Attached files

| file | filename |

|---|---|

| 8-K - TORCHLIGHT ENERGY RESOURCES, INC. 8K - META MATERIALS INC. | torchlight_8k.htm |

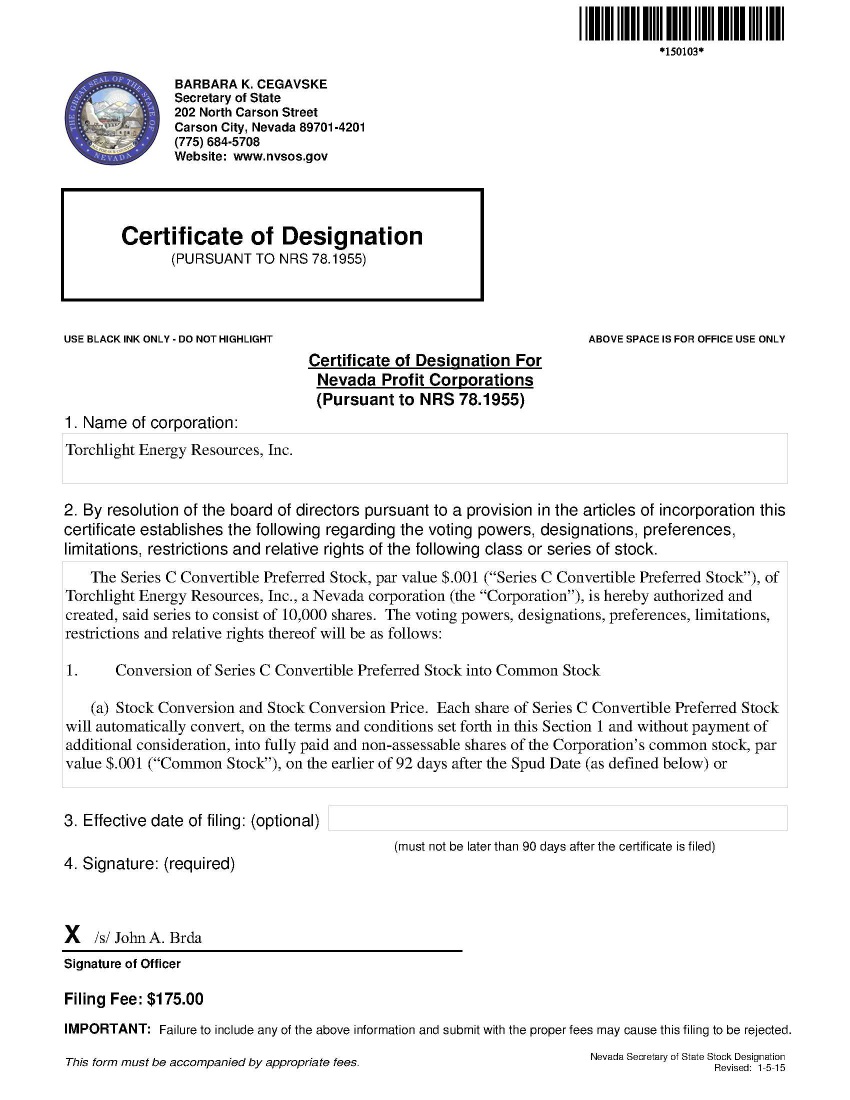

EXHIBIT 4.1

October 13, 2016 (the “Mandatory Stock Conversion Date”) and may, at the election of the holder thereof, convert, on the terms and conditions set forth in this Section 1 and without payment of additional consideration, into Common Stock on any date prior to the Mandatory Stock Conversion Date, provided, however, that if a holder elects to convert any shares of Series C Convertible Preferred Stock into Common Stock prior to the Mandatory Stock Conversion Date, the holder must convert no less than all of its shares of Series C Convertible Preferred Stock then held. The date of any conversion under this Section 1, including without limitation the Mandatory Stock Conversion Date, is referred to hereinafter as the “Stock Conversion Date.”

