Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - WESTERN ALLIANCE BANCORPORATION | pressrelease-6302016.htm |

| 8-K - 8-K - WESTERN ALLIANCE BANCORPORATION | coverpage-pressrelease6302.htm |

2nd Quarter 2016

Earnings Call

July 22, 2016

2

Financial Highlights

▪ Completed Hotel Franchise Finance (HFF) loan portfolio purchase on April 20, 2016, increasing total loans by $1.28 billion as

of the acquisition date

▪ Net income of $61.6 million and earnings per share of $0.60, inclusive of $0.02 in acquisition / restructure expense, compared

to $61.3 million and $0.60 per share for Q1 2016, and $39.5 million and $0.44 per share, inclusive of $0.06 in acquisition /

restructure expense, for Q2 2015

▪ Net interest margin of 4.63%, compared to 4.58% in Q1 2016, and 4.41% in Q2 2015

▪ Efficiency ratio of 43.0%, compared to 45.6% in Q1 2016, and 44.7% in Q2 2015

▪ Total loans of $12.88 billion, up $1.64 billion from prior quarter and total deposits of $14.20 billion, up $1.12 billion from prior

quarter

▪ Nonperforming assets (nonaccrual loans and repossessed assets) decreased to 0.54% of total assets, from 0.57% at

March 31, 2016

▪ Annualized net (recoveries) charge-offs to average loans outstanding of (0.01)%, compared to 0.08% in Q1 2016, and

compared to (0.13)% in Q2 2015

▪ Qualifying debt of $382 million, up $172 million from prior quarter due to issuance of long-term subordinated debt

▪ Stockholders' equity of $1.80 billion, up $136 million from prior quarter as a result of net income and the at-the-market common

stock issuances during the quarter

▪ Tangible common equity ratio of 9.1% and tangible book value per share, net of tax, of $14.25, compared to 9.1% and $13.16,

respectively, at March 31, 2016

Note: Prior period financial results for 2015 have been adjusted to reflect the adoption of the accounting guidance in ASU 2016-01, Recognition and Measurement of Financial

Assets and Financial Liabilities. See the supplemental schedule at the end of the 12/31/2015 press release for the impact that adoption had on prior period financial results.

Q2 2016

HIGHLIGHTS

2

3

Quarterly Consolidated Financial Results

$ in millions, except EPS

Q2 2016 HIGHLIGHTS

▪ Net Interest Income increased $18.0

million as a result of the inclusion of

Hotel Franchise Finance

▪ Operating Non-Interest Income

decreased $3.5 million (28.9%),

primarily from a reduction in gain on sale

of loans

▪ Operating Non-Interest Expense

increased $2.0 million (2.6%), primarily

driven by higher data processing costs

▪ Acquisition / Restructure and Other

includes costs related to the Hotel

Franchise Finance acquisition and

system termination costs

▪ Provision for Credit Losses steady at

$2.5 million given current credit quality

metrics

▪ Income Tax Expense increased $6.8

million due to increased pre-tax income

and a non-recurring one-time benefit

recognized in Q1 2016 from the early

adoption of ASU 2016-09

Q2-16 Q1-16 Q2-15

Net Interest Income $ 163.7 $ 145.7 $ 108.7

Operating Non-Interest Income 8.6 12.1 5.6

Net Operating Revenue $ 172.3 $ 157.8 $ 114.3

Operating Non-Interest Expense (77.8) (75.8) (54.6)

Operating Pre-Provision Net Revenue $ 94.5 $ 82.1 $ 59.7

Provision for Credit Losses (2.5) (2.5) —

Gains on OREO and Other Assets (0.4) 0.3 1.2

Gain on Sale of Securities — 1.0 0.1

Acquisition / Restructure and Other (3.7) — (7.9)

Pre-tax Income $ 87.9 $ 80.9 $ 53.1

Income Tax (26.3) (19.5) (13.6)

Net Income $ 61.6 $ 61.3 $ 39.5

Preferred Dividend — — (0.2)

