Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT - High Desert Holding Corp. | highdesert_s1-ex2301.htm |

| EX-10.1 - FORM OF STOCK PURCHASE AGREEMENT - High Desert Holding Corp. | highdesert_s1-ex1001.htm |

| EX-5.1 - LEGAL OPINION - High Desert Holding Corp. | highdesert_s1-ex0501.htm |

As filed with the Securities and Exchange Commission on July 14, 2016.

Registration No. ________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

HIGH DESERT HOLDING CORP.

(Exact name of registrant as specified in its charter)

| Nevada | 1040 | 46-3493034 | ||

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer | ||

| incorporation or organization) | Classification Code Number) | Identification No.) |

865 Tahoe Boulevard, Suite 302

Incline Village, Nevada 89451

(775) 298-2856

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Mark A. Kersey

895 Tahoe Boulevard, Suite 302

Incline Village, Nevada 89451

(775) 298-2856

(Name, address, including zip code, and telephone number, including area code, of agent for service)

From time to time after this Registration Statement becomes effective.

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer o | Accelerated Filer o |

| Non-accelerated Filer o (Do not check if a smaller reporting company) | Smaller Reporting Company x |

Calculation of Registration Fee

|

Title of Each Class of Securities To Be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Share (2) |

Proposed Maximum Aggregate Offering Price |

Amount Of Registration Fee (3) |

||||||||||||

| Common Stock, $0.001 par value per share (1) | 10,000,000 | $0.20 | $2,000,000 | $201.40 | ||||||||||||

| (1) | Pursuant to Rule 416 of the Securities Act, this registration statement also registers such additional shares of common stock as may become issuable to prevent dilution as a result of stock splits, stock dividends or similar transactions. |

| (2) | Estimated in accordance with Rule 457 of the Securities Act of 1933 solely for the purpose of computing the amount of the registration fee. Our common stock is not traded on any national exchange and the offering price is based on the price at which shares of the registrant’s common stock were sold to investors in private transactions, which does not necessarily bear a relationship to the registrant's book value, assets, past operating results, or financial condition. If and when our common stock is quoted on the OTC Bulletin Board or other securities marketplace, the shares may be sold at prevailing market prices or at privately negotiated prices. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority, Inc., which operates the OTC Bulletin Board, that such an application for quotation will be approved or that our common stock ever will trade. The registrant makes no representation as to the price at which its common stock may trade if quoted on the OTC Bulletin Board. |

| (3) | Calculated in accordance with Rule 457(o) under the Securities Act of 1933, as amended. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

| The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the sale is not permitted. |

SUBJECT TO COMPLETION, DATED JULY [__], 2016

HIGH DESERT HOLDING CORP.

PROSPECTUS

This prospectus relates to the issuance and sale of up to 6,500,000 shares of common stock, $0.001 par value per share, of High Desert Holding Corp. that may be sold to third-party investors from time to time, and to the resale of up to 3,500,000 shares of common stock that may be sold by the selling stockholders identified in this prospectus from time to time, for an aggregate offering of 10,000,000 shares of common stock. These selling stockholders, together with their transferees, are referred to throughout this prospectus as “selling stockholders.” We may receive up to $1,300,000 in proceeds from the sale of our common stock in this offering if all 6,500,000 newly issued shares are purchased by third party investors.

Our common stock does not presently trade on any exchange or electronic medium. We have not applied for listing to trade on any public market nor has a market maker applied to have our common stock admitted to quotation on the OTC Bulletin Board. We may seek to identify a market maker to file an application to have our common stock admitted to quotation on the OTC Bulletin Board; however, we cannot assure you that our common stock ever will be quoted on the OTC Bulletin Board or trade on any other public market or electronic medium.

We will pay all of the expenses incident to the registration of the shares offered under this prospectus, except for sales commissions and other expenses of selling stockholders applicable to the sales of their shares.

The shares may be offered for sale from time to time by the selling stockholders acting as principal for their own accounts or in brokerage transactions at prevailing market prices or in transactions at High Desert Holding Corp. or negotiated prices. No representation is made that any shares will or will not be offered for sale. It is not possible at the present time to determine the price to the public in any sale of the shares by the selling stockholders and the selling stockholders reserve the right to accept or reject, in whole or in part, any proposed purchase of shares. Accordingly, the public offering price and the amount of any applicable underwriting discounts and commissions will be determined at the time of such sale by the selling stockholders. See “Selling Stockholders” and “Plan of Distribution” in this prospectus.

An investment in our common stock is speculative and involves a high degree of risk. Investors should carefully consider the risk factors and other uncertainties described in this prospectus before purchasing our common stock. See “Risk Factors” beginning on page 5.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL, ACCURATE, OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is July 14, 2016.

TABLE OF CONTENTS

| Page No. | |

| Cautionary Statement Regarding Forward-Looking Statements | ii |

| Prospectus Summary | 1 |

| Risk Factors | 5 |

| Market and Other Data | 10 |

| Use of Proceeds | 11 |

| Determination of Offering Price | 11 |

| Dilution of the Price You May Pay for Your Shares | 11 |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | 15 |

| Description of Properties | 23 |

| Legal Proceedings | 23 |

| Market For Our Common Stock and Other Related Stockholder Matters | 23 |

| Management | 24 |

| Executive Compensation | 25 |

| Certain Relationships, Related Transactions, and Director Independence | 25 |

| Security Ownership of Certain Beneficial Owners and Management | 26 |

| Selling Stockholders | 28 |

| Plan of Distribution | 30 |

| Description of Securities to be Registered | 31 |

| Shares Eligible For Future Sale | 32 |

| Legal Matters | 32 |

| Experts | 33 |

| Where You Can Find More Information | 33 |

| Index to Financial Statements | F-1 |

AVAILABLE INFORMATION

This prospectus constitutes a part of a registration statement on Form S-1 (together with all amendments and exhibits thereto, the “Registration Statement”) filed by us with the SEC under the Securities Act of 1933, as amended (the “Securities Act”). As permitted by the rules and regulations of the SEC, this prospectus omits certain information contained in the Registration Statement, and reference is made to the Registration Statement and related exhibits for further information with respect to High Desert Holding Corp. and the securities offered hereby. Any statements contained herein concerning the provisions of any document filed as an exhibit to the Registration Statement or otherwise filed with the SEC are not necessarily complete, and in each instance reference is made to the copy of such document so filed. Each such statement is qualified in its entirety by such reference.

