Attached files

| file | filename |

|---|---|

| EX-99.1 - CLEANSPARK, INC. | ex99_1.htm |

| EX-2.1 - CLEANSPARK, INC. | ex2_1.htm |

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

____________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 30, 2016

Stratean Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 000-53498 | 87-044945 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

70 North Main Street, Ste. 105 Bountiful, Utah |

84010 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: 801-244-4405

___________________________________________________ (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] | Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| [ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

CAUTIONARY STATEMENT CONCERNING FORWARD LOOKING STATEMENTS

This Current Report on Form 8-K includes forward-looking statements relating to matters that are not historical facts. Forward-looking statements provide Stratean Inc.’s (the “Company”) current expectations and forecasts about future events. Forward-looking statements may be identified by the use of words such as “expect,” “believe,” “will,” “would,” “should” or comparable terminology or the negative of these words, or by discussions of strategy. While the Company believes its assumptions and expectations underlying forward-looking statements are reasonable, there can be no assurance that actual results will not be materially different. Risks and uncertainties that could cause actual results to differ include, without limitation, failure to consummate or delays in consummating the transactions described herein, transaction costs associated with the transactions described herein, unexpected losses of economies of scope or scale as a result of the transactions described herein, a decrease or adjustment in the purchase price or other amendment to the definitive agreements for the transactions described herein, failure to obtain necessary governmental approvals for the transactions described herein, and other risks and uncertainties included in reports the Company files with or furnishes to the Securities and Exchange Commission. The Company cautions you that no forward-looking statement is a guarantee of future performance, and you should not place undue reliance on these forward-looking statements which reflect the Company’s view only as of the date of this report. Stratean, Inc. undertakes no obligation to update any forward-looking information.

SECTION 1 - REGISTRANT'S BUSINESS AND OPERATIONS

ITEM 1.01 - ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

Asset Purchase

On June 30, 2016, Stratean, Inc. and Cleanspark II, LLC, a wholly-owned subsidiary of Stratean, Inc. (together, the “Company”), entered into an Asset Purchase Agreement (the “Purchase Agreement”) with CleanSpark Holdings LLC, CleanSpark LLC, CleanSpark Technologies LLC and Specialized Energy Solutions, Inc. (together, the “Seller”). The closing of the transactions contemplated by the Purchase Agreement occurred on June 30, 2016 (the “Closing Date”).

On the Closing Date, pursuant to the Purchase Agreement, the Company acquired all the assets (the “Assets”) and assume certain liabilities (the “Assumed Liabilities”) related to Seller and its line of business. The Assets the Company purchased from Seller include:

- Equipment and other tangible assets;

- Domain names, websites and intellectual property;

- All rights to causes of action, lawsuits, judgments, claims and demands of any nature available to or being pursued by the Seller;

- Contracts to which Seller is bound;

- Current and future customer accounts, including accounts receivable;

- All investments, including the holdings that CleanSpark Holdings LLC has in CleanSpark LLC, CleanSpark Technologies LLC and Specialized Energy Solutions, Inc., and any investments those subsidiaries have as well; and

- Any other assets of any nature whatsoever that are related to or used in connection with the business of Seller and its goodwill.

In exchange for the Assets, the Company assumed the Assumed Liabilities, consisting of certain accounts payable amounting to approximately $200,000 arising out of the Assets. The Company also issued to Seller six million (6,000,000) shares of common stock and two-year warrants to purchase four million five hundred thousand (4,500,000) shares of common stock at an exercise price of $1.50 per share.

| 2 |

Simultaneously with the Purchase Agreement, the Company entered into certain ancillary agreements (the “Ancillary Agreements”) with Seller, consisting of a bill of sale, intellectual property assignment and lock-up/leak-out agreement. The lock-up/leak-out agreement prevents Seller from selling the Company’s securities in the public market for a year .

The Purchase Agreement contains customary representations, warranties and covenants. In addition, the Company and Seller agreed to certain post-closing covenants, including the following:

- The board of directors of the Company shall have approval and oversight over a management developed budget to exploit the Assets and will work with the management of CleanSpark II, LLC, to which the Assets have been transferred. For a period of nine months from the Closing Date, the Company agrees to fund on a monthly basis all pre-approved budgetary needs for CleanSpark II, LLC to achieve its business objectives.

- The strategic management of Cleanspark II, LLC shall be determined by the board of directors of the Company. Management shall be appointed for Cleanspark II, LLC and they shall control the day-to-day operations of Cleanspark II, LLC, subject to the oversight of the Company and its board of directors. Employment agreements for appointed management of Cleanspark II, LLC will be negotiated prior to close but will hold an effective date post-closing. The parties shall jointly agree to a business plan for Cleanspark II, LLC within sixty (60) days of closing.

