Attached files

Exhibit 99.1

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Investors of

Adrie Global Holdings Limited

Report on the Financial Statements

We have audited the accompanying balance sheets of Adrie Global Holdings Limited (the “Company”) as of December 31, 2015 and 2014, and the related statements of income and comprehensive income, changes in investor’s equity and cash flows for the years then ended and the related notes to the financial statements.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of the financial statements that are free from material misstatement, whether due to fraud or error.

Auditors’ Responsibility

Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with auditing standards as established by the Auditing Standards Board (United States) and in accordance with the auditing standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditors’ judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the Company as of December 31, 2015 and 2014, and the results of its operations and its cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America.

Marcum Bernstein & Pinchuk LLP

New York, New York

May 6, 2016

Adrie

Global Holdings Limited

cONSOLIDATED Balance Sheets

| December 31, | ||||||||

| 2015 | 2014 | |||||||

| ASSETS | ||||||||

| Cash and cash equivalents | $ | 6,732,601 | $ | 116,132 | ||||

| Loans receivable – third parties, net of allowance for loan losses of $2,197,571 and $1,207,549 at December 31, 2015 and 2014, respectively | 137,602,481 | 119,547,411 | ||||||

| Loans receivable – related parties, net of allowance for loan losses of $11,137 and $123,235 at December 31, 2015 and 2014, respectively | 1,102,593 | 12,200,230 | ||||||

| Interest and fee receivable | 673,626 | 631,389 | ||||||

| Cost method investment | 3,851,071 | — | ||||||

| Property and equipment, net | 116,298 | 19,967 | ||||||

| Deferred tax assets | 243,440 | — | ||||||

| Amount due from a related party | 1,653,839 | — | ||||||

| Other assets | 374,387 | 322,045 | ||||||

| Total Assets | $ | 152,350,336 | $ | 132,837,174 | ||||

| LIABILITIES AND INVESTORS’ EQUITY | ||||||||

| Liabilities | ||||||||

| Short-term bank loans | $ | — | $ | 7,321,835 | ||||

| Loans from a cost investment investee | 15,404,285 | — | ||||||

| Secured loan | 24,739,282 | 16,156,850 | ||||||

| Dividends payable | 6,623,843 | 5,723,970 | ||||||

| Taxes payable | 1,235,241 | 2,079,766 | ||||||

| Deferred tax liabilities | — | 21,494 | ||||||

| Other current liabilities | 977,831 | 200,786 | ||||||

| Total liabilities | $ | 48,980,482 | $ | 31,504,701 | ||||

| Investors’ Equity | ||||||||

| Common Stock (par value $0.00000005 per share, 20,000,000 shares authorized; 20,000,000 and 20,000,000 shares issued and outstanding at December 31, 2015 and 2014, respectively) | $ | 1 | $ | 1 | ||||

| Additional paid-in capital | 94,723,963 | 94,188,868 | ||||||

| Statutory reserves | 4,667,254 | 3,243,069 | ||||||

| Retained earnings | 6,064,526 | 272,313 | ||||||

| Accumulated other comprehensive (loss)/ income | (2,085,890 | ) | 3,628,222 | |||||

| Total Investors’ Equity | 103,369,854 | 101,332,473 | ||||||

| Total Liabilities and Investors’ Equity | $ | 152,350,336 | $ | 132,837,174 | ||||

See notes to the consolidated financial statements

Certain of the assets of the VIEs can be used only to settle obligations of the consolidated VIEs. Conversely, liabilities recognized as a result of consolidating these VIEs do not represent additional claims on the Company’s general assets.

2

Adrie

Global Holdings Limited

CONSOLIDATED Statements of INCOME and Comprehensive Income

| For The Years Ended December 31, | ||||||||

| 2015 | 2014 | |||||||

| Interest income | ||||||||

| Interests and fees on loans | $ | 27,641,209 | $ | 17,592,593 | ||||

| Interests and fees on loans-related parties | 531,559 | 1,159,974 | ||||||

| Interests on deposits with banks | 5,883 | 8,519 | ||||||

| Total interest and fee income | 28,178,651 | 18,761,086 | ||||||

| Interest expense | ||||||||

| Interest expenses on short-term bank loans | (425,139 | ) | (979,050 | ) | ||||

| Interest expenses and fees on secured loan | (2,302,136 | ) | (689,393 | ) | ||||

| Interest expenses on loans from related parties | (61,542 | ) | (98,775 | ) | ||||

| Interest expenses on loans from a cost investment investee | (1,101,871 | ) | — | |||||

| Total interest expense | (3,890,688 | ) | (1,767,218 | ) | ||||

| Provision for loan losses | (2,166,110 | ) | (584,348 | ) | ||||

| Net Interest Income | 22,121,853 | 16,409,520 | ||||||

| Non-interest income | 13,212 | — | ||||||

| Non-interest expense | ||||||||

| Salaries and employee surcharge | (917,159 | ) | (604,223 | ) | ||||

| Business taxes and surcharge | (1,449,993 | ) | (1,050,052 | ) | ||||

| Other operating expenses | (2,790,192 | ) | (1,349,142 | ) | ||||

| Total non-interest expense | (5,157,344 | ) | (3,003,417 | ) | ||||

| Income Before Tax | 16,977,721 | 13,406,103 | ||||||

| Income tax expense | (2,857,907 | ) | (2,092,776 | ) | ||||

| Net Income | $ | 14,119,814 | $ | 11,313,327 | ||||

| Other comprehensive income | ||||||||

| Foreign currency translation adjustments | (5,714,112 | ) | (172,627 | ) | ||||

| Comprehensive Income | $ | 8,405,702 | $ | 11,140,700 | ||||

| Weighted-average common shares outstanding – basic and diluted | 20,000,000 | 20,000,000 | ||||||

| Earnings per share – Basic and diluted | $ | 0.71 | $ | 0.57 | ||||

See notes to the consolidated financial statements

3

Adrie

Global Holdings Limited

CONSOLIDATED Statements of CHANGES IN Investors’ EquitY

| Share capital | Additional paid-in capital | Statutory reserves | Retained earnings | Accumulated Other comprehensive income | Total | |||||||||||||||||||

| Balance as of January 1, 2014 | $ | 1 | 45,493,103 | $ | 2,065,537 | $ | 1,201,165 | $ | 3,800,849 | $ | 52,560,655 | |||||||||||||

| Issuance of paid-in capital | 48,695,765 | — | — | — | 48,695,765 | |||||||||||||||||||

| Net income for the year | — | — | — | 11,313,327 | — | 11,313,327 | ||||||||||||||||||

| Transfer to statutory reserves | — | — | 1,177,532 | (1,177,532 | ) | — | — | |||||||||||||||||

| Dividends to investors | — | — | — | (11,064,647 | ) | — | (11,064,647 | ) | ||||||||||||||||

| Foreign currency translation loss | — | — | — | — | (172,627 | ) | (172,627 | ) | ||||||||||||||||

| Balance as of December 31, 2014 | $ | 1 | 94,188,868 | $ | 3,243,069 | $ | 272,313 | $ | 3,628,222 | $ | 101,332,473 | |||||||||||||

| Gain on disposal of loans receivable to a related party | — | 535,095 | — | — | — | 535,095 | ||||||||||||||||||

| Net income for the year | — | — | — | 14,119,814 | — | 14,119,814 | ||||||||||||||||||

| Transfer to statutory reserves | — | — | 1,424,185 | (1,424,185 | ) | — | — | |||||||||||||||||

| Dividends to investors | — | — | — | (6,903,416 | ) | — | (6,903,416 | ) | ||||||||||||||||

| Foreign currency translation loss | — | — | — | — | (5,714,112 | ) | (5,174,112 | ) | ||||||||||||||||

| Balance as of December 31, 2015 | $ | 1 | 94,723,963 | $ | 4,667,254 | $ | 6,064,526 | $ | 2,085,890 | $ | 103,369,854 | |||||||||||||