The number of shares of Common Stock into which a holder’s Series C Convertible Preferred Stock is convertible is determined by multiplying the number of shares of Series C Convertible Preferred Stock to be converted by the Series C Convertible Preferred Stock’s Stated Value of $100.00 per share and dividing the result by the stock conversion price of $1.01 (the “Stock Conversion Price”).

A holder of Series C Convertible Preferred Stock will retain no rights to convert any shares of Series C Convertible Preferred Stock, or any interest therein, into a Working Interest under Section 2 after electing to convert such shares of Series C Convertible Preferred Stock into shares of Common Stock under this Section 1.

(b) Mechanics of Stock Conversion. On or before the Stock Conversion Date, the holder of any shares of Series C Convertible Preferred Stock must surrender to the Corporation during regular business hours at the offices of the Corporation or at such other place as may be designated by the Corporation, all certificates held by such holder, duly endorsed for transfer to the Corporation (if required by it). Upon receipt by the Corporation, the Corporation will issue and cause to be sent to the holder thereof or the holder’s designee, at the address designated by such holder, a certificate or certificates for the number of full shares of Common Stock to which the holder is entitled as a result of such conversion. The holder will be deemed to have become a stockholder of record of the number of shares of Common Stock into which the shares of Series C Convertible Preferred Stock have been converted on the Stock Conversion Date.

(c) Fractional Shares. If any conversion of the Series C Convertible Preferred Stock under this Section 1 would result in the issuance of a fractional share of Common Stock (aggregating all shares of Series C Convertible Preferred Stock being converted pursuant to a conversion), such fractional shares shall be payable in cash based upon the closing sales price of the Common Stock on the principal trading market of the Corporation at such time (as determined in good faith by the Board of Directors) and the number of shares of Common Stock issuable upon conversion of the Series C Convertible Preferred Stock shall be the next lower whole number of shares.

(d) Reservation of Common Stock Issuable Upon Stock Conversion. The Corporation shall at all times reserve for issuance and maintain available, out of its authorized but unissued Common Stock, solely for the purpose of effecting the conversion of the Series C Convertible Preferred Stock under this Section 1, the number of shares of Common Stock deliverable upon the conversion of all Series C Convertible Preferred Stock on the Stock Conversion Date. If at any time the number of authorized but unissued shares of Common Stock is not sufficient to effect the conversion of all shares of Series C Convertible Preferred Stock then outstanding under this Section 1, the Corporation shall take such corporate action as may be necessary to increase its authorized but unissued shares of Common Stock to such number of shares as shall be sufficient for such purposes including, without limitation, engaging in best efforts to obtain the requisite stockholder approval of any necessary amendment to the Articles of Incorporation.

1

(e) Adjustments for Subdivisions or Combinations of Common Stock. In the event the outstanding shares of Common Stock shall be subdivided (by stock split, by payment of a stock dividend or otherwise) into a greater number of shares of Common Stock, without a corresponding subdivision of the Series C Convertible Preferred Stock, the Stock Conversion Price of the Series C Convertible Preferred Stock in effect immediately prior to such subdivision shall, concurrently with the effectiveness of such subdivision, be proportionately adjusted. In the event the outstanding shares of Common Stock shall be combined (by reclassification or otherwise) into a lesser number of shares of Common Stock, without a corresponding combination of the Series C Convertible Preferred Stock, the Stock Conversion Price in effect immediately prior to such combination shall, concurrently with the effectiveness of such combination, be proportionately adjusted.

(f) Adjustments for Reclassification, Exchange and Substitution. If the Common Stock issuable upon conversion of the Series C Convertible Preferred Stock under this Section 1 shall be changed into the same or a different number of shares of any other class or classes of stock, whether by capital reorganization, reclassification, recapitalization, conversion or otherwise (other than a subdivision or combination of shares provided for above), then, in any such event, in lieu of the number of shares of Common Stock which the holders would otherwise have been entitled to receive, each holder of such Series C Convertible Preferred Stock shall have the right thereafter to convert such shares of Series C Convertible Preferred Stock into a number of shares of such other class or classes of stock which a holder of the number of shares of Common Stock deliverable upon conversion of such Series C Convertible Preferred Stock immediately before that change would have been entitled to receive in such reorganization, reclassification, recapitalization, conversion or otherwise, all subject to further adjustment as provided herein with respect to such other shares.