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us that we have referred to you. We and the selling stockholders have not, authorized anyone to provide you with additional or different information from that contained in this prospectus. If anyone provides you with additional, different or inconsistent information, you should not rely on it. We and the selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted.

| i |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information contained in this prospectus includes certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts included or incorporated by reference in this report, including, without limitation, statements regarding our future financial position and capital needs, business strategy, projected product development, budgets, projected revenues, projected costs and plans and objectives of management for future operations, are forward-looking statements. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “project,” “estimate,” “anticipate,” or “believe” or the negative thereof or any variation thereon or similar terminology.

Such forward-looking statements are made based on management's beliefs, as well as assumptions made by, and information currently available to, management pursuant to the “safe-harbor” provisions of the Private Securities Litigation Reform Act of 1995. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to have been correct. Such statements are not guarantees of future performance or events and are subject to known and unknown risks and uncertainties that could cause the Company's actual results, events or financial positions to differ materially from those included within the forward-looking statements. Important factors that could cause actual results to differ materially from our expectations include, but are not limited to:

| · | future financial and operating results, including projections of sales, revenue, income, expenditures, liquidity, and other financial items; |

| · | our ability to develop relationships with new customers, and strategic partners; |

| · | execution of our exploration strategies and secure access to properties; |

| · | our ability to meet licensing, permitting, and other regulatory requirements; |

| · | management’s goals and plans for future operations; |

| · | our ability to improve operational efficiencies, manage costs and business risks and obtain profitability; |

| · | growth, expansion, diversification and acquisition strategies, the success of such strategies, and the benefits we believe can be derived from such strategies; |

| · | personnel; |

| · | the outcome of regulatory, tax, and litigation matters; |

| · | sources and availability of materials and equipment; |

| · | overall industry and market performance; |

| · | effects of competition; and |

| · | other assumptions described in this report or underlying or relating to any forward looking statements. |

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date made. All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements. Except as required by law, we undertake no obligation to disclose any revision to these forward-looking statements to reflect events or circumstances after the date made, changes in internal estimates or expectations, or the occurrence of unanticipated events.

| ii |

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. You should read this entire prospectus and should consider, among other things, the matters set forth under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, and our consolidated financial statements and related notes thereto appearing elsewhere in this prospectus before making your investment decision.

Unless the context otherwise requires, any reference to “the Company,” “we,” “us,” or “our” refers to High Desert Holding Corp. and its subsidiaries, a Nevada corporation.

Glossary

“assay” means to test minerals by chemical or other methods for determining the amount of metals contained therein.

“claim” means a mining interest giving its holder the right to prospect, explore for and exploit minerals within a defined area.

“feasibility study” means a comprehensive study undertaken to determine the economic feasibility of a project; typically to determine if a construction and/or production decision can be made.

“grade” means the amount of precious metal in each ton of ore, expressed as troy ounces per ton.

“heap leaching” means a process whereby gold and silver are extracted by “heaping” crushed ore onto impermeable leach pads and applying a weak cyanide solution that dissolves the gold and silver from the ore into a precious metal-laden solution for further recovery.

“lode” is a vein-like deposit or rich supply of or source of gold or other minerals.

“mineralized material” is a body that contains mineralization that has been delineated by appropriately spaced drilling and/ or underground sampling to estimate a sufficient tonnage and average grade of metal(s). Such a deposit does not qualify as a reserve until a comprehensive evaluation based upon unit cost, grade, recoveries, and other material factors conclude legal and economic feasibility of extraction at the time of reserve determination.

“NSR” means net smelter return royalty.

“ore” means a mineral-bearing rock, which may be rich enough to be mined at a profit.

“oxide” means ore in which some of the minerals have been oxidized (i.e., combined with oxygen through exposure to air or water) from surface exposure, fracturing, faulting, or exposure to high temperatures. Oxidation tends to make the ore more porous and permits a more complete permeation of cyanide solutions so that minute particles of gold in the interior of the minerals will be more readily dissolved. Oxide ore is generally processed using a heap leach method.

“placer” means alluvial deposit containing particles or larger pieces of gold or other minerals.

“probable reserves” means reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation.

“proven reserves” means reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth, and mineral content of reserves are well-established.

“quartz” is one of the most common of all rock-forming minerals and one of the most important constituents of the earth’s crust. Quartz may be transparent, translucent, or opaque; it may be colorless or colored.

“recovery” means that portion of the metal contained in the ore that is successfully extracted by processing, can also be expressed as a percentage.

| 1 |

“reserves” or “ore reserves” mean that part of a mineral deposit, which could be economically and legally extracted or produced at the time of the reserve determination.

“stripping ratio” or “strip ratio” means the ratio of waste tons to ore tons mined.

“sulfide” means a compound of sulfur and a metallic element, generally processed using milling methods.

“tailings” means refuse materials resulting from the washing, concentration, or treatment of ore.

“ton” means a short ton (2,000 pounds).

“vein” is a deposit of non-sedimentary origin, which may or may not contain valuable minerals; lode.

“waste” means rock or other material lacking sufficient grade and/or other characteristics to be economically processed or stockpiled as ore and which is often necessary to access an ore deposit.

HIGH DESERT HOLDING CORP.

High Desert Holding Corp. is a mineral exploration company. Our primary focus is identifying mining properties and mining equipment, primarily located within the Western United States that may be economically feasible for commercial development. We have not limited our property identification and subsequent exploration activities to those containing only precious metals as we have determined that non-precious metal markets may provide more near-term benefits to our Company and its shareholders. In the near-term, we are seeking to acquire or obtain rights to acquire properties that possess potentially commercially viable non-precious and/or precious mineral resources throughout the Western United States.

Corporate History

High Desert Holding Corp. (“we”, “us”, “our”, the “Company” or the “Registrant”) was incorporated in the State of Nevada on August 29, 2013. Since inception, we have focused our activities on researching and identifying potential mineral properties, primarily in Nevada, California, Idaho, and Arizona, that may be economically feasible for commercial development. We believe there are many undervalued property opportunities in this region of the United States and we have acquired and seek to acquire or obtain rights to further explore and develop these properties.

Management

Mark A. Kersey, who serves as our Chief Executive Officer and Chief Financial Officer, has extensive business development experience particularly within mining exploration, development, and operations.

Our Business

We are a precious and non-precious mineral exploration company. We have informally established contacts with individuals and other entities to identify potentially viable resources. While we currently do not have any binding letters of intent or obligations, we may seek to partner or enter into other business combinations with other individuals or entities.

Our initial efforts are focused on identifying both public and privately held land that have historically demonstrated commercially viable resources.