Net Income Available to Common $ 61.6 $ 61.3 $ 39.2

Average Diluted Shares Outstanding 103.5 102.5 88.7

Earnings Per Share $ 0.60 $ 0.60 $ 0.44

3

4

Net Interest Drivers

$ in billions

Interest Bearing Deposits and Cost of Funds

Loans and Yield

Interest Earning Assets

Q2-15 Q3-15 Q4-15 Q1-16 Q2-16

Q2 2016 HIGHLIGHTS

▪ Loans increased $1.64 billion primarily

due to Hotel Franchise Finance ($1.26

billion), causing a corresponding

increase in yield

▪ Cost of funds increased four basis

points for interest-bearing deposits

due to higher money market rates

▪ Cost of funds for total deposits,

including non-interest bearing

deposits, increased three basis points

to 0.23%

Total Investments and Yield

Q2-15 Q3-15 Q4-15 Q1-16 Q2-16

3.06%

2.98% 2.98% 3.02% 2.95%

$1.5

$2.0 $2.0 $2.1

$2.3

Q2-15 Q3-15 Q4-15 Q1-16 Q2-16

5.06%

5.31% 5.35% 5.31%

5.43%

$10.4 $10.8 $11.1 $11.2

$12.9

Q2-15 Q3-15 Q4-15 Q1-16 Q2-16

0.31% 0.30% 0.30% 0.31%

0.35%

$7.5 $7.5 $7.9 $8.4 $8.9 83.3% 83.3% 83.9% 78.9% 82.1%

12.3%

$12.4

Cash

Investments

Loans

Interest Bearing Deposits

15.4% 15.4%

$14.2

14.4%

$12.9 $13.3

6.3%

$15.7

4

4.4% 1.3% 0.7% 14.8%

3.5%

5

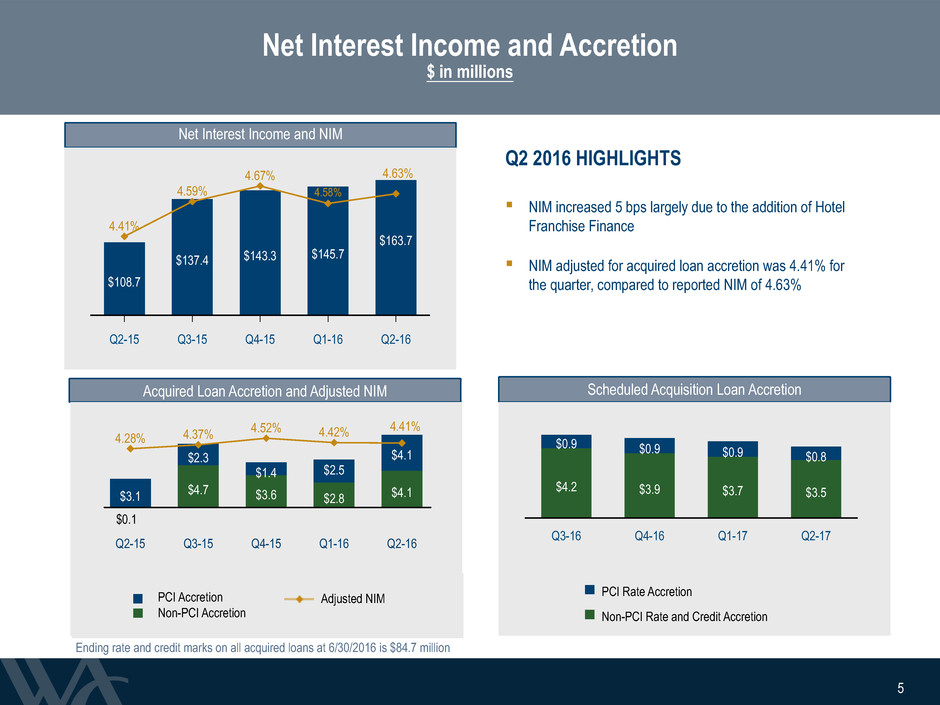

Net Interest Income and Accretion

$ in millions

Q2 2016 HIGHLIGHTS

▪ NIM increased 5 bps largely due to the addition of Hotel

Franchise Finance

▪ NIM adjusted for acquired loan accretion was 4.41% for

the quarter, compared to reported NIM of 4.63%

Net Interest Income and NIM

Acquired Loan Accretion and Adjusted NIM

Q2-15 Q3-15 Q4-15 Q1-16 Q2-16

4.41%

4.59%

4.67%

4.58%

$108.7

$137.4 $143.3 $145.7

$163.7

Non-PCI Accretion

PCI Accretion

Adjusted Net Interest Margin, excluding accretion

Q2-15 Q3-15 Q4-15 Q1-16 Q2-16

$4.7 $3.6 $2.8 $4.1$3.1

$2.3

$1.4 $2.5

$4.1

4.28% 4.37%

4.52% 4.42%

Scheduled Acquisition Loan Accretion

Non-PCI Rate and Credit Accretion

PCI Rate Accretion

Q3-16 Q4-16 Q1-17 Q2-17

$4.2 $3.9 $3.7 $3.5

$0.9 $0.9 $0.9 $0.8

$0.1

Ending rate and credit marks on all acquired loans at 6/30/2016 is $84.7 million

PCI Accretion

Non-PCI Accretion

PCI Rate Accretion

Non-PCI Rate and Credit Accretion

