Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - EQUITY BANCSHARES INC | d223370dex991.htm |

| EX-2.1 - EX-2.1 - EQUITY BANCSHARES INC | d223370dex21.htm |

| 8-K - 8-K - EQUITY BANCSHARES INC | d223370d8k.htm |

Merger with Community First Bancshares, Inc. July 14, 2016 NASDAQ: EQBK Exhibit 99.2

Forward-Looking Statements Special Note Concerning Forward-Looking Statements This press release contains “forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect the current views of Equity’s management with respect to, among other things, future events and Equity’s financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “project,” “forecast,” “goal,” “target,” “would” and “outlook,” or the negative variations of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about Equity’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond Equity’s control. Accordingly, Equity cautions you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although Equity believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Factors that could cause actual results to differ materially from Equity’s expectations include competition from other financial institutions and bank holding companies; the effects of and changes in trade, monetary and fiscal policies and laws, including interest rate policies of the Federal Reserve Board; changes in the demand for loans; fluctuations in value of collateral and loan reserves; inflation, interest rate, market and monetary fluctuations; changes in consumer spending, borrowing and savings habits; and acquisitions and integration of acquired businesses, and similar variables. The foregoing list of factors is not exhaustive. For discussion of these and other risks that may cause actual results to differ from expectations, please refer to “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in Equity’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 17, 2016 and any updates to those risk factors set forth in Equity’s subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. If one or more events related to these or other risks or uncertainties materialize, or if Equity’s underlying assumptions prove to be incorrect, actual results may differ materially from what Equity anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and Equity does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. New risks and uncertainties arise from time to time, and it is not possible for us to predict those events or how they may affect us. In addition, Equity cannot assess the impact of each factor on Equity’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements, expressed or implied, included in this press release are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Equity or persons acting on Equity’s behalf may issue. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

Additional Information for Investors and Shareholders Additional Information for Investors and Shareholders The information contained herein does not constitute an offer to sell or a solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger of Equity and CFBI, Equity will file a registration statement on Form S-4 with the Securities and Exchange Commission (the “SEC”). The registration statement will include a joint proxy statement of Equity and CFBI, which also will constitute a prospectus of Equity, that Equity and CFBI will send to their respective shareholders. Investors and shareholders are advised to read the joint proxy statement/prospectus when it becomes available because it will contain important information about Equity, CFBI and the proposed transaction. These documents will contain important information relating to the proposed transaction. When filed, this document and other documents relating to the merger filed by Equity can be obtained free of charge from the SEC's website at www.sec.gov. These documents also can be obtained free of charge by accessing Equity's website at www.equitybank.com under the tab “Investor Relations” and then under “Financials.” Alternatively, these documents, when available, can be obtained free of charge from Equity by directing a request to Equity Bancshares, Inc., 7701 East Kellogg, Wichita, Kansas 67207, Attention: John J. Hanley, SVP and Investor Relations Officer, Telephone: (316) 612-6000; or to Community First Bancshares, Inc., 200 E. Ridge Avenue, Harrison, Arkansas, Attention: Jerry Maland, Chairman, President & CEO, Telephone: (870) 391-8069. Participants in the Transaction Equity, CFBI and certain of their respective directors and executive officers may be deemed under the rules of the SEC to be participants in the solicitation of proxies from the respective shareholders of Equity and CFBI in connection with the proposed transaction. Certain information regarding the interests of these participants and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the joint proxy statement/prospectus regarding the proposed transaction when it becomes available. Additional information about Equity and its directors and officers may be found in the definitive proxy statement of Equity relating to its 2016 Annual Meeting of Stockholders filed with the SEC on March 28, 2016 and Equity's annual report on Form 10-K for the year ended December 31, 2015 filed with the SEC on March 17, 2016. The definitive proxy statement and annual report can be obtained free of charge from the SEC's website at www.sec.gov. No Offer or Solicitation This press release shall not constitute an offer to sell, a solicitation of an offer to sell, or the solicitation or an offer to buy any securities. There will be no sale of securities in any jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirement of Section 10 of the Securities Act of 1933, as amended.

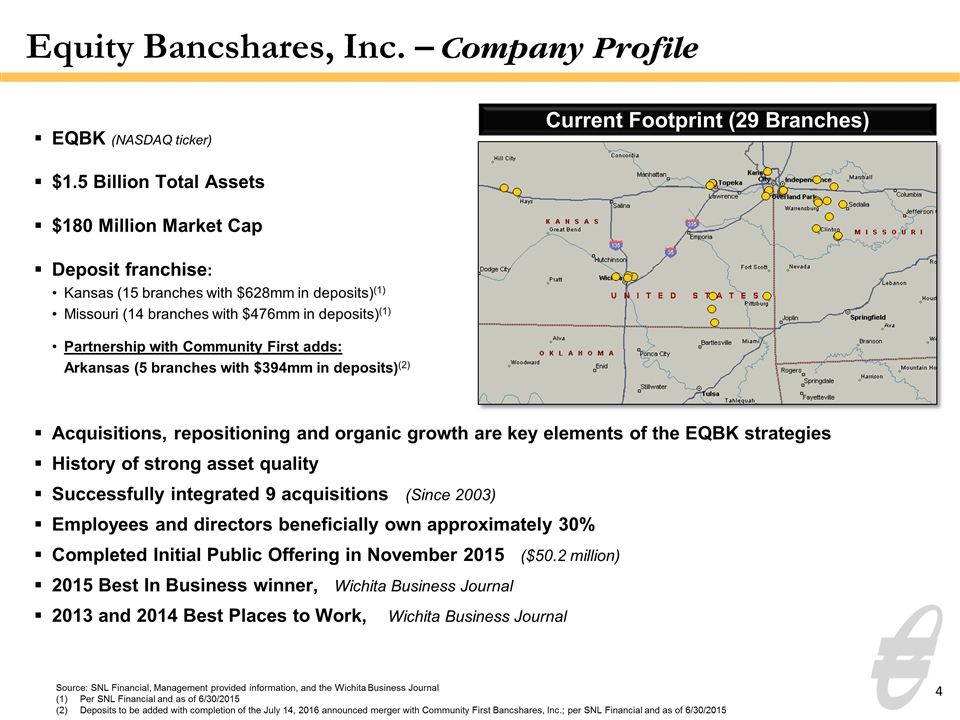

Equity Bancshares, Inc. – Company Profile Source: SNL Financial, Management provided information, and the Wichita Business Journal Per SNL Financial and as of 6/30/2015 Deposits to be added with completion of the July 14, 2016 announced merger with Community First Bancshares, Inc.; per SNL Financial and as of 6/30/2015 EQBK (NASDAQ ticker) $1.5 Billion Total Assets $180 Million Market Cap Deposit franchise: Kansas (15 branches with $628mm in deposits)(1) Missouri (14 branches with $476mm in deposits)(1) Partnership with Community First adds: Arkansas (5 branches with $394mm in deposits)(2) Acquisitions, repositioning and organic growth are key elements of the EQBK strategies History of strong asset quality Successfully integrated 9 acquisitions (Since 2003) Employees and directors beneficially own approximately 30% Completed Initial Public Offering in November 2015 ($50.2 million) 2015 Best In Business winner, Wichita Business Journal 2013 and 2014 Best Places to Work, Wichita Business Journal Current Footprint (29 Branches)