Market Opportunity

We believe that there is a significant opportunity within the precious and non-precious mineral exploration and development industry. While other companies may have significantly more resources and currently identified viable resources, we believe the continued global demand for mining based commodities and market prices for both precious and non-precious minerals allows us to identify, obtain, and potentially develop commercially viable resources. In this regard, we may seek partner with or acquire other companies to achieve our development goals.

Our Key Competitive Strengths

We believe that the following competitive strengths enable us to compete effectively and to capitalize on the growth of the market that includes our products:

| · | Commodity prices for both precious and non-precious minerals remain strong with no material signs of global demand deterioration. |

| · | We have informal relationships with industry experts with significant experience in identifying and preliminarily exploring properties within the United States. |

| · | We have not entered into material obligations to make expenditures on properties that may not contain commercially viable resources. |

| · | We believe we have access to capital markets not readily available to other entities within our industry, however, we have not entered into any formal arrangements to obtain the capital necessary to develop any mineral properties. |

| 2 |

Our Growth Strategy

We are committed to the identification, exploration, and development of commercially viable precious and non-precious mineral properties. We are not seeking short-term returns, rather we are focused on long-term development and production opportunities expected to be achieved through joint ventures or other business combination activities, although we have not entered into any such arrangements.

Principal Executive Offices

Our headquarters is located in Incline Village, Nevada, where we maintain our corporate and administrative offices on a short-term lease basis. Our telephone number is (775) 298-2846. We maintain a website at www.highdesertholdingcorp.com, which contains information about our Company, but that information is not part of this prospectus.

We believe our headquarters is strategically located within the State of Nevada, a historically prosperous mineral exploration, development, and extractive area within the Western United States.

The Offering

This prospectus relates to an aggregate of 3,500,000 shares of common stock of High Desert Holding Corp. that may be offered for sale by the persons named in this prospectus under the heading “Selling Stockholders.” The selling stockholders will be primarily stockholders and other third party investors who acquired shares in private placements of our common stock or in connection with providing services to the Company as officers, directors, employees and consultants. We have no contractual obligation to register any of the shares offered hereunder.

Additionally, this prospectus relates to the issuance and sale of up to 6,500,000 shares of common stock, $0.001 par value per share, of High Desert Holding Corp. that may be sold to third-party investors from time to time.

We appreciate the support of our investors, and would like to do our part as a socially responsible company to help create potential liquidity opportunities for our investors in the future. We believe that the registration of shares hereunder will be of benefit to, and appreciated by, our investors and employees.

Offering Summary

| Common Stock Offered by Us |

6,500,000 shares of common stock

|

|

Common Stock Offered by Selling Stockholders

|

3,500,000 shares of common stock |

|

Common Stock Outstanding

|

44,465,000 shares of common stock |

| Offering Price |

The shares may be offered and sold from time to time by the selling stockholders and/or their registered representatives at prevailing market prices or privately negotiated prices. Currently, the Company’s common stock is not admitted to quotation on the OTC Bulletin Board or another exchange or electronic medium.

|

| Use of Proceeds |

We intend to use net proceeds from the sale of shares by us for working capital and other general corporate purposes, including the identification and exploration of mineral properties. We will not receive any proceeds from shares sold by the selling stockholders.

|

| Dividend Policy |

We intend to retain all available funds and any future earnings, if any, for use in our business operations. Accordingly, we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

|

| Fees and Expenses |

We will pay all expenses incident to the registration of such shares, except for sales commissions and other expenses of selling stockholders.

|

| 3 |

| Market Information |

Our common stock is not currently listed on any national securities exchange and is not quoted on any over-the-counter market. We intend to seek to identify a market maker to file an application with the Financial Industry Regulatory Authority, Inc. for our common stock to be admitted for quotation on the OTC Bulletin Board after the effective date of this Registration Statement. We have not yet identified a market maker that has agreed to file such application. We cannot assure you that a public market for our common stock will develop in the future.

|

| Risk Factors |

An investment in our common stock is highly speculative and involves a high degree of risk. Investors should carefully consider the risk factors and other uncertainties described in this prospectus before purchasing our common stock. See “Risk Factors” beginning on page 5.

|

| 4 |

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the following risk factors in addition to other information in this prospectus, including the financial statements and the related notes thereto. The risks and uncertainties described below are those that are currently deemed to be material and specific to our Company and industry. If any of these risks actually occur, our business may be adversely affected, and you may lose all or part of your investment.

Risks Associated With Our Business

There may be conflicts of interest between our management and the non-management stockholders of the Company.

Conflicts of interest create the risk that management may have an incentive to act adversely to the interests of the stockholders of the Company. A conflict of interest may arise between our management's personal pecuniary interest and its fiduciary duty to our stockholders.

Our independent registered public accounting firm has expressed substantial doubt as to our ability to continue as a going concern.

Based on our financial history since inception, our independent registered public accounting firm has expressed substantial doubt as to our ability to continue as a going concern. We are an exploration stage company that has not generated any revenue; specifically, the Company is proceeding with its business plan to identify and acquire exploratory non-precious or precious mineral properties in the Western United States. The Company has taken certain steps in furtherance of this business plan including soliciting geological consultants with significant exploration experience throughout the Western United States and North America. If we cannot obtain sufficient funding, we may have to delay the implementation of our business strategy.

We have limited operating history and face many of the risks and difficulties frequently encountered by exploration stage companies.

We are an exploration stage company, and to date, our efforts have been focused primarily on the development of our professional staff to identify and acquire mineral properties that or potentially economically viable. We have limited operating history for investors to evaluate the potential of our business development. We have just recently acquired properties and are in the early stages of our exploratory activities. In addition, we also face many of the risks and difficulties inherent in mineral exploration.

We have no proven or probable reserves on our leased mineral properties and we do not know if our properties contain any gold or other minerals that can be mined at a profit.

The leased properties on which we have the right to explore for gold and other minerals may not contain mineral reserves, and we do not know if any deposits of gold or other minerals can be mined at a profit. Whether a gold or other mineral deposit can be mined at a profit depends upon many factors. Some but not all of these factors include: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; operating costs and capital expenditures required to start mining a deposit; the availability and cost of financing; the price of the gold or other minerals, which is highly volatile and cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land use, importing and exporting of minerals, and environmental protection.

We are an exploration stage company and have only recently commenced exploration activities on our claims. We reported net losses for all periods since our inception in 2013 through March 31, 2016 and expect to incur operating losses for the foreseeable future.

