

4Q 2015

1Q 2016

2Q 2016

Return on Average Tangible Equity

9.5%

10.5%

10.7%

10.1%

9.4%

2Q 2015

3Q 2015

4Q 2015

1Q 2016

2Q 2016

People’s United®

Financial, Inc.

11

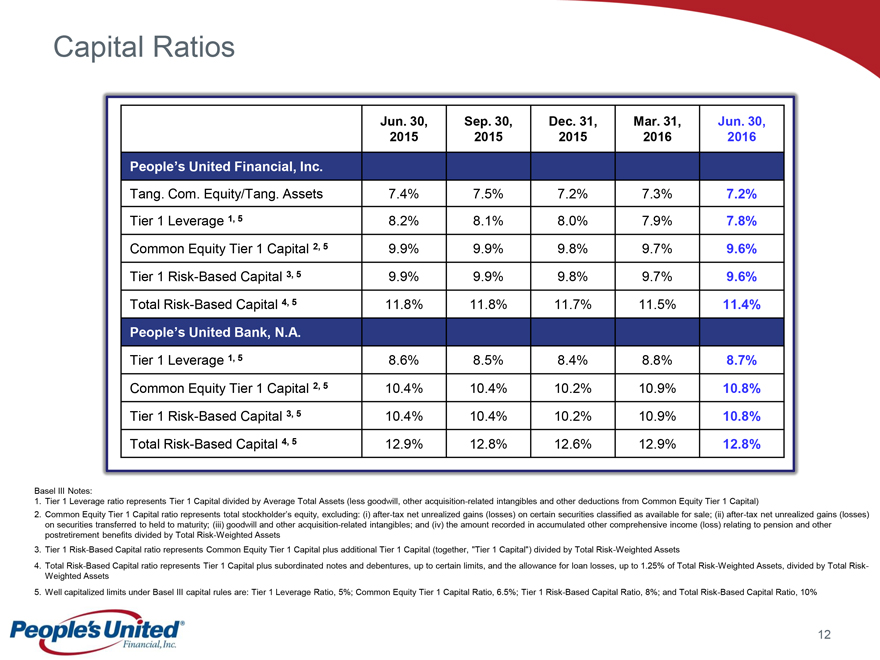

Capital Ratios

Jun. 30,

2015

Sep. 30, 2015

Dec. 31, 2015

Mar. 31, 2016

Jun. 30, 2016

People’s United Financial, Inc.

Tang. Com. Equity/Tang. Assets

7.4% 7.5% 7.2% 7.3% 7.2%

Tier 1 Leverage 1, 5

8.2% 8.1% 8.0% 7.9% 7.8%

Common Equity Tier 1 Capital 2, 5

9.9% 9.9% 9.8% 9.7% 9.6%

Tier 1 Risk-Based Capital 3, 5

9.9% 9.9% 9.8% 9.7% 9.6%

Total Risk-Based Capital 4, 5

11.8% 11.8% 11.7% 11.5% 11.4%

People’s United Bank, N.A.

Tier 1 Leverage 1, 5

8.6% 8.5% 8.4% 8.8% 8.7%

Common Equity Tier 1 Capital 2, 5

10.4% 10.4% 10.2% 10.9% 10.8%

Tier 1 Risk-Based Capital 3, 5

10.4% 10.4% 10.2% 10.9% 10.8%

Total Risk-Based Capital 4, 5

12.9% 12.8% 12.6% 12.9% 12.8%

Basel III Notes:

1. Tier 1 Leverage ratio represents Tier 1 Capital divided by Average Total

Assets (less goodwill, other acquisition-related intangibles and other deductions from Common Equity Tier 1 Capital)

2. Common Equity Tier 1 Capital ratio

represents total stockholder’s equity, excluding: (i) after-tax net unrealized gains (losses) on certain securities classified as available for sale; (ii) after-tax net unrealized gains (losses) on securities transferred to held to maturity;

(iii) goodwill and other acquisition-related intangibles; and (iv) the amount recorded in accumulated other comprehensive income (loss) relating to pension and other postretirement benefits divided by Total Risk-Weighted Assets

3. Tier 1 Risk-Based Capital ratio represents Common Equity Tier 1 Capital plus additional Tier 1 Capital (together, “Tier 1 Capital”) divided by Total Risk-Weighted

Assets

4. Total Risk-Based Capital ratio represents Tier 1 Capital plus subordinated notes and debentures, up to certain limits, and the allowance for loan losses,

up to 1.25% of Total Risk-Weighted Assets, divided by Total Risk-Weighted Assets

5. Well capitalized limits under Basel III capital rules are: Tier 1 Leverage

Ratio, 5%; Common Equity Tier 1 Capital Ratio, 6.5%; Tier 1 Risk-Based Capital Ratio, 8%; and Total Risk-Based Capital Ratio, 10%

People’s United®

Financial, Inc.