(g) Certificate of Adjustment. Upon the occurrence of each adjustment or readjustment of the Stock Conversion Price pursuant to this Section 1, the Corporation at its expense will promptly compute such adjustment or readjustment in accordance with the terms hereof and prepare and furnish to each holder of Series C Convertible Preferred Stock a certificate signed by an officer of the Corporation setting forth (i) such adjustment or readjustment, (ii) the Stock Conversion Price at the time in effect, and (iii) the number of shares of Common Stock and the amount, if any, of other property which at the time would be received upon the conversion of such holder’s Series C Convertible Preferred Stock.

(h) Effect of Stock Conversion. On the date of any conversion of shares of Series C Convertible Preferred Stock into shares of Common Stock under this Section 1, all rights of any holder with respect to the shares of the Series C Convertible Preferred Stock so converted, including the rights, if any, to receive distributions of the Corporation’s assets (including, but not limited to, the Liquidation Rights) or notices from the Corporation, will terminate, except only for the rights of any such holder to receive certificates for the number of shares of Common Stock into which such shares of the Series C Convertible Preferred Stock have been converted and to receive payment in lieu of any fraction of a share otherwise issuable upon such conversion.

2

(i) Status of Shares Converted. Any shares of Series C Convertible Preferred Stock converted under this Section 1, or purchased or otherwise acquired by the Corporation, will be restored to the status of authorized but unissued shares of preferred stock, without designation as to class or series, and may thereafter be reissued, but not as shares of Series C Convertible Preferred Stock.

2. Conversion of Series C Convertible Preferred Stock into Working Interest

(a) Subject O&G Interest. Pursuant to a Purchase Agreement dated April 4, 2016 (the “Purchase Agreement”), McCabe Petroleum Corporation, a Texas corporation (“MPC”), transferred and conveyed certain rights to certain oil and gas leases located in Sterling, Tom Green and Irion Counties, Texas (also known as the “Hazel Prospect”) to Torchlight Energy, Inc., a Nevada corporation and wholly-owned subsidiary of the Corporation (“TEI”). The Hazel Prospect is hereinafter referred to as the “Subject O&G Interest.”

(b) Spud Date of Subject O&G Interest. The “Spud Date” is defined as the date which a rig capable of reaching Total Depth is on location and begins to drill the subject well.

(c) Conversion into Working Interest. The holder of shares of Series C Convertible Preferred Stock may, at its election, convert no less than all of its shares of Series C Convertible Preferred Stock then held, on the terms and conditions set forth in this Section 2 and without payment of additional consideration, into a proportionate heads up working interest (a “Working Interest”) in the Subject O&G Interest, provided such election is made prior to the Mandatory Stock Conversion Date. The date of such conversion is hereinafter referred to as the “Working Interest Conversion Date”).

The holder’s Working Interest is determined by dividing the number of shares of Series C Convertible Preferred Stock the holder is converting by 10,000 and multiplying the result by 1/3.

By electing to convert its Series C Convertible Preferred Stock to a Working Interest, such holder (a “WI Converting Owner”) will (i) agree to be expressly subject to that certain Purchase Agreement described above and that certain Participation Agreement by and between McCabe Petroleum Corporation, Imperial Exploration, LLC and Torchlight Energy, Inc., dated effective May 1, 2016, and (ii) expressly ratify all of the terms and conditions of the Purchase Agreement and Participation Agreement as if it was a party to the original agreements. Accordingly, the WI Converting Owner shall be subject to any all expenditures pursuant to such agreements related to the Subject O&G Interest. Each WI Converting Owner shall have a credit towards their proportionate share of the expenditures, which such credit shall be equal to their percentage Working Interest multiplied by 3 and then multiplied by $1,000,000. By way of example, if a party purchased 300 shares of Series C Convertible Preferred Stock for $30,000 and then elects to convert such Series C Convertible Preferred Stock into a Working Interest hereunder, then such holder would receive 1% of the Subject O&G Interest and would be credited with $30,000 towards the total expenditures incurred on the Subject O&G Interest.