See notes to the financial statements

4

Adrie

Global Holdings Limited

CONSOLIDATED Statements of Cash Flows

| For the Year Ended December 31, | ||||||||

| 2015 | 2014 | |||||||

| Cash Flows from Operating Activities: | ||||||||

| Net income | $ | 14,119,814 | $ | 11,313,327 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation | 39,415 | 13,366 | ||||||

| Gain on disposal of property and equipment | (12,971 | ) | — | |||||

| Deferred tax benefit | (274,924 | ) | (17,818 | ) | ||||

| Provision for loan losses | 2,166,110 | 584,376 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Interest and fee receivable | (79,061 | ) | (276,050 | ) | ||||

| Other assets | (72,426 | ) | (272,189 | ) | ||||

| Taxes payable | (764,741 | ) | 933,663 | |||||

| Other current liabilities | 820,988 | 201,238 | ||||||

| Net Cash Provided by Operating Activities | 15,942,204 | 12,479,913 | ||||||

| Cash Flows from Investing Activities: | ||||||||

| Originated loans disbursement | (237,371,565 | ) | (207,805,457 | ) | ||||

| Repayment of loans from customers | 212,716,218 | 149,367,851 | ||||||

| Purchase of property and equipment | (156,847 | ) | — | |||||

| Proceeds from disposal of property and equipment | 28,898 | — | ||||||

| Payment for a cost method investment | (4,013,614 | ) | — | |||||

| Proceeds from disposal of loans receivable to a related party | 6,737,574 | — | ||||||

| Net Cash Used in Investing Activities | (22,059,336 | ) | (58,437,606 | ) | ||||

| Cash Flows from Financing Activities: | ||||||||

| Proceeds from issuing capital | 1 | 48,695,765 | ||||||

| Proceeds from short-term bank borrowings | 5,619,060 | 7,322,193 | ||||||

| Repayment of short-term bank borrowings | (12,843,565 | ) | (15,457,962 | ) | ||||

| Proceeds from secured loan | 25,783,457 | |||||||

| Repayment of secured loan | (15,942,076 | ) | 16,157,639 | |||||

| Proceeds from loans from a cost investment investee | 16,054,457 | — | ||||||

| Payments of dividends | (5,647,881 | ) | (10,965,833 | ) | ||||

| Net Cash Provided by Financing Activities | 13,023,453 | 45,751,802 | ||||||

| Effect of Exchange Rate Changes on Cash and Cash Equivalents | (289,852 | ) | 117,706 | |||||

| Net Increase/(Decrease) In Cash and Cash Equivalents | 6,616,469 | (88,185 | ) | |||||

| Cash and Cash Equivalents at Beginning of Year | 116,132 | 204,317 | ||||||

| Cash and Cash Equivalents at End of Year | $ | 6,732,601 | $ | 116,132 | ||||

| Supplemental Cash Flow Information | ||||||||

| Cash paid for interest expense | $ | 3,846,128 | $ | 1,721,476 | ||||

| Cash paid for income tax | $ | 3,648,094 | $ | 1,534,198 | ||||

See notes to the consolidated financial statements

5

Adrie

Global Holdings Limited

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 AND 2014

1. ORGANIZATION AND PRINCIPAL ACTIVITIES

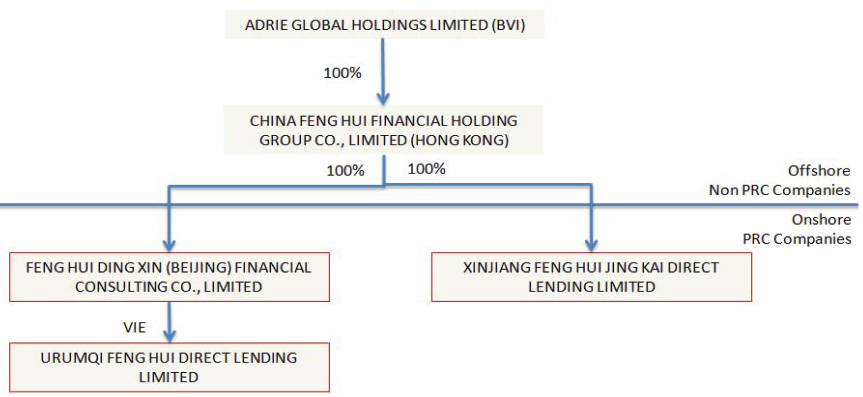

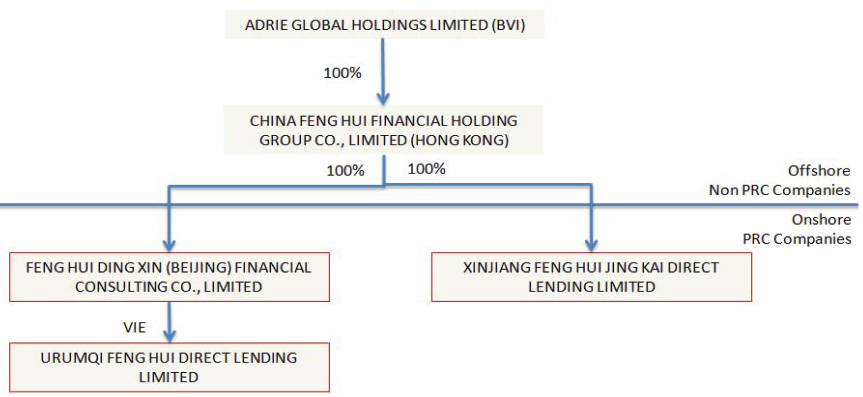

Adrie Global Holdings Limited (“ADRIE,” and together with its subsidiaries and variable interest entity (“VIE”) the “Company”), was incorporated under the laws of British Virgin Islands on November 19, 2014. The Company, through its subsidiaries and VIE engages in the business of providing loan facilities to micro, small and medium sized enterprises and sole proprietors in Xinjiang Uyghur Autonomous Region (“Xinjiang Province”) of the People’s Republic of China (“PRC”).

On February 11, 2015, ADRIE incorporated China Feng Hui Financial Holding Group Co., Limited (“Feng Hui Holding”) in Hong Kong with registered capital of HKD 1. Feng Hui Holding operates through two wholly-owned subsidiaries: Xinjiang Feng Hui Jing Kai Direct Lending Limited (“Jing Kai”) and Feng Hui Ding Xin (Beijing) Financial Consulting Co., Limited (“Ding Xin”).

On May 14, 2015, Feng Hui Holdings established Jing Kai under the laws of the PRC with registered capital of $80,000,000. Feng Hui Holding has no operations of its own to date.

On May 20, 2015, Feng Hui Holding established Ding Xin with registered capital of $1,000,000. Ding Xin is engaged in the business of financial consulting services.

Urumqi Feng Hui Direct Lending Limited (“Feng Hui”) is a company established under the laws of the PRC on June 12, 2009. and its investors as of December 31, 2015 consisted of nine PRC companies and seven PRC individuals. Feng Hui is a microcredit company primarily engaged in providing direct loan services to small-to-medium sized enterprises, farmers and individuals in Xinjiang Province, PRC.

In accordance with US GAAP, the primary beneficiary of a VIE is the variable interest holder (e.g., a contractual counterparty or capital provider) deemed to have the controlling financial interest(s) in the VIE. The primary beneficiary is the reporting entity (or member of a related party group) that has both of the following characteristics:

a) The power to direct the activities that most significantly impact the VIE’s economic performance; and

b) The obligation to absorb losses or the right to receive benefits that could potentially be significant to the VIE.

Currently, Feng Hui is consolidated as a VIE of Ding Xin by a series of VIE Agreements with Ding Xin.

Contractual Arrangements between Ding Xin, Feng Hui, and Feng Hui’s Shareholders

On July 16, 2015, Ding Xin, Feng Hui and/or Feng Hui’s shareholders have executed the following agreements and instruments, pursuant to which China Lending Group, through its subsidiary Ding Xin, controls Feng Hui: Share Pledge Agreement, Exclusive Business Cooperation Agreement, Exclusive Option Agreement and Power of Attorney (“VIE Agreements”). Each of the VIE Agreements is described below, and became effective upon their execution therein.

Exclusive Business Cooperation Agreement

Pursuant to the Exclusive Business Cooperation Agreement between Feng Hui and Ding Xin, Ding Xin provides Feng Hui with comprehensive business support, technical services and consulting services relating to its day-to-day business operations and management, on an exclusive basis.

For services rendered to Feng Hui by Ding Xin under this agreement, Ding Xin is entitled to collect a service fee calculated based on the complexity, required time, contents and commercial value of the consulting services provided by Ding Xin. Ding Xin will calculate and sum up the service fees and correspondingly issue a notice to Feng Hui. Feng Hui will pay such service fees to the bank accounts as designated by Ding Xin within 10 working days from the receipt of such notice.

