Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Inspired Entertainment, Inc. | v444471_8k.htm |

Exhibit 99.1

Investor Presentation – Inspired Entertainment, Inc. (INSE) July 2016 July 2016 Investor Presentation – Inspired Entertainment, Inc. (INSE) This image cannot currently be displayed.

PAGE 1 Forward - Looking Statements This presentation includes forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . These forward - looking statements include, among others, statements regarding the estimated valuations of DMWSL 633 Limited (“Inspired”) and Hydra Industries Acquisition Corp. (“Hydra”) in connection with the acquisit ion ; the number of Hydra shares to be issued to Inspired’s shareholders and the expected post - closing shareholdings of legacy Inspired and Hydra shareholders; the expected benefits of a potential combination of Inspired and Hyd ra and expectations about future business plans, prospective performance (including estimated combined pro forma financial performance) and opportunities; and the expected timing of the completion of the transaction and th e obtaining of required regulatory approvals and approval by Hydra’s shareholders. These forward - looking statements may be identified by the use of words such as “expect,” “anticipate,” “believe,” “estimate,” “potential,” “sh ould”, “will” or similar words intended to identify information that is not historical in nature. These forward - looking statements are based on current expectations and assumptions of management of Inspired and Hydra and are subject to risks, uncertainty and changes in circumstances that could cause the actual events and results in future periods to differ materially from the current expectations of Inspired and Hydra and those expressed or imp lie d by these forward - looking statements. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. These risks, uncertainties and changes in circums tan ces include, among others, (a) the possibility that the transaction does not close when expected or at all; (b) the ability and timing to obtain required regulatory approvals (including approval from gaming regulators), to ob tai n Hydra’s shareholder approval, and to satisfy or waive other closing conditions, or that the parties to the acquisition agreement may be required to modify aspects of the transaction to achieve regulatory approval; (c) the occurrence of any event, change or other circumstance that could give rise to the termination of the acquisition agreement or could otherwise cause the transaction to fail to close; (d) the receipt of an unsolicited offer from another par ty for an alternative business transaction that could interfere with the proposed merger; (e) the ability to retain key employees of Inspired; (f) that there may be a material adverse change affecting Inspired or Hydra, or that the bu sin ess of Inspired may suffer as a result of uncertainty surrounding the transaction; (g) the risk factors disclosed in Hydra’s filings with the Securities and Exchange Commission (the “SEC”), including its Annual Report on Form 10 - K; (h) the inability to obtain or maintain the listing of the post - combination company’s common stock on NASDAQ following the business combination disrupts current plans and operations as a result of the announcement and consum mat ion of the transactions described herein; and (i) the inability to recognize the anticipated benefits of the business combination, which may be affected by, among other things, competition, and the ability of the combi ned business to grow and manage growth profitability that Inspired or Hydra may be adversely affected by other economic, business, political, and/or competitive factors. Forward - looking statements reflect Inspired’s and Hydra’s ma nagement’s current analysis and expectations only as of the date of this presentation, and neither Inspired nor Hydra undertake to update or revise these statements, whether written or oral, to reflect subsequent development s, except as required under the federal securities laws. Readers are cautioned not to place undue reliance on any of these forward - looking statements. Additional Information and Where to Find It This presentation may be deemed to be solicitation material for the prospective shareholder vote with respect to the issuance of shares of Hydra common stock under the acquisition agreement. In connection with the acquisition agreement, Hydra intends to file relevant materials with the SEC, including a preliminary proxy statement and a definitive pr oxy statement. The definitive proxy statement will be mailed to Hydra’s shareholders. This presentation does not constitute a solicitation of any vote or proxy from any shareholder of Hydra or an offer to sell any securities. INV EST ORS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS OR MATERIALS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED ACQUISITION O R I NCORPORATED BY REFERENCE IN THE DEFINITIVE PROXY STATEMENT BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT INSPIRED, HYDRA AND THE PROPOSED ACQUISITION . I nvestors may obtain free copies of the definitive proxy statement, and other relevant materials and documents filed with the SEC (when they become available), without charge, at the SE C’s web site at www.sec.gov. In addition, investors may obtain free copies of the definitive proxy statement, and other relevant materials and documents filed with the SEC (when they become available) by directing a written req uest to Investor Relations, Hydra Industries Acquisition Corp., 250 West 57 th Street, Suite 2223, New York, NY 10107, or by accessing Hydra’s website at www.hydraspac.com under the heading “Investor Information” and then “S EC Filings.” Participants in Prospective Solicitation Inspired, Hydra and their respective directors, executive officers and certain other members of management and employees may be deemed to be “participants” in a prospective solicitation of proxies from shareholders of Hydra in connection with the proposed transaction and other matters set forth in the forthcoming proxy statement, including with re spe ct to the issuance of shares of Hydra common stock under the acquisition agreement. Additional information regarding participants in such a proxy solicitation and a description of their interests in the proposed transact ion will be contained in the proxy statement that Hydra will file with the SEC in connection with the proposed transaction and other relevant documents or materials to be filed with the SEC regarding the proposed transaction. Financial Information and Non - GAAP Financial Measures All years represented in this presentation are fiscal years unless otherwise indicated. References to the 2013, 2014 and 2015 fi scal years refer to the fiscal years ending on September 28, 2013, September 27, 2014 and September 26, 2015, respectively. Hydra’s fiscal year ends on December 31 of each year. All information presented for quarter ly periods, including for the last twelve months ending April 9, 2016, is unaudited. This presentation includes actual, projected and combined information with respect to Inspired and Hydra. Information relating to Hydra and com bin ed information are presented for illustrative purposes only and do not purport to be indicative of what Inspired’s or Hydra’s actual and combined business, financial condition or results of operations will be if the transact ion is consummated. This presentation contains certain financial measures that are not in accordance with generally accepted accounting principle s ( “non - GAAP”). A “non - GAAP financial measure” is defined as a numerical measure of a company’s financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calcu lat ed and presented in accordance with generally accepted accounting principles (“GAAP”) in the statements of income, balance sheets or statements of cash flow of the company. These measures are presented as supplemental dis closures because they are widely used measures of performance and bases for valuation of companies in our industry. EBITDA is defined as earnings before interest expense, provision for income taxes and depreciation an d amortization. Adjusted EBITDA adjusts EBITDA to remove the effects of one - time items including pre - opening expenses, impairments and other losses, gains and losses on non - operating assets and liabilities, disconti nued operations and transition expenses related to acquired operations. Uses of cash flows that are not reflected in Adjusted EBITDA include capital expenditures, interest payments, income taxes, debt principal repayments, an d c ertain regulatory gaming assessments which can be significant. Operating Free Cash Flow represents Adjusted EBITDA less maintenance capital expenditures, change in working capital and income taxes. Adjusted Net In com e represents net income before gain or loss from non - core assets. The pro forma presentations of these non - GAAP measures reflect current estimates of the pro forma combined results of Inspired and Hydra only. The disclosure of EBITDA, Adjusted EBITDA, Property EBITDA, Operating Free Cash Flow, Adjusted Net Income and other non - GAAP financial measures may not be comparable to similarly titled measures reported by other c ompanies. EBITDA, Adjusted EBITDA, Property EBITDA, Operating Free Cash Flow and Adjusted Net Income should be considered in addition to, and not as a substitute, or superior to, net income, operating incom e, cash flows, revenue, or other measures of financial performance prepared in accordance with GAAP. Safe Harbor / Non - GAAP Financial Disclosures

