Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Centric Brands Inc. | a16-15149_18k.htm |

Exhibit 99.1

[LOGO]

DISCLAIMER Forward-Looking Statements This slide presentation and the accompanying oral presentation of Differential Brands Group, Inc. (“Differential”) may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These forward-looking statements involve Differential’s plans, objectives, goals, strategies, expectations, estimates, forecasts and projections relating to Differential’s future operations, including its projected results of operations, performance and product developments, organic growth, retail revenues and total revenues. These forward-looking statements are based on management’s beliefs and assumptions and projections of future results or trends. You should be aware of the speculative nature of “forward-looking statements” and other statements that are not historical in nature, including those that include the words “anticipate”, “estimate”, “plan”,“ project”, “continuing”, “ongoing”, “target”, “aim”, “expect”, “believe”, “intend”, “may”, “will”, “would”, “should”, “could”, “seek”, “potential” or the negative of those words and other comparable words. Our actual results could differ materially from those stated or implied in forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, general economic, market or business conditions; the impact of Differential’s acquisition of the Robert Graham and Hudson businesses on Differential’s business; changes in Differential’s competitive position or competitive actions by other companies; Differential’s ability to maintain strong relationships with its licensees; Differential’s ability to retain key personnel; Differential’s ability to achieve and/or manage growth and to meet target metrics associated with such growth; Differential’s ability to successfully attract new brands; Differential’s ability to identify suitable targets for acquisitions; Differential’s ability to obtain financing for the acquisitions on commercially reasonable terms; Differential’s ability to integrate successfully the new acquisitions into its ongoing business, including those of the Robert Graham and Hudson businesses; the ability to achieve the anticipated results of these and other potential acquisitions; Differential’s ability to comply with government regulations; changes in laws or regulations or policies of federal and state regulators and agencies; and other circumstances beyond Differential’s control. All of the forward-looking statements made in this presentation are qualified by these cautionary statements, and there can be no assurance that the actual results anticipated will be realized or, if substantially realized, will have the expected consequences on Differential’s business or operations. These and other risks are discussed in detail in the periodic reports that Differential files with the Securities and Exchange Commission (the “SEC”), including the last annual report on Form 10-K and quarterly reports on Form 10-Q filed with the SEC. These forward-looking statements are made only as of the date hereof, and, except as required by applicable law, Differential undertakes no obligation to publish updates or revisions of any forward-looking statements, whether as a result of new information, future events or otherwise. It is not possible to predict or identify all risks and uncertainties to which Differential may be subject. Consequently, you should not consider such disclosures to be a complete discussion of all potential risks or uncertainties. This slide presentation includes certain financial projections, which are also forward-looking statements, relating to Differential and potential acquisitions. Although the Company believes the assumptions underlying such projections are reasonable, the reasonableness of these assumptions has not been independently passed upon. Nothing contained in the projections is, or should be relied upon, as a promise or representation as to the future results or prospects of Differential. Trade Names, Trademarks and Service Marks This presentation contains trade names, trademarks and service marks of other companies. We do not intend our use or display of other parties’ trade names, trademarks and service marks to imply a relationship with, or endorsement or sponsorship of, these other parties. Each trade name, trademark or service mark of any other company appearing in this presentation is the property of its respective holder.

OWN, OPERATE, AND MANAGE A DIVERSIFIED PORTFOLIO OF COMPLIMENTARY PREMIUM BRANDS THAT CONSUMERS ARE PASSIONATE ABOUT MISSION STATEMENT 3

COMPANY PHILOSOPHY 3-PART IDEOLOGY focus on organically growing our brands through a global, omni-channel distribution strategy: premium wholesale channels direct-to-consumer retail stores and e-commerce catalog and licensing while seeking opportunities to acquire accretive, complementary, premium brands

EXECUTIVE SUMMARY 5

On January 28th, consumer private equity group, Tengram Capital Partners (“Tengram”), sponsored a strategic restructuring of Joe’s Jeans, Inc. (NASDAQ: JOEZ) through the merger of Robert Graham and Hudson Jeans (1) This transaction transformed Joe’s into a new public platform, which was renamed Differential Brands Group Inc. (NASDAQ:DFBG or the “Company”), focusing on branded operating companies in the premium consumer space EXECUTIVE SUMMARY William Sweedler, seasoned consumer investor and leader, was named Chairman Hamish Sandhu, seasoned public company finance executive, was named CFO (1) RG Parent LLC was merged into Joe’s Jeans, Inc. (“Joe’s”), combining the Robert Graham and Hudson Jeans brands into one company. Michael Buckley, seasoned public company executive from branded apparel space, was named CEO