- Within thirty (30) days of the Closing Date, the Company agrees to appoint one (1) candidate chosen by Seller to the board of directors of the Company. The Company’s board of directors still maintains exclusive rights to accept the suggested appointment and in the case the suggested appointment is rejected by the board, Seller will have the right to present a new candidate until such time as the candidate is approved by the Company’s board of directors. The term of the appointment of Seller’s member of the board shall be in accordance with the Company’s bylaws.

- The Company will appoint an accounting firm of its choosing to maintain Seller’s financial records to ensure compliance with US GAAP. Within 71 days of closing, Seller shall provide the Company with an audit for the two latest fiscal year periods and reviewed financials for an interim period ending June 30, 2016 prepared by Seller’s independent auditor, satisfactory to the Company.

The foregoing description of the Purchase Agreement does not purport to be complete and is subject to, and qualified in its entirety by reference to, the full text of the Purchase Agreement, which is filed as Exhibit 2.1 hereto and incorporated herein by reference.

The Purchase Agreement has been included solely to provide investors and security holders with information regarding its terms. It is not intended to be a source of financial, business or operational information, or to provide any other factual information, about the Assets, the Company or Seller. The representations, warranties and covenants contained in the Purchase Agreement are made only for purposes of the Purchase Agreement and are made as of specific dates; are solely for the benefit of the parties (except as specifically set forth therein); may be subject to qualifications and limitations agreed upon by the parties in connection with negotiating the terms of the Purchase Agreement, including being qualified by confidential disclosures made for the purpose of allocating contractual risk between the parties, instead of establishing matters as facts; and may be subject to standards of materiality and knowledge applicable to the contracting parties that differ from those applicable to investors or security holders. Investors and security holders should not rely on the representations, warranties and covenants or any description thereof as characterizations of the actual state of facts or condition of the Assets, the Company or Seller. Moreover, information concerning the subject matter of the representations, warranties and covenants may change after the date of the Purchase Agreement, as applicable, which subsequent information may or may not be fully reflected in public disclosures.

CleanSpark Business

Overview

As a result of the Purchase Agreement and the acquisition of the Assets, the Company intends to take over the CleanSpark business as another opportunity in the energy sector, along with its existing Gasifier business. The Company believes that that synergies created from these businesses will strengthen its overall capacity to obtain

| 3 |

financing, increase its customer base, open new distribution channels and increase its competitive strength in the energy market, all to the ultimate benefit of the Company’s shareholders.

Integral to CleanSpark’s business is the Flex Power System (the “System”), which the Company acquired in the acquisition of the Assets. The System provides secure, sustainable energy with significant cost savings for its energy customers. The System allows customers to efficiently manage renewable energy generation, storage and consumption. By having control over the facets of energy usage and storage, customers are able to reduce their dependency on utilities, thereby keeping energy costs relatively constant over time. The overall aim is to transform energy consumers into energy producers by supplying power that anticipates their routine instead of interrupting it.

Around the world, the aging grid is becoming unstable and unreliable due to increases in loads and lack of new large-scale generation facilities. This inherent instability is compounded by the push to integrate a growing number and variety of renewable but intermittent energy generators and advanced technologies into outdated electrical systems. Simultaneously, defense installations, industrial complexes, communities, and campuses across the world are turning to virtual power plants and microgrids as a means to decrease their reliance from the grid, utilize cleaner power, and enhance energy security and surety.

The convergence of these factors has created a “perfect storm” in the power supply optimization and energy management arena. Efficiently building and operating the macro- and microgrids of tomorrow, while maximizing the use of sustainable energy to produce affordable, stable, predictable, and reliable power on a large scale, is a significant opportunity that first-movers can leverage to capture a large share of this emerging global industry.

The System works with software that uses generation, consumption, and utility data to decide whether to use or store energy based on prioritized end-user benefits, including cost savings and critical loads. The flexible modular design gives users a turn-key solution that is capable of managing energy based on the needs of its user.

Energy Security Microgrids

Microgrids

A microgrid is comprised of any number of generation, energy storage, and smart distribution assets that serve a single or multiple loads, either connected to the grid or “islanded.” In the past, microgrids have consisted of off-grid generators organized with controls to provide power where utility lines cannot run. Today, modern microgrids integrate renewable energy generation systems, or REGS with advanced energy storage devices and interoperate with the local utility grid. Advanced autonomous cyber-secure microgrid controls relay information between intelligent hardware and localized servers to make decisions in real-time that deliver optimum power where it is needed, when it is needed.

| 4 |

Flex Power System

CleanSpark’s System is an integrated microgrid control platform that seamlessly integrates all forms of energy generation with energy storage devices and controls facility loads to provide energy security in real time free of cyber threats. Able to interoperate with the local utility grid, the System brings users the ability to choose when to buy or sell power to and from the grid, enabling what the Company believes is the most cost effective power solution on the market. CleanSpark’s innovative FractalGrid topology enables multiple microgrids to work together or disassociate based on the system and the customers’ best interest.