Adjusted NIM

5

4.63%

4.41%

6

Q2-15 Q3-15 Q4-15 Q1-16 Q2-16

$32.4 $43.7 $41.2

$44.9 $44.7

$7.2

$9.3 $9.8 $9.6 $10.2$7.3

$8.4 $10.5 $10.1 $11.6$7.7

$10.8 $11.3 $11.2 $11.3

Operating Expenses and Efficiency

$ in millions

Q2 2016 HIGHLIGHTS

▪ The Efficiency Ratio decreased to 43.0% as revenue

growth outpaced expense growth

▪ Data Processing expenses increased due to interim

servicing costs related to Hotel Franchise Finance and

to support growth in customer base

Operating Expenses and Efficiency Ratio

Breakdown of Operating Expenses

Other

Professional Fees + Data Processing

Occupancy + Insurance

Compensation

Q2-15 Q3-15 Q4-15 Q1-16 Q2-16

44.7%

46.8%

45.2% 45.6%

43.0%

$54.6

$72.2 $72.8 $75.8 $77.8

6

7

Operating Pre-Provision Net Revenue, Net Income, and ROA

$ in millions

Operating Pre-Provision Net Revenue and ROA

Q2-15 Q3-15 Q4-15 Q1-16 Q2-16

$59.7

$73.7 $79.9

$82.1

$94.5

2.14% 2.16%

2.28% 2.27%

2.37%

Q2-15 Q3-15 Q4-15 Q1-16 Q2-16

$39.5

$55.9 $58.5 $61.3 $61.6

1.41%

1.64% 1.67% 1.70%

1.55%

▪ Operating Pre-Provision Net Revenue and ROA rose from the prior quarter due to an increase in income from Hotel

Franchise Finance

▪ ROA decreased from the prior quarter due to Acquisition / Restructure Expense and an increase in Income Tax Expense

Net Income and ROA

7

8

Consolidated Balance Sheet

$ in millions, except per share data

▪ Total Loans increased $1.64 billion

(14.6%) over prior quarter and $2.52

billion (24.3%) over prior year with $1.26

billion attributable to Hotel Franchise

Finance and the remainder due to

organic growth

▪ Deposits increased $1.12 billion (8.6%)

over prior quarter and $2.79 billion

(24.5%) over prior year

▪ Borrowings increased $174 million due

to issuance of long-term sub debt

▪ Shareholders' Equity increased $136

million as a result of net income and

ATM common stock issuances

▪ Tangible Book Value/Share increased

$1.09 (8.3%) over prior quarter and

$3.00 (26.7%) over prior year

Q2 2016 HIGHLIGHTSQ2-16 Q1-16 Q2-15

Cash & Investments $ 2,959 $ 3,131 $ 2,290

Total Loans 12,878 11,241 10,361

Allowance for Credit Losses (122) (119) (115)