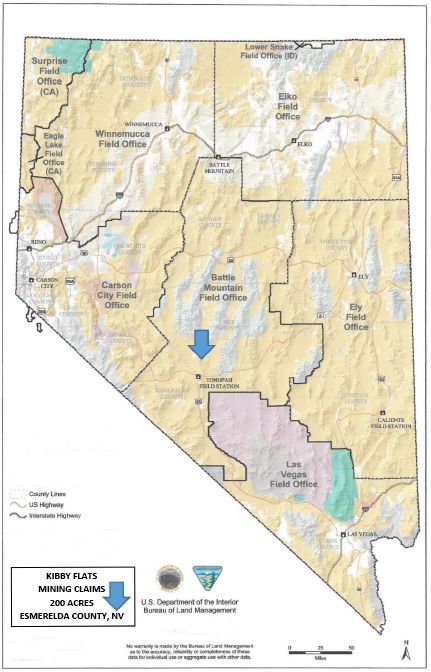

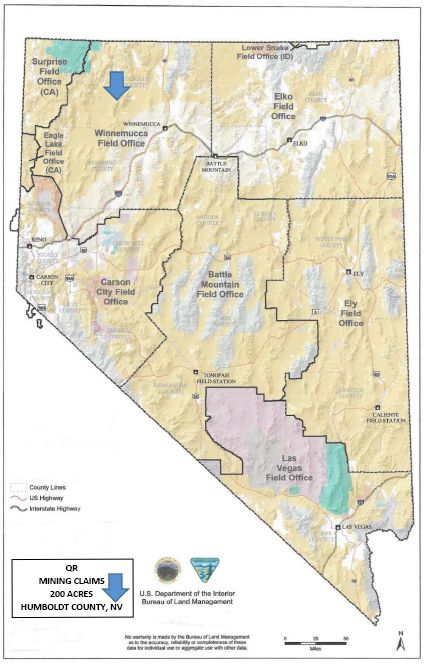

Our evaluation of our Kibby Flats and QR properties is primarily based on recent, minimal geological data from samples taken in 2002 or prior. Our plans for further exploration activities at the property and other claims are in their early stages and preliminary. Accordingly, we are not yet in a position to estimate expected amounts of minerals, yields, or values or evaluate the likelihood that our business will be successful. We have not earned any revenues from any operations. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications, and delays encountered in connection with the exploration of the mineral properties and potential commencement of mining activities based on the conclusions reached from our exploration activities. These potential problems include, but are not limited to, unanticipated problems relating to exploration, costs and expenses that may exceed current estimates and the requirement for external funding to continue our business. Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We expect to incur significant losses into the foreseeable future.

We expect to require additional external financing to fund ongoing exploration for at least the next twelve months. If we are unable to raise external funding, and eventually generate significant revenues from our claims and properties, we will not be able to earn profits or continue operations. We have no production history upon which to base any assumption as to the likelihood that we will prove successful, and it is uncertain that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Exploring for gold and other minerals is inherently speculative, involves substantial expenditures, and is frequently non-productive.

Mineral exploration (currently our only business), and gold exploration in particular, is a business that by its nature is very speculative. We may not be able to establish mineral reserves on our properties or be able to mine any gold or any other minerals on a profitable basis. Few properties that are explored are ultimately developed into producing mines. Unusual or unexpected geological conditions, fires, flooding, explosions, cave-ins, landslides, and the inability to obtain suitable or adequate machinery, equipment or labor are just some of the many risks involved in mineral exploration programs and the subsequent development of gold deposits.

| 5 |

The mining industry is capital intensive and we may be unable to raise necessary funding.

We require additional external financing to pursue our exploration activities at the Kibby Flats and QR properties and for any further properties we may pursue similar activities. We may be unable to secure additional financing on terms acceptable to us, or at all. Our inability to raise additional funds would prevent us from achieving our business objectives and would have a negative impact on our business, financial condition, results of operations, and the value of our securities. If we raise additional funds by issuing additional equity or convertible debt securities, the ownership of existing stockholders may be diluted and the securities that we may issue in the future may have rights, preferences, or privileges senior to those of the current holders of our common stock. Such securities may also be issued at a discount to the market price of our common stock, resulting in possible further dilution to the book value per share of common stock. If we raise additional funds by issuing debt, we could be subject to debt covenants that could place limitations on our operations and financial flexibility.

We are a junior exploration company with no mining activities and we may never have any mining activities in the future.

Our primary business is exploring for gold and, to a lesser extent, other minerals. If we discover commercially exploitable gold or other deposits, we will not be able to make any money from mining activities unless the gold or other deposits are actually mined, or we sell our interest. Accordingly, we will need to seek additional capital through debt or equity financing, find some other entity to mine our properties or operate our facilities on our behalf, enter into joint venture or other arrangements with a third party, or sell or lease the property or rights to mine to third parties. Mine development projects typically require a number of years and significant expenditures during the development phase before production is possible. Such projects could experience unexpected problems and delays during development, construction, and mine start up. Mining operations in the United States are subject to many different federal, state and local laws and regulations, including stringent environmental, health and safety laws. If and when we assume operational responsibility for mining on our properties, it is possible that we will be unable to comply with current or future laws and regulations, which can change at any time. It is possible that changes to these laws will be adverse to any potential mining operations. Moreover, compliance with such laws may cause substantial delays and require capital outlays in excess of those anticipated, adversely affecting any potential mining operations. Our future mining operations, if any, may also be subject to liability for pollution or other environmental damage. It is possible that we will choose to not be insured against this risk because of high insurance costs or other reasons.

We have a short operating history, have a history of losses and may never achieve any meaningful revenue.

We acquired all of our property interests since May 2015, and prior to May 2015 we incurred minimal property exploration due diligence activities. Our operating history consists of our exploration activities. We have no income-producing activities from mining or exploration, and have a history of losses stemming from the acquisition of the rights to explore on our property and conducting our exploration activities. Exploring for gold and other minerals or resources is an inherently speculative activity and there is no assurance we will be able to develop an economically feasible operating plan for the Kibby Flats or QR properties. There is a strong possibility that we will not find any other commercially exploitable gold or other deposits on our property. Because we are an exploration company, we may never achieve any meaningful revenue.

We are required to make annual BLM payments and County filings or we will lose our rights to our property.

We are required to make annual claim maintenance payments to the U.S. Bureau of Land Management (“BLM”) and pay additional fees to the counties in which our mining claims are located in order to maintain our rights to explore and, if warranted, to develop our unpatented mining claims. If we fail to meet these obligations, we will lose the right to explore for gold and other minerals on our property.

Our business is subject to extensive environmental regulations that may make exploring, mining, or related activities prohibitively expensive, and which may change at any time.