Core Components of EQBK’s Story Growth in Commercial Banking Franchise Commercial banking customers (70% of loans) Manufacturing, transportation, business Strong Operating Performance Delivered earnings and EPS growth High, stable and expanding NIM Above peer asset quality through cycles Leveraging infrastructure to achieve efficiencies Proven M&A Acquirer and Integrator Successful track record Ability to integrate, operate and enhance revenue Performance Opportunity Growth Oriented Business Plan Focus on commercial banking Continue organic and acquisition initiatives Leverage efficient, scalable infrastructure Enhance revenue through identified synergies Hire talented, entrepreneurial employees Continue offering sophisticated, improved and customized banking products Market Opportunity Numerous acquisition opportunities Gathering low cost deposits and deploying into our growing target lending markets Management Team & Board Strength Large bank experience with community bank care Success in attracting clients from larger banks Deep alignment with shareholders C-Suite and top-line managers have significant ownership Top-shelf credit culture

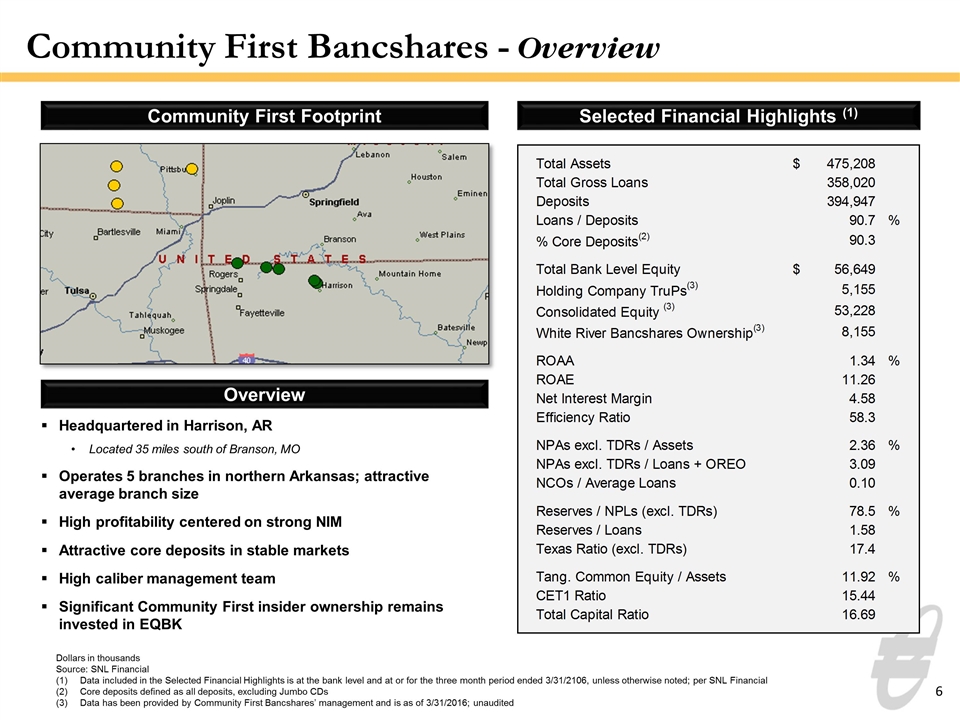

Community First Bancshares - Overview Community First Footprint Selected Financial Highlights (1) Dollars in thousands Source: SNL Financial Data included in the Selected Financial Highlights is at the bank level and at or for the three month period ended 3/31/2106, unless otherwise noted; per SNL Financial Core deposits defined as all deposits, excluding Jumbo CDs Data has been provided by Community First Bancshares’ management and is as of 3/31/2016; unaudited Overview Headquartered in Harrison, AR Located 35 miles south of Branson, MO Operates 5 branches in northern Arkansas; attractive average branch size High profitability centered on strong NIM Attractive core deposits in stable markets High caliber management team Significant Community First insider ownership remains invested in EQBK