Strategic Investment Tengram Capital Partners Invests $50 Million at $11.16 a Share Balance Sheet Utilize a combination of cash, debt and stock to finance acquisitions Annual high-single-digit organic growth Margin Goals Achieve mid-teens EBITDA margins across the Company’s platform Maintain net leverage under 4.0x Rev/EBITDA Growth Goal of achieving $700 million in revenues by year 5 DELIVER 2021 MARCH 2016 OUR ROAD MAP 5 YEAR PLAN 3-4 accretive brand acquisitions Multiple acquisition candidates are currently being explored Growth Rate

CONSUMER PLATFORM WHITE SPACE OPPORTUNITY Differential aims to fill a void in the U.S. public market landscape by focusing exclusively on brands that offer high-end products for consumers shopping at premium retailers Additionally, Differential expects to offer its premium wholesale customers a unique, one-stop resource for their diverse in-store brand needs Luxury Premium Plus Distribution Department Store Mass Distribution Channel

During the month of July, Differential Brands Group Inc. completed the acquisition of Swims An aspirational footwear-based brand known for its playful, modern and innovative approach to stylish performance fashion The brand represents a concept of disruptive footwear, accessories, resort-wear and technical outerwear 1ST ACQUISITION

PLAYBOOK FOR GROWTH 10

Chief Executive Officer 20 Years Consumer Experience Michael Buckley PREFACE: PLAYBOOK FOR GROWTH STRONG LEADERSHIP TEAM Founder & President, Hudson 15 Years Consumer Experience Peter Kim Andrew Berg President, Robert Graham 18 Years Consumer Experience Hamish Sandhu Chief Financial Officer 10 Years Consumer Experience Bill Sweedler Chairman of the Board 25 Years Consumer Experience Alex Eskeland 19 Years Consumer Experience President, Swims

About Michael Buckley Over 30 years of experience driving value in apparel and accessories Michael Buckley CEO Michael Buckley has extensive and relevant experience in managing strong apparel brands. CEO of Differential Brands Group, CEO of Robert Graham since 2011 with experience managing in both domestic and international markets. He has developed a track record of success in the industry, having worked at premium brands like True Religion Apparel, Ben Sherman, and Diesel. Mr. Buckley, incorporating his ROI-driven management approach, has led the operational excellence at Robert Graham. Net sales and profitability have grown from 2011 to 2014. Prior to his role as CEO of Robert Graham, Mr. Buckley most recently held the position of President at True Religion Apparel (“TRA”). During his tenure sales increased from $100mm to more than $300mm. He expanded retail platform from 1 to 105 stores. Prior to joining True Religion, Mr. Buckley was the President of Ben Sherman and also the Vice President of Diesel where he spearheaded the retail development. PREFACE: STRONG SENIOR LEADERSHIP

PLAYBOOK FOR GROWTH CHAPTER 1: ORGANIC GROWTH Differential’s goal is to organically build its core businesses at a high single digit annual growth rate through the following strategies: WHOLESALE Expand brands products and SKUs marketed through existing wholesale accounts and opening brand-appropriate new accounts DIRECT-TO-CONSUMER OMNI-CHANNEL Activate the direct-to-consumer channels including: Retail E-commerce Catalog LICENSING NEW CATEGORIES Identify best-in-class licensing partners giving our brands significant opportunity to grow INTERNATIONAL EXPANSION Introduce premium brands with strong U.S. awareness in both mature and emerging markets, where they may have significant opportunity to grow 13