All of our operations are subject to extensive environmental regulations that can substantially delay exploration and make exploration expensive or prohibit it altogether. We may be subject to potential liabilities associated with the pollution of the environment and the disposal of waste products that may occur as the result of exploring and other related activities. We may have to pay to remedy environmental pollution, which may reduce the amount of money that we have available to use for exploration or other activities, and adversely affect our financial position. If we are unable to fully remedy an environmental problem, we might be required to suspend operations or to enter into interim compliance measures pending the completion of the required remedy. If a decision is made to mine our properties and we retain any operational responsibility for doing so, our potential exposure for remediation may be significant, and this may have a material adverse effect upon our business and financial position. We have not purchased insurance for potential environmental risks (including potential liability for pollution or other hazards associated with the disposal of waste products from our exploration activities) and such insurance may not be available to us on reasonable terms or at a reasonable price. All of our exploration and, if warranted, development activities may be subject to regulation under one or more local, state and federal environmental impact analyses and public review processes. It is possible that future changes in applicable laws, regulations and permits or changes in their enforcement or regulatory interpretation could have significant impact on some portion of our business, which may require our business to be economically re-evaluated from time to time. These risks include, but are not limited to, the risk that regulatory authorities may increase bonding requirements beyond our financial capability. Inasmuch as posting of bonding in accordance with regulatory determinations is a condition to the right to operate under all material operating permits, increases in bonding requirements could prevent operations even if we are in full compliance with all substantive environmental laws.

| 6 |

The government licenses and permits we need to explore on our property may take too long to acquire or cost too much to enable us to proceed with exploration. In the event that we conclude that the Kibby Flats and QR properties can be profitably mined, or discover other commercially exploitable deposits, we may face substantial delays and costs associated with securing the additional government licenses and permits that could preclude our ability to develop the mine.

Exploration activities usually require the granting of permits from various governmental agencies. For example, exploration drilling on unpatented mining claims requires a permit to be obtained from the BLM, which may take several months or longer to grant the requested permit. Depending on the size, location, and scope of the exploration program, additional permits may also be required before exploration activities can be undertaken. Prehistoric or Indian graves, threatened or endangered species, archeological sites or the possibility thereof, difficult access, excessive dust, and important nearby water resources may all result in the need for additional permits before exploration activities can commence.

As with all permitting processes, there is substantial uncertainty about when and if the permits will be issued. There is the risk that unexpected delays and excessive costs may be experienced in obtaining required permits. The needed permits may not be granted or could be challenged by third parties, which could result in protracted litigation that could cause substantial delays, or may be granted in an unacceptable timeframe or cost too much. Additionally, proposed mineral exploration and mining projects can become controversial and be opposed by nearby landowners and communities, which can substantially delay and interfere with the permitting process. Delays in or inability to obtain necessary permits would result in unanticipated costs, which may result in serious adverse effects upon our business.

The value of our property and any other deposits we may seek or locate is subject to volatility in the price of gold.

Our ability to obtain additional and continuing funding, and our profitability if and when we commence mining or sell our rights to mine, will be significantly affected by changes in the market price of gold and other mineral deposits. Gold and other minerals prices fluctuate widely and are affected by numerous factors, all of which are beyond our control. The price of gold may be influenced by:

| · | fluctuation in the supply of, demand, and market price for gold; |

| · | mining activities of our competitors; |

| · | sale or purchase of gold by central banks and for investment purposes by individuals and financial institutions; |

| · | interest rates; |

| · | currency exchange rates; |

| · | inflation or deflation; |

| · | fluctuation in the value of the United States dollar and other currencies; |

| · | global and regional supply and demand, including investment, industrial, and jewelry demand; and |

| · | political and economic conditions of major gold or other mineral-producing countries. |

The price of gold and other minerals have fluctuated widely in recent years, and a decline in the price of gold or other minerals could cause a significant decrease in the value of our property, limit our ability to raise money, and render continued exploration and development of our property impracticable. If that happens, then we could lose our rights to our property or be compelled to sell some or all of these rights. Additionally, the future development of our mining properties beyond the exploration stage is heavily dependent upon gold prices remaining sufficiently high to make the development of our property economically viable.

Our mineral property claims may be challenged. We are not insured against any challenges, impairments, or defects to our mining claims.

Our property is comprised primarily of unpatented lode mining claims located and maintained in accordance with the federal General Mining Law of 1872. Unpatented lode mining claims are unique U.S. property interests and are generally considered to be subject to greater title risk than other real property interests because the validity of unpatented mining claims is often uncertain. This uncertainty arises, in part, out of the complex federal and state laws and regulations with which the owner of an unpatented mining claim must comply in order to locate and maintain a valid claim. Moreover, if we discover mineralization that is close to the claim boundaries, it is possible that some or all of the mineralization may occur outside the boundaries on lands that we do not control. In such a case we would not have the right to extract those minerals. We do not have title reports or opinions covering all of our Kibby Flats and QR properties and other claims. The uncertainty resulting from not having title opinions for all of our properties and claims or having detailed claim surveys on all of our properties leaves us exposed to potential title defects. Defending challenges to our property title would be costly, and may divert funds that could otherwise be used for exploration activities and other purposes.

| 7 |

In addition, unpatented lode mining claims are always subject to possible challenges by third parties or contests by the federal government, which, if successful, may prevent us from exploiting any discovery of commercially extractable gold. Challenges to our title may increase our costs of operation or limit our ability to explore on certain portions of our property. We are not insured against challenges, impairments, or defects to our property title.

Possible amendments to the General Mining Law could make it more difficult or impossible for us to execute our business plan.

In recent years, the U.S. Congress has considered a number of proposed amendments to the General Mining Law, as well as legislation that would make comprehensive changes to the law. Although no such legislation has been adopted to date, there can be no assurance that such legislation will not be adopted in the future. If adopted, such legislation, if it includes concepts that have been part of previous legislative proposals, could, among other things, (i) adopt the limitation on the number of millsites that a claimant may use, discussed below, (ii) impose time limits on the effectiveness of plans of operation that may not coincide with mine life, (iii) impose more stringent environmental compliance and reclamation requirements on activities on unpatented mining claims and millsites, (iv) establish a mechanism that would allow states, localities and Native American tribes to petition for the withdrawal of identified tracts of federal land from the operation of the General Mining Law, (v) allow for administrative determinations that mining would not be allowed in situations where undue degradation of the federal lands in question could not be prevented, (vi) impose royalties on gold and other mineral production from unpatented mining claims or impose fees on production from patented mining claims, and (vii) impose a fee on the amount of material displaced at a mine. Further, it could have an adverse impact on earnings from our operations, could reduce estimates of any reserves we may establish and could curtail our future exploration and development activity on our unpatented claims.