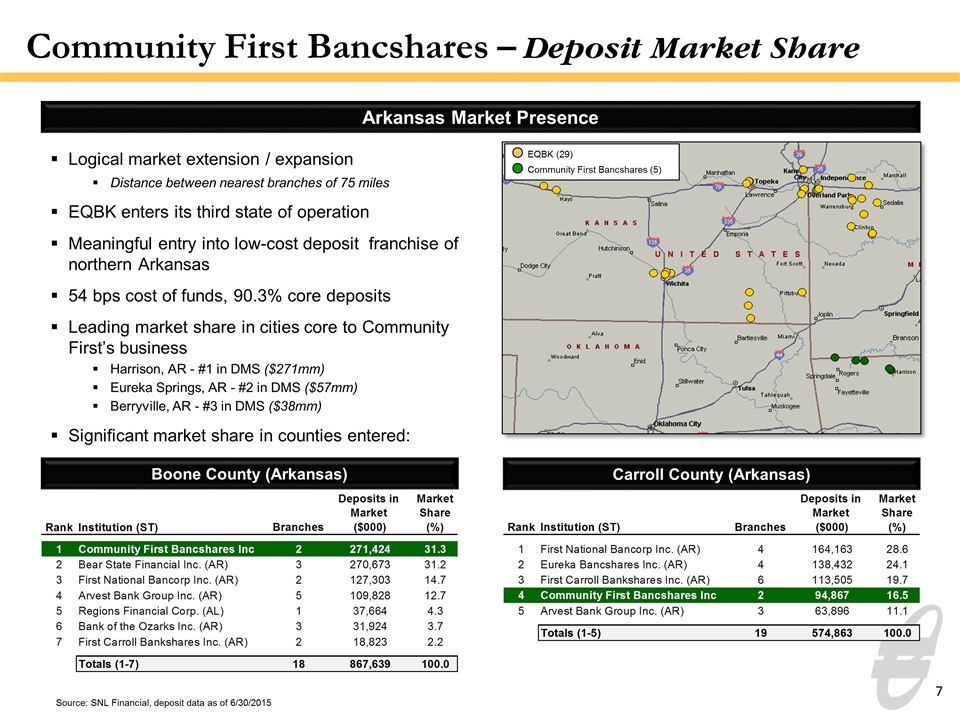

Arkansas Market Presence Community First Bancshares – Deposit Market Share Source: SNL Financial, deposit data as of 6/30/2015 Boone County (Arkansas) Logical market extension / expansion Distance between nearest branches of 75 miles EQBK enters its third state of operation Meaningful entry into low-cost deposit franchise of northern Arkansas 54 bps cost of funds, 90.3% core deposits Leading market share in cities core to Community First’s business Harrison, AR - #1 in DMS ($271mm) Eureka Springs, AR - #2 in DMS ($57mm) Berryville, AR - #3 in DMS ($38mm) Significant market share in counties entered: Carroll County (Arkansas) EQBK (29) Community First Bancshares (5)

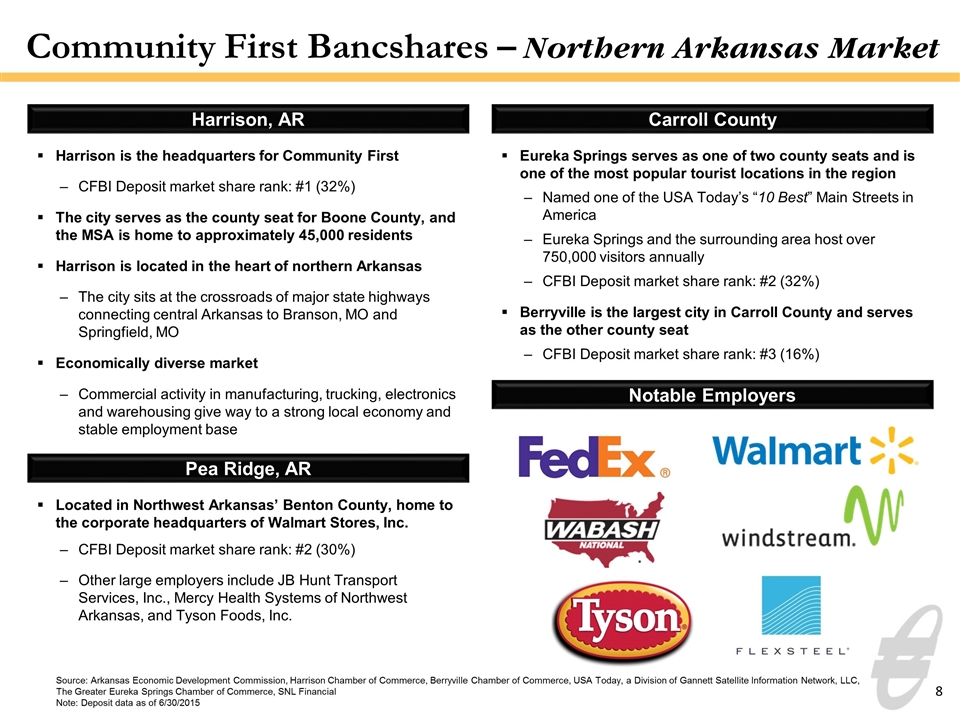

Community First Bancshares – Northern Arkansas Market Source: Arkansas Economic Development Commission, Harrison Chamber of Commerce, Berryville Chamber of Commerce, USA Today, a Division of Gannett Satellite Information Network, LLC, The Greater Eureka Springs Chamber of Commerce, SNL Financial Note: Deposit data as of 6/30/2015 Harrison, AR Pea Ridge, AR Carroll County Harrison is the headquarters for Community First CFBI Deposit market share rank: #1 (32%) The city serves as the county seat for Boone County, and the MSA is home to approximately 45,000 residents Harrison is located in the heart of northern Arkansas The city sits at the crossroads of major state highways connecting central Arkansas to Branson, MO and Springfield, MO Economically diverse market Commercial activity in manufacturing, trucking, electronics and warehousing give way to a strong local economy and stable employment base Eureka Springs serves as one of two county seats and is one of the most popular tourist locations in the region Named one of the USA Today’s “10 Best” Main Streets in America Eureka Springs and the surrounding area host over 750,000 visitors annually CFBI Deposit market share rank: #2 (32%) Berryville is the largest city in Carroll County and serves as the other county seat CFBI Deposit market share rank: #3 (16%) Located in Northwest Arkansas’ Benton County, home to the corporate headquarters of Walmart Stores, Inc. CFBI Deposit market share rank: #2 (30%) Other large employers include JB Hunt Transport Services, Inc., Mercy Health Systems of Northwest Arkansas, and Tyson Foods, Inc. Notable Employers