Some of the features of the System include the following:

- Load Shifting – store excess energy generation and use it to meet peak demand during high-cost periods.

- Power Quality – enable real-time support and control of reactive power, frequency and harmonics to ensure the integrity of sensitive electronics and control equipment.

- Peak Shaving – supply virtually instantaneous energy to cover sudden usage spikes and reduce energy costs.

- Power Smoothing – use stored energy to cover sudden drops or spikes in solar or wind that occur from cloud cover or wind gusts.

- Frequency Regulation – counteract grid frequency deviations due to sudden load or generation changes through dispatch-able energy generation or storage.

- Load Leveling – use active microgrids to optimize the utility grid, allowing central power plants to be run at a constant speed, maximizing fuel efficiency.

- Demand Management and Response – curtail non-critical energy demand in response to current or predicted conditions of the microgrid or utility grid. This ensures future energy supply to the user and system integrity for the utility.

- Protect Existing Energy Assets – CleanSpark’s microgrids are technology-agnostic and integrates legacy assets such as backup generation, combined heat and power, and power distribution systems.

- Critical Load Security – energy independence and uninterruptible power to critical loads and facilities.

- Predictive Capacity and Machine-Learning (Under Development) – integrate predictive resource analysis such as cloud coverage into microgrid load management. The System identifies patterns (e.g., a facility’s energy use, local weather conditions affecting energy generation) and improves its decision-making as historical data accumulates.

| 5 |

The Company believes that the System is ideal for commercial, industrial, healthcare, mining, defense, campus, and community users and ranges in size from 4 KW to 100 MW and beyond and can deliver power at or below the current cost of utility power in many geographies based on local rate structures and regional energy production factors..

CleanSpark’s Microgrid-as-a-Service (MaaS)

CleanSpark works with customers on the design, engineering, integration, installation and operations of the System.

FractalGrid Architecture

Fractals are structures that are self-similar at different scales. The CleanSpark FractalGrid architecture allows any number of microgrids to aggregate into a self-governing, dynamically optimizing network that functions as an individual microgrid. CleanSpark’s technology can integrate with any new or existing generation and storage assets to control loads and meet the customer’s energy goals. All hardware components are commercial-off-the-shelf (COTS) from Tier 1, ISO 9000 vendors. This allows the FractalGrid to continue developing its “plug-and-play” library with additional supported vendors and technologies as an evolving energy operating platform. It is made to scale and evolve as a customer’s business changes over time.

User Interface

| 6 |

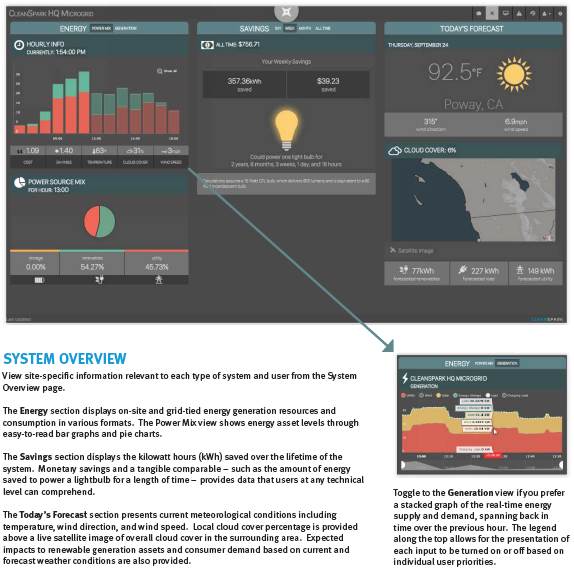

The user-centric interface promotes building occupant awareness through real-time display of energy performance and sustainable building information. By way of kiosks, video displays, desktops, tablets, and mobile devices a facility’s comprehensive energy use is displayed in a user-friendly manner, whether energy is obtained from the utility, solar, wind, gas, waste, storage, or any other proven technology.

A customer can access both individual and portfolio views through CleanSpark’s web portal and/or a local Microgrid Operations Center (MOC), displaying specific real-time performance details. Additional data is available, including past and future performance figures, on site conditions, and engineering data, such as voltages and operations and maintenance information. A display can be deployed at any site to bring efficiency awareness to personnel.