Other Assets 1,014 995 934

Total Assets $ 16,729 $ 15,248 $ 13,470

Deposits $ 14,201 $ 13,082 $ 11,407

Borrowings 421 247 378

Other Liabilities 311 259 170

Total Liabilities $ 14,933 $ 13,588 $ 11,955

Shareholders' Equity 1,796 1,660 1,515

Total Liabilities and Equity $ 16,729 $ 15,248 $ 13,470

Tangible Book Value Per Share $ 14.25 $ 13.16 $ 11.25

8

9

Loan Growth and Portfolio Composition

$ in millions

Q2 2016 HIGHLIGHTS

▪ Quarter-over-quarter loan

growth driven by two loan

categories:

- CRE, Non-OO $1.31 billion

(HFF $1.22 billion)

- C&I $199 million

- Construction & Land $154

million (HFF $42 million)

▪ Year-over-year loan growth

driven by three loan categories:

- CRE, Non-OO $1.39 billion

(HFF $1.22 billion)

- C&I $817 million

- Construction & Land $331

million (HFF $42 million)

$2.52 BILLION YEAR-OVER-YEAR GROWTH

Q2-15 Q3-15 Q4-15 Q1-16 Q2-16

$4,765 $4,964 $5,267 $5,383

$5,582

$2,039 $2,144

$2,103 $2,052 $2,027

$2,209 $2,211

$2,283 $2,291

$3,601$1,003

$1,122 $1,133

$1,180

$1,334

$345

$347

$350 $336

$335

3.3%

19.7%

21.3%

46.0%

9.7%

2.6%

15.7%

28.0%

43.3%

10.4%

Growth

Residential and

Consumer

Construction &

Land

CRE, Non-Owner

Occupied

CRE, Owner

Occupied

Commercial &

Industrial

$10,361

$10,788

+427

$11,136

+348

$11,241

+105

$12,878

+1,637

9

10

AZ: 18%

CA: 39%NV: 15%

Other: 28%

AZ: 18%

CA: 14%

NV: 68%

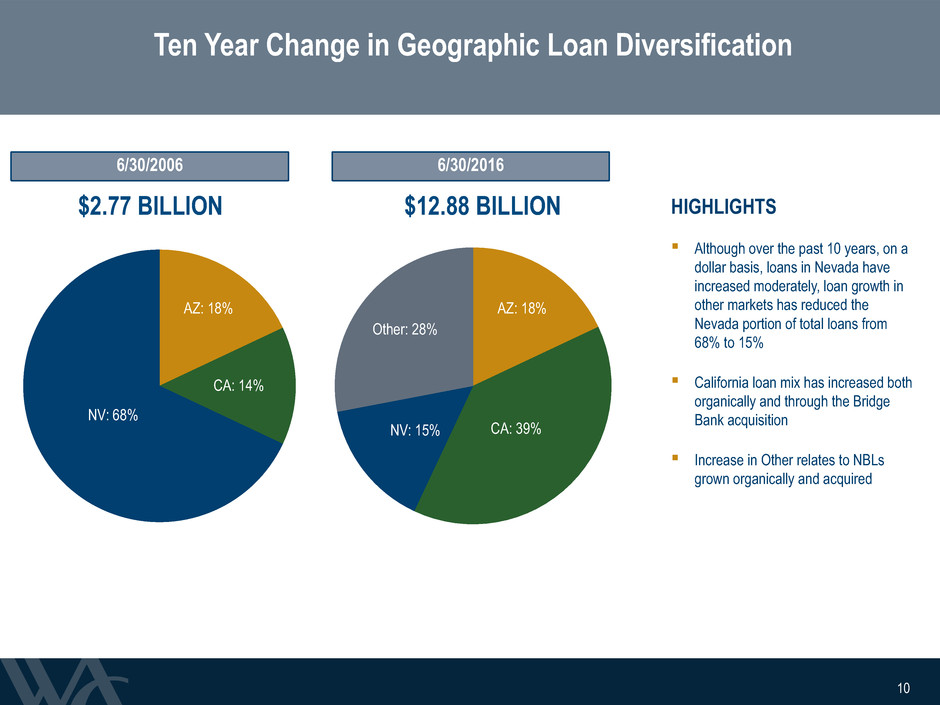