3

A holder of Series C Convertible Preferred Stock will retain no rights to convert any shares of Series C Convertible Preferred Stock, or any interest therein, into shares of Common Stock under Section 1, after electing to convert such shares of Series C Convertible Preferred Stock into a Working Interest under this Section 2.

(d) Mechanics of Working Interest Conversion. On or before the Working Interest Conversion Date, the holder of any shares of Series C Convertible Preferred Stock must surrender to the Corporation during regular business hours at the offices of the Corporation or at such other place as may be designated by the Corporation, all certificates held by such holder, duly endorsed for transfer to the Corporation (if required by it). Upon receipt by the Corporation, the Corporation will cause to be conveyed to the holder thereof or the holder’s designee the Working Interest pursuant to the Farmout and Purchase Agreements by and among the owners of the Subject O&G Interests and an assignment of the working interest in the Subject O&G Interests, which will be made in the usual and customary form. The holder will be deemed to have become a holder of record of the Working Interest into which the shares of Series C Convertible Preferred Stock have been converted on the Working Interest Conversion Date. Notwithstanding the foregoing, the Corporation will not have the ability to convey the Subject O&G Interests unless and until the well is completed. In the event the well is not completed, the holder will not be able to convert its Series C Convertible Preferred Stock.

(e) Effect of Working Interest Conversion. On the date of any conversion of shares of Series C Convertible Preferred Stock into a Working Interest under this Section 2, all rights of any holder with respect to the shares of the Series C Convertible Preferred Stock so converted, including the rights, if any, to receive distributions of the Corporation’s assets (including, but not limited to, the Liquidation Rights) or notices from the Corporation, will terminate, except only for the rights of any such holder to receive conveyance of the Working Interest into which such shares of the Series C Convertible Preferred Stock have been converted.

(f) Status of Shares Converted. Any shares of Series C Convertible Preferred Stock converted under this Section 2, or purchased or otherwise acquired by the Corporation, will be restored to the status of authorized but unissued shares of preferred stock, without designation as to class or series, and may thereafter be reissued, but not as shares of Series C Convertible Preferred Stock.

4

3. Voting of Series C Convertible Preferred Stock

Except as required by law, each holder of Series C Convertible shall not be entitled to vote on any matters.

4. Dividends on Series C Convertible Preferred Stock

The holders of Series C Convertible Preferred Stock shall not be entitled to receive any dividends, whether or not declared on any security of the Corporation.

5. Liquidation Rights

In the event of any voluntary or involuntary liquidation, dissolution or winding up of the Corporation, the holders of shares of Series C Convertible Preferred Stock then outstanding shall be entitled to be paid out of the assets of the Corporation available for distribution to its stockholders, before any payment shall be made to the holders of Common Stock by reason of their ownership thereof, but after the payment to the Series B Convertible Preferred Stockholders, by reason of their ownership thereof, an amount per share equal to the Stated Value of $100.00 per share. If upon any such liquidation, dissolution or winding up of the Corporation, the assets of the Corporation available for distribution to its stockholders shall be insufficient to pay the holders of shares of Series C Convertible Preferred Stock the full amount to which they shall be entitled under this Section 5, the holders of shares of Series C Convertible Preferred Stock shall share ratably in any distribution of the assets available for distribution in proportion to the respective amounts that would otherwise be payable in respect of the shares held by them upon such distribution if all amounts payable on or with respect to such shares were paid in full. For the purposes hereof, a liquidation, dissolution or winding up of the Corporation shall include (A) the acquisition of the Corporation by one or more other persons or entities by means of any transaction or series of related transactions (including, without limitation, any reorganization, merger or consolidation) in which the holders of the Corporation’s outstanding voting stock immediately prior to such transaction own, immediately after such transaction, securities representing less than 50% of the outstanding voting power of the Corporation or other entity surviving such transaction or (B) a sale, lease or other disposition of all or substantially all of the assets of the Corporation.

