Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K FOR ANNUAL SHAREHOLDER MEETING PRESENTATION - VIDLER WATER RESOURCES, INC. | form8-kforasmslidedeck.htm |

1

Photo by Jean-Pierre Lavoie

ANNUAL MEETING OF SHAREHOLDERS

JULY 11, 2016

NASDAQ:PICO

2 2

SAFE HARBOR STATEMENT

This presentation contains forward-looking statements made pursuant to the “safe

harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-

looking statements often address current expected future business and financial

performance, including the demand and pricing of PICO’s real estate and water assets,

and may contain words such as “expects,” “anticipates,” “intends,” “plans,“ “believes,”

“seeks,” or “will”. All forward-looking statements included in this presentation are

based on information available to PICO as of the date hereof, and PICO assumes no

obligation to update any such forward-looking statements. Actual results could differ

materially from those described in the forward-looking statements. Forward-looking

statements involve risks and uncertainties, including, but not limited to, economic,

competitive and governmental factors outside of our control, that may cause our

business, industry, strategy or actual results to differ materially from the forward-

looking statements. Factors that could cause or contribute to such differences include,

but are not limited to those discussed in detail under the heading “Risk Factors” in

PICO’s periodic reports filed with the U.S. Securities and Exchange Commission.

3 3

VIDLER

WATER COMPANY

Update

4 4

5 5

RENO HOUSING UPDATE

• 1Q16 quarterly new home starts 26% higher than 1Q15, highest first quarter

since 2007

• New home closings numbered 1,729 in 1Q16, 4.4% more than 1Q15

• 1 month supply of finished vacant single family homes

• Under construction homes has increased 40% since last year

• 26 months of finished and vacant single family lot inventory; Washoe County

has 14 months of inventory

• Affordability remains a concern - 1Q16 37% of new home starts priced below

$300K up from 33% last year; builders trying to provide low priced homes

Data from: Metrostudy, a Hanleywood Company

Reported by: Northern Nevada Business Weekly

6 6

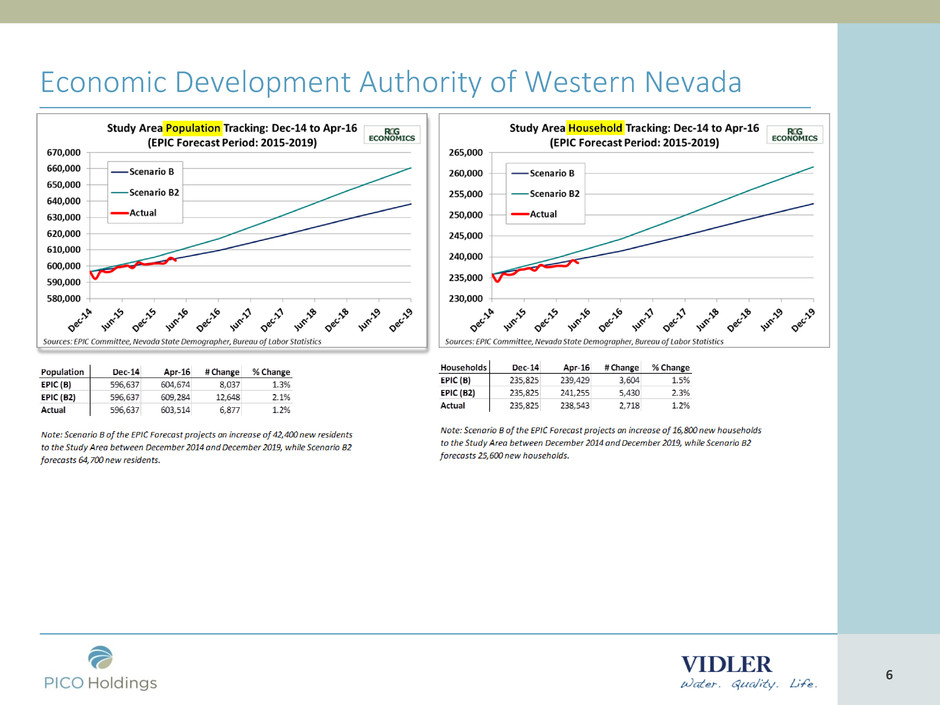

Economic Development Authority of Western Nevada

7 7

NORTH VALLEYS – DEMAND

• Pending projects identified by a University of Nevada study total 20,989± Single

Family Units (SFU), approximately 7,600 acre-feet.