PAGE 2 Presenters Lorne Weil ● Current CEO and Chairman of Hydra Industries Acquisition Corp. ● To be Executive Chairman of the Board of Inspired Entertainment, Inc. Luke Alvarez ● Founder and Current CEO of Inspired Gaming Group ● To be President, CEO and Board Member of Inspired Entertainment, Inc. Daniel Silvers ● To be Chief Strategy Officer of Inspired Entertainment, Inc. ● Experienced Board Member, Investment Banker and Gaming Investor

PAGE 3 Revenue and EBITDA growth poised to accelerate in 2017 and beyond 8 The Opportunity Leadership in fast - growing Virtual Sports (95% of global installs and over $10 billion of handle) positions the company to introduce its digital products to new jurisdictions 3 Stable, contracted recurring revenue from market - leading Server Based Gaming combined with high - growth, high - margin Virtual Sports 1 Leading player in Server Based Gaming with contracted long - term customers will complement expansion in several major markets (UK, Italy, Greece, China, North America…) 2 All digital, omni - channel platform offers best - in - class technology, creates high barriers to entry and provides opportunities for organic growth as well as acquisitions 4 Seasoned management team led by founder Luke Alvarez, partnered with Lorne Weil whose past leadership includes growing a diversified global gaming technology company 6 Sponsorship from Vitruvian Partners and Macquarie Capital with significant equity interest aligned with public shareholders 7 Meaningful expansion opportunities in North America for lottery, gaming and regulated online / mobile 5

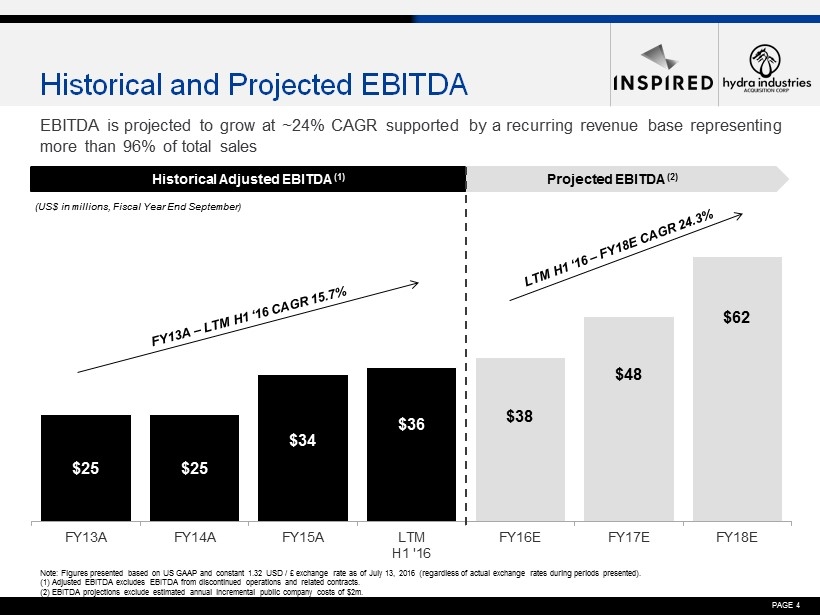

PAGE 4 $25 $25 $34 $36 $38 $48 $62 FY13A FY14A FY15A LTM H1 '16 FY16E FY17E FY18E EBITDA is projected to grow at ~24% CAGR supported by a recurring revenue base representing more than 96% of total sales Note: Figures presented based on US GAAP and constant 1.32 USD / £ exchange rate as of July 13, 2016 (regardless of actual ex cha nge rates during periods presented). (1) Adjusted EBITDA excludes EBITDA from discontinued operations and related contracts. (2) EBITDA projections exclude estimated annual incremental public company costs of $2m. Historical and Projected EBITDA Projected EBITDA (2) Historical Adjusted EBITDA (1) (US$ in millions, Fiscal Year End September)