12

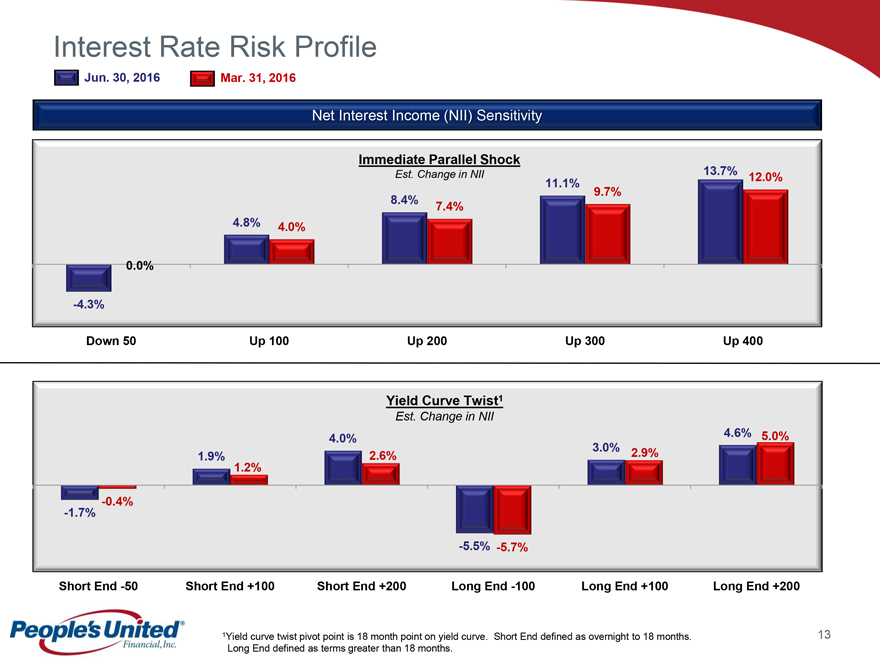

Interest Rate Risk Profile

Jun. 30, 2016 Mar. 31, 2016

Net Interest Income (NII) Sensitivity

Immediate Parallel Shock

Est. Change in NII

4.8%

4.0%

8.4%

7.4%

11.1%

9.7%

13.7%

12.0%

0.0%

-4.3%

Down 50

Up 100

Up 200

Up 300

Up 400

Yield Curve Twist1

Est. Change in NII

1.9% 1.2%

4.0% 2.6%

3.0% 2.9%

4.6% 5.0%

-0.4%

-1.7%

-5.5% -5.7%

Short End -50

Short End +100

Short End +200

Long End -100

Long End +100

Long End +200

People’s United®

Financial, Inc.

1Yield curve twist pivot point is 18 month point on yield curve. Short End defined as overnight to 18 months.

Long End defined as terms greater than 18 months.

13

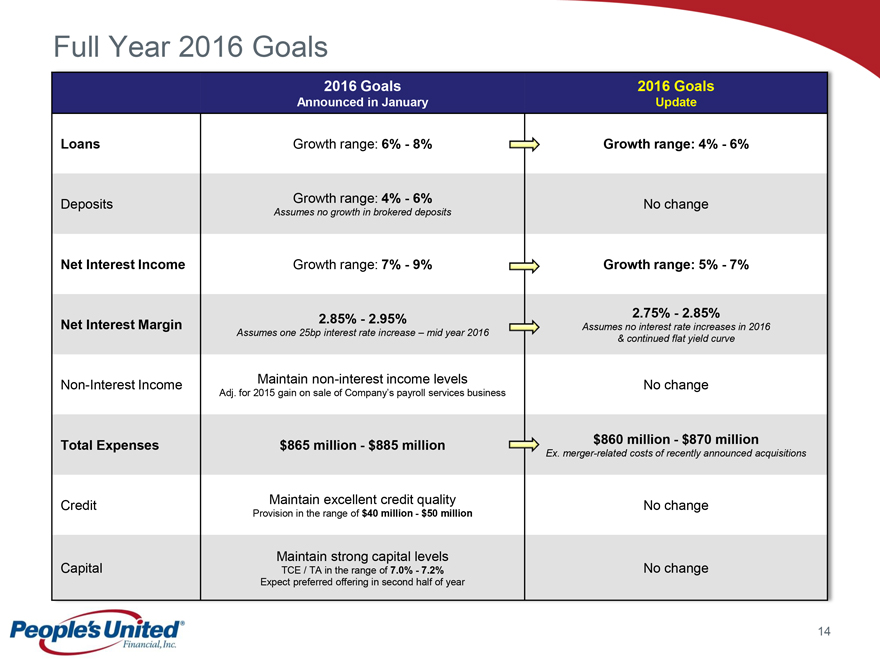

Full Year 2016 Goals

2016

Goals Announced in January

2016 Goals Update

Loans

Growth range: 6% - 8% Growth range: 4% - 6%

Deposits

Growth range: 4% - 6%

Assumes no growth in brokered deposits

No change

Net Interest Income

Growth range: 7% - 9%

Growth range: 5% - 7%

Net Interest Margin

2.85% - 2.95% Assumes one 25bp interest rate increase – mid year 2016

2.75% - 2.85% Assumes no interest rate increases in 2016 & continued flat yield curve