Employees

No employees are transferred by way of this transaction and any retention of key staff will be addressed in separate agreements.

| 7 |

Competition

The amount of advanced energy management service providers for microgrids with comparable technologies and track record are few, but growing at a rapid pace. Because of the breadth of capability and the mission of CleanSpark, the company competes with numerous firms in the software and controls space with greater financial resources and name recognition. The majority of the competition is occupied by established companies, which may be defined as “Traditional” microgrid vendors. There are also a number of early stage companies that focus on either software or controls or energy storage that are defined as “Emerging” vendors that have started to gain traction in the marketplace.

Some of the Traditional vendors include: Schneider Electric, General Electric, ABB and ZBB. Some of the Emerging vendors include: SolarCity/Gridlogic, Stem, Power Analytics, Spirae, Green Energy Corp. and Geli. The Company intends to compete with these more established companies and believes its competitive advantages are as follows:

- Software – The mPULSE software is faster and able to integrate devices and components in a more seamless fashion than known competition. The speed of decision-making fully unlocks the potential of distributed renewables by providing control of storage devices to a near instantaneous degree. The event driven service oriented architecture built upon a robust enterprise service buss enables near real-time monitoring and control which offer a high degree of scalability.

- FractalGrid Architecture - The FractalGrid architecture enables machine-to-machine or microgrid-to-microgrid communications that offers a high degree of scalability. This patent pending approach is believed to be the most efficient and effective method to construct large campus microgrid systems. This topology is believed to be the most rapid, robust and reliable way to transform the centralized model to a distributed nodal system.

- Open Source platform – Traditional micro grid software and control systems are developed for project specific purposes with proprietary technology. Traditional systems are designed to work well with only the developer’s own equipment and software. This can result in expensive and complicated integration. CleanSpark has designed its software and controls using open standards to ensure compatibility with future devices, components and software applications.

- Cyber-Security – The fPS has been developed using the defense-in-depth approach that is taken to ensure strong security is maintained at all levels and compliant with the strictest national security standards.

- Strong intellectual property – CleanSpark’s FractalGrid patent (non-provisional granted) may be the most efficient microgrid architecture for reliability, security and scalability. The Company has also filed several other patents related to its software and microgrid architecture and continues to develop patentable software and hardware products as well as advanced trade secrets.

- Turnkey microgrid / energy security solution – In many geographies, CleanSpark and its storage solutions provide the most affordable, integrated microgrid solution. Navigant Research estimates microgrid costs at $5,000-$7,000/kw compared to CleanSpark’s at ~$3,500/kw, depending on the configuration.

Government Regulation

The Company is subject to federal, state and local laws and regulations governing environmental quality and pollution control. It is anticipated that, absent the occurrence of an extraordinary event, compliance with existing federal, state and local laws, rules and regulations concerning the protection of the environment and human health will not have a material effect upon the Company, its capital expenditures, or earnings. The Company cannot predict what effect additional regulation or legislation, enforcement policies thereunder and claims for damages for injuries to property, employees, other persons and the environment resulting from its operations. The Company’s operations related the CleanSpark business and System are subject to environmental regulation by state and federal authorities including the Environmental Protection Agency ("EPA"). This regulation has not increased the cost of planning, designing and operating to date. Although the Company believes that compliance with environmental regulations will not have a material adverse effect on its operations or results of these operations, there can be no assurance that significant costs and liabilities, including criminal penalties, will not be incurred. Moreover, it is possible that other developments, including stricter environmental laws and regulations, and claims for damages for injuries to property or persons resulting from our activities could result in substantial costs and liabilities.

In addition, companies operating in the energy space are subject to various local, utility, state, and federal policy requirements regarding the generation and sale of electricity. Given increasing renewable energy and grid resili ency initiatives at all policy levels, it is believed that future developments may be beneficial to CleanSpark’s operations.

| 8 |

In the conduct of the Company’s activities its operations will be subject to the requirements of the federal Occupational Safety and Health Act ("OSHA") and comparable state statutes. The OSHA hazard communication standard, the EPA community right-to-know regulations under Title III of the federal Superfund Amendment and Reauthorization Act and similar state statutes require the Company to organize information about hazardous materials used, released or produced in its operations. Certain of this information must be provided to employees, state and local governmental authorities and local citizens. The Company is also subject to the requirements and reporting set forth in OSHA workplace standards.

Risk Factors Associated with CleanSpark Business

The Company expects to experience increased working capital requirements in connection with the acquisition of CleanSpark’s Assets, which could adversely affect the Company’s ability to meet its financing obligations both to its existing business and the CleanSpark business line.

If the Company does not obtain additional financing, the Company’s business plans will be delayed and the Company may not achieve profitable operations.

At March 31, 2016, the Company had cash on hand of $151,689 and accumulated a deficit of $4,156,644. The Company has raised approximately $460,000 for the year ended September 30, 2015 and through the interim period ending March 31, 2016. The Company will need a minimum of $1,500,000 in capital will be needed for general administrative expenses, development of the Company’s existing Gasifier and newly acquired CleanSpark Assets, and marketing costs.

