Attached files

| file | filename |

|---|---|

| 8-K - 8-K - IDEX CORP /DE/ | iex-20160718x8k.htm |

Exhibit 99.1

For further information: TRADED: NYSE (IEX)

Investor Contact:

Heath Mitts

Senior Vice President and Chief Financial Officer

(847) 498-7070

MONDAY, JULY 18, 2016

IDEX REPORTS SECOND QUARTER EPS OF 99 CENTS; REAFFIRMS FULL YEAR

EPS GUIDANCE OF $3.70 -- $3.75

LAKE FOREST, IL, JULY 18 - IDEX Corporation (NYSE: IEX) today announced its financial results for the three month period ended June 30, 2016.

Second Quarter 2016 Highlights

• | Orders and sales were up 5 and 7 percent, respectively |

• | EPS of 99 cents was up 10 cents, or 11 percent |

• | Completed a $200 million private placement of senior notes |

• | Acquired AWG Fittings for €46 million on July 1st |

Second Quarter 2016

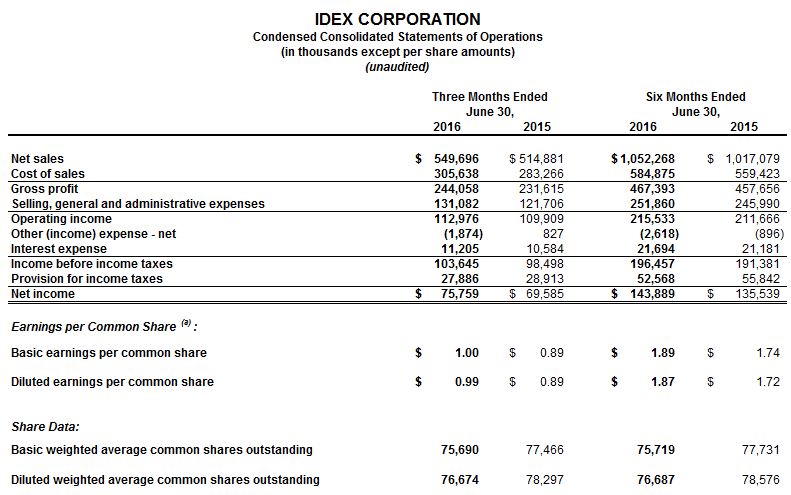

Orders of $529 million were up 5 percent (-2 percent organic, +8 percent acquisitions and -1 percent foreign currency translation) compared with the prior year period. Sales of $550 million were up 7 percent (-1 percent organic and +8 percent acquisitions) compared with the prior year period.

Gross margin of 44.4 percent was down 60 basis points from the prior year period, primarily due to a $3.6 million pre-tax inventory step-up charge related to the Akron Brass acquisition. Operating margin of 20.6 percent was down 70 basis points primarily due to the inventory step-up charge, partially offset by a $1.0 million pre-tax benefit from the reversal of the remaining contingent consideration related to a 2015 acquisition.

Operating income of $113 million drove EBITDA of $137 million which was 25 percent of sales and covered interest expense by more than 12 times.

Net income of $76 million increased 9 percent compared with the prior year period, while earnings per share of 99 cents increased 10 cents, or 11 percent, from the prior year period.

Cash from operations of $88 million resulted in free cash flow of $80 million which was 106 percent of net income.

“In the second quarter of 2016, orders and sales increased 5 and 7 percent, respectively. Our Water, Scientific Fluidics and Dispensing platforms continue to outperform, while the North American industrial market remains challenged compared with a year ago. Recently, we have seen signs that our North American industrial markets are stabilizing, and within our Energy platform large projects that had been delayed for several quarters shipped late in the second quarter. Operating margin of 20.6 percent decreased 70 basis points compared with the prior year period, mainly due to 60 basis points of pressure from the remaining fair value inventory step-up charge related to our Akron Brass acquisition. I’m very pleased with the team’s ability to execute in this difficult organic growth environment. | |

Total shareholder return remains our primary focus. In the first half of the year, we deployed over $270 million toward the strategic acquisitions of Akron Brass, and more recently, AWG. The addition of these two businesses to our fire and rescue operations establishes this platform as a global industry leader. Our acquisition pipeline is robust and we remain committed to investing in long-term organic growth opportunities, funding shareholder dividends and opportunistically repurchasing our stock. | |

Looking ahead, the long-term impact from the recent Brexit decision is relatively unknown, while the stabilization of the North American industrial market is encouraging. Considering these factors, along with the impact of incremental interest expense from our recent private placement and the expected impact from the AWG fair value inventory step-up charge, we are holding our prior EPS guidance of $3.70 to $3.75 for the full year, with EPS of 90 to 92 cents in the third quarter. For the full year, we expect flat organic growth with operating margin between 20.5 and 21.0 percent.” | |

Andrew K. Silvernail | |

Chairman and Chief Executive Officer | |

Second Quarter 2016 Segment Highlights

Fluid & Metering Technologies

• | Sales of $222 million reflected a 3 percent increase compared to the second quarter of 2015 (+1 percent organic and +2 percent acquisitions). |

• | Operating income of $54 million was $2 million higher than the prior year period, while operating margin of 24.3 percent represented a 20 basis point increase compared with the second quarter of 2015 primarily due to higher volume within our Energy platform. |

• | EBITDA of $61 million resulted in an EBITDA margin of 27.7 percent, a 50 basis point increase compared with the second quarter of 2015. |

