Attached files

| file | filename |

|---|---|

| EX-99.1 - JOY GLOBAL INC | pressrelease.htm |

| EX-2.1 - JOY GLOBAL INC | mergeragreement.htm |

| 8-K - JOY GLOBAL INC | body.htm |

Exhibit 99.2

Agreement To Be Acquired By Komatsu in All-Cash Transaction with an Enterprise Value of $3.7 Billion 21 July 2016

Important additional information will be filed with the SEC Additional Information and Where to Find It Joy Global Inc. (“Joy Global”) intends to file with the SEC a proxy statement in connection with the contemplated transactions. The definitive proxy statement will be sent or given to Joy Global stockholders and will contain important information about the contemplated transactions. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE. Investors and security holders may obtain a free copy of the proxy statement (when it is available) and other documents filed with the SEC at the SEC's website at www.sec.gov. Certain Information Concerning Participants Joy Global and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Joy Global investors and security holders in connection with the contemplated transactions. Information about Joy Global’s directors and executive officers is set forth in its proxy statement for its 2016 Annual Meeting of Stockholders and its most recent annual report on Form 10-K. These documents may be obtained for free at the SEC's website at www.sec.gov. Additional information regarding the interests of participants in the solicitation of proxies in connection with the contemplated transactions will be included in the proxy statement that Joy Global intends to file with the SEC. Cautionary Statement Regarding Forward-Looking InformationThis communication contains forward-looking information about Joy Global, Komatsu Limited and Komatsu America Corporation and the proposed transaction. Forward-looking statements are statements that are not historical facts. These statements can be identified by the use of forward-looking terminology such as "believe," "expect," "may," "will," "should," "project," "could," "plan," "goal," "potential," "pro forma," "seek," "intend" or "anticipate" or the negative thereof or comparable terminology, and include discussions of strategy, financial projections, guidance and estimates (including their underlying assumptions), statements regarding plans, objectives, expectations or consequences of announced transactions, and statements about the future performance, operations, products and services of Joy Global and its subsidiaries. Joy Global cautions readers not to place undue reliance on these statements. These forward-looking statements are subject to a variety of risks and uncertainties. Consequently, actual results and experience may materially differ from those contained in any forward-looking statements. Such risks and uncertainties include the following: the failure to obtain Joy Global stockholder approval of the proposed transaction; the possibility that the closing conditions to the contemplated transactions may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant a necessary regulatory approval; delay in closing the transaction or the possibility of non-consummation of the transaction; the potential for regulatory authorities to require divestitures in connection with the proposed transaction; the occurrence of any event that could give rise to termination of the merger agreement; the risk that stockholder litigation in connection with the contemplated transactions may affect the timing or occurrence of the contemplated transactions or result in significant costs of defense, indemnification and liability; risks inherent in the achievement of cost synergies and the timing thereof; risks related to the disruption of the transaction to Joy Global and its management; the effect of announcement of the transaction on Joy Global’s ability to retain and hire key personnel and maintain relationships with customers, suppliers and other third parties; fluctuations in the availability and prices of commodities; difficult global economic and capital markets conditions; risks associated with revenues from foreign markets; interruption, failure or compromise of Joy Global’s information systems; and changes in the legal and regulatory environment. These risks and others are described in greater detail in Joy Global’s Annual Report on Form 10-K for the fiscal year ended October 30, 2015, as well as in Joy Global’s Quarterly Reports on Form 10-Q and other documents filed by Joy Global with the SEC after the date thereof. Joy Global makes no commitment to revise or update any forward-looking statements in order to reflect events or circumstances occurring or existing after the date any forward-looking statement is made.