Ten Year Change in Geographic Loan Diversification

6/30/2006 6/30/2016

10

$2.77 BILLION $12.88 BILLION

▪ Although over the past 10 years, on a

dollar basis, loans in Nevada have

increased moderately, loan growth in

other markets has reduced the

Nevada portion of total loans from

68% to 15%

▪ California loan mix has increased both

organically and through the Bridge

Bank acquisition

▪ Increase in Other relates to NBLs

grown organically and acquired

HIGHLIGHTS

11

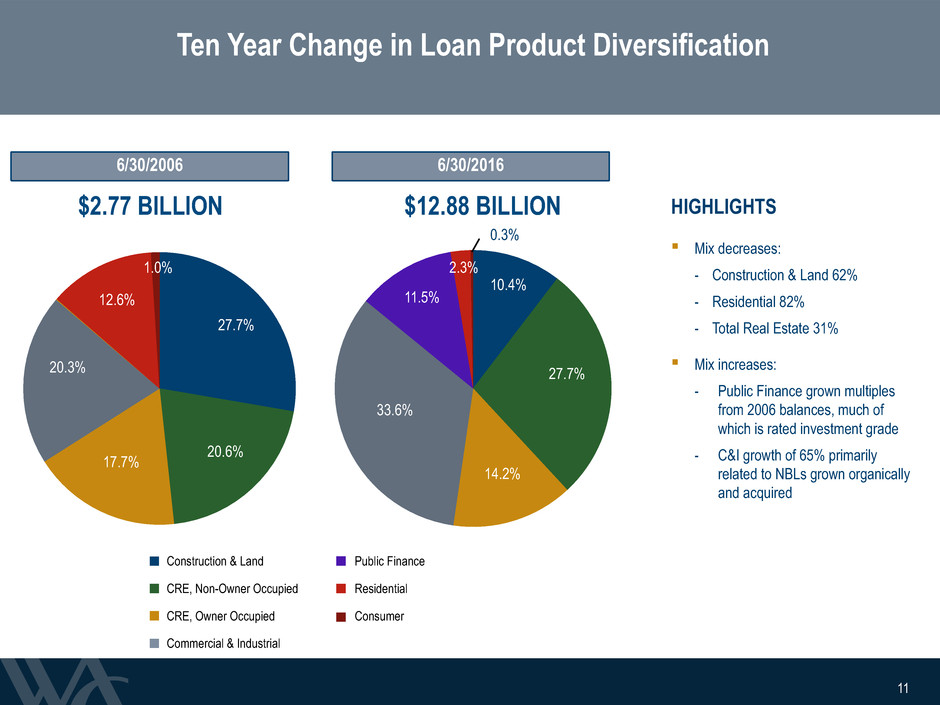

Ten Year Change in Loan Product Diversification

6/30/2006 6/30/2016

11

▪ Mix decreases:

- Construction & Land 62%

- Residential 82%

- Total Real Estate 31%

▪ Mix increases:

- Public Finance grown multiples

from 2006 balances, much of

which is rated investment grade

- C&I growth of 65% primarily

related to NBLs grown organically

and acquired

HIGHLIGHTS

Construction & Land Public Finance

CRE, Non-Owner Occupied Residential

CRE, Owner Occupied Consumer

Commercial & Industrial

27.7%

20.6% 17.7%

20.3%

12.6%

1.0%

10.4%

27.7%

14.2%

33.6%

11.5%

2.3%

0.3%

$2.77 BILLION $12.88 BILLION

12

Q2-15 Q3-15 Q4-15 Q1-16 Q2-16

$3,924 $4,077 $4,094 $4,635

$5,275

$1,001 $1,024 $1,028

$1,088

$1,278

$4,734 $4,673

$5,297

$5,651

$6,006

$1,747 $1,836

$1,611

$1,708

$1,642

Deposit Growth and Composition

$ in millions

Q2 2016 HIGHLIGHTS

▪ Quarter-over-quarter deposit

growth driven by two deposit

categories:

- Non-Int Bearing DDA $640

million

- Savings & MMDA $355

million

▪ Year-over-year deposit growth

driven by two deposit

categories:

- Non-Int Bearing DDA $1.35

billion

- Savings & MMDA $1.27

billion

8.8%

15.3%

34.4%

41.5%

9.0%

11.6%

37.1%

42.3%

$2.79 BILLION YEAR-OVER-YEAR GROWTH

CDs

Savings &

MMDA

NOW

Non-Interest

Bearing DDA

Growth $12,030

+420$11,610

+203 $11,407

$13,082

+1,052

$14,201

+1,119

12

13

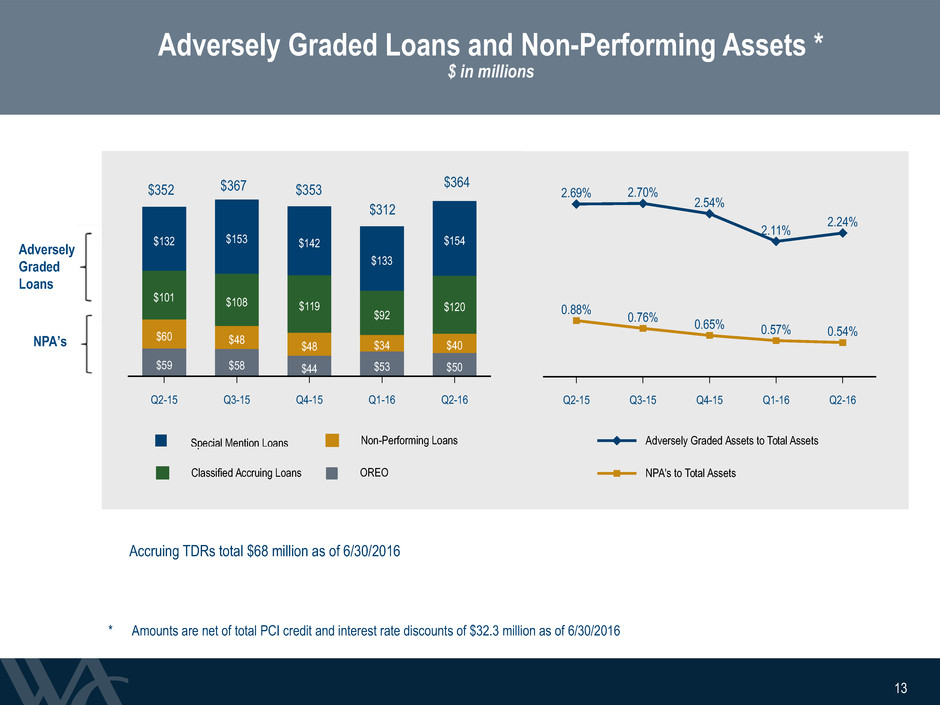

Adversely Graded Assets to Total Assets

NPA's to Total Assets

Q2-15 Q3-15 Q4-15 Q1-16 Q2-16

2.69% 2.70%

2.54%

2.11% 2.24%

0.88% 0.76% 0.65% 0.57% 0.54%

OREO Non-Performing Loans

Classified Accruing Loans Special Mention Loans

Q2-15 Q3-15 Q4-15 Q1-16 Q2-16

$59 $58 $44 $53 $50

$60 $48 $48 $34 $40

$101 $108 $119

$92 $120

$132 $153 $142

$133

$154

Adversely Graded Loans and Non-Performing Assets *

$ in millions

NPA’s

Adversely

Graded

Loans

$312

Accruing TDRs total $68 million as of 6/30/2016

$352 $367 $353 $364

* Amounts are net of total PCI credit and interest rate discounts of $32.3 million as of 6/30/2016

13

Special Mention Loans

OREO

14

Hotel Franchise Finance Purchase

$ in millions

* Purchase accounting adjustments are preliminary as of 6/30/2016 and

are subject to measurement period adjustments.