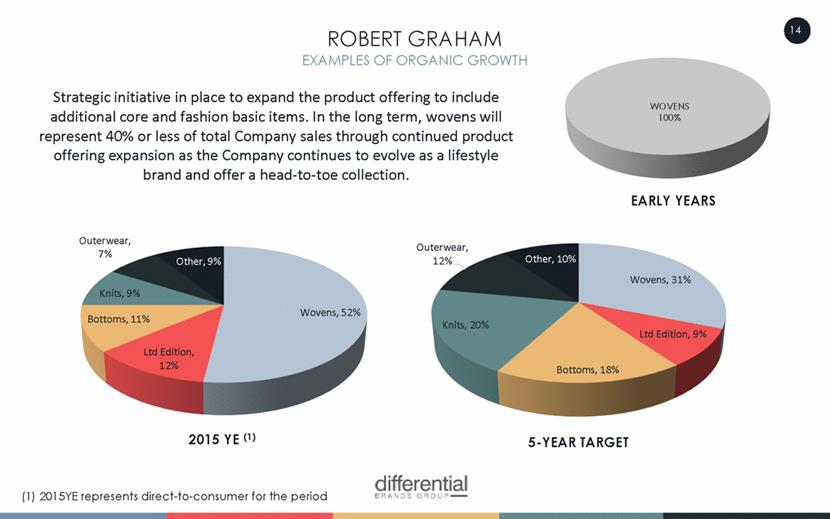

ROBERT GRAHAM EXAMPLES OF ORGANIC GROWTH Strategic initiative in place to expand the product offering to include additional core and fashion basic items. In the long term, wovens will represent 40% or less of total Company sales through continued product offering expansion as the Company continues to evolve as a lifestyle brand and offer a head-to-toe collection. EARLY YEARS 2015 YE (1) 5-YEAR TARGET (1) 2015YE represents direct-to-consumer for the period 14 WOVENS 100% Wovens, 52% Ltd Edition, 12% Bottoms, 11% Knits, 9% Outerwear, 7% Other, 9% Wovens, 31% Ltd Edition, 9% Bottoms, 18% Knits, 20% Outerwear, 12% Other, 10%

ROBERT GRAHAM EXAMPLES OF ORGANIC GROWTH 15 1,011 doors 800 domestic / 211 international 100 shop-in-shops currently 30 stores currently. Spring 2016 Circulation of 100,000 to house file Tailored Clothing/ Dress Shirts/Neckwear Belts/Wallets/ Small Leather Goods Headwear Hosiery Sunglasses & Optical Jewelry Footwear Fragrance Underwear/Loungewear Canadian Distributor WHOLESALE SHOP-IN-SHOP COMPANY-OWNED RETAIL 1.1M visits in 2015 Mobile/Tablet visits 58% AOV $344, UPT 1.8 E-COMMERCE CATALOG LICENSING DIRECT TO CONSUMER 15

PLAYBOOK FOR GROWTH CHAPTER 2: ACCRETIVE AQCUISITIONS We are actively pursuing an acquisitive strategy across the premium apparel, footwear and accessories categories We expect to target growing brands that: maintain premium positioning in their sector have a passionate consumer following have the ability to expand into new distribution channels and territories can support a high margin cohesive direct-to-consumer strategy (i.e., retail, ecommerce, catalog) bring a diversity of consumers, distribution channels and partners to Differential’s portfolio drive accretive growth to Differential’s platform Differential believes that it will be able to: leverage its operational expertise and relationships to drive incremental growth utilize its back-end platform to enhance margins Sector Premium apparel, footwear and accessories Revenue $70 – $100 million EBITDA $10 - $15 million Financing Structure Conservative use of leverage (3.0x – 4.0x) Balance funded by cash and DFBG stock ILLUSTRATIVE TARGET ACQUISITION PROFILE CRITERIA 16

PLAYBOOK FOR GROWTH The Company has been re-structured to create a streamlined back-end platform that is optimized around an infrastructure that provides guidance, SAVINGS, and expertise across non-branded critical back-end functions: Each individual brand remains true and unique to its brand DNA and the consumer experiences a seamless “front of curtain” experience on all branded touchpoints Creative, marketing and sales functions are aimed to be distinctly brand-specific and focused Employ a lean and efficient corporate back-office to create meaningful operating leverage across the divisions of the Company PREFACE: INFRASTRUCTURE LEVERAGE (Ecommerce/Catalog/Retail back-end, Finance, Distribution, IT, Legal, HR functions) CREATIVE, MARKETING, AND SALES FUNCTIONS CREATIVE, MARKETING, AND SALES FUNCTIONS CREATIVE, MARKETING, AND SALES FUNCTIONS CREATIVE, MARKETING, AND SALES FUNCTIONS CREATIVE, MARKETING, AND SALES FUNCTIONS CREATIVE, MARKETING, AND SALES FUNCTIONS 17

PORTFOLIO OVERVIEW 18

Products Apparel (5%) Bottoms (95%) Footwear (0%) Accessories (0%) Apparel (61%) Bottoms (22%) Footwear (3%) Accessories (14%) Apparel (11%) Bottoms (0%) Footwear (82%) Accessories (7%) Apparel (31%) Bottoms (53%) Footwear (9%) Accessories (7%) Gender Men (20%) Women (80%) Men (90%) Women (10%) Men (70%) Women (30%) Men (56%) Women (44%) Retail Pricing Sportswear ($125 - $220) Premium Denim ($155 - $260) Sportswear ($178 - $228) Denim ($168 - $228) Outerwear/Sport Coat ($298 - $698) Sportswear ($70 - $160) Footwear ($ 100 - $240) Accessories ($60 - $240) Outerwear/Other ($130 - $470) 2015P Retail Locations No retail currently 30 doors 10 franchise stores 1 company owned store 41 doors PORTFOLIO OVERVIEW CURRENT BRAND SUMMARIES OVERVIEW Robert Graham and Hudson are complementary brands from a distribution, product and end-customer standpoint 19