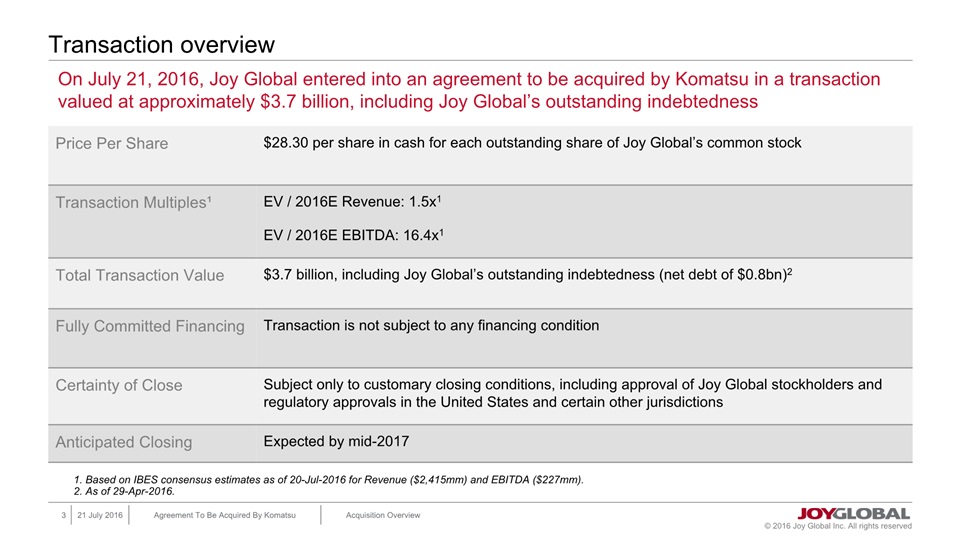

Transaction overview Price Per Share $28.30 per share in cash for each outstanding share of Joy Global’s common stock Transaction Multiples¹ EV / 2016E Revenue: 1.5x1 EV / 2016E EBITDA: 16.4x1 Total Transaction Value $3.7 billion, including Joy Global’s outstanding indebtedness (net debt of $0.8bn)2 Fully Committed Financing Transaction is not subject to any financing condition Certainty of Close Subject only to customary closing conditions, including approval of Joy Global stockholders and regulatory approvals in the United States and certain other jurisdictions Anticipated Closing Expected by mid-2017 On July 21, 2016, Joy Global entered into an agreement to be acquired by Komatsu in a transaction valued at approximately $3.7 billion, including Joy Global’s outstanding indebtedness 1. Based on IBES consensus estimates as of 20-Jul-2016 for Revenue ($2,415mm) and EBITDA ($227mm). 2. As of 29-Apr-2016.

Compelling offer for Joy Global shareholders Provides Joy Global shareholders with substantial certain cash value of $28.30 per shareOffers an attractive premium to Joy Global shareholders:Premium to 90-day VWAP of 48%Premium to 60-day VWAP of 41%Transaction represents highly attractive acquisition multiples$28.30 offer is $8.30 above the median of research analysts’ 12-month target prices for Joy Global of $20.00 per share Delivers significant premium and cash certainty 1. Based on LTM financials as of April 2016; LTM Revenue of $2,786mm and Adjusted EBITDA of $317mm. See reconciliation for LTM figures in the appendix. 2. Based on IBES consensus estimates as of 20-Jul-2016 for Revenue ($2,415mm) and EBITDA ($227mm). LTM FYQ2 2016¹ FY2016E² EV / Revenue 1.3x 1.5x EV / Adj. EBITDA 11.7x 16.4x

Update on market environment In recent years, Joy Global has implemented strategic and operational measures to redefine its business in light of challenging end market conditionsExpanded positions in underground hard rockEnhanced product range and direct service network Implemented optimization plans to increase operational efficiencies across the organizationDespite recent positive movements in commodity prices, our industry continues to face prolonged headwinds and challenging market conditions are likely to persistCommodity prices remain near multi-year lowsSupply curtailments are offset by weak end-user demand and excess unused equipment Customers are focused on reducing capexU.S. coal industry is under increasing pressure and undergoing structural changesDespite continued decline in US coal production, inventories are increasing as export opportunities are limitedCoal-fired electricity is falling and natural gas-fired generation is expected to exceed coal in 2016Increasing focus on environmental standards globally accelerates shift to renewable energy sourcesIn this environment, our customers are intently focused on productivity and demand cost effective and innovative solutions powered by advanced analytics systems on a global basis which creates advantages for larger, more diversified and global companies to win in this increasingly challenging industry

A better combination for Joy Global’s stakeholders Komatsu will retain the Joy Global brand names and will operate as a separate businessKomatsu has stated its commitment to the long-term growth of Joy GlobalThe combined company will be better positioned to compete in the marketplace A mutual commitment to innovation, operational excellence, and social and environmental responsibility EmployeesAccess to more opportunities as part of a larger, stronger organization CustomersRight partnership to meet the evolving needs of customers Share fundamental strategies of direct sales and serviceOptimizing customer operations by using connected data systems, analytics and automationFocus on pursuit of zero harm, maximizing productivity and reducing lifecycle costs for our customersOffer a broader line of full-system surface solutions A stronger financial position will enable more flexibility and greater access to capital for future growth