PAGE 5 ; Leading provider of Server Based Gaming (”SBG”) systems and terminals ; Currently has 25,000 SBG terminals live and more than 5,000 contracted ; E - Table gaming platforms including “Sabre” multi - win roulette and casino Storm terminals ; Leader in the UK with ~50% of machine volume and #3 in Italy ; International retail and lottery venues in Italy, Greece, China and Latin America Unified Digital Gaming Platform Server Based Gaming Virtual Sports Key Customers ; Retail Virtual Sports includes widest range of sports, races and numbers games (e.g., English football, tennis, bike, car, dog and horse racing, darts, cricket etc.) ; Global leader in mobile and retail virtuals ; Live in over 30,000 retail venues, 200+ websites and over 35 countries globally ; #1 global provider of Virtual Sports games globally with over 95% of all installs ; Mobile Virtual Sports includes licensing of unique game content to third parties ; Contracts with majority of the key regulated online operators ; Leverage presence in existing EU mobile gaming markets to expand into North America and other new jurisdictions Key Customers Inspired’s digital platform positions the company well to participate in global growth

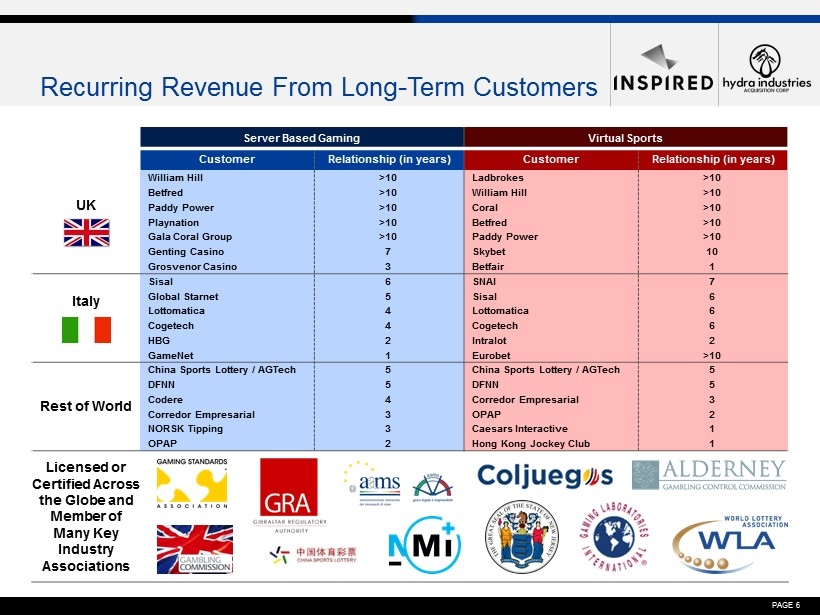

PAGE 6 Server Based Gaming Virtual Sports Customer Relationship (in years) Customer Relationship (in years) UK William Hill >10 Ladbrokes >10 Betfred >10 William Hill >10 Paddy Power >10 Coral >10 Playnation >10 Betfred >10 Gala Coral Group >10 Paddy Power >10 Genting Casino 7 Skybet 10 Grosvenor Casino 3 Betfair 1 Italy Sisal 6 SNAI 7 Global Starnet 5 Sisal 6 Lottomatica 4 Lottomatica 6 Cogetech 4 Cogetech 6 HBG 2 Intralot 2 GameNet 1 Eurobet >10 Rest of World China Sports Lottery / AGTech 5 China Sports Lottery / AGTech 5 DFNN 5 DFNN 5 Codere 4 Corredor Empresarial 3 Corredor Empresarial 3 OPAP 2 NORSK Tipping 3 Caesars Interactive 1 OPAP 2 Hong Kong Jockey Club 1 Licensed or Certified Across the Globe and Member of Many Key Industry Associations Recurring Revenue From Long - Term Customers

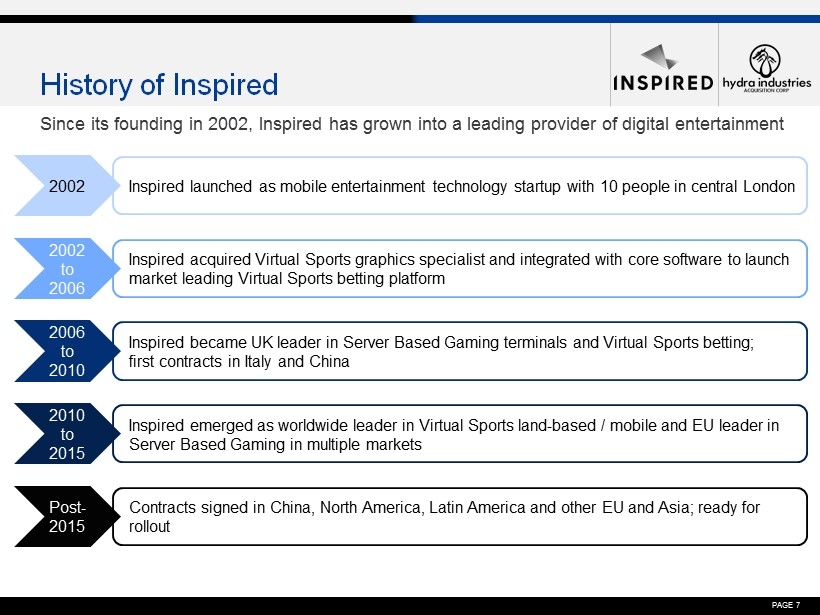

PAGE 7 Since its founding in 2002, Inspired has grown into a leading provider of digital entertainment History of Inspired 2002 Inspired launched as mobile entertainment technology startup with 10 people in central London 2002 to 2006 Inspired acquired Virtual Sports graphics specialist and integrated with core software to launch market leading Virtual Sports betting platform 2006 to 2010 Inspired became UK leader in Server Based Gaming terminals and Virtual Sports betting; first contracts in Italy and China 2010 to 2015 Inspired emerged as worldwide leader in Virtual Sports land - based / mobile and EU leader in Server Based Gaming in multiple markets Post - 2015 Contracts signed in China, North America, Latin America and other EU and Asia; ready for rollout