The Exclusive Business Cooperation Agreement shall remain in effect for five years unless it is terminated by Ding Xin at its discretion with 30-days prior notice. Feng Hui does not have the right to terminate the Exclusive Business Cooperation Agreement unilaterally. Ding Xin may at its discretion unilaterally extend the term of the Exclusive Business Cooperation Agreement. This agreement grants Ding Xin the position as the primary beneficiary who is entitled to absorb losses and to receive benefits that could potentially be significant to Feng Hui.

6

Adrie

Global Holdings Limited

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 AND 2014

1. ORGANIZATION AND PRINCIPAL ACTIVITIES (cont.)

Share Pledge Agreement

Under the Share Pledge Agreement between the Feng Hui shareholders and Ding Xin, the 16 Feng Hui shareholders pledged all of their equity interests in Feng Hui to Ding Xin to guarantee the secured indebtedness caused by failure of performance of Feng Hui’s and the Feng Hui shareholders’ obligations under the Exclusive Business Cooperation Agreement, Exclusive Option Agreement and Power of Attorney. Under the terms of the Share Pledge Agreement, any dividend or bonus received by Feng Hui in respect of the Pledged Equity shall be deposited into an account designated by Ding Xin. The Feng Hui shareholders also agreed that upon occurrence of any event of default, as set forth in the Share Pledge Agreement, Ding Xin is entitled to dispose of the pledged equity interest in accordance with applicable PRC laws. The Feng Hui shareholders further agreed not to dispose of the pledged equity interests or take any actions that would prejudice Ding Xin’s interest.

The Share Pledge Agreement shall be effective until all obligations under the other VIE Agreements have been performed by Feng Hui, when the VIE Agreements are terminated or when the secured indebtedness has been satisfied in full. Under the terms of the agreement, in the event that Feng Hui or its investors breach their respective contractual obligations under the Exclusive Business Cooperation Agreement, Ding Xin, as pledgee, will be entitled to certain rights, including, but not limited to, the right to collect dividends generated by the pledged equity interests and absorbs expected losses. This agreement grants Ding Xin the position as the primary beneficiary who is entitled to absorb losses and to receive benefits that could potentially be significant to Feng Hui.

Exclusive Option Agreement

Under the Exclusive Option Agreement, the Feng Hui shareholders irrevocably granted Ding Xin (or its designee) an exclusive option to purchase, to the extent permitted under PRC law, once or at multiple times, at any time, part or all of their equity interests in Feng Hui. The option price is equal to the lowest price permissible by PRC laws.

The Exclusive Option Agreement will remain effective for a term of five years and may be renewed at Ding Xin’s discretion.

Power of Attorney

Under the Power of Attorney, each Feng Hui shareholder authorized Ding Xin to act on the shareholder’s behalf as his, her or its exclusive agent and attorney with respect to all rights as a shareholder of Feng Hui, under PRC laws and the Articles of Association of Feng Hui, including but not limited to attending shareholder meetings and voting to approve the sale or transfer or pledge or disposition of shares in part or in whole or to designate and appoint the legal representative, directors, and supervisors of Feng Hui. When Ding Xin executes such shareholders’ rights, it should obtain all the current Ding Xin directors’ approval by the resolution of board of directors.

The Power of Attorney shall be continuously valid with respect to each Feng Hui shareholder from the date of execution of the Power of Attorney, so long as such Feng Hui shareholder is a shareholder of Feng Hui. Ding Xin is entitled to terminate the Power of Attorney unilaterally at its discretion by the written notice to Feng Hui.

The effective period of the VIE agreements is from July 16, 2015 to July 15, 2020. The VIE agreements can be renewed by written confirmation by Ding Xin to Feng Hui before their expiration. The extension length can be decided by Ding Xin solely. Once renewed, all the aforesaid agreed terms shall be unconditionally accepted by Feng Hui. Each VIE agreement can only be terminated if all parties thereto agree in writing to terminate the VIE agreement or if Ding Xin delivers to Feng Hui a notice of termination at least 30 days in advance of the termination effective date. Feng Hui has no right to terminate the VIE agreements unilaterally. Under this agreement, Ding Xin processes the power to direct the activities that most significantly impact the Feng Hui’s economic performance.

Upon a series of VIE Agreements, currently, substantially all of ADRIE’s consolidated assets are held, and its consolidated revenues and income are generated, by Feng Hui, its consolidated variable interest entity that is controlled by contractual arrangements. Feng Hui is based in Urumqi, the capital city and business hub of Xinjiang Province, and most of Feng Hui’s lending activities are to enterprises and individual proprietors based there. The consolidated VIE’s assets may be used as collateral for the VIE’s obligation and the creditors of consolidated VIE have no recourse to the general credit of the primary beneficiary.

7

Adrie

Global Holdings Limited

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 AND 2014

1. ORGANIZATION AND PRINCIPAL ACTIVITIES (cont.)

As of December 31, 2015, the group structure of Adrie Group is as follow:

Consolidated financial statements as of and for the year ended December 31, 2015 included ADRIE, Feng Hui Holding, Jin Kai, Ding Xin and Feng Hui. The balance sheet as of December 31, 2015 and 2014, and the statements of income and comprehensive income, changes in investors’ equity and cash flows for the years ended December 31, 2015 and 2014 were retrospectively adjusted to furnish comparative information, and included Feng Hui Holding, Jin Kai, Ding Xin and Feng Hui. ADRIE recognized the acquired entities’ assets and liabilities at their carrying amounts in the accounts of the acquired entities at the date of the capital transaction under common control. After the completion of the capital transactions, the group mainly conducts business through Feng Hui. The number of shares in the computation of earnings per share has been retrospectively stated to reflect that 20,000,000 shares were issued and outstanding as of the beginning of each year.

2. Summary of Significant Accounting Policies

Basis of presentation

The consolidated financial statements of the Company and its subsidiaries and VIE are prepared and presented in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) and pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (“SEC”).

All significant inter-company transactions and balances have been eliminated upon consolidation.

Cash and cash equivalents

Cash and cash equivalents consist of bank deposits with original maturities of three months or less, which are unrestricted as to withdrawal and use the Company maintained accounts at banks and have not experienced any losses from such concentrations.

Loans receivable, net

Loans receivable primarily represent loan amount due from customers. Loans receivable are recorded at unpaid principal balances and allowance that reflects the Company’s best estimate of the amounts that will not be collected. The loans receivable portfolio consists of corporate loans and personal loans (See Note 4).

8

Adrie

Global Holdings Limited

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 AND 2014

2. Summary of Significant Accounting Policies (cont.)

Allowance for loan losses

The allowance for loan losses is increased by charges to income and decreased by charge offs (net of recoveries). Recoveries represent subsequent collection of amounts previously charged-off. The increase in allowance for loan losses is the netting effect of “reversal” and “provision” for both business and personal loans. If the ending balance of the allowance for loan losses after any charge offs (net of recoveries) is less than the beginning balance, it will be recorded as a “reversal”; if it is larger, it will be recorded as a “provision” in the allowance for loan loss. The netting amount of the “reversal” and the “provision” is presented in the statements of income and comprehensive income

The Company recognizes a charge-off when management determines that full repayment of a loan is not probable. The primary factor in making that determination is the potential outcome of a lawsuit against the delinquent debtor. The Company will recognize a charge-off when the Company loses contact with the delinquent borrower for more than nine months or when the court rules against the Company to seize the collateral asset of the delinquent debt from either the guarantor or borrower. In addition, when the recoverability of the delinquent debt is highly unlikely, the senior management team will go through a stringent procedure to approve a charge-off.

The allowance for loan losses is maintained at a level believed to be reasonable by management to absorb probable losses inherent in the portfolio as of each balance sheet date. The allowance is based on factors such as the size and current risk characteristics of the portfolio, an assessment of individual loans and actual loss, delinquency, and/or risk rating record within the portfolio (Note 5). The Company evaluates its allowance for loan losses on a quarterly basis or more often as necessary.

Interest and fee receivable

Interest and fee receivable are accrued and credited to income as earned but not received. The Company determines a loan past due status by the number of days that have elapsed since a borrower has failed to make a contractual interest or principal payment. Accrual of interest is generally discontinued when either (i) reasonable doubt exists as to the full, timely collection of interest or principal or (ii) when a loan interest or principal becomes past due by more than 90 days. Additionally, any previously accrued but uncollected interest is reversed. Subsequent recognition of income occurs only to the extent payment is received, subject to management’s assessment of the collectability of the remaining interest and principal. Loans are generally restored to an accrual status when it is no longer delinquent and collectability of interest and principal is no longer in doubt and past due interest is recognized at that time.