Health & Science Technologies

• | Sales of $187 million reflected a 1 percent decrease compared to the second quarter of 2015 (-2 percent organic, +2 percent acquisitions and -1 percent foreign currency translation). |

• | Operating income of $41 million was $1 million lower than the prior year period, while operating margin of 22.0 percent represented a 30 basis point decrease compared with the second quarter of 2015 primarily due to lower volume in the more industrially-exposed portions of the segment. |

• | EBITDA of $53 million resulted in an EBITDA margin of 28.4 percent, a 90 basis point increase compared with the second quarter of 2015. |

Fire & Safety/Diversified Products

• | Sales of $142 million reflected a 27 percent increase compared to the second quarter of 2015 (-1 percent organic and +28 percent acquisition). |

• | Operating income of $34 million was $3 million higher than the prior year period, while operating margin of 24.1 percent represented a 400 basis point decrease compared with the second quarter of 2015 primarily due to the fair value inventory step-up charge related to the Akron Brass acquisition. |

• | EBITDA of $38 million resulted in an EBITDA margin of 26.9 percent, a 260 basis point decrease compared with the second quarter of 2015. |

For the second quarter of 2016, Fluid & Metering Technologies contributed 40 percent of sales, 42 percent of operating income and 40 percent of EBITDA; Health & Science Technologies accounted for 34 percent of sales, 32 percent of operating income and 35 percent of EBITDA; and Fire & Safety/Diversified Products represented 26 percent of sales, 26 percent of operating income and 25 percent of EBITDA.

Non-U.S. GAAP Measures of Financial Performance

The Company supplements certain U.S. GAAP financial performance metrics with non-U.S. GAAP financial performance metrics in order to provide investors with better insight and increased transparency while also allowing for a more comprehensive understanding of the financial information used by management in its decision making. Reconciliations of non-U.S. GAAP financial performance metrics to their most comparable U.S. GAAP financial performance metrics are defined and presented below and should not be considered a substitute for, nor superior to, the financial data prepared in accordance with U.S. GAAP. There were no adjustments to U.S. GAAP financial performance metrics other than the items noted below.

• | Organic orders and sales are calculated according to U.S. GAAP excluding amounts from acquired or divested businesses during the first twelve months of ownership or divestiture and the impact of foreign currency translation. |

• | EBITDA is calculated as net income plus interest expense plus provision for income taxes plus depreciation and amortization. We reconciled EBITDA to net income on a consolidated basis as we do not allocate consolidated interest expense or consolidated provision for income taxes to our segments. |

• | Free cash flow is calculated as cash flow from operating activities less capital expenditures. |

Conference Call to be Broadcast over the Internet

IDEX will broadcast its second quarter earnings conference call over the Internet on Tuesday, July 19, 2016 at 9:30 a.m. CT. Chairman and Chief Executive Officer Andy Silvernail and Senior Vice President and Chief Financial Officer Heath Mitts will discuss the Company’s recent financial performance and respond to questions from the financial analyst community. IDEX invites interested investors to listen to the call and view the accompanying slide presentation, which will be carried live on its website at www.idexcorp.com. Those who wish to participate should log on several minutes before the discussion begins. After clicking on the presentation icon, investors should follow the instructions to ensure their systems are set up to hear the event and view the presentation slides, or download the correct applications at no charge. Investors will also be able to hear a replay of the call by dialing 877.660.6853 (or 201.612.7415 for international participants) using the ID #13620006.

Forward-Looking Statements

This news release contains “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These statements may relate to, among other things, capital expenditures, acquisitions, cost reductions, cash flow, revenues, earnings, market conditions, global economies and operating improvements, and are indicated by words or phrases such as “anticipate,” “estimate,” “plans,” “expects,” “projects,” “forecasts,” “should,” “could,” “will,” “management believes,” “the company believes,” “the company intends,” and similar words or phrases. These statements are subject to inherent uncertainties and risks that could cause actual results to differ materially from those anticipated at the date of this news release. The risks and uncertainties include, but are not limited to, the following: economic and political consequences resulting from terrorist attacks and wars; levels of industrial activity and economic conditions in the U.S. and other countries around the world; pricing pressures and other competitive factors, and levels of capital spending in certain industries - all of which could have a material impact on order rates and IDEX’s results, particularly in light of the low levels of order backlogs it typically maintains; its ability to make acquisitions and to integrate and operate acquired businesses on a profitable basis; the relationship of the U.S. dollar to other currencies and its impact on pricing and cost competitiveness; political and economic conditions in foreign countries in which the company operates; interest rates; capacity utilization and the effect this has on costs; labor markets; market conditions and material costs; and developments with respect to contingencies, such as litigation and environmental matters. Additional factors that could cause actual results to differ materially from those reflected in the forward-looking statements include, but are not limited to, the risks discussed in the “Risk Factors” section included in the Company’s most recent annual report on Form 10-K filed with the SEC and the other risks discussed in the Company’s filings with the SEC. The forward-looking statements included here are only made as of the date of this news release, and management undertakes no obligation to publicly update them to reflect subsequent events or circumstances, except as may be required by law. Investors are cautioned not to rely unduly on forward-looking statements when evaluating the information presented here.

About IDEX

IDEX Corporation is an applied solutions company specializing in fluid and metering technologies, health and science technologies, and fire, safety and other diversified products built to its customers’ exacting specifications. Its products are sold in niche markets to a wide range of industries throughout the world. IDEX shares are traded on the New York Stock Exchange and Chicago Stock Exchange under the symbol “IEX”.

For further information on IDEX Corporation and its business units, visit the company’s website at www.idexcorp.com.

(Financial reports follow)