20

ROBERT GRAHAM Company Highlights High-growth, accessible luxury lifestyle brand known for its innovative styling, unique fabrics and exceptional workmanship Loyal and passionate consumer base with brand engagement Offers a cohesive lifestyle collection, including knits, polos, t-shirts, sweaters, sport coats, outerwear, jeans, pants, shorts, swimwear, sport shirts and accessories Multi-Channel Distribution 30 company-owned retail locations Growing e-commerce and catalog channels 1,011 productive wholesale doors globally Over 100 shop-in-shop locations Profitable, licensing channel Quick Facts Founded: 2001 Website: www.robertgraham.us REVENUE BY CHANNEL PRODUCT MIX 21 Wovens, 52% Ltd Edition, 12% Bottoms, 11% Knits, 9% Outerwear, 7% Other, 9% Wholesale, 57% Retail, 35% Ecommerce, 6 % Licensing, 2%

ROBERT GRAHAM POSITIONING Aspirational luxury with contemporary positioning that competes with global eclectic fashion brands Brand Heritage – sport shirts PREMIUM PRICE MODERATE PRICE CLASSIC CONTEMPORARY 22

NECKWEAR BLAZERS ROBERT GRAHAM BROADENING PRODUCT CLASSIFICATIONS WOVENS KNITS DENIM/BOTTOMS SWIM SWEATERS OUTERWEAR SOCKS/UNDERWEAR BAGS/LEATHER GOODS FOOTWEAR TAILORED CLOTHING FRAGRANCE 23

ROBERT GRAHAM CUSTOMER PROFILE GENDER MALE 90% FEMALE 10% AGE 25 – 35 8% 36 – 45 29% 46 –55 39% 56 – 65 17% 65+ 7% MARITAL STATUS MARRIED 68% SINGLE 14% DOMESTIC PARTNER 8% HAVE CHILDREN IN HOUSE 70% COLLEGE CHILDREN OR OLDER 65% EDUCATION COLLEGE EDUCATED 82% PROFESSIONAL DEGREES 21% HOME OWNERSHIP OWN HOMES 88% OWN SECONDARY HOMES 29% HOUSEHOLD INCOME $75 – $100k 13% $100 – $200k 39% $200 – $300k 20% $300 – $400k 9% $400 – $500k 5% $500k+ 12% ETHNICITY CAUCASIAN 78% AFRICAN AMERICAN 8% ASIAN 3% SPANISH / LATINO 7% WORK STATUS EMPLOYED FULL TIME 86% PART TIME 4% RETIRED 9% 24

25

HUDSON Company Highlights Denim-based lifestyle brand rooted in consumer aspiration and optimism Dedicated consumer following with strong celebrity support Well-regarded for innovative and high quality design work and superior fit; known for iconic back-flap pockets Multi-Channel Distribution Wholesale distribution through premium department stores and specialty apparel stores Prominent customers include Nordstrom, Bloomingdale’s, Saks and Neiman Marcus Growing ecommerce channel Quick Facts Founded: 2002 Website: www.hudsonjeans.com REVENUE BY CHANNEL PRODUCT MIX 26 Bottoms, 90% Apparel, 5% Accessories, 5% Wholesale, 94% Ecommerce, 5% Licensing, 1%

HUDSON POSITIONING Aspirational Luxury contemporary denim collection that competes with global denim based brands Brand Heritage – Denim jeans PREMIUM PRICE MODERATE PRICE CLASSIC CONTEMPORARY 27

HUDSON BROADENING PRODUCT CLASSIFICATIONS FASHION CLASSIC NOVELTY MEN MATERNITY TOPS/JACKETS KIDS 28 29% 17% 10% 8% 10% 9% 17% Fashion Classic Special Makeup Novelty Off-price Basic Replen Other