Cost method investment

In accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Subtopic 325-20, “Investments-Other: Cost Method Investments” (“ASC 325-20”), the Company carries the cost method investments at cost and only adjusts for other-than-temporary impairment and distributions of earnings. Management regularly evaluates the impairment of the cost method investments based on performance and financial position of the investee as well as other evidence of market value. Such evaluation includes, but is not limited to, reviewing the investee’s cash position, recent financing, projected and historical financial performance, cash flow forecasts and financing needs.

Property and equipment

The property and equipment are stated at cost less accumulated depreciation. The depreciation is computed on a straight-line method over the estimated useful lives of the assets with 5% salvage value. Estimated useful lives of property and equipment are stated in Note 7.

The Company eliminates the cost and related accumulated depreciation of assets sold or otherwise retired from the accounts and includes any gain or loss in the statement of income. The Company charges maintenance, repairs and minor renewals directly to expenses as incurred; major additions and betterment to equipment are capitalized.

9

Adrie

Global Holdings Limited

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 AND 2014

2. Summary of Significant Accounting Policies (cont.)

Impairment of long-lived assets

The Company applies the provisions of ASC No. 360 Subtopic 10, “Impairment or Disposal of Long-Lived Assets” (“ASC 360-10”) issued by the FASB. ASC 360-10 requires that long-lived assets be reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable through the estimated undiscounted cash flows expected to result from the use and eventual disposition of the assets. Whenever any such impairment exists, an impairment loss will be recognized for the amount by which the carrying value exceeds the fair value.

The Company tests long-lived assets, including property and equipment and finite lived intangible assets, for impairment at least annually or more frequently upon the occurrence of an event or when circumstances indicate that the net carrying amount is greater than its fair value. Assets are grouped and evaluated at the lowest level for their identifiable cash flows that are largely independent of the cash flows of other groups of assets. The Company considers historical performance and future estimated results in its evaluation of potential impairment and then compares the carrying amount of the asset to the future estimated cash flows expected to result from the use of the asset. If the carrying amount of the asset exceeds estimated expected undiscounted future cash flows, the Company measures the amount of impairment by comparing the carrying amount of the asset to its fair value. The estimation of fair value is generally measured by discounting expected future cash flows as the rate the Company utilizes to evaluate potential investments. The Company estimates fair value based on the information available in making whatever estimates, judgments and projections are considered necessary. There were no impairment losses in the year ended December 31, 2015 and 2014.

Fair values of financial instruments

ASC Topic 825, “Financial Instruments” (“Topic 825”), requires disclosure of fair value information of financial instruments, whether or not recognized in the balance sheets, for which it is practicable to estimate that value. In cases where quoted market prices are not available, fair values are based on estimates using present value or other valuation techniques. Those techniques are significantly affected by the assumptions used, including the discount rate and estimates of future cash flows. In that regard, the derived fair value estimates cannot be substantiated by comparison to independent markets and, in many cases, could not be realized in immediate settlement of the instruments. Topic 825 excludes certain financial instruments and all nonfinancial assets and liabilities from its disclosure requirements. Accordingly, the aggregate fair value amounts do not represent the underlying value of the Company.

Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets.

Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liability, either directly or indirectly, for substantially the full term of the financial instruments.

Level 3 inputs to the valuation methodology are unobservable and significant to the fair value.

As of December 31, 2015 and 2014, financial instruments of the Company were primarily comprised of cash, loans receivable, accrued interest receivables, cost method investment, other receivables, short-term bank loans, secured loans and loans from a cost investment investee, deposits payables and accrued expenses, which were carried at cost on the balance sheets, and carrying amounts approximated their fair values because of their generally short maturities.

Foreign currency translation and transactions

The reporting currency of the Company is United States Dollars (“$”), which is also the Company’s functional currency. The PRC subsidiaries and VIE maintain their books and records in its local currency, the Renminbi Yuan (“RMB”), which is their functional currencies as being the primary currency of the economic environment in which these entities operate.

10

Adrie

Global Holdings Limited

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 AND 2014

2. Summary of Significant Accounting Policies (cont.)

Transactions in foreign currencies other than functional currencies are initially recorded at the functional currency rate ruling at the date of transaction. Any differences between the initially recorded amount and the settlement amount are recorded as a gain or loss on foreign currency transaction in the statements of income. Monetary assets and liabilities denominated in foreign currency are translated at the functional currency rate of exchange ruling at the balance sheet date. Any differences are taken to profit or loss as a gain or loss on foreign currency translation in the statements of income.

In accordance with ASC Topic 830, “Foreign Currency Matters,” the Company translated the assets and liabilities into US dollars using the rate of exchange prevailing at the applicable balance sheet date and the statements of income and cash flows are translated at an average rate during the reporting period, as set forth in the following tables. Adjustments resulting from the translation are recorded in investors’ equity as part of accumulated other comprehensive income.

| December 31, | ||||||||

| 2015 | 2014 | |||||||

| Balance sheet items, except for equity accounts | 6.4917 | 6.1460 | ||||||

| For the Years Ended December 31, | ||||||||

| 2015 | 2014 | |||||||

| Items in the statements of income and comprehensive income, and statements of cash flows | 6.2288 | 6.1457 | ||||||

Use of estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. On an ongoing basis, management reviews these estimates using the currently available information. Changes in facts and circumstances may cause the Company to revise its estimates. Significant accounting estimates reflected in the financial statements include: (i) the allowance for loan losses; (ii) accrual of estimated liabilities; (iii) contingencies and litigation; and (iv) deferred tax liabilities and assets.

Revenue recognition

The Company recognizes revenue when persuasive evidence of an arrangement exists, service has been performed, the price is fixed or determinable and collection is reasonably assured, on the following:

1) Interest income on loans. Interest on loan receivables is accrued monthly in accordance with their contractual terms and recorded in accrued interest receivable. The Company does not charge prepayment penalty from customers. Additionally, any previously accrued but uncollected interest is reversed and accrual is discontinued, when either (i) reasonable doubt exists as to the full, timely collection of interest or principal or (ii) when a loan becomes past due by more than 90 days.

2) Consultancy services on loans. The Company receives fees from consultancy services in full at inception and records as unearned income before amortizing it throughout the period of services.

Non-interest expenses

Non-interest expenses primarily consist of salary and benefits for employees, traveling cost, entertainment expenses, depreciation of equipment, office rental expenses, professional service fee, office supply, etc., and are expensed as incurred.

11

Adrie

Global Holdings Limited

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 AND 2014

2. Summary of Significant Accounting Policies (cont.)

Income tax

Current income taxes are provided for in accordance with the laws of the relevant taxing authorities. As part of the process of preparing financial statements, the Company is required to estimate its income taxes in each of the jurisdictions in which it operates. The Company accounts for income taxes using the liability method. Under this method, deferred income taxes are recognized for tax consequences in future years of differences between the tax bases of assets and liabilities and their reported amounts in the financial statements at each year-end and tax loss carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates applicable for the differences that are expected to affect taxable income.

The Company adopts a more likely than not threshold and a two-step approach for the tax position measurement and financial statement recognition. Under the two-step approach, the first step is to evaluate the tax position for recognition by determining if the weight of available evidence indicates that it is more likely than not that the position will be sustained, including resolution of related appeals or litigation process, if any. The second step is to measure the tax benefit as the largest amount that is more than 50% likely of being realized upon settlement. As of December 31, 2015 and 2014, the Company did not have any uncertain tax position.

Comprehensive income

Comprehensive income includes net income and foreign currency adjustments. Comprehensive income is reported in the statements of income and comprehensive income.

Accumulated other comprehensive (loss) income, as presented on the balance sheets are the cumulative foreign currency translation adjustments.

Operating leases

The Company leases its principal office under a lease agreement that qualifies as an operating lease. Payments made under operating leases are charged to the consolidated statements of comprehensive income on a straight line basis over the lease periods.

Commitments and contingencies

In the normal course of business, the Company is subject to loss contingencies, such as legal proceedings and claims arising out of its business, that cover a wide range of matters, including, among others, government investigations and tax matters. In accordance with ASC No. 450 Subtopic 20, “Loss Contingencies”, the Company records accruals for such loss contingencies when it is probable that a liability has been incurred and the amount of loss can be reasonably estimated.

