Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - BEASLEY BROADCAST GROUP INC | d220595dex991.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - BEASLEY BROADCAST GROUP INC | d220595dex21.htm |

| 8-K - FORM 8-K - BEASLEY BROADCAST GROUP INC | d220595d8k.htm |

| Exhibit 99.2

|

Acquisition of Greater Media, Inc.

BEASLEY BROADCAST GROUP, INC.

July 19, 2016

|

|

Disclaimer

Forward-Looking Statements

This presentation contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based upon current beliefs and expectations of Beasley Broadcast Group, Inc.’s (“Beasley”) management and are subject to known and unknown risks and uncertainties. Words or expressions such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates” “may,” “will,” “plans,” “projects,” “could,”

“should,” “would,” “seek,” “forecast,” or other similar expressions help identify forward-looking statements.

Factors that could cause actual events to differ include, but are not limited to: the risk that the transaction may not be completed; the ability of Beasley to obtain debt financing for the transaction; the ability to successfully combine the businesses of Beasley and Greater Media; the ability of Beasley to achieve the expected cost savings, synergies and other benefits from the proposed transaction within the expected time frames or at all; the incurrence of significant transaction and other related fees and costs; the incurrence of unexpected costs, liabilities or delays relating to the transaction; the risk that the public assigns a lower value to Greater Media’s business than the value used in negotiating the terms of the transaction; the effects of the transaction on the interests of Beasley’s current stockholders in the earnings, voting power and market value of the company; the risk that the transaction may not be accretive to Beasley’s current stockholders; the risk that the transaction may prevent Beasley from acting on future opportunities to enhance stockholder value; the impact of the issuance of the Class A common stock in connection with the transaction; the risk that any goodwill or identifiable intangible assets recorded due to the transaction could become impaired; the risk due to business uncertainties and contractual restrictions while the transaction is pending that could disrupt Beasley’s business; the risk that a closing condition to the proposed transaction may not be satisfied; the occurrence of any event, change or other circumstances that could give rise to the termination of the transaction; and other economic, business, competitive, and regulatory factors affecting the businesses of Beasley and Greater Media generally, including those set forth in Beasley’s filings with the SEC, including its annual reports on Form 10-K quarterly reports on Form 10-Q, current reports on Form 8-K, and other SEC filings.

Actual results, events and performance may differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Beasley undertakes no obligation to release publicly the result of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Important Additional Information

Beasley will file an Information Statement and other relevant documents concerning the proposed transaction and related matters with the Securities and Exchange

Commission (“SEC”). The Information Statement and other materials filed with the SEC will contain important information regarding the transaction and the issuance of Beasley’s Class A common stock in connection with the transaction. SHAREHOLDERS ARE ENCOURAGED TO READ THE INFORMATION STATEMENT AND OTHER MATERIALS THAT THE COMPANY FILES WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION, THE ISSUANCE OF THE SHARES OF CLASS A COMMON STOCK IN THE TRANSACTION AND RELATED MATTERS. You will be able to obtain the Information Statement, as well as other filings containing information about the Company, free of charge, at the website maintained by the SEC at www.sec.gov. Copies of the proxy statement and other filings made by the Company with the SEC can also be obtained, free of charge, by directing a request to Beasley Broadcast Group, Inc., 3033 Riviera Drive, Suite 200, Naples, Florida 34103, Attention: Corporate Secretary.

2

|

|

Strategic Rationale for the Greater Media Acquisition

Enhances Enables Beasley to be more competitive in certain markets

Ability to

Compete—Philadelphia, PA and Boston, MA

Diversifies geographic footprint and financial profile

Strengthens

- Adds four new attractive media markets

Diversification

- New markets have strong performance and cash flow generation

Meaningfully increases Beasley’s footprint

Increases

- Beasley is expected to jump from #17 ranked radio group to #9 ranked radio group in terms of revenue

Scale

- Pro forma 2015 revenue of $247 million

Attractive expected synergies from the transaction

Synergies—Combination synergies of approximately $7 million expected within 12 months of closing

- Opportunity for incremental synergies as integration is executed

Enhances On a pro forma annual basis, the acquisition transaction is expected to be accretive to EPS