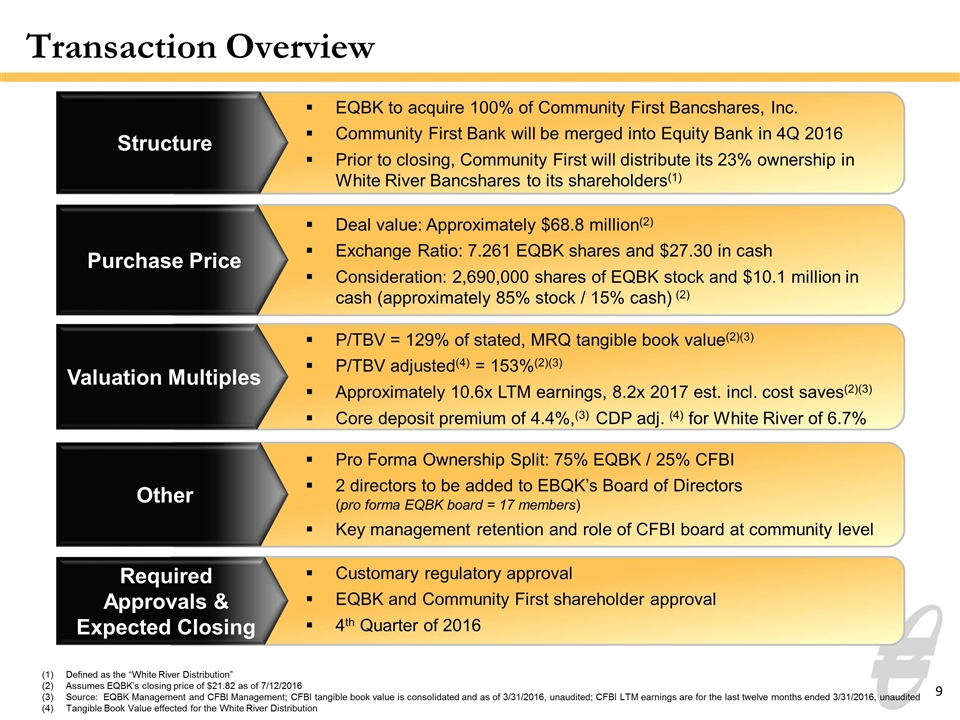

Transaction Overview Structure EQBK to acquire 100% of Community First Bancshares, Inc. Community First Bank will be merged into Equity Bank in 4Q 2016 Prior to closing, Community First will distribute its 23% ownership in White River Bancshares to its shareholders(1) Purchase Price Deal value: Approximately $68.8 million(2) Exchange Ratio: 7.261 EQBK shares and $27.30 in cash Consideration: 2,690,000 shares of EQBK stock and $10.1 million in cash (approximately 85% stock / 15% cash) (2) Valuation Multiples P/TBV = 129% of stated, MRQ tangible book value(2)(3) P/TBV adjusted(4) = 153%(2)(3) Approximately 10.6x LTM earnings, 8.2x 2017 est. incl. cost saves(2)(3) Core deposit premium of 4.4%,(3) CDP adj. (4) for White River of 6.7% Required Approvals & Expected Closing Customary regulatory approval EQBK and Community First shareholder approval 4th Quarter of 2016 Defined as the “White River Distribution” Assumes EQBK’s closing price of $21.82 as of 7/12/2016 Source: EQBK Management and CFBI Management; CFBI tangible book value is consolidated and as of 3/31/2016, unaudited; CFBI LTM earnings are for the last twelve months ended 3/31/2016, unaudited Tangible Book Value effected for the White River Distribution Other Pro Forma Ownership Split: 75% EQBK / 25% CFBI 2 directors to be added to EBQK’s Board of Directors (pro forma EQBK board = 17 members) Key management retention and role of CFBI board at community level

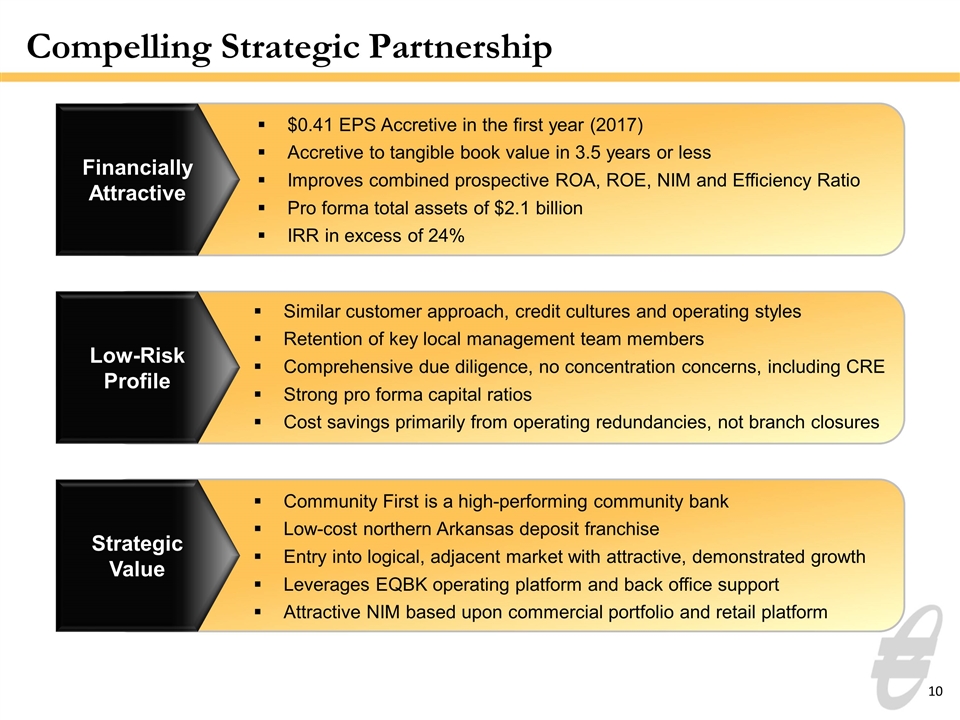

Compelling Strategic Partnership Low-Risk Profile Similar customer approach, credit cultures and operating styles Retention of key local management team members Comprehensive due diligence, no concentration concerns, including CRE Strong pro forma capital ratios Cost savings primarily from operating redundancies, not branch closures Strategic Value Community First is a high-performing community bank Low-cost northern Arkansas deposit franchise Entry into logical, adjacent market with attractive, demonstrated growth Leverages EQBK operating platform and back office support Attractive NIM based upon commercial portfolio and retail platform $0.41 EPS Accretive in the first year (2017) Accretive to tangible book value in 3.5 years or less Improves combined prospective ROA, ROE, NIM and Efficiency Ratio Pro forma total assets of $2.1 billion IRR in excess of 24% Financially Attractive