Does not

include

Industrial &

Commercial

Demands

8 8

NORTH VALLEYS EXPECTED TRANSACTION SCHEDULE

Development Single Family Units

Commercial/

Industrial Acres

Date Estimated for

Contract

Estimated Water

Usage (AF)

1 680/1,300 Nov-16/Mar-17 249/470

2 454 May-17 163

3 913 May-17 329

4 3,800 (336+MF) 235 May-18 2,026

5 1,300 May-18 470

6 324 342 May-18 300

7 1,600 May-18 449

8 5,679 62 May-18 2,612

9 1700 Mar-18 200

10 3,529 Jan-18 1,270

TOTAL 8,068 / 8,289

Based on discussions with area developers: represents best estimate at July, 2016

9 9

DAYTON VALLEY – DEMAND

• Projects identified by a University of Nevada study total 13,308± Single Family

Units (SFU) needing water rights (Dayton-5,832 SFU, Mark Twain-7,476 SFU).

Approximately 6,700 acre-feet required.

Does not include

Industrial &

Commercial

Demands

Does not include

Municipal Demand

in Stage coach

10 10

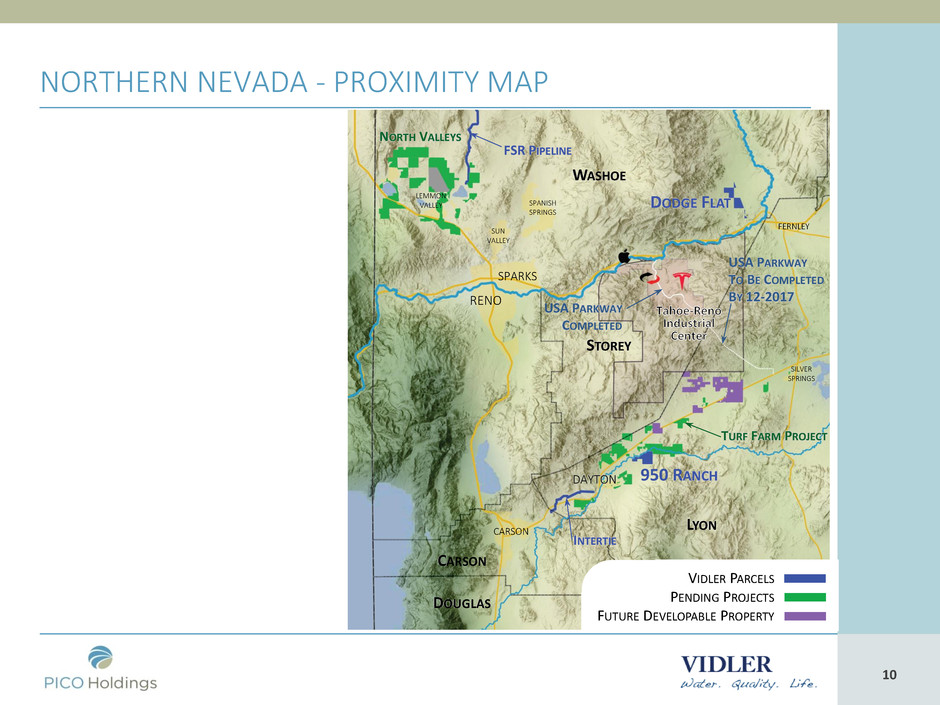

NORTHERN NEVADA - PROXIMITY MAP

VIDLER PARCELS

PENDING PROJECTS

FUTURE DEVELOPABLE PROPERTY

WASHOE

TURF FARM PROJECT

DODGE FLAT

RENO

SPARKS

FERNLEY