The Company’s operations could require the Company to utilize large sums of working capital, sometimes on short notice and sometimes without the ability to completely recover the expenditures on a timely basis or at all. If the Company encounters significant working capital requirements or cash outflows as a result of these or other factors, the Company may not have sufficient liquidity or the credit capacity to meet all of the Company’s cash needs.

The Company does not currently have any arrangements for financing and obtaining additional financing will be subject to a number of factors, including general market conditions, investor acceptance of the Company’s plan of operations and initial results from the Company’s business operations. There is no assurance that any additional financing will be available or if available, on terms that will be acceptable to the Company. Failure to raise additional financing may cause the Company to go out of business. If this happens, you could lose all or part of your investment.

The Company has a limited operating history and, accordingly, you will not have a significant basis on which to evaluate the Company’s ability to achieve the Company’s business objectives.

The Company has had limited operating results to date. The Company has a very limited operating history with comparatively limited assets and cash resources. Because of the Company’s limited operating history, you will have a small basis upon which to evaluate the Company’s ability to achieve the Company’s business objectives.

The Company may be forced to litigate to enforce or defend its intellectual property rights, which could negatively impact the Company’s business.

The Company may be forced to litigate to enforce or defend its intellectual property rights against infringement and unauthorized use by competitors, and to protect its trade secrets. In so doing, the Company may place its intellectual property at risk of being invalidated, held unenforceable, narrowed in scope or otherwise limited. Further, an adverse result in any litigation or defense proceedings may increase the risk of non-issuance of pending applications. Any such litigation could be very costly and could distract management from focusing on operating the Company’s business. The existence and/or outcome of any such litigation could harm the Company’s business, results of operations and financial condition.

Recently, CleanSpark has completed a preliminary investigation in relation to past employee(s) whom may have had acc ess and ability to remove confidential information from its possession that could be used to compete in similar applications. At this time it is unclear if any confidential information was retained by former employees but the

| 9 |

Company intends to further its investigation in the coming months and will take all measures to protect its intangible assets.

Furthermore, because of the substantial amount of discovery required in connection with intellectual property litigation, there is a risk that some of the Company’s confidential and proprietary information could be compromised by disclosure during this type of litigation. In addition, there could be public announcements of the results of hearings, motions or other interim proceedings or developments. If securities analysts or investors perceive these results to be negative, it could have a substantial adverse effect on the price of our stock.

The Company may not be able to protect its proprietary technology in the marketplace or the cost of doing so may be prohibitive or excessive.

The Company’s success will depend, in part, on its ability to obtain patents, protect its trade secrets and operate without infringing on the proprietary rights of others. The Company plans to rely upon a combination of patents, trade secret protection (i.e., know-how), and confidentiality agreements to protect the intellectual property of its System. The scope and validity of patents in the energy field involve complex legal and scientific questions and can be uncertain. Where appropriate, the Company seeks patent protection for its System. Filing, prosecuting and defending patents throughout the world would be prohibitively expensive, so the Company’s policy is to patent technology in jurisdictions with significant commercial opportunities. However, patent protection may not be available for some of the System.

The Company has filed a patent application 14/885,627 titled, “Establishing Communication and Power Sharing Links Between Components of a Distributed Energy System.” To maintain the status of the application, the Company must respond to the U.S. Patent and Trademark Office. This will involve Company time and resources, which may not be available.

If the Company must spend significant time and money obtaining patent protection or protecting or enforcing its patents, if obtained, its business results of operations and financial condition may be harmed. The Company may not develop additional proprietary products that are patentable.

Many companies have encountered significant problems in protecting and enforcing intellectual property rights in foreign jurisdictions. The legal systems of certain countries, particularly certain developing countries, do not favor the enforcement of patents and other intellectual property rights, particularly those relating to energy, which could make it difficult for the Company to stop the infringement of its patents or marketing of competing products in violation of its proprietary rights generally. Proceedings to enforce the Company’s patent rights in foreign jurisdictions could result in substantial cost and divert efforts and attention from other aspects of the Company’s business.

In addition, patents have a limited lifespan. In most countries, including the United States, the standard expiration of a patent is 20 years from the effective filing date. Various extensions of patent term may be available in particular countries, however in all circumstances the life of a patent, and the protection it affords, has a limited term.

Any loss of, or failure to obtain, patent protection could have a material adverse impact on the Company’s business. As such, the Company may be unable to prevent competitors from entering the market with products that are similar to or the same as the System.