HFF Purchase Accounting Adjustments *

$36.0

$3.6

$11.9 $6.1

14

Non-PCI PCI

Rate Credit Rate Credit Unfunded

Reserve

$3.2

$0.5

$3.7

$0.9

$0.7

$0.7

▪ The purchase of GE's domestic select-service Hotel Franchise

Finance (HFF) loan portfolio closed on April 20, 2016

▪ At acquisition, HFF portfolio consisted of loans with an

outstanding principal balance of $1.34 billion

- Portfolio consisted of CRE Non-OO loans (94%) and

Construction loans (6%)

- All loans are performing

- 96% of loans rated pass, 4% ($54 million) rated special

mention or classified accruing

▪ Loans were recorded net of rate and credit marks totaling $60

million

- Non-PCI rate and credit marks will be accreted over a

weighted avg term of approximately 3.75 years

- PCI rate marks will be accreted over a weighted avg

term of approximately 4.25 years

- An reserve for unfunded commitments of $7.0 million

was also recorded

▪ Total purchase price was $1.27 billion, representing a 5%

discount ($67 million) to outstanding balances

▪ Preliminary fair value adjustments total $67 million, resulting in

preliminary goodwill of $0.2 million

▪ Loans expected to be integrated into our platform by end of Q3

Construction

CRE, Non-Owner Occupied

15

Gross Charge-Offs Recoveries

Q2-15 Q3-15 Q4-15 Q1-16 Q2-16

$8.0

$(5.0) $(3.1) $(5.7)

Charge-Offs, Recoveries, ALLL, and Provision

$ in millions

Gross Charge-Offs and (Recoveries)

Net (Recoveries) / Charge-Offs and Rate

ALLL+CD/Total Loans Loan Loss Provision

ALLL/Total Loans

Q2-15 Q3-15 Q4-15 Q1-16 Q2-16

1.35% 1.32% 1.25% 1.21%

1.42%

$0.0 $0.0 $2.5 $2.5 $2.5

1.11% 1.09% 1.07% 1.06% 0.95%

Net Charge-Offs (Recoveries)

Net Charge-Off (Recovery) Rate

Q2-15 Q3-15 Q4-15 Q1-16 Q2-16

$2.3

(0.13)% (0.08)%

0.08%

(0.01)%

ALLL and Credit Discounts

ALLL Credit Discounts

Q2-15 Q3-15 Q4-15 Q1-16 Q2-16

$115 $117 $119 $119 $122

$25 $26 $21 $16

$62

Provision for Credit Losses and ALLL Ratios

15

Credit Discounts

(CD)

ALLL

$(2.0)

$0.5

$(3.0)

$(0.4)

0.02%

$2.0 $1.1 $2.5 $1.5

$(2.0) $(1.8)