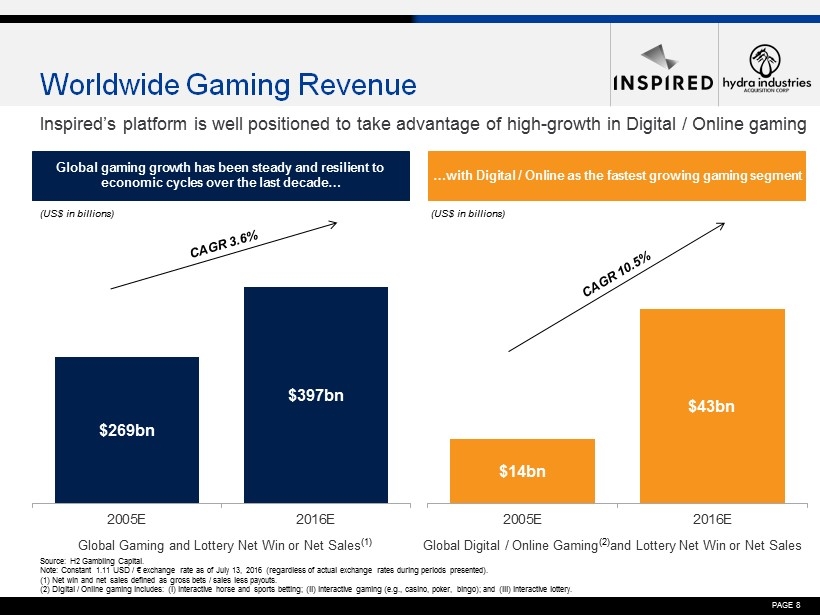

PAGE 8 $ 14bn $ 43bn 2005E 2016E Global Digital / Online Gaming and Lottery Net Win or Net Sales $ 269bn $ 397bn 2005E 2016E Global Gaming and Lottery Net Win or Net Sales Inspired’s platform is well positioned to take advantage of high - growth in Digital / Online gaming Source: H2 Gambling Capital. Note: Constant 1.11 USD / € exchange rate as of July 13, 2016 (regardless of actual exchange rates during periods presented). (1) Net win and net sales defined as gross bets / sales less payouts. (2) Digital / Online gaming includes: (i) interactive horse and sports betting; (ii) interactive gaming (e.g., casino, poker, bi ngo); and (iii) interactive lottery. Worldwide Gaming Revenue (US$ in billions) Global gaming growth has been steady and resilient to economic cycles over the last decade… …with Digital / Online as the fastest growing gaming segment (US$ in billions) (1) (2)

PAGE 9 United Kingdom Betting Shop Influencers of Digital Adoption ; Governments: Opening of new gaming territories – Italy, Greece, Spain, Philippines and China ; Distributed Gaming Revenues: Expansion of regulated gaming away from relatively few large resort casinos into many more distributed venues ; Digital Multi - Channel Offering: Replacement of legacy analog machines with larger volume of smart digital devices – retail and mobile ; Smartphone / Mobile: Rapid adoption of gaming and lottery applications on growing volume of devices United States Lottery Venues Italy Arcade and Betting Shop China Sports Lottery Shop

PAGE 10 Our Competitive Focus ; Leader in UK with 50% of market ; Top 2 - 3 provider in Italy, Greece and internationally ; 25,000 Server Based Gaming terminals live — More than 5,000 additional machines contracted ; 100+ games integrated on open platform ; Unitary platform approved across multiple jurisdictions — Proven platform stability in Italy — Chinese Academy of Science tested for Chinese regulated terminal markets — GLI approved — G2S ready for North American terminal markets ; #1 provider of Virtual Sports segment globally ; Key product to target millennials, and as opportunity to grow lottery revenues ; Live in over 30,000 retail venues, 200+ websites and over 35 countries globally ; Exclusive branded content such as Mike Tyson and Rush Football 2 ; Italian case study: >$1 billion in customer handle from our products in 1st Year — Product launched across ~7,000 retail venues in Italy — Launched across online and mobile platforms — Key products are virtual football and horse racing …and Leader in Server Based Gaming This image cannot currently be displayed. Pioneer in Virtual Sports …