Non-Interest Income

Maintain non-interest income levels Adj. for 2015 gain on sale of

Company’s payroll services business

No change

Total Expenses

$865 million - $885 million

$860 million - $870 million Ex. merger-related costs of recently

announced acquisitions

Credit

Maintain excellent credit quality Provision in

the range of $40 million - $50 million Maintain strong capital levels

No change

Capital

TCE / TA in the range of 7.0% - 7.2% Expect preferred offering in

second half of year

No change

People’s United®

Financial, Inc.

14

Summary

Premium brand

built over 170 years

Deep focus on expense management

Conservative &

well-defined underwriting culture

Breadth of products & services

Commitment to relationship-based banking

...with significant knowledge at the

local level

Operate in large & attractive Northeast markets…

Experienced leadership team

People’s United®

Financial, Inc.

A Uniquely Positioned Franchise

People’s United®

Financial, Inc.

15

Appendix

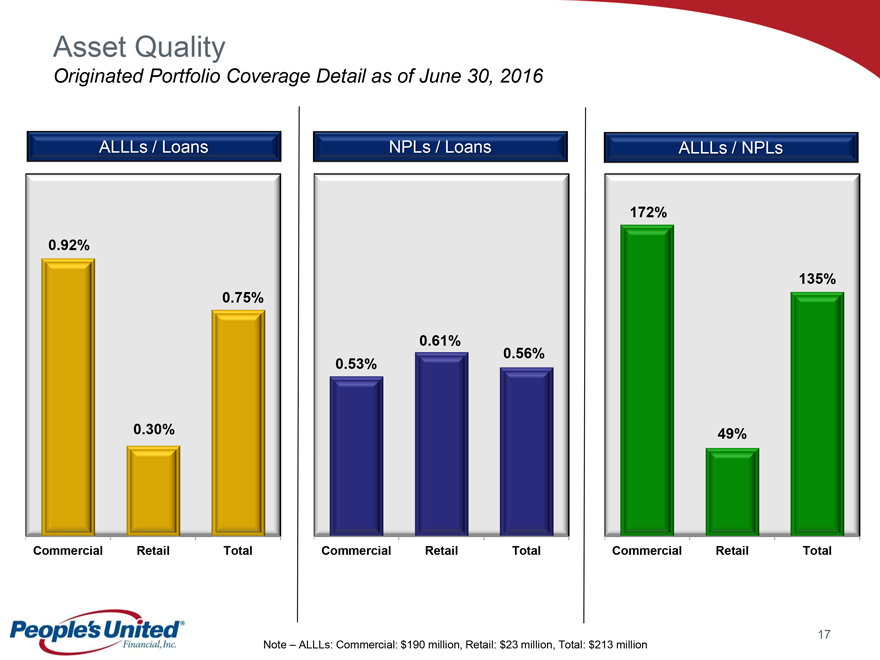

Asset Quality

Originated

Portfolio Coverage Detail as of June 30, 2016

ALLLs / Loans

0.92%

0.30%

0.75%

Commercial Retail Total

NPLs / Loans

0.53%

0.61%

0.56%

Commercial Retail Total

ALLLs / NPLs

172%

49%

135%

Commercial

Retail

Total

People’s United®

Financial, Inc.

Note – ALLLs: Commercial: $190 million, Retail: $23 million, Total: $213

million

17

Peer Group

Firm

Ticker

City

State

1 Associated ASB Green Bay WI

2 Citizens CFG Providence RI

3 Comerica CMA Dallas TX

4 Cullen/Frost CFR San Antonio TX

5 East West EWBC Pasadena CA

6 First Horizon FHN Memphis TN

7 FirstMerit FMER Akron OH

8 Huntington HBAN Columbus OH

9 KeyCorp KEY Cleveland OH

10 M&T MTB Buffalo NY

11 New York Community NYCB Westbury NY

12 Signature SBNY New York NY

13 Synovus SNV Columbus GA

14 Umpqua UMPQ Portland OR

15 Webster WBS Waterbury CT

16 Zions ZION Salt Lake City UT

People’s United®

Financial, Inc.

18

People’s United®

Financial, Inc.

For more information, investors may contact:

Andrew S. Hersom

(203) 338-4581

andrew.hersom@ peoples.com

NASDAQ: PBCT