HUDSON CUSTOMER PROFILE GENDER FEMALE 80% MALE 20% AGE 18 – 24 19% 25 – 34 34% 35 – 44 23% 45 – 54 13% 55+ 11% MARITAL STATUS MARRIED 55% SINGLE 45% HOUSEHOLD INCOME UNDER $50K 21% $50 – $74K 18% $75 – $99K 16% $100 – $124K 11% $125K+ 35% HUDSON BRAND DNA “THE SIREN” EDGY / ROCKER FLARE DISTINCTIVE SUPERIOR FIT ICONIC BACK-FLAP POCKET TARGET: CASUAL FASHION ENTHUSIAST YOUNG, BUT MATURE METROPOLITAN FASHION FORWARD / IMAGE CONSCIOUS BRAND LOYAL (ALL PREMIUM, ALMOST ALL THE TIME) ALSO OWNS THEORY, J BRAND, GENETIC DENIM, 7 FOR ALL MANKIND, ALICE & OLIVIA, SHOSHANNA, MILLY, HAUTE HIPPIE, DVF 29

30

SWIMS Company Highlights Accessible premium concept brand known for its playful, modern and innovative approach to stylish performance fashion Loyal, attractive and engaging consumer base across all continents Offers a concept of disruptive footwear, accessories, resort-wear and technical outerwear Multi-Channel Distribution Fast growing, newly launched e-commerce channel 1,200 productive wholesale doors globally Represented in top WS-doors across Europe, North America, Latin America and Asia 10 Franchise SWIMS brand stores Quick Facts Founded: 2006 Website: www.swims.com 31 *2016 **Based on 2016 quantity 7% 73% 6% 9% 5% PRODUCT MIX** accessories footwear apparel galoshes outerwear 85% 10% 2% 3% REVENUE BY CHANNEL* Wholesale E-Commerce B2B Outlet Retail

SWIMS POSITIONING Affordable premium with contemporary positioning that competes with global functional fashion brands Brand Heritage – galoshes and loafers 32

GALOSHES NAUTICAL BOAT LOAFERS SWIMS BROADENING PRODUCT CLASSIFICATIONS ACCESSORIES OUTERWEAR BAGS PREMIUM LOAFERS TOPS CLASSIC LOAFERS SPORT TECH LOAFERS SWIMWEAR WINTER FOOTWEAR 33

URBAN EXPLORER SWIMS BROADENING PRODUCT CLASSIFICATIONS SUMMER CLASSICS MARINE TECH SPORT CITY LUX 34

SWIMS CUSTOMER PROFILE GENDER MALE 70% FEMALE 30% AGE 18 – 24 11% 25 – 34 39% 35 – 44 29% 45 –54 14% 55 – 64 5% 65+ 2% MARITAL STATUS MARRIED 53% SINGLE 47% EDUCATION HIGH SCHOOL 13% COLLEGE EDUCATED 71% PROFESSIONAL DEGREES 16% HOME OWNERSHIP * OWN HOMES 75% RENT HOMES 35% HOUSEHOLD INCOME * $30 – $100k 60% $100 – $150k 20% $150 – $250k 20% $250 – $350k 5% $350 – $500k 0% $500k+ 15% 35 * Based on US only

FINAL THOUGHTS 36

FUEL FOR GROWTH PRODUCT INNOVATION ACQUIRE ACCRETIVE, COMPLIMENTARY PREMIUM BRANDS INCREASE WHOLESALE DISTRIBUTION GROW DIRECT TO CONSUMER STORES, E-COMMERCE & CATALOG GARNER INTERNATIONAL APPEAL EXTEND ASSORTMENT THROUGH LICENSING

Strategic Investment Tengram Capital Partners Invests $50 Million at $11.17 a Share Balance Sheet Utilize a combination of cash, debt and stock to finance acquisitions Annual high-single-digit organic growth Margin Goals Achieve mid-teens EBITDA margins across the Company’s platform Maintain net leverage under 4.0x Rev/EBITDA Growth Goal of achieving $700 million in revenues by year 5 DELIVER 2021 MARCH 2016 OUR ROAD MAP 5 YEAR PLAN 3-4 accretive brand acquisitions Multiple acquisition candidates are currently being explored Growth Rate

DIFFERENTIAL BRANDS GROUP Q1 RESULTS Three months ended (in thousands) March 31, 2016 March 31, 2015 Net Sales $ 34,923 $ 18,948 Adjusted EBITDA (1) $ 3,962 $ 1,599 39 (1) Adjusted EBITDA excludes i) stock compensation expense, ii) operating loss related to the continued operation of certain Joe’s branded retail stores following the Merger until their closure on February 29, 2016, iii) expenses related to the lease termination for one Robert Graham retail store that will close in June 2016 iv) acquisition-and merger related costs related to legal, advisory, accounting services and other expenses and restructuring costs related to the Merger that are not representative of the Company’s day-to-day business.

THANK YOU differentialbrandsgroup.com