Further given that our technology relates to energy, political pressure or ethical decisions may result in a change to the scope of patent claims for which the Company may be eligible. Different patent offices throughout the world may adopt different procedures and guidelines in relation to what is and is not patentable and as a result different protection could be obtained in different areas of the world which may impact the Company’s ability to maximize commercialization of its technology.

The Company may also incur increased expenses and cost in relation to the filing and prosecution of patent applications where third parties choose to challenge the scope or oppose the grant of any patent application or, following grant, seek to limit or invalidate any patent.

| 10 |

Any increased prosecution or defense required in relation to such patents and patent applications, whether relating to third party observation or any other third party challenge or opposition, entails increased cost and resource commitment to the business and may result in patents and patent applications being abandoned, invalidated or narrowed in scope.

The Company may be unable to adequately prevent disclosure of trade secrets and other proprietary information.

The Company relies on trade secrets to protect its proprietary know-how and technological advances, especially where it does not believe patent protection is appropriate or obtainable. However, trade secrets are difficult to protect. The Company relies, in part, on confidentiality agreements with its employees, consultants, outside collaborators and other advisors to protect its trade secrets and other proprietary information. These agreements may not effectively prevent disclosure of confidential information and may not provide an adequate remedy in the event of unauthorized disclosure of confidential information. In addition, others may independently discover the Company’s trade secrets and proprietary information. Costly and time-consuming litigation could be necessary to enforce and determine the scope of the Company’s proprietary rights. Failure to obtain or maintain trade secret protection, or failure to adequately protect the Company’s intellectual property, could enable competitors to develop generic products or use the Company’s proprietary information to develop other products that compete with the Company’s System or have additional, material adverse effects upon the Company’s business, results of operations and financial condition.

In addition, the Company may provide trial periods to third parties under material transfer agreements, including to government entities or other organizations that the Company cannot control. There is a risk that such third parties could disclose details of the Company’s technology to others that could facilitate or assist such parties in the development of competing products.

Because CleanSpark is dependent on a small concentration of customers, any loss of a customer or failure to obtain additional customers will result in negative operating results and could put the Company out of business.

CleanSpark’s and its wholly owned subsidiares’ revenues are concentrated in 3 customers: City of Colton; a private golf club and Camp Pendleton FractalGrid Demonstration. The loss of one or more of these customers or the failure to acquire more customers could have a significant negative impact on the Company’s operating results and could put the Company out of business.

Because CleanSpark is a small company in a large industry of well-established and well-known companies, it may encounter difficulties procuring customers and projects.

The majority of the Company’s competition is occupied by established companies, which may be defined as “Traditional” microgrid vendors. There are also a number of early stage companies that focus on either software or controls or energy storage that are defined as “Emerging” vendors that have started to gain traction in the marketplace.

The Company is a small Emerging vendor in a very large energy industry. Many of the Company’s competitors have greater financial resources and brand recognition. While the Company believes that its technology has strong competitive strengths, it may have difficulty locating customers and establishing projects. Sales in this industry are oftentimes project-based and are usually obtained through a subcontract with a large general contractor. The Company may not win projects due to its size and perceived value and experience. In addition, large general contractors may see the Company as a competitor and choose not do business with it. In addition, larger competitors may have the resources to under bid projects, which the Company could not afford to take.

There are also risks associated with the Company’s inability to support customers that require support staff that the Company does not have or customers that are not in proximity with the Company over long distances. The Company may have geographic limitations on projects it is able to bid on due to limited resources and limited size of personnel. Currently all projects are in California as the operations are headquartered in San Diego, California. The Company plans to expand into the west coast and then into the mid-west, but that will take time and resources that the Company does not currently have available.

If the Company is unable to locate customers and expand its base of operations, it may never successfully compete in the industry and could go out of business.

| 11 |

Because of the nature and location of a FractalGrid asset on Camp Pendleton, the U.S. Marine Corps may assert its right to take possession of the system with cause.

The California Energy Commission awarded $1.7 million to Harper Construction Company, Inc. in July 2013 to support a microgrid technology demonstration project. CleanSpark was subcontracted to provided design, development, integration, and installation services for the FractalGrid at the School of Infantry in the 52 Area of Marine Corps Base Camp Pendleton.

The project included integration of CleanSpark’s proprietary software and controls platform with a variety of energy storage technologies to include various energy storage devices. Together, the energy storage devices stores solar energy generated by existing fixed-tilt solar photovoltaic panels and fifteen dual axis tracking concentrated photovoltaic units. CleanSpark’s distributed controls combine the generation and storage technologies to create four separate microgrids that self align together to create a larger microgrid that ties directly into the larger utility grid at the 12kV level.