In addition, a consortium of environmental groups has filed a lawsuit in the United District Court for the District of Columbia against the Department of the Interior, the Department of Agriculture, the BLM, and the USFS, asking the court to order the BLM and USFS to adopt the five-acre millsite limitation. That lawsuit also asks the court to order the BLM and the USFS to require mining claimants to pay fair market value for their use of the surface of federal lands where those claimants have not demonstrated the validity of their unpatented mining claims and millsites. If the plaintiffs in that lawsuit were to prevail, that could have an adverse impact on our ability to use our unpatented millsites for facilities ancillary to our exploration, development and mining activities, and could significantly increase the cost of using federal lands at our properties for such ancillary facilities.

Market forces or unforeseen developments may prevent us from obtaining the supplies and equipment necessary to explore for gold and other minerals.

Gold exploration and mineral exploration in general, is a very competitive business. Competitive demands for contractors and unforeseen shortages of supplies and/or equipment could result in the disruption of our planned exploration activities. Current demand for exploration drilling services, equipment, and supplies is robust and could result in suitable equipment and skilled manpower being unavailable at scheduled times for our exploration program. Fuel prices are extremely volatile as well. We will attempt to locate suitable equipment, materials, manpower, and fuel if sufficient funds are available. If we cannot find the equipment and supplies needed for our various exploration programs, we may have to suspend some or all of them until equipment, supplies, funds, and/or skilled manpower become available. Any such disruption in our activities may adversely affect our exploration activities and financial condition.

Our directors and executive officers lack significant experience or technical training in exploring for precious and base metal deposits and in developing mines.

Most of our directors and executive officers lack significant experience or technical training in exploring for precious and base metal deposits and in developing mines. Our management may not be fully aware of many of the other specific requirements related to working within this industry. Their decisions and choices may not take into account standard engineering or managerial approaches that mineral exploration companies commonly use. Consequently, our operations and ultimate financial success could suffer irreparable harm due to some of our management’s lack of experience in the mining industry.

| 8 |

We may not be able to maintain the infrastructure necessary to conduct exploration activities.

Our exploration activities depend upon adequate infrastructure. Reliable roads, bridges, power sources, and water supply are important factors that affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage, government, or other interference in the maintenance or provision of such infrastructure could adversely affect our exploration activities and financial condition.

Our exploration activities may be adversely affected by the local climate or seismic events, which could prevent us from gaining access to our property year-round.

Earthquakes, heavy rains, snowstorms, and floods could result in serious damage to or the destruction of facilities, equipment or means of access to our properties, or may otherwise prevent us from conducting exploration activities on our property. There may be short periods of time when the unpaved portion of the access road is impassible in the event of extreme weather conditions or unusually muddy conditions. During these periods, it may be difficult or impossible for us to access our property, make repairs, or otherwise conduct exploration activities on them.

Risks Related to our Stockholders and Shares of Common Stock

There is currently no trading market for our Common Stock, and liquidity of shares of our Common Stock is limited.

Shares of our Common Stock are not registered under the securities laws of any state or other jurisdiction, and accordingly there is no public trading market for the Common Stock. Further, no public trading market is expected to develop until the Company obtains effectiveness of a registration statement under the Securities Act of 1933, as amended (the “Securities Act”). Therefore, outstanding shares of Common Stock cannot be offered, sold, pledged or otherwise transferred unless subsequently registered pursuant to, or exempt from registration under, the Securities Act and any other applicable federal or state securities laws or regulations. Compliance with the criteria for securing exemptions under federal securities laws and the securities laws of the various states is extremely complex, especially in respect of those exemptions affording flexibility and the elimination of trading restrictions in respect of securities received in exempt transactions and subsequently disposed of without registration under the Securities Act or state securities laws.

Our stock is a penny stock. Trading of our stock may be restricted by the Securities and Exchange Commission’s penny stock regulations which may limit an investor’s ability to buy and sell our stock.

Our stock is a penny stock. The Securities and Exchange Commission has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

We are controlled by our management.

Management and affiliates of our management currently beneficially own and vote a majority of the issued and outstanding Common Stock of the Company. Consequently, management has the ability to influence control of the operations of the Company and, acting together, will have the ability to influence or control substantially all matters submitted to stockholders for approval, including:

| · | Election of our board of directors (the “Board of Directors”); |

| · | Removal of directors; |

| · | Amendment to the Company’s Articles of Incorporation or Bylaws; and |

| · | Adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination. |

| 9 |

These stockholders have complete control over our affairs. Accordingly, this concentration of ownership by itself may have the effect of impeding a merger, consolidation, takeover or other business consolidation, or discouraging a potential acquirer from making a tender offer for the Common Stock.

We have never paid dividends on our Common Stock.

We have never paid dividends on our Common Stock and do not presently intend to pay any dividends in the foreseeable future. We anticipate that any funds available for payment of dividends will be re-invested into the Company to further its business strategy.

We have not issued Preferred Stock.

Our Articles of Incorporation authorizes the issuance of up to 5,000,000 shares of Preferred Stock, with designations, rights and preferences determined from time to time by the Board of Directors, in its sole discretion. Accordingly, our Board of Directors is empowered, without stockholder approval, to issue Preferred Stock with dividend, liquidation, conversion, voting, or other rights which could adversely affect the voting power or other rights of the holders of the Common Stock. In the event of issuance, the Preferred Stock could be utilized, under certain circumstances, as a method of discouraging, delaying or preventing a change in control of the Company, which is sometimes referred to in corporate parlance as a “poison pill”. Although we have no present intention to issue any shares of our authorized Preferred Stock, there can be no assurance that the Company will not do so in the future. However, no Preferred Stock has been issued.

Offers or availability for sale of a substantial number of shares of our common stock may cause the price of our common stock to decline.

If our stockholders sell substantial amounts of our common stock in the public market or upon the expiration of any statutory holding period, under Rule 144, or upon the exercise of outstanding options or warrants, it could create a circumstance commonly referred to as an “overhang” in anticipation of which the market price of our common stock could decline. The existence of an overhang, whether or not sales have occurred or are occurring, also could make it more difficult for us to raise additional financing through the sale of equity or equity-related securities in the future at a time and price that we deem reasonable or appropriate.

The elimination of monetary liability against our directors, officers and employees under our articles of incorporation and the existence of indemnification rights to our directors, officers and employees may result in substantial expenditures by our Company and may discourage lawsuits against our directors, officers and employees.