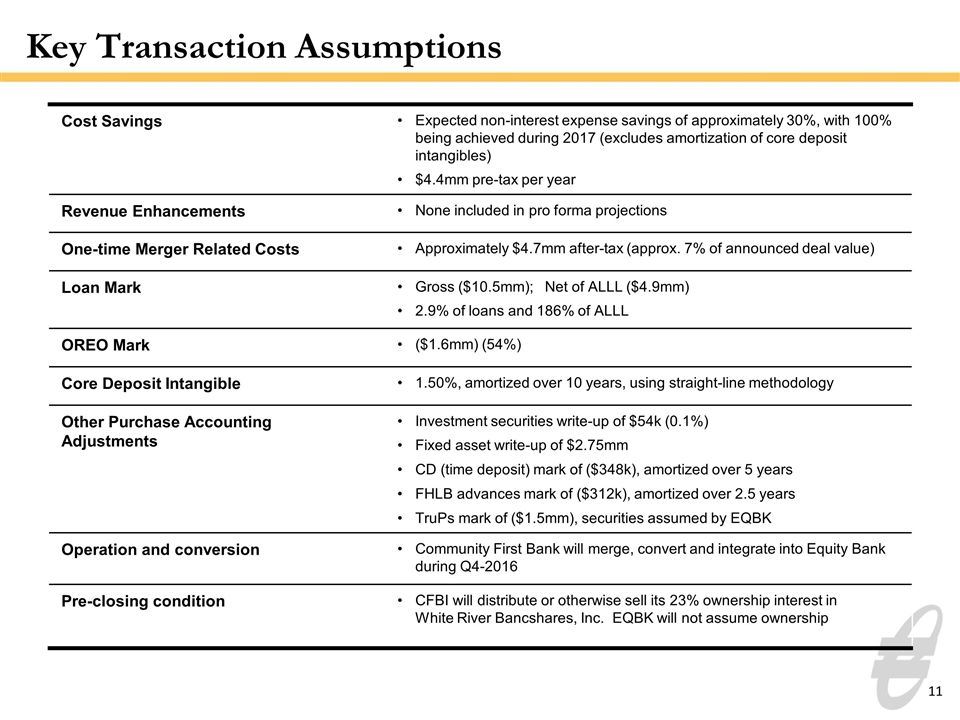

Key Transaction Assumptions Cost Savings Expected non-interest expense savings of approximately 30%, with 100% being achieved during 2017 (excludes amortization of core deposit intangibles) $4.4mm pre-tax per year Revenue Enhancements None included in pro forma projections One-time Merger Related Costs Approximately $4.7mm after-tax (approx. 7% of announced deal value) Loan Mark Gross ($10.5mm); Net of ALLL ($4.9mm) 2.9% of loans and 186% of ALLL OREO Mark ($1.6mm) (54%) Core Deposit Intangible 1.50%, amortized over 10 years, using straight-line methodology Other Purchase Accounting Adjustments Investment securities write-up of $54k (0.1%) Fixed asset write-up of $2.75mm CD (time deposit) mark of ($348k), amortized over 5 years FHLB advances mark of ($312k), amortized over 2.5 years TruPs mark of ($1.5mm), securities assumed by EQBK Operation and conversion Community First Bank will merge, convert and integrate into Equity Bank during Q4-2016 Pre-closing condition CFBI will distribute or otherwise sell its 23% ownership interest in White River Bancshares, Inc. EQBK will not assume ownership

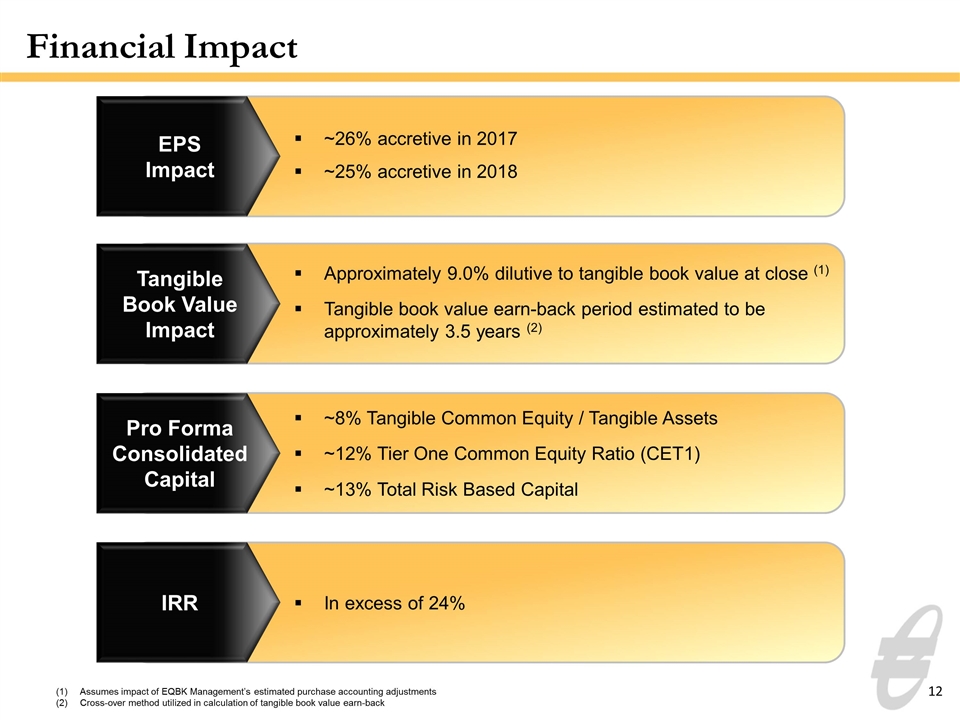

Financial Impact EPS Impact ~26% accretive in 2017 ~25% accretive in 2018 Tangible Book Value Impact Approximately 9.0% dilutive to tangible book value at close (1) Tangible book value earn-back period estimated to be approximately 3.5 years (2) Pro Forma Consolidated Capital ~8% Tangible Common Equity / Tangible Assets ~12% Tier One Common Equity Ratio (CET1) ~13% Total Risk Based Capital IRR In excess of 24% Assumes impact of EQBK Management’s estimated purchase accounting adjustments Cross-over method utilized in calculation of tangible book value earn-back

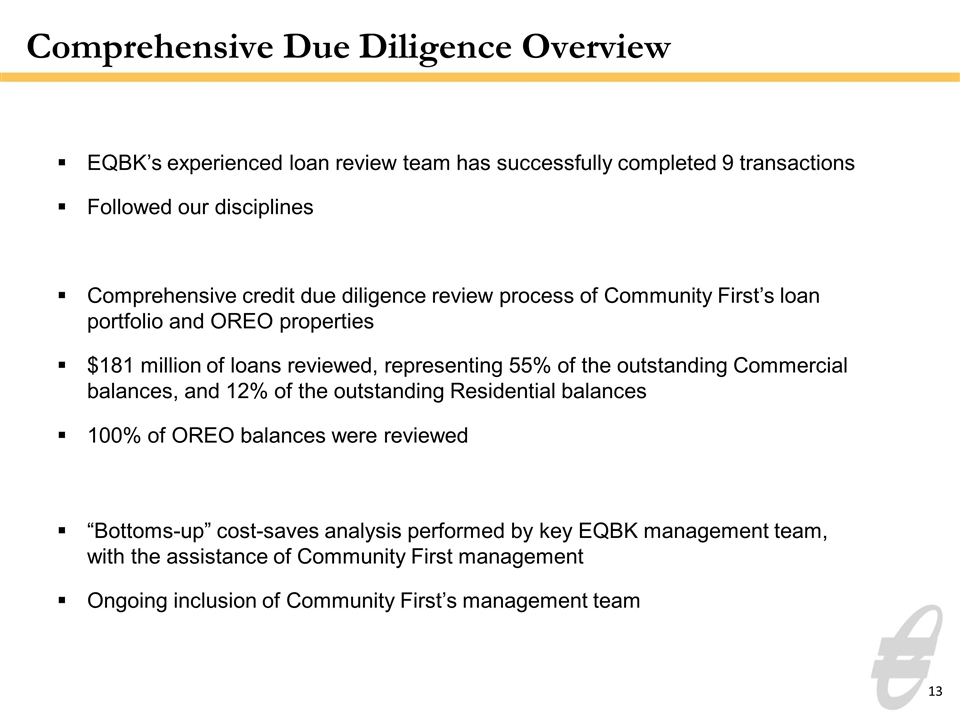

Comprehensive Due Diligence Overview EQBK’s experienced loan review team has successfully completed 9 transactions Followed our disciplines Comprehensive credit due diligence review process of Community First’s loan portfolio and OREO properties $181 million of loans reviewed, representing 55% of the outstanding Commercial balances, and 12% of the outstanding Residential balances 100% of OREO balances were reviewed “Bottoms-up” cost-saves analysis performed by key EQBK management team, with the assistance of Community First management Ongoing inclusion of Community First’s management team