Recently issued accounting standards

In May of 2014, the FASB issued ASC Topic 606, “Revenue from Contracts with Customers” (“Topic 606”). Topic 606 clarifies the principles for recognizing revenue and develops a common revenue standard for U.S. GAAP and IFRS. Simultaneously, Topic 606 supersedes the revenue recognition requirements in ASC Topic 605, Revenue Recognition, and most industry-specific guidance throughout the Industry Topics of the Accounting Standards Codification. The core principle of the guidance requires an entity to recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. To achieve that core principle, an entity should apply the five steps: (1) identify the contract(s) with a customer; (2) identify the performance obligations in the contract; (3) determine the transaction price; (4) allocate the transaction price to the performance obligations in the contract; and (5) recognize revenue when (or as) the entity satisfies a performance obligation. The amendments are effective for annual reporting periods beginning after December 15, 2016, including interim periods within that reporting period. Early application is not permitted. This amendment shall be applied retrospectively either to each prior reporting periods or with the cumulative effect of initially applying this amendments recognized at the date of initial application. There is no impact on the consolidated financial statements for current reporting periods since early adoption is not permitted. The Group is in process of evaluating the cumulative effect on the consolidated financial statements of adopting this guidance so as to transit to the new revenue recognition guidance in the year of 2016.

12

Adrie

Global Holdings Limited

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 AND 2014

2. Summary of Significant Accounting Policies (cont.)

In August 2014, the FASB issued Accounting Standards Update (“ASU”) No. 2015-17, “Presentation of Financial Statements — Going Concern (Subtopic 205-40).” This standard requires management to evaluate for each annual and interim reporting period whether it is probable that the reporting entity will not be able to meet its obligations as they become due within one year after the date that the financial statements are issued. If the entity is in such a position, the standard provides for certain disclosures depending on whether or not the entity will be able to successfully mitigate its going concern status. This guidance is effective for fiscal years ending after December 15, 2016 and interim periods within those years. Early application is permitted. The Company does not anticipate that this adoption will have a significant impact on its financial position, results of operations, or cash flows.

In November 2015, the FASB issued ASU No. 2015-17, “Balance Sheet Classification of Deferred Taxes” (“ASU 2015-17”). To simplify presentation, ASU 2015-17 requires that all deferred tax assets and liabilities, along with any related valuation allowance, be classified as noncurrent on the balance sheet. As a result, each jurisdiction will now only have one net noncurrent deferred tax asset or liability. ASU 2015-17 does not change the existing requirement that only permits offsetting within a jurisdiction — that is, companies are still prohibited from offsetting deferred tax liabilities from one jurisdiction against deferred tax assets of another jurisdiction. ASU 2015-17 is effective for public business entities in fiscal years beginning after December 15, 2016, including interim periods within those years. Early adoption is permitted. An entity can elect to adopt ASU 2015-17 either (1) prospectively for all deferred tax assets and liabilities, or (2) retrospectively by reclassifying the comparative balance sheet. If applied prospectively, an entity is required to include a statement that prior periods were not retrospectively adjusted. If applied retrospectively, an entity is also required to include quantitative information about the effects of the change on prior periods. The Company does not anticipate that this adoption will have a significant impact on its financial statements since the Company does not separate current and noncurrent assets and liabilities on the balance sheet.

In February 2016, the FASB issued ASU 2016-02 “Leases (Topic 842).” This standard requires entities that lease assets to recognize on the balance sheet the assets and liabilities for the rights and obligations created by those leases. The standard is effective for fiscal years and the interim periods within those fiscal years beginning after December 15, 2018. The guidance is required to be applied by the modified retrospective transition approach. Early adoption is permitted. The Company is currently assessing the impact of the adoption of this new guidance on its financial position, results of operations and disclosures.

3. Risks

(a) Credit risk

Credit risk is one of the most significant risks for the Company’s business and arise principally in lending activities.

Credit risk is controlled by the application of credit approvals, limits and monitoring procedures. The Company manages credit risk through in-house research and analysis of the Chinese economy and the underlying obligors and transaction structures. To minimize credit risk, the Company requires collateral in the form of rights to cash, securities or property and equipment.

The Company identifies credit risk collectively based on industry, geography and customer type. This information is monitored regularly by management.

13

Adrie

Global Holdings Limited

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 AND 2014

3. Risks (cont.)

In measuring the credit risk of lending loans to corporate customers, the Company mainly reflects the “probability of default” by the customer on its contractual obligations and considers the current financial position of the customer and the exposures to the customer and its likely future development. For individual customers, the Company uses standard approval procedures to manage credit risk for personal loans.

(b) Liquidity risk

The Company is also exposed to liquidity risk which is risk that it is unable to provide sufficient capital resources and liquidity to meet its commitments and business needs. Liquidity risk is controlled by the application of financial position analysis and monitoring procedures. When necessary, the Company will turn to other financial institutions and the owners to obtain short-term funding to meet the liquidity shortage.

(c) Foreign currency risk

A majority of the Company’s operating activities and a significant portion of the Company’s assets and liabilities are denominated in RMB, which is not freely convertible into foreign currencies. All foreign exchange transactions take place either through the Peoples’ Bank of China (“PBOC”) or other authorized financial institutions at exchange rates quoted by PBOC. Approval of foreign currency payments by the PBOC or other regulatory institutions requires submitting a payment application form together with suppliers’ invoices and signed contracts. The value of RMB is subject to changes in central government policies and to international economic and political developments affecting supply and demand in the China Foreign Exchange Trading System market.

4. Loans Receivable, Net

The interest rates on loans issued ranged between 8% and 24% for the years ended December 31, 2015 and 2014.

Loans receivable consisted of the following:

| December 31, | ||||||||

| 2015 | 2014 | |||||||

| Business loans | $ | 41,794,907 | $ | 46,692,158 | ||||

| Personal loans | 99,118,875 | 86,386,267 | ||||||

| Total loan receivable | 140,913,782 | 133,078,425 | ||||||

| Allowance for loan losses | ||||||||

| Collectively assessed | (1,401,061 | ) | (1,330,784 | ) | ||||

| Individually assessed | (807,647 | ) | — | |||||

| Allowance for loan losses | (2,208,708 | ) | (1,330,784 | ) | ||||

| Loans receivable, net | $ | 138,705,074 | $ | 131,747,641 | ||||

The Company originates loans to customers located primarily in Urumqi City, Xinjiang Province. This geographic concentration of credit exposes the Company to a higher degree of risk associated with this economic region.

All loans are short-term loans that the Company has made to either business or individual customers. As of December 31, 2015 and 2014, the Company had 36 and 30 business loan customers, and 125 and 65 personal loan customers, respectively. Most loans are either guaranteed by a third party whose financial strength is assessed by the Company to be sufficient or secured by collateral. Allowance for loan losses is estimated on a quarterly basis in accordance with probable based on an assessment of specific evidence indicating doubtful collection, historical experience, loan balance aging and prevailing economic conditions.

14

Adrie

Global Holdings Limited

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 AND 2014

4. Loans Receivable, Net (cont.)

For the years ended December 31, 2015 and 2014, a provision of $2,166,110 and $584,348 were charged to the statement of income, respectively. $642,178 and $0 write-offs against allowances have occurred for these years, respectively.

Interest on loans receivable is accrued and credited to income as earned. The Company determines a loan’s past due status by the number of days that have elapsed since a borrower has failed to make a contractual loan payment. Accrual of interest is generally discontinued when either (i) reasonable doubt exists as to the full, timely collection of interest or principal or (ii) when a loan becomes past due by more than 90 days.