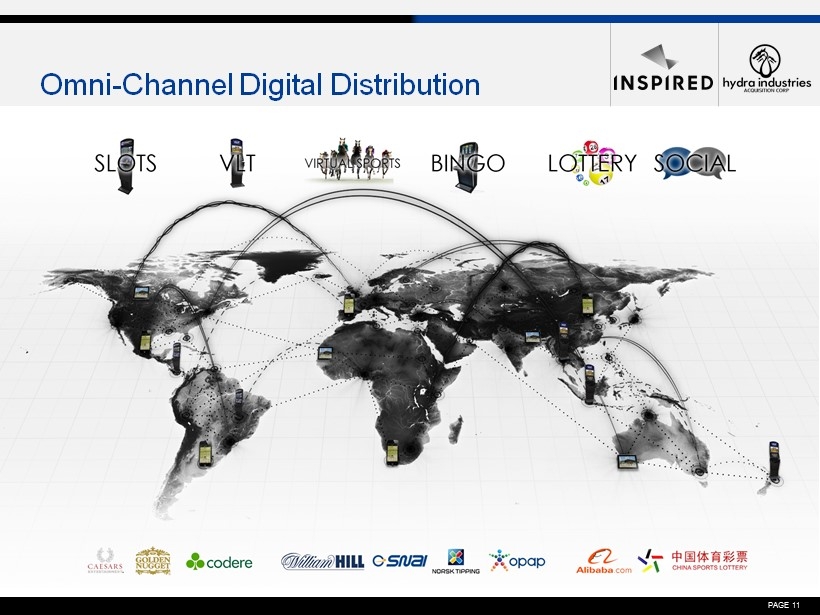

PAGE 11 Omni - Channel Digital Distribution

PAGE 12 Organic Growth Opportunities Four Core Products, One Common Platform Retail Virtual Sports Mobile Virtual Sports Virtual Sports ; Existing Virtuals Customers – Income growth from key UK and Italian contracts plus cross sell of new products ; New Virtuals Customers – Continue track record of winning new customers in existing and new jurisdictions (e.g., Nordic regions) ; North America – Expansion of Virtual Sports business into North American market – now live in Nevada and licensed in New Jersey with four contracts signed… ; Asia – Live in mainland China and Philippines; significant growth upside in mainland China and new regulated markets ; Mobile – Remote Gaming Server live in 2015 with organic growth in UK and new markets; significant upside in Asia, China and North America Server Based Gaming ; UK – Steady income growth and new Server Based Gaming terminals in adjacent verticals ; Italy – Roll - out of new terminals from recent contract wins ; Greece (New Jurisdiction) – Signed contract to provide 4,000 terminals with upside ; Other New Jurisdictions – Contract signed with significant volume to deploy in 2017 / 2018 – China – European Union – Latin America ; North America – Significant upside from recent G2S approvals and Hydra’s relationships to cultivate new customers Mobile Video Lottery Server Based Gaming

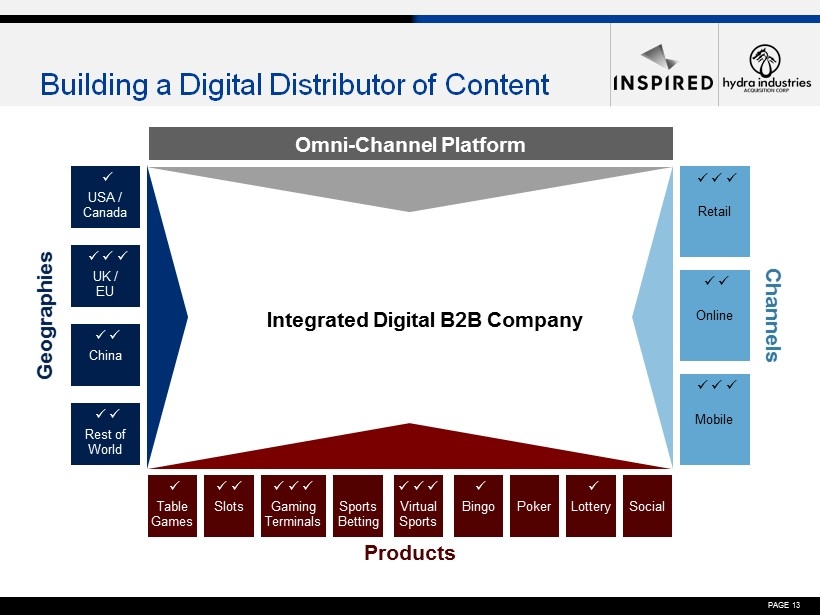

PAGE 13 Building a Digital Distributor of Content USA / Canada x UK / EU x x x China x x Rest of World x x Sports Betting Poker Social Virtual Sports x x x Gaming Terminals x x x Slots x x Lottery x Table Games x Bingo x Products Geographies Retail x x x Online x x Mobile x x x Channels Omni - Channel Platform Integrated Digital B2B Company