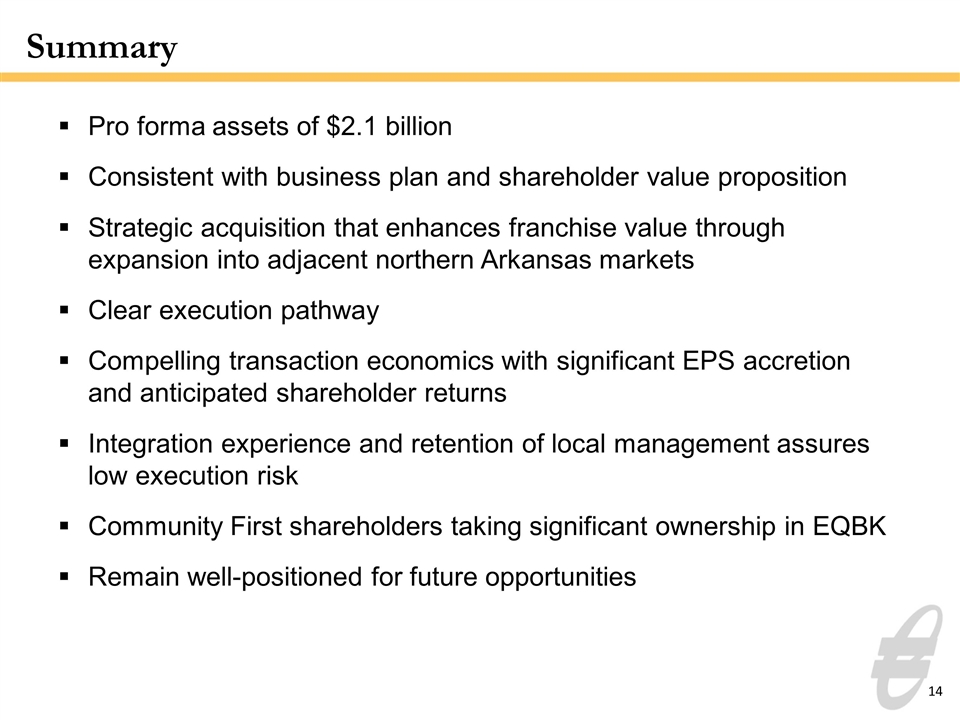

Summary Pro forma assets of $2.1 billion Consistent with business plan and shareholder value proposition Strategic acquisition that enhances franchise value through expansion into adjacent northern Arkansas markets Clear execution pathway Compelling transaction economics with significant EPS accretion and anticipated shareholder returns Integration experience and retention of local management assures low execution risk Community First shareholders taking significant ownership in EQBK Remain well-positioned for future opportunities

Benefits to the Combined Stakeholders Customers Community banking model with a focus on serving clients Addition of branch presence in appealing northern Arkansas markets Ability to provided enhanced products and services Community bank market leader in Kansas, Missouri and Arkansas Employees Similar cultures and markets allows for a simplified employee transition Larger organization creates opportunities for career advancement Long-term dedicated management teams Larger size increases public identity and recruiting capability Strategically and financially attractive transaction Successful Board and management team with strong community ties Improved liquidity for Community First shareholders Opportunity for increased shareholder value for both companies Shareholders