The following table presents nonaccrual loans with aging over 90 days by classes of loan portfolio as of December 31, 2015 and 2014, respectively:

| December 31, | ||||||||

| 2015 | 2014 | |||||||

| Business loans | $ | 10,468,752 | $ | 955,093 | ||||

| Personal loans | 4,254,664 | 1,301,660 | ||||||

| $ | 14,723,416 | $ | 2,256,753 | |||||

The following table represents the aging of loans as of December 31, 2015 by type of loan:

| 1-89 Days Past Due | 90-179 Days Past Due | 180-365 Days Past Due | Over 1 year Past Due | Total Past Due | Current | Total Loans | ||||||||||||||||||||||

| Business loans | $ | — | $ | 9,698,538 | $ | 770,214 | $ | — | $ | 10,468,752 | $ | 31,326,155 | $ | 41,794,907 | ||||||||||||||

| Personal loans | — | 4,254,664 | — | — | 4,254,664 | 94,864,211 | 99,118,875 | |||||||||||||||||||||

| $ | — | $ | 13,953,202 | $ | 770,214 | $ | — | $ | 14,723,416 | $ | 126,190,366 | $ | 140,913,782 | |||||||||||||||

The following table represents the aging of loans as of December 31, 2014 by type of loan:

| 1-89 Days Past Due | 90-179 Days Past Due | 180-365 Days Past Due | Over 1 year Past Due | Total Past Due | Current | Total Loans | ||||||||||||||||||||||

| Business loans | $ | — | $ | — | $ | 406,769 | $ | 548,324 | $ | 955,093 | $ | 45,737,065 | $ | 46,692,158 | ||||||||||||||

| Personal loans | — | 1,301,660 | — | — | 1,301,660 | 85,084,607 | 86,386,267 | |||||||||||||||||||||

| $ | — | $ | 1,301,660 | $ | 406,769 | $ | 548,324 | $ | 2,256,753 | $ | 130,821,672 | $ | 133,078,425 | |||||||||||||||

Analysis of loans by collateral

The following table summarizes the Company’s loan portfolio by collateral as of December 31, 2015:

| Business loans | Personal loans | Total | ||||||||||

| Guarantee backed loans | $ | 16,505,692 | $ | 30,525,132 | $ | 47,030,824 | ||||||

| Pledged assets backed loans | 5,593,296 | 65,289,524 | 70,882,820 | |||||||||

| Collateral backed loans | 19,695,919 | 3,304,219 | 23,000,138 | |||||||||

| $ | 41,794,907 | $ | 99,118,875 | $ | 140,913,782 | |||||||

The following table summarizes the Company’s loan portfolio by collateral as of December 31, 2014:

| Business loans | Personal loans | Total | ||||||||||

| Guarantee backed loans | $ | 4,930,036 | $ | 73,442,890 | $ | 78,372,926 | ||||||

| Pledged assets backed loans | 36,230,068 | 11,218,679 | 47,448,747 | |||||||||

| Collateral backed loans | 5,532,054 | 1,724,698 | 7,256,752 | |||||||||

| $ | 46,692,158 | $ | 86,386,267 | $ | 133,078,425 | |||||||

Most guarantee backed loans were guaranteed by investors of the Company. (See note 20).

15

Adrie

Global Holdings Limited

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 AND 2014

4. Loans Receivable, Net (cont.)

Collateral Backed Loans

A collateral backed loan is a loan in which the borrower puts up an asset under their ownership, possession or control, as collateral for the loan. An asset usually is land use rights, inventory, equipment or buildings. The loan is secured against the collateral and we do not take physical possession of the collateral at the time the loan is made. We will verify ownership of the collateral and then register the collateral with the appropriate government entities to complete the secured transaction. In the event that the borrower defaults, we can then take possession of the collateral asset and sell it to recover the outstanding balance owed. If the sale proceeds of the collateral asset is not sufficient to pay off the loan in full, we will file a lawsuit against the borrower and seek judgment for the remaining balance.

Pledged Asset Backed Loans

Pledged assets backed loans are loans with pledged assets. The pledged assets are usually certificates of deposit. Lenders take physical possession of the pledged assets at the time the loan is made and do not need to register them with government entities to secure the loan. If the borrower defaults, we can sell the assets to recover the outstanding balance owed.

Both collateral loans and pledged loans are considered secured loans. The amount of a loan that lenders provide depends on the value of the collateral pledged.

Guarantee Backed Loans

A guaranteed loan is a loan guaranteed by a corporation or high net worth individual. As of December 31, 2015 and 2014, guaranteed loans make up 33.4% and 58.9% of our direct loan portfolio, respectively.

As of December 31, 2015 and 2014, the Company pledged $44,512,224 and $3,302,961 gross loans receivable for loans Feng Hui borrowed from third parties (See Note 10 and Note 11), which consisted of the following:

| December 31, | December 31, | |||||||

| 2015 | 2014 | |||||||

| Business loans | $ | 13,241,523 | $ | 813,537 | ||||

| Personal loans | 31,270,700 | 2,489,424 | ||||||

| Total pledged loans receivable | $ | 44,512,223 | $ | 3,302,961 | ||||

5. Allowance for Loan Losses

The allowance for loan losses is maintained at a level considered adequate to provide for losses that can be reasonably anticipated. Management performs a quarterly evaluation of the adequacy of the allowance. The allowance is based on the Company’s past loan loss history, known and inherent risks in the portfolio, adverse situations that may affect the borrower’s ability to repay, the estimated value of any underlying collateral, composition of the loan portfolio, current economic conditions and other relevant factors. This evaluation is inherently subjective as it requires material estimates that may be susceptible to significant revision as more information becomes available.

The allowance is calculated at portfolio-level since our loans portfolio is generally comprised of smaller balance homogenous loans and is collectively evaluated for impairment.

For the purpose of calculating portfolio-level reserves, we have grouped our loans into two portfolio segments: Business and Personal. The allowance consists of the combination of a quantitative assessment component based on statistical models, a retrospective evaluation of actual loss information to loss forecasts, value of collateral, pledged asset and guarantee, and could include a qualitative component based on management judgment.

In estimating the probable loss of the loan portfolio, the Company also considers qualitative factors such as current economic conditions and/or events in specific industries and geographical areas, including unemployment levels, trends in real estate values, peer comparisons, and other pertinent factors such as regulatory guidance. Finally, as appropriate, the Company also considers individual borrower circumstances and the condition, and fair value of the loan collateral, pledged asset and guarantee, if any.

16

Adrie

Global Holdings Limited

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 AND 2014

5. Allowance for Loan Losses (cont.)

The Company considers the loans backed by collateral, pledged asset and guarantee are of the same importance in determining allowance for loans loss.

In addition, the Company calculates the provision amount as below:

| 1. | General Reserve — is based on total loan receivable balance and to be used to cover unidentified probable loan loss. | |

| 2. | Special Reserve — is fund set aside covering losses due to risks related to a particular country, region, industry, company or type of loans. The reserve rate is decided based on management estimate of loan collectability. The loan portfolio did not include any loans outside of the PRC. |

Generally, the primary factors for the evaluation of allowance for loan losses consist of business performance, financial position, cash flow and other operational performance of the debtors. Among these, cash flow of the debtors is the primary funding source for repayment for determining the allowance for loan losses and any collateral, pledged asset or guarantee is considered as a secondary funding source for repayment.

Besides the repayment ability and willingness to repay, China Lending Group evaluates the allowance for loan losses of collateral backed loans based on whether the fair value of the collateral if the repayment is expected to be provided by the collateral is sufficient or not. For loans with pledged assets, the net realizable value of pledged assets for pledged backed loans will be estimated to see if they have sufficient coverage on the loans. For the guarantee backed loans, China Lending Group evaluates the allowance for loan losses based on the combination of the guarantee including the fair value and net realizable value of guarantor’s financial position, credibility, liquidity and cash flow.

As of December 31, 2015, the percentage of collateral, pledged asset, and guarantee backed loans were 16.3%, 50.3% and 33.4% respectively. As of December 31, 2014, the percentage of collateral, pledged asset, and guarantee backed loans were 5.5%, 35.7% and 58.9%, respectively.

The valuation assessment of collateral and pledged assets was based on the valuation report issued by a valuation firm or the Company’s internal risk control department. The assets values were generally 50% to 60% of the fair value of collateral and pledged assets. The valuation will be updated for the loan period over one year in case of renewals and repeat customers. However, China Lending Group’s average loan term is less than 7 months, the value of the collateral and pledged assets, and guarantee backing the loans will be reviewed and monitored on a monthly basis through site visits. As of December 31, 2015 and December 31, 2014, 11.28% and 18.32% of collateral backed and pledged backed loan were under valuation assessment by a valuation firm. The assessment of the remaining loans was performed by the Company’s internal risk control department.

China Lending Group issues guarantee-backed loans in accordance with its loan management policy, and each guarantee-backed loan will undergo standard assessment procedures for willingness and ability of the guarantor to perform under its guarantee. China Lending Group accepts guarantees provided by three types of guarantors: professional guarantee companies, corporations and individuals.

In assessing the willingness and ability of a professional guarantee company to perform under a guarantee, the Company consider factors including its guarantee licenses, size of registered capital, corporate governance, internal audit system, risk management and compensation system, risk and reserve, length of operation history especially cooperation history with China Lending Group, its default costs and other pertinent factors such as the loan size backed by guarantee over its net assets.