Shareholder

Value Pro forma entity well positioned for continued growth

3

|

|

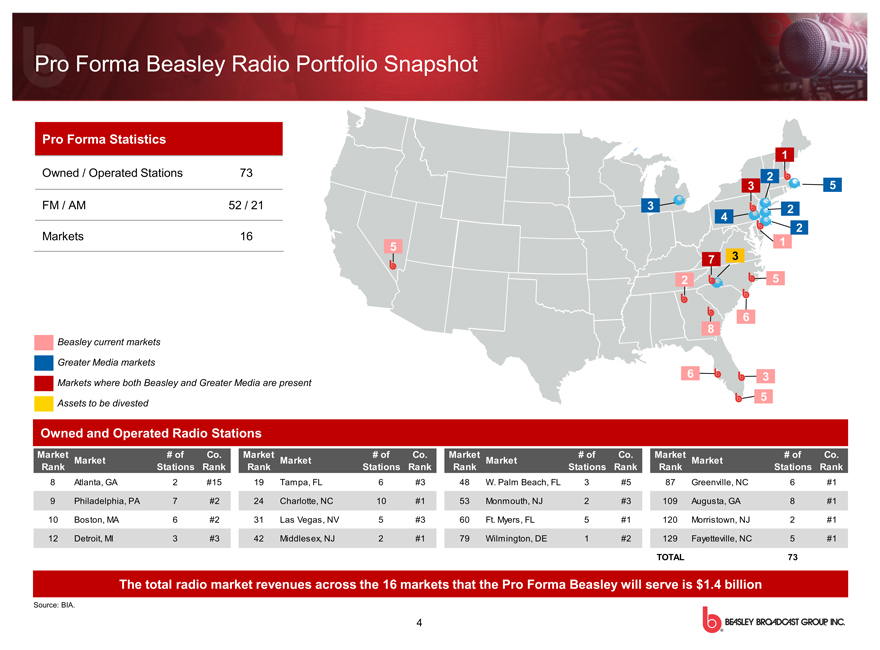

Pro Forma Beasley Radio Portfolio Snapshot

Pro Forma Statistics

1

Owned / Operated Stations 73

2

3 5

FM / AM 52 / 21 3 2

4

2

Markets 16

5 1

7 3

2 5

6 8

Beasley current markets

Greater Media markets

Markets where both Beasley and Greater Media are present 6 3

5

Assets to be divested

Owned and Operated Radio Stations

Market # of Co. Market # of Co. Market # of Co. Market # of Co. Market Market Market Market Rank Stations Rank Rank Stations Rank Rank Stations Rank Rank Stations Rank

8 Atlanta, GA 2 #15 19 Tampa, FL 6 #3 48 W. Palm Beach, FL 3 #5 87 Greenville, NC 6 #1

9 Philadelphia, PA 7 #2 24 Charlotte, NC 10 #1 53 Monmouth, NJ 2 #3 109 Augusta, GA 8 #1

10 Boston, MA 6 #2 31 Las Vegas, NV 5 #3 60 Ft. Myers, FL 5 #1 120 Morristown, NJ 2 #1

12 Detroit, MI 3 #3 42 Middlesex, NJ 2 #1 79 Wilmington, DE 1 #2 129 Fayetteville, NC 5 #1

TOTAL 73

The total radio market revenues across the 16 markets that the Pro Forma Beasley will serve is $1.4 billion

Source: BIA.

4

|

|

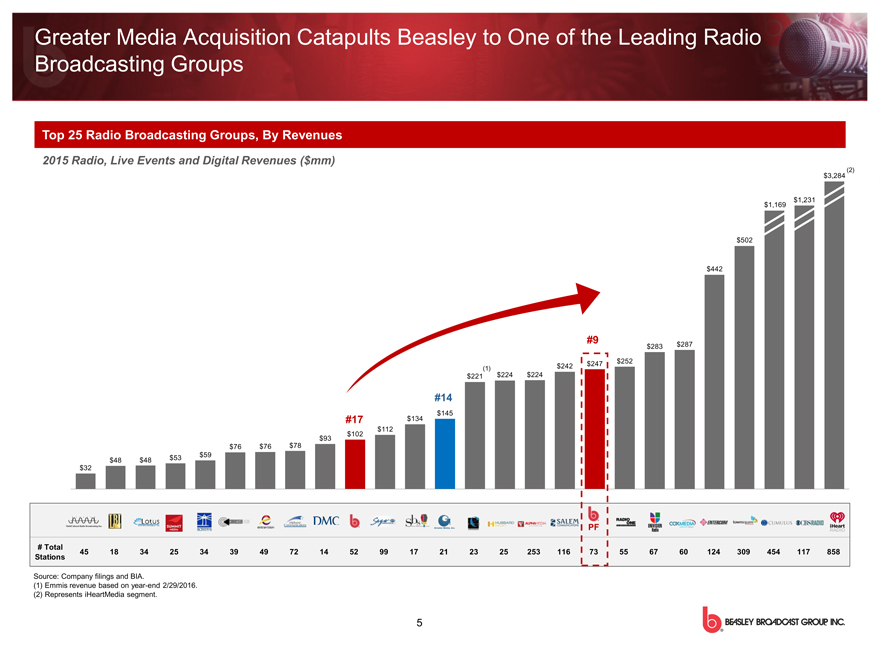

Greater Media Acquisition Catapults Beasley to One of the Leading Radio Broadcasting Groups

Top 25 Radio Broadcasting Groups, By Revenues

2015 Radio, Live Events and Digital Revenues ($mm)

$3,284 (2)

$1,231 $1,169

$502

$442

#9

$283 $287 $247 $252 (1) $242 $221 $224 $224

#14

$145 #17 $134 $112 $102 $93

$76 $76 $78

$53 $59

$48 $48 $32

PF

# Total

45 18 34 25 34 39 49 72 14 52 99 17 21 23 25 253 116 73 55 67 60 124 309 454 117 858 Stations

Source: Company filings and BIA.

(1) Emmis revenue based on year-end 2/29/2016. (2) Represents iHeartMedia segment.

5