16

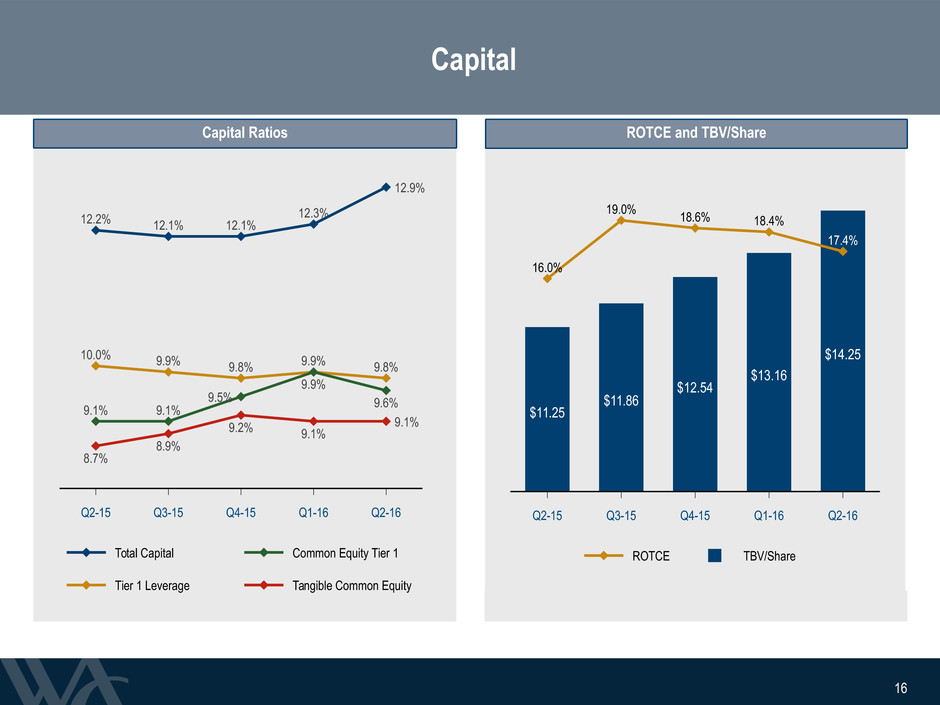

ROTCE TBV/Share

Q2-15 Q3-15 Q4-15 Q1-16 Q2-16

16.0%

19.0% 18.6% 18.4%

17.4%

$11.25

$11.86

$12.54

$13.16

$14.25

Capital

Total Capital Common Equity Tier 1

Tier 1 Leverage Tangible Common Equity

Q2-15 Q3-15 Q4-15 Q1-16 Q2-16

12.2% 12.1% 12.1%

12.3%

12.9%

9.1% 9.1%

9.5%

9.9%

9.6%

10.0% 9.9% 9.8% 9.9% 9.8%

8.7%

8.9%

9.2% 9.1%

9.1%

Capital Ratios ROTCE and TBV/Share

16

17

Outlook 3rd Quarter 2016

▪ Loan and Deposit Growth

▪ Interest Margin

▪ Operating Efficiency

▪ Asset Quality

17

18

Forward-Looking Statements

This presentation contains contains forward-looking statements that relate to expectations, beliefs, projections, future plans and

strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. Examples of forward-

looking statements include, among others, statements we make regarding our expectations with regard to our business, financial and

operating results, and future economic performance, including our recent domestic select-service hotel franchise finance loan portfolio

acquisition. The forward-looking statements contained herein reflect our current views about future events and financial performance

and are subject to risks, uncertainties, assumptions and changes in circumstances that may cause our actual results to differ significantly

from historical results and those expressed in any forward-looking statement. Some factors that could cause actual results to differ

materially from historical or expected results include, among others: the risk factors discussed in the Company’s Annual Report on

Form 10-K for the year ended December 31, 2015 as filed with the Securities and Exchange Commission; changes in general economic

conditions, either nationally or locally in the areas in which we conduct or will conduct our business; inflation, interest rate, market and

monetary fluctuations; increases in competitive pressures among financial institutions and businesses offering similar products and

services; higher defaults on our loan portfolio than we expect; changes in management’s estimate of the adequacy of the allowance

for credit losses; legislative or regulatory changes or changes in accounting principles, policies or guidelines; supervisory actions by

regulatory agencies which may limit our ability to pursue certain growth opportunities, including expansion through acquisitions;

additional regulatory requirements resulting from our continued growth; management’s estimates and projections of interest rates and

interest rate policy; the execution of our business plan; and other factors affecting the financial services industry generally or the banking

industry in particular.

Any forward-looking statement made by us in this presentation is based only on information currently available to us and speaks

only as of the date on which it is made. We do not intend and disclaim any duty or obligation to update or revise any industry information

or forward-looking statements, whether written or oral, that may be made from time to time, set forth in this presentation to reflect new

information, future events or otherwise.

18