In assessing the of willingness and ability of a corporate guarantor to perform under a guarantee, the Company consider factors including nature of its businesses, size of registered capital, annual revenues, continuous profitability in the past three years, stability and adequacy of income and cash flows, clean credit history, current liabilities, willingness to accept credit monitoring by China Lending Group, its default costs and other pertinent factors such as the loan size backed by guarantee over its net assets.

17

Adrie

Global Holdings Limited

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 AND 2014

5. Allowance for Loan Losses (cont.)

In assessing the willingness and ability of an individual guarantor to perform under a guarantee, the Company consider factors including their residency, whether being able to provide permanent residential addresses, marital status, occupations, legitimacy and stability of incomes, assets and liabilities, clean credit history, no criminal history, their default costs and other pertinent factors such as the loan size backed by guarantee over their net assets.

The global economic environment became worse during the past and the current fiscal years. Such economic environment has caused liquidity problem for many companies, which also increased the frequency on defaulting the repayments by debtors, hence the increases of special reserve for loan losses.

For the year ended December 31, 2015 and 2014, $807,647 and $nil were charged as specific reserve with categories ranged from 5%-25% and 0%, respectively.

While management uses the best information available to make loan loss allowance evaluations, adjustments to the allowance may be necessary based on changes in economic and other conditions or changes in accounting guidance.

The following tables present the activity in the allowance for loan losses and related recorded investment in loans receivable by classes of the loans individually and collectively evaluated for impairment as of and for the years ended December 31, 2015 and 2014:

For the year ended December 31, 2015

| Business loans | Personal loans | Total | ||||||||||

| Beginning balance | $ | 466,921 | $ | 863,863 | $ | 1,330,784 | ||||||

| Charge-offs | (642,178 | ) | — | (642,178 | ) | |||||||

| Write-off in loans sold to a related party (see Note 20) | (32,109 | ) | (502,986 | ) | (535,095 | ) | ||||||

| Provisions | 1,311,620 | 854,490 | 2,166,110 | |||||||||

| Foreign currency translation adjustment | (50,675 | ) | (60,238 | ) | (110,913 | ) | ||||||

| Ending balance | 1,053,579 | 1,155,129 | 2,208,708 | |||||||||

| Ending balance: individually evaluated for impairment | 642,051 | 165,596 | 807,647 | |||||||||

| Ending balance: collectively evaluated for impairment | $ | 411,528 | $ | 989,533 | $ | 1,401,061 | ||||||

For the year ended December 31, 2014

| Business loans | Personal loans | Total | ||||||||||

| Beginning balance | $ | 268,201 | $ | 482,363 | $ | 750,564 | ||||||

| Charge-offs | — | — | — | |||||||||

| Provisions | 200,168 | 384,180 | 584,348 | |||||||||

| Foreign currency translation adjustment | (1,448 | ) | (2,680 | ) | (4,128 | ) | ||||||

| Ending balance | 466,921 | 863,863 | 1,330,784 | |||||||||

| Ending balance: individually evaluated for impairment | — | — | — | |||||||||

| Ending balance: collectively evaluated for impairment | $ | 466,921 | $ | 863,863 | $ | 1,330,784 | ||||||

6. Loan impairment

A loan is considered impaired when, based on current information and events, it is probable that the Company will be unable to collect the scheduled payments of principal or interest when due according to the contractual terms of the loan agreement. Factors considered by management in determining impairment include payment status, collateral value and the probability of collecting scheduled principal and interest payments when due. Loans that experience insignificant payment delays and payment shortfalls generally are not classified as impaired. Management determines the significance of payment delays and payment shortfalls on a case-by-case basis, taking into consideration all of the circumstances surrounding the loan and the borrower, including the length of the delay, the reasons for the delay, the borrower’s prior payment record and the amount of the shortfall in relation to the principal and interest owed. Impairment is measured on a loan by loan basis for corporate and personal loans by either the present value of expected future cash flows discounted at the loan’s effective interest rate or the fair value of the collateral if the loan is collateral dependent.

18

Adrie

Global Holdings Limited

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 AND 2014

6. Loan impairment (cont.)

An allowance for loan losses is established for an impaired loan if its carrying value exceeds its estimated fair value. Currently, estimated fair values of substantially all of the Company’s impaired loans are measured based on the estimated fair value of the loan’s collateral which approximates to the carrying value due to the short term nature of the loans. The impaired amounts of personal loans were $4,254,664 and $nil as of December 31, 2015 and December 31, 2014, respectively. The impaired amounts of business loans were $10,468,752 and $nil as of December 31, 2015 and December 31, 2014, respectively.

Loans with modified terms are classified as troubled debt restructurings if the Company grants such borrowers concessions and it is deemed that those borrowers are experiencing financial difficulty. Concessions granted under a troubled debt restructuring generally involve a temporary below market rate reduction in interest rate or an extension of a loan’s stated maturity date. Non-accrual troubled debt restructurings are restored to accrual status if principal and interest payments, under the modified terms, are current for six consecutive months after modification. Loans classified as troubled debt restructurings are designated as impaired. Due to the nature of the Company’s operation and the concessions granted, the troubled debt restructuring designation will not be removed until the loan is paid off or otherwise disposed of. The Company reported its first troubled debt restructuring in December 31, 2015. The Company has not removed any loan classified as a troubled debt restructuring from that classification.

The Company allows a one-time loan extension based on an ancillary company policy with a period up to the original loan period, which is usually within twelve months. According to the Company’s loan management policy, granting initial one-time extension requires a new underwriting and credit evaluation. Borrowers are required to submit extension application 10 days before expiration of the original loan. Then the company’s loan service department will investigate whether material changes have happened to the borrower’s business which may impact its repayment ability. The company’s risk management department will reevaluate the loan. If the company decides to grant one-time extension, an extension agreement will be executed between the borrower and the company, plus commitment letter from guarantor to agree the loan extension and extend the guarantee duration. In evaluating the extension and underwriting new loans, China Lending Group will request that borrowers obtain guarantees from state-owned or public guarantee companies. Even though the Company allows a one-time loan extension with a period up to the original loan period, which is usually within twelve months. Such extension is not considered to be a troubled debt restructuring because the Company does not grant a concession to borrowers. The principal of the loan remains the same and the interest rate is fixed at the current interest rate at the time of extension. 17 loans of $14.9 million and 9 loans of $10.7 million were granted one-time extension in years ended December 31, 2015 and 2014, respectively, which accounted for 6.3% and 5.24% of total loans made for the year ended December 31, 2015 and 2014, respectively.

In addition, the troubled debt restructuring amounts of personal loans were $1,035,168 and $nil as of December 31, 2015 and December 31, 2014, respectively after providing one-time concession on interest amounting to $26,627 and providing an allowance for loan loss amounting to $26,998. The trouble debt restructuring amounts of business loans were $3,080,857 and $nil as of December 31, 2015 and December 31, 2014, respectively, after providing one-time concession on interest amounting to $22,175 and providing an allowance for loan loss amounting to $73,129.

A loan is considered to be a troubled debt restructuring loan when that is restructured or modified for economic or legal reasons, where these conditions are present: 1) The Company grants a concession that it otherwise would not consider and 2) The borrower is having financial difficulties. Under unusual circumstance, in order to reduce the potential losses on troubled debt, the Company may consider granting concession to borrowers with financial difficulties which has significant delay or significant shortfall in amount of payments. In order to deter troubled debt restructurings, stringent scrutiny and approval from the Company’s Loan Review Committee is required prior to the granting of concession on troubled debt.

As of December 31, 2015 and 2014, there were no receivable derecognized for the real estate related investment obtained from collateral.

19

Adrie

Global Holdings Limited

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 AND 2014

7. Property and Equipment

The Company’s property and equipment used to conduct day-to-day business are recorded at cost less accumulated depreciation. Depreciation expense is calculated using straight-line method over the estimated useful life below:

| Useful Life | December 31, | |||||||||

| years | 2015 | 2014 | ||||||||

| Furniture and fixtures | 5 | $ | 4,208 | $ | 325 | |||||

| Vehicles | 4 | 143,229 | 56,145 | |||||||

| Electronic equipment | 3 | 16,256 | 13,615 | |||||||

| Less: accumulated depreciation | (47,395 | ) | (50,118 | ) | ||||||

| Property and equipment, net | $ | 116,298 | $ | 19,967 | ||||||

Depreciation expense totaled $39,415 and $13,366 for the years ended December 31, 2015 and 2014, respectively.