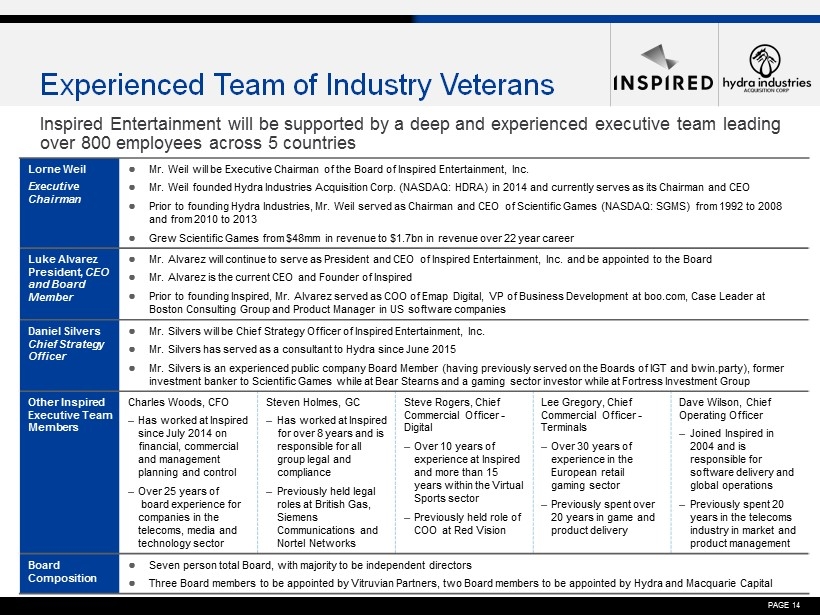

PAGE 14 Lorne Weil Executive Chairman ● Mr. Weil will be Executive Chairman of the Board of Inspired Entertainment, Inc. ● Mr. Weil founded Hydra Industries Acquisition Corp. (NASDAQ: HDRA) in 2014 and currently serves as its Chairman and CEO ● Prior to founding Hydra Industries, Mr. Weil served as Chairman and CEO of Scientific Games (NASDAQ: SGMS) from 1992 to 2008 and from 2010 to 2013 ● Grew Scientific Games from $48mm in revenue to $1.7bn in revenue over 22 year career Luke Alvarez President, CEO and Board Member ● Mr. Alvarez will continue to serve as President and CEO of Inspired Entertainment, Inc. and be appointed to the Board ● Mr. Alvarez is the current CEO and Founder of Inspired ● Prior to founding Inspired, Mr. Alvarez served as COO of Emap Digital, VP of Business Development at boo.com, Case Leader at Boston Consulting Group and Product Manager in US software companies Daniel Silvers Chief Strategy Officer ● Mr. Silvers will be Chief Strategy Officer of Inspired Entertainment, Inc. ● Mr. Silvers has served as a consultant to Hydra since June 2015 ● Mr. Silvers is an experienced public company Board Member (having previously served on the Boards of IGT and bwin.party), for mer investment banker to Scientific Games while at Bear Stearns and a gaming sector investor while at Fortress Investment Group Other Inspired Executive Team Members Charles Woods, CFO – Has worked at Inspired since July 2014 on financial, commercial and management planning and control – Over 25 years of board experience for companies in the telecoms, media and technology sector Steven Holmes, GC – Has worked at Inspired for over 8 years and is responsible for all group legal and compliance – Previously held legal roles at British Gas, Siemens Communications and Nortel Networks Steve Rogers, Chief Commercial Officer - Digital – Over 10 years of experience at Inspired and more than 15 years within the Virtual Sports sector – Previously held role of COO at Red Vision Lee Gregory, Chief Commercial Officer - Terminals – Over 30 years of experience in the European retail gaming sector – Previously spent over 20 years in game and product delivery Dave Wilson, Chief Operating Officer – Joined Inspired in 2004 and is responsible for software delivery and global operations – Previously spent 20 years in the telecoms industry in market and product management Board Composition ● Seven person total Board, with majority to be independent directors ● Three Board members to be appointed by Vitruvian Partners, two Board members to be appointed by Hydra and Macquarie Capital Experienced Team of Industry Veterans Inspired Entertainment will be supported by a deep and experienced executive team leading over 800 employees across 5 countries

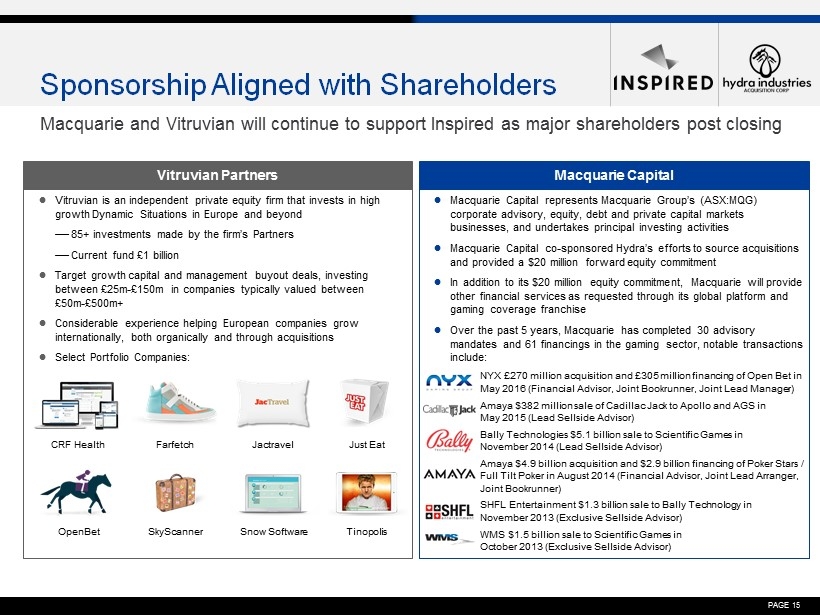

PAGE 15 Macquarie and Vitruvian will continue to support Inspired as major shareholders post closing Sponsorship Aligned with Shareholders Vitruvian Partners Macquarie Capital ; Macquarie Capital represents Macquarie Group’s (ASX:MQG) corporate advisory, equity, debt and private capital markets businesses, and undertakes principal investing activities ; Macquarie Capital co - sponsored Hydra’s efforts to source acquisitions and provided a $20 million forward equity commitment ; In addition to its $20 million equity commitment, Macquarie will provide other financial services as requested through its global platform and gaming coverage franchise ; Over the past 5 years, Macquarie has completed 30 advisory mandates and 61 financings in the gaming sector, notable transactions include: NYX £270 million acquisition and £305 million financing of Open Bet in May 2016 (Financial Advisor, Joint Bookrunner, Joint Lead Manager) Amaya $382 million sale of Cadillac Jack to Apollo and AGS in May 2015 (Lead Sellside Advisor) Bally Technologies $5.1 billion sale to Scientific Games in November 2014 (Lead Sellside Advisor) Amaya $4.9 billion acquisition and $2.9 billion financing of Poker Stars / Full Tilt Poker in August 2014 (Financial Advisor, Joint Lead Arranger, Joint Bookrunner) SHFL Entertainment $1.3 billion sale to Bally Technology in November 2013 (Exclusive Sellside Advisor) WMS $1.5 billion sale to Scientific Games in October 2013 (Exclusive Sellside Advisor) ; Vitruvian is an independent private equity firm that invests in high growth Dynamic Situations in Europe and beyond — 85+ investments made by the firm’s Partners — Current fund £1 billion ; Target growth capital and management buyout deals, investing between £25m - £150m in companies typically valued between £50m - £500m+ ; Considerable experience helping European companies grow internationally, both organically and through acquisitions ; Select Portfolio Companies: CRF Health Farfetch OpenBet SkyScanner Tinopolis Snow Software Jactravel Just Eat