Our articles of incorporation contain provisions which eliminate the liability of our directors for monetary damages to our Company and stockholders. Our bylaws also require us to indemnify our officers and directors. We may also have contractual indemnification obligations under our agreements with our directors, officers and employees. The foregoing indemnification obligations could result in our Company incurring substantial expenditures to cover the cost of settlement or damage awards against directors, officers and employees that we may be unable to recoup. These provisions and resultant costs may also discourage our Company from bringing a lawsuit against directors, officers and employees for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our stockholders against our directors, officers and employees even though such actions, if successful, might otherwise benefit our Company and stockholders.

Anti-takeover provisions may impede the acquisition of our Company.

Certain provisions of the Nevada General Corporation Law have anti-takeover effects and may inhibit a non-negotiated merger or other business combination. These provisions are intended to encourage any person interested in acquiring us to negotiate with, and to obtain the approval of, our board of directors in connection with such a transaction. However, certain of these provisions may discourage a future acquisition of us, including an acquisition in which the stockholders might otherwise receive a premium for their shares. As a result, stockholders who might desire to participate in such a transaction may not have the opportunity to do so.

MARKET AND OTHER DATA

The industry and market data contained in this prospectus are based on independent industry publications, reports by market research firms or other published independent sources and, in each case, are believed by us to be reliable and accurate. However, industry and market data is subject to change and cannot always be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey. In addition, consumption patterns and customer preferences can and do change. The industry and market data sources upon which we relied are publicly available and were not prepared for our benefit or paid for by us.

| 10 |

USE OF PROCEEDS

Our offering is being made on a self-underwritten, best-efforts basis: no minimum number of shares must be sold in order for the offering to proceed. The offering price per share is $0.20. The following table sets forth the uses of proceeds assuming sales less than the maximum securities offered for sale by the Company. Each individual use of proceeds is disclosed in the order of priority in which any such proceeds will be used. The offering scenarios presented are for illustrative purposes only, the actual amount of proceeds, if any, may differ. There is no assurance that we will be successful in our efforts.

| Amounts Raised as a Percentage of Total Offering | ||||||||||||||||

| 75% | 25% | 10% | 3% | |||||||||||||

| Gross Proceeds | $ | 1,080,000 | $ | 360,000 | $ | 144,000 | $ | 50,000 | ||||||||

| Registration Costs | 10,000 | 10,000 | 10,000 | 10,000 | ||||||||||||

| Net Proceeds | $ | 1,070,000 | $ | 350,000 | $ | 134,000 | 40,000 | |||||||||

| Use of Proceeds | ||||||||||||||||

| Professional Fees and Compliance | $ | 60,000 | $ | 60,000 | $ | 60,000 | $ | 24,000 | ||||||||

| Permitting | 130,000 | 80,000 | 60,000 | 16,000 | ||||||||||||

| Exploration | 350,000 | 150,000 | 14,000 | – | ||||||||||||

| Capital Expenditures | 100,000 | 60,000 | – | – | ||||||||||||

| Mineral Property Acquisitions | 250,000 | – | – | – | ||||||||||||

| Working capital reserve | 130,000 | – | – | – | ||||||||||||

The above figures represent only estimated costs. All proceeds will be deposited into our corporate bank account. No proceeds from this offering will be used to repay the founders of the Company for their investments in the Company. We anticipate that we will require a minimum funding of approximately $50,000 for a minimum period of one year including costs associated with this offering and maintaining a reporting status with the SEC. If adequate funds are not raised, we expect that our founders will invest further or loan money to the Company, although there are no such contractual commitments.

The effectiveness of the registration with respect to the shares of common stock offered by this prospectus that are being registered for the account of the selling stockholders named in this prospectus, we will not receive any proceeds from the sale of the common stock offered through this prospectus by the selling stockholders. We will pay all of the expenses incident to the registration of the shares pursuant to this prospectus except for sales commissions and other expenses of selling stockholders named herein.

DETERMINATION OF OFFERING PRICE

The offering price of the shares has been determined arbitrarily by us. The price does not bear any relationship to our assets, book value, earnings, or other established criteria for valuing a privately held company. In determining the number of shares to be offered and the offering price, we took into consideration our cash on hand and the amount of money we would need to implement our business plan. Accordingly, the offering price should not be considered an indication of the actual value of the securities.

DILUTION OF THE PRICE YOU PAY FOR YOUR SHARES

Dilution represents the difference between the offering price and the net tangible book value per share immediately after completion of this offering. Net tangible book value is the amount that results from subtracting total liabilities and intangible assets from total assets. Dilution arises mainly as a result of our arbitrary determination of the offering price of the shares being offered. Dilution of the value of the shares you purchase is also a result of the lower book value of the shares held by our existing stockholders.

Investors who purchase our common stock will be diluted to the extent of the difference between the public offering price per share of our common stock and the pro forma as adjusted net tangible book value per share of our common stock immediately after this offering. Net tangible book value per share is determined by dividing our total tangible assets less total liabilities by the number of outstanding shares of our common stock. As of March 31, 2016, we had a net tangible book value of $960,203, or approximately $0.03 per share of common stock.

| 11 |

Dilution in net tangible book value per share represents the difference between the assumed offering price per share of common stock of $0.20 and the pro forma as adjusted net tangible book value per share of common stock immediately after the sale of the 6,500,000 shares of common stock being registered for resale in accordance with this Offering. Therefore, after giving effect to our assumed receipt of $1,300,000 in estimated net proceeds from the issuance of 6,500,000 shares of common stock under this Offering and registered in this offering (assuming a purchase price of $0.20 per share, 100% of the closing price of the common stock and assuming such sale was made on March 31, 2016, and after deducting estimated offering commissions and expenses payable by us), our pro forma as adjusted net tangible book value as of March 31, 2016 would have been $2,260,203, or $0.05 per share. This would represent an immediate increase in the net tangible book value of $0.02 per share to existing shareholders attributable to this offering. The following table illustrates this per share dilution:

| Assumed offering price per share of common stock | $ | 0.20 | ||||||

| Net tangible book value per share as of March 31, 2016 | $ | 0.03 | ||||||

| Increase in as adjusted net tangible book value per share attributable to the sale of shares under the Purchase Agreement | 0.02 | |||||||

| Pro forma net tangible book value per share after the sale of shares under the Purchase Agreement | 0.05 | |||||||

| Dilution per share to new investors | $ | 0.05 |

To the extent that we sell more or less than $1,300,000 worth of shares under this Offering, or to the extent that some or all sales are made at prices lower than or in excess of the assumed price per share of $0.20, then the dilution reflected in the table above will differ. The above table is based on 37,965,000 shares of our common stock outstanding as of March 31, 2016, adjusted for the assumed sale of $1,300,000 in shares to the Equity Purchaser under the Purchase Agreement at the assumed purchase price described above and after deducting estimated offering commissions and expenses payable by us.