6. Protective Provisions.

So long as any shares of Series C Convertible Preferred Stock are outstanding, the Corporation shall not without first obtaining the approval (by written consent) of the holders of 66.67% of the then outstanding shares of Series C Convertible Preferred Stock, voting together as a class:

(a) Increase or decrease (other than by conversion) the total number of authorized shares of Series C Convertible Preferred Stock;

(b) Effect an exchange, reclassification, or cancellation of all or a part of the Series C Convertible Preferred Stock, but excluding a stock split or reverse stock split of the Corporation’s Common Stock, Series B Convertible Preferred Stock or Series C Convertible Preferred Stock;

5

(c) Effect an exchange, or create a right of exchange, of all or part of the shares of another class of shares into shares of Series C Convertible Preferred Stock; or

(d) Alter or change the rights, preferences or privileges of the shares of Series C Convertible Preferred Stock so as to affect adversely the shares of such series, including the rights set forth in this Designation.

PROVIDED, HOWEVER, that the Corporation may, by any means authorized by law and without any vote of the holders of shares of the Series C Convertible Preferred Stock, make technical, corrective, administrative or similar changes in this Statement of Designations that do not, individually or in the aggregate, adversely affect the rights or preferences of the holders of shares of the Series C Convertible Preferred Stock. The Corporation may also designate and issue additional series of preferred stock from time to time in the sole discretion of the Corporation’s Board of Directors, which such rights, privileges, preferences and limitations shall be determined by the Corporation’s Board of Directors in its sole discretion, and which designations and issuances shall not require the approval of the holders of the Series C Convertible Preferred Stock.

7. Preemptive Rights.

Holders of Series C Convertible Preferred Stock shall not be entitled to any preemptive, subscription or similar rights in respect to any securities of the Corporation, except as specifically set forth herein or in any other document agreed to by the Corporation.

8. Right to Participate in Subsequent Private Offering.

(a) Right. The holders of Series C Convertible Preferred Stock will have the right to participate in up to 100% of the first $1,000,000 to be raised, in the aggregate, on a pro-rata basis (as calculated herein), in any subsequent private placement offerings by the Corporation of its equity securities that is commenced subsequent to the issuance of the Series C Convertible Preferred Stock, including a private offering of Common Stock or securities exercisable or convertible into Common Stock (a “Subsequent Offering”), on identical terms and conditions as set forth in such Subsequent Offering. This right terminates with respect to any holder that no longer holds any shares of Series C Convertible Preferred Stock, by way of transfer, conversion or otherwise. Each holder’s pro-rata percentage to the right hereunder will be calculated by dividing the number of shares of Series C Convertible Preferred Stock then held by such holder by 10,000. If any holder of Series C Convertible Preferred Stock declines or fails to exercise its right hereunder, the other holders will not have the right to participate in such unexercised percentage of the subject Subsequent Offering.

6

(b) Procedures. At least 5 days prior to closing on a Subsequent Offering, the Corporation shall provide written notice of such Subsequent Offering to all holders of Series C Convertible Preferred Stock, which notice will include the terms and conditions of the Subsequent Offering. For 5 days after such notice is provided (the “Option Period”), each holder will have the right to subscribe to purchase its pro-rata percentage of the first $1,000,000 to be raised in the Subsequent Offering on the identical terms and conditions of the Subsequent Offering by providing written notice to the Corporation. Upon providing such notice of its election to subscribe to the Subsequent Offering, the holder must provide the entire amount of funds for the securities subscribed within 5 days of the end of the Option Period. The Corporation will have 60 days from the end the Option Period to sell any portion of the Subsequent Offering not purchased by the holders of the Series C Convertible Preferred Stock to third-party investors. If the Corporation fails to close the Subsequent Offering with such third-party investors within 60 days after the end of the Option Period or if the terms of such Subsequent Offering change in any material respect, then, if there are still shares of Series C Convertible Preferred then outstanding, the Corporation may not close on the Subsequent Offering without again delivering a notice in accordance with the terms of Section 8(b) and otherwise complying with the provisions set forth in this Section 8.