Supplemental Information

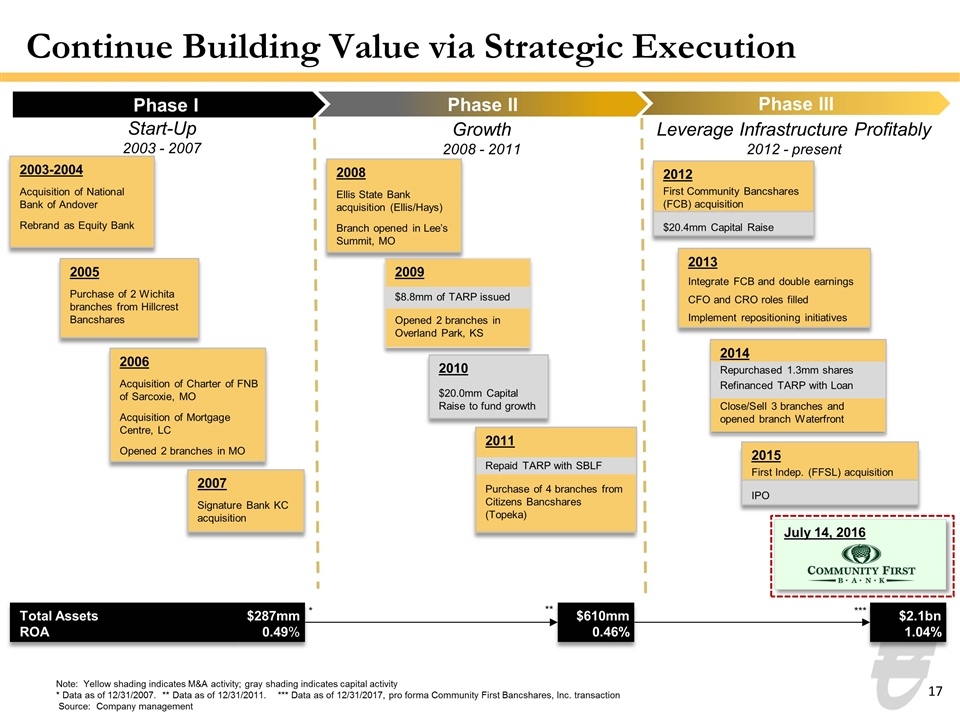

Note: Yellow shading indicates M&A activity; gray shading indicates capital activity * Data as of 12/31/2007. ** Data as of 12/31/2011. *** Data as of 12/31/2017, pro forma Community First Bancshares, Inc. transaction Source: Company management 2009 $8.8mm of TARP issued Opened 2 branches in Overland Park, KS 2014 Repurchased 1.3mm shares Refinanced TARP with Loan Close/Sell 3 branches and opened branch Waterfront 2012 First Community Bancshares (FCB) acquisition $20.4mm Capital Raise 2011 Repaid TARP with SBLF Purchase of 4 branches from Citizens Bancshares (Topeka) Continue Building Value via Strategic Execution 2003-2004 Acquisition of National Bank of Andover Rebrand as Equity Bank 2005 Purchase of 2 Wichita branches from Hillcrest Bancshares 2006 Acquisition of Charter of FNB of Sarcoxie, MO Acquisition of Mortgage Centre, LC Opened 2 branches in MO 2008 Ellis State Bank acquisition (Ellis/Hays) Branch opened in Lee’s Summit, MO 2010 $20.0mm Capital Raise to fund growth 2013 Integrate FCB and double earnings CFO and CRO roles filled Implement repositioning initiatives 2007 Signature Bank KC acquisition Phase I Phase II Phase III Start-Up 2003 - 2007 Growth 2008 - 2011 Leverage Infrastructure Profitably 2012 - present $2.1bn 1.04% Total Assets ROA $287mm 0.49% $610mm 0.46% * ** *** 2015 First Indep. (FFSL) acquisition IPO July 14, 2016 Comm. First (CFBI) acquisition

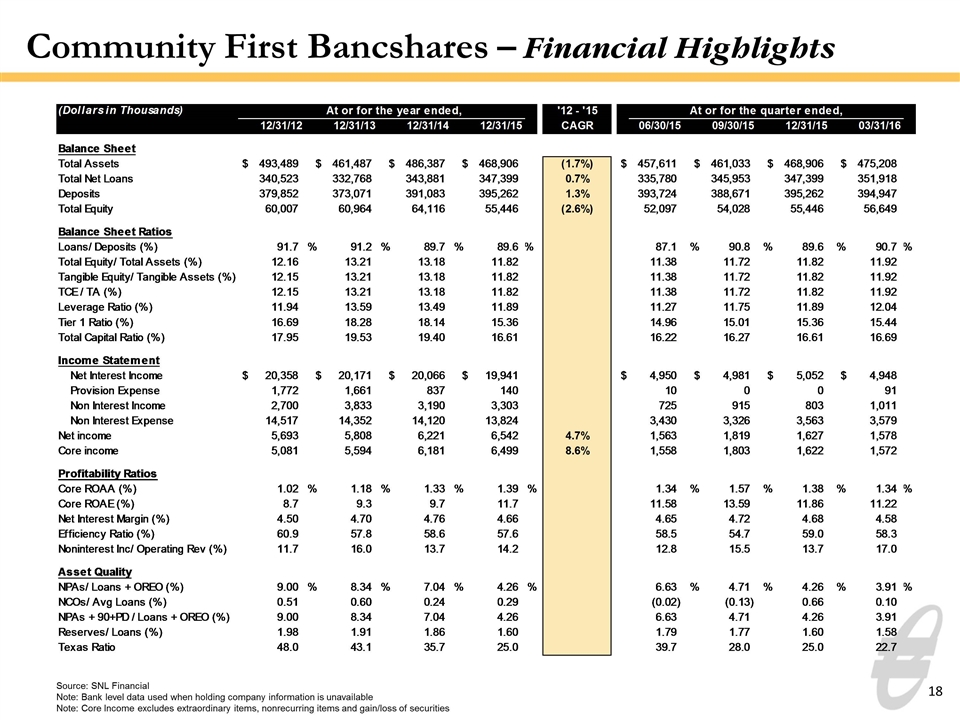

Community First Bancshares – Financial Highlights Source: SNL Financial Note: Bank level data used when holding company information is unavailable Note: Core Income excludes extraordinary items, nonrecurring items and gain/loss of securities