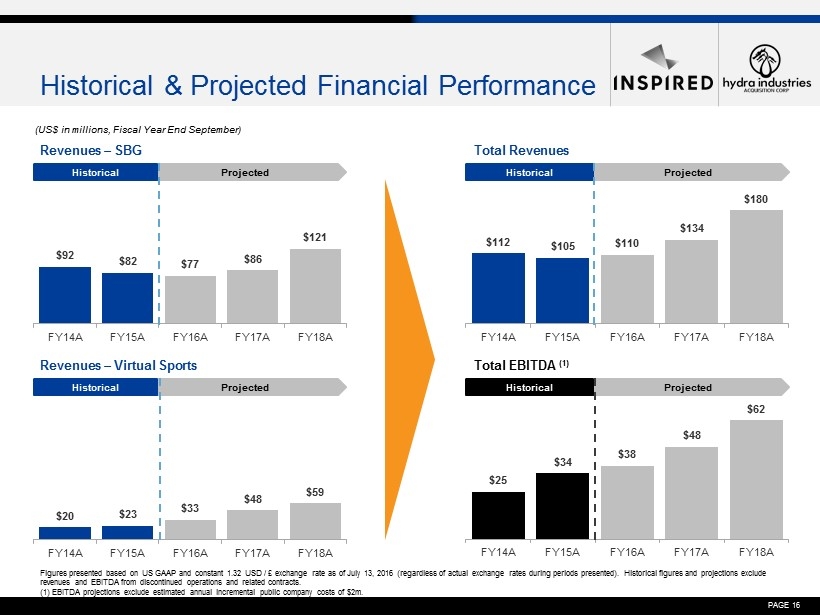

PAGE 16 $112 $105 $110 $134 $180 FY14A FY15A FY16A FY17A FY18A $25 $34 $38 $48 $62 FY14A FY15A FY16A FY17A FY18A $20 $23 $33 $48 $59 FY14A FY15A FY16A FY17A FY18A $92 $82 $77 $86 $121 FY14A FY15A FY16A FY17A FY18A (US$ in millions, Fiscal Year End September) Figures presented based on US GAAP and constant 1.32 USD / £ exchange rate as of July 13, 2016 (regardless of actual exchange ra tes during periods presented). Historical figures and projections exclude revenues and EBITDA from discontinued operations and related contracts. (1) EBITDA projections exclude estimated annual incremental public company costs of $2m. Total Revenues Revenues – Virtual Sports Revenues – SBG Total EBITDA (1) Historical & Projected Financial Performance Projected Historical Projected Historical Projected Historical Projected Historical

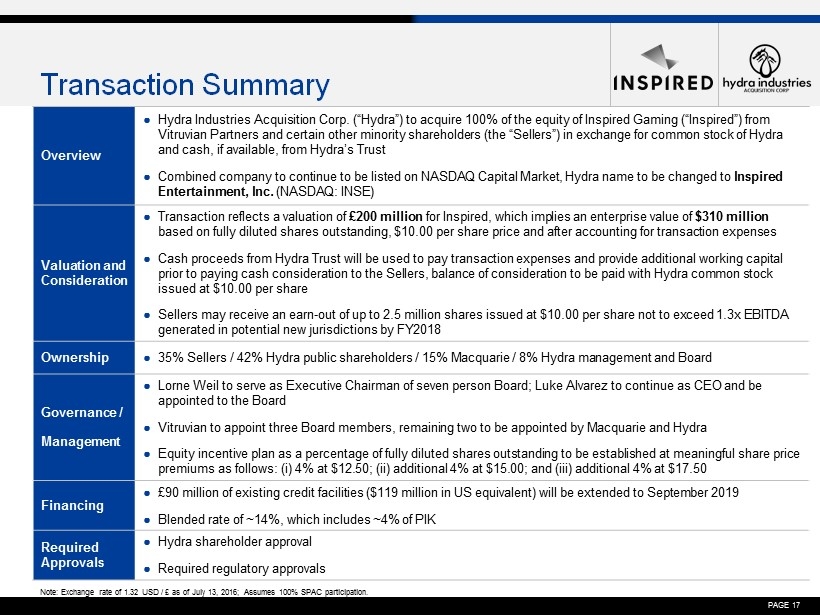

PAGE 17 Note: Exchange rate of 1.32 USD / £ as of July 13, 2016; Assumes 100% SPAC participation. Overview ● Hydra Industries Acquisition Corp. (“Hydra”) to acquire 100% of the equity of Inspired Gaming (“Inspired”) from Vitruvian Partners and certain other minority shareholders (the “Sellers”) in exchange for common stock of Hydra and cash, if available, from Hydra’s Trust ● Combined company to continue to be listed on NASDAQ Capital Market, Hydra name to be changed to Inspired Entertainment, Inc. (NASDAQ: INSE) Valuation and Consideration ● Transaction reflects a valuation of £200 million for Inspired , which implies an enterprise value of $310 million based on fully diluted shares outstanding, $10.00 per share price and after accounting for transaction expenses ● Cash proceeds from Hydra Trust will be used to pay transaction expenses and provide additional working capital prior to paying cash consideration to the Sellers, balance of consideration to be paid with Hydra common stock issued at $10.00 per share ● Sellers may receive an earn - out of up to 2.5 million shares issued at $10.00 per share not to exceed 1.3x EBITDA generated in potential new jurisdictions by FY2018 Ownership ● 35 % Sellers / 42% Hydra public shareholders / 15% Macquarie / 8% Hydra management and Board Governance / Management ● Lorne Weil to serve as Executive Chairman of seven person Board; Luke Alvarez to continue as CEO and be appointed to the Board ● Vitruvian to appoint three Board members, remaining two to be appointed by Macquarie and Hydra ● Equity incentive plan as a percentage of fully diluted shares outstanding to be established at meaningful share price premiums as follows: (i) 4% at $12.50; (ii) additional 4% at $15.00; and (iii) additional 4% at $17.50 Financing ● £90 million of existing credit facilities ($119 million in US equivalent) will be extended to September 2019 ● Blended rate of ~14%, which includes ~4% of PIK Required Approvals ● Hydra shareholder approval ● Required regulatory approvals Transaction Summary