Appendix: Non-GAAP Reconciliation

Transaction reconciliation Offer Price per Share $ 28.30 Joy Global Diluted Shares Outstanding (in millions) 101 Implied Fully Diluted Equity Value $ 2.9 A Bank Debt (as of 29-Apr-2016) $850 Revolving Credit Facility - Term Loan Due 2019 $ 0.4 Bonds (as of 29-Apr-2016) 5.125 % Senior Notes due 2021 $ 0.5 6.625 % Senior Notes due 2036 0.1 Total Debt $ 1.0 B Less: Cash & Cash Equivalents (as of 29-Apr-2016) $(0.2) C Net Debt $ 0.8 D (= B + C) Total Implied Enterprise Value (EV) $ 3.7 A + D EV / LTM Sales¹ 1.3 x EV / LTM Adjusted EBITDA¹ 11.7 x 1. LTM Period ending 29-Apr-2016. See next page for LTM Reconciliation. Note: Figures are in billions, except per share data

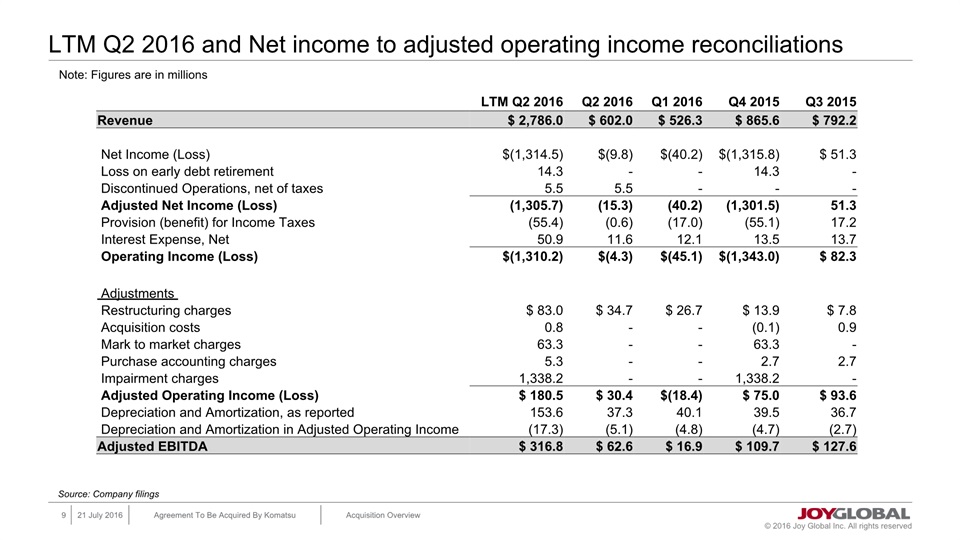

LTM Q2 2016 and Net income to adjusted operating income reconciliations LTM Q2 2016 Q2 2016 Q1 2016 Q4 2015 Q3 2015 Revenue $ 2,786.0 $ 602.0 $ 526.3 $ 865.6 $ 792.2 Net Income (Loss) $(1,314.5) $(9.8) $(40.2) $(1,315.8) $ 51.3 Loss on early debt retirement 14.3 - - 14.3 - Discontinued Operations, net of taxes 5.5 5.5 - - - Adjusted Net Income (Loss) (1,305.7) (15.3) (40.2) (1,301.5) 51.3 Provision (benefit) for Income Taxes (55.4) (0.6) (17.0) (55.1) 17.2 Interest Expense, Net 50.9 11.6 12.1 13.5 13.7 Operating Income (Loss) $(1,310.2) $(4.3) $(45.1) $(1,343.0) $ 82.3 Adjustments Restructuring charges $ 83.0 $ 34.7 $ 26.7 $ 13.9 $ 7.8 Acquisition costs 0.8 - - (0.1) 0.9 Mark to market charges 63.3 - - 63.3 - Purchase accounting charges 5.3 - - 2.7 2.7 Impairment charges 1,338.2 - - 1,338.2 - Adjusted Operating Income (Loss) $ 180.5 $ 30.4 $(18.4) $ 75.0 $ 93.6 Depreciation and Amortization, as reported 153.6 37.3 40.1 39.5 36.7 Depreciation and Amortization in Adjusted Operating Income (17.3) (5.1) (4.8) (4.7) (2.7) Adjusted EBITDA $ 316.8 $ 62.6 $ 16.9 $ 109.7 $ 127.6 Source: Company filings Note: Figures are in millions