To the extent that we issue additional shares of common stock in the future, there may be further dilution to investors participating in this offering. In addition, we may choose to raise additional capital because of market conditions or strategic considerations, even if we believe that we have sufficient funds for our current or future operating plans. If we raise additional capital through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our shareholders.

| 12 |

TERMS OF THE OFFERING

We have 37,965,000 shares of common stock issued and outstanding as of the date of this prospectus of which 3,500,000 of the shares will be registered. The Company is registering an additional 6,500,000 shares of its common stock for sale at the price of $0.20 per share for private placement by the Company. There is no arrangement to address the possible effect of the offering on the price of the stock.

In connection with the Company’s selling efforts in the offering, our Chief Executive Officer will not register as a broker-dealer pursuant to Section 15 of the Exchange Act, but rather will rely upon the “safe harbor” provisions of SEC Rule 3a4-1, promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Generally speaking, Rule 3a4-1 provides an exemption from the broker-dealer registration requirements of the Exchange Act for persons associated with an issuer that participate in an offering of the issuer’s securities. Our CEO is not subject to any statutory disqualification, as that term is defined in Section 3(a)(39) of the Exchange Act. Mr. Kersey will not be compensated in connection with his participation in the offering by the payment of commissions or other remuneration based either directly or indirectly on transactions in our securities. Mr. Kersey is not, nor has been within the past 12 months, a broker or dealer, and he is not, nor has been within the past 12 months, an associated person of a broker or dealer. At the end of the offering, Mr. Kersey will continue to primarily perform substantial duties for the Company or on its behalf otherwise than in connection with transactions in securities. Mr. Kersey will not participate in selling an offering of securities for any issuer more than once every 12 months other than in reliance on Exchange Act Rule 3a4-1(a)(4)(i) or (iii).

High Desert Holding Corp. will receive all proceeds from the sale of the 6,500,000 shares being offered. The price per share is fixed at $0.20 for the duration of this offering. Although our common stock is not listed on a public exchange or quoted over-the-counter, we intend to seek to have our shares of common stock quoted on the OTC Bulletin Board. To be quoted on the OTC Bulletin Boarda market maker must file an application on our behalf to make a market for our common stock. As of the date of this Registration Statement, we have not engaged market maker to file such an application. There is no guarantee that a market marker will file an application on our behalf, and even if an application is filed, there is no guarantee that we will be accepted for quotation. Our stock may become quoted, rather than traded, on the OTC Bulletin Board.

The Company’s shares may be sold to purchasers from time to time directly by and subject to the discretion of the Company. Further, the Company will not offer its shares for sale through underwriters, dealers, agents, or anyone who may receive compensation in the form of underwriting discounts, concessions, or commissions from the Company and/or the purchasers of the shares for whom they may act as agents. The shares of common stock sold by the Company may be occasionally sold in one or more transactions; all shares sold under this prospectus will be sold at a fixed price of $0.20 per share.

In order to comply with the applicable securities laws of certain States, the securities will be offered or sold in those States only if they have been registered or qualified for sale or if an exemption from such registration or qualification requirement is available and with which the Company has complied.

In addition, and without limiting the foregoing, the Company will be subject to applicable provisions, rules and regulations under the Exchange Act with regard to security transactions during the period of time when this Registration Statement is effective.

Our shares of common stock are subject to the “penny stock” rules of the Securities and Exchange Commission. The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in "penny stocks”. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system). Penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document prepared by the SEC, which specifies information about penny stocks and the nature and significance of risks of the penny stock market. A broker-dealer must also provide the customer with bid and offer quotations for the penny stock, the compensation of the broker-dealer, and sales person in the transaction, and monthly account statements indicating the market value of each penny stock held in the customer's account. In addition, the penny stock rules require that, prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for stock that becomes subject to those penny stock rules. If a trading market for our common stock develops, our common stock will probably become subject to the penny stock rules, and shareholders may have difficulty in selling their shares.

| 13 |

We will pay all expenses incidental to the registration of the shares, which we expect to be approximately $10,000.

Offering Period and Expiration Date

This offering will start on the date that this registration statement is declared effective by the SEC and continue for a period of one hundred and eighty (180) days. The offering shall terminate on the earlier of (i) the date when the sale of all 10,000,000 shares is completed, (ii) when the Board of Directors decides that it is in the best interest of the Company to terminate the offering prior the completion of the sale of all 10,000,000 shares registered under the Registration Statement of which this Prospectus is part or (iii) the 181st day after the effective date of this prospectus. We will not accept any money until this registration statement is declared effective by the SEC.

Procedures for Subscribing

If you decide to subscribe for any shares in this offering, you must

| · | execute and deliver a subscription agreement; and |

| · | deliver a check or certified funds to us for acceptance or rejection. |

All checks for subscriptions must be made payable to “High Desert Holding Corp.” The Company will deliver stock certificates attributable to shares of common stock purchased directly to the purchasers within ninety (90) days of the close of the offering.

Once you submit the subscription agreement and it is accepted, you may not revoke or change your subscription or request a refund of monies paid. All accepted subscriptions are irrevocable, even if you subsequently learn information about us that you consider to be materially unfavorable.

Right to Reject Subscriptions

We have the right to accept or reject subscriptions in whole or in part, for any reason or for no reason. All monies from rejected subscriptions will be returned immediately by us to the subscriber, without interest or deductions. Subscriptions for securities will be accepted or rejected within 48 hours after we receive them.

FORWARD LOOKING STATEMENTS

Some information contained in or incorporated by reference into this registration statement on Form S-1 may contain forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995. These statements include statements relating to our plans to explore our Kibby Flats and QR properties, and any other properties we may acquire; expectations and the timing and budget for exploration and potential monetization of our Kibby Flats and QR properties; or our planned expenditures for at least the next twelve months from the date of this report.

We use the words “anticipate,” “continue,” “likely,” “estimate,” “expect,” “may,” “could,” “will,” “project,” “should,” “believe” and similar expressions to identify forward-looking statements. Statements that contain these words discuss our future expectations and plans, related permitting and exploration activities, expenditures or other matters, or state other forward-looking information. Although we believe the expectations and assumptions reflected in those forward-looking statements are reasonable, we cannot assure you that these expectations and assumptions will prove to be correct. Our actual results could differ materially from those expressed or implied in these forward-looking statements as a result of various factors described in this registration statement on Form S-1, including:

| · | Risks relating to the 2016 exploration efforts, determining the feasibility and economic viability of commencing mining, our ability to fund future exploration costs or purchase additional equipment, and our ability to obtain or amend the necessary permits, consents, or authorizations; |