The project has demonstrated that in the event of an outage or other energy surety threat, the software has the ability to autonomously separate the microgrids from the utility and the controls operate them independently in “island” mode, and in most cases without interrupting service to critical circuits. Once energy from the grid is stabilized, CleanSpark’s platform has demonstrated its ability to reconnect the microgrid to the utility.

CleanSpark’s agreement on the project provides that Camp Pendleton may assert a right to take possession of the system for cause, defined as what may be necessary in the interest of the United States Marine Corps for defense purposes.

CleanSpark may become a party to lawsuits/disputes from time to time with uncertain consequences, the outcome of potential judgments may negatively affect the Company’s financial condition and results of operations.

CleanSpark was notified of Trademark infringement regarding its “Synapse” line of microgrid controllers. Another vendor has been using a similar naming convention and asserted CleanSpark’s naming convention created ambiguity in the marketplace. CleanSpark has agreed to rename its product to resolve the issue. CleanSpark is in the process of revising marketing and public materials accordingly.

As the Company continues to grow, it can expect to have to deal with lawsuits that affect its business. Lawsuits are uncertain and involve a substantial degree of risk. If the Company is unable to successfully prosecute or defend these actions, its financial condition and results of operations could suffer.

The Company’s products may contain defects, which could adversely affect the Company’s reputation and cause it to incur significant costs, which it may not be able to afford.

Defects may be found in the Company’s products. Any such defects could cause the Company to incur significant return and exchange costs, re-engineering costs, divert the attention of the Company’s engineering personnel from product development efforts, and cause significant customer relations and business reputation problems. Any such defects could force the Company to undertake a product recall program, which could cause the Company to incur significant expenses and could harm its reputation and that of its products. If the Company delivers products with defects, the Company’s credibility and the market acceptance and sales of its products could be harmed.

If the Company is the subject of future product defect or liability suits, its business will likely fail.

In the course of the Company’s planned operations, it may become subject to legal actions based on a claim that its products are defective in workmanship or have caused personal or other injuries. The Company, through one of the subsidiaries acquired, has liability insurance , but it may not be adequate to cover all potential claims. Moreover, even with sufficient insurance coverage, any successful claim could significantly harm its business, financial condition and results of operations.

Because the Company does not have exclusive agreements with the third party vendors that will supply the Company’s hardware components, the Company may be unable to effectively supply and distribute hardware

| 12 |

components to customers, which would adversely affect the Company’s reputation and materially reduce its revenues.

The Company does not own or operate any manufacturing facilities. However, there are a number of vendors that are capable of providing the hardware the Company uses for its FractalGrid Architecture. The Company has no written agreements with its vendors. The Company’s arrangement with its vendors to acquire components is strictly through purchase orders.

If the Company loses the services of its third party vendors, it may be unable to secure the services of replacement vendors in a manner that would not harm or disrupt the Company’s business. In addition, because the Company does not have written agreements with its vendors, they could refuse to supply some or all of the needed components, reduce the number of components that they supply or change the terms and prices under which they normally supply components. The occurrence of any such conditions will have a materially negative effect upon the Company’s reputation and its ability to deploy the System, which will cause a material reduction in the Company’s revenues.

If the Company fails to adequately manage the size of its business, it could have a severe negative effect on financial results or stock price.

The Company’s management believes that in order to be successful it must appropriately manage the size of its business. This may mean reducing costs and overhead in certain economic periods, and selectively growing in periods of economic expansion. In addition, the Company will be required to implement operational, financial and management information procedures and controls that are efficient and appropriate for the size and scope of operations. The management skills and systems currently in place may not be adequate and the Company may not be able to manage any significant cost reductions or effectively provide for its growth.

The loss of executive officers or key employees could have a material adverse effect on the Company’s business.

The Company depends greatly on the efforts of the Company’s executive officers and other key employees to manage the Company’s operations, including new employees needed to run the CleanSpark side of the business.

The Company has not yet retained any designers and engineers needed to run the CleanSpark business. Staffing key personnel is expected to be addressed in separate agreements with qualified consultants within the coming weeks. The Company will need engineers with specific knowledge in designing and developing its products and services and there are limited resources available that have this specific experience. The Company will also need to hire professionals who understand the process, procedure and regulations associated with the energy sector. We will also need to identify sales and marketing professionals with specific experience in selling into energy sector channels.

The market for skilled employees is highly competitive, especially for employees in technical fields. There can be no assurance that we will be able to retain the services of all our key employees or a sufficient number to execute our plans, nor can there be any assurance we will be able to continue to attract new employees as required.

Personnel may voluntarily terminate their relationship with the Company at any time, and competition for qualified personnel, especially engineers, is intense. The process of locating additional personnel with the combination of skills and attributes required to carry out the Company’s strategy could be lengthy, costly and disruptive.