9. Notices.

Any notices or other communications required or permitted hereunder shall be in writing and deemed sufficiently given if delivered by email at the email address specified in this section or if delivered in person or sent by registered or certified mail (return receipt requested) or nationally recognized overnight delivery service, postage pre-paid, addressed as follows, or to such other address as such party may notify to the other parties in writing:

|

If to the Corporation:

|

Torchlight Energy Resources, Inc. |

| 5700 Plano Parkway, Suite 3600 | |

| Plano, Texas 75093 | |

| Telephone No.: (214) 432-8002 | |

| Attention: John Brda, CEO | |

| Email: john@torchlightenergy.com | |

| to the holder of Series C | |

| Convertible Preferred Stock: | To the address set forth under such holder’s name on its signature page of the Securities Purchase Agreement. |

| Or such other address as may be designated in writing hereafter, in the same manner, by such holder. |

A notice or communication will be effective (i) if delivered in person or by overnight courier, on the business day it is delivered; (ii) if sent by registered or certified mail, 3 business days after dispatch; and (iii) if sent by email, at the email address specified in this section if sent prior to 5:00 p.m., Central Time on the date sent or if later, then on the next day, provided that a copy is sent by a nationally recognized overnight delivery service, next day delivery.

7

10. Miscellaneous.

(a) If any Series C Convertible Preferred Stock certificate shall be mutilated, lost, stolen or destroyed, the Corporation shall, upon the request and at the expense of the holder, issue, in exchange and in substitution for and upon cancellation of the mutilated Series C Convertible Preferred Stock certificate, or in lieu of and substitution for the Series C Convertible Preferred Stock certificate lost, stolen or destroyed, a new Series C Convertible Preferred Stock certificate of like tenor and representing an equivalent amount of shares of the Series C Convertible Preferred Stock, but only upon receipt of evidence of such loss, theft or destruction of such Series C Convertible Preferred Stock certificate and indemnity, if requested, satisfactory to the Corporation and/or its transfer agent. The Corporation shall not be required to issue any physical certificates representing shares of the Series C Convertible Preferred Stock on or after any conversion date with respect to such shares of the Series C Convertible Preferred Stock. In place of the delivery of a replacement certificate following any such conversion date, upon delivery of the evidence and indemnity described above, the Corporation will deliver the shares of Common Stock.

(b) The headings of the various sections and subsections of this Certificate of Designation are for convenience of reference only and shall not affect the interpretation of any of the provisions of this Certificate of Designation.

(c) Whenever possible, each provision of this Certificate of Designation shall be interpreted in a manner as to be effective and valid under applicable law and public policy. If any provision set forth herein is held to be invalid, unlawful or incapable of being enforced by reason of any rule of law or public policy, such provision shall be ineffective only to the extent of such prohibition or invalidity, without invalidating or otherwise adversely affecting the remaining provisions of this Certificate of Designation. No provision herein set forth shall be deemed dependent upon any other provision unless so expressed herein. If a court of competent jurisdiction should determine that a provision of this Certificate of Designation would be valid or enforceable if a period of time were extended or shortened, then such court may make such change as shall be necessary to render the provision in question effective and valid under applicable law.

(d) Except as may otherwise be required by law, the shares of the Series C Convertible Preferred Stock shall not have any powers, designations, preferences or other special rights, other than those specifically set forth in this Certificate of Designation.

(e) If the Corporation is required, by terms of any indenture or security of the Corporation or the rules and regulations under the Securities Exchange Act of 1934, as amended, to furnish an annual report to any of its security holders, it will furnish such annual report to holders of shares of Series C Convertible Preferred Stock.

8