DAYTON

CARSON

950 RANCH

NORTH VALLEYS

STOREY

LYON

DOUGLAS

CARSON

SPANISH

SPRINGS

SUN

VALLEY

SILVER

SPRINGS

LEMMON

VALLEY

FSR PIPELINE

INTERTIE

USA PARKWAY

COMPLETED

USA PARKWAY

TO BE COMPLETED

BY 12-2017

11 11

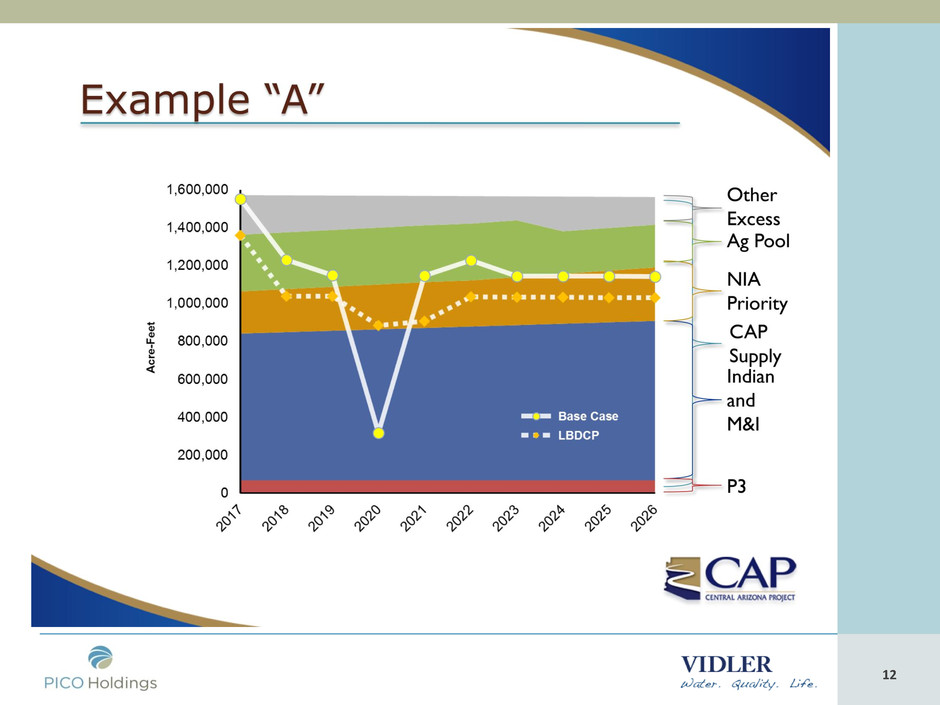

Lower Basin Drought

Contingency Proposal

(Requires Legislation)

*Minute 319 reductions extend through 2017. Assume reductions continue in Minute 32X.

12 12

13 13

Lake Mead at Hoover Dam – March 2nd 2016

1221 Full Pool Elevation

1084.2 March 2nd 2016

1153 November 2002

14 14

Lake Mead at Hoover Dam – May 19th 2016

1221 Full Pool Elevation

1074.5 May 19th 2016

1153 November 2002

15 15

CORPORATE

Update

16 16

COST SAVINGS

• Cost savings over the last year approximately $2.3 million per annum

(current cash overhead for Corporate & Vidler approximately $11 million per

annum from 2Q 2016)

• Estimated future annual cost savings anticipated to be up to $1.5 million

over the course of the next 12 months (reduction of total Corporate & Vidler

cash overhead to approximately $9.5 million per annum)

17 17

Q. & A.