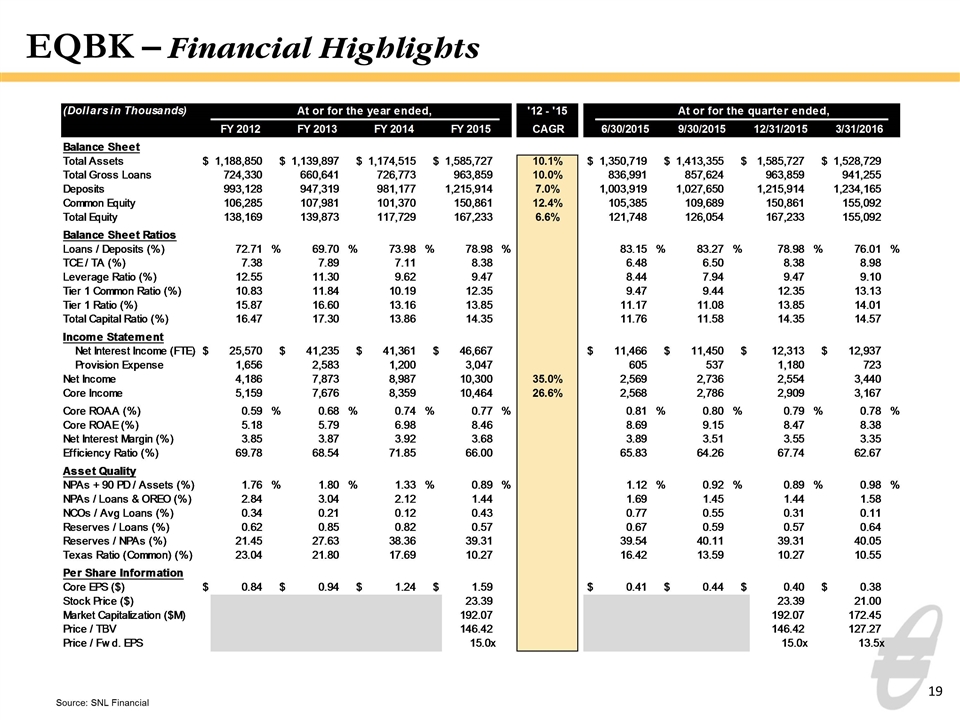

EQBK – Financial Highlights Source: SNL Financial

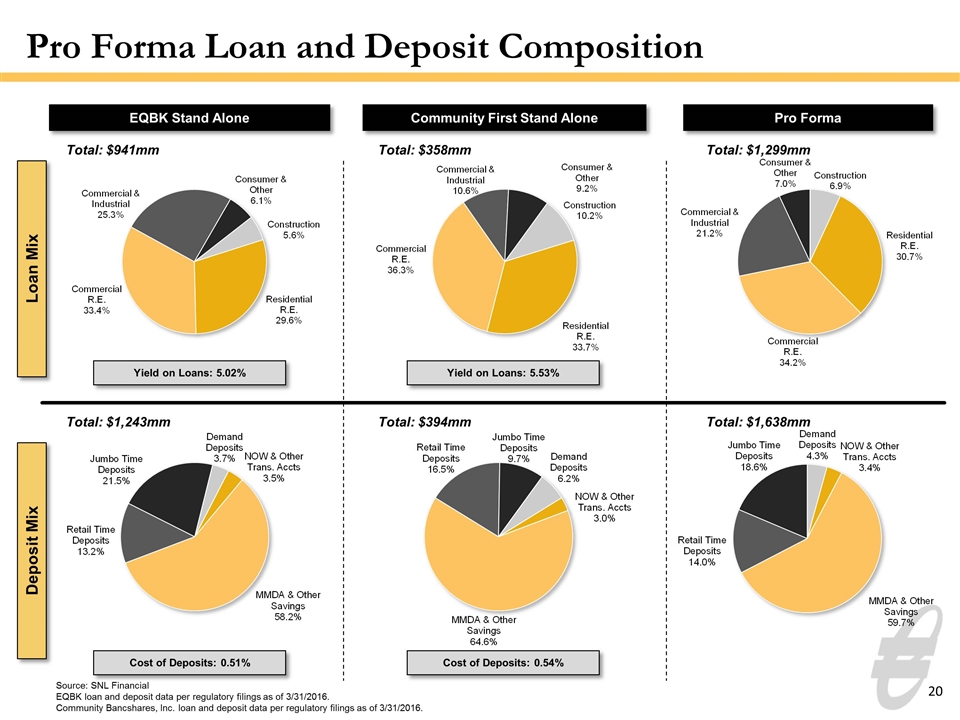

Source: SNL Financial EQBK loan and deposit data per regulatory filings as of 3/31/2016. Community Bancshares, Inc. loan and deposit data per regulatory filings as of 3/31/2016. Cost of Deposits: 0.51% Cost of Deposits: 0.54% Deposit Mix Loan Mix EQBK Stand Alone Community First Stand Alone Pro Forma Total: Total: Total: Yield on Loans: 5.02% Yield on Loans: 5.53% Total: Total: Total: $941mm $358mm $1,299mm $1,243mm $394mm $1,638mm Pro Forma Loan and Deposit Composition

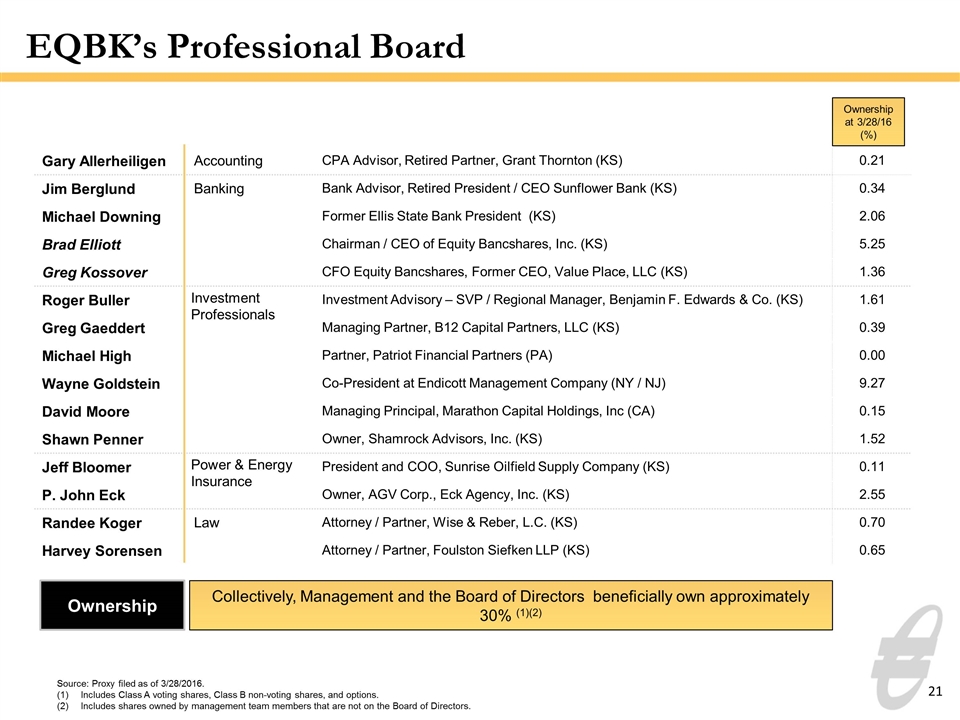

EQBK’s Professional Board Gary Allerheiligen Accounting CPA Advisor, Retired Partner, Grant Thornton (KS) 0.21 Jim Berglund Banking Bank Advisor, Retired President / CEO Sunflower Bank (KS) 0.34 Michael Downing Former Ellis State Bank President (KS) 2.06 Brad Elliott Chairman / CEO of Equity Bancshares, Inc. (KS) 5.25 Greg Kossover CFO Equity Bancshares, Former CEO, Value Place, LLC (KS) 1.36 Roger Buller Investment Advisory – SVP / Regional Manager, Benjamin F. Edwards & Co. (KS) 1.61 Greg Gaeddert Managing Partner, B12 Capital Partners, LLC (KS) 0.39 Michael High Partner, Patriot Financial Partners (PA) 0.00 Wayne Goldstein Co-President at Endicott Management Company (NY / NJ) 9.27 David Moore Managing Principal, Marathon Capital Holdings, Inc (CA) 0.15 Shawn Penner Owner, Shamrock Advisors, Inc. (KS) 1.52 Jeff Bloomer President and COO, Sunrise Oilfield Supply Company (KS) 0.11 P. John Eck Owner, AGV Corp., Eck Agency, Inc. (KS) 2.55 Randee Koger Law Attorney / Partner, Wise & Reber, L.C. (KS) 0.70 Harvey Sorensen Attorney / Partner, Foulston Siefken LLP (KS) 0.65 Investment Professionals Power & Energy Insurance Collectively, Management and the Board of Directors beneficially own approximately 30% (1)(2) Ownership Ownership at 3/28/16 (%) Source: Proxy filed as of 3/28/2016. Includes Class A voting shares, Class B non-voting shares, and options. Includes shares owned by management team members that are not on the Board of Directors.

Merger with Community First Bancshares, Inc. July 14, 2016 NASDAQ: EQBK