If the Company is unable to hire key personnel to run its business, lose the services of key personnel, or fail to replace the services of key personnel who depart, the Company could experience a severe negative effect on our financial results and stock price. In addition, there is intense competition for highly qualified engineering and marketing personnel in the locations where the Company principally operates. The failure to acquire the services of any key engineering, marketing or other personnel or the Company’s failure to attract, integrate, motivate and retain additional key employees could have a material adverse effect on the Company’s business, operating and financial results and stock price.

The Company’s growth is dependent on obtaining new contracts and the failure to secure those contracts will result in poor operating results and could ultimately cause the Company to go out of business.

| 13 |

The Company’s strategy is to grow by selling and licensing Gasification and CleanSpark systems and other energy technologies. Successful implementation of this strategy is conditional on numerous conditions, such as the ability to identify and close sales and there can be no assurance that the Company’s expansion strategy can be successfully executed. If the Company is unable to obtain contracts to generate revenues, the Company will go out of business.

The Company’s failure to meet government regulations or any unfavorable changes in government regulation could harm the Company’s business.

The Company’s products and services are subject to various international, federal, state and local laws, regulations and administrative practices affecting the Company’s business. Projects using the Company’s systems could be delayed or prevented by difficulties in obtaining or maintaining the required approvals, permits or licenses. The Company cannot predict the nature of future laws, regulations, interpretations or applications, or determine what effect either additional government regulations or administrative orders, when and if promulgated, or disparate federal, state and local regulatory issues would have on the Company’s business in the future.

Government regulation, environmental risks and taxes could adversely affect the Company’s operating results.

The Company's energy operations will be subject to regulation by federal and state governments, including environmental laws. To date, the Company has not had to expend significant resources in order to satisfy environmental laws and regulations presently in effect. However, compliance costs under any new laws and regulations that might be enacted could adversely affect the Company's business and increase the costs of planning, designing, and producing the Company’s products.

SECTION 2 – FINANCIAL INFORMATION

Item 2.01 Completion of Acquisition or Disposition of Assets

The information set forth in Item 1.01 of this Current Report on Form 8-K that relates to the completion of acquisition of assets is incorporated by reference into this Item 2.01.

SECTION 3 – SECURITIES AND TRADING MARKETS

Item 3.02 Unregistered Sales of Equity Securities

The information set forth in Item 1.01 of this Current Report on Form 8-K that relates to the unregistered sales of equity securities is incorporated by reference into this Item 3.02.

On June 30, 2016, the Company issued a total of 600,000 shares of its Series A Preferred Stock to the four members of the Company’s board of directors for services rendered.

The issuance of the shares is exempt from registration in reliance upon Section 4(2) and/or Regulation D of the Securities Act of 1933, as amended.

SECTION 5 - CORPORATE GOVERNANCE AND MANAGEMENT

Item 5.01 Changes in Control of Registrant

The information set forth in Item 1.01 of this Current Report on Form 8-K that relates to the change of control of the registrant is incorporated by reference into this Item 3.02.

As a result of the issuance to Seller (namely Cleanspark Holdings, LLC) amounting to roughly 22% of the Company’s issued and outstanding shares of common stock, there has been a change in control of the Company.

In connection with the change in control of our company, Seller has the right to appoint one person to the Company’s board of directors, as discussed more fully in Item 1.01 above.

| 14 |

There are no arrangements known to the Company, the operation of which may, at a subsequent date, result in a change in control of the Company.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The information set forth in Item 3.02 of this Current Report on Form 8-K that relates to the compensatory arrangements of directors is incorporated by reference into this Item 5.02.

SECTION 8 – OTHER EVENTS

Item 8.01 Other Events

On July 7, 2016, we issued a press release concerning the acquisition of assets of CleanSpark. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information in Item 8.01 of this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

SECTION 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

| (a) | Financial statements of businesses acquired |

To the extent the financial statements and additional information required pursuant to Item 9.01(a) of Form 8-K are determined to be required to be filed, they will be filed by amendment to this Current Report on Form 8-K within 71 calendar days after the date on which this Current Report on Form 8-K must be filed.

| (b) | Pro forma financial information. |

To the extent the pro forma financial information required pursuant to Item 9.01(b) of Form 8-K is determined to be required to be filed, it will be filed by amendment to this Current Report on Form 8-K within 71 calendar days after the date on which this Current Report on Form 8-K must be filed.

(d) Exhibits

| Exhibit No. | Description |

| 2.1 | Asset Purchase Agreement, dated June 30, 2016 |

| 99.1 | Press Release, dated July 7, 2016 |

| 15 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Stratean, Inc.

| /s/ Zachary Bradford |

| Zachary

Bradford Chief Financial Officer |

| Date: July 7, 2016 |

| 16 |