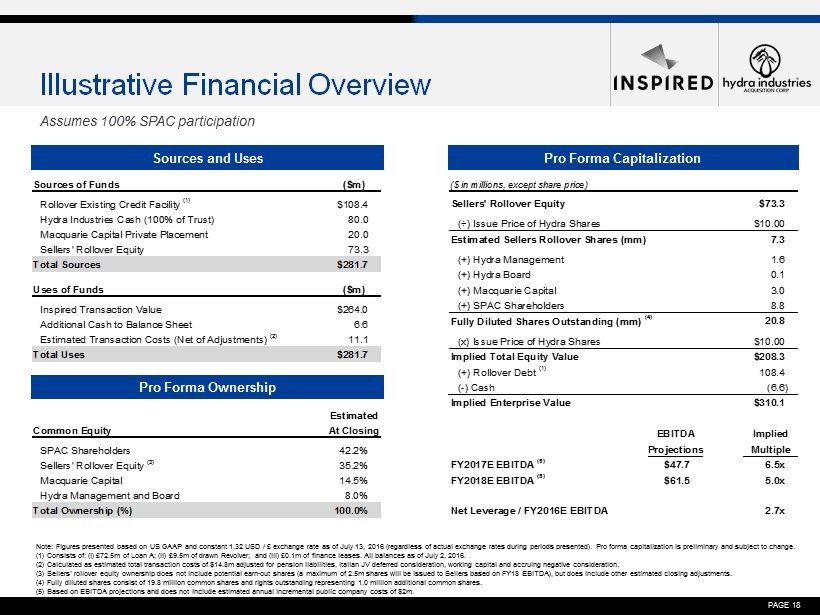

PAGE 18 ($ in millions, except share price) Sellers' Rollover Equity $73.3 (÷) Issue Price of Hydra Shares $10.00 Estimated Sellers Rollover Shares (mm) 7.3 (+) Hydra Management 1.6 (+) Hydra Board 0.1 (+) Macquarie Capital 3.0 (+) SPAC Shareholders 8.8 Fully Diluted Shares Outstanding (mm) (4) 20.8 (x) Issue Price of Hydra Shares $10.00 Implied Total Equity Value $208.3 (+) Rollover Debt (1) 108.4 (-) Cash (6.6) Implied Enterprise Value $310.1 EBITDA Implied Projections Multiple FY2017E EBITDA (5) $47.7 6.5x FY2018E EBITDA (5) $61.5 5.0x Net Leverage / FY2016E EBITDA 2.7x Estimated Common Equity At Closing SPAC Shareholders 42.2% Sellers' Rollover Equity (3) 35.2% Macquarie Capital 14.5% Hydra Management and Board 8.0% Total Ownership (%) 100.0% Sources of Funds ($m) Rollover Existing Credit Facility (1) $108.4 Hydra Industries Cash (100% of Trust) 80.0 Macquarie Capital Private Placement 20.0 Sellers' Rollover Equity 73.3 Total Sources $281.7 Uses of Funds ($m) Inspired Transaction Value $264.0 Additional Cash to Balance Sheet 6.6 Estimated Transaction Costs (Net of Adjustments) (2) 11.1 Total Uses $281.7 Note: Figures presented based on US GAAP and constant 1.32 USD / £ exchange rate as of July 13, 2016 (regardless of actual ex cha nge rates during periods presented). Pro forma capitalization is preliminary and subject to change. (1) Consists of: (i) £72.5m of Loan A; (ii) £9.5m of drawn Revolver; and (iii) £0.1m of finance leases. All balances as of Ju ly 2, 2016. (2) Calculated as estimated total transaction costs of $14.8m adjusted for pension liabilities, Italian JV deferred considera tio n, working capital and accruing negative consideration. (3) Sellers’ rollover equity ownership does not include potential earn - out shares (a maximum of 2.5m shares will be issued to Se llers based on FY18 EBITDA), but does include other estimated closing adjustments. (4) Fully diluted shares consist of 19.8 million common shares and rights outstanding representing 1.0 million additional com mon shares. (5) Based on EBITDA projections and does not include estimated annual incremental public company costs of $2m. Illustrative Financial Overview Sources and Uses Pro Forma Ownership Pro Forma Capitalization Assumes 100% SPAC participation

PAGE 19 5.6x 13.0x 6.2x 6.3x 8.2x 7.9x 5.8x 11.3x 6.3x 7.9x 7.5x Gaming Equipment EV / 2017E Median: 7.1x EV / 2018E Median: 7.5x Illustrative Trading Comparables Source: Public company filings, broker research consensus estimates and CapitalIQ. Note: Financials and trading prices converted to USD at current spot rates. Market pricing as of July 18, 2016. Digital Games EV / 2017E Median: 12.7x EV / 2018E Median: 11.2x Inspired offers a compelling value proposition with a stable and recurring core terminal business and upside from high - growth digital games platform EV / 2017E EBITDA EV / 2018E EBITDA EV / 2017E 6.5x EV / 2018E 5.0x N/A 16.3x 12.7x 24.9x 7.6x 8.7x 13.6x 11.2x 21.3x 6.8x 7.5x 6 .5x 5.0x

PAGE 20 Anticipated Transaction Timeline Date Event July 14 th ; Transaction announced Late July ; File preliminary proxy materials with SEC August ; Se t record date for shareholder vote September ; Mail final proxy materials to shareholders October ; Hold shareholder vote and close transaction Note: Estimated timeline based on current information and subject to change.

PAGE 21 Revenue and EBITDA growth poised to accelerate in 2017 and beyond 8 Compelling Opportunity Leadership in fast - growing Virtual Sports (95% of global installs and over $10 billion of handle) positions the company to introduce its digital products to new jurisdictions 3 Stable, contracted recurring revenue from market - leading Server Based Gaming combined with high - growth, high - margin Virtual Sports 1 Leading player in Server Based Gaming with contracted long - term customers will complement expansion in several major markets (UK, Italy, Greece, China, North America…) 2 All digital, omni - channel platform offers best - in - class technology, creates high barriers to entry and provides opportunities for organic growth as well as acquisitions 4 Seasoned management team led by founder Luke Alvarez, partnered with Lorne Weil whose past leadership includes growing a diversified global gaming technology company 6 Sponsorship from Vitruvian Partners and Macquarie Capital with significant equity interest aligned with public shareholders 7 Meaningful expansion opportunities in North America for lottery, gaming and regulated online / mobile 5