8. COST METHOD INVESTMENT

| December 31, | ||||||||

| 2015 | 2014 | |||||||

| Beginning balance | $ | — | $ | — | ||||

| Addition | 3,851,071 | — | ||||||

| Less: impairment loss | — | — | ||||||

| Ending balance | $ | 3,851,071 | $ | — | ||||

In January 2015, the Company made a commitment to invest 5% of the paid-in capital in Xinjiang Microcredit Refinancing Co., Ltd. (“Microcredit Refinancing”). Microcredit Refinancing is a newly formed micro refinancing company in the PRC with total registered capital of RMB 1,000,000,000 (approximately $154,042,855). As at December 31, 2015, Microcredit Refinancing had paid-in capital of RMB 500,000,000 (approximately $77,021,427), and the Company had invested RMB 25,000,000 (approximately $3,851,071) in Microcredit Refinancing. Such investment is accounted for under the cost method as the Company does not have significant influence over Microcredit Refinancing. The cost of this investment approximated $3,851,071 as of December 31, 2015.

An impairment charge is recorded if the carrying amount of the equity investment exceeds its fair value and this condition is determined to be other-than-temporary. The Company performs an impairment test on its cost method investment whenever events or changes in business circumstances indicate that an other-than-temporary impairment has occurred, by considering current economic and market conditions, operating performance, development stages and technology development, and engaging an independent third-party valuation firm to estimate the fair value of cost method investment, as appropriate. The Company recorded no impairment charge to the carrying value of its investments under the cost method for the year ended December 31, 2015.

9. Short-term Bank Loans

The following is a summary of the Company’s short-term bank loans as of December 31, 2015 and 2014:

| December 31, | December 31. | |||||||||||

| Bank name | Interest rate | Term | 2015 | 2014 | ||||||||

| Shanghai Pudong Development Bank | Fixed annual rate of 7.8% | From March 21, 2014 to March 21, 2015 | $ | — | $ | 3,254,149 | ||||||

| Shanghai Pudong Development Bank | Fixed annual rate of 7.8% | From April 15, 2014 to April 15, 2015 | — | 4,067,686 | ||||||||

| $ | — | $ | 7,321,835 | |||||||||

20

Adrie

Global Holdings Limited

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 AND 2014

9. Short-term Bank Loans (cont.)

Interest expense incurred on the above short-term bank loans was $145,400 and $474,342 for the year ended December 31, 2015 and 2014, respectively. The loans were guaranteed by the Company’s investors and related parties. (See Note 20)

During the year ended December 31, 2015 and 2014, Feng Hui was granted loans from China Merchants Bank which were entrusted by a former related party of Feng Hui, Urumqi Changhe Financing Guarantee Co., Ltd (“Changhe”), who was an investor of Feng Hui before May 5, 2015. After Changhe ceased to be Feng Hui’s investor, it entrusted Tianshan Rural Commercial Bank to grant Feng Hui more loans. The interest expense incurred on loans provided by Changhe were $347,668 and $98,775 for the year ended December 31, 2015 and 2014, respectively. The Company repaid all matured bank loans as of December 31, 2015.

| Lender Name | Entrust Bank Name | Interest Rate | Term | Amount | ||||||

| Urumqi Changhe Financing Guarantee Co., Ltd. | China Merchants Bank | Fixed annual rate of 12% | From January 27, 2015 to December 26, 2015 | $ | 1,605,446 | |||||

| Urumqi Changhe Financing Guarantee Co., Ltd. | Tianshan Rural Commercial Bank | Fixed annual rate of 10% | From July 23, 2015 to December 22, 2015 | $ | 4,013,614 | |||||

| Urumqi Changhe Financing Guarantee Co., Ltd. | China Merchants Bank | Fixed annual rate of 12% | From April 11, 2014 to October 10, 2014 | $ | 1,627,154 | |||||

The loans granted through China Merchants Bank were guaranteed by the Company’s investors and related parties. (See Note 20)

10. Secured LoanS

The following is a summary of the Company’s secured loans as of December 31, 2015 and 2014:

| December 31, | December 31, | |||||||||||

| Lender name | Interest rate | Term | 2015 | 2014 | ||||||||

| China Great Wall Assets Management Co. Ltd. | Fixed annual rate of 12% | From August 25, 2014 to August 24, 2015 | $ | — | $ | 16,156,850 | ||||||

| China Great Wall Assets Management Co. Ltd. | Fixed annual rate of 12% | From May 29, 2015 to May 28, 2016 | 9,365,806 | — | ||||||||

| China Great Wall Assets Management Co. Ltd. | Fixed annual rate of 11.5% | From October 29, 2015 to October 28, 2016 | 15,373,476 | |||||||||

| $ | 24,739,282 | $ | 16,156,850 | |||||||||

As of December 31, 2015 and 2014, the secured loan has maturity terms within 1 year. Interest expense incurred on the secured loan was $2,302,136 and $689,393 for the years ended December 31, 2015 and 2014, respectively.

The secured loan was guaranteed by investors of the Company (See Note 20), and Feng Hui pledged $11,830,491 and $3,302,961 loans receivable from its customers as of December 31, 2015 and 2014, respectively, to secure these loans for the lender.

21

Adrie

Global Holdings Limited

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 AND 2014

11. loans FROM A COST INVESTMENT INVESTEE

The following is a summary of the Company’s loans from Xinjiang Microcredit Refinancing Co. Ltd., financing company in which the Company has a cost-basis investment (see Note 8), as of December 31, 2015 and 2014:

| December 31, | ||||||||

| 2015 | 2014 | |||||||

| Xinjiang Microcredit Refinancing Co. Ltd. | $ | 15,404,285 | $ | — | ||||

The following table summarizes the terms and the December 31, 2015 balances of the Company’s loans from Xinjiang Microcredit Refinancing Co., Ltd.:

| Lender name | Interest rate | Term | December 31, 2015 | |||||

| Xinjiang Microcredit Refinancing Co. Ltd. | Fixed annual rate of 12.0% | From August 10, 2015 to August 9, 2016 | $ | 770,214 | ||||

| Xinjiang Microcredit Refinancing Co. Ltd. | Fixed annual rate of 12.0% | From August 24, 2015 to August 23, 2016 | 770,214 | |||||

| Xinjiang Microcredit Refinancing Co. Ltd. | Fixed annual rate of 12.0% | From August 25, 2015 to August 24, 2016 | 3,080,857 | |||||

| Xinjiang Microcredit Refinancing Co. Ltd. | Fixed annual rate of 12.0% | From September 1, 2015 to August 31, 2016 | 3,080,857 | |||||

| Xinjiang Microcredit Refinancing Co. Ltd. | Fixed annual rate of 12.0% | From September 23, 2015 to September 22, 2016 | 7,702,143 | |||||

| $ | 15,404,285 | |||||||

Interest expense incurred on the above loans for the year ended December 31, 2015 was $1,101,871. The proceeds from these loans were used to fund Feng Hui’s operations. Feng Hui pledged loans receivable totaled $32,681,732 for these loans as of December 31, 2015, and Feng Hui’s investors provided guarantee for these loans. (See note 20)

12. OTHER CURRENT LIABILITIES

Other current liabilities as of December 31, 2015 and 2014 consisted of:

| December 31, | ||||||||

| 2015 | 2014 | |||||||

| Interest payable | $ | 551,492 | $ | 71,771 | ||||

| Stamp duty payable | — | 2,398 | ||||||

| Accruals | 236,701 | — | ||||||

| Other payables | 189,638 | 126,617 | ||||||

| $ | 977,831 | $ | 200,786 | |||||

13. Other Operating Expense

Other operating expense for the years ended December 31, 2015 and 2014 consisted of:

| For the Years Ended December 31, | ||||||||

| 2015 | 2014 | |||||||

| Depreciation and amortization | $ | 40,259 | $ | 13,366 | ||||

| Guarantee fee | 217,725 | 227,955 | ||||||

| Legal and professional expenses | 1,520,930 | 260,345 | ||||||

| Office related expenses | 265,928 | 447,090 | ||||||

| Travel and entertainment | 283,405 | 107,098 | ||||||

| Rental expense | — | 42,256 | ||||||

| Fees on loans | 461,945 | 251,032 | ||||||

| Total | $ | 2,790,192 | $ | 1,349,142 | ||||

22

Adrie

Global Holdings Limited

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 AND 2014